Tire Changing Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430447 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Tire Changing Machines Market Size

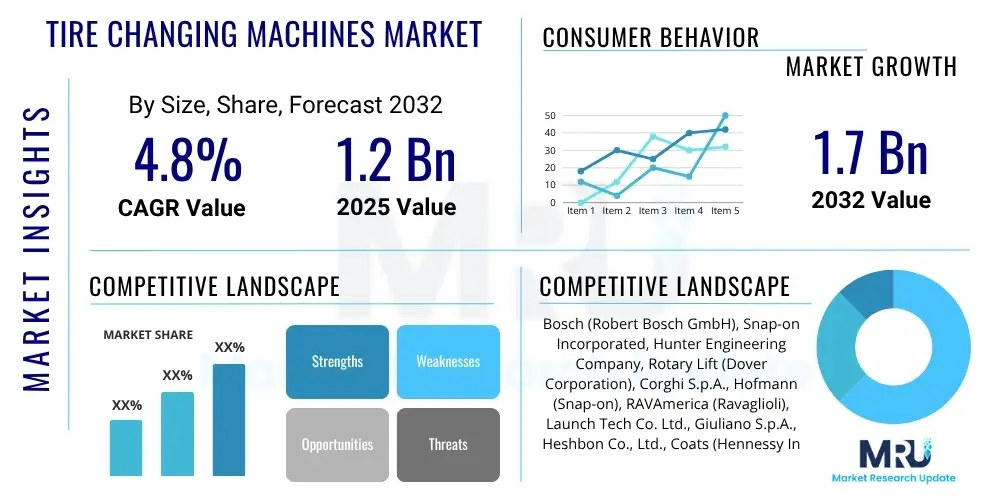

The Tire Changing Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2032. The market is estimated at USD 1.2 Billion in 2025 and is projected to reach USD 1.7 Billion by the end of the forecast period in 2032.

Tire Changing Machines Market introduction

Tire changing machines represent an indispensable category of garage and workshop equipment designed to facilitate the intricate process of mounting and demounting vehicle tires from their corresponding wheels. These sophisticated devices are engineered to dramatically reduce the physical labor, time, and potential for damage associated with manual tire changing methods. Their widespread adoption across the global automotive service industry underscores their critical role in maintaining vehicle safety and performance, catering to a diverse range of vehicles from compact passenger cars to robust commercial trucks, motorcycles, and specialized industrial equipment. The fundamental value proposition of these machines lies in their ability to streamline a labor-intensive task, ensuring both efficiency and precision in tire servicing operations.

The primary applications of tire changing machines are pervasive throughout the automotive aftermarket and vehicle maintenance sectors. They are standard equipment in independent automotive repair garages, authorized franchised dealerships, dedicated tire service centers, and commercial fleet maintenance facilities. Beyond these traditional settings, specialty shops catering to racing vehicles, heavy construction machinery, and agricultural equipment also rely heavily on specialized variants of these machines. Key benefits derived from their use include substantial improvements in operational throughput, a significant reduction in labor costs per tire change, enhanced safety protocols for technicians by minimizing strenuous physical strain, and a notable decrease in the likelihood of damage to expensive alloy wheels or modern low-profile tires during the changing process. Advanced features such as pneumatic bead breakers, automatic wheel clamping mechanisms, and revolutionary leverless technology further amplify these advantages, making the process more intuitive and less prone to error.

Several driving factors are propelling the sustained growth of the Tire Changing Machines Market. Foremost among these is the continuous expansion of the global vehicle parc, which naturally escalates the demand for regular tire maintenance, repairs, and replacements. Coupled with this, ongoing technological advancements within the automotive industry, particularly the evolution of complex wheel and tire designs including run-flat tires, ultra-high-performance tires, and large-diameter alloy wheels, necessitate the use of specialized, high-precision machinery. These modern tire configurations are often challenging, if not impossible, to service effectively with older or manual equipment. Furthermore, a rising emphasis on automotive safety standards, the increasing complexity of tire pressure monitoring systems (TPMS), and the persistent need for service centers to enhance efficiency and customer satisfaction are all significant contributors to the market's robust trajectory. The shift towards electric vehicles (EVs), which often have unique tire characteristics and weight distribution, is also creating new demands for advanced tire changing solutions capable of handling these specific requirements.

Tire Changing Machines Market Executive Summary

The Tire Changing Machines Market is set for consistent and dynamic expansion, underpinned by strong underlying business trends that reflect a thriving global automotive sector and an increasingly sophisticated aftermarket service landscape. Key among these trends is the pervasive drive towards automation and digitalization within workshop environments, as service providers seek to optimize operational efficiencies, reduce reliance on highly skilled manual labor, and accommodate the servicing requirements of modern, complex vehicle architectures. Manufacturers are actively responding by innovating with products that offer enhanced automation, ergonomic design, and integrated diagnostic capabilities, thereby supporting workshops in delivering faster, more precise, and higher-quality tire services. The focus on developing multi-functional machines that can handle a wide array of tire types, from standard passenger car tires to specialty and heavy-duty applications, remains a critical strategic imperative.

Regional dynamics present a diverse picture of market maturity and growth potential. Developed regions such as North America and Europe, characterized by high labor costs and stringent safety regulations, exhibit a robust demand for premium, highly automated, and technologically advanced tire changing solutions. These markets are driven by the need for maximum efficiency and precision, catering to a discerning customer base and sophisticated vehicle fleets. In stark contrast, the Asia Pacific region is rapidly emerging as the foremost growth engine, propelled by burgeoning vehicle sales, extensive infrastructure development, and a burgeoning middle class across economies like China, India, and Southeast Asian nations. This region is witnessing significant investment in automotive service infrastructure, driving demand for both entry-level and advanced semi-automatic and automatic machines. Latin America, along with the Middle East and Africa, represents markets with growing opportunities, though demand often skews towards more cost-effective and durable equipment, reflecting varying economic development stages and automotive market structures.

Segmentation analysis reveals pivotal shifts in product preference and application focus. The automatic and leverless tire changing machine segments are experiencing accelerated adoption rates, especially in developed markets, due to their superior performance, enhanced safety features, and ability to handle delicate and complex wheel assemblies without damage. While passenger vehicle applications continue to command the largest market share, the heavy commercial vehicle (HCV) and light commercial vehicle (LCV) segments are demonstrating significant growth. This is largely attributable to the increasing volume of logistics and transportation operations globally, necessitating efficient in-house tire maintenance solutions to minimize fleet downtime. Furthermore, the integration of tire changing capabilities with wheel balancing and alignment systems into a single, cohesive workshop solution is a noticeable trend, driven by the desire for streamlined workflows, improved diagnostic accuracy, and overall enhanced productivity across the diverse spectrum of end-users, from small independent repair shops to large, multi-brand dealerships.

AI Impact Analysis on Tire Changing Machines Market

Users are increasingly curious about the transformative potential of Artificial Intelligence (AI) within the tire changing machines market, often posing questions centered on its role in achieving higher levels of automation, precision, and operational intelligence. Common inquiries delve into whether AI can facilitate fully autonomous tire changing processes, improve the accuracy of related services like wheel balancing and alignment, or enable predictive maintenance for the machinery itself. The overarching sentiment is one of anticipation regarding AI's capacity to enhance workshop efficiency, minimize human error, and provide actionable, data-driven insights for optimized service delivery and business management. Stakeholders are particularly keen on understanding how AI can contribute to superior customer service, extend tire lifespan through better diagnostics, and simplify complex procedures for technicians, thereby addressing the persistent challenges of skill shortages and rising labor costs in the automotive aftermarket.

However, alongside these high expectations, there are inherent concerns regarding the practical implementation of AI in this domain. Users often express reservations about the substantial upfront investment required for integrating AI technologies, the potential need for extensive specialized training for workshop personnel, and the reliability and adaptability of AI systems in dynamic and sometimes harsh workshop environments. The critical issue of data privacy and security, especially when AI systems collect and process vehicle or customer data, also frequently arises. Furthermore, there is a legitimate concern about the potential for job displacement among skilled tire technicians, as increasingly intelligent machines take over more complex tasks. Despite these challenges, the general consensus points towards a future where AI will play an indispensable role in revolutionizing tire service operations, moving beyond simple automation to intelligent assistance and autonomous execution.

- Enhanced Diagnostic Capabilities: AI-powered sensor arrays and vision systems can meticulously analyze tire conditions, including wear patterns, tread depth uniformity, sidewall integrity, and pressure inconsistencies. This enables highly accurate and predictive diagnostics for optimal service recommendations and proactive maintenance, extending tire life and ensuring vehicle safety.

- Predictive Maintenance for Machines: Sophisticated AI algorithms continuously monitor the operational parameters, vibrations, and performance metrics of tire changing machines. By identifying subtle anomalies and trends, AI can accurately predict potential mechanical failures or required maintenance intervals, thereby minimizing unexpected downtime, optimizing maintenance schedules, and significantly extending the operational lifespan of expensive equipment.

- Automated and Autonomous Operations: The integration of AI with advanced robotics and sophisticated computer vision systems is paving the way for increasingly autonomous tire mounting, demounting, and inflation processes. This minimizes direct human intervention, reduces physical strain on technicians, ensures consistent execution, and drastically improves overall service speed and throughput.

- Optimized Wheel Balancing and Alignment: AI can process vast quantities of data from advanced wheel balancers and alignment systems, factoring in tire characteristics, wheel dynamics, and vehicle specifications. This allows AI to precisely calculate and recommend optimal counterweights or alignment adjustments, resulting in superior vehicle handling, reduced vibration, and maximized tire longevity.

- Intelligent Training and Support: AI-driven augmented reality (AR) or virtual reality (VR) platforms can provide highly immersive and interactive training simulations for technicians, guiding them through complex tire changing procedures, troubleshooting machine issues, and familiarizing them with new technologies. This addresses skill gaps and accelerates the learning curve for advanced equipment.

- Smart Inventory Management: AI can analyze historical sales data, seasonal trends, and upcoming service schedules to predict demand for specific tire types and machine spare parts. This optimization leads to more efficient inventory management, reducing carrying costs, preventing stockouts, and ensuring the right components are available when needed.

- Advanced Quality Control and Error Detection: AI-powered vision systems are capable of real-time monitoring during the tire changing process, detecting minute errors, potential damages to rims or tires, and ensuring adherence to stringent quality standards. This proactive error detection minimizes rework and enhances customer satisfaction.

- Customized Service Recommendations and Customer Engagement: By leveraging AI to analyze individual vehicle service history, driving patterns, and customer preferences, workshops can offer highly personalized tire service recommendations, proactive reminders, and targeted promotions, thereby fostering stronger customer loyalty and increasing service revenue.

DRO & Impact Forces Of Tire Changing Machines Market

The Tire Changing Machines Market is primarily propelled by a confluence of robust drivers. A significant factor is the consistently expanding global vehicle parc, which naturally translates into an escalating demand for routine tire maintenance, repair, and replacement services across all vehicle categories. This fundamental need for tire servicing forms the bedrock of market growth. Concurrently, continuous advancements in automotive technology, particularly the development of more complex and specialized wheel and tire assemblies such as run-flat tires, ultra-high-performance tires, and larger diameter alloy wheels, necessitate the use of advanced, precise, and automated tire changing equipment. These modern tire configurations are often challenging, if not impossible, to service manually or with outdated machinery, thereby compelling service providers to invest in contemporary solutions. Furthermore, the pervasive trend towards greater operational efficiency, enhanced safety standards in workshops, and the imperative for faster service turnaround times also act as strong driving forces, pushing workshops to adopt automated and ergonomic machines.

Despite these growth enablers, the market contends with several inherent restraints. The substantial initial investment cost associated with purchasing high-end, technologically advanced tire changing machines can be a significant barrier for smaller independent garages or new entrants, particularly in developing economies where capital access might be limited. Economic volatility, including inflation, currency fluctuations, and disruptions in global supply chains for raw materials and components, can negatively impact manufacturing costs and product pricing, consequently affecting demand. Another critical restraint is the growing shortage of skilled technicians capable of operating, maintaining, and troubleshooting increasingly complex and AI-integrated tire changing equipment. The learning curve associated with new technologies can deter adoption. Additionally, environmental regulations pertaining to noise pollution, energy consumption, and the disposal of older machinery or waste materials pose operational and compliance challenges for manufacturers and service providers alike, requiring adherence to stricter standards.

The market is profoundly influenced by a diverse array of impact forces. Technologically, the relentless pace of innovation continuously reshapes the market, introducing features like leverless operation, integrated diagnostics, and smart connectivity, which redefine efficiency and precision in tire servicing. Regulatory forces, including vehicle safety standards, workshop operational safety guidelines, and environmental protection mandates, directly influence product design, manufacturing processes, and market access. Economically, global and regional economic growth rates, consumer spending patterns, and business investment cycles dictate the purchasing power and willingness of workshops to upgrade their equipment. The competitive landscape is intensely dynamic, with both established giants and agile innovators vying for market share through product differentiation, pricing strategies, and service excellence. Lastly, social trends, such as evolving consumer expectations for quick, convenient, and high-quality vehicle servicing, as well as an increasing awareness regarding tire safety and performance, indirectly but significantly shape the demand for advanced tire changing solutions. These forces interact to create a complex yet opportunity-rich market environment.

Segmentation Analysis

The Tire Changing Machines Market undergoes comprehensive segmentation across multiple dimensions, providing a granular and insightful framework for understanding its intricate dynamics. This detailed classification enables market participants, including manufacturers, distributors, and service providers, to accurately identify specific market niches, assess growth trajectories, and formulate targeted strategies. The segmentation process is crucial for discerning varied customer needs, technological preferences, and application-specific demands within the diverse global automotive aftermarket. By categorizing the market based on operational methodology, vehicle compatibility, end-user type, distribution mechanisms, underlying technology, and wheel handling capabilities, stakeholders gain a nuanced perspective on market structure and evolving trends.

Each segment reflects distinct market characteristics and growth drivers. For instance, the "By Operation Type" segment highlights the ongoing shift from purely manual systems to more advanced automatic and leverless machines, indicative of the industry's drive towards automation and efficiency. The "By Vehicle Type" segmentation underscores the diverse requirements across different vehicle categories, ranging from the delicate handling needed for passenger car tires to the robust capabilities demanded by heavy commercial vehicle tires. Similarly, the "By End-User" breakdown illustrates how various types of service outlets, from small independent garages to large franchised dealerships, have unique investment patterns and operational priorities when acquiring tire changing equipment. This multifaceted segmentation serves as a critical analytical tool for strategic planning and competitive positioning within the tire changing machines industry.

- By Operation Type: This segment categorizes machines based on their level of automation and operational methodology.

- Manual Tire Changers: Basic machines requiring significant physical effort, suitable for low-volume shops or entry-level markets.

- Semi-Automatic Tire Changers: Incorporate pneumatic or hydraulic assistance for certain functions, reducing manual strain and increasing efficiency compared to manual types.

- Automatic Tire Changers: Offer a higher degree of automation, performing most operations (clamping, bead breaking, mounting/demounting) with minimal technician intervention, enhancing speed and precision.

- Leverless Tire Changers: An advanced type of automatic machine that eliminates the traditional tire lever, preventing wheel damage and simplifying work with delicate or run-flat tires.

- By Vehicle Type: This segmentation focuses on the type of vehicle whose tires the machine is designed to service, reflecting varying sizes, weights, and complexity of wheels and tires.

- Passenger Cars: Machines optimized for standard cars, SUVs, and light crossovers, balancing speed with gentle handling.

- Light Commercial Vehicles (LCVs): Equipment designed for vans, pick-up trucks, and smaller commercial vehicles, requiring more robust capabilities than passenger car changers.

- Heavy Commercial Vehicles (HCVs): Specialized, heavy-duty machines built to handle large, heavy tires and wheels found on trucks, buses, and trailers, often featuring hydraulic power.

- Motorcycles: Compact and precise machines tailored for the unique requirements of motorcycle wheels and tires, preventing rim damage.

- Off-Road Vehicles (ORVs) / Industrial: Robust changers for large, rugged tires used on agricultural machinery, construction equipment, and ATVs, built for durability and high torque.

- By End-User: This segment differentiates buyers based on their business model and operational scale, influencing their purchasing decisions for equipment features and price points.

- Automotive Repair Shops: General repair facilities seeking versatile machines to service a broad range of vehicles.

- Franchised Dealerships: Often require high-end, OEM-approved, and technologically advanced machines to meet specific brand standards and handle new vehicle technologies.

- Tire Service Centers: Businesses exclusively focused on tire sales, installation, and repair, demanding high-throughput, reliable machines for continuous operation.

- Commercial Fleet Operators: Companies managing their own vehicle fleets (e.g., logistics, municipal) that invest in heavy-duty changers for in-house maintenance to reduce downtime.

- Independent Garages: Smaller, locally-owned shops often prioritizing cost-effectiveness and ease of use for general servicing.

- Specialty Shops: Outlets catering to specific markets like performance tuning, custom wheels, or classic cars, requiring specialized or precision-oriented equipment.

- By Distribution Channel: This segmentation outlines the primary avenues through which tire changing machines reach their end-users.

- Online: E-commerce platforms and manufacturer websites offering convenience and sometimes competitive pricing, often for smaller units or accessories.

- Offline (Direct Sales, Distributors): Traditional channels including direct sales teams from manufacturers, large equipment distributors, and specialized automotive tool retailers providing sales, installation, and after-sales support.

- By Technology: This segment refers to the underlying operational mechanism or power source of the machine.

- Pneumatic: Machines primarily using compressed air for various functions, known for reliability and common in most workshops.

- Electro-Hydraulic: Systems that combine electric motors with hydraulic power for robust and precise operations, typically found in heavy-duty or advanced automatic changers.

- Hybrid: Machines that integrate aspects of both pneumatic and electro-hydraulic systems to optimize performance and efficiency.

- By Wheel Diameter Capability: This categorizes machines based on the maximum wheel diameter they can effectively and safely handle.

- Small (Up to 20 inches): Suited for smaller passenger cars and motorcycles.

- Medium (20-26 inches): Covers a wide range of passenger cars, SUVs, and light commercial vehicles.

- Large (Above 26 inches): Designed for heavy-duty commercial vehicles, large SUVs, and specialized industrial equipment with oversized wheels.

Value Chain Analysis For Tire Changing Machines Market

The value chain for the Tire Changing Machines Market is a complex ecosystem, beginning with the critical upstream activities focused on the sourcing, processing, and manufacturing of essential raw materials and specialized components. This initial stage involves a global network of suppliers providing high-grade steel and aluminum for frames and structural parts, advanced plastics for protective covers and operational interfaces, and sophisticated electronic components for control systems, sensors, and diagnostics. Key upstream partners include metal foundries, precision engineering firms for pneumatic and hydraulic cylinders, motor manufacturers, and advanced electronics providers. The efficiency and quality at this foundational level are paramount, directly influencing the final product's performance, durability, and cost-effectiveness. Manufacturers often engage in strategic partnerships and rigorous supplier qualification processes to ensure a consistent supply of high-quality, competitively priced inputs.

Moving into the midstream, the core activities revolve around the design, engineering, assembly, and stringent quality control of the tire changing machines by the original equipment manufacturers (OEMs). This phase is characterized by significant investment in research and development (R&D) to integrate cutting-edge features such as leverless technology, automatic wheel clamping, laser-guided systems, and digital interfaces. The manufacturing process involves precision machining, welding, assembly of complex sub-systems (e.g., bead breaking arms, turntables, control consoles), and extensive testing to ensure functionality, safety, and compliance with international standards. Innovation in this stage is crucial for competitive differentiation, allowing manufacturers to introduce ergonomic designs, enhanced automation, and smart functionalities that meet the evolving demands of the automotive service industry. This stage defines the technological prowess and reliability of the final product.

Downstream activities encompass the distribution, sales, installation, and comprehensive after-sales support of the tire changing machines to end-users. Distribution channels are varied, including direct sales efforts by manufacturers to large franchised dealerships or commercial fleet operators who often require customized solutions and extensive training. Indirect channels, which form a substantial portion of the market, involve a robust network of specialized automotive equipment distributors, wholesalers, and retail chains that cater to independent garages and smaller workshops. These intermediaries play a crucial role in market penetration, providing localized sales, inventory management, and technical expertise. After-sales service, including warranty support, routine maintenance, timely provision of spare parts, and remote or on-site technical assistance, is a critical component of customer satisfaction and brand loyalty. The integration of online platforms for information, sales support, and even remote diagnostics is also gaining traction, enhancing the reach and responsiveness of the downstream segment and ensuring a seamless end-to-end customer experience.

Tire Changing Machines Market Potential Customers

The ecosystem of potential customers and end-users for tire changing machines is broad and diverse, reflecting the universal need for tire maintenance across various segments of the automotive and transportation industries. Foremost among these are independent automotive repair shops, which form the backbone of local vehicle servicing. These establishments require versatile, reliable, and often cost-effective machines capable of handling a wide range of vehicle types and tire complexities. Their purchasing decisions are primarily influenced by the need for operational efficiency, durability, ease of use for multiple technicians, and a strong return on investment, making semi-automatic and mid-range automatic models particularly attractive to cater to a diverse customer base and manage overheads effectively.

Franchised dealerships, representing specific automotive brands, constitute another critical customer segment. These entities typically demand high-end, technologically advanced, and often OEM-approved tire changing solutions that align with the specific technical standards and advanced vehicle technologies of their respective manufacturers. Precision, speed, and the ability to seamlessly integrate with other workshop equipment and diagnostic systems are paramount for dealerships, as they cater to newer vehicle models often equipped with run-flat tires, sophisticated TPMS, and delicate alloy wheels. Commercial fleet operators, encompassing trucking companies, public transportation services, logistics firms, and rental agencies, represent a rapidly growing segment. They invest significantly in heavy-duty tire changing machines for in-house maintenance facilities to minimize vehicle downtime, optimize operational costs, and ensure consistent service quality for their extensive fleets, which often involve specialized and oversized tires.

Specialized tire service centers, dedicated exclusively to tire sales, mounting, balancing, and repair, are quintessential high-volume users. These centers require robust, high-throughput automatic or leverless machines capable of continuous, heavy-duty operation and equipped with advanced features for handling complex tire assemblies efficiently. Motorcycle repair shops, off-road vehicle (ORV) and ATV service centers, and industrial equipment maintenance facilities also represent important niche segments. They require specialized tire changing machines tailored to their unique wheel and tire dimensions and operational demands, focusing on precision and prevention of damage to often-expensive and sensitive rims. Furthermore, the burgeoning trend of vehicle customization, performance tuning, and the restoration of classic cars creates a market for advanced and precision-oriented tire changing solutions in specialty and bespoke modification shops, showcasing the breadth of the market's customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.2 Billion |

| Market Forecast in 2032 | USD 1.7 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch (Robert Bosch GmbH), Snap-on Incorporated, Hunter Engineering Company, Rotary Lift (Dover Corporation), Corghi S.p.A., Hofmann (Snap-on), RAVAmerica (Ravaglioli), Launch Tech Co. Ltd., Giuliano S.p.A., Heshbon Co., Ltd., Coats (Hennessy Industries, a Dover Company), SICE (Nexion S.p.A.), Nussbaum Automotive Lifts LP, CEMB Hofmann (part of CEMB S.p.A.), Bright Technology (Guangzhou Brightway Autocare Equipment Co., Ltd.), Twin Busch GmbH, Autel Intelligent Technology Corp., Ltd., FASEP S.r.l., Unite (Guangzhou Unite Auto Equipment Co., Ltd.), Ranger Products (BendPak Inc.), Tecnomotor S.p.A., M&B Engineering S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tire Changing Machines Market Key Technology Landscape

The technological landscape of the Tire Changing Machines Market is characterized by continuous innovation aimed at enhancing efficiency, precision, and safety while accommodating the increasing complexity of modern vehicle wheels and tires. At its core, the operational technology relies heavily on robust pneumatic and electro-hydraulic systems, which provide the necessary power and control for critical functions such as bead breaking, wheel clamping, and the precise manipulation required for mounting and demounting. Advanced control systems, often incorporating microprocessors and programmable logic controllers (PLCs), are integral for orchestrating these movements with high accuracy and repeatability, significantly mitigating the risk of damage to delicate rims or sophisticated tire constructions. A prominent advancement has been the widespread adoption of leverless technology, which fundamentally redesigns the mounting head to eliminate the need for a traditional tire lever, thus protecting expensive alloy wheels from scratches and simplifying the process for run-flat and low-profile tires.

Further driving the technological evolution are integrated diagnostic capabilities and sophisticated sensor technologies. Modern machines frequently feature laser-guided systems for exact wheel positioning, precise bead breaking, and accurate run-out measurement, ensuring optimal balance and fitment. Vision systems are increasingly being incorporated for automatic tire identification, detailed inspection of tire and wheel integrity, and even for identifying specific tire damage before the changing process begins. The trend towards the convergence of tire changing machines with other essential workshop equipment, such as wheel balancers and alignment systems, into integrated service bays is another significant development. This holistic approach, often facilitated by advanced software interfaces and network connectivity, allows for seamless data transfer, centralized control, and optimized workflow, leading to substantial improvements in overall workshop productivity, diagnostic accuracy, and vehicle turnaround times. This integration is vital for workshops aiming to offer comprehensive and efficient tire services in a single, streamlined process.

Looking ahead, the market is rapidly embracing smart technologies, ushering in a new era of connectivity and intelligence. Internet of Things (IoT) integration enables features like remote diagnostics, allowing manufacturers to troubleshoot issues off-site and push software updates, thereby reducing downtime. Predictive maintenance, powered by IoT sensors and data analytics, can anticipate potential machine failures before they occur, enabling proactive servicing and extending equipment lifespan. Artificial Intelligence (AI) and Machine Learning (ML) are beginning to play a transformative role, from providing guided step-by-step procedures for complex tasks to potentially automating decision-making based on tire characteristics and historical data. Ergonomic design principles, intuitive touch-screen interfaces, and the development of energy-efficient motors are also crucial aspects of the contemporary technology landscape, enhancing user experience, minimizing operational fatigue, and contributing to environmental sustainability. These comprehensive technological advancements are collectively poised to make tire service operations faster, safer, more precise, and more adaptable to the evolving demands of a diverse vehicle fleet, including the unique requirements posed by electric vehicles (EVs).

Regional Highlights

- North America: This region represents a mature and highly developed market for tire changing machines, characterized by a substantial demand for automated, technologically advanced, and premium-segment equipment. The drive for operational efficiency, coupled with high labor costs and stringent safety regulations in countries like the United States and Canada, propels the adoption of sophisticated machines featuring leverless technology, integrated diagnostics, and smart connectivity. The large existing vehicle parc and a well-established automotive aftermarket infrastructure further underpin sustained growth, with a strong emphasis on reducing service times and enhancing technician productivity.

- Europe: Europe stands as another significant and mature market, exhibiting a robust demand for high-precision, ergonomic, and environmentally compliant tire changing solutions. Countries such as Germany, the United Kingdom, France, and Italy are key contributors, known for their preference for cutting-edge European-manufactured equipment that emphasizes innovation, safety, and durability. The market is driven by continuous regulatory updates, a strong focus on quality service, and the need to handle the increasing complexity of vehicle tires and wheels, including those for luxury and performance vehicles. The region also demonstrates a growing interest in energy-efficient and low-noise machinery.

- Asia Pacific (APAC): Positioned as the fastest-growing region in the global Tire Changing Machines Market, APAC is experiencing exponential expansion fueled by rapid urbanization, burgeoning vehicle sales, and a significant increase in disposable incomes across economies like China, India, Japan, South Korea, and Southeast Asian nations. This region presents immense growth opportunities for both international manufacturers and local players. The demand spectrum is broad, ranging from cost-effective semi-automatic machines for rapidly expanding independent garages to advanced automatic and leverless systems for large dealerships and modern service centers that are keeping pace with global automotive technology trends. Infrastructure development in the automotive aftermarket is a key growth catalyst.

- Latin America: This market is evolving, characterized by increasing vehicle ownership and a developing automotive service infrastructure. Countries like Brazil, Mexico, and Argentina are driving moderate growth, with demand influenced by economic conditions and investment capacity. While there is a market for basic and semi-automatic changers due to budget considerations for smaller shops, larger dealerships and fleet operators are increasingly investing in more efficient automatic machines to improve service quality and reduce operational costs. The focus here is on durable and reliable equipment that offers a strong value proposition.

- Middle East and Africa (MEA): The MEA region is experiencing steady market growth, largely attributable to increasing vehicle imports, investments in transportation infrastructure, and the expansion of automotive service networks, particularly in the Gulf Cooperation Council (GCC) countries and parts of South Africa. The market demand is highly diverse, ranging from basic manual changers for smaller, local workshops to sophisticated, heavy-duty automated systems required by large service centers and commercial fleet maintenance operations. Factors such as a growing young population, urbanization, and a developing automotive aftermarket are contributing to the positive trajectory of this region's market.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tire Changing Machines Market.- Bosch (Robert Bosch GmbH)

- Snap-on Incorporated

- Hunter Engineering Company

- Rotary Lift (Dover Corporation)

- Corghi S.p.A.

- Hofmann (Snap-on)

- RAVAmerica (Ravaglioli)

- Launch Tech Co. Ltd.

- Giuliano S.p.A.

- Heshbon Co., Ltd.

- Coats (Hennessy Industries, a Dover Company)

- SICE (Nexion S.p.A.)

- Nussbaum Automotive Lifts LP

- CEMB Hofmann (part of CEMB S.p.A.)

- Bright Technology (Guangzhou Brightway Autocare Equipment Co., Ltd.)

- Twin Busch GmbH

- Autel Intelligent Technology Corp., Ltd.

- FASEP S.r.l.

- Unite (Guangzhou Unite Auto Equipment Co., Ltd.)

- Ranger Products (BendPak Inc.)

- Tecnomotor S.p.A.

- M&B Engineering S.p.A.

Frequently Asked Questions

What is a tire changing machine and why is it essential for automotive workshops?

A tire changing machine is a specialized piece of equipment designed to safely and efficiently mount and demount vehicle tires from their wheels. It is essential for workshops because it minimizes manual labor, accelerates service times, prevents damage to expensive wheels and tires, and enhances technician safety, thereby improving overall operational efficiency and service quality in automotive maintenance.

How do automatic tire changers differ from semi-automatic ones in terms of features and benefits?

Automatic tire changers perform most functions, such as clamping, bead breaking, and mounting/demounting, through motorized and pneumatic systems with minimal manual input, offering superior speed, precision, and consistency. Semi-automatic machines, while still offering significant assistance over manual methods, require more hands-on operation from the technician for certain steps, providing a more cost-effective solution while still improving efficiency and reducing strain.

What are the key technological advancements driving innovation in the Tire Changing Machines Market?

Key technological advancements include the widespread adoption of leverless technology to prevent wheel damage, integrated diagnostic capabilities for precise wheel positioning and tire analysis, and the convergence of tire changers with wheel balancers and alignment systems. Future innovations involve IoT connectivity for remote diagnostics, AI/ML for predictive maintenance, and further automation for enhanced operational intelligence and efficiency.

Which geographical regions are expected to exhibit the highest growth in the Tire Changing Machines Market and why?

The Asia Pacific (APAC) region is projected to experience the highest growth due to rapid urbanization, increasing disposable incomes, and the booming automotive industries in countries like China and India. This surge in vehicle ownership and the expansion of automotive aftermarket services create a significant demand for both entry-level and advanced tire changing equipment across the region.

What are the primary challenges or restraints faced by the Tire Changing Machines Market?

Primary restraints include the high initial investment cost for advanced machinery, particularly for smaller businesses. Other challenges include the shortage of skilled technicians capable of operating and maintaining complex equipment, economic volatility impacting purchasing power, and supply chain disruptions affecting manufacturing costs and availability of components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager