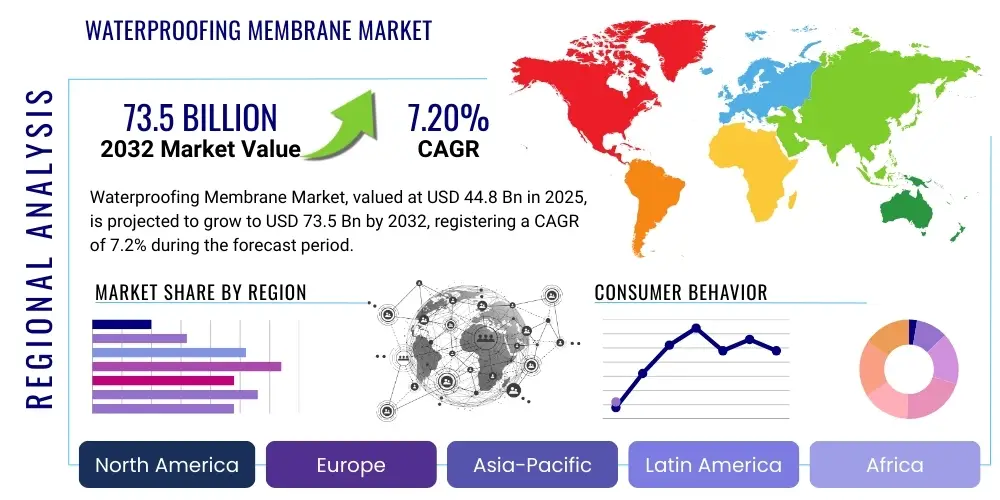

Waterproofing Membrane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427437 | Date : Oct, 2025 | Pages : 244 | Region : Global | Publisher : MRU

Waterproofing Membrane Market Size

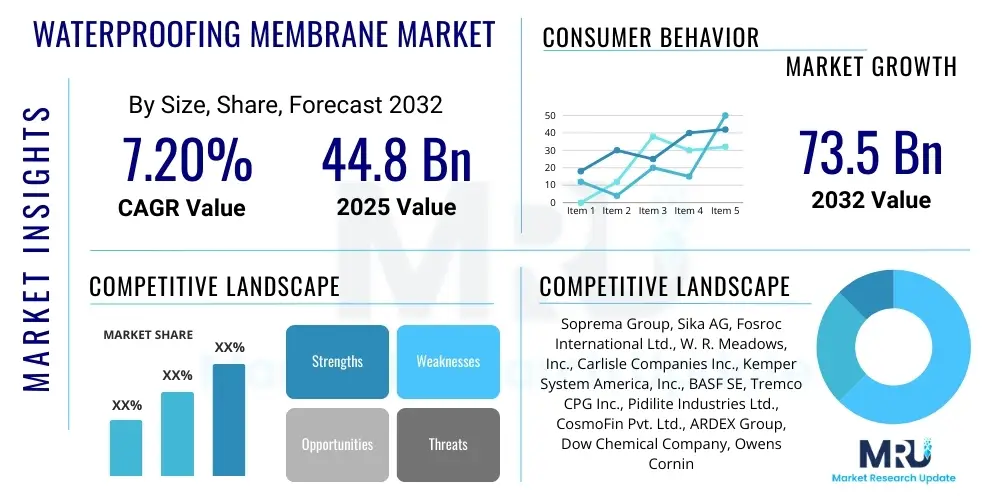

The Waterproofing Membrane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2032. The market is estimated at USD 44.8 billion in 2025 and is projected to reach USD 73.5 billion by the end of the forecast period in 2032. This robust expansion is primarily driven by increasing urbanization, heightened demand for durable and resilient infrastructure, and a growing awareness regarding the long-term benefits of comprehensive moisture protection in both residential and commercial constructions. The markets upward trajectory is also influenced by stringent building codes and regulatory frameworks promoting the use of advanced waterproofing solutions to enhance structural integrity and extend asset lifespans across diverse geographical regions. Innovations in material science and application techniques are further contributing to this growth, offering more efficient and environmentally friendly options that cater to evolving industry needs.

Waterproofing Membrane Market introduction

The waterproofing membrane market encompasses a wide array of materials and systems designed to prevent water ingress into building structures, infrastructure, and various industrial applications. These membranes form an impermeable barrier, protecting substrates from moisture damage, mold growth, and structural degradation, thereby significantly enhancing the longevity and safety of assets. Products range from bituminous, polymeric (PVC, EPDM, TPO), and liquid-applied membranes, each offering distinct properties suited for specific environmental conditions and application requirements. Their primary purpose is to seal surfaces and joints against water penetration, ensuring the integrity of basements, roofs, walls, bridges, tunnels, and water containment structures. The increasing prevalence of extreme weather events and rising concerns over water-induced damage have underscored the critical importance of effective waterproofing solutions in modern construction.

Major applications for waterproofing membranes are extensive, covering both new construction projects and renovation activities. In the building sector, they are indispensable for roofing systems, ensuring leak-free protection for flat and sloped roofs; in foundation waterproofing, they safeguard basements and subterranean structures from groundwater intrusion; and in wet areas like bathrooms and kitchens, they prevent moisture migration within the building envelope. Beyond traditional buildings, these membranes are crucial in civil engineering for protecting bridges, tunnels, highways, and water treatment plants from environmental wear and tear. Benefits derived from their implementation include enhanced structural durability, reduced maintenance costs, improved energy efficiency by preventing moisture-related insulation degradation, and the creation of healthier indoor environments by mitigating mold and mildew growth. Key driving factors fueling market expansion include rapid urbanization and industrialization, significant investments in infrastructure development, increasing demand for green buildings, and stringent regulatory mandates for building resilience and safety, all contributing to a sustained demand for high-performance waterproofing solutions across the globe.

Waterproofing Membrane Market Executive Summary

The global waterproofing membrane market is experiencing dynamic growth, characterized by significant business trends that underscore innovation, sustainability, and market consolidation. Strategic partnerships, mergers, and acquisitions are prevalent as companies seek to expand their product portfolios, enhance technological capabilities, and strengthen their regional presence. There is a discernible shift towards sustainable and eco-friendly products, with manufacturers investing heavily in research and development to produce membranes with lower VOC emissions, recycled content, and longer lifespans, aligning with global environmental objectives and green building certifications. Digitalization is also playing a crucial role, influencing supply chain optimization, project management, and the adoption of Building Information Modeling (BIM) for more efficient application processes. The market is also witnessing an increase in customization, with tailored solutions addressing specific climate challenges and structural demands, moving beyond one-size-fits-all approaches to specialized, high-performance systems.

Regional trends indicate robust demand from Asia Pacific, particularly driven by rapid urbanization, extensive infrastructure projects in China and India, and a burgeoning construction sector in Southeast Asian nations. North America and Europe demonstrate a mature market with a focus on renovation, maintenance, and the adoption of advanced, high-performance membranes that comply with stringent environmental regulations and energy efficiency standards. Latin America and the Middle East & Africa regions are emerging as high-growth markets, fueled by economic development, increasing foreign investments in real estate and infrastructure, and a rising awareness of the long-term benefits of effective waterproofing. Segment trends reveal sustained dominance of bituminous membranes due to their cost-effectiveness and proven track record, while the polymeric and liquid-applied segments are witnessing accelerated growth driven by their superior performance, flexibility, and ease of application. The roofing and building structure applications continue to hold the largest market shares, though civil engineering applications, including tunnels, bridges, and water management, are projected for significant expansion, indicating diversified demand across the construction ecosystem.

AI Impact Analysis on Waterproofing Membrane Market

The integration of Artificial Intelligence (AI) within the waterproofing membrane market presents a transformative paradigm, addressing common user questions about efficiency, predictive capabilities, and material innovation. Users are increasingly curious about how AI can optimize the design and selection of membranes, enhance quality control during manufacturing and installation, and enable predictive maintenance for existing structures. There is also significant interest in AIs role in developing smarter materials, such as self-healing membranes, and in streamlining supply chain logistics to reduce costs and waste. The central theme revolves around leveraging AI to improve product performance, reduce operational complexities, and foster more sustainable practices across the entire lifecycle of waterproofing applications, from material synthesis to post-installation monitoring and maintenance, ensuring higher reliability and longevity of waterproofed structures. The collective expectation is for AI to usher in an era of intelligent waterproofing solutions that offer unprecedented levels of precision, durability, and cost-effectiveness.

- AI-driven material science accelerating the development of novel, high-performance waterproofing compounds.

- Predictive analytics enhancing maintenance schedules for existing waterproofing systems, preventing failures.

- Optimized manufacturing processes through AI for consistent product quality and reduced waste.

- Smart sensors integrated with AI for real-time monitoring of membrane integrity and early leak detection.

- AI algorithms supporting contractors in selecting optimal membrane types and application methods for specific projects.

- Supply chain optimization using AI for efficient raw material sourcing and product distribution.

- Automated quality control systems employing AI for defect detection during membrane production.

- Robotics and AI assisting in complex membrane installations, especially in hazardous or difficult-to-reach areas.

- Personalized product recommendations for customers based on project specifications and environmental conditions.

- Enhanced Building Information Modeling (BIM) integration for comprehensive waterproofing system design and management.

DRO & Impact Forces Of Waterproofing Membrane Market

The waterproofing membrane market is profoundly shaped by a confluence of drivers, restraints, opportunities, and the broader competitive landscape influenced by various impact forces. Key drivers include accelerating urbanization and industrialization, particularly in emerging economies, leading to a surge in both residential and commercial construction activities requiring robust moisture protection. Growing awareness among developers and homeowners regarding the long-term benefits of effective waterproofing, such as extended structural lifespan and reduced maintenance costs, further propels demand. Government initiatives and stringent building codes mandating the use of high-quality waterproofing solutions, especially in regions prone to heavy rainfall or seismic activity, provide a regulatory push. Additionally, the increasing focus on green building practices and sustainable construction methodologies encourages the adoption of environmentally friendly and durable membrane systems. The escalating frequency and intensity of extreme weather events, including heavy precipitation and flooding, heighten the imperative for resilient waterproofing solutions across all types of infrastructure, from public works to private dwellings, reinforcing market expansion. Technological advancements in material science, leading to the development of more effective, easier-to-apply, and eco-friendly membranes, also act as a significant driver, continuously innovating the product offerings and expanding their range of applications. This cumulative effect of urban development, climate change resilience, and regulatory support forms a strong foundation for sustained market growth.

Conversely, the market faces several notable restraints. Volatility in raw material prices, particularly for crude oil derivatives used in bituminous and polymeric membranes, can significantly impact manufacturing costs and profit margins, leading to price fluctuations for end-users. The availability of skilled labor for membrane installation remains a persistent challenge, as improper application can compromise the effectiveness of even the highest quality membranes, leading to performance issues and potential structural damage. Environmental regulations, while driving innovation towards sustainable products, can also pose a restraint by increasing compliance costs for manufacturers and requiring substantial investments in new production technologies. Competition from alternative waterproofing methods, such as integral waterproofing admixtures or crystalline waterproofing, though often less comprehensive, can present a challenge, particularly in cost-sensitive projects. The long product lifecycle of waterproofing membranes, while a benefit to consumers, can sometimes lead to slower replacement cycles, thus tempering market growth in mature regions. Despite these challenges, numerous opportunities exist, including the vast potential in emerging markets for infrastructure development, the increasing demand for advanced materials like self-healing and smart membranes, and the growing application in non-traditional areas such as liquid containment and waste management facilities. The emphasis on refurbishment and retrofitting of aging infrastructure in developed economies also presents a substantial opportunity for specialized waterproofing solutions.

The impact forces influencing the waterproofing membrane market are multifaceted. The bargaining power of buyers is moderate to high, driven by the availability of multiple suppliers and a range of product types, allowing them to choose solutions based on cost, performance, and application suitability. However, for specialized, high-performance solutions, buyer power may diminish. The bargaining power of suppliers is also moderate, influenced by the global supply chains for raw materials and the degree of consolidation among key material providers; fluctuations in raw material costs directly impact supplier leverage. The threat of new entrants is low to moderate due to significant capital investment requirements for manufacturing, extensive R&D, established distribution networks, and the need for certifications and regulatory compliance. However, niche players offering innovative or highly specialized solutions can still penetrate specific market segments. The threat of substitute products, while present from alternative waterproofing methods, is generally low for comprehensive membrane systems, as membranes offer superior, long-lasting, and verifiable protection against water ingress for critical applications. The intensity of competitive rivalry is high, characterized by numerous global and regional players striving for market share through product differentiation, technological innovation, aggressive pricing strategies, and expanding their geographical reach. This intense competition fosters continuous improvement and innovation within the industry, benefiting end-users with a broader range of advanced and specialized waterproofing solutions.

Segmentation Analysis

The waterproofing membrane market is intricately segmented across various dimensions, including product type, application, and end-user, reflecting the diverse requirements and complexities of modern construction and infrastructure projects. This segmentation allows for a granular understanding of market dynamics, enabling manufacturers to tailor products to specific needs and for stakeholders to identify key growth areas. The overarching trend observed across all segments is a drive towards higher performance, ease of application, and greater sustainability, catalyzed by regulatory pressures and increasing awareness of environmental impacts. Understanding these distinct segments is critical for strategic planning, product development, and market entry, as each category presents unique challenges and opportunities within the broader waterproofing industry, from the material composition of the membranes to their specific use cases in various structural contexts. The evolution of materials and application techniques continues to refine these segments, paving the way for specialized solutions that address the nuanced demands of the global construction landscape. The markets structure reflects a balance between established, traditional solutions and innovative, emerging technologies, all contributing to the resilience and longevity of built environments across the globe.

- By Type: Bituminous Membranes (Modified Bitumen, Self-Adhering), Polymeric Membranes (PVC, EPDM, TPO, HDPE), Liquid-Applied Membranes (Polyurethane, Acrylic, Cementitious), Others (Cementitious Slurries, Bentonite).

- By Application: Roofing (Flat Roofs, Pitched Roofs), Walls & Facades, Building Structures (Basements, Foundations, Below-Ground Structures), Tunnels & Bridges, Waste & Water Management (Landfills, Reservoirs, Wastewater Treatment Plants), Civil Engineering (Roads, Railways), Others (Swimming Pools, Ponds).

- By End-User: Residential, Commercial (Office Buildings, Retail, Hospitality), Industrial (Manufacturing Plants, Warehouses), Public Infrastructure (Government Buildings, Transport Hubs), Healthcare, Educational Institutions.

Waterproofing Membrane Market Value Chain Analysis

The value chain for the waterproofing membrane market begins with upstream activities, primarily involving the sourcing and processing of raw materials. This includes petroleum-based products like bitumen and polymers (PVC, EPDM, TPO, polyurethane), synthetic rubbers, and various additives such as plasticizers, stabilizers, and fillers. Key suppliers in this stage are petrochemical companies, chemical manufacturers, and aggregate providers. The quality and cost of these raw materials significantly influence the final products performance and pricing, making supplier relationships and supply chain resilience critical. Following material procurement, manufacturing processes involve compounding, extrusion, calendering, and coating to produce various types of membranes, often requiring specialized machinery and technical expertise. Research and development also play a crucial upstream role in innovating new materials, improving product performance, and ensuring compliance with evolving environmental and safety standards, driving the development of more sustainable and high-performing solutions.

Midstream activities primarily focus on the manufacturing and primary distribution of waterproofing membranes. Manufacturers convert raw materials into finished products, adhering to strict quality control standards and industry specifications. This stage also includes branding, packaging, and storage of the membranes before they enter the distribution channels. Distribution channels for waterproofing membranes are diverse, encompassing both direct and indirect routes. Direct sales often involve large-scale projects where manufacturers sell directly to major construction companies, government agencies, or specialized applicators, providing technical support and custom solutions. This approach allows for direct communication, better control over product delivery, and a deeper understanding of client needs, fostering strong long-term relationships and facilitating the provision of tailored technical advice and on-site support for complex installations. Indirect distribution is more prevalent for smaller projects and general market access, utilizing a network of distributors, wholesalers, building material suppliers, and retailers. These intermediaries play a vital role in warehousing products, managing logistics, and providing local availability, reaching a broader customer base including individual contractors, small construction firms, and DIY enthusiasts. They also often provide a crucial link between manufacturers and applicators, offering product information, technical guidance, and facilitating orders, thus ensuring widespread market penetration and efficient delivery to diverse end-users.

Downstream activities involve the application of waterproofing membranes by specialized contractors, construction companies, and trained applicators. This stage is critical, as improper installation can negate the benefits of even the highest quality membranes. Post-installation services, including inspection, maintenance, and repair, also form part of the downstream value chain, ensuring the long-term effectiveness and durability of the waterproofing system. The end-users of waterproofing membranes are diverse, spanning residential, commercial, industrial, and infrastructure sectors. Feedback from these end-users is invaluable, influencing future product development and improvements. The effectiveness of the entire value chain hinges on seamless collaboration between raw material suppliers, manufacturers, distributors, applicators, and end-users, with an increasing emphasis on sustainable practices and circular economy principles to reduce waste and optimize resource utilization throughout the product lifecycle.

Waterproofing Membrane Market Potential Customers

The primary potential customers and end-users of waterproofing membrane products are extensive and diversified across various sectors of the construction and infrastructure industries. Residential building developers and individual homeowners represent a significant segment, demanding membranes for roofing, basements, bathrooms, and balconies to protect their properties from water damage, ensure structural integrity, and enhance indoor air quality. Commercial sector clients, including developers of office buildings, retail complexes, hotels, and educational institutions, require robust waterproofing solutions for large-scale roofing systems, expansive foundations, and specialized areas like plaza decks and green roofs, prioritizing durability, aesthetic integration, and long-term performance to safeguard substantial investments and ensure occupant comfort. The increasing complexity of commercial structures, with their varied architectural designs and extensive service life expectations, necessitates high-performance and often customized membrane systems that can withstand diverse environmental stressors and maintain their efficacy over decades.

Industrial end-users, encompassing manufacturing facilities, warehouses, chemical processing plants, and energy infrastructure, have unique and often more stringent requirements for waterproofing membranes. These applications frequently demand resistance to specific chemicals, extreme temperatures, and heavy operational loads, necessitating specialized membranes that offer superior chemical resistance, puncture resistance, and fire safety properties. In many industrial settings, the prevention of leaks is not only about structural protection but also about environmental compliance and operational continuity, making high-integrity waterproofing an absolute imperative. The public infrastructure sector, including government agencies and municipal bodies, constitutes another major customer base, requiring waterproofing for critical projects such as bridges, tunnels, highways, dams, reservoirs, and wastewater treatment plants. These large-scale civil engineering applications necessitate membranes that can withstand significant mechanical stresses, hydrostatic pressures, and prolonged exposure to harsh environmental conditions, with a strong emphasis on longevity, maintainability, and public safety. Urban development projects, driven by governmental investment in smart city initiatives and resilient infrastructure, further bolster demand from this sector. Additionally, specialized niche customers include landscape architects and contractors for green roofs and living walls, as well as sports facility developers for stadiums and recreational areas, all seeking reliable solutions for moisture management and structural preservation. The growing global focus on climate resilience and sustainable urban planning continually expands the scope and diversity of potential customers for advanced waterproofing membrane solutions across all these segments.

Waterproofing Membrane Market Key Technology Landscape

The waterproofing membrane market is characterized by a dynamic and continuously evolving technology landscape, driven by advancements in material science, application techniques, and sustainability goals. Traditional technologies like bituminous membranes, while foundational and widely used for their cost-effectiveness and proven performance, have seen significant enhancements through polymer modification (e.g., APP and SBS modified bitumen). These modifications improve flexibility, resistance to UV radiation, and temperature stability, extending their lifespan and versatility in various climatic conditions. Alongside this, the segment of polymeric membranes, including PVC (Polyvinyl Chloride), EPDM (Ethylene Propylene Diene Monomer), and TPO (Thermoplastic Polyolefin), represents a significant technological leap, offering superior elasticity, puncture resistance, and chemical resistance. TPO membranes, in particular, are gaining traction due to their heat-weldable seams, recyclability, and excellent performance in cool roofing applications, contributing to energy efficiency in buildings. The development of advanced formulations for these polymeric materials aims to further enhance their environmental profile and ease of installation, such as the creation of halogen-free variants or membranes with integrated reflective properties, designed to mitigate urban heat island effects and reduce cooling loads on buildings.

Liquid-applied membranes (LAMs) represent another cutting-edge technology, offering seamless, monolithic waterproofing layers that conform to complex shapes and surfaces without the need for seams or overlaps. Polyurethane, acrylic, and cementitious LAMs are prominent in this category, each providing distinct benefits in terms of elasticity, adhesion, and cure times. Polyurethane LAMs are highly favored for their excellent elongation and crack-bridging properties, making them ideal for high-movement structures and challenging architectural designs. Acrylic LAMs offer good UV resistance and are often water-based, making them environmentally friendly and easy to apply. Cementitious LAMs, often polymer-modified, provide robust protection for concrete structures, particularly in wet areas and subterranean applications, blending the durability of cement with the flexibility of polymers. Furthermore, the market is witnessing the emergence of "smart" and "self-healing" membrane technologies, which integrate advanced sensors for real-time leak detection or incorporate materials that can autonomously repair small cracks and punctures, significantly extending the lifespan of the waterproofing system and reducing maintenance efforts. Nanotechnology is also being explored to develop membranes with enhanced barrier properties, improved durability, and multifunctional characteristics such, as self-cleaning or anti-microbial surfaces. Application technologies are also advancing, with automated robotic systems being developed for large-scale or hazardous installations, improving efficiency, safety, and precision. These technological innovations collectively aim to address the increasing demand for high-performance, durable, sustainable, and easily applicable waterproofing solutions, aligning with global trends in smart construction and resilient infrastructure development.

Regional Highlights

- Asia Pacific: This region is a dominant and rapidly growing market, fueled by unprecedented infrastructure development, rapid urbanization, and extensive construction activities in countries like China, India, and Southeast Asian nations. Significant investments in public and private projects, coupled with a burgeoning middle-class population and increased disposable income, are driving the demand for advanced waterproofing solutions in both new constructions and renovation projects. Government initiatives promoting smart cities and sustainable building practices further bolster market growth.

- North America: A mature market characterized by a strong focus on renovation, retrofitting aging infrastructure, and adherence to stringent building codes. The demand is primarily for high-performance, energy-efficient, and sustainable membranes, with a significant emphasis on roofing applications and the protection of critical infrastructure. Technological innovation and a well-established distribution network define this region.

- Europe: Similar to North America, Europe is a mature market driven by strict environmental regulations, a high emphasis on energy efficiency, and a robust renovation sector. Western European countries are early adopters of advanced and eco-friendly membrane technologies. Eastern Europe presents growth opportunities due to ongoing modernization of infrastructure and a growing construction sector.

- Latin America: An emerging market experiencing consistent growth due to economic development, increasing foreign investments, and expanding construction activities, particularly in Brazil, Mexico, and Argentina. Rising awareness of quality construction and the need for durable waterproofing solutions are key drivers.

- Middle East & Africa (MEA): This region offers significant growth potential, driven by mega-projects in the UAE, Saudi Arabia, and Qatar, focusing on diversified economies and infrastructure expansion. Hot climatic conditions necessitate high-performance, UV-resistant membranes. Growing construction in African nations also contributes to market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Waterproofing Membrane Market.- Soprema Group

- Sika AG

- Fosroc International Ltd.

- W. R. Meadows, Inc.

- Carlisle Companies Inc.

- Kemper System America, Inc.

- BASF SE

- Tremco CPG Inc.

- Pidilite Industries Ltd.

- CosmoFin Pvt. Ltd.

- ARDEX Group

- Dow Chemical Company

- Owens Corning

- GCP Applied Technologies Inc.

- Standard Industries Inc. (Gaco Western)

- Danosa S.A.U.

- Paul Bauder GmbH & Co. KG

- BMI Group (Braas Monier Building Group)

- Johns Manville

Frequently Asked Questions

What is the projected growth rate of the Waterproofing Membrane Market?

The Waterproofing Membrane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2032, driven by urbanization and infrastructure development.

Which types of waterproofing membranes are most commonly used?

Common types include bituminous membranes (modified bitumen), polymeric membranes (PVC, EPDM, TPO), and liquid-applied membranes (polyurethane, acrylic), each suited for various applications.

How does AI impact the Waterproofing Membrane Market?

AI impacts the market through predictive maintenance, enhanced quality control, accelerated material development, and optimized supply chains, leading to more durable and efficient solutions.

What are the primary applications of waterproofing membranes?

Primary applications include roofing, basements, foundations, walls, tunnels, bridges, and water management structures in residential, commercial, and industrial sectors.

What are the key drivers for market growth?

Key drivers include rapid urbanization, increasing infrastructure spending, stringent building codes, growing awareness of long-term benefits, and technological advancements in material science.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Synthetic Polymer Waterproofing Membrane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Liquid Waterproofing Membrane Market Statistics 2025 Analysis By Application (Roofs, Walls, Balconies, Floors, Others), By Type (Polymer Modified Bitumen Emulsions, Glass Reinforced Resilient Unsaturated Polyester Resins, Flexible Unsaturated Polyester Resins, Polyurethanes, Water Dispersible Polymers, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Waterproofing Membrane Market Statistics 2025 Analysis By Application (Roofing, Walls, Building Structures, Landfills & Tunnels), By Type (Modified Bitumen Membrane, Synthetic Polymer Waterproofing Membrane), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager