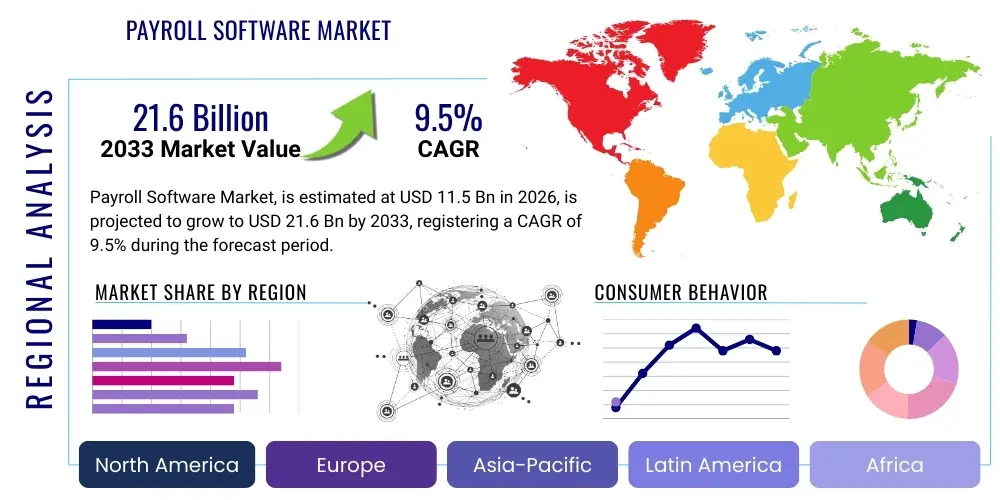

Payroll Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436371 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Payroll Software Market Size

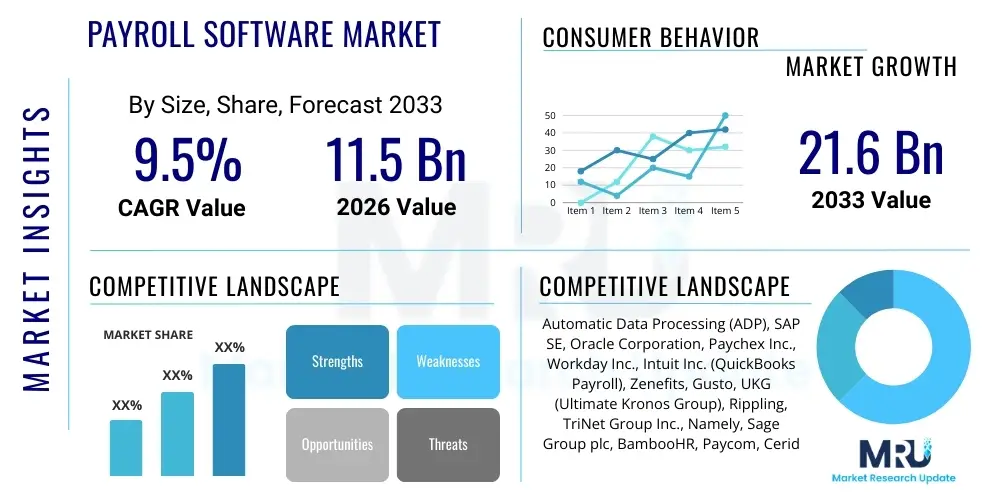

The Payroll Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 11.5 billion in 2026 and is projected to reach USD 21.6 billion by the end of the forecast period in 2033.

Payroll Software Market introduction

The Payroll Software Market encompasses a wide array of specialized digital solutions designed to automate and streamline the process of calculating employee wages, deducting taxes, managing benefits, and ensuring regulatory compliance. These sophisticated platforms move beyond basic arithmetic to handle complex variables such as overtime calculations, shift differentials, global payroll harmonization, and timely tax filings with governmental agencies. The evolution of this market is closely tied to advancements in cloud computing and the increasing need for real-time data accessibility, transforming payroll from a backend administrative task into a strategic component of human capital management (HCM). These systems are crucial for minimizing errors, reducing administrative burdens, and providing employees with accurate and timely compensation information, which directly impacts workforce morale and operational efficiency across all organizational sizes.

Major applications of payroll software span across various industries, including banking, healthcare, manufacturing, retail, and professional services, with a particularly high adoption rate among Small and Medium-sized Businesses (SMBs) seeking cost-effective compliance solutions. The core benefits derived from implementing dedicated payroll software include enhanced data security, guaranteed adherence to continually changing local and international labor laws, and deep integration capabilities with other financial and HR modules, such as time and attendance tracking and enterprise resource planning (ERP) systems. By centralizing payroll operations, organizations achieve greater transparency and audit readiness, which is increasingly important in the current stringent regulatory environment. Furthermore, modern payroll solutions often provide self-service portals, allowing employees to manage personal information, access pay stubs, and view benefit deductions, thereby significantly reducing inquiries directed toward HR staff.

Driving factors for the sustained growth of the Payroll Software Market include the global shift towards remote and hybrid work models, necessitating centralized and accessible cloud-based systems, and the relentless increase in regulatory complexity, especially concerning international employment and data privacy laws like GDPR and CCPA. The pervasive trend of digital transformation across enterprises is compelling companies to replace legacy on-premise systems with advanced Software-as-a-Service (SaaS) offerings that offer scalability and minimal maintenance requirements. Moreover, the demand for embedded analytics and reporting functionalities within payroll platforms is accelerating, as organizations increasingly leverage compensation data to inform strategic financial planning, budget forecasting, and employee retention strategies, cementing payroll software's role as an indispensable business tool.

Payroll Software Market Executive Summary

The global Payroll Software Market is characterized by robust growth, primarily propelled by the widespread acceptance of cloud-based deployment models and the continuous need for multinational enterprises to harmonize disparate regional payroll processes. Key business trends indicate a strong move away from traditional in-house managed systems toward integrated Human Capital Management (HCM) suites that incorporate payroll functionalities alongside core HR, talent management, and benefits administration. This integration is driving consolidation in the vendor landscape, where leading providers are expanding their capabilities through strategic acquisitions focused on specialized compliance features or advanced technological integrations, particularly in areas concerning predictive analytics and artificial intelligence. Security and compliance remain paramount concerns, shaping product development towards solutions offering advanced encryption and robust, multi-layered access controls tailored for sensitive financial and personal data.

Regionally, North America maintains its dominance due to early adoption, the presence of major industry players, and a highly complex federal and state tax structure necessitating sophisticated software solutions. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period, driven by rapid industrialization, increasing foreign direct investment, and the subsequent establishment of formal employment structures demanding standardized payroll mechanisms. European markets are heavily influenced by the General Data Protection Regulation (GDPR) and stringent labor laws, leading to strong demand for highly localized and compliant software solutions that can efficiently manage collective bargaining agreements and specific national benefit schemes. Emerging markets in Latin America and the Middle East and Africa (MEA) are also showing promising growth as local businesses transition from manual spreadsheets to automated, scalable payroll platforms to support their expansion.

Segment trends underscore the rising dominance of the SaaS model within deployment types, favored for its flexibility, lower upfront costs, and automatic updates essential for regulatory changes. Furthermore, the large enterprise segment, while mature, is increasingly demanding global payroll solutions that offer unified dashboards and standardized reporting across diverse international locations. Conversely, the SMB segment is driving innovation in user experience, prioritizing intuitive, easy-to-use interfaces and bundled HR offerings, such as those provided by payroll specialists that cater specifically to small business compliance complexities. The strategic importance of payroll data integration for financial planning and accurate workforce cost accounting is pushing the application segment toward greater fusion with financial accounting software (ERP) platforms.

AI Impact Analysis on Payroll Software Market

Common user questions regarding AI's impact on the Payroll Software Market frequently revolve around the security implications of AI-driven data processing, the potential for job displacement among payroll administrators, and the actual return on investment (ROI) derived from implementing advanced predictive analytics. Users express concerns about the accuracy and bias inherent in machine learning models applied to wage calculations and forecasting, alongside the challenge of maintaining regulatory transparency when complex AI algorithms determine payment outcomes. Conversely, there is significant anticipation regarding AI's capability to drastically reduce manual processing errors, automate exception handling, and provide deeper insights into workforce costs and compliance vulnerabilities. These inquiries summarize a key market tension: the balance between leveraging AI for efficiency and scalability while maintaining necessary human oversight, auditability, and absolute compliance with ever-changing labor legislation.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the operational capabilities of modern payroll software, shifting its utility from purely transactional to highly strategic. AI algorithms are now deployed to perform automated anomaly detection, scrutinizing vast datasets of time, attendance, and expense reports to identify fraudulent activities, input errors, or unusual deviations that could lead to non-compliance or incorrect payments. This capability significantly enhances the accuracy and integrity of the payroll process, reducing the frequency of costly retrospective adjustments. Moreover, AI is crucial in processing unstructured data inputs, such as handwritten expense claims or complex contractual clauses, translating them into structured, actionable payroll data, thereby accelerating the data entry phase and improving overall efficiency.

Beyond error reduction and data parsing, predictive analytics powered by AI is enabling payroll systems to model future workforce compensation expenses based on forecasted hiring, attrition rates, benefit enrollment changes, and anticipated regulatory modifications. This provides finance departments with unprecedented visibility and control over labor budgets, transforming payroll management into a proactive strategic function rather than a reactive administrative task. Furthermore, sophisticated AI-driven chatbots and natural language processing (NLP) capabilities are being embedded into employee self-service portals, automating responses to common employee inquiries about pay stubs, tax documentation, and vacation balances, leading to improved employee experience and significant reductions in HR support load. This integration signifies a major leap in automation, ensuring compliance remains continuous and adaptive, rather than static.

- Automated Anomaly Detection: AI identifies payroll discrepancies, potential fraud, and input errors in real-time, drastically reducing error rates.

- Predictive Cost Modeling: ML algorithms forecast future labor costs based on operational plans and regulatory changes, aiding strategic budgeting.

- Regulatory Compliance Monitoring: AI continuously scans global and local regulatory updates, automatically flagging necessary system adjustments to maintain compliance.

- Enhanced Employee Self-Service: NLP-driven chatbots provide instant, accurate answers to complex payroll inquiries, improving HR efficiency.

- Intelligent Data Extraction: AI converts unstructured data (e.g., expense receipts, complex employment agreements) into structured payroll inputs, streamlining data entry.

- Optimized Tax Calculation: Machine learning models improve the accuracy of complex, localized tax withholdings across diverse international jurisdictions.

DRO & Impact Forces Of Payroll Software Market

The trajectory of the Payroll Software Market is strongly influenced by a confluence of accelerating drivers, persistent restraints, and significant long-term opportunities, all shaped by the overall impact forces of digital transformation and globalization. Primary drivers include the increasingly complicated global regulatory environment, which mandates specialized, up-to-date software to manage compliance risks, coupled with the organizational pressure to reduce operational expenditure through automation. However, growth is tempered by critical restraints, namely persistent concerns over data security and the integration complexities associated with linking legacy HR systems with modern cloud-based payroll platforms. The major opportunities lie in leveraging emerging technologies like Artificial Intelligence and blockchain for enhanced security and predictive capabilities, particularly within specialized vertical markets that demand highly tailored compensation structures, ensuring sustained market evolution and expansion.

Key drivers include the shift towards centralized Global Payroll Management systems, necessitated by the expansion of multinational corporations that require unified oversight and reporting across diverse international workforces, each subject to distinct local labor laws. The imperative for timely and accurate compliance, especially in high-growth regions like APAC and Latin America, mandates the adoption of commercial software over internal, manually maintained systems. Furthermore, the pervasive adoption of the remote and hybrid work model across all major economies emphasizes the need for cloud-accessible, mobile-optimized payroll solutions that can manage varied time zones, multi-state or multi-country tax liabilities, and ensure equitable compensation regardless of the employee's physical location. This operational necessity provides significant momentum for SaaS providers specializing in flexible workforce management.

Conversely, significant restraints challenge market expansion, primarily focused on the high initial implementation costs and the recurring subscription fees associated with enterprise-grade payroll solutions, which can be prohibitive for smaller businesses. Data security and privacy remain a major bottleneck; the highly sensitive nature of financial and personal employee data makes payroll systems a prime target for cyberattacks, requiring vendors to continuously invest heavily in robust encryption and compliance with frameworks like ISO 27001. Integration challenges further restrain adoption, particularly when enterprises attempt to connect new, sophisticated payroll software with older, proprietary Enterprise Resource Planning (ERP) or Human Resource Information Systems (HRIS) that lack modern API capabilities, leading to costly and protracted integration cycles and potential data synchronization issues.

The principal opportunities fueling future market growth involve the adoption of specialized vertical payroll solutions, targeting sectors like construction, healthcare, or maritime industries, where unique payment schedules, collective bargaining agreements, or variable compensation models are common. Secondly, the increasing deployment of blockchain technology offers immense potential to revolutionize data integrity and security, providing immutable audit trails for sensitive compensation records and tax filings, significantly reducing fraud potential. Finally, the move towards real-time payroll, driven by fintech advancements and the demand for instant payment solutions, presents a compelling opportunity for vendors to differentiate their offerings by providing on-demand wage access capabilities, enhancing employee financial wellness and organizational competitiveness.

Segmentation Analysis

The Payroll Software Market is comprehensively segmented based on several key operational and functional parameters, primarily categorized by deployment type, enterprise size, and application focus. Deployment segmentation highlights the critical industry transition from legacy On-Premise installations to the more flexible, scalable, and cost-efficient Cloud-Based (SaaS) models, which currently command the majority market share. The segmentation by enterprise size demonstrates tailored product development, addressing the distinct needs of Small and Medium Enterprises (SMEs) which prioritize ease of use and affordability, versus Large Enterprises, which demand robust global compliance, deep system integration, and advanced security features. Application analysis further clarifies market needs, identifying core areas such as payroll management, tax and compliance, and benefits administration, all driving demand for specialized module integration.

- By Deployment Type:

- Cloud-Based/SaaS

- On-Premise

- By Enterprise Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Application:

- Payroll and Compensation Management

- Tax and Compliance Management

- Benefits Administration

- Reporting and Analytics

- Time and Attendance Integration

- By End-User Industry:

- IT and Telecom

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare

- Manufacturing

- Retail and Consumer Goods

- Government and Public Sector

Value Chain Analysis For Payroll Software Market

The value chain for the Payroll Software Market is complex, beginning with upstream technology providers who supply the foundational components, extending through solution developers and integrators, and culminating at the end-users and distribution channels. The upstream segment involves critical suppliers of cloud infrastructure services (AWS, Azure, Google Cloud), database management systems, and specialized compliance research firms that furnish regulatory knowledge essential for system accuracy. These technology partners ensure the underlying platform is scalable, secure, and technologically current, enabling core vendors to focus on application layer development and user interface design. Successful operation in this segment hinges on maintaining strategic alliances with top-tier infrastructure providers to guarantee high availability and geographical reach, particularly for global payroll solutions.

The mid-stream segment is dominated by core payroll software developers and system integrators. Developers are responsible for creating highly accurate computational engines, designing intuitive user interfaces, and ensuring continuous compliance updates across multiple jurisdictions. System integrators play a crucial role in customizing and deploying these solutions, especially for large enterprises with complex organizational structures and deep integration needs with existing ERP or HRIS platforms. The downstream segment focuses heavily on distribution and delivery. Distribution channels are typically bifurcated into direct sales models, where large vendors market directly to large enterprises often requiring customized contracts and dedicated support, and indirect channels, utilizing channel partners, certified public accountants (CPAs), and professional employer organizations (PEOs) who bundle the software with their service offerings, particularly targeting the SME market.

The efficiency of the entire value chain is dictated by the seamless flow of regulatory information and the speed of software updates. Direct distribution offers vendors greater control over customer relationships and service quality, which is critical given the sensitive nature of payroll. Indirect distribution leverages the extensive reach and expertise of channel partners, allowing vendors to quickly penetrate local markets where specific regulatory knowledge is essential. For global solutions, a hybrid distribution model is standard, balancing direct enterprise sales with localized partner networks to manage disparate tax and compliance requirements. Ultimately, successful value creation is achieved by providing accurate, secure, and compliant solutions that minimize implementation friction and maximize long-term customer retention through continuous regulatory maintenance and high-quality support services.

Payroll Software Market Potential Customers

The potential customers for the Payroll Software Market are broadly categorized by their employment complexity and size, encompassing virtually every entity that employs personnel, ranging from micro-businesses to multinational conglomerates and government agencies. Small and Medium-sized Enterprises (SMEs) represent a critical and highly addressable segment, primarily seeking cost-effective, out-of-the-box SaaS solutions that offer straightforward compliance management without requiring dedicated IT staff. These customers value simplicity, bundled services (like basic HR features), and subscription models that align with their operational budgets. Their buying decisions are heavily influenced by ease of integration with accounting software and the level of support provided to navigate initial setup and ongoing tax filing obligations, often preferring providers that simplify the entire HR and payroll stack.

Large Enterprises constitute the second major customer segment, characterized by complex global operations, high employee volumes, and the need for sophisticated, highly configurable systems capable of managing thousands of localized payment variables, collective agreements, and international benefit schemes. These customers typically require unified global platforms that can integrate deeply with advanced ERP systems (such as SAP or Oracle), demand high levels of data security assurance, and rely on vendors who provide dedicated implementation consulting and ongoing compliance monitoring across numerous jurisdictions. The demand from large enterprises focuses on centralized reporting, advanced workforce analytics, and robust APIs for connecting to proprietary or specialized in-house systems, valuing customization and deep functional capabilities over minimal cost.

Furthermore, specialized vertical sectors form a growing segment of potential customers, including construction, healthcare, retail, and manufacturing. These industries often have unique payroll requirements such as highly variable shift work, complex commission structures, union dues, job costing integration, or regulatory obligations (e.g., patient-to-staff ratios in healthcare impacting wages). These customers actively seek industry-specific modules or fully tailored solutions that address their distinctive operational challenges, such as integrating time clocks on manufacturing floors or managing tips and fluctuating schedules in the retail and hospitality sectors. The public sector, including local and federal government agencies, also represents a consistent customer base, prioritizing security, rigorous auditing capabilities, and strict adherence to governmental financial reporting standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 21.6 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Automatic Data Processing (ADP), SAP SE, Oracle Corporation, Paychex Inc., Workday Inc., Intuit Inc. (QuickBooks Payroll), Zenefits, Gusto, UKG (Ultimate Kronos Group), Rippling, TriNet Group Inc., Namely, Sage Group plc, BambooHR, Paycom, Ceridian HCM Holding Inc., Microsoft Dynamics, Wave Financial, Dayforce (Ceridian). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Payroll Software Market Key Technology Landscape

The technological evolution of the Payroll Software Market is fundamentally driven by the proliferation of cloud computing and the imperative for real-time data processing and security. Cloud-native architectures, typically utilizing microservices, now dominate the landscape, offering unparalleled scalability, elasticity, and continuous delivery of regulatory updates without requiring manual intervention from the end-user. This deployment model is critical for supporting distributed global workforces and ensuring that systems are instantly compliant with rapidly evolving tax laws across multiple geographical regions. Furthermore, the reliance on robust Application Programming Interfaces (APIs) is paramount, enabling seamless, secure, and bidirectional integration between payroll engines and external systems such as time tracking devices, benefits providers, accounting software (ERP), and dedicated HR management platforms, minimizing data silos and manual reconciliation efforts.

Security technologies are undergoing rapid enhancements, moving beyond standard encryption methods to incorporate advanced features like zero-trust architecture and multi-factor authentication (MFA) to protect highly sensitive employee financial data. Emerging technologies such as blockchain are beginning to gain traction, offering potential applications for creating immutable, distributed ledgers for storing sensitive wage and tax records. This approach not only enhances auditability and transparency but also offers a robust mechanism against data tampering and fraud, which is particularly appealing to large financial and governmental organizations. The shift towards mobile-first design is also key, with software providers optimizing user interfaces and core functionalities for mobile access, allowing employees to access pay stubs, update personal information, and request time off directly from their smart devices, thereby boosting engagement and self-service utilization.

The integration of advanced analytics and intelligent automation (IA) forms another critical component of the modern technology landscape. Machine Learning (ML) models are increasingly employed for predictive scheduling, automated compliance checks, and forecasting future labor costs based on complex organizational variables. Furthermore, the adoption of robotic process automation (RPA) tools automates repetitive, high-volume tasks such as data validation, report generation, and the reconciliation of payroll data across various financial books. This focus on IA significantly reduces the incidence of human error, speeds up the payroll cycle closure process, and allows payroll professionals to concentrate on strategic tasks and exception handling, ultimately driving greater operational efficiency and enhancing the strategic value of the payroll department within the organization.

Regional Highlights

The Payroll Software Market exhibits distinct regional dynamics driven by varying levels of technological maturity, regulatory environments, and economic development. North America, encompassing the United States and Canada, represents the most mature market, characterized by high adoption rates of advanced cloud-based HCM suites and a vendor landscape dominated by global market leaders. The complex federal, state, and provincial tax structures in this region necessitate sophisticated, specialized software, driving continuous investment in compliance features and integrated tax filing services. High disposable income and technological readiness ensure that North American enterprises are early adopters of innovative technologies like AI-driven analytics and real-time payroll processing, maintaining the region's leading position in terms of market value and software spend per employee.

Europe stands as the second largest market, defined by strict data protection laws, notably GDPR, and highly diverse labor legislation influenced by strong collective bargaining agreements and specific national benefit schemes. The demand in Europe is highly focused on localized software solutions that offer multi-language support and guaranteed adherence to country-specific regulations, often requiring partnerships with local compliance experts. Western European nations, such as the UK, Germany, and France, exhibit high adoption rates of specialized solutions tailored to their stringent employee protection and reporting standards. Central and Eastern Europe are experiencing accelerated growth as businesses digitalize and seek efficient means to manage cross-border employment within the European Union.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, propelled by rapid economic expansion, increasing formalization of employment, and substantial foreign investment flowing into countries like China, India, and Southeast Asian nations. While regulatory complexity is high due to the sheer number of distinct legal systems, the market is characterized by a significant transition from manual processes directly to cloud-based payroll platforms, bypassing older on-premise solutions. Growth is fueled by the large population base and the increasing operational scale of local businesses, which demand scalable solutions capable of managing localized tax obligations, currency variations, and often fragmented employee benefit schemes. Latin America and the Middle East & Africa (MEA) are emerging regions, where growth is driven by digitalization initiatives and the need for standardized systems to navigate political and economic volatility, focusing on core automation and basic compliance tools.

- North America (Dominant Market): High maturity, rapid adoption of SaaS HCM suites, demand driven by highly complex federal and state tax compliance requirements.

- Europe (Compliance-Driven): Strong growth influenced by GDPR and diverse national labor laws; high demand for multi-lingual and localized payroll engines.

- Asia Pacific (Fastest Growth): Accelerated digitalization, increasing employment formalization, high volume of SMEs transitioning directly to cloud solutions, requiring expertise in complex local regulations (e.g., India, China).

- Latin America (Emerging Market): Focus on regulatory stability and basic payroll automation driven by economic modernization and foreign investment in sectors like manufacturing and services.

- Middle East and Africa (MEA): Growth stimulated by Vision 2030 initiatives and digitalization efforts, driving adoption of solutions compliant with Sharia law and regional labor contracts (e.g., UAE, Saudi Arabia).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Payroll Software Market.- Automatic Data Processing (ADP)

- SAP SE

- Oracle Corporation

- Paychex Inc.

- Workday Inc.

- Intuit Inc. (QuickBooks Payroll)

- Zenefits

- Gusto

- UKG (Ultimate Kronos Group)

- Rippling

- TriNet Group Inc.

- Namely

- Sage Group plc

- BambooHR

- Paycom

- Ceridian HCM Holding Inc.

- Microsoft Dynamics

- Wave Financial

- Dayforce (Ceridian)

Frequently Asked Questions

Analyze common user questions about the Payroll Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of migrating payroll operations from on-premise systems to cloud-based payroll software (SaaS)?

The primary benefit of migrating to cloud-based SaaS payroll software is superior regulatory compliance and reduced administrative burden, as cloud solutions offer automatic, real-time updates for tax laws and labor regulations, ensuring businesses remain compliant globally without manual intervention. SaaS also provides scalability, lower total cost of ownership (TCO), and accessibility for remote workforces.

How does the integration of Artificial Intelligence (AI) enhance the accuracy and efficiency of modern payroll systems?

AI significantly enhances payroll accuracy by utilizing machine learning algorithms for automated anomaly detection, identifying errors in time cards, expenses, or benefit deductions instantly. Furthermore, AI automates repetitive data validation tasks (RPA) and forecasts labor costs, shifting the payroll function from transactional processing to strategic financial planning.

What are the most significant security concerns associated with adopting third-party payroll software, and how are vendors addressing them?

The most significant security concern is the protection of sensitive employee financial and personal data from breaches or cyberattacks. Vendors address this by employing advanced security protocols, including ISO 27001 compliance, end-to-end encryption, multi-factor authentication (MFA), and, increasingly, zero-trust architectures and blockchain technology for immutable audit trails and enhanced data integrity.

For Small and Medium-sized Enterprises (SMEs), what key features should be prioritized when selecting a payroll software solution?

SMEs should prioritize payroll solutions that offer ease of use (intuitive interface), affordability (transparent SaaS pricing), comprehensive tax filing automation, seamless integration with existing accounting software (like QuickBooks or Xero), and robust customer support to handle compliance questions without needing specialized in-house expertise.

What is 'Global Payroll Management,' and why is it crucial for large enterprises operating across multiple international jurisdictions?

Global Payroll Management refers to unified software solutions that centralize payroll processing, compliance, and reporting across all international entities under a single system. It is crucial for large enterprises as it ensures regulatory adherence in diverse jurisdictions, standardizes reporting formats, and provides a consolidated view of global workforce costs, simplifying financial governance and audit processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- HR Payroll Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- HR Payroll Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Employee Self-Service Software, Claims Reimbursement Software, Leave Management Software), By Application (Large SizeL Organizations, Medium Size Organizations, Small Size Organizations), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager