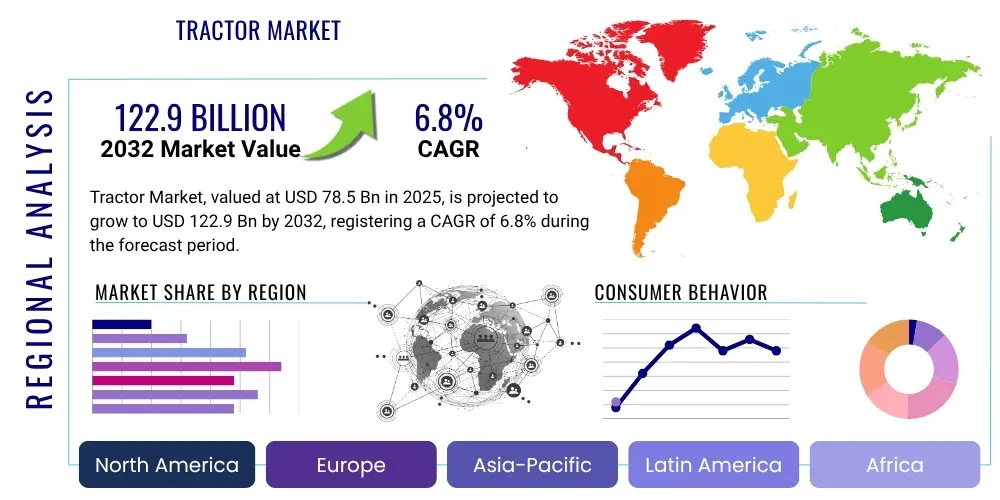

Tractor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430775 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Tractor Market Size

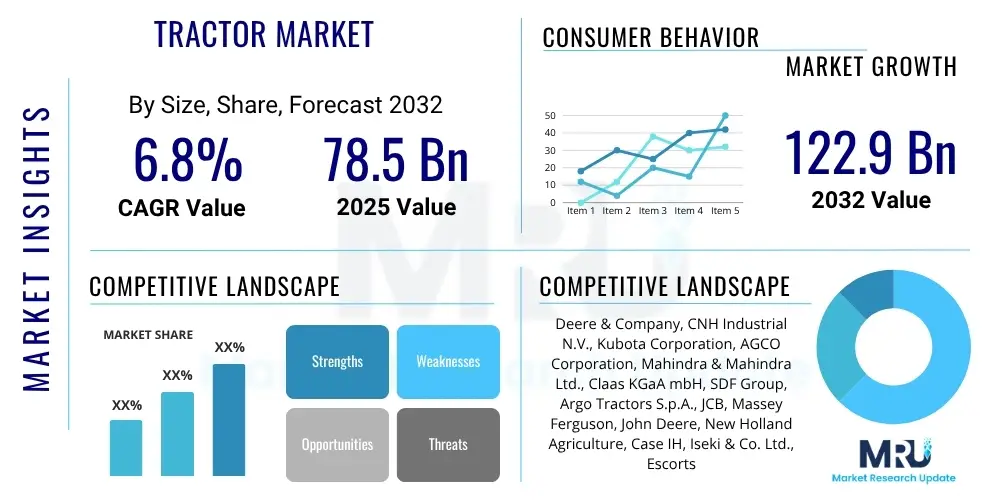

The Tractor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at $78.5 Billion in 2025 and is projected to reach $122.9 Billion by the end of the forecast period in 2032.

Tractor Market introduction

The global tractor market, a foundational pillar of the agricultural machinery sector, encompasses a diverse array of specialized vehicles engineered for executing a multitude of tasks, predominantly within farming and related industries. These robust machines are indispensable for critical agricultural processes such as initial land preparation, precise planting, efficient cultivation, timely harvesting, and the vital transportation of agricultural produce. The product spectrum is expansive, ranging from compact utility tractors designed for smaller farm holdings, horticulture, and landscaping applications, to formidable heavy-duty articulated tractors built to meet the rigorous demands of extensive commercial agricultural operations, including large-scale tilling and high-capacity hauling.

Major applications of tractors span a broad functional landscape, including mechanical plowing to break and loosen soil, thorough tilling to prepare seedbeds, precise harrowing for fine soil conditioning, accurate seeding for crop establishment, targeted spraying for pest and disease control, and efficient material handling for stacking and loading. These applications collectively contribute to a significant enhancement in operational efficiency and overall productivity across the agricultural value chain. The adoption of advanced tractor technologies offers numerous tangible benefits, notably a substantial reduction in reliance on manual labor, a marked increase in the speed and scale of field operations, improved yield potential through the timely execution of critical farming tasks, and the inherent capability to operate effectively across diverse terrains and challenging weather conditions, ensuring continuity in agricultural cycles.

Key driving factors currently propelling the expansion of the tractor market include the persistent and increasing global population, which necessitates higher levels of food production and agricultural output to meet rising demand. Furthermore, the pervasive trend of agricultural mechanization continues to gain momentum, especially in developing economies, as farmers seek to overcome labor shortages and improve operational efficiencies. Supportive government policies and incentive programs aimed at modernizing agriculture, providing subsidies for farm equipment purchases, and promoting sustainable farming practices also play a crucial role. Finally, continuous technological advancements, including the integration of GPS, telematics, and automation, are leading to the development of more efficient, precise, and sophisticated tractor models that further drive adoption and market growth.

Tractor Market Executive Summary

The global tractor market is experiencing dynamic shifts, characterized by several key business, regional, and segment trends. Business trends highlight a strong emphasis on technological innovation, with manufacturers investing heavily in research and development to integrate features like precision agriculture capabilities, telematics, and autonomous functionalities into their tractor offerings. Strategic partnerships, mergers, and acquisitions are increasingly prevalent as companies seek to consolidate market share, expand product portfolios, and gain access to new geographical markets and advanced technologies. The market also observes a growing focus on sustainability, with companies developing electric and alternative fuel tractors to meet environmental regulations and consumer demand for greener solutions, alongside an expansion in offering comprehensive service and financing packages to support customer adoption and loyalty.

Regional trends indicate a robust demand for tractors in emerging economies, particularly across Asia Pacific, Latin America, and parts of Africa, driven by increasing agricultural mechanization, government initiatives supporting farming, and a burgeoning farmer population. India and China, with their vast agricultural lands and governmental support, remain dominant markets, while Southeast Asian nations are rapidly catching up. In contrast, developed regions such as North America and Europe are witnessing demand for high-horsepower and technologically advanced tractors, with a strong focus on precision farming tools and advanced automation to optimize existing large-scale operations and address labor scarcity. These regions are also at the forefront of adopting electric and autonomous tractor technologies, setting global benchmarks for innovation.

Segment trends reveal distinct patterns across different power outputs, drive types, and applications. The mid-horsepower segment (30-70 HP and 71-130 HP) continues to dominate in terms of volume, driven by its versatility and suitability for a wide range of agricultural tasks across small to medium-sized farms. However, the high-horsepower segment (131 HP and above) is experiencing significant growth, particularly in developed agricultural markets, as large-scale farming operations prioritize efficiency and speed. In terms of drive type, 4-wheel drive tractors are gaining increasing traction due to their enhanced traction, stability, and pulling power, making them ideal for heavy-duty applications and challenging terrains. Application-wise, agriculture remains the primary segment, but construction and industrial sectors are also seeing steady demand for specialized tractors, diversifying the market landscape.

AI Impact Analysis on Tractor Market

Common user questions regarding AI's impact on the tractor market frequently revolve around how artificial intelligence will transform traditional farming practices, enhance operational efficiency, and address pressing agricultural challenges such as labor shortages and resource optimization. Users express curiosity about the specific applications of AI in tractors, including autonomous navigation, predictive maintenance, and intelligent decision-making systems for tasks like planting and harvesting. There is also a keen interest in understanding the cost implications, accessibility for smaller farms, and the potential for increased agricultural productivity and sustainability. Concerns often touch upon data privacy, the technical skills required for adoption, and the potential disruption to existing agricultural labor markets, reflecting a mix of excitement for innovation and apprehension regarding implementation hurdles. The overarching expectation is that AI will usher in an era of hyper-efficient, data-driven, and environmentally conscious farming, significantly improving yields and reducing waste.

- Enhanced precision agriculture through AI-driven sensors and analytics, optimizing planting, fertilizing, and irrigation.

- Development of fully autonomous or semi-autonomous tractors, reducing manual labor and enabling 24/7 operation.

- Predictive maintenance capabilities, utilizing AI to forecast equipment failures and minimize downtime, extending asset lifespan.

- Optimized route planning and fuel efficiency through AI algorithms, reducing operational costs and environmental impact.

- Improved yield forecasting and crop health monitoring via AI-powered image recognition and machine learning.

- Integration of AI with robotics for specialized tasks like targeted weeding and precise harvesting, minimizing waste.

- Enhanced safety features with AI-driven obstacle detection and collision avoidance systems in autonomous operations.

- Data-driven decision-making for farmers, providing actionable insights on soil conditions, weather patterns, and market trends.

DRO & Impact Forces Of Tractor Market

The Tractor Market is profoundly shaped by a complex interplay of drivers, restraints, and opportunities, alongside significant impact forces. Key drivers fueling market expansion include the burgeoning global population, which necessitates a continuous increase in food production and agricultural output, thereby escalating the demand for efficient farming machinery. The persistent trend of agricultural mechanization, particularly in developing economies, as farmers seek to mitigate labor shortages, enhance productivity, and reduce operational costs, is a crucial accelerator. Furthermore, proactive government support through subsidies, loan schemes, and modernization programs aimed at boosting agricultural output and farmer incomes significantly stimulates tractor adoption. Continuous technological advancements, such as the integration of GPS, telematics, and smart farming solutions, create a strong incentive for upgrading to more sophisticated and efficient models.

However, the market also faces considerable restraints that temper its growth trajectory. The high initial capital investment required for purchasing modern tractors, especially those equipped with advanced technologies, can be a significant barrier for small and marginal farmers, hindering widespread adoption. Stringent environmental regulations aimed at reducing emissions and promoting sustainable practices necessitate manufacturers to invest heavily in R&D for cleaner engine technologies, potentially increasing production costs and subsequently tractor prices. Additionally, the availability and cost of skilled labor required to operate and maintain technologically advanced tractors, particularly in remote agricultural areas, pose a challenge. Fluctuations in agricultural commodity prices and unpredictable weather patterns also introduce uncertainties, impacting farmers' purchasing power and investment decisions.

Amidst these challenges, substantial opportunities exist for market growth and innovation. The increasing global adoption of precision agriculture techniques and autonomous farming offers a fertile ground for manufacturers to develop and commercialize next-generation intelligent tractors capable of optimizing resource utilization and maximizing yields. The expansion into emerging markets, where mechanization levels are still relatively low, presents significant untapped potential. Furthermore, the growing trend of tractor rental services provides an alternative for farmers unable to afford outright purchase, democratizing access to modern equipment. The development of electric and hybrid tractors, driven by environmental concerns and advancements in battery technology, represents a substantial opportunity for sustainable market expansion and differentiation, attracting environmentally conscious buyers and addressing future regulatory demands. Overall, the market's direction is heavily influenced by global economic cycles, climate change impacts on agriculture, geopolitical stability affecting trade and supply chains, and the rapid pace of technological disruption reshaping traditional farming paradigms.

Segmentation Analysis

The tractor market is comprehensively segmented to provide granular insights into its diverse components, reflecting various product types, power capabilities, drive systems, and end-use applications. This segmentation allows for a detailed understanding of market dynamics, consumer preferences, and growth opportunities across different categories. The primary segmentation criteria include power output, which categorizes tractors based on their engine horsepower; drive type, distinguishing between two-wheel and four-wheel drive systems; and application, identifying the primary industry or purpose for which the tractor is utilized. Furthermore, the market can be segmented by specific tractor types, each designed for particular functions and operational environments, catering to the varied needs of farmers and industrial users worldwide. This multi-faceted approach to segmentation is crucial for strategic planning, product development, and targeted marketing efforts within the industry.

- By Power Output (HP):

- Less than 30 HP

- 30-70 HP

- 71-130 HP

- 131-250 HP

- More than 250 HP

- By Drive Type:

- 2-Wheel Drive

- 4-Wheel Drive

- By Application:

- Agriculture

- Construction

- Mining

- Industrial

- Others

- By Type:

- Utility Tractors

- Row Crop Tractors

- Orchard Tractors

- Industrial Tractors

- Garden Tractors

- Compact Tractors

Value Chain Analysis For Tractor Market

The value chain for the tractor market is intricate, involving multiple stages from raw material sourcing to end-user consumption and aftermarket services. At the upstream analysis stage, it begins with the procurement of essential raw materials such as steel, aluminum, rubber, and various electronic components and specialized parts like engines, transmissions, and hydraulic systems. Key suppliers in this segment are often large industrial manufacturers and specialized component providers. The efficiency and quality of these upstream processes are critical as they directly impact the cost, reliability, and performance of the final tractor product. Robust supply chain management, including strategic sourcing and inventory control, is vital to mitigate risks and ensure a steady flow of materials for production.

The core of the value chain involves the manufacturing and assembly of tractors, where original equipment manufacturers (OEMs) design, develop, and produce a diverse range of models tailored to different market needs. This stage encompasses significant capital investment in advanced manufacturing facilities, research and development for innovation, and quality control processes. After manufacturing, the downstream analysis focuses on distribution and sales. The distribution channel is multifaceted, comprising both direct and indirect sales approaches. Direct distribution often involves large OEMs selling directly to major agricultural enterprises or institutional buyers, potentially through dedicated sales forces or online platforms for parts and accessories. This allows for direct customer relationships and greater control over the sales process.

Indirect distribution, which forms the larger part of the market, relies heavily on a network of authorized dealers and distributors. These intermediaries play a crucial role in reaching diverse customer bases, especially individual farmers and small to medium-sized agricultural businesses. Dealers provide local sales support, technical advice, spare parts, and essential after-sales services such as maintenance and repairs, which are critical for customer satisfaction and brand loyalty. The effectiveness of the distribution channel is paramount for market penetration and customer retention. Furthermore, the value chain extends to aftermarket services, including parts supply, service contracts, and used equipment sales, which represent significant revenue streams and reinforce customer relationships throughout the product lifecycle. The integration of advanced digital tools for inventory management, customer relationship management, and service scheduling is enhancing efficiency across the entire value chain.

Tractor Market Potential Customers

The potential customers and end-users of tractor products are diverse, primarily segmented across agricultural, construction, and industrial sectors, each with distinct needs and purchasing drivers. In the agricultural sector, the largest customer base includes individual farmers, ranging from small-scale and subsistence farmers to large-scale commercial farming operations, as well as agricultural cooperatives and agribusinesses. Small and medium-sized farmers typically seek versatile, durable, and fuel-efficient tractors in the low to mid-horsepower range for general farming tasks such as plowing, tilling, and planting. Large commercial farms and agribusinesses, conversely, require high-horsepower, technologically advanced tractors equipped with precision agriculture capabilities, GPS guidance, and automation features to maximize efficiency, cover vast land areas, and optimize yields.

Beyond traditional agriculture, the construction industry represents a significant segment of potential customers. Construction companies and infrastructure developers utilize specialized industrial tractors, often equipped with front-end loaders, backhoes, and other attachments, for site preparation, material handling, excavation, and landscaping projects. These customers prioritize robustness, power, and the ability to operate in challenging terrains and demanding conditions. Municipalities and government agencies also fall into this category, requiring tractors for public works, road maintenance, and park management.

Furthermore, various industrial and commercial enterprises constitute another customer group. This includes landscaping companies, golf course maintenance crews, forestry operations, and even large estates or property management firms that require utility or compact tractors for groundskeeping, material movement, and specialized tasks. The rental sector also plays a crucial role, serving as an intermediary buyer that then provides equipment to a broad range of temporary users across agriculture, construction, and landscaping, making modern machinery accessible to those who cannot afford direct purchase. Each segment’s purchasing decisions are influenced by factors such as initial cost, operational efficiency, maintenance requirements, dealer support, and the availability of specific attachments and functionalities tailored to their unique operational demands.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $78.5 Billion |

| Market Forecast in 2032 | $122.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deere & Company, CNH Industrial N.V., Kubota Corporation, AGCO Corporation, Mahindra & Mahindra Ltd., Claas KGaA mbH, SDF Group, Argo Tractors S.p.A., JCB, Massey Ferguson, John Deere, New Holland Agriculture, Case IH, Iseki & Co. Ltd., Escorts Kubota Limited, Sonalika International Tractors Ltd., VST Tillers Tractors Ltd., Yanmar Holdings Co. Ltd., Farmtrac Tractors Europe, Foton Lovol International Heavy Industry Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tractor Market Key Technology Landscape

The tractor market is undergoing a significant technological transformation, driven by advancements aimed at enhancing efficiency, productivity, and sustainability in agricultural and industrial operations. A pivotal technology is precision agriculture, which integrates GPS/GNSS guidance systems to enable highly accurate field operations, minimizing overlap and optimizing the use of inputs like seeds, fertilizers, and pesticides. This includes auto-steering and automatic section control, which reduce operator fatigue and improve operational precision. Telematics systems are also becoming standard, allowing for real-time monitoring of tractor performance, location, fuel consumption, and maintenance needs, facilitating remote diagnostics and fleet management. These systems provide invaluable data for optimizing operational efficiency and reducing downtime.

The emergence of autonomous and semi-autonomous tractor technology represents a revolutionary shift, promising to address labor shortages and enable continuous, precise operations. These systems leverage a combination of AI, machine learning, advanced sensors (LiDAR, radar, cameras), and sophisticated algorithms for navigation, obstacle detection, and task execution without constant human intervention. While fully autonomous operations are still nascent in large-scale commercial deployment, semi-autonomous features like headland turns and implement automation are already widely adopted. Furthermore, advancements in engine technology are crucial, with manufacturers focusing on developing more fuel-efficient engines that comply with stringent emission standards, often incorporating selective catalytic reduction (SCR) and diesel particulate filters (DPF) for environmental compliance. The push for electrification is also gaining momentum, with electric and hybrid tractor models being introduced to offer quieter operation, lower emissions, and reduced running costs, particularly for smaller utility and specialized applications.

Beyond core machinery, the integration of data analytics and cloud computing is transforming how tractors interact with the broader farm ecosystem. Farmers can now collect vast amounts of data from their tractors and implements, analyze it through cloud-based platforms, and gain actionable insights into soil health, crop growth, and operational performance. This data-driven approach supports optimized decision-making across the entire farming cycle. Additionally, enhanced connectivity through IoT devices and 5G networks is facilitating seamless communication between tractors, other farm equipment, and central management systems, paving the way for truly connected and intelligent farming operations. The development of advanced hydraulics and power take-off (PTO) systems also allows for more efficient and versatile use of a wide range of implements, further increasing the utility and value proposition of modern tractors.

Regional Highlights

- North America: A mature market characterized by demand for high-horsepower, technologically advanced tractors with precision farming capabilities. Dominated by large-scale commercial farming, strong emphasis on automation and digital integration to address labor scarcity and maximize efficiency. Significant investments in R&D for autonomous solutions.

- Europe: Diverse market with varying demands; Western Europe focuses on high-tech, environmentally compliant, and specialized tractors, while Eastern Europe sees growing demand for mid-horsepower utility tractors due to increasing mechanization. Strict emissions regulations drive innovation in electric and alternative fuel technologies.

- Asia Pacific (APAC): The largest and fastest-growing market globally, driven by rising agricultural mechanization in India, China, and Southeast Asia. Characterized by demand for compact and mid-horsepower tractors suitable for small and fragmented landholdings. Government subsidies and a large agrarian population are key growth drivers.

- Latin America: Exhibiting steady growth, fueled by the expansion of commercial agriculture and agribusiness in countries like Brazil and Argentina. Demand spans across all horsepower segments, with a growing interest in precision agriculture technologies to boost productivity in vast farmlands.

- Middle East and Africa (MEA): An emerging market with significant potential, primarily driven by government initiatives to enhance food security and modernize agricultural practices. Demand for basic to mid-range utility tractors is prominent, with selective adoption of advanced technologies in more developed agricultural regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tractor Market.- Deere & Company

- CNH Industrial N.V.

- Kubota Corporation

- AGCO Corporation

- Mahindra & Mahindra Ltd.

- Claas KGaA mbH

- SDF Group

- Argo Tractors S.p.A.

- JCB

- Massey Ferguson (AGCO Brand)

- John Deere (Deere & Company Brand)

- New Holland Agriculture (CNH Industrial Brand)

- Case IH (CNH Industrial Brand)

- Iseki & Co. Ltd.

- Escorts Kubota Limited

- Sonalika International Tractors Ltd.

- VST Tillers Tractors Ltd.

- Yanmar Holdings Co. Ltd.

- Farmtrac Tractors Europe (Escorts Kubota Brand)

- Foton Lovol International Heavy Industry Co. Ltd.

Frequently Asked Questions

What factors are driving the growth of the tractor market?

The growth of the tractor market is primarily driven by increasing global food demand, the ongoing trend of agricultural mechanization, supportive government policies and subsidies for farmers, and continuous technological advancements leading to more efficient and sophisticated tractor models.

How is AI impacting modern tractor technology and farming?

AI is significantly impacting tractor technology by enabling precision agriculture, autonomous operations, predictive maintenance, and optimized resource utilization. AI-driven systems improve efficiency, reduce labor, and enhance decision-making for better yields and sustainability.

Which regions are leading the demand for tractors, and why?

The Asia Pacific region, particularly India and China, leads in tractor demand due to extensive agricultural mechanization, a large agrarian population, and significant government support for farm modernization. North America and Europe lead in demand for high-horsepower and advanced technology tractors due to large-scale farming and focus on automation.

What are the main types of tractors available in the market?

The main types of tractors include utility tractors for general farm tasks, row crop tractors for cultivating specific crops, orchard tractors designed for narrow spaces, industrial tractors for construction and heavy-duty applications, garden tractors for landscaping, and compact tractors for smaller farms and diverse utility.

What are the key challenges faced by the tractor market?

The tractor market faces challenges such as the high initial cost of advanced machinery, stringent environmental regulations requiring significant R&D, the scarcity of skilled labor for operation and maintenance, and the impact of fluctuating agricultural commodity prices and unpredictable weather patterns on farmer investment capacity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Catering and Food Services Contractor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Walking Tractor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Aircraft Tractor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Battery Swap Tractor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Sliding Cell Extractor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager