Outsourcing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433762 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Outsourcing Market Size

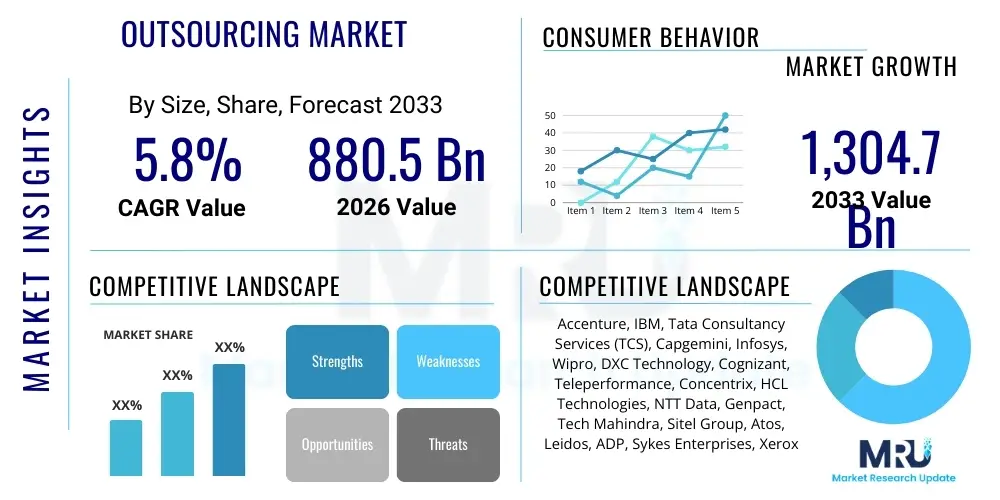

The Outsourcing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $880.5 Billion USD in 2026 and is projected to reach $1,304.7 Billion USD by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the accelerating global trend of digital transformation initiatives across industries, necessitating specialized technical expertise that is often more efficiently acquired via external vendors rather than internal development. Furthermore, strategic resource allocation and the imperative for companies to focus intensely on core competencies are solidifying outsourcing as a critical operational strategy rather than just a cost-saving measure.

Outsourcing Market introduction

The Outsourcing Market encompasses the contractual practice where a company delegates specific business activities, functions, or processes to an external third-party provider. This delegation spans a wide array of services, including information technology (IT), human resources, finance and accounting, customer service (BPO), and specialized knowledge-based tasks (KPO). Products in this market are fundamentally service offerings structured around defined Service Level Agreements (SLAs) designed to deliver operational efficiency and access to specialized global talent pools. Major applications include managing enterprise IT infrastructure, handling customer relationship management (CRM) tasks, and supporting complex legal and research operations.

The primary benefits derived from utilizing outsourcing services involve substantial cost reduction achieved through labor arbitrage and optimized resource utilization, alongside enhanced operational flexibility that allows organizations to scale operations rapidly in response to fluctuating market demands. Furthermore, outsourcing enables access to cutting-edge technologies and best-in-class expertise that might be prohibitively expensive or time-consuming to develop internally. Key driving factors propelling market growth include the mandatory shift towards digital platforms, the increasing global shortage of highly skilled IT professionals in developed economies, and the continuous need for corporations to rationalize operating expenditure in highly competitive global environments.

The evolution of the outsourcing paradigm has transitioned from simple labor cost arbitrage to sophisticated strategic partnerships focused on value co-creation and innovation. Modern outsourcing arrangements often integrate advanced technologies like cloud computing, automation, and data analytics to optimize the delegated functions, making the service provider an integral strategic partner in the client's long-term business roadmap. This shift towards value-added, technology-centric outsourcing is sustaining the market's robust trajectory, especially within segments like digital transformation consulting and cloud migration services.

Outsourcing Market Executive Summary

The global Outsourcing Market is experiencing a pivotal transformation driven by technological integration and shifting client expectations toward outcome-based contracts. Business trends highlight a strong movement away from traditional labor-intensive BPO toward complex, high-value KPO and advanced IT services, particularly those supporting cloud infrastructure, cybersecurity, and artificial intelligence integration. This evolution is transforming service providers into strategic partners capable of driving innovation, rather than mere executors of routine tasks. Geographic diversification is also accelerating, moving beyond historical hubs to include emerging destinations in Eastern Europe and Southeast Asia that offer specialized technical talent pools and competitive operating environments.

Regional trends indicate North America maintains dominance due to the high concentration of major technology firms and early adoption of advanced IT outsourcing services, particularly in financial services and healthcare sectors. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, fueled by increasing digitization in India, China, and Australia, and the region's emergence as the world’s foremost supply hub for outsourcing talent and infrastructure. Europe remains a significant market, characterized by stringent regulatory environments like GDPR, which drives demand for specialized compliance and data security outsourcing solutions, particularly within the BFSI and government sectors.

Segment trends emphasize the overwhelming prominence of IT Outsourcing (ITO), which includes application development, infrastructure management, and digital services. Within ITO, cloud services outsourcing and cybersecurity services are critical high-growth sub-segments reflecting the mandatory nature of modern enterprise operations. Concurrently, Business Process Outsourcing (BPO) is undergoing massive internal restructuring through robotic process automation (RPA) and intelligent automation, minimizing reliance on manual labor while boosting efficiency and accuracy in functions such as customer service and back-office finance operations. This blend of specialized IT and automated business processes defines the current market landscape.

AI Impact Analysis on Outsourcing Market

User queries regarding the impact of Artificial Intelligence (AI) on the Outsourcing Market frequently center on potential job displacement, the required upskilling of vendor staff, and how AI can be leveraged to create higher-value, more strategic outsourcing services. Key concerns revolve around the efficiency gains versus the need for human oversight, especially in customer experience (CX) and complex decision-making processes. Users are keenly interested in determining which outsourced functions are most susceptible to automation (e.g., routine data entry, basic customer queries) and how service providers are incorporating Generative AI to improve productivity and quality, particularly in software development, coding, and creative content generation. The consensus theme is that AI will not eliminate outsourcing, but rather elevate it, shifting the focus from transactional services to managed intelligence and cognitive process outsourcing (CPO), requiring vendors to demonstrate robust AI implementation capabilities.

- AI adoption drives hyper-automation in BPO, significantly reducing manual labor volumes in back-office operations and transaction processing.

- Generative AI accelerates software development lifecycles (SDLC) by automating code generation, testing, and documentation tasks, enhancing IT outsourcing efficiency.

- Shift from traditional BPO to Cognitive Process Outsourcing (CPO), focusing on analytical tasks, predictive modeling, and data interpretation services.

- Increased demand for outsourcing expertise in AI governance, model maintenance, data labeling, and ethical AI deployment frameworks.

- AI enhances customer experience (CX) outsourcing through advanced chatbots and predictive routing, allowing human agents to focus on complex, emotional interactions.

- Mandates significant upskilling and reskilling of the outsourcing workforce to manage, monitor, and train AI systems, creating a new layer of specialized talent requirements.

- Risk of disruption to traditional voice and transactional services, pressuring service providers to rapidly invest in proprietary automation platforms.

DRO & Impact Forces Of Outsourcing Market

The Outsourcing Market is currently governed by a powerful mix of economic incentives and technological mandates. Drivers predominantly include the imperative for cost reduction and the critical need for enterprises to access specialized technical capabilities, particularly in domains like cloud computing, cybersecurity, and data science, which are often scarce internally. These drivers are heavily amplified by the acceleration of global digital transformation initiatives following increased remote work adoption and competition. However, this growth trajectory is balanced by significant restraints, primarily centered on escalating concerns regarding data security, regulatory compliance complexity (such as adherence to GDPR and CCPA), and challenges associated with effective vendor management and contract governance, especially across diverse geographical jurisdictions.

Opportunities within the market are abundant, primarily focused on the expansion into specialized, high-value services such as Knowledge Process Outsourcing (KPO) and Research & Development (R&D) outsourcing, moving beyond basic transactional services. The development and deployment of hyperautomation platforms (combining RPA, AI, and process mining) present substantial opportunities for vendors to offer differentiated, outcome-based services that deliver measurable business improvement beyond simple labor cost savings. Furthermore, smaller, highly specialized firms have an opportunity to capture niche market shares by focusing exclusively on emerging technologies like quantum computing services or industry-specific vertical solutions, such as specialized compliance services for the fintech sector.

The impact forces driving change in the outsourcing ecosystem are powerful and multi-directional. Economic globalization continues to pull sourcing decisions toward lower-cost regions, while simultaneously, the geopolitical climate and supply chain resilience concerns are pushing some sourcing back toward nearshore or reshoring models to mitigate risk. Technology is the most transformative force; the rapid commoditization of cloud services necessitates that outsourcing providers pivot their business models from managing physical infrastructure to managing complex cloud environments and delivering business outcomes enabled by these platforms. The ongoing tension between cost efficiency (pull factor) and data sovereignty/security (push factor) dictates regional market dynamics and contract structures across the globe.

Segmentation Analysis

The Outsourcing Market is comprehensively segmented based on the type of service delivered, the specific industry receiving the service, and the geographic location of both the client and the vendor. Understanding these segments is crucial for analyzing market dynamics, as different segments exhibit varied growth rates and adoption maturity levels. Service-based segmentation is the most critical, differentiating between IT-centric solutions necessary for digital infrastructure and business process-centric solutions focused on operational efficiency. Industry segmentation reflects the varying degrees of regulatory oversight and technological needs across sectors like BFSI and Healthcare, dictating the specialization required by vendors. The dominance of the IT Outsourcing segment underscores the modern enterprise's reliance on external expertise to manage increasingly complex digital estates and accelerate innovation cycles.

- By Service Type:

- IT Outsourcing (ITO)

- Application Services

- Infrastructure Services (Cloud, Data Center, Network)

- Security Services

- Digital Services (Analytics, Mobility)

- Business Process Outsourcing (BPO)

- Customer Services (Contact Center)

- Finance and Accounting (F&A)

- Human Resources (HR)

- Procurement/Supply Chain

- Knowledge Process Outsourcing (KPO)

- Data Analytics and Research

- Legal Process Outsourcing (LPO)

- Market Research Services

- IT Outsourcing (ITO)

- By End-Use Industry:

- Banking, Financial Services, and Insurance (BFSI)

- Telecommunications and IT

- Healthcare and Pharmaceuticals

- Government and Public Sector

- Manufacturing and Automotive

- Retail and Consumer Goods

- Energy and Utilities

- By Region:

- North America (U.S., Canada)

- Europe (U.K., Germany, France)

- Asia Pacific (APAC) (India, China, Japan)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Outsourcing Market

The outsourcing value chain begins with the Upstream Analysis, which involves the crucial foundational activities that enable service delivery. This stage includes talent acquisition, rigorous training and certification of technical staff, development of intellectual property (IP) such as proprietary platforms and automation tools, and investment in robust, scalable infrastructure (data centers, cloud licenses, secure networks). The strength of the upstream component dictates the quality and cost-effectiveness of the final service offering. Key upstream stakeholders include educational institutions providing talent, technology providers (like Microsoft, AWS, Oracle) whose platforms are utilized, and internal centers of excellence responsible for knowledge retention and innovation.

The core of the value chain is the service delivery stage, followed by Downstream Analysis. This stage involves the direct execution of outsourced processes, performance monitoring against established SLAs, client relationship management, and continuous process improvement facilitated by analytics and automation. Downstream value creation focuses on optimizing the client's business outcomes—reducing costs, accelerating time-to-market, or improving customer satisfaction. Essential downstream activities include transition management (onboarding new processes), continuous quality assurance, and quarterly business reviews focused on strategic alignment rather than just operational metrics. Successful providers seamlessly integrate these delivery processes with client operations.

The distribution channel for outsourcing services is predominantly Direct, characterized by complex, long-term contracts negotiated directly between the client enterprise and the outsourcing vendor (e.g., Accenture selling a multi-year IT services contract to a major bank). However, Indirect channels are increasingly gaining prominence, particularly for mid-market and smaller contracts, utilizing technology advisory firms, system integrators (who often partner with larger BPO/ITO providers), and specialized cloud service brokers. While direct sales teams handle large enterprise deals due to the necessity of custom solutions, indirect channels provide scalability and reach, leveraging established consulting relationships to identify and secure outsourcing opportunities globally, especially in niche technological areas where specialist advice is required.

Outsourcing Market Potential Customers

Potential customers for outsourcing services span the entirety of the global corporate landscape, primarily comprising organizations seeking strategic leverage, operational efficiency, or access to scarce talent. End-users are typically large enterprises with complex, distributed operations across multiple geographies, particularly within the BFSI, Telecom, and Healthcare sectors, where regulatory demands and massive transaction volumes necessitate highly efficient, scalable back-office support and robust IT infrastructure management. These customers prioritize vendors capable of demonstrating strong domain expertise and compliance adherence.

Beyond traditional large enterprises, the mid-market segment (companies with revenues generally ranging from $100 million to $1 billion) represents a rapidly growing buyer segment. These mid-market companies often lack the internal capital or scale to build out specialized departments like advanced cybersecurity or sophisticated data analytics centers. Therefore, they turn to outsourcing to gain instant access to world-class capabilities and specialized intellectual property, enabling them to compete effectively against larger incumbents without incurring massive fixed costs. The demand from these customers is often focused on flexible, subscription-based outsourcing models (as-a-service offerings) rather than traditional fixed-price contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $880.5 Billion USD |

| Market Forecast in 2033 | $1,304.7 Billion USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Accenture, IBM, Tata Consultancy Services (TCS), Capgemini, Infosys, Wipro, DXC Technology, Cognizant, Teleperformance, Concentrix, HCL Technologies, NTT Data, Genpact, Tech Mahindra, Sitel Group, Atos, Leidos, ADP, Sykes Enterprises, Xerox |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Outsourcing Market Key Technology Landscape

The operational efficiency and strategic value proposition of modern outsourcing services are inextricably linked to advanced technological capabilities. The core technology stack driving the market is dominated by Cloud Computing platforms (AWS, Azure, GCP), which form the foundation for scalable, flexible infrastructure outsourcing and application hosting. Beyond foundational infrastructure, the critical technological differentiator for modern service providers is the integration of Hyperautomation suites, encompassing Robotic Process Automation (RPA) tools (e.g., UiPath, Automation Anywhere), intelligent document processing, and process mining capabilities. These tools allow vendors to offer transformational, low-touch services in traditional BPO areas like finance and customer service, drastically lowering operational costs while simultaneously improving data accuracy and compliance.

Furthermore, technologies enabling secure and intelligent data handling are paramount. Cybersecurity services outsourcing relies heavily on advanced threat detection tools, Security Information and Event Management (SIEM) systems, and specialized Zero Trust Architecture implementation expertise. Data analytics platforms, coupled with machine learning algorithms, are essential for KPO offerings, allowing providers to move beyond simple data reporting to deliver predictive insights and strategic decision support to clients across all industries. The successful service provider must integrate these varied technologies cohesively, often through proprietary platforms and integrated delivery frameworks, ensuring interoperability and maintaining strict security protocols across multi-cloud environments.

The increasing focus on specialized services demands niche technological expertise. For example, in Legal Process Outsourcing (LPO), technologies like advanced e-discovery platforms and AI-driven contract review software are standard requirements. In the healthcare sector, vendors must utilize specialized Electronic Health Record (EHR) systems and ensure compliance technologies meet HIPAA or regional equivalents. Overall, the technology landscape is characterized by constant investment in proprietary IP development and strategic partnerships with leading software and hardware vendors, moving away from purely human capital arbitrage towards a technology-enabled managed service model, where innovation through integrated tech stacks is the key competitive advantage.

Regional Highlights

- North America (NA): Dominates the global outsourcing market in terms of spending and mature adoption, driven by the massive scale of the BFSI, technology, and healthcare industries in the U.S. and Canada. The region focuses heavily on high-value outsourcing services, including complex IT consulting, cybersecurity managed services, and advanced KPO, often leveraging nearshore partners in Latin America (Mexico, Canada) for time-zone proximity and cultural affinity, though substantial offshore partnerships remain with India and the Philippines for scale.

- Europe: Characterized by highly fragmented demand across diverse economies (Germany prioritizing manufacturing IT, UK strong in financial services BPO), Europe presents significant complexity due to strict regulatory requirements like GDPR and the need for data localization. This drives demand for specialized outsourcing focusing on compliance, data sovereignty, and secure cloud environments. Western European clients often favor nearshore providers in Eastern Europe (Poland, Romania) due to cultural alignment and technical expertise.

- Asia Pacific (APAC): The fastest-growing regional market, APAC is distinguished by its dual role as both the world's primary outsourcing supply hub (India, Philippines, China) and a rapidly expanding client base (Japan, Australia, Southeast Asian countries) undergoing massive domestic digital transformation. The region’s growth is fueled by massive infrastructure projects, burgeoning startup ecosystems, and governmental mandates for digitization, leading to soaring demand for cloud migration and digital marketing outsourcing within the region.

- Latin America (LATAM): Gaining increasing prominence, particularly as a nearshore alternative for North American clients seeking operational resilience and cultural compatibility. Key markets like Mexico, Brazil, and Colombia offer strong multilingual capabilities, making them attractive hubs for BPO, contact center services, and application development, serving both the local Spanish/Portuguese-speaking markets and the U.S. East Coast time zone.

- Middle East and Africa (MEA): Emerging market driven primarily by government-led diversification initiatives away from oil dependency (e.g., Saudi Arabia’s Vision 2030, UAE’s push for smart cities). This region exhibits high demand for infrastructure outsourcing, specialized fintech solutions, and large-scale public sector digitization projects, often relying on global providers to rapidly import necessary technical expertise and established operational frameworks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Outsourcing Market.- Accenture

- IBM

- Tata Consultancy Services (TCS)

- Capgemini

- Infosys

- Wipro

- DXC Technology

- Cognizant

- Teleperformance

- Concentrix

- HCL Technologies

- NTT Data

- Genpact

- Tech Mahindra

- Sitel Group

- Atos

- Leidos

- ADP

- Sykes Enterprises

- Xerox

Frequently Asked Questions

Analyze common user questions about the Outsourcing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the modern Outsourcing Market?

The primary driver is the accelerating need for specialized technical expertise, specifically in cloud migration, data analytics, and cybersecurity. Companies outsource not just to reduce costs, but strategically to gain access to cutting-edge capabilities and accelerate their mandatory digital transformation efforts.

How is AI impacting traditional Business Process Outsourcing (BPO)?

AI is transforming BPO by automating routine transactional tasks through Robotic Process Automation (RPA) and intelligent agents. This shift is leading to a contraction in basic, low-skill roles but is simultaneously creating demand for higher-value Cognitive Process Outsourcing (CPO) roles focused on managing and optimizing automated systems.

What are the biggest risks associated with IT Outsourcing in the current market?

The biggest risks include data breaches and cybersecurity vulnerabilities, vendor lock-in, and the complexity of ensuring global regulatory compliance (such as GDPR). Mitigating these risks requires stringent contractual Service Level Agreements (SLAs) focused on security guarantees and data governance transparency.

Which geographical region is showing the highest growth potential for outsourcing services?

The Asia Pacific (APAC) region exhibits the highest growth velocity, driven by robust domestic digital adoption in countries like India and China, and the continued reliance on the region as the global hub for scalable IT and BPO talent delivery.

What is the difference between Offshore, Nearshore, and Reshoring outsourcing models?

Offshore refers to outsourcing to a distant location (e.g., US company using India). Nearshore involves outsourcing to a geographically closer country with similar time zones (e.g., US company using Mexico). Reshoring involves bringing outsourced functions back to the client's original home country, often due to quality control or geopolitical risks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Insurance Business Process Outsourcing (BPO) Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Recruitment Process Outsourcing (RPO) Services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Manpower Outsourcing Services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Human Resource Outsourcing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Human Resource Outsourcing (HRO) Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager