Organo Silica Sol Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434599 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Organo Silica Sol Market Size

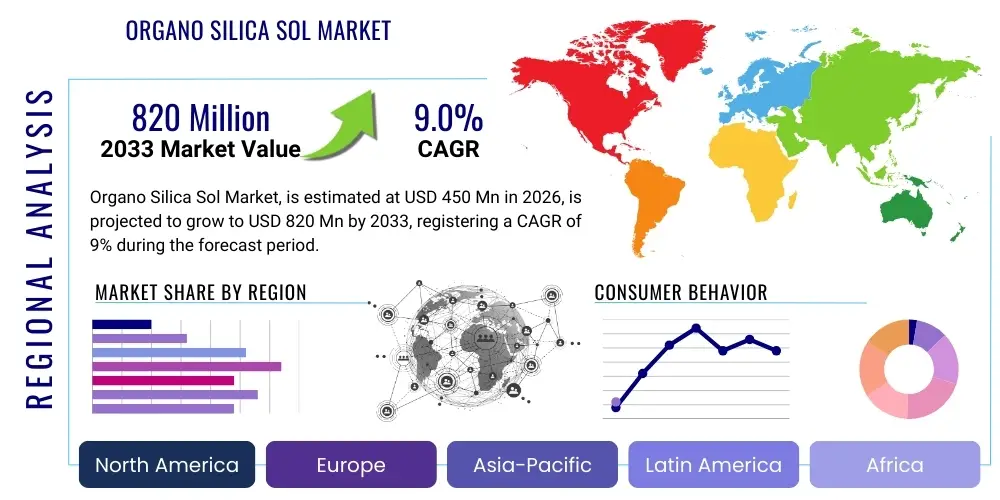

The Organo Silica Sol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.0% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 820 Million by the end of the forecast period in 2033.

Organo Silica Sol Market introduction

Organo Silica Sol refers to a colloidal suspension where nano-sized silica particles are stabilized and dispersed within an organic solvent or modified with organic functional groups on their surface. This unique hybrid structure combines the excellent thermal stability, hardness, and chemical resistance of inorganic silica with the flexibility, solubility, and compatibility offered by organic materials. The synergy between the inorganic core and the organic shell enables these sols to be easily integrated into various polymeric matrices, significantly enhancing the final product performance in areas such as scratch resistance, UV stability, and adhesion. These characteristics make Organo Silica Sols indispensable raw materials in high-performance applications across several critical industries.

The primary applications of Organo Silica Sols span demanding sectors, including advanced coatings and paints, high-performance adhesives and sealants, precision electronics, and sophisticated composite materials. In coatings, they are utilized to impart superior anti-corrosion properties and enhance surface hardness, particularly in automotive and aerospace applications. In electronics, the high purity and dielectric properties of these sols are crucial for fabricating insulating layers and semiconductor components. The key benefits driving their adoption include improved mechanical strength, enhanced thermal resistance, excellent dispersibility in organic systems, and tunable surface reactivity, allowing for tailored performance based on end-user requirements.

Market growth is predominantly driven by the escalating demand for environmentally friendly, high-solid content coatings that reduce Volatile Organic Compound (VOC) emissions, aligning with increasingly stringent global environmental regulations. Furthermore, the rapid expansion of the electronics sector, particularly in Asia Pacific, necessitates advanced materials that offer superior dielectric constant control and durability. Innovation in nanotechnology allowing for precise control over particle size distribution and surface functionalization further fuels market expansion, enabling novel applications in sectors previously limited by traditional silica technology. The intrinsic ability of these materials to enhance multi-functional performance characteristics provides a strong impetus for continued market penetration.

Organo Silica Sol Market Executive Summary

The Organo Silica Sol market is experiencing robust growth, primarily propelled by the global shift towards performance-enhancing additives in materials science and the imperative for sustainability in manufacturing processes. Key business trends include aggressive investment in R&D aimed at developing specialized hybrid sols with customized organic functionalities to meet niche application needs, such as high-refractive-index coatings or specialized battery components. Market fragmentation is moderate, characterized by intense competition among established chemical giants and specialized niche players focusing on particle morphology control and dispersion stability. Strategic collaborations between material producers and end-use manufacturers are becoming common to co-develop products specifically tailored for new generation technologies, reinforcing supply chain stability and accelerating time-to-market for innovative formulations.

Regionally, Asia Pacific dominates the Organo Silica Sol landscape, driven by massive manufacturing capacities in electronics, automotive production, and general construction, particularly in countries like China, Japan, and South Korea. However, North America and Europe are exhibiting significant growth due to stringent regulatory frameworks favoring high-performance, low-VOC materials, pushing industrial players to adopt advanced organo silica formulations in protective and decorative coatings. Regulatory pressures concerning environmental safety and performance standards in these developed regions act as powerful catalysts for innovation and adoption of advanced materials. Emerging economies in Latin America and MEA are beginning to show promise, primarily fueled by infrastructural development projects demanding durable coating solutions.

Segment trends reveal that the Coatings & Paints application segment maintains the largest market share, consistently driving demand for improved surface hardness and durability in automotive finishes and industrial equipment. Concurrently, the Electronics segment is projected to exhibit the highest CAGR due to the relentless miniaturization of components and the increasing requirement for advanced planarization and dielectric materials in semiconductor fabrication. Regarding product type, water-based Organo Silica Sols are gaining traction over solvent-based variants, directly reflecting the global industry movement toward greener chemistry and reducing reliance on hazardous solvents. This transition is expected to reshape the market dynamics, favoring suppliers who can provide stable, high-performance aqueous dispersions.

AI Impact Analysis on Organo Silica Sol Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Organo Silica Sol market frequently center on three core themes: optimization of complex synthesis pathways, prediction of material performance characteristics, and efficiency enhancement in quality control processes. Users are keen to understand how AI-driven computational chemistry can reduce the time and cost associated with synthesizing novel organo silica architectures, specifically how machine learning algorithms can predict the optimal organic functionalization or particle size distribution required for specific applications (e.g., maximizing scratch resistance in a UV-cured coating). Furthermore, there is significant interest in utilizing AI for advanced process control in large-scale manufacturing, ensuring colloidal stability and minimizing batch-to-batch variation, which is critical for highly demanding end-user industries like electronics. Concerns often revolve around the initial investment cost for AI infrastructure and the need for specialized data scientists in traditional chemical manufacturing environments.

AI's primary influence is expected to revolutionize the research and development pipeline for organo silica sols. By leveraging large datasets encompassing synthesis parameters, characterization results, and end-use performance data, machine learning models can identify non-intuitive correlations that accelerate the discovery of new functionalized silanes and optimal reaction conditions for their incorporation into the sol structure. This predictive capability significantly reduces the reliance on traditional, time-consuming trial-and-error experimentation. This not only speeds up innovation cycles but also allows manufacturers to rapidly customize product formulations in response to evolving customer demands, thereby increasing market responsiveness and competitive advantage.

Beyond R&D, AI algorithms are vital for operational efficiency. In manufacturing, AI-powered predictive maintenance minimizes downtime of critical dispersion equipment, while real-time data analysis ensures tight control over particle aggregation and stabilization processes. The integration of AI into automated spectroscopic analysis allows for instantaneous quality assurance testing of colloidal stability and purity. This level of precision is paramount, particularly for applications requiring ultra-high purity, such as those within the semiconductor industry, ensuring that every batch of Organo Silica Sol meets stringent specifications before downstream integration, leading to significant reductions in material waste and overall manufacturing costs.

- AI-driven optimization of synthesis parameters for controlled particle size and morphology.

- Machine learning prediction of resulting material properties, such as hardness, refractive index, and thermal stability.

- Enhanced quality control using computer vision and pattern recognition for real-time defect detection in sols.

- Predictive maintenance schedules for manufacturing equipment, minimizing downtime and ensuring continuous production flow.

- Accelerated discovery of novel organic functional groups compatible with silica surfaces via computational chemistry simulations.

- Supply chain optimization and demand forecasting based on historical sales data and external market indicators.

DRO & Impact Forces Of Organo Silica Sol Market

The Organo Silica Sol market is influenced by a dynamic interplay of growth drivers stemming from technological advancements and regulatory shifts, tempered by specific restraints related to cost and complexity, while opportunities arise from emerging technologies. Key drivers include the strong demand for multi-functional materials across the automotive and aerospace sectors, where lightweighting and durability are critical requirements. The rapid expansion of electronics manufacturing, demanding high-purity insulating and dielectric materials, further fuels demand. However, the market is constrained by the high cost associated with manufacturing ultra-stable, highly uniform nano-colloidal suspensions, which requires specialized equipment and stringent processing conditions. Furthermore, achieving long-term stability in certain solvent systems remains a technical challenge that hampers broader adoption in certain niche applications.

Opportunities for market growth are significant and are centered around the rise of additive manufacturing (3D printing), where customized organo silica formulations can serve as high-performance fillers or binders, creating materials with unique mechanical properties. The development of advanced energy storage systems, specifically next-generation battery technologies, presents a major opportunity, as organo silica sols can be used to improve electrolyte stability and safety features. Impact forces acting upon this market are primarily related to environmental regulations, which heavily favor water-based, low-VOC products, pushing innovation toward eco-friendly dispersion media and synthesis routes. Economic shifts, particularly those affecting global manufacturing output, also significantly influence demand for industrial coatings and electronic components, consequently impacting the organo silica sol sector.

The complexity of intellectual property rights surrounding the various functionalized silane precursors and stabilization technologies acts as an additional market restraint, potentially limiting competition and raising entry barriers for new participants. Despite these challenges, the inherent superior performance capabilities of organo silica sols—offering a crucial balance between inorganic stability and organic flexibility—ensure continued demand across premium segments. The persistent push for material innovation in sectors like renewable energy (solar panels) and high-speed data transmission further solidifies the market's long-term growth trajectory, overriding short-term economic fluctuations and cost concerns through tangible performance benefits.

Segmentation Analysis

The Organo Silica Sol market is comprehensively segmented based on product type, end-user application, and geographical region, reflecting the diverse utilization patterns of this advanced material. Segmentation by product type primarily distinguishes between water-based and solvent-based dispersions, with water-based variants gaining rapid momentum due to global environmental compliance standards. Application segmentation is crucial as it dictates the required functionalization and purity level of the sol; the most prominent applications are found in industries requiring high-durability coatings, precision adhesives, and specialized electronic components. Understanding these segments is vital for manufacturers to tailor their production capabilities and marketing strategies effectively, focusing resources on the fastest-growing and highest-value segments.

- By Product Type:

- Water-based Organo Silica Sol

- Solvent-based Organo Silica Sol (e.g., Ethanol, MEK, Isopropanol)

- By Application:

- Coatings & Paints (Automotive, Industrial, Architectural)

- Adhesives & Sealants

- Electronics & Semiconductors (Planarization, Dielectrics)

- Composites (Fiber-reinforced plastics, Polymers)

- Textiles & Fabrics

- Others (Catalysis, Biomedical)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Organo Silica Sol Market

The value chain for the Organo Silica Sol market begins with the procurement of critical raw materials (upstream analysis), primarily silicon precursors like alkoxysilanes and high-purity solvents or water. Suppliers in this segment must meet rigorous quality standards, as the purity of the precursor directly influences the stability and performance of the final sol. Key activities at the intermediate stage involve the synthesis process—hydrolysis, condensation, and stabilization—followed by functionalization using organoalkoxysilanes to impart specific organic properties. This phase is capital-intensive, requiring specialized reaction vessels and highly controlled environments to manage particle size uniformity and prevent aggregation, representing the core value-addition step in the chain.

The distribution channel is generally bifurcated into direct sales for large, specialized end-users (such as major semiconductor manufacturers) who require custom formulations and indirect sales through specialized chemical distributors and agents for smaller batch requirements or widespread industrial applications like standard coatings. Direct channels offer better technical support and immediate feedback loops, crucial for high-value custom products. Indirect channels provide broader market reach and logistical efficiency. Market players often maintain a hybrid model, utilizing direct sales to strategic partners while leveraging distributors to penetrate fragmented regional markets, ensuring optimal inventory management and rapid fulfillment.

The downstream analysis focuses on the final integration of the Organo Silica Sol into end-user products across various industries. Major consumers include manufacturers of high-end automotive coatings, composite materials for aerospace, and specialized electronic components. The technical service provided at this stage is crucial, as the sol often needs to be perfectly compatible with complex polymer matrices or application equipment. Successful market penetration relies heavily on the ability of the sol producer to collaborate closely with end-users to fine-tune the formulation, ensuring maximum performance enhancement (e.g., scratch resistance, thermal barrier function) without compromising processability or cost efficiency, thereby capturing the final value of the specialized chemical material.

Organo Silica Sol Market Potential Customers

Potential customers for Organo Silica Sol are predominantly large-scale industrial manufacturers and specialty formulators seeking to enhance the performance characteristics of their final products using advanced nanotechnology. The primary end-users are those operating in the materials science space, focusing on durability, heat resistance, and optical clarity. These include major automotive OEMs and their Tier 1 suppliers who demand superior clear coats and primer systems; specialized chemical companies that formulate high-performance industrial coatings used in infrastructure and marine environments; and manufacturers of composite materials requiring improved strength-to-weight ratios in aerospace and wind energy applications. These buyers prioritize product stability, consistent particle distribution, and demonstrated performance validation data.

A secondary, yet rapidly growing customer base, exists within the high-tech electronics and semiconductor industries. These buyers, including wafer fabrication facilities and display panel manufacturers, utilize Organo Silica Sols for chemical mechanical planarization (CMP) slurries, dielectric layers, and low-k insulating films. Their requirements are exceptionally stringent, demanding ultra-high purity (low metal contamination) and precise control over particle morphology to ensure defect-free manufacturing of microelectronic devices. Procurement in this segment is highly technical, often involving rigorous qualification processes lasting several months, highlighting the value placed on reliability and consistency in supply.

Furthermore, specialized segments such as the textile industry, seeking durable, functional finishes (e.g., UV protection, fire resistance), and the medical sector, requiring biocompatible coatings for devices and drug delivery systems, also represent significant potential customers. These diverse end-user applications underscore the versatility of Organo Silica Sol technology. Suppliers must therefore adopt a market strategy that allows for both high-volume standardized production for sectors like coatings, and low-volume, highly customized, high-purity production for specialized segments like electronics and biomedical applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 820 Million |

| Growth Rate | 9.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AkzoNobel, BASF SE, Evonik Industries AG, Merck KGaA, Nissan Chemical Corporation, Fuso Chemical Co. Ltd., Nouryon, Wacker Chemie AG, Cabot Corporation, Momentive Performance Materials Inc., Chemiewerk Bad Köstritz GmbH, ADEKA Corporation, Dow Inc., REMET Corporation, Colloidal Dynamics, KCC Corporation, Suzhou Nano Solution Co., Ltd., Elkem ASA, Shin-Etsu Chemical Co., Ltd., QuantumSphere, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Organo Silica Sol Market Key Technology Landscape

The technological landscape of the Organo Silica Sol market is centered on sophisticated synthesis methods designed to precisely control the size, shape, and surface chemistry of silica nanoparticles, ensuring stability within various organic media. The dominant technologies include the Stöber process and modified sol-gel methods, which allow for the creation of spherical, monodisperse silica particles. However, the true technological advancement lies in the post-synthesis surface modification techniques, where organoalkoxysilanes (coupling agents) are strategically grafted onto the silica surface. This functionalization process is critical for rendering the inorganic particle compatible with specific organic polymers or solvents, facilitating seamless integration into the final product matrix, thereby maximizing performance benefits such as increased cross-linking density and improved interfacial adhesion.

A crucial area of technological focus involves the continuous improvement of dispersion stability, particularly for high-solid content, water-based sols. Innovations in steric stabilization, utilizing specialized non-ionic surfactants or polymer brushes, are essential to prevent particle aggregation (flocculation) over extended periods, which is a common challenge in concentrated colloidal systems. Furthermore, advancements in analytical instrumentation, such as Dynamic Light Scattering (DLS) and Small-Angle X-ray Scattering (SAXS), play a key role. These technologies enable real-time monitoring of particle size distribution and aggregation state during synthesis and formulation, providing manufacturers with the precise control necessary to meet the ultra-high quality demands of industries like optics and microelectronics.

Emerging technologies include the development of structured or non-spherical silica morphologies, such as porous or rod-shaped particles, which offer unique properties like enhanced surface area for catalytic applications or anisotropic behavior in advanced composites. Furthermore, the integration of continuous flow synthesis reactors is being explored to move away from traditional batch processing. Continuous flow methods offer advantages in scalability, process efficiency, and greater control over reaction kinetics, leading to more uniform particle products and reduced manufacturing variability, positioning them as the next generation of industrial production technology for highly specialized nano-colloidal materials.

Regional Highlights

Asia Pacific (APAC) stands as the dominant region in the Organo Silica Sol market, driven primarily by its extensive manufacturing ecosystem encompassing consumer electronics, automotive assembly, and massive infrastructure development projects. Countries like China, South Korea, and Japan are global hubs for semiconductor production and display panel manufacturing, creating immense demand for high-purity organo silica materials used in CMP and advanced insulation layers. Furthermore, the burgeoning automotive industry in India and Southeast Asia, requiring durable and aesthetically pleasing finishes, significantly contributes to the consumption of high-performance coatings additives derived from these sols. The favorable governmental policies supporting high-tech manufacturing and the availability of skilled chemical processing workforce further solidify APAC's leading position.

North America and Europe represent mature, high-value markets characterized by stringent environmental regulations and a strong focus on advanced materials research. The adoption of Organo Silica Sols in these regions is heavily concentrated in sophisticated applications such as aerospace coatings, high-end industrial maintenance finishes, and medical device manufacturing, where the high cost of the material is justified by superior performance and longevity. The emphasis on low-VOC and sustainable solutions in the European Union (EU) particularly drives innovation toward water-based Organo Silica Sols, forcing manufacturers to invest heavily in developing stable, greener dispersions. These regions are also centers for key end-user industry R&D, often leading to the early commercialization of novel applications for organo silica technology.

The Middle East and Africa (MEA) and Latin America (LATAM) are emerging markets, currently characterized by lower market penetration but with high growth potential, particularly in construction and oil & gas infrastructure. The extreme climatic conditions in MEA necessitate highly durable, anti-corrosion coatings, where organo silica plays a critical reinforcing role. LATAM's market growth is tied to automotive production and general industrialization, where local manufacturers are increasingly upgrading their material specifications to meet international quality benchmarks. While these regions currently rely heavily on imports, increasing local production capacity and establishing specialized distribution networks are key strategies for market players seeking to capture future growth in these geographies.

- Asia Pacific (APAC): Dominates consumption driven by electronics manufacturing (China, South Korea) and high volume automotive coatings production.

- North America: High-value market focused on aerospace, protective industrial coatings, and advanced R&D in composite materials.

- Europe: Growth propelled by stringent REACH regulations favoring low-VOC and sustainable water-based organo silica formulations in coatings and industrial adhesives.

- Latin America (LATAM): Emerging demand tied to automotive assembly growth and modernization of industrial infrastructure.

- Middle East & Africa (MEA): Growth driven by severe climate conditions necessitating high-performance anti-corrosion and protective coatings, particularly in the oil & gas sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Organo Silica Sol Market.- AkzoNobel

- BASF SE

- Evonik Industries AG

- Merck KGaA

- Nissan Chemical Corporation

- Fuso Chemical Co. Ltd.

- Nouryon

- Wacker Chemie AG

- Cabot Corporation

- Momentive Performance Materials Inc.

- Chemiewerk Bad Köstritz GmbH

- ADEKA Corporation

- Dow Inc.

- REMET Corporation

- Colloidal Dynamics

- KCC Corporation

- Suzhou Nano Solution Co., Ltd.

- Elkem ASA

- Shin-Etsu Chemical Co., Ltd.

- QuantumSphere, Inc.

Frequently Asked Questions

Analyze common user questions about the Organo Silica Sol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Organo Silica Sol in coating applications?

The primary function of Organo Silica Sol in coatings is to significantly enhance mechanical properties, specifically scratch resistance, surface hardness, and abrasion resistance. The nano-silica particles, functionalized with organic groups, integrate seamlessly into polymer matrices, creating a denser, more resilient network without compromising the coating's transparency or flexibility. They also contribute to improved UV stability and thermal endurance of the film.

How do environmental regulations influence the Organo Silica Sol market growth?

Environmental regulations, particularly those restricting Volatile Organic Compound (VOC) emissions (e.g., EU REACH, US EPA standards), are a major driver for the market. These regulations push manufacturers away from traditional solvent-based systems toward water-based, high-solid, or UV-curable formulations. Organo Silica Sols are crucial enablers in these greener formulations, as they maintain or improve performance while minimizing environmental impact, leading to increased adoption in regulated markets like North America and Europe.

Which application segment holds the highest growth potential for Organo Silica Sol?

The Electronics and Semiconductor segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This growth is driven by the relentless miniaturization trend, which requires ultra-pure and specialized Organo Silica Sols for processes such as Chemical Mechanical Planarization (CMP) slurries and for manufacturing high-performance dielectric and insulating layers essential for advanced microelectronic components and displays.

What is the main technical challenge faced by Organo Silica Sol manufacturers?

The main technical challenge is achieving long-term colloidal stability, especially in high-concentration or diverse organic solvent systems. Preventing the irreversible aggregation (flocculation) of highly reactive nanoparticles requires complex surface chemistry modification and precise process control during synthesis and storage. Stability is critical, as any particle aggregation negatively impacts the performance and homogeneity of the final product, especially in thin film applications.

What is the difference between standard Silica Sol and Organo Silica Sol?

Standard Silica Sol typically consists of untreated, naked silica nanoparticles dispersed in water (Aqueous Silica Sol) or alcohol, primarily relying on electrostatic stabilization. Organo Silica Sol, conversely, features silica nanoparticles whose surfaces are chemically modified or grafted with specific organic functional groups (e.g., vinyl, epoxy, amine groups). This organic shell makes the particle compatible with specific organic resins and polymers, providing a critical hybrid functionality and improving dispersibility in non-polar media.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- High Purity Organo Silica Sol Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Organo Silica Sol Market Statistics 2025 Analysis By Application (Microelectronics Field, Ceramic Binder, Nano-composite Materials), By Type (Hydrophilic Solvent, Hydrophobic Solvent, Hydrophilic solvent is the most common type of organo silica sol, which has more than 53% market share in 2019.), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager