Tile Adhesive Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428903 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Tile Adhesive Market Size

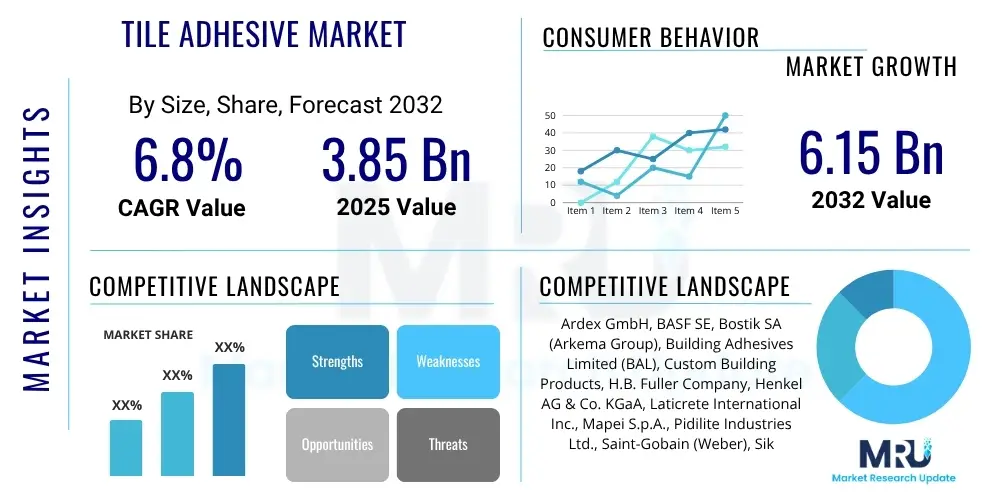

The Tile Adhesive Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 3.85 billion in 2025 and is projected to reach USD 6.15 billion by the end of the forecast period in 2032.

Tile Adhesive Market introduction

Tile adhesives are specialized bonding materials engineered to secure tiles to various substrates, offering superior adhesion, flexibility, and durability compared to traditional cement mortars. These advanced formulations typically comprise cement, polymers, sand, and various additives, which together enhance workability, water resistance, and bond strength. The market encompasses a wide array of products, including cementitious, dispersion, and epoxy-based adhesives, each tailored for specific applications and environmental conditions, ensuring optimal performance across diverse tiling projects.

Major applications for tile adhesives span across residential, commercial, and industrial sectors. In residential buildings, they are extensively used for flooring, wall tiling, and bathrooms, while commercial applications include shopping malls, hotels, offices, and hospitals, demanding high performance and aesthetic appeal. Industrial settings utilize specialized adhesives for areas exposed to harsh chemicals or heavy loads. The primary benefits of using modern tile adhesives include significantly improved bond strength, reduced water absorption, enhanced flexibility to accommodate substrate movement, and faster installation times. These attributes contribute to the longevity and aesthetic integrity of tiled surfaces, making them indispensable in contemporary construction and renovation.

The market's growth is predominantly driven by a confluence of factors such as rapid urbanization, increasing construction activities globally, and a rising demand for aesthetically pleasing and durable flooring and wall finishes. Furthermore, a growing preference for ceramic and porcelain tiles, coupled with the need for high-performance installation materials in modern architecture, continues to fuel market expansion. The booming renovation and remodeling sector, especially in developed economies, also contributes significantly to the demand for advanced tile adhesive solutions, as consumers seek improved home aesthetics and functionality.

Tile Adhesive Market Executive Summary

The Tile Adhesive Market is undergoing robust expansion, propelled by significant global business trends, including an escalating focus on sustainable construction practices and the adoption of advanced material science. Industry players are increasingly investing in research and development to introduce eco-friendly and high-performance adhesive solutions, such as low volatile organic compound (VOC) formulations and products incorporating recycled content. Moreover, the trend towards pre-mixed and ready-to-use adhesives is gaining traction, addressing the demand for convenience and efficiency in construction. Consolidation through mergers and acquisitions is also shaping the competitive landscape, as larger entities seek to expand their product portfolios and geographical reach, enhancing their market presence and operational synergies.

Regionally, the market exhibits dynamic growth patterns. The Asia Pacific region stands out as the primary growth engine, driven by massive infrastructure development projects, rapid urbanization, and a burgeoning housing sector, particularly in countries like China, India, and Southeast Asian nations. North America and Europe, while mature markets, are experiencing steady growth fueled by renovation and remodeling activities, stringent building codes promoting high-quality materials, and a consistent demand for premium, specialized adhesives. Latin America and the Middle East & Africa regions are also showing promising growth, albeit from a smaller base, attributed to increasing foreign investments in real estate and the development of new urban centers.

Segmentation analysis reveals key trends influencing market dynamics. The cementitious segment continues to dominate due to its cost-effectiveness and versatility, yet polymer-modified and epoxy-based adhesives are witnessing accelerated adoption for their enhanced performance attributes, such as superior flexibility, water resistance, and chemical resistance. Application-wise, the residential sector remains the largest consumer, but commercial and industrial applications are demonstrating strong growth rates, driven by large-scale projects requiring specialized bonding solutions. The shift towards large-format tiles and the increasing use of challenging substrates further necessitate the development and adoption of advanced adhesive technologies, influencing product development and market offerings across all segments.

AI Impact Analysis on Tile Adhesive Market

User inquiries regarding Artificial Intelligence in the Tile Adhesive Market frequently revolve around how AI can enhance manufacturing efficiency, optimize supply chains, improve product quality, and potentially automate aspects of application. Key themes include the use of AI for predictive maintenance of production machinery, intelligent inventory management to reduce waste, and leveraging data analytics for customized product development based on real-time market needs and performance feedback. There is also considerable interest in AI's role in quality control, enabling automated detection of formulation inconsistencies or application defects, and in forecasting demand to improve production planning. Users anticipate AI to bring significant advancements in material science through simulations and rapid prototyping, leading to more sustainable and high-performance adhesive solutions, while also seeking clarification on the practical implementation challenges and cost implications.

- AI can optimize manufacturing processes, reducing energy consumption and material waste through predictive analytics.

- Predictive maintenance schedules for production equipment can be improved by AI, minimizing downtime and increasing operational efficiency.

- AI-driven supply chain management enhances inventory control, demand forecasting, and logistics, ensuring timely delivery and cost savings.

- Formulation development can be accelerated through AI-powered simulations, identifying optimal ingredient combinations for desired properties.

- Quality control can be automated using AI vision systems to detect defects in adhesive batches, ensuring consistent product performance.

- AI tools can personalize product recommendations for professional installers based on project specifications and environmental conditions.

- Data analytics from application sites can inform R&D, leading to the development of more effective and specialized tile adhesives.

DRO & Impact Forces Of Tile Adhesive Market

The Tile Adhesive Market is significantly shaped by a combination of key drivers, formidable restraints, and emerging opportunities, all acting as dynamic impact forces on its trajectory. Primary drivers include the escalating pace of urbanization worldwide, particularly in developing economies, which fuels massive construction and infrastructure development. The global surge in renovation and remodeling activities, driven by evolving consumer preferences for modern aesthetics and durable finishes, also acts as a potent catalyst. Furthermore, technological advancements leading to superior adhesive formulations with enhanced properties like flexibility, faster setting times, and eco-friendliness are broadening application possibilities and market penetration, while increasing disposable incomes contribute to higher spending on quality construction materials.

However, the market also faces considerable restraints. Volatility in raw material prices, including polymers, cement, and various chemical additives, poses a significant challenge, directly impacting production costs and profit margins for manufacturers. Stringent environmental regulations concerning VOC emissions and sustainable manufacturing practices necessitate continuous innovation and compliance, which can be capital-intensive. Additionally, the availability of traditional, lower-cost alternatives, though offering inferior performance, can sometimes impede the adoption of advanced tile adhesives, particularly in price-sensitive markets. The scarcity of skilled labor for precise application of specialized adhesives also presents a hurdle, affecting installation quality and project timelines.

Opportunities within the market are abundant and promising. The growing emphasis on green building and sustainable construction offers a substantial avenue for manufacturers to develop and market environmentally friendly tile adhesives, aligning with global ecological mandates. The emergence of smart cities and large-scale infrastructure projects in developing nations presents vast potential for specialized, high-performance adhesive solutions. The expansion of the do-it-yourself (DIY) market, driven by easy-to-use product formulations and online tutorials, opens new customer segments. Moreover, the continuous demand for aesthetically pleasing and long-lasting tiling solutions in high-traffic commercial and public spaces provides ongoing growth opportunities for innovative product offerings. These forces collectively dictate the market's competitive intensity, innovation cycles, and overall growth potential, influencing strategic decisions of market players.

Segmentation Analysis

The Tile Adhesive Market is comprehensively segmented to provide a detailed understanding of its diverse landscape, considering various product types, chemical compositions, application areas, and end-use sectors. This segmentation helps in identifying specific market niches, understanding consumer preferences, and developing targeted marketing strategies. The market is broadly categorized by product type, focusing on the fundamental chemical makeup of the adhesives, and by application, delineating where these adhesives are predominantly used. Further sub-segmentation allows for a granular analysis of market dynamics, enabling stakeholders to pinpoint high-growth areas and emerging trends across the globe. Each segment responds uniquely to economic conditions, technological advancements, and regional construction trends, making a detailed analysis crucial for strategic planning.

- By Type

- Cementitious Tile Adhesives

- Standard (C1)

- Improved (C2)

- Fast Setting (F)

- Flexible (S1, S2)

- Dispersion Tile Adhesives (D1, D2)

- Epoxy Tile Adhesives (R1, R2)

- Reactive Resin Adhesives

- Polymer Modified Adhesives

- Ready to Use Adhesives

- Cementitious Tile Adhesives

- By Application

- Floor Tiling

- Wall Tiling

- Ceiling Tiling

- Exterior Applications

- Specialized Applications (e.g., swimming pools, industrial floors, wet areas)

- By End-Use Sector

- Residential (New Construction, Renovation & Repair)

- Commercial (Hotels, Offices, Retail, Healthcare, Educational Institutions)

- Industrial (Factories, Warehouses)

- Infrastructure (Airports, Railway Stations)

- By Material Type of Tile

- Ceramic Tiles

- Porcelain Tiles

- Natural Stone Tiles (Marble, Granite)

- Mosaic Tiles

- Large Format Tiles

Value Chain Analysis For Tile Adhesive Market

The value chain for the Tile Adhesive Market is a complex network involving several stages, beginning with the sourcing of raw materials and culminating in the final application by end-users. The upstream segment involves suppliers of critical raw materials such as cement, polymers (like redispersible polymer powder, acrylics), sand, and various chemical additives including thickeners, plasticizers, and accelerators. These suppliers often operate in fragmented markets, and their pricing and availability directly impact the production costs of tile adhesives. Efficient procurement and quality control at this stage are paramount for manufacturers to maintain competitive pricing and consistent product quality, requiring robust relationships with a diverse range of suppliers.

The core of the value chain lies in the manufacturing and formulation of tile adhesives, where raw materials are processed, blended, and packaged into final products. Manufacturers invest significantly in research and development to innovate new formulations that meet evolving market demands for performance, sustainability, and ease of use. Once manufactured, the products move through a sophisticated distribution channel. This involves both direct and indirect distribution. Direct channels typically include sales directly to large construction companies, major contractors, and infrastructure projects, allowing for tailored solutions and bulk purchasing. Indirect channels are more prevalent, utilizing a network of wholesalers, distributors, retail outlets (including hardware stores and big-box retailers), and increasingly, e-commerce platforms.

The downstream segment of the value chain focuses on the end-users and the services associated with product application. This includes professional tilers, general contractors, developers, and individual homeowners involved in DIY projects. The effectiveness of the tile adhesive largely depends on correct application, thus training and technical support provided by manufacturers or distributors become crucial. Post-sale services, warranty, and feedback mechanisms also form an integral part of this stage, influencing brand loyalty and market reputation. Each stage adds value, and optimizing processes across the entire chain from raw material acquisition to final application is essential for achieving cost efficiencies, enhancing product quality, and ensuring customer satisfaction in the competitive tile adhesive market.

Tile Adhesive Market Potential Customers

The potential customers for tile adhesives span a broad spectrum, encompassing various entities involved in construction, renovation, and interior design across different sectors. Primarily, professional contractors and construction companies represent a significant portion of the market, as they undertake large-scale residential, commercial, and industrial projects requiring high volumes of reliable adhesive solutions. These customers often prioritize performance specifications, consistency, and bulk pricing. Developers of real estate, whether for residential complexes, commercial spaces, or hospitality projects, also form a core customer base, influencing product selection through their project specifications and procurement policies, often driven by both cost-effectiveness and long-term durability requirements.

Individual homeowners and DIY enthusiasts constitute another rapidly growing segment of potential customers. This group increasingly engages in home renovation and improvement projects, opting for user-friendly, ready-to-use, and often specialized tile adhesive products available through retail channels. Their purchasing decisions are often influenced by ease of application, brand reputation, and specific aesthetic or functional needs for smaller-scale projects. Architectural firms and interior designers, while not direct buyers, significantly influence product choices by specifying particular types of adhesives in their designs, especially for projects demanding specific technical properties or aesthetic outcomes.

Beyond these, specialized industries and public sector entities also emerge as key buyers. This includes institutions like hospitals, schools, and government buildings that require highly durable and sometimes anti-bacterial or chemical-resistant adhesives for specific applications. Infrastructure development projects, such as airports, metro stations, and public spaces, necessitate robust, long-lasting tile adhesives capable of withstanding heavy foot traffic and varied environmental conditions. The diversity of these end-users underscores the need for manufacturers to offer a wide range of products, catering to varying technical requirements, project scales, and budget considerations, while maintaining a strong focus on distribution network efficiency to reach all customer segments effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 3.85 billion |

| Market Forecast in 2032 | USD 6.15 billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ardex GmbH, BASF SE, Bostik SA (Arkema Group), Building Adhesives Limited (BAL), Custom Building Products, H.B. Fuller Company, Henkel AG & Co. KGaA, Laticrete International Inc., Mapei S.p.A., Pidilite Industries Ltd., Saint-Gobain (Weber), Sika AG, The Dow Chemical Company, UltraTileFix (Instarmac Group plc), W. R. Meadows, Inc., DAP Global Inc., Kerakoll SpA, ParexGroup (Soprema Group), Prince Group, CEMEX S.A.B. de C.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tile Adhesive Market Key Technology Landscape

The Tile Adhesive Market is characterized by a dynamic and evolving technology landscape, with continuous advancements aimed at enhancing product performance, sustainability, and ease of application. A prominent technological development is the widespread adoption of polymer modification, where various polymers like acrylics, vinyl acetate ethylene (VAE) copolymers, and styrene-butadiene rubber (SBR) are incorporated into cementitious formulations. This modification significantly improves flexibility, adhesion strength, water resistance, and deformability, making adhesives suitable for a wider range of challenging substrates and large-format tiles, and reducing the risk of cracking due to substrate movement or thermal expansion.

Another crucial technological trend involves the development of rapid-setting and quick-drying formulations. These technologies enable faster project completion, reducing downtime and improving efficiency for contractors, which is particularly beneficial in commercial and renovation projects where speed is critical. Furthermore, the industry is increasingly focusing on green chemistry, leading to the innovation of low VOC (Volatile Organic Compound) and formaldehyde-free adhesives. These environmentally friendly products align with stringent building regulations and consumer demand for healthier indoor air quality, contributing to sustainable construction practices and enhancing product marketability across eco-conscious regions. Innovations in lightweight adhesive technology are also gaining traction, particularly for vertical applications and when tiling over existing finishes, reducing structural load and making installation easier.

Self-leveling compounds are another significant technological advancement, designed to create perfectly flat and smooth surfaces prior to tiling, thereby improving the overall finish and longevity of the tiled surface. Technologies that provide enhanced moisture resistance and anti-efflorescence properties are crucial for wet areas like bathrooms, kitchens, and swimming pools, preventing discoloration and degradation of the tile grout and adhesive layer over time. Moreover, nanotechnology is beginning to influence adhesive formulations, with nanoparticles potentially enhancing bond strength, durability, and resistance to environmental factors. Digitalization and automation in manufacturing processes are also contributing to higher consistency and quality in adhesive production, ensuring that advanced formulations are reliably delivered to the market, further cementing the role of technology as a primary driver of market evolution and competitive differentiation.

Regional Highlights

- North America: This mature market is characterized by a strong emphasis on renovation and remodeling projects, particularly in residential and commercial sectors. Demand is driven by stringent building codes and a preference for high-performance, specialized adhesives that offer durability and longevity. Innovations in sustainable and low VOC products are also significant, with key markets including the United States and Canada.

- Europe: The European market demonstrates steady growth, propelled by robust construction activity in Central and Eastern Europe and a strong focus on sustainable and green building practices across the continent. Strict environmental regulations necessitate the development of eco-friendly and high-quality adhesive solutions. Renovation of historical buildings and infrastructure upgrades are also significant contributors, with Germany, the UK, France, and Italy being major players.

- Asia Pacific (APAC): APAC is the leading and fastest-growing region in the tile adhesive market, fueled by rapid urbanization, massive infrastructure development, and a burgeoning housing sector. Countries like China and India are at the forefront of this expansion, driven by increasing disposable incomes and a growing demand for modern residential and commercial spaces. Southeast Asian nations are also witnessing substantial growth due to foreign investments and construction booms.

- Latin America: This region presents a developing market with significant potential, marked by increasing construction activities and urbanization trends in countries such as Brazil, Mexico, and Argentina. While still nascent compared to APAC, growing investments in residential and commercial projects, coupled with a rising middle class, are contributing to a steady increase in demand for tile adhesives.

- Middle East and Africa (MEA): The MEA region is experiencing substantial growth, primarily driven by mega-construction projects, infrastructure development, and a rapidly expanding tourism and hospitality sector, particularly in the GCC countries. Government initiatives to diversify economies and attract investment are spurring significant real estate and commercial developments, increasing the need for quality tiling solutions in countries like Saudi Arabia, UAE, and Qatar.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tile Adhesive Market.- Ardex GmbH

- BASF SE

- Bostik SA (Arkema Group)

- Building Adhesives Limited (BAL)

- Custom Building Products

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Laticrete International Inc.

- Mapei S.p.A.

- Pidilite Industries Ltd.

- Saint-Gobain (Weber)

- Sika AG

- The Dow Chemical Company

- UltraTileFix (Instarmac Group plc)

- W. R. Meadows, Inc.

- DAP Global Inc.

- Kerakoll SpA

- ParexGroup (Soprema Group)

- Prince Group

- CEMEX S.A.B. de C.V.

Frequently Asked Questions

What is the primary factor driving the growth of the Tile Adhesive Market?

The primary factor driving the growth of the Tile Adhesive Market is rapid urbanization and the escalating number of construction and renovation projects worldwide, particularly in emerging economies, leading to increased demand for efficient and durable tiling solutions.

What are the main types of tile adhesives available in the market?

The main types of tile adhesives include cementitious (standard, improved, fast setting, flexible), dispersion, and epoxy adhesives, each offering distinct performance characteristics for various applications and substrates.

How do environmental regulations impact the Tile Adhesive Market?

Environmental regulations, particularly those concerning Volatile Organic Compounds (VOCs) and sustainable manufacturing, compel manufacturers to innovate and develop eco-friendly, low-VOC formulations, influencing product development and market competition.

Which region is expected to dominate the Tile Adhesive Market, and why?

The Asia Pacific region is expected to dominate the Tile Adhesive Market due to extensive infrastructure development, rapid urbanization, a booming housing sector, and increasing disposable incomes in countries like China and India.

What technological advancements are shaping the tile adhesive industry?

Technological advancements shaping the industry include polymer modification for enhanced flexibility, rapid-setting formulations for faster installation, low-VOC products for sustainability, and lightweight adhesives for easier application.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Heavy Brick Type Tile Adhesive Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Ceramic Tile Adhesive Market Statistics 2025 Analysis By Application (Stone Floor Pasting, Tiled Floor Pasting, Polyethylene Floor Pasting, Wood Floor Pasting), By Type (Cementitious Adhesive, Dispersion Adhesive, Reaction Resin Adhesive), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager