Wood Pallets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430785 | Date : Nov, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Wood Pallets Market Size

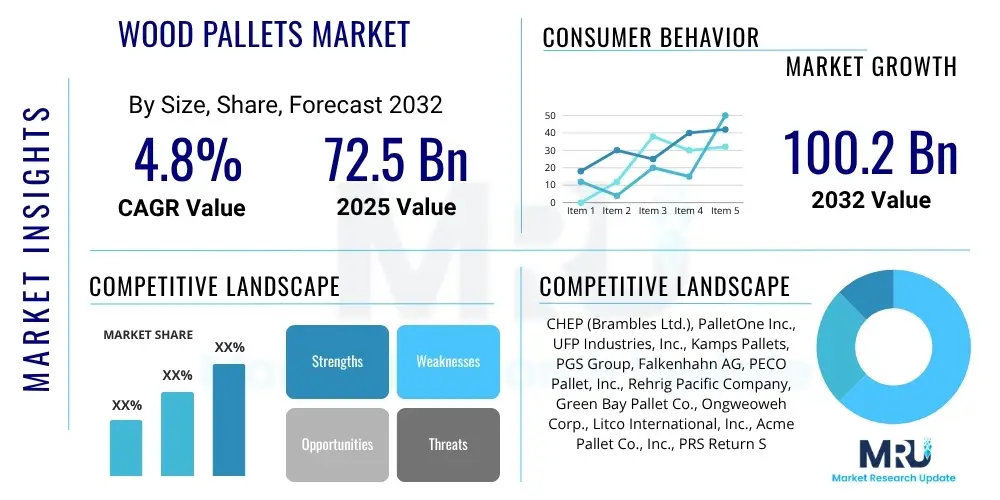

The Wood Pallets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2032. The market is estimated at USD 72.5 billion in 2025 and is projected to reach USD 100.2 billion by the end of the forecast period in 2032.

Wood Pallets Market introduction

The wood pallets market forms a foundational component of global supply chains, enabling the efficient and secure transportation and storage of goods across diverse industries. Wood pallets are flat, portable platforms made primarily from timber, designed to support goods in a stable fashion while being lifted by forklifts, pallet jacks, or other material handling equipment. Their robust construction, cost-effectiveness, and reparability make them an indispensable asset for logistics, manufacturing, retail, and agriculture sectors. The product’s versatility extends from standard block and stringer designs to customized solutions tailored for specific load requirements and environmental conditions, offering a blend of durability and sustainability.

Major applications of wood pallets span across virtually all industries involved in the movement of physical goods. These include fast-moving consumer goods (FMCG), pharmaceuticals, automotive, chemicals, food and beverages, construction materials, and electronics. In the food and beverage industry, they are critical for cold chain logistics and warehouse management. For manufacturing, pallets facilitate the internal movement of components and the shipment of finished products. The growing e-commerce sector heavily relies on pallets for warehouse operations and efficient last-mile delivery preparation, underscoring their broad utility and continuous demand.

The primary benefits of wood pallets encompass their high strength-to-weight ratio, ease of repair, and recyclability, contributing to their widespread adoption. They provide a stable base for stacking and unitizing loads, minimizing damage during transit and optimizing storage space. Key driving factors for market growth include the expansion of international trade, the robust growth of the e-commerce industry necessitating efficient logistics infrastructure, and increasing demand from developing economies undergoing industrialization. Additionally, advancements in pallet treatment technologies and standardization efforts further enhance their appeal and application breadth across global supply chains.

Wood Pallets Market Executive Summary

The global wood pallets market is experiencing steady growth, propelled by the persistent expansion of global trade, the booming e-commerce sector, and increasing industrial output worldwide. Business trends indicate a strong focus on supply chain resilience and optimization, leading companies to invest in more durable and sustainable pallet solutions. There is a discernible shift towards rental and pooling services, particularly for higher-grade pallets, as businesses seek to reduce upfront costs, manage inventory more efficiently, and adhere to environmental sustainability goals. Furthermore, technological integration in logistics, such as automated warehousing systems, is driving demand for pallets with consistent dimensions and quality, fostering innovation in pallet manufacturing processes.

Regional trends highlight distinct growth patterns and market dynamics. Asia Pacific, particularly China and India, represents the largest and fastest-growing market due to rapid industrialization, urbanization, and a burgeoning manufacturing base coupled with expanding retail and e-commerce landscapes. North America and Europe demonstrate mature markets, characterized by a strong emphasis on sustainability, automation compatibility, and the adoption of advanced pallet management systems. Latin America, the Middle East, and Africa are showing significant potential, driven by infrastructure development and increasing international trade activities, albeit with varying levels of standardization and adoption of modern logistics practices.

Segment trends reveal that stringer pallets continue to dominate the market due to their cost-effectiveness and widespread use, especially in general warehousing and transportation. However, block pallets are gaining traction in automated environments and for international shipping where four-way entry is beneficial. In terms of material, softwood pallets remain prevalent, but hardwood pallets are preferred for heavy-duty applications and enhanced durability. The rental and pooling segment is poised for significant expansion, offering a circular economy model that appeals to environmentally conscious businesses and provides operational efficiencies by reducing waste and optimizing asset utilization across the supply chain.

AI Impact Analysis on Wood Pallets Market

User questions related to AI's impact on the wood pallets market frequently revolve around how artificial intelligence can enhance efficiency, reduce costs, and improve sustainability within pallet manufacturing, logistics, and supply chain management. Common inquiries include the potential for AI in optimizing pallet design for strength and material usage, predicting pallet repair and replacement needs, improving tracking and inventory management through smart systems, and streamlining logistics by integrating with warehouse automation. Concerns often focus on the investment required for AI implementation, the availability of skilled labor to manage AI-driven systems, and the practical challenges of integrating advanced technologies into traditional, often low-tech, wood pallet operations. Expectations are high regarding AI’s ability to drive significant operational improvements and support more sustainable practices across the pallet lifecycle.

- AI-driven demand forecasting can optimize wood procurement and pallet production schedules, reducing waste and overstocking.

- Predictive maintenance analytics using AI can identify potential failure points in manufacturing equipment, minimizing downtime and increasing efficiency.

- Computer vision systems powered by AI can automate quality control inspections for newly manufactured and repaired pallets, ensuring consistent standards.

- AI algorithms can optimize pallet stacking patterns and warehouse layouts, maximizing storage density and improving material handling efficiency.

- Integration of AI with IoT sensors on pallets can enable real-time tracking of location, temperature, and humidity, enhancing supply chain visibility.

- AI-powered route optimization for pallet transport and retrieval services can reduce fuel consumption and delivery times.

- Machine learning models can analyze historical data to predict optimal pallet lifecycles, guiding repair versus replace decisions for pooling companies.

- Generative design AI could potentially optimize pallet structures for specific load types, reducing wood usage while maintaining or improving strength.

- Automated robotic systems in warehouses, guided by AI, can efficiently pick, place, and move palletized goods, reducing labor costs.

- AI can analyze freight data to recommend the most cost-effective and environmentally friendly pallet types for various shipping needs.

- Enhanced security and fraud detection in pallet pooling systems through AI monitoring of usage patterns and returns.

- Improved resource allocation for pallet repair facilities, with AI predicting repair volume and required materials.

DRO & Impact Forces Of Wood Pallets Market

The wood pallets market is fundamentally driven by the relentless expansion of global trade and the burgeoning e-commerce sector, which necessitates efficient and robust logistics infrastructure. The increasing volume of goods being shipped internationally and within domestic markets directly translates into higher demand for pallets to facilitate secure and standardized unit loads. Furthermore, industrial growth and manufacturing activities across diverse sectors such as food and beverage, automotive, and pharmaceuticals contribute significantly to market expansion. The cost-effectiveness and recyclability of wood pallets, coupled with their high strength-to-weight ratio, ensure their continued preference over alternative materials. Innovations in pallet management systems and the growing adoption of automated warehousing solutions also act as strong drivers, pushing for higher quality and more consistently dimensioned wood pallets.

Despite these strong drivers, the market faces several restraints. Volatility in timber prices, driven by factors such as fluctuating harvest rates, environmental regulations, and global trade policies, can significantly impact manufacturing costs and profitability. Additionally, the increasing focus on sustainability and deforestation concerns can lead to stricter sourcing regulations and a push towards reusable or alternative pallet materials, potentially impacting demand for new wood pallets. The emergence of plastic and composite pallets, offering advantages such as lighter weight, longer lifespan, and consistent dimensions, poses a competitive threat, particularly in closed-loop systems or industries requiring stringent hygiene standards. Moreover, the prevalence of illegal logging in certain regions can create supply chain inconsistencies and ethical dilemmas for manufacturers.

Opportunities within the wood pallets market are primarily centered around enhancing sustainability and integrating advanced technologies. Developing certified sustainable sourcing practices and promoting the use of recycled wood for pallet manufacturing can open new market segments and improve brand perception. The expansion of pallet pooling and rental services presents a significant opportunity for market players to offer cost-effective and environmentally friendly solutions, moving towards a circular economy model. Furthermore, incorporating IoT sensors and RFID tags into pallets for improved tracking and supply chain visibility, while still nascent, offers a long-term growth avenue. Investing in advanced repair and remanufacturing processes to extend the lifespan of wooden pallets also contributes to sustainability and cost savings, providing compelling value propositions to end-users and fostering market resilience.

Segmentation Analysis

The wood pallets market is comprehensively segmented to provide a detailed understanding of its diverse components and dynamics. This segmentation typically considers factors such as the type of pallet, the material used, the application industries, and the service model. Analyzing these segments helps in identifying key growth areas, understanding customer preferences, and strategizing market entry or expansion. The market's structure reflects the varied requirements of global logistics and supply chains, from basic transportation needs to specialized applications demanding high durability or specific design features, allowing for tailored product offerings and targeted marketing efforts by manufacturers and service providers.

- By Type

- Stringer Pallets: Characterized by boards running between top and bottom deck boards, typically two-way or four-way entry.

- Block Pallets: Utilize blocks of solid wood or plywood between the top and bottom decks, offering true four-way entry for forklifts.

- GMA Pallets: A standardized stringer pallet type, widely used in the grocery industry in North America.

- Euro Pallets (EPAL Pallets): Standardized block pallets common in Europe, designed for interoperability across automated systems.

- Custom Pallets: Pallets designed to specific dimensions or load-bearing capacities for unique industrial applications.

- By Material

- Softwood Pallets: Primarily made from pine, spruce, or fir, offering cost-effectiveness and good workability.

- Hardwood Pallets: Constructed from oak, maple, or other hardwoods, known for superior durability and load-bearing capacity.

- By Application

- Food and Beverage: Critical for transport and storage of packaged foods, beverages, and agricultural products.

- Chemicals and Pharmaceuticals: Used for handling sensitive and regulated products, often requiring specialized treatments.

- Manufacturing: Facilitates internal logistics and shipment of components and finished goods across various industries.

- Retail and Consumer Goods: Essential for warehousing, distribution, and point-of-sale inventory management.

- Logistics and Transportation: Core infrastructure for freight forwarding, warehousing, and intermodal transport.

- Other Applications: Includes construction, electronics, automotive, and various industrial sectors.

- By End-Use Industry

- FMCG: Fast-moving consumer goods companies rely heavily on pallets for high-volume distribution.

- Retail & E-commerce: For efficient inventory management, fulfillment centers, and store delivery.

- Automotive: For transporting parts and finished vehicles securely within the supply chain.

- Construction: For moving heavy building materials such as bricks, cement bags, and tiles.

- Agriculture: For handling bulk produce, fertilizers, and packaged goods from farm to market.

- By Service Model

- New Pallets: Directly purchased from manufacturers for long-term use or specific applications.

- Used Pallets: Refurbished or reconditioned pallets offering a cost-effective and sustainable option.

- Rental and Pooling: Pallets are rented from a third-party provider and managed in a closed-loop system, promoting reuse and sustainability.

Value Chain Analysis For Wood Pallets Market

The value chain for the wood pallets market begins with upstream activities primarily centered on raw material sourcing and primary processing. This stage involves timber harvesting from forests, often sourced from sustainably managed woodlands to meet certification standards like FSC or PEFC. Sawmills then process the raw timber into lumber, specifically cut to the dimensions required for pallet components such as deck boards, stringers, or blocks. Key considerations at this stage include the quality of timber, species selection (softwood vs. hardwood), and adherence to environmental regulations, which directly impact the cost and availability of raw materials for pallet manufacturers.

Midstream activities involve the actual manufacturing and assembly of wood pallets. Pallet manufacturers receive processed lumber, which undergoes further cutting, notching, and fastening using nails or staples. This stage often incorporates automation to enhance efficiency and ensure dimensional consistency, especially for pallets destined for automated warehouse systems. Quality control is critical to ensure pallets meet industry standards (e.g., ISPM 15 for international shipping to prevent pest infestation) and client specifications regarding load capacity, durability, and type. Customization, heat treatment, and branding are also performed here, preparing the pallets for their specific end-use applications.

Downstream activities encompass the distribution, usage, and end-of-life management of pallets. Distribution channels can be direct, where large end-users purchase directly from manufacturers, or indirect, involving distributors and pallet pooling companies. Pallet pooling services play a significant role by renting pallets to users, managing their repair, and facilitating their reuse across supply chains, thereby extending their lifecycle and promoting circularity. The end-users, ranging from manufacturers to retailers, integrate these pallets into their logistics and warehousing operations. At the end of their functional life, pallets are either repaired, recycled into other wood products (e.g., mulch, biomass), or responsibly disposed of, highlighting the importance of reverse logistics in minimizing waste and maximizing resource utilization within the industry.

Wood Pallets Market Potential Customers

The primary potential customers for wood pallets are diverse and span across nearly every sector involved in the movement, storage, and distribution of physical goods. This includes large-scale manufacturers who require pallets for both internal material handling and the shipment of finished products to distributors and retailers. Industries such as automotive, chemicals, pharmaceuticals, and electronics are constant high-volume buyers, often demanding specialized or custom-sized pallets that meet stringent quality and safety standards for their valuable and sometimes delicate products. These businesses prioritize durability, consistent quality, and compliance with international shipping regulations like ISPM 15.

Another significant customer segment comprises the vast network of logistics and transportation companies, including freight forwarders, warehousing providers, and third-party logistics (3PL) providers. These entities operate as intermediaries, managing the complex supply chains for numerous clients across various industries. They require a steady supply of standard and specialized pallets to facilitate efficient loading, unloading, and transportation of goods, whether by truck, rail, sea, or air. Their purchasing decisions are often driven by cost-effectiveness, availability, and the ability to integrate pallets seamlessly into their automated or semi-automated material handling systems.

Furthermore, the retail and e-commerce sectors represent a rapidly expanding customer base. Retail chains utilize pallets for receiving goods from suppliers, stocking warehouses, and distributing products to individual stores. E-commerce giants and smaller online retailers rely heavily on pallets for efficient fulfillment center operations, from inbound inventory storage to outbound shipping preparation. The food and beverage industry also stands out as a critical end-user, requiring vast quantities of pallets for transporting perishable and non-perishable goods, often necessitating adherence to strict hygiene standards and potentially requiring heat-treated pallets for food safety compliance. Agricultural producers also use pallets for handling bulk produce and packaged goods from farms to processing facilities and markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 72.5 billion |

| Market Forecast in 2032 | USD 100.2 billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CHEP (Brambles Ltd.), PalletOne Inc., UFP Industries, Inc., Kamps Pallets, PGS Group, Falkenhahn AG, PECO Pallet, Inc., Rehrig Pacific Company, Green Bay Pallet Co., Ongweoweh Corp., Litco International, Inc., Acme Pallet Co., Inc., PRS Return System GmbH, Pallet Logistics of America (PLA), Millwood, Inc., C & K Pallets, Inc., Atlas Pallet, Inc., John Rock, Inc., Twinwood Inc., Pallet Service Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wood Pallets Market Key Technology Landscape

The wood pallets market, while seemingly traditional, is increasingly integrating various technologies to enhance efficiency, durability, and sustainability across its lifecycle. In manufacturing, advanced automated nailing machines and robotic assembly systems are becoming more prevalent, improving production speed, consistency, and worker safety. Computer-aided design (CAD) software is utilized to optimize pallet structures for specific load requirements, material usage, and performance characteristics, leading to more efficient and resilient designs. Furthermore, heat treatment technologies, essential for compliance with ISPM 15 international shipping regulations to mitigate pest transmission, are continually refined for energy efficiency and throughput.

Beyond the manufacturing floor, the technology landscape extends into logistics and supply chain management. The adoption of Radio-Frequency Identification (RFID) tags and barcode systems embedded or affixed to pallets is growing. These technologies enable precise tracking of pallet movements, inventory levels, and asset management within large warehouses and across global supply chains. This provides real-time visibility, reduces loss, and optimizes asset utilization, especially for pallet pooling and rental companies. The data collected from these tracking systems can then be leveraged by analytics software to predict maintenance needs, optimize distribution routes, and improve overall operational efficiency.

Moreover, the integration of material handling automation, such as automated guided vehicles (AGVs), autonomous mobile robots (AMRs), and sophisticated conveyor systems in warehouses, is driving demand for higher precision and consistent pallet quality. Pallets are designed to be compatible with these automated systems, requiring strict dimensional tolerances and robust construction to withstand continuous use in dynamic environments. Innovations in wood processing, such as engineered wood products or composite lumber for pallet components, are also emerging, offering enhanced durability, moisture resistance, and potentially lighter weight alternatives, further diversifying the technological toolkit available within the wood pallets market.

Regional Highlights

- North America: A mature market characterized by high adoption of automated warehousing and a strong emphasis on pallet pooling and recycling programs. The United States and Canada are leading in demand due to robust manufacturing and e-commerce sectors, with a growing focus on sustainable sourcing and optimized logistics.

- Europe: Driven by strict environmental regulations and high standardization, particularly with the widespread use of Euro Pallets (EPAL). Western European countries like Germany, France, and the UK are key consumers, investing in advanced pallet management systems and promoting circular economy principles through extensive pallet rental networks.

- Asia Pacific (APAC): The largest and fastest-growing market globally, propelled by rapid industrialization, burgeoning manufacturing hubs in China, India, and Southeast Asian nations, and explosive growth in e-commerce. Increasing international trade and improving logistics infrastructure are significantly boosting demand for wood pallets across the region.

- Latin America: Demonstrates significant growth potential, driven by expanding agricultural exports, increasing manufacturing activities, and improving trade relations. Countries like Brazil and Mexico are leading the demand, though market maturity and standardization vary across the region.

- Middle East and Africa (MEA): An emerging market benefiting from infrastructure development projects, diversification of economies away from oil, and growing trade volumes. The GCC countries and South Africa are key contributors, with increasing investment in logistics and warehousing facilities fueling pallet demand.

- China: Dominant in APAC, with massive industrial output, e-commerce penetration, and export-driven economy leading to unparalleled demand for wood pallets. Focus is on both new pallet production and expanding domestic pallet pooling systems.

- India: Experiencing strong growth due to rapid economic development, manufacturing expansion under initiatives like "Make in India," and a burgeoning retail and logistics sector. Increasing adoption of modern warehousing practices drives demand.

- Germany: A key European market known for its advanced logistics infrastructure and high adherence to quality and environmental standards for wood pallets, particularly Euro Pallets. Strong emphasis on recycling and pallet repair.

- United States: Largest market in North America, characterized by a diverse industrial base, extensive supply chains, and significant investment in pallet automation and pooling services to optimize operational efficiency.

- Brazil: Leading market in Latin America, driven by its vast agricultural exports and growing manufacturing sector. Focus on both domestic and international shipping standards for pallets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wood Pallets Market.- CHEP (Brambles Ltd.)

- PalletOne Inc.

- UFP Industries, Inc.

- Kamps Pallets

- PGS Group

- Falkenhahn AG

- PECO Pallet, Inc.

- Rehrig Pacific Company

- Green Bay Pallet Co.

- Ongweoweh Corp.

- Litco International, Inc.

- Acme Pallet Co., Inc.

- PRS Return System GmbH

- Pallet Logistics of America (PLA)

- Millwood, Inc.

- C & K Pallets, Inc.

- Atlas Pallet, Inc.

- John Rock, Inc.

- Twinwood Inc.

- Pallet Service Corporation

Frequently Asked Questions

What is the primary factor driving the growth of the wood pallets market?

The primary factor driving market growth is the consistent expansion of global trade and the booming e-commerce industry, which necessitate robust and efficient logistics infrastructure for transporting and storing goods worldwide.

How do wood pallets contribute to sustainable supply chains?

Wood pallets contribute to sustainability through their recyclability, reparability, and the increasing adoption of pallet pooling and rental models, which promote reuse and significantly reduce waste compared to single-use options.

What are the key differences between stringer and block pallets?

Stringer pallets use boards running between top and bottom deck boards, typically allowing two-way or sometimes partial four-way forklift entry. Block pallets, conversely, use blocks to create space between decks, providing true four-way entry, which is more versatile for automated systems.

What role does ISPM 15 play in the wood pallets market?

ISPM 15 (International Standards for Phytosanitary Measures No. 15) dictates that wood packaging materials used in international trade must be debarked and heat treated or fumigated to prevent the spread of pests, ensuring global compliance and preventing trade disruptions.

What are the emerging technologies impacting the wood pallets market?

Emerging technologies include RFID and barcode tracking for enhanced visibility, AI-driven demand forecasting and quality control, and advanced automation compatibility for improved integration with modern warehouse systems, leading to greater efficiency and data utilization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager