Transmission Substation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428407 | Date : Oct, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Transmission Substation Market Size

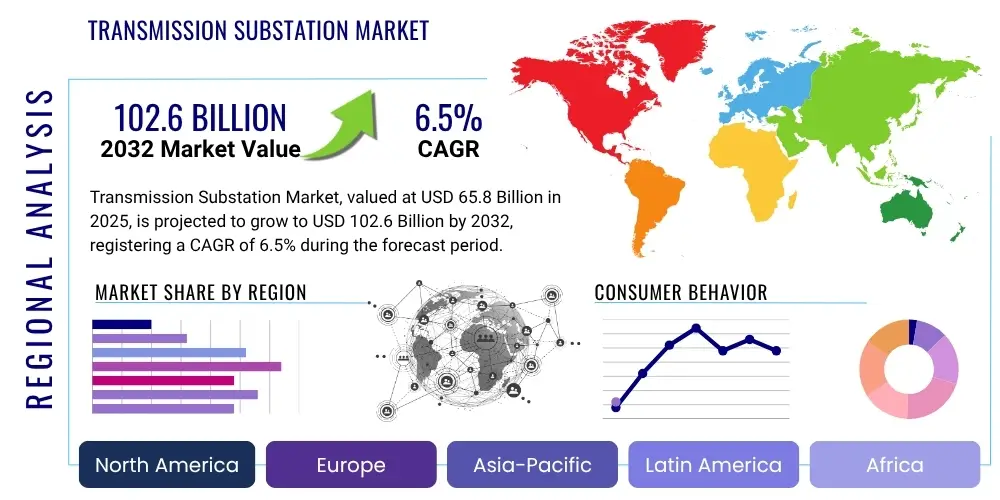

The Transmission Substation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 65.8 billion in 2025 and is projected to reach USD 102.6 billion by the end of the forecast period in 2032.

Transmission Substation Market introduction

The Transmission Substation Market encompasses the design, construction, installation, and maintenance of critical infrastructure necessary for the efficient and reliable transfer of electrical energy across grids. These substations serve as pivotal nodes within power transmission networks, facilitating voltage transformation, circuit switching, and protection functions. The core product in this market involves a sophisticated integration of transformers, switchgear, control systems, protective relays, and communication equipment designed to manage high-voltage electricity flow from generation sources to distribution networks.

Major applications of transmission substations span across utility-scale power grids, connecting large power plants, renewable energy farms, and industrial complexes to the broader electrical infrastructure. They are fundamental in enabling grid modernization efforts, integrating intermittent renewable energy sources, and ensuring stable power supply to urban centers and industrial zones. The benefits derived from advanced transmission substations include enhanced grid stability, reduced transmission losses, improved fault isolation capabilities, and greater operational flexibility, all of which contribute significantly to the overall reliability and efficiency of electricity delivery.

Driving factors for market growth are primarily fueled by the accelerating global demand for electricity, rapid industrialization and urbanization in emerging economies, and the ambitious targets for renewable energy integration worldwide. Furthermore, the aging electricity infrastructure in developed nations necessitates substantial investments in grid upgrades and modernization, including the replacement and enhancement of existing transmission substations with more technologically advanced and resilient systems. The push towards smart grids and the digitalization of energy infrastructure also critically underpins the expansion of this market, demanding more intelligent and automated substation solutions.

Transmission Substation Market Executive Summary

The Transmission Substation Market is poised for substantial expansion, driven by pivotal business trends such as escalating investments in grid infrastructure, the global energy transition towards decarbonization, and the increasing adoption of digital technologies for grid management. Key industry players are focusing on developing innovative solutions that offer enhanced efficiency, reliability, and automation, addressing the complex requirements of modern power grids. Furthermore, the growing emphasis on cybersecurity within critical infrastructure is influencing product development, leading to more resilient and secure substation designs. Mergers, acquisitions, and strategic partnerships are also becoming prevalent as companies seek to expand their market reach and technological capabilities, particularly in areas like smart grid integration and high-voltage direct current (HVDC) solutions.

Regionally, the market exhibits dynamic growth patterns, with Asia Pacific emerging as a dominant force due to rapid industrialization, urbanization, and significant investments in new power generation and transmission projects, especially in countries like China and India. North America and Europe are characterized by extensive grid modernization initiatives, including the replacement of aging infrastructure and the integration of large-scale renewable energy projects, thereby fostering demand for advanced substation components and systems. Latin America, the Middle East, and Africa are also witnessing considerable growth, driven by electrification programs, economic development, and the exploitation of diverse energy resources, necessitating robust transmission infrastructure development.

Segment-wise, the market is experiencing notable shifts. The digital substation segment is projected to grow at a faster rate, propelled by the benefits of improved data analytics, remote monitoring, and enhanced operational efficiency. Within components, transformers and switchgear continue to hold significant shares, with a rising preference for compact and environmentally friendly gas-insulated switchgear (GIS) solutions. Voltage levels exceeding 500 kV are seeing increased demand due to the need for long-distance power transmission from remote renewable energy hubs. The utility application segment remains the largest end-user, but industrial applications are also expanding with the electrification of industrial processes and the establishment of dedicated microgrids.

AI Impact Analysis on Transmission Substation Market

Users frequently inquire about how Artificial Intelligence (AI) will revolutionize the operation, maintenance, and planning of transmission substations, seeking to understand the tangible benefits in terms of efficiency, reliability, and cost reduction. Common concerns revolve around the complexity of integrating AI, data security, the need for skilled personnel, and the return on investment for such advanced systems. Stakeholders are particularly interested in AI's role in predictive maintenance, optimizing grid performance, improving fault detection and isolation, and enhancing the cybersecurity posture of critical substation infrastructure. There is a clear expectation that AI will move substations towards greater autonomy and intelligence, fostering a more resilient and responsive power grid capable of handling the intricacies of distributed generation and dynamic load conditions.

- AI-powered predictive maintenance reduces unplanned outages and extends asset life by analyzing sensor data to forecast equipment failures.

- Optimized load management and voltage control through AI algorithms enhance grid stability and minimize transmission losses.

- Automated fault detection and isolation capabilities, driven by AI, significantly improve grid reliability and accelerate restoration times.

- Enhanced cybersecurity measures, leveraging AI for anomaly detection and threat identification, bolster the resilience of substation control systems.

- AI-driven real-time data analysis supports proactive decision-making for grid operators, improving operational efficiency and resource allocation.

- Autonomous substation operations, enabled by AI, reduce human intervention and operational costs in routine tasks.

- Intelligent planning and design of new substations are supported by AI, optimizing layout, component selection, and construction timelines.

- Integration of machine learning algorithms improves demand forecasting and renewable energy output prediction, balancing grid supply and demand more effectively.

DRO & Impact Forces Of Transmission Substation Market

The Transmission Substation Market is shaped by a confluence of influential factors categorized as Drivers, Restraints, and Opportunities, which collectively constitute the Impact Forces. A primary driver is the burgeoning global demand for electricity, fueled by population growth, rapid urbanization, and industrial expansion, particularly in developing economies. This demand necessitates robust and expanded transmission infrastructure, making substations indispensable. Another significant driver is the global energy transition, which involves integrating a greater share of renewable energy sources such as solar and wind into existing grids. These intermittent sources require advanced substation technologies to ensure grid stability and reliability. Furthermore, aging grid infrastructure in developed nations mandates substantial investments in modernization and upgrades, including the refurbishment and replacement of obsolete substations with more efficient and resilient systems. Government initiatives and policies supporting grid expansion and renewable energy deployment also act as strong market catalysts.

However, the market faces considerable restraints. The high capital expenditure associated with the construction and upgrading of transmission substations presents a significant barrier, especially for emerging economies with limited financial resources. Complex land acquisition processes and environmental clearances, often coupled with public opposition, can delay or halt substation projects. Stringent regulatory frameworks and varying international standards add to the complexity and cost of project execution. Additionally, the shortage of skilled labor and specialized engineers capable of designing, installing, and maintaining advanced substation technologies poses an operational challenge across many regions. Cybersecurity threats to critical infrastructure also introduce ongoing operational and investment challenges, requiring continuous updates and robust protection measures.

Despite these challenges, substantial opportunities exist. The advent of smart grid technologies, including digital substations and advanced automation systems, offers avenues for enhanced operational efficiency, reduced maintenance costs, and improved grid resilience. The increasing adoption of High-Voltage Direct Current (HVDC) transmission substations presents opportunities for long-distance bulk power transmission with lower losses and greater stability, especially for connecting remote renewable energy sites. Integration with energy storage systems at substations is another promising area, helping to balance supply and demand fluctuations. Moreover, the vast untapped potential in emerging markets for new infrastructure development and electrification initiatives offers long-term growth prospects. The continuous evolution of materials science and component technology also provides opportunities for developing more compact, efficient, and environmentally friendly substation solutions.

Segmentation Analysis

The Transmission Substation Market is comprehensively segmented to provide a detailed understanding of its diverse components, technologies, and applications. This segmentation allows for a granular analysis of market dynamics, identifying key growth areas and trends across different facets of the industry. The market can be broadly categorized by Type, which distinguishes between conventional and increasingly prevalent digital substations, reflecting the industry’s evolution towards smart grid technologies. Further segmentation by Component highlights the crucial elements that constitute a substation, such as transformers, switchgear, and protective devices, each with its own technological advancements and market dynamics. Voltage Level segmentation is critical as it dictates the scale and complexity of the substation, ranging from medium to ultra-high voltage applications. Finally, segmentation by Application illustrates the primary end-use sectors driving demand, including utilities, industrial, commercial, and residential.

- By Type

- Conventional Substation

- Digital Substation

- By Component

- Transformers

- Power Transformers

- Instrument Transformers

- Switchgear

- Circuit Breakers

- Disconnectors

- Load Break Switches

- Gas Insulated Switchgear (GIS)

- Air Insulated Switchgear (AIS)

- Busbar

- Flexible Busbar

- Rigid Busbar

- Protection & Control Systems

- Relays

- Control Panels

- SCADA Systems

- Capacitors & Reactors

- Insulators

- Communication Systems

- Other Components (e.g., Surge Arresters, Battery Systems)

- Transformers

- By Voltage Level

- Less than 100 kV

- 100 kV to 220 kV

- 221 kV to 500 kV

- More than 500 kV

- By Application

- Utility (National and Regional Grids)

- Industrial (Heavy Industries, Manufacturing, Oil & Gas)

- Commercial (Large Commercial Complexes, Data Centers)

- Residential (Community Power Distribution)

Value Chain Analysis For Transmission Substation Market

The value chain for the Transmission Substation Market is a complex ecosystem involving multiple stages, from raw material sourcing to final project commissioning and aftermarket services. The upstream segment primarily involves the procurement of essential raw materials such as steel for structures, copper and aluminum for conductors, silicon steel for transformer cores, and specialized insulating materials like porcelain, polymer, and SF6 gas. Key suppliers in this stage include metal refineries, chemical manufacturers, and specialized material providers. The quality and availability of these raw materials directly impact the manufacturing process and the overall cost and performance of substation components. Strong relationships with reliable suppliers are crucial for maintaining consistent production schedules and product quality.

The midstream segment encompasses the manufacturing of individual substation components like power transformers, instrument transformers, various types of switchgear (GIS, AIS), protection and control systems, and communication equipment. This stage also includes the integration of these components into complete substation solutions through engineering, procurement, and construction (EPC) contractors. These EPC firms play a pivotal role in designing substation layouts, managing project logistics, and ensuring the seamless installation and commissioning of the entire system. Research and development activities, focusing on improving efficiency, reducing environmental impact, and enhancing smart grid functionalities, are also significant at this stage, driven by component manufacturers and technology innovators.

The downstream segment primarily involves the end-users and the operational aspects of substations. The primary end-users are national and regional electric utilities, independent power producers (IPPs), large industrial complexes, and increasingly, renewable energy developers who require substations to connect their generation facilities to the main grid. Distribution channels are largely direct, with manufacturers and EPC contractors engaging directly with utility companies and large industrial clients for bespoke project solutions. Indirect channels may involve local distributors or agents for smaller components or maintenance parts. Aftermarket services, including maintenance, repair, and upgrades, form a crucial part of the downstream value chain, ensuring the long-term reliability and performance of installed substations and often providing recurring revenue streams for market participants.

Transmission Substation Market Potential Customers

The primary potential customers for transmission substation products and services are diverse, yet fundamentally linked to the generation, transmission, and consumption of electrical energy across various scales. At the forefront are national and regional electricity grid operators and utilities, which are responsible for maintaining and expanding the backbone of power transmission infrastructure. These entities continually invest in new substations to accommodate growing electricity demand, integrate new power sources, modernize aging grids, and enhance overall grid stability and reliability. Their procurement decisions are heavily influenced by regulatory requirements, long-term energy policies, and the need for robust, efficient, and secure power delivery systems.

Beyond traditional utilities, independent power producers (IPPs) and developers of renewable energy projects constitute a rapidly growing segment of potential customers. As investments in solar farms, wind power plants, and hydroelectric facilities surge globally, these developers require specialized transmission substations to connect their generation assets to the main grid. These substations must be designed to handle the intermittent nature of renewable energy and often require advanced grid integration capabilities. Industrial sectors, particularly those with high energy demands such as manufacturing, metallurgy, chemicals, and oil and gas, also represent significant end-users, requiring dedicated substations for their operational facilities to ensure a stable and reliable power supply tailored to their specific load requirements.

Furthermore, large commercial complexes, data centers, and transportation infrastructure projects like high-speed rail networks also serve as important customers, albeit often through local distribution companies or EPC contractors. These entities require robust and dependable power connections to support their continuous operations and critical services. Emerging markets, characterized by rapid urbanization and infrastructure development, represent a substantial future customer base, as new cities, industrial zones, and rural electrification projects necessitate the construction of extensive transmission and distribution networks, invariably including numerous transmission substations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 65.8 Billion |

| Market Forecast in 2032 | USD 102.6 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens Energy AG, General Electric Company (GE Grid Solutions), Hitachi Energy Ltd., Eaton Corporation plc, Schneider Electric SE, Mitsubishi Electric Corporation, Toshiba Corporation, Hyundai Electric Co. Ltd., Larsen & Toubro Limited, CG Power and Industrial Solutions Ltd., NR Electric Co. Ltd., Xian Electric Engineering Co. Ltd., China XD Electric Co. Ltd., State Grid Corporation of China (as a major operator/influencer), Bharat Heavy Electricals Limited (BHEL), KEC International Ltd., Fuji Electric Co., Ltd., WEG S.A., Arteche Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Transmission Substation Market Key Technology Landscape

The Transmission Substation Market is undergoing a profound technological transformation, driven by the imperative for greater efficiency, resilience, and intelligence in power grids. A leading trend is the widespread adoption of digital substations, which leverage fiber optic communication, intelligent electronic devices (IEDs), and process bus technology to replace traditional copper wiring and electromechanical relays. This digitalization enables real-time data acquisition, enhanced remote monitoring and control, and significantly reduces engineering, installation, and maintenance costs. Digital substations also provide a robust foundation for integrating advanced analytics and artificial intelligence, paving the way for predictive maintenance and optimized operational strategies.

Another critical technology is Gas Insulated Switchgear (GIS), which offers a compact and reliable alternative to conventional air-insulated switchgear (AIS), especially in urban areas where space is a premium. GIS uses SF6 gas (or increasingly, eco-friendly alternatives) as an insulating medium, allowing for much smaller footprints and improved safety. Hybrid switchgear, combining elements of both AIS and GIS, is also gaining traction, offering a balance of space efficiency and cost-effectiveness. In terms of power electronics, the development of High-Voltage Direct Current (HVDC) converter substations is vital for long-distance bulk power transmission and interconnecting asynchronous AC grids, facilitating the integration of remote renewable energy sources and improving grid stability.

Furthermore, advanced control and protection systems, including sophisticated Supervisory Control and Data Acquisition (SCADA) systems and Wide Area Monitoring Systems (WAMS), are crucial for grid modernization. These systems, often integrated with Internet of Things (IoT) sensors, provide comprehensive visibility and control over substation operations, enabling faster fault detection and isolation. Cybersecurity solutions are increasingly integrated into substation designs to protect against cyber threats targeting critical infrastructure. Innovations in energy storage integration, such as battery energy storage systems (BESS) co-located at substations, are also emerging, providing ancillary services like frequency regulation and voltage support, thereby enhancing grid flexibility and reliability.

Regional Highlights

- North America: This region is characterized by significant investments in modernizing aging grid infrastructure and enhancing resilience against extreme weather events. The push for renewable energy integration, particularly wind and solar, necessitates advanced transmission substations capable of handling fluctuating power inputs. Regulatory frameworks and federal incentives drive smart grid initiatives and digital substation deployments, ensuring higher operational efficiency and reliability.

- Europe: Driven by ambitious decarbonization targets and cross-border energy trading, Europe is a leader in developing highly interconnected and smart grids. Investments focus on upgrading existing infrastructure, integrating offshore wind power, and developing HVDC links for efficient long-distance power transmission. Strict environmental regulations also foster the adoption of eco-friendly insulation gases and sustainable substation designs.

- Asia Pacific (APAC): APAC is the fastest-growing market, propelled by rapid industrialization, urbanization, and burgeoning electricity demand from countries like China, India, and Southeast Asian nations. Massive investments in new power generation capacity, including both conventional and renewable sources, are driving the construction of extensive new transmission networks and substations. Government initiatives for rural electrification and grid expansion further fuel market growth.

- Latin America: This region is witnessing substantial infrastructure development, with a focus on expanding access to electricity and leveraging abundant renewable energy resources, particularly hydropower and solar. Investments in transmission substations are critical for connecting new generation projects to consumption centers and improving grid reliability across vast geographical areas. Political and economic stability fluctuations can, however, influence project timelines.

- Middle East and Africa (MEA): The MEA region is experiencing growth driven by electrification programs, economic diversification initiatives, and large-scale industrial projects, including oil and gas ventures. Investments in transmission infrastructure are vital for supporting new urban developments and connecting remote energy sources. The region also presents opportunities for integrating solar energy due to abundant sunlight, requiring robust substation infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Transmission Substation Market.- ABB Ltd.

- Siemens Energy AG

- General Electric Company (GE Grid Solutions)

- Hitachi Energy Ltd.

- Eaton Corporation plc

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Hyundai Electric Co. Ltd.

- Larsen & Toubro Limited

- CG Power and Industrial Solutions Ltd.

- NR Electric Co. Ltd.

- Xian Electric Engineering Co. Ltd.

- China XD Electric Co. Ltd.

- State Grid Corporation of China (as a major operator/influencer)

- Bharat Heavy Electricals Limited (BHEL)

- KEC International Ltd.

- Fuji Electric Co., Ltd.

- WEG S.A.

- Arteche Group

Frequently Asked Questions

What is a transmission substation and why is it important?

A transmission substation is a critical electrical facility that transforms voltage from high to low or vice-versa, switches circuits, and protects equipment in a power grid. It is essential for efficient and reliable electricity transmission from power plants to consumers, ensuring grid stability and managing power flow.

How is renewable energy impacting the Transmission Substation Market?

Renewable energy integration significantly drives the market as intermittent sources like solar and wind require advanced substations for grid connection, voltage regulation, and stability management, leading to demand for smarter, more flexible, and often HVDC-capable substation solutions.

What are the benefits of digital substations compared to conventional ones?

Digital substations offer enhanced operational efficiency, improved data analytics, real-time remote monitoring, reduced maintenance costs, and a smaller physical footprint. They use fiber optics and intelligent electronic devices (IEDs) instead of traditional copper wiring, leading to greater reliability and faster fault detection.

What are the major challenges facing the Transmission Substation Market?

Key challenges include high capital expenditure, complex land acquisition processes, stringent regulatory requirements, environmental concerns related to SF6 gas, and the escalating threat of cyberattacks on critical infrastructure. Shortage of skilled workforce also poses a significant hurdle for advanced technology adoption.

Which regions are leading the growth in the Transmission Substation Market?

The Asia Pacific region, particularly China and India, is leading market growth due to rapid industrialization, urbanization, and extensive grid expansion projects. North America and Europe also contribute significantly through grid modernization and large-scale renewable energy integration initiatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- High Voltage Industrial Transmission Substation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Utility Scale Transmission Substation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Industrial Transmission Substation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Medium Voltage Transmission Substation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager