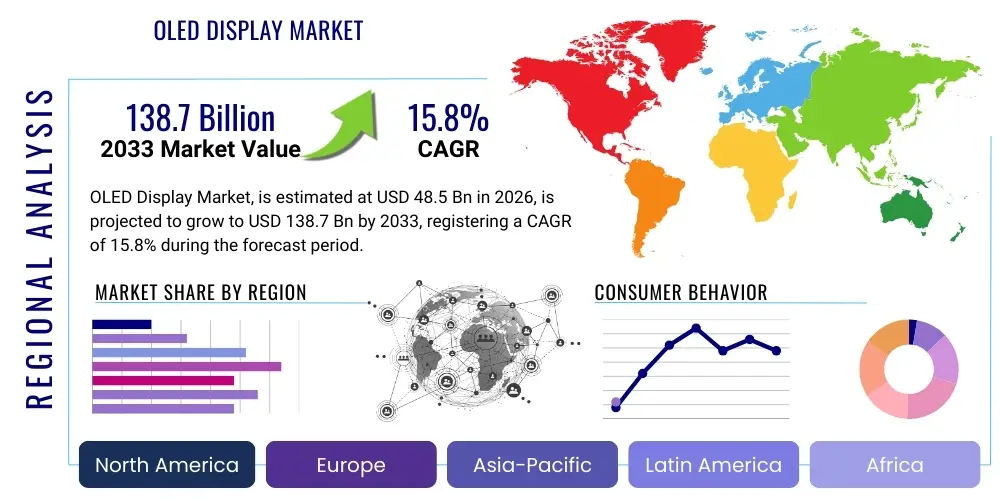

OLED Display Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437698 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

OLED Display Market Size

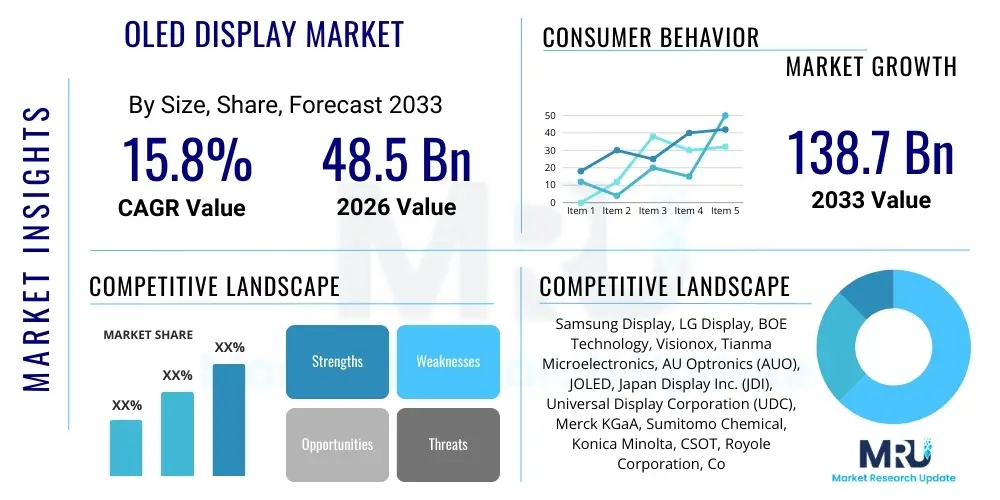

The OLED Display Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 48.5 Billion in 2026 and is projected to reach USD 138.7 Billion by the end of the forecast period in 2033.

OLED Display Market introduction

The Organic Light Emitting Diode (OLED) Display Market encompasses the production, distribution, and utilization of display panels that use organic compounds to emit light when an electric current is applied. Unlike traditional Liquid Crystal Displays (LCDs) that require a separate backlight, OLED technology is self-emissive, allowing for superior contrast ratios, true blacks, faster response times, and wider viewing angles. This inherent self-lighting capability enables manufacturers to produce thinner, more flexible, and energy-efficient displays, driving their rapid adoption across various consumer electronics and emerging industrial applications. The technology is broadly categorized into Active-Matrix OLED (AMOLED), predominantly used in high-end smartphones and televisions, and Passive-Matrix OLED (PMOLED), often utilized in smaller, simpler displays for wearable devices and auxiliary screens.

Major applications of OLED displays span a wide spectrum, ranging from small-sized screens in smartphones, smartwatches, and virtual reality (VR) headsets, to medium-sized displays in automotive dashboards and tablets, and large-sized panels in high-definition televisions (OLED TVs). The technology's ability to offer perfect black levels and vibrant colors makes it highly desirable for high-fidelity visual experiences, positioning it as a premium display solution. Furthermore, the development of flexible and transparent OLED panels is opening new avenues in sectors like digital signage, architectural design, and flexible computing devices, indicating a robust diversification of the application portfolio.

The primary driving factors propelling the market expansion include the increasing demand for high-resolution displays in premium smartphones and the continuous transition from LCD to OLED technology in the television segment, particularly in developed economies. Benefits such as reduced power consumption, lightweight design, and the capacity for producing foldable and rollable devices are crucial technological advantages sustaining market growth. Continuous investments in manufacturing capacity expansion, particularly in Gen 6 and Gen 8 fabs, by key Asian players further solidify the supply chain necessary to meet escalating global demand.

OLED Display Market Executive Summary

The OLED display market is characterized by intense technological innovation and aggressive capital expenditure, fundamentally reshaping the global display landscape. Business trends indicate a strategic shift towards hybrid OLED structures and tandem stack architectures aimed at improving brightness and extending panel lifespan, essential for long-term commercial applications like automotive displays and IT products (laptops and monitors). Supply chain resilience is a major focus, with key players investing heavily in securing stable material sourcing and optimizing proprietary manufacturing processes, such as evaporation and inkjet printing technologies. The transition to larger panel sizes and higher pixel densities is generating significant revenue growth, moving OLED technology beyond consumer handhelds into premium computing and automotive segments, which command higher average selling prices (ASPs).

Regionally, the Asia Pacific (APAC) continues its dominance, driven primarily by the colossal manufacturing bases in South Korea and China, which account for the vast majority of global OLED production capacity. South Korea remains the leader in large-area OLED and advanced flexible AMOLED production, while China is rapidly increasing its capacity, particularly for small and medium-sized displays, fostered by strong government support and significant domestic demand from local consumer electronics brands. North America and Europe serve as critical consumption hubs, characterized by early adoption of premium OLED devices, including high-end televisions and monitors, thereby setting global performance benchmarks and driving demand for next-generation features like variable refresh rates and ultra-high brightness.

Segment trends highlight the persistent strength of the small and medium-sized display segment, particularly within the smartphone and wearable categories, which acts as the core revenue generator for flexible AMOLED producers. However, the fastest growth is anticipated in the IT segment (laptops and monitors), driven by the desire for superior color accuracy and thinner form factors in professional and gaming notebooks. Furthermore, the automotive display segment is exhibiting a substantial CAGR, moving away from traditional LCD instrument clusters towards larger, integrated OLED infotainment systems and digital cockpits, which leverage the technology's deep contrast and design flexibility for enhanced cabin aesthetics and functionality.

AI Impact Analysis on OLED Display Market

User inquiries regarding the interplay between Artificial Intelligence (AI) and the OLED Display Market frequently revolve around how AI can optimize display manufacturing processes, enhance image quality through machine learning algorithms, and facilitate the creation of next-generation display architectures. Key themes emerging from these questions include the potential for AI-driven fault detection to boost manufacturing yield rates, the use of neural networks to perform real-time pixel-level compensation for burn-in prevention and uniformity correction, and the integration of AI-powered ambient light sensing and image processing within devices to dynamically optimize display parameters. Users also express interest in AI's role in accelerating material science research for novel organic emitters and potentially reducing the lengthy cycle times associated with traditional R&D, thereby suggesting expectations for both efficiency gains in production and significant performance enhancements at the consumer level.

- AI-Driven Manufacturing Optimization: Using machine learning models to predict defects, optimize vapor deposition processes, and enhance panel uniformity, leading to improved manufacturing yields and cost reduction.

- Real-time Pixel Compensation: Employing neural networks within display driver ICs (DDI) to dynamically adjust current flow to individual pixels, actively preventing burn-in and maintaining long-term image quality and color balance.

- Enhanced Image Processing: Integrating AI algorithms for superior image upscaling, noise reduction, and content-aware color mapping (AI Picture Processing), maximizing the visual fidelity capabilities of OLED hardware.

- Supply Chain and Logistics: Utilizing predictive AI for demand forecasting, inventory management of specialized materials, and optimizing the complex global logistics network required for panel distribution.

- Accelerated Material Discovery: Applying AI and computational chemistry to rapidly screen and develop new, highly efficient, and durable organic materials for emitters (blue light), reducing R&D timelines significantly.

- Adaptive Display Performance: Enabling displays to use AI and sensors to automatically adjust brightness, color temperature, and contrast based on ambient lighting and user gaze, improving power efficiency and viewing comfort.

DRO & Impact Forces Of OLED Display Market

The OLED Display Market is primarily driven by the escalating consumer preference for high-end visual experiences offered by OLED’s perfect black and infinite contrast ratio, coupled with the rapid adoption of flexible and foldable device form factors, which are technologically enabled by OLED substrates. Restraints largely stem from the high manufacturing complexity and associated capital expenditure required for building Gen 8 or Gen 10 fabs, leading to higher initial costs compared to mature LCD technologies. Furthermore, technological limitations related to panel longevity, specifically burn-in risks and the relatively short lifespan of blue organic emitters, pose ongoing challenges, particularly in static image applications like IT monitors and automotive displays. Opportunities lie significantly in expanding penetration into the high-volume IT sector (laptops and tablets) and establishing dominance in the nascent automotive display market, alongside the potential commercialization of advanced technologies such as quantum dot (QD)-OLED and Micro-OLED for virtual reality applications, promising higher efficiency and brightness.

Impact forces within the market are predominantly defined by the aggressive capital investments from East Asian nations, which effectively control the global supply and price structure of advanced panels. The intense competition from alternative technologies, notably Mini-LED backlighting in LCDs, forces OLED manufacturers to continuously innovate, particularly regarding brightness levels and cost efficiency, influencing pricing strategies and market share capture. Regulatory and environmental pressures related to manufacturing processes and material toxicity also exert influence, pushing companies towards more sustainable and energy-efficient production methods, further accelerating the demand for intrinsically low-power consumption displays like OLEDs over traditional backlit panels. The bargaining power of major display panel buyers (e.g., Apple, Samsung Electronics, Sony) remains high, compelling suppliers to meet stringent quality standards and competitive pricing requirements.

Segmentation Analysis

The OLED Display Market segmentation provides a granular view of its varied commercial and technological landscape, primarily categorized by panel size, application, technology, and material type. Understanding these segments is crucial as different sizes and technologies cater to distinct end-user needs and market maturity levels. For instance, the small display segment utilizes flexible AMOLED technology extensively, driven by the smartphone sector, while the large display segment relies heavily on RGB side-by-side or White OLED (WOLED) architectures for premium televisions. Growth rates vary significantly across these segments, with automotive and IT applications showing the highest potential for future expansion, driven by the integration of large-format, high-resolution screens into vehicles and professional workstations, requiring specific performance metrics such as high luminance and extended temperature tolerance.

- By Display Panel Size

- Small-Sized Displays (Less than 6 inches)

- Medium-Sized Displays (6 inches to 17 inches)

- Large-Sized Displays (Greater than 17 inches)

- By Technology Type

- Active-Matrix OLED (AMOLED)

- Passive-Matrix OLED (PMOLED)

- White OLED (WOLED)

- Quantum Dot OLED (QD-OLED)

- Transparent OLED

- Flexible and Foldable OLED

- By Material Type

- Emitter Materials (Fluorescent, Phosphorescent, TADF)

- Substrate Materials (Glass, Flexible Plastic/Polyimide)

- Encapsulation Materials

- By Application

- Smartphones and Tablets

- Televisions and Digital Signage

- Wearable Devices (Smartwatches, AR/VR Headsets)

- Automotive Displays (Infotainment, Instrument Clusters)

- IT Products (Laptops, Monitors)

- Industrial and Medical Devices

Value Chain Analysis For OLED Display Market

The OLED display value chain is highly complex and integrated, starting with upstream activities centered on the development and supply of highly specialized materials and components. Upstream analysis involves key material suppliers providing organic compounds, fine metal masks (FMMs), substrate materials (like polyimide for flexible panels), and advanced driver integrated circuits (DDIs). This stage is characterized by high barriers to entry due to stringent purity requirements and intellectual property constraints, leading to dominance by a few specialized chemical and equipment manufacturers, primarily located in East Asia, Europe, and the U.S. The performance and cost structure of the final display product are critically dependent on the innovation occurring at this material sourcing level, particularly concerning blue emitter efficiency and encapsulation effectiveness.

Midstream activities encompass the actual panel manufacturing, fabrication, and module assembly, primarily dominated by large display panel producers (Samsung Display, LG Display, BOE). These companies operate multi-billion dollar fabrication facilities (fabs) where processes like thin-film transistor (TFT) backplane creation, organic material deposition, and encapsulation are executed. Manufacturing prowess and yield optimization are key competitive differentiators at this stage. Direct distribution channels are often utilized for large-volume sales to major original equipment manufacturers (OEMs) like Apple or Samsung Electronics, involving long-term supply contracts and highly customized panel specifications. Indirect distribution involves sales through specialized display distributors and integrators who cater to smaller OEMs, niche industrial applications, or regional assembly markets, facilitating wider market access.

Downstream analysis focuses on the integration of OLED panels into final consumer products across diverse application segments—smartphones, TVs, automotive dashboards, and IT accessories. This stage dictates final consumer demand and quality feedback. Key players in this downstream segment are the global consumer electronics giants. The market structure dictates that panel makers often have high bargaining power over material suppliers but face intense price pressure from massive downstream buyers, who utilize their volume purchase capabilities to negotiate favorable terms, directly impacting overall market pricing and margins across the entire value chain.

OLED Display Market Potential Customers

The primary consumers and end-users of OLED display technology are large-scale Original Equipment Manufacturers (OEMs) across the consumer electronics, automotive, and IT sectors who prioritize premium display performance and sleek design. In the consumer electronics segment, smartphone manufacturers are the largest volume buyers, followed by television brands focused on the luxury and high-end market segments. These buyers demand panels that offer high brightness, low power consumption, flexibility, and robust long-term reliability for their flagship product lines. The shift towards foldable phones and larger, high-refresh-rate gaming monitors is continually expanding the requirements placed upon display suppliers.

Furthermore, the automotive industry represents a rapidly growing segment of potential customers. Automobile manufacturers are increasingly replacing traditional analog gauges and small LCD screens with large, seamless, integrated OLED panels for instrument clusters, central information displays (CIDs), and passenger entertainment systems. These customers require displays that meet stringent automotive standards for temperature tolerance, vibration resistance, and lifespan (up to 10 years). Specialized industrial and medical equipment manufacturers, requiring high-contrast and reliable displays for sensitive monitoring systems and portable diagnostic tools, also constitute a significant, albeit niche, customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 48.5 Billion |

| Market Forecast in 2033 | USD 138.7 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Display, LG Display, BOE Technology, Visionox, Tianma Microelectronics, AU Optronics (AUO), JOLED, Japan Display Inc. (JDI), Universal Display Corporation (UDC), Merck KGaA, Sumitomo Chemical, Konica Minolta, CSOT, Royole Corporation, Corning Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

OLED Display Market Key Technology Landscape

The OLED Display market is defined by several sophisticated and evolving technological architectures aimed at improving efficiency, brightness, and manufacturing feasibility. The core technology centers around Active-Matrix OLED (AMOLED), which utilizes a thin-film transistor (TFT) backplane to independently control each pixel, enabling high-resolution and complex display content, predominantly used in smartphones and tablets. For large-area displays, especially in televisions, White OLED (WOLED) is the dominant architecture, developed and patented primarily by LG Display. WOLED uses stacked blue and yellow emitters to create white light, which then passes through color filters. This technique simplifies manufacturing complexity for large screens but can lead to reduced power efficiency compared to pure RGB architectures.

The next generation of display technology is increasingly focusing on enhancing durability and performance through novel material and manufacturing techniques. Quantum Dot OLED (QD-OLED), championed by Samsung Display, integrates a blue OLED emitter layer with a quantum dot color conversion layer. This hybrid approach aims to combine the perfect blacks of OLEDs with the superior color gamut and longevity associated with quantum dots, avoiding the efficiency challenges inherent in traditional WOLED color filtering. Furthermore, Tandem Stack structures, where multiple emission layers are stacked vertically, are gaining traction, particularly for IT and automotive applications, as they significantly boost luminance and extend the operational lifespan, crucial for use cases involving static images or high ambient light conditions.

Manufacturing advancements, such as the transition from highly complex and inefficient Fine Metal Mask (FMM) evaporation processes to Inkjet Printing (IJP) technology, represent a significant technological shift. IJP promises substantial cost reductions and improved material utilization, especially for medium to large displays, by precisely depositing organic materials, thereby enabling the production of more affordable OLED panels for the mainstream IT and monitor markets. Parallel developments in flexible substrates (using polyimide or flexible glass) and thin-film encapsulation (TFE) are critical enablers for the production of foldable, rollable, and ultra-thin devices, continually pushing the boundaries of device form factors and opening new design possibilities in consumer electronics.

Regional Highlights

Regional dynamics heavily influence the OLED Display Market, dictated by both concentrated manufacturing capabilities and disparate consumer demand profiles. Asia Pacific (APAC) stands as the epicenter of the global market, not only dominating the production landscape but also acting as a primary consumption market. Countries like South Korea and China are critical, with South Korea housing the leaders in advanced flexible AMOLED and large-area WOLED production. China is rapidly catching up, utilizing massive state investments to expand its Gen 6 AMOLED capacities, primarily serving domestic demand and competing aggressively in the global smartphone display segment. APAC's lead is sustained by vast supply chain infrastructure, technical expertise, and continuous governmental support for the display industry.

North America and Europe are pivotal demand regions characterized by high purchasing power and early adoption of premium technologies. North America, driven by major tech companies and strong consumer preference for high-end televisions and flagship mobile devices, represents a crucial market for large and medium-sized OLED panels. European markets follow a similar trend, focusing on design, image quality, and energy efficiency, particularly in the high-end television and computing segments. The regulatory environment in Europe, favoring sustainable and energy-efficient technologies, provides an inherent advantage to OLED over traditional high-power-consuming LCD alternatives, driving integration into professional and commercial applications.

The Latin America and Middle East and Africa (MEA) regions are emerging markets that exhibit significant potential, largely characterized by increasing penetration of mid-range and high-end smartphones. While these regions do not host large-scale production facilities, they are vital for final product consumption. Market growth here is linked to rising disposable incomes, improving mobile network infrastructure, and the growing availability of affordable OLED-equipped devices, leading to gradual but consistent expansion in demand, particularly for small-sized AMOLED displays used in mid-to-high-tier mobile devices.

- Asia Pacific (APAC): Dominates both production and consumption; led by South Korea (large-area and flexible OLED expertise) and China (rapidly expanding AMOLED capacity and domestic demand).

- North America: Key early adopter of premium OLED devices; strong market for high-end televisions, monitors, and flagship smartphones; demand focused on high-performance criteria.

- Europe: Focus on premium quality, energy efficiency, and design in televisions and IT products; growing penetration in automotive displays due to luxury vehicle manufacturing base.

- Latin America (LATAM): Emerging market with rising adoption of OLED smartphones; growth trajectory tied to economic stability and increasing middle-class spending on consumer electronics.

- Middle East & Africa (MEA): Gradual increase in demand for small and medium-sized OLED displays, driven by urbanization and improved access to advanced mobile technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the OLED Display Market.- Samsung Display Co., Ltd. (SDC)

- LG Display Co., Ltd. (LGD)

- BOE Technology Group Co., Ltd.

- Visionox Technology Inc.

- Tianma Microelectronics Co., Ltd.

- AU Optronics Corp. (AUO)

- JOLED Inc.

- Japan Display Inc. (JDI)

- Universal Display Corporation (UDC)

- Merck KGaA

- Sumitomo Chemical Co., Ltd.

- Konica Minolta, Inc.

- China Star Optoelectronics Technology (CSOT)

- Royole Corporation

- Corning Incorporated

- Shenzhen China Star Optoelectronics Technology (CSOT)

- Novaled GmbH

- E Ink Holdings Inc. (While primarily e-paper, relevant in display technology evolution)

- Kateeva, Inc. (Equipment manufacturer specializing in inkjet printing)

- Applied Materials, Inc. (Key supplier of manufacturing equipment)

Frequently Asked Questions

Analyze common user questions about the OLED Display market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between OLED, Micro-LED, and Mini-LED technologies?

OLED is a self-emissive technology offering perfect blacks and infinite contrast, but with risks of burn-in and lifetime issues. Mini-LED is an advanced LCD backlight technology, improving contrast and brightness but still requiring backlighting. Micro-LED is also self-emissive, potentially superior to OLED in brightness and lifespan, but remains prohibitively expensive and technically challenging for mass production, especially for small displays.

Is burn-in still a significant concern for modern OLED displays, and how is the industry addressing it?

While burn-in (permanent image retention) remains a possibility, modern OLED panels, particularly those in premium TVs and smartphones, have significantly mitigated this risk through advanced technologies like pixel shifting, real-time pixel-level compensation (RPLC) algorithms, and improved organic material efficiency (Tandem Stack structures), extending panel lifespan and reliability substantially.

Which market segment is expected to drive the highest growth in the OLED industry through 2033?

The IT products segment, specifically laptops, tablets, and desktop monitors, is projected to exhibit the fastest growth. This is due to the current low penetration rate coupled with increasing enterprise and professional user demand for the superior color accuracy, contrast, and thin form factor enabled by AMOLED technology, replacing traditional high-end LCDs.

How does the shift towards flexible and foldable devices impact OLED manufacturing techniques?

The shift necessitates the use of flexible polyimide (PI) or ultra-thin glass substrates instead of rigid glass. It also requires advanced Thin-Film Encapsulation (TFE) to protect the organic materials from moisture and oxygen during continuous bending and folding, driving innovation in both substrate material science and encapsulation processes.

What role does Quantum Dot (QD) technology play in the future development of OLED displays?

QD technology, specifically utilized in QD-OLED, uses highly efficient blue OLED emitters combined with quantum dot color converters to achieve superior color volume and brightness without relying on traditional color filters. This hybrid approach aims to deliver a wider color gamut and higher peak brightness than conventional WOLED architectures, enhancing performance for next-generation televisions and monitors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- OLED Display Market Size Report By Type (Active-Matrix Organic Light-Emitting Diode(AMOLED Display), Passive Matrix OLED(PMOLED)), By Application (Smartphone, Smart Watch, Wearable Device, Digital Cameras, TV Sets, MP3 Players, Radio Decks), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- AMOLED Display Market Size Report By Type (Active-Matrix Organic Light-Emitting Diode(AMOLED Display), Passive Matrix OLED(PMOLED)), By Application (Smartphone, smart watch ,Wearable device, digital cameras, TV sets, MP3 players, radio decks for automobiles, small devices), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- OLED Display Driver IC Market Statistics 2025 Analysis By Application (Mobile Computing Devices, TVs, Automotive infotainment systems), By Type (8 channel, 16 channel, 32 channel, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Amoled Display Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Conventional, Flexible, Transparent, 3D), By Application (Smartphone, Smart watch, Wearable device, Digital cameras, TV sets, MP4), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager