Optometry Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432163 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Optometry Market Size

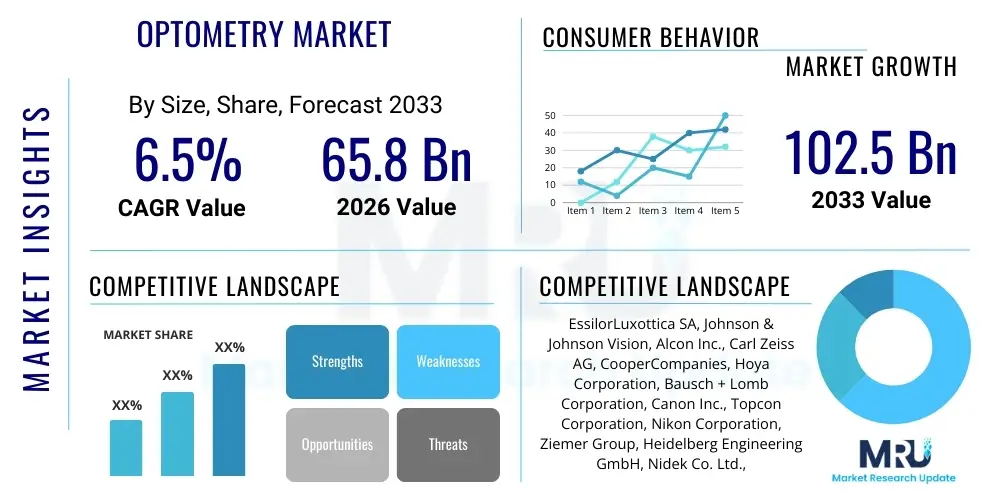

The Optometry Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $65.8 Billion USD in 2026 and is projected to reach $102.5 Billion USD by the end of the forecast period in 2033.

Optometry Market introduction

The Optometry Market encompasses products, services, and technologies dedicated to the primary care of the eye, including the diagnosis, management, and treatment of refractive errors, ocular diseases, and visual function issues. This sector is characterized by continuous innovation in diagnostic equipment, corrective lenses, and vision therapies. Key market offerings include prescription eyeglasses, contact lenses, optical diagnostic tools such as fundus cameras and Optical Coherence Tomography (OCT) devices, and specialized low-vision aids. The increasing prevalence of vision-related conditions, driven primarily by the global aging population and lifestyle changes associated with prolonged digital screen usage, positions optometry as a crucial component of overall healthcare delivery.

Major applications of optometry services span routine eye examinations, pediatric vision care, geriatric eye health monitoring, and the co-management of systemic diseases that manifest ocular complications, such as diabetes and hypertension. Furthermore, the market benefits significantly from consumer preferences shifting toward premium, customized vision solutions, including personalized progressive lenses and specialty contact lenses designed for managing conditions like dry eye or keratoconus. Regulatory frameworks supporting preventative eye care initiatives and growing public awareness regarding the importance of early detection of diseases like glaucoma and macular degeneration also act as core market drivers.

Technological advancement remains a pivotal element defining market growth, with manufacturers constantly introducing integrated digital platforms that improve diagnostic accuracy and clinical efficiency. The market is increasingly adopting digital refraction systems, portable screening tools, and teleoptometry platforms to expand access to care, particularly in rural or underserved areas. These innovations not only enhance the quality of patient care but also optimize the workflow for practitioners, driving increased adoption of advanced instrumentation across independent clinics, large retail chains, and hospital settings globally. The persistent demand for high-quality vision correction solutions ensures stable revenue generation for the optometry sector.

- Market Scope: Diagnosis and management of refractive errors, ocular diseases, and visual function.

- Product Segments: Corrective lenses (spectacles, contact lenses), diagnostic and imaging equipment (OCT, autorefractors), and low-vision devices.

- Driving Factors: Aging demographics, rising prevalence of chronic conditions (e.g., diabetes-related retinopathy), and increased screen time leading to digital eye strain.

- Key Benefit: Provides essential primary eye care, facilitates early detection of serious systemic and ocular diseases, and improves quality of life through vision correction.

Optometry Market Executive Summary

The Optometry Market is experiencing a robust period of expansion, primarily fueled by significant technological convergence and evolving consumer behavior. Key business trends indicate a strong move toward vertical integration among leading optical retailers and manufacturers, aimed at controlling the entire value chain from lens production to retail dispensing. Furthermore, the adoption of subscription models for contact lenses and preventative vision packages is gaining traction, providing stable recurring revenue streams and enhancing customer loyalty. Market players are heavily investing in digital infrastructure to support e-commerce platforms and enhance the patient experience through virtual try-ons and online consultations, reflecting a profound shift toward hybrid care models that blend in-person examination with digital convenience.

Regionally, North America maintains market dominance due to high healthcare expenditure, sophisticated technological infrastructure, and established reimbursement policies that facilitate the adoption of high-value diagnostic equipment. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), driven by rapid urbanization, a burgeoning middle class with greater disposable income, and increasing governmental focus on improving primary healthcare access. Countries such as China and India present immense opportunities due to their large patient populations suffering from untreated or under-treated refractive errors and increasing incidence of myopia. European markets show stable growth, heavily influenced by public healthcare systems emphasizing chronic disease management and standardized regulatory compliance for medical devices.

Segmentation trends highlight the corrective lenses segment as the largest revenue contributor, particularly driven by the demand for customized and high-index materials offering superior aesthetics and comfort. Within diagnostic equipment, the non-invasive imaging segment, especially OCT and wide-field retinal imaging, is seeing accelerated adoption due to its critical role in the early diagnosis of chronic eye conditions. End-user analysis suggests that independent optometry practices and retail optical chains remain the primary points of care delivery, although hospital ophthalmology departments continue to be crucial for advanced disease management and surgical referrals. The overall market narrative is defined by innovation aimed at making comprehensive eye care more accessible, precise, and integrated into broader healthcare systems.

AI Impact Analysis on Optometry Market

Common user inquiries regarding AI’s influence on the Optometry Market predominantly revolve around the themes of diagnostic accuracy, automation efficiency, ethical considerations, and potential displacement of traditional roles. Users frequently ask if AI algorithms can reliably detect early signs of diseases like diabetic retinopathy or glaucoma better than human practitioners, and how quickly automated refraction systems might replace manual processes. Additionally, concerns focus on data privacy when utilizing large datasets for machine learning models and the necessary integration standards for seamless incorporation of AI tools into existing Electronic Health Records (EHRs). The overall expectation is that AI will augment clinical decision-making by rapidly processing complex imaging data, improving screening efficacy, and allowing optometrists to focus more intently on patient interaction and therapeutic management, rather than solely on routine data interpretation.

- Enhanced Diagnostic Precision: AI algorithms enable rapid, high-throughput analysis of retinal images (fundus photography, OCT scans) for early detection and grading of diabetic retinopathy, age-related macular degeneration (AMD), and glaucoma.

- Automation of Routine Tasks: Implementation of AI-powered diagnostic assistants and automated visual field testing reduces the time burden on clinical staff, allowing optometrists to manage a higher volume of patients.

- Predictive Analytics: Utilizing machine learning to predict disease progression, helping tailor preventative treatment plans and personalize patient recall schedules based on risk stratification.

- Teleoptometry Integration: AI facilitates remote screening and consultation by providing preliminary diagnostic reports from images captured outside a traditional clinic setting, significantly expanding access to care in remote areas.

- Drug and Treatment Optimization: AI aids in analyzing patient response to specific treatments, potentially leading to faster development of customized therapeutic interventions and improved clinical trial efficiency.

DRO & Impact Forces Of Optometry Market

The dynamics of the Optometry Market are significantly shaped by a confluence of driving forces, inherent restraints, and emerging opportunities, collectively defining the trajectory of growth. Key drivers include the demographic shift toward an aging population globally, which inherently increases the prevalence of age-related vision impairments such as cataracts, presbyopia, and macular degeneration. This demographic pressure is compounded by the rising incidence of lifestyle-related chronic diseases, particularly diabetes, which necessitates regular and specialized ophthalmic screening. Furthermore, continuous product innovation, particularly in digital imaging and corrective lens technology (e.g., photochromic lenses, blue light filters), enhances the efficacy and desirability of optometric solutions, thereby boosting market demand and patient compliance with treatment protocols.

Conversely, the market faces several restraining forces that impede accelerated growth. High costs associated with sophisticated diagnostic equipment, such as advanced OCT devices and specialized lasers, pose a significant barrier to entry and adoption, particularly for smaller, independent practices and in developing economies where capital investment capacity is limited. Additionally, regulatory hurdles and complex reimbursement structures, which vary significantly across different healthcare systems, can delay product launches and limit patient access to newer, more expensive technologies. A persistent shortage of qualified optometry professionals in certain regions also constrains the ability of the market to meet the growing patient demand effectively, leading to extended wait times for necessary appointments.

Significant opportunities for expansion lie in the rapid proliferation of teleoptometry and remote monitoring solutions, which leverage digital platforms to deliver eye care services efficiently, thereby circumventing geographical limitations. The expansion into specialized pediatric optometry, driven by the global surge in juvenile myopia, represents a substantial untapped segment requiring customized corrective and control solutions, such as multifocal contact lenses and specific spectacle lens designs. Finally, the growing consumer interest in preventative vision health and wellness, spurred by increased screen time, offers an avenue for market players to introduce premium, value-added services beyond routine refraction, focusing on ocular nutrition, dry eye management, and customized ergonomic vision assessments for digital users. These impact forces necessitate strategic adaptation and investment in technology infrastructure across the entire optometry value chain.

Segmentation Analysis

The Optometry Market is structurally segmented based on product type, end-user, and distribution channel, reflecting the diverse nature of services and goods offered. This detailed segmentation allows for a granular understanding of revenue streams, technological adoption rates, and end-user requirements across the global landscape. The product segmentation is critical, dividing the market into high-volume vision care components (lenses, frames, solutions) and high-value diagnostic instruments (imaging systems, refractors). End-user segregation highlights the dominant role of specialized eye clinics and retail optical stores in dispensing care, contrasting with the referral and advanced treatment services provided by hospitals and academic research institutions. Understanding these segments is crucial for manufacturers and service providers aiming to tailor their strategies and product offerings to specific market needs and regulatory environments.

- Product Type:

- Vision Care Products (Contact Lenses, Spectacle Lenses, Lens Solutions, Frames)

- Diagnostic Equipment (Fundus Cameras, Optical Coherence Tomography (OCT), Autorefractors and Keratometers, Phoropters and Slit Lamps, Tonometer)

- Low Vision Aids

- End-User:

- Optical Shops and Retail Chains

- Independent Optometry Clinics

- Hospitals and Vision Centers

- Academic and Research Institutes

- Distribution Channel:

- Direct Sales (for high-cost diagnostic equipment)

- Indirect Sales (Wholesalers, Distributors)

- Online Channels (E-commerce, Subscription Services)

Value Chain Analysis For Optometry Market

The value chain of the Optometry Market begins with the upstream segment, which involves the sourcing and production of raw materials essential for manufacturing both corrective lenses and diagnostic equipment. This includes specialized optical grade polymers, glass, and coatings for lenses, alongside sophisticated electronic components, optics, and precision engineering materials required for advanced imaging devices like OCTs and automated refractors. Key upstream challenges involve maintaining high quality control standards for these inputs and managing supply chain resilience, especially for highly regulated medical device components. Strong relationships with specialized chemical and electronics suppliers are crucial for market players to ensure consistent output and innovation velocity.

The midstream process involves the manufacturing and assembly of finished products. For vision care, this includes the precise grinding, coating, and assembly of spectacle lenses and the molding and sterilization of contact lenses, often requiring complex, high-precision machinery. For diagnostic equipment, manufacturing involves integrating hardware, software, and highly sensitive optics, coupled with rigorous testing to meet global medical device safety and efficacy standards (e.g., FDA, CE marking). Efficiency in this stage, driven by automation and lean manufacturing practices, significantly influences the final cost structure and time-to-market for new optometric tools and products.

The downstream distribution channels are multifaceted, handling the final delivery of products and services to the end-user. Direct channels are predominantly used for high-capital diagnostic equipment, where manufacturers provide installation, training, and ongoing maintenance support directly to hospitals and large clinics. Indirect channels, involving wholesalers and distributors, efficiently manage the high-volume movement of consumables like lenses, frames, and solutions to retail optical chains and independent practices. E-commerce and direct-to-consumer models have rapidly expanded, particularly for contact lenses and non-prescription eyewear, necessitating robust logistics and personalized customer support infrastructure. This complexity requires strategic channel management to maximize market reach while ensuring regulatory compliance at the point of sale.

Optometry Market Potential Customers

The potential customer base for the Optometry Market is highly diverse, segmented across various age groups, levels of economic development, and specific ocular needs. The largest segment comprises the general population requiring routine vision correction services, including individuals with myopia, hyperopia, astigmatism, and presbyopia. This group serves as the consistent baseline demand for corrective lenses and annual comprehensive eye examinations. Specific demographic groups, notably the elderly (over 65), represent a high-value customer segment due to their increased susceptibility to age-related vision impairment and need for advanced diagnostic monitoring and specialized low-vision aids, driving demand for premium products and frequent clinical visits.

Beyond routine care, a significant and rapidly expanding customer segment includes individuals diagnosed with systemic health conditions, such as diabetes, hypertension, and autoimmune disorders, who require specialized optometric co-management. These patients necessitate advanced imaging and monitoring services (like frequent OCT scans) to track ocular manifestations of their systemic disease, ensuring early intervention to prevent permanent vision loss. This segment drives the demand for cutting-edge diagnostic technology and multidisciplinary clinical integration between optometry and other medical specialties.

Furthermore, the growing global population of school-age children and adolescents presents a critical segment, particularly in Asia, due to the global epidemic of progressive myopia. Parents and educational institutions are increasingly becoming purchasers of specialized myopia control treatments, including customized contact lenses (e.g., orthokeratology) and pharmaceutical interventions prescribed by optometrists. This segment is highly responsive to preventative care solutions and technological innovations aimed at managing long-term eye health, ensuring that the market focuses on early intervention and continuous monitoring across the lifespan.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $65.8 Billion USD |

| Market Forecast in 2033 | $102.5 Billion USD |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EssilorLuxottica SA, Johnson & Johnson Vision, Alcon Inc., Carl Zeiss AG, CooperCompanies, Hoya Corporation, Bausch + Lomb Corporation, Canon Inc., Topcon Corporation, Nikon Corporation, Ziemer Group, Heidelberg Engineering GmbH, Nidek Co. Ltd., Menicon Co., Ltd., Rodenstock GmbH, Vision Service Plan (VSP Global), ClarVista Medical Inc., Haag-Streit Group, Ocular Instruments Inc., Escalon Medical Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Optometry Market Key Technology Landscape

The technological landscape within the Optometry Market is rapidly evolving, driven by the push for non-invasive, high-resolution imaging and increased automation in clinical procedures. One of the most impactful technologies is Optical Coherence Tomography (OCT) Angiography (OCTA), which provides detailed, cross-sectional imaging of the retina and optic nerve heads without the need for invasive dye injections. This shift towards non-invasive visualization is critical for diagnosing and monitoring conditions like diabetic macular edema and glaucoma with unprecedented detail, leading to earlier and more precise therapeutic interventions. Furthermore, the integration of ultra-widefield retinal imaging systems allows practitioners to capture up to 200 degrees of the retina in a single image, significantly enhancing screening efficacy for peripheral retinal pathology that might be missed with traditional cameras.

Automation and digitalization are central to modern optometry practices. Digital refraction systems, which replace traditional manual phoropters, offer faster, more accurate measurements of refractive errors, often integrated with automated lensometers and corneal topographers. This entire digital workflow improves patient comfort and minimizes human error, standardizing the prescription process. Alongside hardware advancements, sophisticated clinical data management software and integrated Electronic Health Records (EHR) platforms are optimizing practice management, enabling seamless data sharing between different diagnostic modalities and facilitating the application of AI and machine learning algorithms for large-scale data analysis and predictive modeling.

The development of specialized lens technologies represents another major innovation area. Myopia control lenses, including peripheral defocus spectacle and contact lenses (e.g., DIMS and peripheral power profiles), are fundamentally changing the treatment paradigm for juvenile myopia. In addition, customized wavefront aberrometry technology is being utilized not only in post-surgical care but also for designing highly personalized progressive lenses that account for individual visual aberrations, providing superior clarity and comfort compared to standard progressive designs. These technologies underscore the industry’s shift from simple vision correction to proactive vision management and disease prevention.

Regional Highlights

- North America: This region holds the largest market share, characterized by high penetration of advanced diagnostic technologies and strong adoption rates for premium vision care products. The presence of well-established reimbursement policies, high patient awareness regarding preventive eye care, and significant investments in R&D, particularly in AI-driven diagnostic tools, contribute to its dominance. The United States, specifically, leads in the adoption of specialized contact lenses and high-end optical coherence tomography devices. Furthermore, the robust regulatory environment and the concentration of key market players foster continuous innovation and market growth. The region's aging population significantly drives demand for cataract, glaucoma, and AMD management services, necessitating frequent use of advanced optometric equipment.

- Europe: Europe represents a mature market with steady growth, heavily influenced by robust public healthcare systems, such as the NHS in the UK and centralized systems in Germany and France, which prioritize early detection and management of chronic eye diseases. Strict regulatory adherence (e.g., MDR compliance) ensures high-quality standards for medical devices and lenses. Western European countries exhibit high per capita expenditure on vision correction, driving demand for technologically sophisticated spectacle lenses and personalized vision solutions. Eastern Europe is emerging as a growing market, spurred by improving economic conditions and increasing investment in modernizing clinical infrastructure.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, projected to expand significantly over the forecast period. This accelerated growth is primarily attributed to the massive population base, increasing prevalence of myopia (especially in East Asia), and rising disposable incomes fueling demand for quality healthcare services. Governments across nations like China, India, and South Korea are increasing spending on eye health awareness programs and infrastructure development. The high unmet need for basic vision correction, coupled with increasing accessibility to retail optical chains and burgeoning teleoptometry services, positions APAC as the primary engine for future market expansion. Regulatory liberalization in countries like India further facilitates foreign investment and technology adoption.

- Latin America (LATAM): The LATAM market exhibits moderate growth, driven by improving economic stability and growing healthcare infrastructure, particularly in major economies like Brazil and Mexico. Challenges include inconsistent regulatory frameworks and limited public access to specialized, high-cost diagnostic equipment. However, urbanization and increasing health insurance coverage are gradually expanding the patient pool demanding primary optometric services and corrective lenses.

- Middle East and Africa (MEA): This region is characterized by diverse market maturity levels. The GCC countries (UAE, Saudi Arabia) display high-end demand for premium products and advanced diagnostics, supported by substantial government investment in world-class healthcare facilities. Conversely, many African nations still face significant challenges related to lack of infrastructure, low awareness, and high prevalence of treatable vision impairment, making them target regions for humanitarian aid and mobile optometric outreach programs. The potential for growth is high, contingent upon infrastructure improvements and increased private sector investment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Optometry Market.- EssilorLuxottica SA

- Johnson & Johnson Vision

- Alcon Inc.

- Carl Zeiss AG

- CooperCompanies

- Hoya Corporation

- Bausch + Lomb Corporation

- Canon Inc.

- Topcon Corporation

- Nikon Corporation

- Ziemer Group

- Heidelberg Engineering GmbH

- Nidek Co. Ltd.

- Menicon Co., Ltd.

- Rodenstock GmbH

- Vision Service Plan (VSP Global)

- ClarVista Medical Inc.

- Haag-Streit Group

- Ocular Instruments Inc.

- Escalon Medical Corp.

Frequently Asked Questions

Analyze common user questions about the Optometry market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Optometry Market?

The primary driver is the accelerating global aging population, coupled with the increasing prevalence of chronic systemic diseases like diabetes, which necessitate frequent and advanced optometric monitoring and care for associated ocular complications such as retinopathy and glaucoma.

How is digital transformation impacting the delivery of optometry services?

Digital transformation is profoundly impacting service delivery through the rapid expansion of teleoptometry platforms, enabling remote patient consultations and screenings. It also involves the adoption of integrated digital refraction systems and AI-powered diagnostic imaging tools, enhancing clinical efficiency and patient access, especially in underserved geographical areas.

Which geographical region is expected to show the highest growth rate in the optometry sector?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by significant factors including large, untapped patient populations, rising disposable incomes, rapid urbanization, and the extremely high prevalence of juvenile myopia across several key economies in the region.

What are the key technological advancements shaping diagnostic capabilities in optometry?

Key technological advancements include the widespread adoption of Optical Coherence Tomography (OCT) and OCT Angiography (OCTA) for non-invasive, high-resolution retinal imaging. Additionally, the integration of Artificial Intelligence (AI) for automated analysis of fundus images is enhancing early detection capabilities for sight-threatening diseases.

What are the main segments within the Optometry Market product portfolio?

The main segments are broadly categorized into Vision Care Products (including spectacle lenses, contact lenses, and frames) and Diagnostic Equipment (encompassing devices such as fundus cameras, OCT machines, autorefractors, and slit lamps used for comprehensive eye examinations and disease monitoring).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Optometry Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Optometry Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Therapeutics, Vision Care Equipment), By Application (Hospital Pharmacies, Online and Retail Stores, Optometry Clinics, Optical Centres, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Optometry Instruments Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Retina Examination, General Examination, Cornea Examination), By Application (Optical Retail, Eye Clinics, Hospitals), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager