Optical Biometry Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435052 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Optical Biometry Devices Market Size

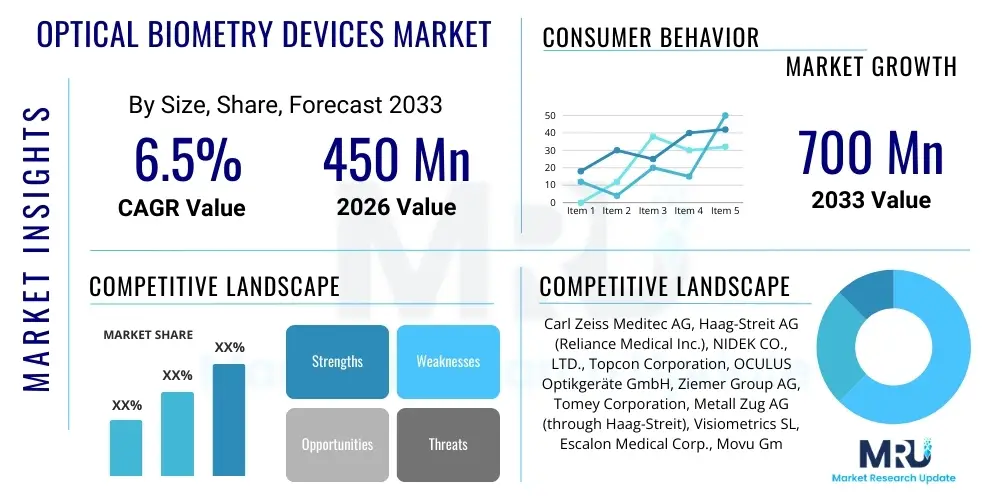

The Optical Biometry Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $450 Million USD in 2026 and is projected to reach $700 Million USD by the end of the forecast period in 2033. This consistent expansion is predominantly fueled by the increasing global prevalence of cataracts, coupled with significant technological advancements in diagnostic imaging that require enhanced precision in intraocular lens (IOL) calculation. The shift towards premium IOLs (P-IOLs), which necessitate highly accurate pre-operative measurements, further solidifies the market's robust trajectory, especially in developed economies with established healthcare infrastructure.

Optical Biometry Devices Market introduction

Optical biometry devices represent a critical class of diagnostic medical equipment utilized in ophthalmology to precisely measure the anatomical dimensions of the eye, particularly axial length, corneal curvature, anterior chamber depth, and lens thickness. These measurements are fundamental for accurate calculation of the power of the Intraocular Lens (IOL) to be implanted following cataract extraction surgery, ensuring optimal refractive outcomes for the patient. The technology primarily relies on non-contact methods, such as Partial Coherence Interferometry (PCI) and Optical Coherence Tomography (OCT), offering significant advantages over traditional ultrasound biometry by providing superior accuracy, repeatability, and speed, thereby minimizing the potential for post-operative refractive surprise.

Major applications for optical biometry extend beyond cataract surgery planning to include monitoring myopia progression, assessing the fit for contact lenses, and evaluating anatomical risks associated with glaucoma. The devices are essential components in high-volume ophthalmic centers and surgical clinics globally, ensuring standardized and efficient patient throughput. The demand is heavily driven by demographic factors, particularly the accelerating aging population worldwide, as cataracts remain the leading cause of reversible blindness and their incidence correlates directly with advanced age. Furthermore, the rising awareness and adoption of advanced surgical techniques, coupled with patient expectations for superior visual quality post-surgery, compel clinics to invest in state-of-the-art biometry platforms.

Key benefits derived from utilizing optical biometry devices include enhanced surgical precision, improved patient satisfaction rates due to better visual outcomes, and reduced operational time for ophthalmologists. Driving factors propelling this market growth encompass continuous innovations leading to faster acquisition times (e.g., Swept Source OCT), integration with sophisticated planning software, and the increasing availability of third- and fourth-generation IOL formulas optimized specifically for optical biometric data. Additionally, market expansion is supported by favorable reimbursement policies in key regions and strategic expansion by leading manufacturers into emerging economies.

Optical Biometry Devices Market Executive Summary

The Optical Biometry Devices Market is characterized by intense competition focused on technological superiority, particularly the development of instruments offering broader measurement ranges, greater penetration through dense cataracts, and seamless integration with Electronic Health Records (EHRs) and advanced calculation engines. Business trends indicate a strong focus on merger and acquisition activities among established players seeking to consolidate market share and acquire specialized intellectual property related to proprietary light sources (like Swept Source technology). Furthermore, there is a pronounced shift towards platform solutions that combine biometry with topography, wavefront analysis, and pachymetry into single, multi-functional units, optimizing clinic workflows and reducing the need for multiple discrete devices. Manufacturers are also prioritizing user interface simplicity and AI integration to enhance data interpretation efficiency and predictive accuracy.

Regionally, North America and Europe currently dominate the market due to high healthcare expenditure, early adoption of premium technologies, and a high volume of cataract surgeries performed annually. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate throughout the forecast period. This rapid expansion in APAC is attributable to vast, untapped patient populations, increasing access to sophisticated ophthalmic care due to improving economic conditions, and government initiatives aimed at reducing the backlog of untreated vision impairment. Countries such as China, India, and Japan are becoming significant consumers of advanced biometry devices, driving localized sales and distribution network expansion.

Segmentation trends highlight the dominance of the Swept Source OCT technology segment, which provides superior depth penetration and measurement accuracy compared to older PCI-based systems, positioning it as the preferred technology for complex cases. The application segment remains heavily skewed towards Cataract Diagnosis and Pre-operative Planning, although the Myopia Assessment segment is emerging rapidly due to the global epidemic of high myopia and the need for frequent, precise axial length monitoring, particularly in pediatric populations. End-user analysis reveals that specialized Ophthalmic Clinics and Ambulatory Surgical Centers (ASCs) are the primary purchasers, valuing devices that offer high throughput and reliability essential for efficient surgical scheduling and management.

AI Impact Analysis on Optical Biometry Devices Market

Users frequently inquire about the integration of Artificial Intelligence (AI) and machine learning algorithms into optical biometry workflows, particularly concerning how these systems can enhance measurement quality assurance, automate complex data checks, and refine IOL power calculations. Key themes revolve around the potential of AI to accurately predict post-operative refractive outcomes in challenging eyes—such as those with silicone oil fill, previous radial keratotomy (RK), or extreme axial lengths—where standard formulas often fail. Users are eager to understand how AI-driven predictive modeling can minimize human error during data entry and interpretation, thereby elevating the overall safety and accuracy profile of cataract surgery planning. Expectations are high regarding AI’s capacity to dynamically analyze vast datasets of surgical outcomes, learning from historical data to continuously optimize proprietary calculation formulas and provide personalized recommendations for lens selection and implantation depth.

- AI algorithms facilitate real-time quality control and identify erroneous measurements, ensuring data reliability before surgery planning.

- Machine learning models enhance IOL power calculation accuracy, particularly for post-refractive surgery patients where conventional formulas are inadequate.

- AI-driven automated workflow analysis reduces examination time and minimizes operator dependence, improving clinic throughput.

- Predictive analytics utilize aggregated patient data to forecast potential post-operative complications or refractive deviations, aiding surgical risk management.

- Advanced image recognition within biometers uses AI to segment ocular structures (e.g., lens, cornea) with greater precision than traditional methods.

- Development of proprietary AI-powered nomograms optimized for specific device hardware further personalizes refractive targeting.

DRO & Impact Forces Of Optical Biometry Devices Market

The market for optical biometry devices is significantly influenced by a confluence of accelerating drivers, persistent restraints, and transformative opportunities that collectively shape its trajectory and competitive landscape. Primary drivers include the global demographic shift toward an older population, which directly increases the incidence of age-related vision disorders, most notably cataracts, necessitating high-volume precise biometry. Technological innovation, specifically the introduction and rapid adoption of Swept Source OCT technology offering superior measurement quality, acts as a pivotal force. The growing patient demand for premium, spectacle-independent vision post-surgery mandates the use of highly accurate biometers to correctly calculate toric and multifocal IOL powers, reinforcing device necessity.

Conversely, significant restraints hinder uniform market growth, primarily the high capital cost associated with purchasing and maintaining advanced optical biometry equipment, which limits adoption in smaller clinics and healthcare facilities in low and middle-income countries. Additionally, the requirement for skilled technicians and ophthalmologists trained specifically in operating and interpreting complex biometric outputs presents a barrier to entry, particularly in regions with medical professional shortages. Regulatory hurdles and the lengthy approval processes for novel devices in highly regulated markets like the U.S. and Europe also periodically slow down the introduction of next-generation instruments.

The primary opportunities stem from the expansion of diagnostic capabilities beyond IOL calculation, particularly into myopia management, where longitudinal axial length monitoring is becoming a standard of care globally. The integration of advanced computational optics and AI into existing platforms offers a substantial opportunity for manufacturers to differentiate their products by providing 'smart' biometry solutions that simplify complex calculations. Furthermore, strategic market penetration into high-growth emerging economies, coupled with development of cost-effective, high-precision portable devices, represents an area ripe for substantial revenue generation, catering to underserved rural populations and increasing overall accessibility to quality ophthalmic measurements.

Segmentation Analysis

The Optical Biometry Devices Market is comprehensively segmented across several dimensions, including the underlying technology, the primary application for which the measurement is performed, and the type of end-user facility utilizing the equipment. This segmentation allows for targeted market analysis and strategic development tailored to specific industry needs, recognizing that the demands of a high-volume hospital differ significantly from those of a specialized refractive clinic. Technological segmentation is paramount, differentiating between first-generation devices and cutting-edge platforms that offer superior performance characteristics essential for modern surgical practices. The dominant segment currently is the Cataract Surgery application, although rapid growth is observed in Myopia Management due to preventative healthcare trends.

- By Technology

- Partial Coherence Interferometry (PCI)

- Optical Coherence Tomography (OCT)

- Swept Source OCT (SS-OCT)

- By Application

- Cataract Diagnosis and Pre-operative Planning

- Myopia Assessment and Monitoring

- Anterior Segment Analysis

- By End-User

- Hospitals

- Ophthalmic Clinics and Centers

- Ambulatory Surgical Centers (ASCs)

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Optical Biometry Devices Market

The value chain for the Optical Biometry Devices Market is complex, beginning with highly specialized upstream component manufacturing and culminating in the provision of critical diagnostic data to end-user healthcare providers. The upstream analysis involves manufacturers of critical components such as light sources (e.g., tunable lasers for SS-OCT), high-speed detectors, sophisticated optical lenses, and advanced computing hardware and software algorithms necessary for data processing and IOL calculation. Suppliers of these components often possess niche expertise and operate within stringent quality control frameworks due to the precision required in ophthalmic instrumentation. Innovation at this stage, particularly in light source technology, dictates the overall performance capabilities of the final device.

The mid-stream encompasses the primary device manufacturers, who are responsible for the design, assembly, rigorous testing, regulatory approval, and branding of the final biometry systems. These companies invest heavily in R&D to integrate the latest component technologies and software advancements (including AI-driven algorithms and connectivity features) into user-friendly platforms. Distribution is a crucial segment, typically handled through a combination of direct sales forces for large, strategically important markets, and specialized medical device distributors who manage sales, installation, training, and ongoing technical support in regional markets. These distributors often require deep technical knowledge of ophthalmic equipment and established relationships with key opinion leaders (KOLs) and high-volume clinical centers.

Downstream analysis focuses on the end-users—hospitals, large ophthalmic clinics, and Ambulatory Surgical Centers (ASCs)—where the devices are utilized to generate the essential patient biometric data. The value captured downstream relates to efficiency gains, improved surgical outcomes, and increased patient throughput facilitated by accurate and fast devices. Direct distribution models allow manufacturers greater control over pricing and customer relationships, while indirect channels through distributors provide necessary local expertise, logistical support, and rapid technical maintenance, which is vital given the critical nature of the equipment for daily surgical planning. The entire chain emphasizes precision, reliability, and strong after-sales support to ensure continuous operation and high data integrity for patient safety.

Optical Biometry Devices Market Potential Customers

The primary customers and end-users of optical biometry devices are specialized healthcare facilities dedicated to eye care and surgical intervention. These encompass a broad range of institutions from large governmental and private hospitals with dedicated ophthalmology departments to highly focused private ophthalmic clinics. Hospitals often serve as significant volume purchasers, driven by standardized procurement processes and the need to support diverse patient demographics and teaching programs. They prioritize devices offering robust performance, integration capabilities with hospital IT systems, and comprehensive manufacturer service agreements.

Ophthalmic Clinics, particularly those specializing in refractive surgery and premium cataract treatments, represent the fastest-growing segment of potential customers. These centers require the highest precision devices (like SS-OCT) to maximize outcomes for high-paying patients opting for premium IOLs (multifocal, extended depth of focus, and toric lenses). For these clinics, the device’s speed, accuracy, and ability to handle complex eyes (e.g., post-refractive surgery) are key purchasing criteria. Ambulatory Surgical Centers (ASCs) are also major customers, focused intensely on operational efficiency, requiring devices that offer quick measurement acquisition times and minimal downtime to maintain their high patient throughput models, making reliability and ease of use crucial factors in their purchasing decisions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million USD |

| Market Forecast in 2033 | $700 Million USD |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Carl Zeiss Meditec AG, Haag-Streit AG (Reliance Medical Inc.), NIDEK CO., LTD., Topcon Corporation, OCULUS Optikgeräte GmbH, Ziemer Group AG, Tomey Corporation, Metall Zug AG (through Haag-Streit), Visiometrics SL, Escalon Medical Corp., Movu GmbH, Shin-Nippon Ophthalmic Instruments, LENSTAR Inc., Optovue, Inc., LENSAR, Inc., Alcon Inc., Bausch + Lomb (Bausch Health Companies Inc.), EssilorLuxottica, Canon Inc., Medtronic plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Optical Biometry Devices Market Key Technology Landscape

The technological landscape of the Optical Biometry Devices Market is dominated by non-contact, light-based measurement techniques that offer high accuracy essential for refractive surgery planning. The evolution of this field began with Partial Coherence Interferometry (PCI), exemplified by devices like the IOLMaster 500. PCI revolutionized IOL calculation by providing highly accurate axial length measurements compared to ultrasound, but it faced limitations in penetrating dense cataracts, leading to measurement failure in complex eyes. Subsequent advancements introduced traditional Optical Coherence Tomography (OCT) based biometers, which offered better tissue penetration but were eventually surpassed by the next technological leap.

The current state-of-the-art technology is Swept Source Optical Coherence Tomography (SS-OCT), utilized in devices like the IOLMaster 700 and the Argos. SS-OCT employs a tunable laser source to scan a broader spectrum of light at a much faster rate than conventional OCT, resulting in deeper penetration, significantly improved visualization of the posterior segment (including the fovea and the retinal pigment epithelium), and consistently higher measurement success rates, even in eyes with mature cataracts. This technology allows for total eye length measurement (cornea to retina) rather than just lens-to-retina measurement, which is crucial for modern calculation formulas like the Barrett True K and Kane formulas, dramatically improving post-refractive surgery outcomes.

The future technology landscape is moving towards integration and automation, leveraging advanced algorithms. Manufacturers are focusing on incorporating advanced anterior segment analysis (corneal topography, tomography, and wavefront analysis) directly into the biometer platform, eliminating the need for separate devices and streamlining the surgical planning workflow. Furthermore, enhanced signal processing techniques are being developed to minimize ambient light interference and noise, ensuring reliable measurements across various clinical settings. Connectivity protocols that allow seamless data transfer to surgical planning systems and surgical navigation platforms (like image-guided surgery systems) are also becoming standard features, forming a fully integrated digital ecosystem for cataract surgery.

Regional Highlights

Regional dynamics play a significant role in defining the growth trajectory and market size of optical biometry devices, largely driven by healthcare infrastructure maturity, government expenditure on eye care, and surgical volume.

- North America: Represents the largest market share due to the high adoption rate of technologically advanced SS-OCT devices, robust healthcare spending, favorable reimbursement scenarios for advanced cataract procedures (including premium IOLs), and the presence of major global market leaders. The region maintains high surgical standards requiring the utmost precision in biometry.

- Europe: Characterized by high penetration rates of sophisticated biometry devices, particularly in Western European nations (Germany, France, UK). Growth is steady, fueled by an aging population and high patient expectations for refractive outcomes, leading to continuous replacement cycles of older PCI equipment with new OCT-based platforms.

- Asia Pacific (APAC): Expected to register the fastest CAGR. This growth is driven by increasing prevalence of cataracts due to population size, rising disposable incomes leading to greater accessibility to modern eye care, and government investments in upgrading ophthalmic clinics in countries like China and India to address massive backlogs of untreated vision disorders.

- Latin America (LATAM): Exhibits moderate growth, primarily centered in key economies like Brazil and Mexico. Market expansion is dependent on improving economic conditions and increased foreign investment by international medical device companies seeking to establish local distribution networks and training facilities.

- Middle East and Africa (MEA): Currently holds the smallest market share but shows promising growth, particularly in the Gulf Cooperation Council (GCC) countries, driven by medical tourism and significant investments in high-end private healthcare infrastructure that demands premium diagnostic equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Optical Biometry Devices Market.- Carl Zeiss Meditec AG

- Haag-Streit AG (Reliance Medical Inc.)

- NIDEK CO., LTD.

- Topcon Corporation

- OCULUS Optikgeräte GmbH

- Ziemer Group AG

- Tomey Corporation

- Metall Zug AG (through Haag-Streit)

- Visiometrics SL

- Escalon Medical Corp.

- Movu GmbH

- Shin-Nippon Ophthalmic Instruments

- LENSTAR Inc.

- Optovue, Inc.

- LENSAR, Inc.

- Alcon Inc.

- Bausch + Lomb (Bausch Health Companies Inc.)

- EssilorLuxottica

- Canon Inc.

- Medtronic plc

Frequently Asked Questions

Analyze common user questions about the Optical Biometry Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What technological factors are driving the demand for new optical biometers?

The primary driver is the shift from Partial Coherence Interferometry (PCI) to Swept Source Optical Coherence Tomography (SS-OCT). SS-OCT provides superior axial length measurement, crucial for premium IOL calculations, and maintains high success rates even when measuring eyes with dense cataracts, resolving the key limitation of older technologies.

How does the integration of AI impact the accuracy of IOL calculations?

AI integrates machine learning models to analyze vast outcome databases, refining IOL formulas (such as the Kane or Barrett formulas) to improve predictive accuracy, especially for complex eyes (e.g., post-refractive surgery) where traditional regression formulas yield inconsistent results.

Which end-user segment is expected to show the highest growth in biometry device adoption?

Specialized Ophthalmic Clinics and Ambulatory Surgical Centers (ASCs) are anticipated to show the highest growth. These centers prioritize high-throughput and high-accuracy devices necessary to support the growing demand for premium cataract and refractive surgery interventions.

What are the main advantages of optical biometry over conventional immersion ultrasound biometry?

Optical biometry is non-contact, significantly reduces the risk of measurement errors associated with corneal compression, offers superior repeatability, and provides higher precision data points for all ocular parameters, leading directly to better post-operative refractive outcomes.

Is the market trending towards standalone or integrated biometry solutions?

The market is strongly trending towards integrated solutions. Leading manufacturers are developing platforms that combine optical biometry with corneal topography, wavefront analysis, and pachymetry, streamlining the entire pre-operative assessment process into a single, efficient device to optimize clinic workflows.

The market for optical biometry devices is demonstrating robust resilience and sustained growth, underpinned by fundamental demographic shifts and continuous technological refinement focused on precision and workflow efficiency. The adoption of advanced diagnostics is increasingly recognized as a non-negotiable prerequisite for high-quality refractive outcomes in cataract surgery, ensuring the sustained investment across both developed and rapidly evolving emerging markets. The integration of artificial intelligence is poised to be the next transformative element, shifting the paradigm from data collection to intelligent surgical planning assistance. Manufacturers are keenly focused on developing compact, highly connected, and computationally advanced instruments that can handle the complexities of modern ophthalmology, particularly the management of astigmatism, spherical aberration, and presbyopia correction through sophisticated IOL technology. The strategic imperative for market players remains the continuous enhancement of measurement speed and success rate, coupled with maximizing seamless interoperability with established clinical data management systems. Regional market dynamics confirm that while North America and Europe lead in current consumption value, the Asia Pacific region will define future volume expansion, necessitating customized distribution and support strategies tailored to local economic constraints and healthcare provision models. This comprehensive analysis confirms the optical biometry sector as a high-value, innovation-driven segment within the broader ophthalmic device industry.

Further elaborating on the technological drivers, the competitive landscape is rapidly shifting toward systems that can generate volumetric scans rather than linear measurements, utilizing 3D imaging capabilities inherent in advanced SS-OCT. This allows for more comprehensive mapping of the anterior chamber, which is crucial for determining effective lens position (ELP)—a primary source of refractive error post-cataract surgery. Devices that integrate intraoperative measurements or offer compatibility with intraoperative aberrometry systems are gaining significant traction, bridging the gap between pre-operative planning and surgical execution. The industry is also witnessing a push for standardization in data output formats, facilitating easier data exchange between different diagnostic platforms and surgical planning software, which reduces transcription errors and enhances overall clinical safety. This focus on digital connectivity and data integrity underscores the maturity of the optical biometry market, moving beyond mere measurement tools to comprehensive surgical planning centers.

The impact of regulatory frameworks, particularly the emphasis on clinical trials demonstrating equivalence or superiority of new devices over established standards, continues to influence the pace of technological introduction. Companies must navigate complex approval processes, investing significant resources into clinical validation to gain trust among key ophthalmic specialists. The high barrier to entry due to necessary intellectual property protection surrounding light sources and algorithms means that the market structure remains relatively consolidated, dominated by a few established global players who possess deep expertise in optical physics and software development. However, niche players focusing on cost-effective portable or handheld biometry devices are gaining attention, particularly in mobile clinics or outreach programs designed to reach remote populations, potentially disrupting distribution models in emerging economies where centralized care is less prevalent. Overall, the market remains dynamic, driven by the irreversible need for precision in vision correction surgery.

The evolution of IOL technology itself acts as a strong pull factor for advanced biometry. As lenses become more complex—offering simultaneous correction for astigmatism, presbyopia, and spherical aberration—the permissible margin for error in pre-operative measurements shrinks significantly. Surgeons performing refractive cataract surgery often rely on devices that not only provide axial length and keratometry but also offer high-resolution lens thickness and anterior chamber metrics with associated normative databases for comparison. This emphasis on anatomical detail necessitates investment in SS-OCT platforms capable of high-density scans. Furthermore, the development of post-operative measurement capabilities, allowing biometers to accurately measure the position and tilt of the implanted IOL, is an emerging technological trend that supports surgical auditing and long-term patient follow-up. This capability provides valuable feedback data that contributes directly back into the AI-driven refinement of IOL formulas, creating a closed-loop system of continuous improvement in refractive surgery planning.

The adoption curve for optical biometry devices demonstrates a clear stratification based on economic prosperity and healthcare financing models. Developed markets are undergoing a device replacement cycle, upgrading from older PCI models to advanced SS-OCT or next-generation integrated platforms, sustaining the market value growth. Conversely, developing markets often bypass the older PCI technology entirely, moving directly to more cost-effective entry-level OCT or simplified SS-OCT systems as their initial investment. This bifurcated adoption pattern requires manufacturers to maintain a diverse product portfolio, catering to both the high-end premium segment demanding maximum features and the mid-tier segment prioritizing excellent performance at a competitive price point. Strategic alliances with local distribution partners who understand regional pricing sensitivities and regulatory nuances are critical for successful market penetration in high-growth regions like APAC and LATAM, ensuring sustainable sales growth throughout the forecast period.

In terms of competitive strategy, differentiation is increasingly achieved through software and data handling capabilities rather than just hardware specifications. Companies are investing heavily in creating secure, cloud-based data ecosystems that allow surgeons to access and manage biometric data across multiple clinical sites, integrate complex calculation results automatically, and participate in global data sharing initiatives for formula refinement. The ability to seamlessly connect the biometer data output to femtosecond laser systems or corneal reshaping planning software is a major selling point, positioning the biometer as the central hub of the modern digital ophthalmic operating room. This shift toward system integration mandates expertise in IT security and data governance alongside core optical engineering, shaping the future skill requirements within the industry. The long-term success of market leaders will be contingent upon their ability to deliver not just accurate measurements, but comprehensive, secure, and integrated surgical planning solutions.

The global incidence of high myopia, particularly in East Asian populations, is transforming the application segment of the market. While cataract planning remains dominant, the urgent public health need to monitor and manage pediatric axial length progression has opened a significant avenue for biometry devices optimized for this longitudinal tracking. Myopia management requires high-frequency, non-invasive, and highly reliable axial length measurements over extended periods. Devices targeting this application must be fast, easy to use for pediatric patients, and equipped with analytical tools to plot progression against normative growth charts. This diversification into preventative and pediatric eye care represents a substantial, largely untapped opportunity for market expansion and requires different marketing approaches focused on pediatric ophthalmologists and optometrists, broadening the traditional end-user base of cataract surgeons.

Furthermore, the restraining factor of high capital cost is being addressed through innovative financing and leasing models offered by key manufacturers, making advanced biometers more accessible to smaller clinics or practices with limited capital budgets. These models often package hardware, software licensing, and extended service agreements into monthly subscription fees, spreading the investment burden over several years. This trend is vital for maintaining market growth momentum, particularly in fragmented markets where small independent practices form the majority of potential buyers. The drive for continuous cost optimization in manufacturing, without compromising measurement accuracy, remains a persistent challenge that defines competitive pricing strategies across all geographical regions.

Ultimately, the Optical Biometry Devices Market is characterized by a strong convergence of diagnostic technology, surgical innovation (IOLs), and digital health infrastructure. The core value proposition of these devices—delivering the high-precision data essential for achieving patient expectations of excellent, spectacle-free vision—ensures their continued indispensability in modern ophthalmology. Future R&D efforts are expected to focus on miniaturization, enhanced portability, and even greater automation using advanced computer vision techniques to minimize operator variability. The market is positioned for sustained high-single-digit growth, driven by an aging global populace demanding premium eye care and supported by rapidly advancing capabilities in SS-OCT and AI integration.

The increasing complexity of corneal measurements required for modern IOL calculations is also forcing a technological merger. Modern biometers are no longer simple axial length measuring devices; they must accurately capture anterior and posterior corneal surfaces (keratometry and topography/tomography) to precisely account for total corneal power, addressing the limitations of relying solely on standard anterior keratometry. This shift toward holistic corneal analysis within the biometer platform positions devices as multi-functional diagnostic hubs. Consequently, the intellectual property battleground is shifting from simple interferometry techniques to proprietary algorithms that seamlessly fuse disparate measurements (axial length, lens thickness, corneal geometry) into a unified, accurate surgical plan, significantly raising the technology barrier for new entrants.

The emphasis on robust training and education for end-users is another critical component of market success. Given the high cost and sophisticated nature of the equipment, manufacturers must provide extensive support to ensure clinicians maximize the utility of the devices and correctly interpret the complex data outputs, especially when using advanced calculation formulas. Comprehensive training programs, often involving virtual reality or high-fidelity simulation, are essential for widespread adoption and minimizing clinical errors. This service component contributes substantially to the overall value chain and customer retention, highlighting the importance of the sales and support network provided by either direct manufacturer teams or highly specialized distributors, particularly in geographically spread-out regions like the MEA or rural LATAM.

Regarding restraints, cybersecurity risks are emerging as a concern, particularly with the increased connectivity of devices to hospital networks and cloud services for data storage and AI processing. Biometry data, as protected health information, must be handled according to strict regulatory compliance standards (such as HIPAA in the US or GDPR in Europe). Manufacturers must invest heavily in secure data encryption and robust network protocols to protect patient privacy and maintain the integrity of the diagnostic data, which adds to the overall development and maintenance costs. Addressing these IT security challenges is paramount for sustained market trust and acceptance, especially as AI-driven solutions rely heavily on secure data transmission and cloud computation.

Finally, the growing trend of personalized medicine in ophthalmology fuels the demand for ultra-precise biometry. Personalized IOL calculations require not just highly accurate measurements, but also advanced software capable of incorporating patient-specific factors, such as expected post-operative lens movement or individual surgical constants derived from the surgeon's historical outcome data. Biometers that facilitate the seamless import and utilization of such personalized data are becoming highly desirable. The market is thus transitioning from a hardware-centric model to a data and intelligence-centric model, where the value lies equally in the quality of the measurement hardware and the sophistication of the embedded software and analytical capabilities. This complex interdependency ensures continuous innovation across all layers of the product ecosystem, guaranteeing the market's trajectory towards the projected valuation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager