Pallet Conveyor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435509 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Pallet Conveyor Market Size

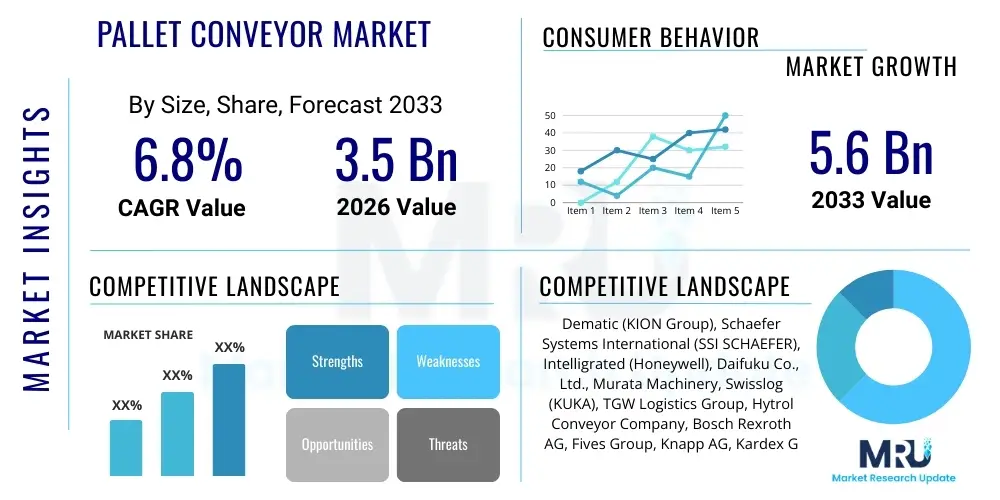

The Pallet Conveyor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $5.6 Billion by the end of the forecast period in 2033.

Pallet Conveyor Market introduction

The Pallet Conveyor Market encompasses a range of automated material handling systems designed specifically for the transportation, accumulation, and indexing of heavy unit loads, primarily utilizing pallets. These systems are integral to modern logistics, warehousing, and manufacturing environments, providing a streamlined, high-throughput solution for moving goods between different processing stations, storage areas, or shipping docks. Pallet conveyors differ significantly from standard package conveyors due to their robust construction, higher load capacity, and specialized handling features necessary to manage standard industrial pallets (such as EURO pallets, standard 48" x 40" pallets, or CHEP pallets). Key product types include chain-driven live rollers (CDLR), gravity conveyors, chain conveyors (two-strand or three-strand), and automated transfer cars (ATCs), each optimized for specific functions like transportation, merging, diverting, or buffering within an automated workflow.

Major applications of pallet conveyor systems span across diverse sectors, including e-commerce and retail distribution centers, automotive manufacturing, food and beverage processing, and pharmaceutical warehousing. In the highly demanding environment of e-commerce fulfillment, these systems are critical for moving bulk goods into depalletizing stations or transporting full pallet loads to automated storage and retrieval systems (AS/RS). The primary benefit derived from implementing pallet conveyance infrastructure is the significant reduction in manual labor required for material movement, leading to increased operational efficiency, reduced risk of product damage, and enhanced safety within the facility. Furthermore, their integration into broader facility management software facilitates accurate tracking and inventory control, providing real-time visibility into material flow.

The principal driving factors accelerating market expansion include the sustained global growth of e-commerce, which necessitates rapid expansion of automated warehouse infrastructure; the pervasive trend toward industrial automation (Industry 4.0) aimed at optimizing supply chain resilience; and the continuous pressure on businesses to reduce operational costs associated with manual material handling. Furthermore, the increasing complexity of supply chains, requiring efficient buffering and sequencing of goods, mandates the adoption of sophisticated pallet handling equipment capable of managing diverse pallet sizes and weights. The continuous innovation in motor technology, controls, and energy efficiency further strengthens the value proposition of modern pallet conveyor systems, driving replacement and expansion investment across established industrial regions.

Pallet Conveyor Market Executive Summary

The Pallet Conveyor Market is undergoing a rapid transformation, driven by fundamental shifts in global business trends, intense regional investment in logistics infrastructure, and sophisticated technological advancements across various segments. Business trends emphasize the necessity for flexible, modular conveyor systems that can quickly adapt to fluctuating inventory profiles and seasonal demand spikes, particularly evident in the 3PL and fast-moving consumer goods (FMCG) sectors. The incorporation of decentralized control architectures and standardized, pre-engineered modules allows system integrators to deploy solutions with shorter lead times and reduced installation complexities, making high-throughput automation accessible to a broader range of enterprises, including mid-sized manufacturing facilities seeking operational scale-up. This focus on modularity also supports sustainability goals by allowing easier modification and expansion, extending the equipment lifespan.

Regionally, the Asia Pacific (APAC) stands out as the primary engine of market growth, fueled by massive public and private sector investments in warehousing, port automation, and manufacturing capacity expansion, particularly in China, India, and Southeast Asian nations where industrialization is still accelerating rapidly. North America and Europe, characterized by high labor costs and existing mature infrastructures, are focusing on modernization and replacement cycles, prioritizing conveyors equipped with advanced diagnostics, predictive maintenance capabilities, and high energy efficiency ratings to maximize return on investment. The drive towards localizing manufacturing supply chains, accelerated by recent geopolitical events, further compels regional markets to invest in high-efficiency intra-logistics systems capable of handling localized production volumes reliably.

Segment trends reveal a pronounced shift toward electrically driven roller (EDR) and motor-driven roller (MDR) technologies, which offer superior energy conservation and zone-specific control compared to traditional pneumatically or chain-driven systems, particularly favoring accumulation and zero-pressure accumulation applications where pallet spacing and flow control are critical. Furthermore, the segmentation by end-user demonstrates robust growth in the e-commerce/retail sector due to the high volume of goods requiring palletized storage and cross-docking operations. The implementation of sophisticated sensors, integration with Warehouse Management Systems (WMS) and Warehouse Control Systems (WCS), and the rising adoption of specialized pallet handling accessories like turntables and shuttles are defining the competitive landscape, pushing manufacturers to offer highly integrated and software-driven material flow solutions.

AI Impact Analysis on Pallet Conveyor Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the Pallet Conveyor Market center primarily on optimizing operational uptime, enhancing predictive maintenance scheduling, and improving material flow efficiency through autonomous decision-making. Users frequently ask how AI can prevent system bottlenecks, predict component failure before it impacts production, and dynamically adjust conveyor speeds or routing in response to real-time order priority changes. A critical theme is the integration challenge: how can existing legacy conveyor infrastructure be retrofitted with AI capabilities without complete system overhaul? The market expects AI to transition pallet conveyance from reactive maintenance models to proactive, condition-based monitoring, dramatically reducing total cost of ownership and maximizing throughput capacity, especially in complex, multi-system integration environments where throughput balancing is paramount. Furthermore, there is significant interest in how machine learning algorithms can analyze vast datasets generated by conveyor sensors (vibration, temperature, current draw) to reveal hidden inefficiencies or imminent maintenance requirements, transforming the standard conveyor from a mechanical device into an intelligent data-generating asset.

- AI-Powered Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data (vibration, temperature, power consumption) to predict the failure of critical components (motors, bearings, chains) days or weeks in advance, minimizing unplanned downtime and maximizing asset lifespan.

- Dynamic Throughput Optimization: Implementing AI models to continuously monitor material flow, automatically adjusting conveyor speeds, merge timings, and diversion sequences in real-time to prevent bottlenecks, ensure balanced workload distribution, and prioritize critical orders based on WMS inputs.

- Autonomous Route Planning: Integrating AI with automated guided vehicles (AGVs) or robotic transfer systems that interact with conveyors, allowing for autonomous path planning and congestion avoidance, enhancing system flexibility and responsiveness to floor layout changes.

- Energy Consumption Reduction: Employing deep learning techniques to identify and optimize energy usage patterns across the conveyor network, automatically powering down non-essential zones during low-demand periods without compromising operational readiness, thereby reducing overall utility costs.

- Automated Fault Diagnosis: Using computer vision and AI classifiers to instantaneously detect anomalies, such as misaligned pallets, damaged loads, or mechanical issues on the conveyor line, triggering immediate localized shutdowns or maintenance alerts, improving safety and reducing product damage rates.

DRO & Impact Forces Of Pallet Conveyor Market

The Pallet Conveyor Market is principally shaped by the powerful global drivers of automated logistics expansion and industrial digitalization, balanced against the significant restraints posed by capital expenditure requirements and integration complexity, while abundant opportunities exist in smart system integration and specialized application growth. The primary driving force is the imperative for efficiency gains across the global supply chain, necessitated by rapidly expanding e-commerce volumes and increasingly high customer expectations for delivery speed. This demand compels businesses across manufacturing and distribution sectors to invest heavily in automated internal logistics systems, making pallet conveyors a foundational necessity for any high-volume operation. Conversely, the substantial initial investment required for sophisticated conveyor systems, particularly those integrated with AS/RS and complex control systems, acts as a restraint, especially for Small and Medium-sized Enterprises (SMEs) that may struggle with the high sunk costs and the long return on investment periods associated with complex infrastructure.

The impactful forces influencing market dynamics are multi-faceted, combining technological push with economic pull factors. The growing adoption of Industry 4.0 standards pushes manufacturers to integrate sophisticated sensor technology and edge computing capabilities into conveyor systems, enhancing their data collection and operational intelligence. This technological push creates opportunities in offering modular, scalable solutions that can be easily customized or expanded, addressing the diverse needs of end-users. Opportunities also arise from the increasing requirement for specialized conveyance systems tailored for cold chain logistics and intrinsically safe environments (e.g., chemical or pharmaceutical industries), which demand specific material and control specifications that standard systems cannot meet, thus opening high-value niche segments.

However, geopolitical instability, supply chain volatility in raw materials (steel, specialized motors), and the persistent shortage of skilled labor required for installation, maintenance, and programming of complex conveyor systems represent significant limiting factors. Impact forces related to regulation, particularly regarding worker safety and energy consumption standards (AEO regulations in Europe, for example), mandate continuous redesign and certification, adding to development costs. Successfully navigating this landscape requires manufacturers to focus on product differentiation through superior reliability, ease of integration with third-party software, and embedding remote diagnostic services, thereby turning potential challenges into competitive advantages through value-added service offerings.

Segmentation Analysis

The Pallet Conveyor Market segmentation provides a granular view of market dynamics, categorized fundamentally by type, application, operating principle, and end-user industry. Analyzing these segments reveals shifting preferences toward high-efficiency, controlled-flow systems that support complex, multi-tiered warehousing operations. The dominance of the chain-driven live roller (CDLR) segment persists due to its robustness and capacity for handling heavy loads, though the newer motor-driven roller (MDR) segment is rapidly gaining traction, favored for its modularity, zone control capabilities, and superior energy consumption profiles, particularly in accumulation and sequencing zones. Understanding these sub-segments is critical for manufacturers aiming to align their product development pipelines with the accelerating demand for decentralized control and energy conservation technologies across the logistics ecosystem.

- By Type

- Chain Conveyor (Two-Strand, Three-Strand)

- Chain-Driven Live Roller (CDLR) Conveyor

- Gravity Roller Conveyor

- Motor-Driven Roller (MDR) Conveyor / Electrically Driven Roller (EDR)

- Slat Conveyor

- Pallet Stacker/Destacker

- By Operating Principle

- Accumulation Conveyors (Zero-Pressure)

- Transportation Conveyors (Continuous Flow)

- Transfer and Shuttle Cars

- Indexing and Positioning Conveyors

- By Speed/Capacity

- Low Capacity (Up to 1000 kg)

- Medium Capacity (1000 kg to 2000 kg)

- High Capacity (Above 2000 kg)

- By End-User Industry

- E-commerce and Retail Distribution Centers

- Automotive and Component Manufacturing

- Food and Beverage Processing

- Pharmaceutical and Healthcare

- Third-Party Logistics (3PL)

- Chemical and Heavy Industry

- By Component

- Conveyor Structure (Frames and Beams)

- Drives and Motors (AC Motors, Servo Drives)

- Control Systems (PLCs, Sensors, HMI)

- Rollers and Chains

- Accessories (Turntables, Lifters, Transfers)

Value Chain Analysis For Pallet Conveyor Market

The value chain of the Pallet Conveyor Market is a complex integration spanning raw material sourcing, specialized component manufacturing, system integration, deployment, and crucial aftermarket services. Upstream activities begin with the procurement of essential raw materials, primarily specialized steel and aluminum alloys for the frame structures, and high-quality plastics for rollers and belts. Critical component suppliers, including manufacturers of motors, gearboxes, control panels (PLCs), and precision bearings, form the next layer. These suppliers must adhere to stringent industrial quality standards and often provide customized solutions regarding power ratings and protection classes (IP ratings) suitable for demanding industrial environments. The upstream efficiency, particularly the reliability and supply consistency of specialized drives and control electronics, directly impacts the final product cost and delivery schedule.

Midstream involves the core manufacturing and assembly processes undertaken by the conveyor system original equipment manufacturers (OEMs) and system integrators. OEMs focus on designing and fabricating the mechanical structures, while the system integrators specialize in configuring, programming, and installing the complex controls necessary to coordinate the pallet flow with broader WMS/WCS architectures. The distribution channel is bifurcated into direct sales for large, customized projects (common in automotive or large 3PL installations) and indirect channels utilizing regional distributors or value-added resellers (VARs) for smaller, standardized systems or regional market coverage. Direct channels allow for higher degrees of customization and service control, while indirect channels provide market penetration and localized support.

Downstream activities center on end-user implementation and post-sales support. This includes site preparation, complex installation and commissioning services, operator training, and ongoing maintenance contracts. Given the critical role conveyors play in continuous production environments, aftermarket services—including spare parts provisioning, scheduled preventative maintenance, and rapid response repairs—represent a significant, high-margin component of the overall value chain. The growing reliance on remote diagnostics and software updates, often provided by the OEM or integrator, further integrates the downstream service layer with technological capabilities, ensuring long-term system optimization and reliability. The successful player in this market manages to minimize coordination costs between the component suppliers and the final system commissioning phase while maximizing the long-term service relationship with the end-user.

Pallet Conveyor Market Potential Customers

Potential customers for pallet conveyor systems are defined by any industrial operation that requires the automated, high-volume movement and buffering of unit loads exceeding the capacity of standard package handling systems, fundamentally targeting entities focused on scale, efficiency, and continuous production flow. The primary end-users, encompassing large-scale distribution centers and manufacturing plants, rely on these systems as the backbone of their material flow strategy. Specifically, companies operating in the e-commerce sector are massive consumers, needing highly integrated systems to feed goods into automated storage, sortation, and palletizing operations required to manage increasing order complexity and volume. Their purchasing decisions are heavily influenced by system throughput, integration ease, and scalability to accommodate future growth projections.

The automotive industry represents another critical customer base, utilizing heavy-duty pallet conveyors to move components, engines, and completed sub-assemblies through production lines (e.g., body-in-white shops or engine assembly). For these customers, reliability, precision indexing, and synchronization with complex robotic workstations are paramount, necessitating specialized, often highly customized, conveyor designs such as slat conveyors or precise chain conveyors. Similarly, the food and beverage industry requires robust, hygienic conveyor systems, frequently demanding stainless steel construction and wash-down capabilities, particularly in primary and secondary packaging areas where goods are palletized before distribution.

Furthermore, Third-Party Logistics (3PL) providers constitute a rapidly growing customer segment. As 3PLs manage outsourced logistics for diverse clients, their demand is focused on highly flexible, modular, and easily reconfigurable systems that can handle a wide variety of pallet sizes and weights specific to different clients. These buyers prioritize systems with advanced WCS integration capabilities to optimize dynamic space allocation and cross-docking operations. Overall, the buying process is characterized by technical sophistication, extensive consultation, and a strong emphasis on long-term Total Cost of Ownership (TCO) rather than just initial purchase price, driving demand for high-quality, durable components with low maintenance requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dematic (KION Group), Schaefer Systems International (SSI SCHAEFER), Intelligrated (Honeywell), Daifuku Co., Ltd., Murata Machinery, Swisslog (KUKA), TGW Logistics Group, Hytrol Conveyor Company, Bosch Rexroth AG, Fives Group, Knapp AG, Kardex Group, BEUMER Group, System Plast (Regal Rexnord), Conveyor Systems Ltd (CSL), Interroll Group, Bastian Solutions, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pallet Conveyor Market Key Technology Landscape

The Pallet Conveyor Market's technology landscape is rapidly evolving, moving beyond simple mechanical transport towards sophisticated, data-driven material flow management, heavily reliant on integrated control systems and advanced drives. A defining trend is the shift from large, centralized drives to decentralized, low-voltage motor-driven roller (MDR) technology. MDR systems utilize 24V DC power, allowing for zone-specific control and zero-pressure accumulation capabilities. This technological evolution not only significantly reduces energy consumption compared to traditional AC motor systems but also enhances safety and simplifies maintenance by eliminating complex pneumatic or hydraulic infrastructure typically required for accumulation zones. Furthermore, the modular nature of MDR components allows for much greater flexibility in layout design and quicker adaptation to changing warehouse floor plans, addressing the demand for agility in modern logistics operations.

Control systems form the intellectual core of the modern pallet conveyor. The integration of high-speed programmable logic controllers (PLCs) and industrial networks (such as EtherCAT or PROFINET) enables precise synchronization between multiple conveyor segments, high-speed transfers, and seamless communication with overarching Warehouse Control Systems (WCS). Crucially, the deployment of Industrial Internet of Things (IIoT) sensors, which monitor operational parameters like bearing vibration, motor temperature, and current draw, is becoming standard. This sensor proliferation generates massive data sets, which are then analyzed at the edge or in the cloud using analytical software to provide condition monitoring, enabling highly accurate predictive maintenance schedules. This transition minimizes unexpected operational failures, maximizing system uptime, a critical metric in high-throughput environments like e-commerce distribution.

Another area of intense technological focus is the development of advanced material components and specialized handling accessories. Innovations in roller material and surface treatments are improving grip and reducing noise, while new designs for transfers, turntables, and shuttles are increasing the speed and stability with which pallets can be merged, diverted, or rotated. Furthermore, the integration of vision systems and sophisticated barcode/RFID readers directly onto the conveyor infrastructure ensures accurate tracking and verification of every pallet load in motion. This technological synergy, combining smart drives, advanced controls, and sensor integration, transforms the conveyor system from a passive transport mechanism into an active, intelligent part of the overall supply chain automation infrastructure, capable of autonomous flow adjustments.

Regional Highlights

- Asia Pacific (APAC): The APAC region is the fastest-growing market segment, primarily driven by massive infrastructure investments in China, India, and Japan, fueled by robust manufacturing expansion and the explosive growth of regional e-commerce powerhouses. The region's increasing urbanization and growing consumer class necessitate the rapid establishment of large, automated distribution centers, making it a critical consumer of pallet conveyance systems. Government initiatives promoting industrial automation (such as 'Made in China 2025') further accelerate the adoption of advanced material handling technologies, focusing heavily on high-capacity and durable systems for diverse industrial environments.

- North America: North America represents a mature yet dynamic market, characterized by continuous investment in modernization and technology upgrades, especially within the e-commerce fulfillment and 3PL sectors. The high cost of labor in the United States and Canada drives a strong demand for fully automated solutions, favoring high-throughput, integrated pallet conveyor systems capable of interfacing seamlessly with AS/RS and robotic palletizers. The focus here is on maximizing operational density and minimizing footprint, promoting the adoption of sophisticated transfer cars and high-speed sortation technologies for pallet loads.

- Europe: Europe exhibits stable growth, driven by stringent regulatory environments focusing on worker safety and energy efficiency. Key markets like Germany and the Netherlands are leaders in implementing Industry 4.0 principles, resulting in a high demand for energy-efficient motor-driven roller (MDR) systems and conveyor solutions integrated with advanced diagnostic and predictive maintenance software. The European market prioritizes modularity, long-term durability, and compliance with high safety standards, particularly in the automotive and food processing industries.

- Latin America (LATAM): The LATAM market is characterized by increasing adoption rates, moving from basic manual handling to semi-automated and automated systems, particularly in large economies like Brazil and Mexico. Investment is concentrated in sectors related to international trade, such as ports and regional distribution hubs. Market growth is stimulated by foreign direct investment in manufacturing and the development of local retail logistics networks, though often constrained by fluctuating economic conditions and a focus on cost-effective, durable machinery.

- Middle East and Africa (MEA): The MEA region, particularly the UAE and Saudi Arabia, is experiencing growth driven by ambitious national diversification plans focused on logistics, trade, and establishing smart cities. Significant investment in port automation and the establishment of large-scale, climate-controlled warehouses (especially for food security) fuels the demand for high-capacity, heavy-duty pallet conveyance infrastructure. The market requires systems capable of operating reliably in harsh climate conditions and integrating complex security features.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pallet Conveyor Market.- Dematic (KION Group)

- Schaefer Systems International (SSI SCHAEFER)

- Intelligrated (Honeywell)

- Daifuku Co., Ltd.

- Murata Machinery

- Swisslog (KUKA)

- TGW Logistics Group

- Hytrol Conveyor Company

- Bosch Rexroth AG

- Fives Group

- Knapp AG

- Kardex Group

- BEUMER Group

- System Plast (Regal Rexnord)

- Conveyor Systems Ltd (CSL)

- Interroll Group

- Bastian Solutions, Inc.

- Vanderlande Industries (Toyota Advanced Logistics)

- Logistex

- DMW&H

Frequently Asked Questions

Analyze common user questions about the Pallet Conveyor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between CDLR and MDR pallet conveyor systems?

Chain-Driven Live Roller (CDLR) systems are characterized by their robust construction, suitability for extremely heavy loads, and continuous operation using a single motor and chain drive. Motor-Driven Roller (MDR) systems use localized 24V DC motors within each roller zone, offering superior energy efficiency, zero-pressure accumulation, modularity, and enhanced safety due to lower voltage, making them ideal for flexible, high-density distribution centers where zone control is paramount.

How does the growth of e-commerce specifically impact the demand for pallet conveyors?

E-commerce growth necessitates massive expansion in distribution and fulfillment center capacity, driving demand for automated systems capable of handling high throughput of palletized inbound inventory and transporting outbound mixed unit loads to shipping areas. This increases the need for high-speed, integrated pallet movement systems, especially accumulation conveyors and specialized transfer equipment linking automated storage systems (AS/RS) with manual operations.

What role does Industry 4.0 play in the evolution of pallet conveyor technology?

Industry 4.0 principles drive the integration of smart sensors (IIoT) and advanced control systems into pallet conveyors, enabling real-time data collection on system health, performance, and material flow. This integration facilitates predictive maintenance, dynamic throughput optimization using machine learning, and seamless communication with enterprise resource planning (ERP) and warehouse management systems (WMS), transitioning conveyors into intelligent, connected assets.

What are the key factors determining the Total Cost of Ownership (TCO) for a pallet conveyor system?

The TCO includes the initial capital expenditure (equipment and installation), operational costs (energy consumption and labor), and maintenance expenses (spare parts and scheduled repairs). Systems with low maintenance requirements, high energy efficiency (like MDR), and integrated remote diagnostics generally offer the lowest long-term TCO, despite potentially higher initial investment compared to older, less sophisticated chain-driven models.

Which end-user segment is expected to show the highest growth rate for pallet conveyor adoption?

The E-commerce and Third-Party Logistics (3PL) sector is projected to exhibit the highest growth rate. This is due to the relentless demand for faster fulfillment cycles, the need to manage diverse client inventories, and the continuous scaling required to handle fluctuating global parcel volumes, compelling these organizations to prioritize investments in high-speed, flexible pallet handling automation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Pallet Conveyor Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Pallet Conveyor Market Size Report By Type (Drag Chain, Roller (driven or gravity), Plastic Type, Slat Type), By Application (Retail/Logistic, Industrial, Food, Beverage (separate from Food), Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Pallet Conveyor Market Statistics 2025 Analysis By Application (Retail/Logistic, Industrial, Food, Beverage (separate from Food)), By Type (Drag Chain, Roller (driven or gravity), Plastic Type, Slat Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Conveyor Sorting Systems Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Belt Conveyor Type, Roller Conveyor Type, Pallet Conveyor Type, Others), By Application (Airport, Logistics Sorting, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Pallet Conveyor Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Drag Chain, Roller, Plastic Type, Slat Type), By Application (Retail/Logistic, Industrial, Food & Beverage, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager