PEGylated Drugs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435957 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

PEGylated Drugs Market Size

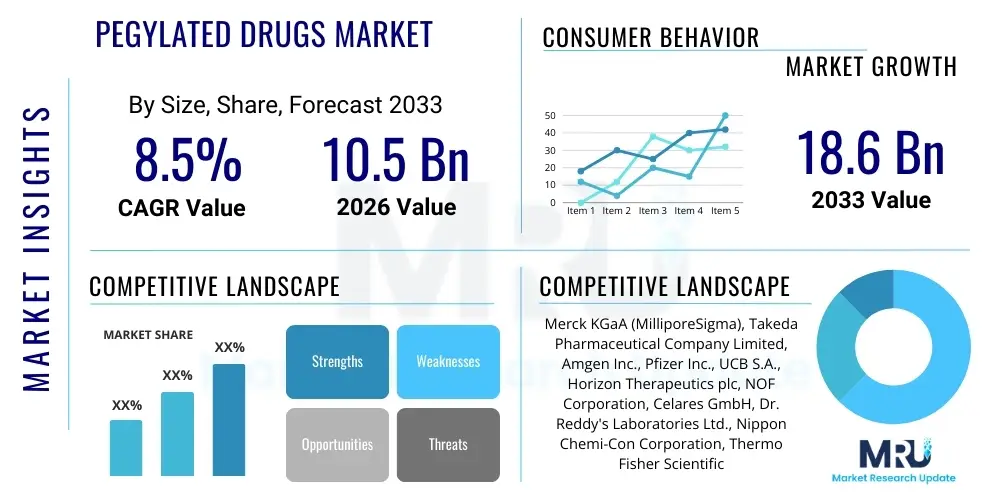

The PEGylated Drugs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 10.5 Billion in 2026 and is projected to reach USD 18.6 Billion by the end of the forecast period in 2033.

PEGylated Drugs Market introduction

The PEGylated Drugs Market encompasses therapeutic products where active pharmaceutical ingredients (APIs), primarily proteins, peptides, and small molecules, are covalently modified by the attachment of polyethylene glycol (PEG) polymer chains. This bioconjugation process, known as PEGylation, significantly enhances the pharmacokinetic and pharmacodynamic properties of the drug substance. The fundamental objective of PEGylation is to increase the hydrodynamic size of the therapeutic agent, thereby reducing renal clearance, extending circulation half-life, reducing immunogenicity, and enhancing solubility and stability. This modification technique has revolutionized the delivery and efficacy of biologics, making previously challenging drug candidates viable for clinical use, particularly in chronic disease management and oncology.

Major applications for PEGylated drugs span critical therapeutic areas, including hematology, oncology, gastroenterology, infectious diseases, and nephrology. In oncology, PEGylation is instrumental in improving drug accumulation at tumor sites through the enhanced permeability and retention (EPR) effect, while in hematology, it stabilizes coagulation factors, reducing the frequency of dosing for conditions like hemophilia. The market benefits from substantial advantages over conventional unmodified biologics, offering superior patient compliance due to less frequent injections and reduced systemic toxicity. Furthermore, the technology’s versatility allows its application across various drug classes, from interferon treatments to complex monoclonal antibodies and enzyme replacement therapies, solidifying its essential role in modern pharmacology.

Driving factors propelling market expansion include the surging demand for long-acting drug formulations, continuous advancements in polymer chemistry facilitating more efficient conjugation techniques (such as site-specific PEGylation), and the rising prevalence of chronic diseases globally that require sustained therapeutic intervention. Furthermore, extensive research and development investments by pharmaceutical and biotechnology companies into next-generation PEGylation platforms, alongside increasing approvals for novel PEGylated therapeutics by regulatory bodies, are ensuring sustained market momentum. The successful track record of established PEGylated products continues to build confidence in this platform technology for developing biosimilar and biobetter drugs.

PEGylated Drugs Market Executive Summary

The PEGylated Drugs Market is characterized by robust business trends driven by significant intellectual property (IP) activity and strategic collaborations between specialty chemical providers and large pharmaceutical firms focused on developing advanced conjugation technologies. Key business dynamics include the transition towards multi-functional PEGylation agents and the increasing emphasis on developing reversible PEGylation techniques that optimize drug release kinetics. Companies are heavily investing in proprietary site-specific PEGylation technologies, which promise better control over conjugation sites, leading to homogenous products with superior clinical profiles compared to traditional random conjugation methods. The commercial success of blockbuster PEGylated drugs continues to incentivize pipeline development, maintaining high valuation multiples for firms specializing in drug modification platforms.

Regionally, North America maintains market dominance due to high healthcare expenditure, established biopharmaceutical infrastructure, and supportive regulatory frameworks favoring advanced biologic therapies. However, the Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, primarily fueled by the expanding patient pool, increasing accessibility to advanced healthcare treatments, and governmental initiatives promoting domestic biotechnology research and manufacturing capabilities in countries like China and India. Europe remains a strong market segment, characterized by high adoption rates of premium biological drugs and significant academic research focused on polymer applications in drug delivery, positioning it as a mature but steadily growing market.

Segmentation trends reveal that the protein/peptide segment holds the largest market share, owing to the high success rate of PEGylation in stabilizing and extending the lifespan of these complex macromolecules. Within applications, the oncology segment is projected to exhibit the highest growth, driven by the need for enhanced targeted delivery and reduced systemic toxicity associated with cancer treatments. Furthermore, technology trends show a clear shift towards advanced, controlled release formulations, including the use of branched and high molecular weight PEG architectures, offering superior performance characteristics compared to older linear PEG polymers. These structural innovations are crucial for unlocking new therapeutic applications and addressing limitations in existing drug regimens.

AI Impact Analysis on PEGylated Drugs Market

Users frequently inquire about how Artificial Intelligence (AI) can streamline the notoriously complex and resource-intensive process of designing and optimizing PEGylated drug candidates. Common questions revolve around AI’s capacity to predict the optimal PEG molecular weight, the ideal conjugation site on a protein, and the resulting drug’s stability, immunogenicity, and half-life in vivo. There is strong user expectation that machine learning algorithms can rapidly screen vast libraries of polymer and drug combinations, significantly reducing the experimental trial-and-error phase. The key themes summarized are the expectation of accelerated R&D timelines, improved predictive accuracy concerning formulation stability, and AI's role in personalizing PEGylated drug dosages by analyzing patient-specific pharmacokinetic data.

AI’s influence is primarily felt in the early stages of drug development, where advanced computational models are utilized to simulate the interaction between the PEG polymer and the active therapeutic agent. These simulations help in predicting the most suitable PEG architecture—linear, branched, or star-shaped—that will yield the desired therapeutic profile, such as extended half-life without compromising activity. By analyzing large datasets comprising molecular properties, reaction conditions, and clinical outcomes, AI algorithms can identify novel PEGylation chemistries that were previously overlooked. This data-driven approach minimizes the need for extensive laboratory synthesis and testing, translating into substantial cost savings and expedited discovery processes.

Furthermore, AI is increasingly deployed in manufacturing optimization and quality control for PEGylated drugs. Complex processes like chromatography and ultrafiltration, crucial for separating the PEGylated product from unreacted materials, can be optimized using machine learning to predict process variances and maintain batch consistency. This ensures higher purity and yield, critical for high-value biological products. In clinical settings, AI contributes to pharmacovigilance by analyzing real-world evidence to better understand the long-term safety and efficacy profiles of PEGylated drugs across diverse patient populations, providing a feedback loop that informs future polymer design and formulation improvements.

- AI accelerates target identification and validation for new PEGylation sites on complex biologics.

- Machine learning models predict optimal PEG chain length and architecture for desired pharmacokinetic profiles (extended half-life, reduced clearance).

- Computational chemistry simulations reduce bench-work trials for optimizing reaction conditions and conjugation efficiency.

- AI enhances quality control and process analytical technology (PAT) during large-scale manufacturing of PEGylated compounds.

- Predictive analytics are used to minimize potential immunogenicity issues associated with specific PEGylation strategies.

- Deep learning assists in analyzing vast patient data to tailor drug dosage based on predicted metabolism rates of PEGylated products.

- AI supports the design of novel, biodegradable, or reversible PEGylation chemistries for sophisticated delivery systems.

DRO & Impact Forces Of PEGylated Drugs Market

The PEGylated Drugs Market is primarily driven by the escalating demand for long-acting biologics that minimize dosing frequency and improve patient adherence, especially in the context of chronic diseases such as diabetes, arthritis, and cancer. A major driving force is the established clinical success and safety profile of numerous approved PEGylated products, which de-risks the development pipeline for new candidates. Innovations in site-specific and enzyme-assisted PEGylation technologies are expanding the scope of treatable molecules, allowing for the modification of increasingly complex and sensitive drug substances. Furthermore, the push towards developing ‘biobetter’ drugs—enhanced versions of existing biologics—strongly favors the utilization of PEGylation technology.

Conversely, the market faces significant restraints, chiefly related to the regulatory complexity surrounding novel PEGylated products, particularly concerning residual unreacted PEG and the potential for anti-PEG antibodies, which can compromise drug efficacy or safety. The high manufacturing costs associated with pharmaceutical-grade specialty PEGs and the sophisticated purification steps required to ensure product homogeneity present substantial economic barriers, particularly for smaller biotechnology firms. Moreover, patent expiration of key blockbuster PEGylated drugs is fostering competition from biosimilars, potentially diluting premium pricing power and forcing incumbent companies to rapidly innovate their modification platforms.

Opportunities abound in utilizing PEGylation for gene therapies and cell-based medicines, where the polymer can offer protection and improved targeting efficiency. The development of next-generation non-PEG alternatives (such as HESylation or polysialylation) remains a competitive threat but also spurs innovation within the PEGylation sector, pushing developers toward creating ultra-pure, multifunctional, and cleavable PEG structures. Key impact forces include technological advancements that reduce manufacturing complexity, strong IP protection for proprietary conjugation methods, and favorable reimbursement policies for long-acting treatments. The convergence of polymer science with targeted drug delivery systems is the most potent impact force shaping the market's future trajectory.

Segmentation Analysis

The PEGylated Drugs Market segmentation provides a granular view of market dynamics based on the type of molecule modified, the specific therapeutic application, and the technique used for conjugation. Understanding these segments is crucial for strategic planning, as distinct R&D pipelines, regulatory pathways, and competitive landscapes characterize each category. The market is naturally divided based on the complexity and scale of manufacturing required for different molecule classes—proteins demand high precision due to their large size and folding requirements, while small molecules offer greater flexibility. Furthermore, application segmentation highlights the varying commercial successes and developmental urgency across major therapeutic areas, with oncology and chronic care dominating expenditure and pipeline activity.

The primary segment by product type, proteins and peptides, benefits immensely from PEGylation's ability to minimize proteolytic degradation and extend systemic exposure, essential for therapeutic efficacy. Within applications, the treatment of chronic metabolic disorders and autoimmune diseases represents a stable, high-volume market, while emerging applications in RNA delivery and vaccine development are poised for rapid future expansion. Technology segmentation reflects the evolving maturity of the field, moving from older, less efficient chemistry (e.g., random amine conjugation) to precise, bio-orthogonal methods (e.g., thiol-based conjugation), enhancing product quality and therapeutic predictability.

- Product Type:

- PEGylated Proteins and Peptides (e.g., Interferons, G-CSFs, Erythropoietins, Growth Hormones)

- PEGylated Small Molecules (e.g., Doxorubicin, L-asparaginase)

- PEGylated Liposomes and Nanoparticles

- Application:

- Oncology (Solid Tumors, Hematological Malignancies)

- Immunology and Autoimmune Disorders

- Infectious Diseases (Hepatitis C, HIV)

- Hematology (Hemophilia, Neutropenia)

- Gastroenterology

- Others (e.g., Nephrology, Dermatology)

- Technology:

- Covalent Attachment (e.g., Activated PEG Esters, Urethane linkages)

- Site-Specific PEGylation

- Enzyme-Assisted PEGylation

- Non-Covalent Encapsulation

- End-User:

- Hospitals and Clinics

- Academic and Research Institutes

- Biotechnology and Pharmaceutical Companies

Value Chain Analysis For PEGylated Drugs Market

The value chain for the PEGylated Drugs Market begins with the upstream segment, dominated by specialized chemical suppliers focused on synthesizing high-quality, monodisperse polyethylene glycol (PEG) polymers, often activated with specific functional groups (e.g., maleimide, succinimidyl carbonate) necessary for conjugation. These suppliers, often requiring stringent Good Manufacturing Practice (GMP) compliance, invest heavily in R&D to develop novel polymer architectures (branched, comb, or cleavable) that offer patented advantages in drug stability and half-life extension. Key activities in the upstream phase involve high-purity polymer synthesis, functionalization, and validation, establishing the foundational quality and intellectual property for the final drug product.

The middle segment of the value chain involves the conjugation and manufacturing process, predominantly managed by biotechnology and large pharmaceutical companies. This stage requires highly specialized expertise in bioconjugation chemistry, advanced purification techniques (like preparative chromatography), and lyophilization to ensure the final PEGylated drug product is homogeneous and stable. Contract Development and Manufacturing Organizations (CDMOs) play an increasingly critical role here, offering specialized services to smaller biotech firms that lack the infrastructure for complex biologic manufacturing. Success at this stage hinges on optimizing the reaction conditions to achieve maximum yield of the desired PEGylation isomer while minimizing impurity formation.

The downstream segment covers distribution channels, market access, and patient administration. Distribution flows through both direct channels (large pharma distributing to major hospitals) and indirect channels (specialty pharmaceutical distributors and wholesalers). Due to the high cost and sensitivity of PEGylated biologics, cold chain logistics and controlled dispensing through specialty pharmacies are common requirements. Direct channels are often utilized for new product launches or high-volume hospital contracts, ensuring rapid market penetration. Indirect channels leverage established networks for broad geographic reach. Final users include hospitals, oncology centers, and outpatient clinics where administration is supervised by healthcare professionals.

PEGylated Drugs Market Potential Customers

Potential customers for PEGylated drugs are predominantly large healthcare providers, including specialized hospitals, regional clinic networks, and oncology centers that treat chronic and complex diseases requiring long-term, high-efficacy drug regimens. These institutional buyers value the clinical benefits of PEGylation, such as reduced dosing frequency, which enhances patient compliance and reduces the burden on healthcare staff. Specifically, hematology wards, which manage hemophilia and neutropenia, are major consumers of PEGylated factors and growth factors, due to the proven safety and superior half-life provided by this technology compared to first-generation unmodified products.

Another significant customer segment includes Contract Research Organizations (CROs) and academic research institutions focused on drug development and preclinical testing. These entities purchase specialized PEGylation reagents and small-batch PEGylated compounds for early-stage screening, stability studies, and in vivo evaluations of novel therapeutic candidates. They are primarily interested in the cutting-edge aspects of the technology, such as site-specific PEGylation kits and novel polymer chemistries that can accelerate their research timelines and overcome formulation challenges inherent in complex new biologics.

Finally, pharmaceutical and biotechnology companies themselves represent a crucial internal customer and external service buyer, particularly those engaging CDMOs for manufacturing and formulation services. These companies seek partners with proven expertise in scaling up PEGylation processes and navigating the stringent regulatory requirements for biologics. Their decision-making is driven by factors such as proprietary access to novel PEG chemistry, proven regulatory track records, and the ability to maintain consistent batch purity and yield under strict GMP conditions, facilitating rapid progression through clinical trials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.5 Billion |

| Market Forecast in 2033 | USD 18.6 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA (MilliporeSigma), Takeda Pharmaceutical Company Limited, Amgen Inc., Pfizer Inc., UCB S.A., Horizon Therapeutics plc, NOF Corporation, Celares GmbH, Dr. Reddy's Laboratories Ltd., Nippon Chemi-Con Corporation, Thermo Fisher Scientific Inc., Enzon Pharmaceuticals Inc. (Divested assets), Bio-Rad Laboratories, Inc., JenKem Technology USA Inc., Creative PEGWorks, Ligand Pharmaceuticals Incorporated, Baxter International Inc., Lonza Group, Sandoz International GmbH (Novartis), Teva Pharmaceutical Industries Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PEGylated Drugs Market Key Technology Landscape

The technological landscape of the PEGylated Drugs Market is rapidly evolving, moving away from first-generation, non-specific conjugation methods towards highly controlled, precision-based techniques. The dominant technology remains covalent attachment, utilizing various activated PEG derivatives such as succinimidyl esters (for amine reaction), maleimides (for thiol reaction), and aldehydes. However, the critical differentiation now lies in achieving site-specificity. Second-generation technologies focus heavily on modifying specific amino acids (like cysteine or lysine residues) or introducing non-natural amino acids at predetermined locations on the therapeutic protein, ensuring a homogenous product with optimal retained biological activity and reduced variability between batches.

A significant trend involves the adoption of enzyme-assisted PEGylation, which uses enzymes like transglutaminases to precisely attach PEG at defined sites under mild conditions, minimizing the risk of protein denaturation. This method is particularly promising for complex, sensitive biologics where preserving three-dimensional structure is paramount. Furthermore, there is growing interest in developing ‘cleavable’ PEG linkers, which are designed to release the unmodified active drug at the target site or over a specific time window. This innovation addresses the limitation of some standard PEGylated drugs where the permanent attachment of the polymer can slightly reduce intrinsic activity or slow clearance.

Beyond traditional protein modification, the technology landscape includes advanced polymer architectures. Researchers are increasingly utilizing branched, dendritic, and hydrogel-forming PEGs that offer higher molecular weights and improved shielding effects compared to standard linear PEGs, thereby further extending the half-life. These advanced polymer designs also play a crucial role in developing stealth liposomes and nanoparticles, where the PEG coating prevents rapid recognition and clearance by the reticuloendothelial system (RES), enhancing drug accumulation in target tissues, notably in oncology applications.

Regional Highlights

- North America: This region maintains the largest market share, driven by a mature and robust biopharmaceutical industry, extremely high healthcare spending, and proactive adoption of advanced biologic therapies. The US is the primary contributor, characterized by a favorable regulatory environment (FDA approvals), substantial R&D investments by major pharmaceutical companies, and a high prevalence of chronic diseases requiring long-term treatments. The presence of numerous key PEGylation technology providers and specialized CDMOs further solidifies its leading position.

- Europe: The European market is the second largest, marked by strong government support for biotechnology research and high standards of healthcare quality. Countries like Germany, Switzerland, and the UK are hubs for polymer chemistry and drug delivery innovation. The market benefits from established reimbursement structures for high-cost specialized medicines, though pricing negotiations across the diverse national healthcare systems introduce market complexities not seen in the unified US market.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region. This acceleration is attributed to improving healthcare infrastructure, rising disposable incomes, and the expansion of generic and biosimilar manufacturing capabilities, particularly in China and India. Government initiatives promoting domestic biopharma R&D and increasing awareness regarding advanced treatment options are fueling the adoption of PEGylated drugs, often used as 'biobetter' alternatives to established therapies.

- Latin America (LATAM): The LATAM market, while smaller, is growing steadily. Growth is concentrated in countries like Brazil and Mexico, driven by increasing access to imported advanced therapies and an expanding middle class seeking higher quality healthcare. Market expansion is often hampered by challenging regulatory harmonization and economic volatility, but the rising incidence of chronic diseases provides a consistent demand floor.

- Middle East and Africa (MEA): This region is an emerging market, largely driven by significant healthcare investment in the Gulf Cooperation Council (GCC) countries. The focus is primarily on importing established, high-value PEGylated drugs for complex diseases. Local manufacturing remains nascent, but strategic partnerships aiming to transfer technology and establish regional production hubs are gradually increasing the market penetration of advanced biologics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PEGylated Drugs Market.- Merck KGaA (MilliporeSigma)

- Takeda Pharmaceutical Company Limited

- Amgen Inc.

- Pfizer Inc.

- UCB S.A.

- Horizon Therapeutics plc

- NOF Corporation

- Celares GmbH

- Dr. Reddy's Laboratories Ltd.

- Nippon Chemi-Con Corporation

- Thermo Fisher Scientific Inc.

- Enzon Pharmaceuticals Inc. (Divested assets)

- Bio-Rad Laboratories, Inc.

- JenKem Technology USA Inc.

- Creative PEGWorks

- Ligand Pharmaceuticals Incorporated

- Baxter International Inc.

- Lonza Group

- Sandoz International GmbH (Novartis)

- Teva Pharmaceutical Industries Ltd.

Frequently Asked Questions

Analyze common user questions about the PEGylated Drugs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is PEGylation and why is it essential for drug development?

PEGylation is the process of covalently attaching polyethylene glycol (PEG) chains to a therapeutic molecule. It is essential because it increases the drug's size, significantly extending its circulation half-life by reducing renal clearance, enhancing stability, and often decreasing immunogenicity, allowing for less frequent dosing.

Which therapeutic areas see the highest utilization of PEGylated drugs?

The highest utilization is observed in oncology, hematology (treating conditions like hemophilia and neutropenia), and infectious diseases. PEGylated formulations in these areas provide superior pharmacokinetic profiles critical for sustained therapeutic efficacy in chronic or life-threatening conditions.

What are the primary challenges restraining the growth of the PEGylated Drugs Market?

Key challenges include the high cost and technical complexity of manufacturing pharmaceutical- grade PEG polymers, the difficulty in achieving homogenous drug products, and regulatory scrutiny regarding the potential formation of anti-PEG antibodies in patients, which can neutralize drug effects.

How do site-specific PEGylation technologies differ from traditional methods?

Traditional PEGylation often results in random conjugation across multiple reactive sites, leading to a heterogeneous mixture of products. Site-specific technologies ensure the PEG polymer attaches to a single, predetermined site on the molecule, resulting in a highly uniform product with predictable activity and improved consistency.

What impact do biosimilars have on the PEGylated Drugs Market?

The entry of biosimilars following the patent expiration of blockbuster PEGylated drugs increases market competition and drives down pricing for established products. This forces incumbent manufacturers to innovate and develop 'biobetter' versions using advanced, proprietary PEGylation chemistries to maintain competitive differentiation and premium pricing.

The strategic dynamics within the PEGylated Drugs Market are heavily influenced by intellectual property rights, particularly patents related to novel PEG derivatives and specific conjugation chemistries. Firms that successfully patent site-specific attachment technologies gain significant competitive advantages, ensuring proprietary control over next-generation biobetter drugs. This patent landscape creates high barriers to entry for smaller competitors and dictates the pace of innovation. Large pharmaceutical companies often engage in licensing agreements or acquisitions of smaller biotech firms that possess unique PEGylation platforms, securing their future pipeline against emerging competition. Furthermore, the regulatory pathway for PEGylated biosimilars, while defined, requires extensive comparative studies, emphasizing the necessity of robust analytical characterization throughout the development process. Investor confidence remains high, supported by the historical resilience and consistent revenue streams generated by established PEGylated products, underscoring the platform's long-term commercial viability across multiple therapeutic indications. Detailed analysis of clinical trial data is routinely used to benchmark the performance improvements achieved through PEGylation versus the unmodified parent compound, influencing prescribing patterns and market adoption rates globally. The ongoing quest for reduced production cost without compromising purity drives continuous process optimization initiatives across the industry, particularly concerning large-scale purification techniques like tangential flow filtration and specialized chromatographic methods tailored for polymer separation. The chemical stability of the final drug product under various storage conditions is a critical quality attribute often enhanced by the polymeric modification, contributing to extended shelf life and global distribution feasibility. Market players are also exploring the use of non-linear PEG architectures, such as hyperbranched or star polymers, which offer tunable properties regarding molecular weight and branching density, further diversifying the chemical toolkit available for optimizing drug delivery parameters. These advanced polymers are being specifically designed to overcome challenges such as accelerated blood clearance observed with certain high molecular weight PEGylated entities. The focus on patient-centric care is increasingly driving the development of subcutaneous injectable formulations, which PEGylation aids by concentrating the drug and reducing injection volume, improving patient compliance significantly. Research into alternative polymers, while competitive, also motivates PEG suppliers to enhance their offering, particularly by focusing on biocompatibility and minimizing potential accumulation of non-biodegradable polymer fragments in the body over long-term treatment courses. The pharmaceutical supply chain for PEGylated drugs requires specialized handling protocols, particularly temperature control, ensuring the integrity of these complex biological molecules from manufacturing facility to the point of care. Market analysts consistently track the pipeline activity in oncology, noting the critical role of PEGylation in enhancing tumor targeting and reducing systemic toxicity of potent chemotherapeutic agents, maintaining this application segment as a key growth driver. Collaboration between academic research groups and industry leaders is vital for translating breakthrough discoveries in polymer science into clinically viable drug candidates, reinforcing the innovation feedback loop crucial for sustained market expansion. Detailed pharmacoeconomic studies evaluating the cost-effectiveness of PEGylated drugs compared to conventional treatments are becoming increasingly important for securing favorable national reimbursement status, especially in mature European markets and emerging markets where budget constraints are more significant. The environmental impact of pharmaceutical manufacturing, including the synthesis of specialty polymers, is also a growing area of concern, prompting some companies to explore greener chemistry and more sustainable production methods for high-ppurity PEG derivatives. The technological shift towards personalized medicine introduces complexity, requiring PEGylation strategies that can be customized or adapted to individual patient profiles, an area where AI and advanced modeling techniques are expected to play a transformative role in the coming decade. Monitoring long-term patient outcomes and safety data is paramount, especially concerning chronic administration, ensuring the sustained trust of regulatory bodies and prescribers in the long-term safety profile of PEGylated therapies. Regulatory harmonization efforts, particularly between the FDA, EMA, and comparable agencies in APAC, significantly influence the speed and efficiency with which new PEGylated products gain global market access. Investment in quality control instrumentation capable of detailed polymer characterization, such as specialized chromatography and mass spectrometry techniques, is non-negotiable for manufacturers aiming for high standards of batch consistency and purity. The continued exploration of PEGylation for non-traditional modalities, such as oligonucleotides and gene editing components, represents a frontier opportunity that could unlock massive new value streams for the market in the post-forecast period. Furthermore, the development of orally available PEGylated drug formulations, although technically challenging due to gastrointestinal absorption barriers, remains a high-value research goal promising a paradigm shift in patient convenience and compliance. The inherent challenges in analyzing the exact structure and size distribution of PEGylated species drive constant demand for advanced analytical method development, underpinning the scientific rigor required in this segment of the biopharmaceutical industry.

The convergence of polymer science with targeted drug delivery systems is recognized as a dominant force shaping future market strategy, directing research towards multifunctional PEG structures that incorporate targeting ligands alongside the polymer chain. These advanced systems aim to enhance therapeutic index by maximizing local drug concentration at the diseased site while minimizing systemic exposure, a critical requirement for potent biopharmaceuticals. Market competition is intensifying not only from classical biosimilars but also from non-PEGylation alternatives like albumin fusion technology and XTEN, which aim to achieve comparable half-life extension benefits without using the PEG polymer. This competitive pressure encourages continuous refinement of PEGylation techniques, focusing on bio-degradability and minimizing polymer load while retaining optimal pharmacokinetic properties. The expansion of clinical applications into pediatric and geriatric patient populations necessitates specialized formulation development, often requiring lower concentration, higher stability PEGylated products suitable for administration in varied healthcare settings. The global supply chain resilience for essential raw materials, particularly the starting materials for pharmaceutical-grade PEG synthesis, is a critical operational factor influencing production costs and reliability. Companies are actively diversifying their supply bases and engaging in strategic forward integration to mitigate potential disruptions and ensure consistent access to high-purity functionalized polymers. The emphasis on intellectual property protection extends beyond the conjugation method to the specific formulation patents, including excipients and delivery devices used alongside the PEGylated therapeutic. This multilayered patent strategy is vital for maximizing the commercial longevity of successful products. Furthermore, the role of Contract Development and Manufacturing Organizations (CDMOs) specializing in biologic conjugation is expanding rapidly, offering scalable and compliant manufacturing solutions that allow biotech innovators to focus purely on R&D rather than infrastructure overhead. The regulatory landscape continues to evolve, with increasing global expectations for clear demonstration of stability and absence of long-term toxicity related to the PEG component itself, irrespective of the attached drug substance. Detailed toxicological studies focused on high molecular weight PEG are essential for new product approvals. Market growth is also indirectly supported by advancements in recombinant DNA technology, which enables the large-scale, high-purity production of protein substrates necessary for efficient and cost-effective PEGylation reactions. These upstream efficiency gains contribute positively to the overall economic viability of PEGylated drug development programs. The utilization of automated high-throughput screening technologies is increasingly common in identifying optimal PEGylation conditions, drastically reducing the time required for pre-formulation studies and accelerating the transition from lab bench to clinical trials. Data integrity and the application of machine learning (ML) for predictive quality assurance are transforming manufacturing processes, ensuring higher product yields and reducing batch rejection rates, critical for maintaining profitability in the high-cost biologics sector. The ongoing research into reversible PEGylation strategies, using pH- or enzyme-sensitive linkers, promises a significant breakthrough by allowing the active drug to be released in its native form at the site of action, potentially maximizing therapeutic potency and mitigating some polymer-related side effects.

In the Asia Pacific region, specifically, the rise of domestic biopharma champions and the increasing affordability of advanced treatments are key structural changes driving demand. Governments in countries like South Korea and Japan are actively subsidizing R&D in bioconjugation technologies, fostering a strong local ecosystem for PEGylated drug innovation and production. This regional momentum is shifting the geographical distribution of market growth, making APAC an increasingly vital strategic focus for global market leaders. The clinical trial landscape is becoming more internationalized, with studies for new PEGylated drugs often conducted simultaneously across North America, Europe, and Asia, reflecting the global nature of regulatory strategy and market access planning. Educational initiatives targeting healthcare professionals in emerging markets regarding the benefits and proper administration of long-acting PEGylated therapies are crucial for translating market potential into realized sales growth. The competitive environment is also characterized by continuous M&A activity, where larger players consolidate specialized polymer technology providers or absorb competitors with strong regional market shares, streamlining production and expanding intellectual property portfolios. The development pipeline shows a notable increase in PEGylated products targeting central nervous system (CNS) disorders, leveraging the polymer's potential to enhance drug stability and potentially aid in traversing the blood-brain barrier, representing a challenging yet high-reward therapeutic frontier. Furthermore, standardization in reporting and analytical methods across the industry, often mandated by regulatory bodies, ensures that quality metrics for PEGylated products are uniformly high, benefiting both patient safety and global trade efficiency. The need for specialized sterile filling and finishing capabilities for these injectable products maintains high capital expenditure requirements for manufacturers, contributing to the competitive advantage of integrated biopharmaceutical giants and specialized CDMOs. The long-term forecast suggests that while novel non-PEG alternatives will emerge, PEGylation will retain its dominant market position for the foreseeable future due to its decades of proven clinical track record, predictable safety profile, and the ongoing sophistication of available polymer chemistry, securing its status as the benchmark technology for half-life extension of biologics. This sustained relevance necessitates continuous investment in analytical chemistry to accurately characterize increasingly complex PEGylated molecules, including multi-PEGylation and combination therapies, ensuring rigorous quality standards are maintained globally across all jurisdictions and product life cycles. The strategic importance of optimizing dosing frequency remains paramount, not just for patient comfort but also for reducing the overall cost burden on healthcare systems, reinforcing the fundamental value proposition of PEGylation technology in the modern pharmaceutical landscape.

The technical hurdles associated with scaling up the production of high molecular weight, branched PEGs represent a persistent challenge that demands continuous investment in chemical engineering and process optimization. The solubility and viscosity of highly concentrated PEGylated solutions are critical physical constraints that must be overcome to enable low-volume, patient-friendly injections, driving research into novel formulation buffers and excipients. Market resilience is demonstrated by the ability of key players to successfully transition their pipeline focus towards next-generation PEGylated products even as their original blockbusters face biosimilar competition, maintaining a strong position in the biobetter segment. Furthermore, the application of PEGylation in vaccine development is gaining traction, where the polymer can stabilize antigen structures or modify delivery kinetics to enhance immune response, offering a new area of expansion beyond traditional protein therapeutics. The patent cliffs affecting several high-revenue PEGylated drugs necessitate proactive R&D strategies centered on developing proprietary conjugation methods that extend patent protection and market exclusivity, thus preserving high margins. Regulatory agencies are increasingly focused on the quantification and characterization of impurities, specifically unreacted PEG and different PEGylation isomers, requiring highly sensitive and validated analytical techniques throughout the manufacturing release process. This heightened regulatory scrutiny drives demand for advanced chromatographic separation and spectroscopic analysis tools within the industry. The geographic spread of clinical trials for new PEGylated candidates is becoming more diverse, incorporating sites in emerging markets to gather data on efficacy and safety across varied ethnic and genetic backgrounds, enhancing the global applicability of the final product. Sustainable growth in the market is contingent upon the development of cost-efficient manufacturing protocols that can democratize access to these advanced therapies in developing nations without compromising quality or efficacy. The exploration of alternative conjugation chemistries, such as click chemistry techniques applied to PEGylation, offers opportunities for extremely selective and rapid bioconjugation under physiologically relevant conditions, potentially simplifying production workflows and improving product homogeneity further. Strategic partnerships with specialized raw material suppliers are crucial for securing consistent access to highly specialized, non-commodity PEG precursors, minimizing supply chain risks and maintaining manufacturing schedules. Finally, the long-term impact of AI on streamlining the entire development lifecycle, from initial polymer design selection to final clinical dosing recommendation, represents the most significant impending technological transformation for the PEGylated Drugs Market, promising unprecedented acceleration and precision in drug engineering.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager