Particle Board Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434261 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Particle Board Market Size

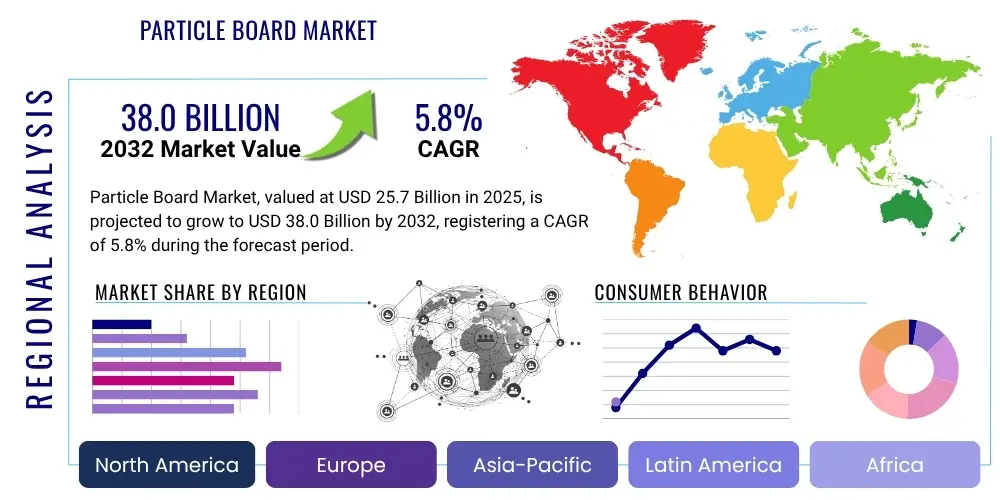

The Particle Board Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 27.5 Billion by the end of the forecast period in 2033.

Particle Board Market introduction

Particle board, also known as chipboard, is an engineered wood product manufactured from wood chips, sawmill shavings, or agricultural residues, pressed and extruded, and bound together by synthetic resin or other suitable binders under heat and pressure. This widely utilized material offers a cost-effective alternative to solid wood and plywood, making it indispensable across the construction and furniture industries. Its primary benefit lies in its efficient use of waste wood materials, contributing to resource optimization and sustainability efforts within the timber processing sector. The uniformity and dimensional stability of particle board, particularly when laminated or veneered, enhance its aesthetic and structural suitability for various interior applications.

Major applications of particle board include ready-to-assemble (RTA) furniture, kitchen cabinets, shelving, flooring substrates, and decorative paneling. The increasing global demand for affordable housing and modular furniture systems is a significant catalyst driving market expansion, especially in rapidly urbanizing regions. Furthermore, technological advancements in pressing techniques and adhesive chemistries have led to the development of enhanced moisture-resistant and fire-retardant particle board variants, broadening their scope of application beyond traditional interior spaces to include commercial settings requiring stricter safety and durability standards. The market continues to evolve with a focus on producing panels with lower formaldehyde emissions to meet stringent regulatory requirements across North America and Europe.

Key driving factors supporting the sustained growth of the particle board market include favorable governmental policies promoting sustainable construction practices, the inherent cost advantage of particle board over conventional lumber, and the rising consumer preference for customizable and modular home furnishings. The efficiency of production, coupled with the ability to utilize recycled and composite materials, positions particle board as a primary material in circular economy initiatives within the building materials sector. However, the market faces challenges related to fluctuations in raw material (wood chip) pricing and increasing competition from medium-density fiberboard (MDF) and oriented strand board (OSB) in certain structural applications, necessitating continuous innovation in product quality and manufacturing efficiency.

Particle Board Market Executive Summary

The Particle Board Market is characterized by robust business trends centered on sustainability, digitalization of manufacturing processes, and consolidation among major global players. The shift toward bio-based and low-emission formaldehyde binders, driven by stringent health regulations such as those imposed by the European Union and the U.S. EPA, is forcing manufacturers to invest heavily in R&D and process modernization. Furthermore, the integration of Industry 4.0 technologies, including automated quality control systems and predictive maintenance powered by sensors, is optimizing production yields and reducing waste, thereby improving overall operational profitability. Strategic alliances between particle board producers and major furniture retailers or construction companies are becoming more common, ensuring stable demand channels and mitigating supply chain volatility.

Regionally, the Asia Pacific (APAC) stands as the dominant market, driven primarily by the colossal residential construction activity and the rapid expansion of the organized furniture manufacturing sector in countries like China and India. The high population density and increasing disposable income in these economies fuel the demand for affordable, ready-to-use furniture, positioning particle board as the material of choice. Conversely, mature markets like North America and Europe focus on premium, specialty boards, emphasizing high aesthetic finishes, enhanced durability (moisture and fire resistance), and superior environmental certifications. Regulatory mandates concerning air quality and resource efficiency significantly shape regional investment strategies, compelling manufacturers in these regions to adopt closed-loop recycling systems and utilize non-wood cellulosic fibers.

Segmentation trends indicate that standard particle board remains the highest revenue-generating segment by type, predominantly due to its ubiquitous use in basic furniture and non-structural applications. However, specialized segments such as decorative particle board (laminated or veneered) are experiencing faster growth rates, reflecting consumer demand for aesthetically pleasing interior finishes without incurring the high cost of solid wood. In terms of application, the residential sector, particularly modular kitchen and wardrobe segments, continues to hold the largest market share. The adhesive segment is witnessing a transition away from traditional urea-formaldehyde (UF) resins towards melamine-urea-formaldehyde (MUF) and phenol-formaldehyde (PF) resins, and increasingly, toward innovative formaldehyde-free binders, reflecting the industry's commitment to healthier indoor environments and aligning with global market expectations for sustainable building materials.

AI Impact Analysis on Particle Board Market

Common user questions regarding AI's impact on the Particle Board Market center around optimizing raw material usage, enhancing quality consistency, and predicting supply chain disruptions. Users are keenly interested in how machine learning algorithms can analyze variations in wood chip characteristics (moisture content, size distribution) to adjust pressing parameters in real-time, thereby maximizing panel strength and minimizing defects. Concerns frequently raised include the initial investment cost for implementing AI systems and the need for specialized personnel to manage and interpret complex data generated from production lines. Expectations are high regarding AI's ability to significantly reduce energy consumption during the heat pressing stage and to streamline the complex logistics involved in sourcing raw wood residues from multiple suppliers, ensuring a continuous and cost-effective material flow necessary for high-volume production.

AI and machine learning applications are revolutionizing the traditional manufacturing landscape of particle board production, transitioning it toward a smart manufacturing environment. These technologies allow for predictive quality control, where algorithms monitor parameters such as temperature, pressure, and binder concentration during the forming and pressing stages. This continuous monitoring enables instantaneous adjustments, drastically reducing batch variability and lowering the rejection rate of panels that fail to meet strict density or strength specifications. Furthermore, AI-driven demand forecasting significantly improves inventory management, allowing manufacturers to optimize stock levels of finished goods and critical raw materials (adhesives and wood residues) based on real-time market signals and seasonal construction cycles.

The implementation of AI also extends to maintenance and energy efficiency. Predictive maintenance models analyze vibration, temperature, and current consumption data from crucial machinery (like refiners, blenders, and hot presses) to forecast potential equipment failures before they occur. This proactive approach minimizes costly unplanned downtime, which is particularly detrimental in continuous process industries like particle board manufacturing. Moreover, complex optimization algorithms are employed to manage the energy-intensive hot pressing cycle, identifying the most efficient combination of time and temperature based on the specific board thickness and raw material composition, leading to quantifiable savings in electricity and heat generation, thereby enhancing the environmental profile of the product.

- AI-powered predictive quality control ensuring real-time adjustment of pressing parameters.

- Optimization of raw material blend ratios based on sensor data analysis.

- Enhanced energy efficiency modeling for hot press operations to reduce consumption.

- Predictive maintenance schedules for continuous manufacturing machinery, minimizing downtime.

- Improved supply chain logistics and forecasting for wood chip sourcing and finished product distribution.

- Automated defect detection systems using computer vision and machine learning for surface inspection.

DRO & Impact Forces Of Particle Board Market

The Particle Board Market's trajectory is primarily driven by the ongoing global urbanization trend and the subsequent boom in residential construction and infrastructure development, particularly across emerging economies in APAC and MEA. The intrinsic affordability and versatility of particle board make it a preferred material for budget-conscious construction projects and the mass production of modular furniture, acting as a crucial driver. However, the market faces significant restraints, chiefly stemming from regulatory pressures concerning formaldehyde emissions, which necessitate costly transitions to less harmful binding agents. Furthermore, the perception of particle board as less durable or aesthetically inferior compared to solid wood or high-density alternatives sometimes limits its adoption in high-end projects, although surface lamination technologies are mitigating this concern. Opportunities abound in developing specialty particle boards, such as lightweight, acoustically insulating, or water-resistant variants, and exploring innovative raw material sources like recycled wood, bamboo, or agri-fibers to ensure supply chain resilience and meet circular economy objectives.

The impact forces influencing the market are multifaceted, encompassing technological advancements in adhesive chemistry, evolving consumer preferences for sustainable products, and the volatility of global commodity prices, specifically for wood fiber and petrochemical-derived binders. The shift toward sustainable building certifications (e.g., LEED, BREEAM) acts as a powerful external force compelling manufacturers to adopt environmentally friendly production practices and certify their low-emission products, thereby segmenting the market between standard and eco-friendly offerings. The cyclical nature of the construction industry remains a primary macroeconomic force, dictating short-term demand fluctuations, while competitive pressure from substituting products like OSB and MDF forces continuous cost reduction and product innovation within the particle board sector. Regulatory forces are arguably the most transformative, shaping operational costs and product formulations globally.

Technological impact forces are currently focused on reducing the carbon footprint of production. Innovations in continuous pressing technology (ContiRoll processes) improve efficiency and homogeneity, enabling faster production cycles and better energy utilization. The drive for formaldehyde-free products is accelerating the adoption of alternative binders such as isocyanate (MDI) and soy-based adhesives, which, while sometimes more expensive, offer superior performance in moisture resistance and meet the most stringent indoor air quality standards. The ability of key market players to successfully navigate these technological and regulatory constraints by offering a diverse portfolio of environmentally compliant and cost-effective products will determine future market leadership and sustained growth in highly competitive construction material landscapes worldwide, requiring significant capital expenditure on modern manufacturing facilities.

Segmentation Analysis

The Particle Board Market is systematically segmented based on Type, Application, and Binder. This detailed breakdown provides critical insights into consumption patterns and product specialization across different end-use industries. By Type, the market is primarily divided into Standard Particle Board, Moisture Resistant Particle Board (MR), and Fire Retardant Particle Board, reflecting varying functional requirements dictated by installation environment and regulatory mandates. Standard particle board dominates volume due to its lower cost and extensive use in interior non-structural elements like cabinets and tables. However, MR particle board is growing rapidly, driven by its adoption in kitchen, bathroom, and semi-exposed applications where high humidity levels are common.

The Application segmentation distinguishes between Residential, Commercial, and Industrial uses, with the residential sector holding the largest share owing to mass-market furniture manufacturing and home renovation activities. The commercial sector, encompassing offices, hotels, and retail spaces, provides consistent demand for decorative laminated particle boards used in paneling and custom fixture construction. The binder type classification is crucial due to increasing health and environmental scrutiny. Traditional Urea-Formaldehyde (UF) resins are still prevalent due to their low cost and excellent bonding strength, but the rapid transition toward Melamine-Urea-Formaldehyde (MUF), Phenol-Formaldehyde (PF), and, most notably, Formaldehyde-Free Binders (FFB) is transforming the competitive landscape, aligning manufacturers with stricter international health and safety standards and providing better performance characteristics.

Analyzing these segments reveals important trends: the demand for higher-performance particle boards (MR and Fire Retardant) is increasing faster than the standard variant, reflecting a market maturation where quality and safety features are prioritized, especially in developed economies. Geographically, APAC is the primary consumption hub for standard particle board used in mass-produced furniture, while North America and Europe show a higher proportional demand for FFB and specialized MR variants. Strategic positioning within the FFB segment offers manufacturers a significant competitive edge in markets governed by rigorous indoor air quality standards, driving innovation in sustainable adhesive technology and securing premium pricing for advanced products.

- Type:

- Standard Particle Board

- Moisture Resistant Particle Board (MR)

- Fire Retardant Particle Board

- Application:

- Residential (Furniture, Flooring Substrates, Shelving)

- Commercial (Office Furniture, Hospitality Fixtures, Retail Displays)

- Industrial (Packaging, Pallets, Non-structural Elements)

- Binder Type:

- Urea-Formaldehyde (UF)

- Melamine-Urea-Formaldehyde (MUF)

- Phenol-Formaldehyde (PF)

- Formaldehyde-Free Binders (FFB)

Value Chain Analysis For Particle Board Market

The value chain for the particle board market initiates with upstream activities focused on raw material sourcing, predominantly consisting of wood residuals (sawmill waste, recycled wood) and, increasingly, agricultural residues. Raw material procurement is highly geographically dependent, requiring efficient logistics to minimize transportation costs, which can constitute a substantial portion of the overall production expense. Following sourcing, the midstream phase involves manufacturing—chipping, drying, blending with adhesives, mat forming, and hot pressing. This stage is capital-intensive and requires high energy input, making process efficiency (e.g., continuous pressing lines) a critical competitive differentiator. Quality control at this stage, particularly ensuring appropriate moisture content and density uniformity, is vital for final product performance.

The downstream segment focuses on distribution and final application. Products are typically distributed through direct channels to large furniture manufacturers and construction companies, or through indirect channels involving wholesalers, dealers, and retail outlets catering to smaller builders and DIY consumers. The effectiveness of the distribution network, especially the ability to manage large panel sizes and prevent damage during transit, directly impacts profitability and market reach. Direct sales often allow for customized orders and long-term contracts, providing stable revenue streams, whereas indirect sales widen the market penetration into diverse regional geographies and smaller project needs, requiring strong partnership management.

The trend towards value-added services in the downstream segment is notable. Many manufacturers now offer cutting-to-size, edge banding, and decorative lamination services, effectively integrating further processing steps into their primary offering. This integration not only captures higher margins but also simplifies the supply chain for end-users, such as RTA furniture producers. The success of the particle board value chain relies heavily on optimizing raw material costs (upstream) and maintaining robust relationships with large, organized furniture and construction firms (downstream), while continually investing in cleaner, more efficient adhesive and pressing technologies (midstream) to ensure compliance and product quality in a demanding global market.

Particle Board Market Potential Customers

Potential customers for the particle board market are primarily segmented into the furniture industry, the construction sector, and specialized industrial users. The furniture manufacturing industry, including both large-scale RTA (Ready-to-Assemble) manufacturers and bespoke cabinet makers, constitutes the largest buying segment. These buyers prioritize cost-effectiveness, dimensional stability, and the surface finish quality of laminated boards, which are essential for producing items like kitchen cabinets, office desks, bookshelves, and bedroom sets. The preference here is increasingly shifting toward certified low-formaldehyde emission boards to meet health standards imposed by global retailers and consumer protection agencies, influencing purchasing specifications significantly.

The construction and interior design sector forms the second major customer base, utilizing particle board for non-structural applications such as underlayment for flooring, wall partitioning, subflooring, and ceiling elements. Developers and contractors look for fire-retardant and moisture-resistant variants to comply with local building codes, especially in commercial and public infrastructure projects. The need for quick installation and the material’s ease of handling on-site make it a preferred material for time-sensitive projects, while its relative lightness compared to plywood is a logistical advantage. Growth in this segment is strongly tied to economic cycles and governmental spending on residential and commercial building permits.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 27.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kronospan, Egger Group, Arauco, Laminex Group (Borg Manufacturing), Kastamonu Entegre, DareGlobal Wood Co. Ltd., Green River Particleboard, TATA Panel Products, Weyerhaeuser Company (Norbord), Georgia-Pacific LLC, Boise Cascade Company, Sonae Arauco, Century Plyboards (India) Ltd., Swiss Krono Group, Unilin, Purbanchal Laminates, Fantoni Group, Roseburg Forest Products, Masisa, D&N Particleboard. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Particle Board Market Key Technology Landscape

The technology landscape in the particle board market is continuously evolving, primarily driven by the need for increased production efficiency, enhanced product performance, and stringent environmental compliance. Key technological advancements center around continuous pressing systems, such as the Siempelkamp ContiRoll or Dieffenbacher CPS, which offer superior panel homogeneity, density profiles, and faster throughput compared to traditional multi-opening presses. These continuous presses facilitate the manufacture of extra-long or wide panels with precise dimensional tolerances, crucial for modern, highly automated furniture production lines. Furthermore, sophisticated blending and dosing systems utilize gravimetric feeders and automated sensors to ensure precise application and distribution of the binder and wood particles, directly impacting the final board quality and minimizing expensive adhesive wastage.

Material science and chemical technology form another core pillar of innovation, particularly concerning adhesive formulation. The industry is rapidly migrating toward advanced binding agents to meet mandated low- or zero-formaldehyde emission standards. This includes the increased adoption of MDI (Methylene diphenyl diisocyanate) binders, known for providing exceptional moisture resistance and bonding strength, making them suitable for high-humidity applications. Additionally, research into natural or bio-based adhesives, such as lignin-based or soy-protein-based resins, represents a long-term technological opportunity aimed at creating truly sustainable and non-toxic panel products. These binder innovations are fundamentally altering the cost structure and environmental marketing narrative of particle board manufacturers, requiring significant collaboration with chemical suppliers.

Beyond core manufacturing, digitalization and automation technologies are reshaping plant operations. Modern particle board facilities integrate advanced process control systems (PCS) and SCADA architecture to monitor and control every phase of production, from wood preparation to stacking. Non-contact measurement systems, including X-ray and gamma-ray density analyzers, ensure optimal density distribution across the panel thickness, which is critical for structural integrity and screw holding capability. Technologies supporting efficient wood waste handling and recycling, coupled with advanced thermal oil heating systems for the presses, further define the competitive technology landscape, emphasizing reduced operational costs and improved resource circularity within the highly competitive engineered wood sector.

Regional Highlights

The Particle Board Market exhibits significant regional disparities in terms of production capacity, consumption volume, and regulatory environments. Asia Pacific (APAC) dominates the global market, accounting for the largest share in both production and consumption. This dominance is attributed to massive infrastructure spending, robust growth in the organized furniture sector, particularly in countries like China, India, and Southeast Asia, and the availability of cost-effective raw materials. The region's expanding middle class and high rate of urbanization necessitate rapid, affordable interior solutions, cementing particle board's role as a staple material. Future growth in APAC will be further catalyzed by local manufacturers scaling up production capabilities and investing in technologies to meet rising regional quality expectations.

Europe represents a mature yet highly quality-focused market. Demand is steady, driven by strict environmental regulations and high consumer expectations for premium interior finishes and sustainable products. European manufacturers are leaders in developing specialty particle boards, including those with superior fire resistance, low-formaldehyde emissions (E0 or F**** standards), and aesthetically enhanced decorative laminates. The regulatory push towards closed-loop recycling and the utilization of urban wood waste also distinguishes the European market, fostering innovation in materials sourcing and processing efficiency. Germany, Poland, and Turkey are key production hubs, leveraging advanced automation and proximity to established furniture manufacturing clusters to maintain market competitiveness.

North America is characterized by high consumption of specialized, high-performance particle boards, largely influenced by stringent indoor air quality standards (e.g., CARB and TSCA Title VI). The market here prioritizes formaldehyde-free and moisture-resistant boards used extensively in high-end cabinetry, residential remodeling, and commercial applications. While production capacity growth is moderate compared to APAC, the emphasis remains on technological differentiation and product safety. Latin America and the Middle East & Africa (MEA) are emerging markets showing accelerating growth. MEA benefits from growing residential construction fueled by oil revenues and population growth, increasing the need for imported and domestically produced cost-effective panel products, while Latin America leverages abundant forestry resources to supply both domestic and export markets, with Brazil and Chile being notable production centers.

- Asia Pacific (APAC): Market leader driven by rapid urbanization, massive furniture production, and large-scale residential construction in China, India, and Vietnam.

- Europe: High demand for sustainable, specialty (low-emission, fire-retardant) boards; stringent regulatory environment; major production centers in Germany and Eastern Europe.

- North America: Focus on high-performance particle board (FFB, MR); strict air quality regulations (TSCA Title VI); steady demand from remodeling and high-end cabinetry.

- Latin America: Growing domestic consumption linked to affordable housing initiatives; strong regional forestry resources support production in Brazil and Chile.

- Middle East & Africa (MEA): Emerging construction markets, particularly in the GCC states and North Africa, increasing reliance on panel products for new developments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Particle Board Market.- Kronospan

- Egger Group

- Arauco

- Laminex Group (Borg Manufacturing)

- Kastamonu Entegre

- DareGlobal Wood Co. Ltd.

- Green River Particleboard

- TATA Panel Products

- Weyerhaeuser Company (Norbord)

- Georgia-Pacific LLC

- Boise Cascade Company

- Sonae Arauco

- Century Plyboards (India) Ltd.

- Swiss Krono Group

- Unilin

- Purbanchal Laminates

- Fantoni Group

- Roseburg Forest Products

- Masisa

- D&N Particleboard

Frequently Asked Questions

Analyze common user questions about the Particle Board market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between particle board and MDF?

Particle board utilizes coarser wood particles, resulting in a less dense and generally lower-cost product, making it ideal for standard furniture and shelving. Medium-Density Fiberboard (MDF) is made from finely defibrated wood fibers, resulting in a denser, smoother surface suitable for detailed machining, routing, and high-quality paint finishes, often at a higher price point.

Which binder technology is driving market innovation in particle board production?

The transition toward formaldehyde-free binders (FFB), particularly Methylene diphenyl diisocyanate (MDI) and bio-based adhesives such as soy-protein resins, is driving innovation. This shift is essential for compliance with stringent global air quality standards like TSCA Title VI and for meeting growing consumer demand for healthier, low-emission indoor materials.

How do global sustainability initiatives impact particle board manufacturers?

Sustainability mandates require manufacturers to focus on resource efficiency by maximizing the use of wood waste and recycled content. Furthermore, they must ensure responsible forestry sourcing (FSC or PEFC certification) and reduce Volatile Organic Compound (VOC) emissions, leading to investments in cleaner production technologies and eco-friendly product lines to maintain market access.

What are the key application areas exhibiting the fastest growth in the market?

The fastest growth is observed in the residential sector, specifically within the Ready-to-Assemble (RTA) furniture market and modular kitchen manufacturing, driven by rapid urbanization and the necessity for cost-effective, factory-produced housing interiors, particularly across the Asia Pacific region.

What is the expected CAGR for the Particle Board Market from 2026 to 2033?

The Particle Board Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period spanning 2026 through 2033, supported by global construction activities and continuous technological improvements in moisture resistance and emission control.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Particle Board Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Slack Wax Market Size Report By Type (Slack Wax LMO, Slack Wax MMO, Slack Wax SPO), By Application (Candle, Particle Board & MDF, Polishing, Sealing), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Particle Board in Furniture Market Statistics 2025 Analysis By Application (Home Furniture, Commercial Furniture), By Type (Fire-rated, Moisture-resistant, Standard), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Slack Wax Market Statistics 2025 Analysis By Application (Candle, Particle Board & MDF, Polishing, Sealing), By Type (Slack Wax LMO, Slack Wax MMO, Slack Wax SPO), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Cement Bonded Particle Board Market Statistics 2025 Analysis By Application (Furniture, Ceiling, Siding, Packages), By Type (Below 6 mm, 8-18mm, 20-30mm, Above 30 mm), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager