Perfluorosulfonic Acid Proton Exchange Membrane Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439835 | Date : Jan, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Perfluorosulfonic Acid Proton Exchange Membrane Market Size

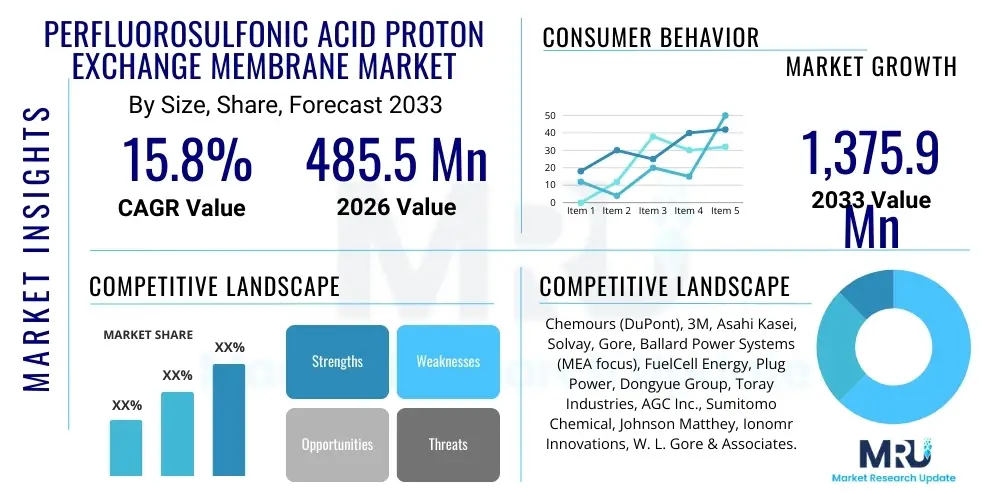

The Perfluorosulfonic Acid Proton Exchange Membrane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.8% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 10.5 Billion by the end of the forecast period in 2033.

Perfluorosulfonic Acid Proton Exchange Membrane Market introduction

The Perfluorosulfonic Acid (PFSA) Proton Exchange Membrane market is a critical and rapidly expanding segment within the advanced materials industry, foundational to the burgeoning hydrogen economy and various electrochemical applications. PFSA membranes are specialized ionomers, typically derived from fluoropolymers like polytetrafluoroethylene (PTFE), engineered with sulfonic acid groups that facilitate highly efficient proton transport. This unique chemical structure imparts exceptional thermal, chemical, and mechanical stability, crucial for their operation in demanding environments. These membranes serve as the central electrolyte in proton exchange membrane fuel cells (PEMFCs) and proton exchange membrane electrolyzers (PEMELs), where their primary function is to conduct protons while acting as an electronic insulator and gas separator.

Major applications for PFSA PEMs span across the automotive sector, powering hydrogen fuel cell electric vehicles (FCEVs), and in stationary power generation, offering clean energy solutions. Furthermore, they are indispensable in the production of green hydrogen through water electrolysis, a key enabler for decarbonization across industrial and energy sectors. Beyond these primary applications, PFSA PEMs find utility in redox flow batteries for grid-scale energy storage, various electrochemical sensors, and certain chemical processes requiring selective ion transport. Their inherent benefits include high proton conductivity, which translates to efficient energy conversion, superior chemical inertness ensuring long operational lifespans, and robust mechanical properties that allow for thin, flexible, and durable membrane designs. These attributes make PFSA membranes the material of choice for high-performance electrochemical devices seeking to maximize efficiency and reliability.

The market is significantly driven by global efforts towards decarbonization and the urgent need to transition to sustainable energy sources. Government policies and substantial investments in hydrogen infrastructure development, coupled with growing consumer and industrial demand for cleaner energy technologies, are accelerating the adoption of PFSA PEMs. The increasing popularity of electric vehicles, particularly hydrogen FCEVs, is creating a strong pull for advanced membrane materials, while the expansion of green hydrogen production capacity worldwide underscores the critical role of PEM electrolyzers. Ongoing research and development efforts aimed at improving membrane performance, reducing manufacturing costs, and enhancing durability are further fueling market expansion, solidifying the position of PFSA PEMs as a cornerstone technology for the future of energy.

Perfluorosulfonic Acid Proton Exchange Membrane Market Executive Summary

The Perfluorosulfonic Acid Proton Exchange Membrane (PFSA PEM) market is experiencing robust growth, propelled by the escalating global emphasis on clean energy and sustainable technologies. Business trends indicate a strong focus on strategic collaborations and partnerships among material suppliers, membrane manufacturers, and system integrators to accelerate product development and market penetration. There is a discernible trend towards vertical integration within the supply chain to enhance control over quality and cost. Companies are also heavily investing in research and development to innovate next-generation membranes with improved performance characteristics, such as higher temperature operation, enhanced durability, and reduced precious metal catalyst loading. Furthermore, manufacturing process optimization, including the adoption of advanced fabrication techniques and automation, is a key business strategy aimed at scaling production and achieving economies of scale to meet the rapidly expanding demand from fuel cell and electrolyzer applications. The market is also witnessing an increase in merger and acquisition activities, as larger players consolidate their positions and acquire specialized expertise or technologies.

Regionally, the Asia-Pacific continues to dominate the PFSA PEM market, driven primarily by ambitious green hydrogen initiatives and the rapid expansion of the electric vehicle market, particularly in countries like China, Japan, and South Korea. These nations are heavily investing in fuel cell technology for transportation and stationary power, as well as in large-scale hydrogen production projects. Europe is also emerging as a significant growth region, fueled by the European Green Deal and various national hydrogen strategies that mandate substantial increases in renewable hydrogen production and deployment of fuel cell applications. North America is experiencing a resurgence, largely due to supportive government policies, such as the Inflation Reduction Act in the United States, which provides significant incentives for clean hydrogen production and fuel cell deployment, stimulating investment in manufacturing and infrastructure. Latin America, the Middle East, and Africa, while smaller, are showing promising growth potential as they begin to explore and implement hydrogen-based energy solutions.

Segment-wise, the fuel cell application segment, particularly for automotive and stationary power, remains a major revenue driver, underpinned by advancements in vehicle technology and the increasing adoption of FCEVs and backup power solutions. However, the electrolyzer segment is projected to exhibit the highest growth rate during the forecast period, reflecting the global imperative to produce green hydrogen from renewable energy sources. This surge is attributed to the critical role of PEM electrolyzers in enabling large-scale, efficient, and flexible hydrogen production. Within the material type, long-side chain PFSA membranes continue to hold a significant share due to their proven performance and stability, while short-side chain and composite membranes are gaining traction due to their potential for improved performance-to-cost ratios and enhanced durability under specific operating conditions. The drive towards more cost-effective and robust membranes is a unifying trend across all segmentation categories.

AI Impact Analysis on Perfluorosulfonic Acid Proton Exchange Membrane Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is poised to revolutionize the Perfluorosulfonic Acid Proton Exchange Membrane (PFSA PEM) market by significantly accelerating research, optimizing manufacturing processes, and enhancing product performance. Users frequently inquire about how AI can expedite the discovery of novel PFSA chemistries with improved properties, reduce the lengthy material development cycles, and enable predictive maintenance for PEM systems. Key themes emerging from these discussions include AI's potential in high-throughput material screening, simulating complex electrochemical interactions, designing more efficient membrane electrode assemblies (MEAs), and intelligent process control for scalable and consistent membrane production. There is a strong expectation that AI will not only drive down costs and improve efficiency but also lead to the creation of next-generation membranes capable of operating under more extreme conditions, addressing current limitations such as durability and cost. The overarching sentiment is that AI will act as a force multiplier, unlocking innovations that would be difficult or impossible to achieve through traditional experimental methods alone.

- AI-driven computational chemistry and molecular simulations accelerate the discovery and design of novel PFSA polymers with enhanced proton conductivity, thermal stability, and mechanical strength, drastically reducing experimental trial-and-error.

- Machine learning algorithms can analyze vast datasets from material synthesis and characterization, identifying optimal processing parameters for membrane fabrication, leading to improved consistency, reduced waste, and lower manufacturing costs.

- AI-powered predictive modeling can forecast the long-term performance and degradation of PFSA membranes in fuel cells and electrolyzers, enabling proactive maintenance, extended lifespan, and the development of more robust membrane designs.

- Intelligent control systems leverage AI to optimize operational parameters of PEM fuel cell and electrolyzer stacks in real-time, maximizing efficiency, power output, and system reliability under varying load conditions.

- AI-enhanced characterization techniques, such as image analysis for microstructural evaluation, provide deeper insights into membrane morphology and defect detection, facilitating quality control and continuous product improvement.

- Automated robotic systems, guided by AI, can streamline membrane assembly and integration into MEAs, increasing production speed and precision while reducing labor costs.

- AI can identify new market opportunities and application niches for PFSA PEMs by analyzing global energy trends, policy changes, and technological advancements, guiding strategic investment decisions.

DRO & Impact Forces Of Perfluorosulfonic Acid Proton Exchange Membrane Market

The Perfluorosulfonic Acid Proton Exchange Membrane (PFSA PEM) market is influenced by a dynamic interplay of drivers, restraints, opportunities, and broader impact forces. Key drivers include the escalating global demand for clean energy solutions, particularly the rapid expansion of the hydrogen economy, which is heavily reliant on PEM fuel cells for transportation and stationary power, and PEM electrolyzers for green hydrogen production. Aggressive climate change mitigation policies and government incentives worldwide, such as carbon pricing mechanisms, tax credits for fuel cell electric vehicles (FCEVs), and subsidies for hydrogen infrastructure, are providing significant impetus for market growth. Technological advancements in membrane design and manufacturing processes, aimed at improving efficiency, durability, and cost-effectiveness, are also crucial drivers. Furthermore, the increasing adoption of electric vehicles and the desire for diversified energy portfolios contribute to the demand for high-performance membranes.

Despite the strong growth drivers, the PFSA PEM market faces several notable restraints. The high manufacturing cost of PFSA membranes, primarily due to the complex synthesis of fluoropolymers and specialized processing techniques, remains a significant barrier to widespread adoption, particularly in cost-sensitive applications. Durability and long-term stability issues, especially under harsh operating conditions such as high temperatures or humidity fluctuations, continue to pose technical challenges, necessitating ongoing research. The reliance on a limited number of specialized raw material suppliers and complex supply chains for fluorinated chemicals can lead to vulnerabilities and price volatility. Additionally, competition from alternative energy technologies, such as battery electric vehicles (BEVs) and other forms of hydrogen production or energy storage, presents a competitive restraint that requires continuous innovation to overcome. The intricate and energy-intensive production of the base polymers further adds to the cost and environmental footprint challenges.

However, the market is rich with opportunities that can mitigate these restraints and accelerate growth. The development of advanced, next-generation PFSA membranes with enhanced performance characteristics, such as improved conductivity at higher temperatures, reduced gas crossover, and greater resistance to chemical degradation, presents substantial opportunities. The emergence of new and niche applications beyond traditional fuel cells and electrolyzers, including specialized sensors, advanced separation technologies, and grid-scale energy storage systems (e.g., redox flow batteries), offers avenues for market diversification. Expanding manufacturing capacities and optimizing production processes to achieve economies of scale and reduce costs represents a significant opportunity for market players. Furthermore, increasing investments in hydrogen infrastructure globally, coupled with a growing focus on circular economy principles and recycling technologies for spent membranes, can create sustainable growth pathways. Collaborative R&D initiatives between industry, academia, and government bodies are also vital for unlocking these opportunities.

The broader impact forces shaping the PFSA PEM market are multifaceted. Environmental regulations and global commitments to achieve net-zero emissions are powerful overarching forces, directly driving demand for clean hydrogen and fuel cell technologies. Geopolitical dynamics and energy security concerns are prompting nations to diversify their energy sources, favoring indigenous hydrogen production and advanced energy storage, thereby boosting the PEM market. Economic factors, including global inflation, investment trends in green technologies, and the availability of venture capital for innovative startups, significantly influence market development. Technological innovation, particularly in materials science, electrochemistry, and manufacturing automation, acts as a constant force pushing the boundaries of what is possible with PFSA membranes. Societal acceptance and public perception of hydrogen technology also play a role, influencing policy support and consumer adoption. These forces collectively define the market's trajectory, emphasizing a clear trend towards sustainable and high-performance energy solutions.

Segmentation Analysis

The Perfluorosulfonic Acid Proton Exchange Membrane (PFSA PEM) market is meticulously segmented to provide a granular understanding of its diverse components, encompassing various types of membranes, their extensive applications, and the distinct end-use industries they serve. This segmentation allows for a detailed analysis of market dynamics, growth drivers, and specific challenges within each category, enabling stakeholders to identify key growth areas and tailor strategies effectively. The complexity of PFSA membranes, from their chemical structure to their integration into complex electrochemical systems, necessitates a multi-dimensional view to fully capture the market’s scope and potential. Understanding these segments is crucial for market participants looking to innovate, optimize supply chains, and strategically position their products or services within this evolving landscape. The market's growth is inherently linked to the performance and cost-effectiveness of these segmented offerings across various critical applications that underpin the global energy transition.

- By Type:

- Short-Side Chain Perfluorosulfonic Acid (SSC PFSA) Membranes: Characterized by shorter side chains connecting the sulfonic acid group to the fluoropolymer backbone, offering potentially higher proton conductivity at lower humidity and improved mechanical properties, often at a reduced cost.

- Long-Side Chain Perfluorosulfonic Acid (LSC PFSA) Membranes: Represented prominently by Nafion, these membranes feature longer side chains, providing excellent chemical and thermal stability, good mechanical strength, and established performance, especially in traditional fuel cell applications.

- Composite Membranes: Advanced membranes incorporating inorganic fillers (e.g., SiO2, TiO2) or other polymers into the PFSA matrix to enhance properties like mechanical strength, high-temperature performance, reduced gas crossover, and improved durability, addressing limitations of pure PFSA membranes.

- By Application:

- Fuel Cells:

- Automotive Fuel Cells: Used in hydrogen fuel cell electric vehicles (FCEVs) for passenger cars, buses, trucks, and forklifts, driving the demand for high-performance and durable membranes.

- Stationary Fuel Cells: Employed in combined heat and power (CHP) systems, backup power for critical infrastructure, and distributed power generation units.

- Portable Fuel Cells: Utilized in smaller devices for military, recreational, and niche electronic applications.

- Electrolyzers: Essential for the production of green hydrogen from water, critical for industrial feedstock, energy storage, and decarbonization efforts.

- Redox Flow Batteries: Used as separators to prevent cross-contamination of electrolytes while allowing ion exchange, particularly in large-scale energy storage systems.

- Sensors and Separators: Applied in various electrochemical sensors for gas detection, water purification systems, and other specialized chemical separation processes.

- Others: Includes applications in humidifiers, desiccants, and specific laboratory equipment requiring ion exchange properties.

- Fuel Cells:

- By End-Use Industry:

- Automotive: The largest segment, driven by the shift towards FCEVs and stricter emission regulations.

- Energy & Power Generation: Includes utilities, independent power producers, and companies involved in stationary power, green hydrogen production, and grid-scale storage.

- Chemical Processing: Utilizes PFSA membranes for various electrochemical processes, separations, and acid purification.

- Electronics: Niche applications in portable power devices and advanced electronic components.

- Aerospace & Defense: High-performance fuel cell systems for unmanned aerial vehicles (UAVs) and specialized military equipment.

- Healthcare & Medical: Emerging applications in portable medical devices and advanced diagnostic tools.

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Perfluorosulfonic Acid Proton Exchange Membrane Market

The value chain for the Perfluorosulfonic Acid Proton Exchange Membrane (PFSA PEM) market is intricate, involving multiple specialized stages from raw material sourcing to end-user deployment. At the upstream analysis stage, the process begins with the extraction and refining of basic chemical feedstocks required for fluoropolymer synthesis, primarily involving fluorine and hydrocarbon sources. Key suppliers in this segment provide high-purity monomers, such as tetrafluoroethylene (TFE) and perfluorovinyl ethers containing sulfonic acid precursors, which are the foundational building blocks for PFSA polymers. This stage is characterized by a limited number of highly specialized chemical manufacturers with advanced capabilities in fluorochemistry, controlling the supply of critical intermediates. The quality and purity of these raw materials are paramount, as they directly impact the performance and durability of the final membrane. Innovation at this stage focuses on developing more cost-effective and environmentally friendly synthesis routes for the monomers, while ensuring a consistent supply to meet the growing demand.

Moving downstream, the value chain encompasses the sophisticated process of polymer synthesis and membrane fabrication. This involves polymerizing the specialty monomers to create the PFSA ionomer resin, followed by various membrane casting or extrusion techniques to form thin, durable films. Leading manufacturers in this segment possess proprietary technologies for optimizing membrane thickness, porosity, and surface chemistry to achieve desired proton conductivity and mechanical properties. Further downstream are the Membrane Electrode Assembly (MEA) integrators, who combine the PFSA membrane with catalyst layers (typically platinum-group metals), gas diffusion layers, and bipolar plates to create the core component of fuel cells and electrolyzers. These integrators work closely with system manufacturers to ensure the MEA meets specific performance and durability requirements for the final application. This stage demands precision engineering and advanced materials science expertise, as the interface between the membrane and catalyst layers is critical for overall device efficiency and lifespan.

The distribution channel for PFSA PEMs and integrated MEAs is typically multi-layered, involving both direct and indirect routes to reach the end-user. Direct sales are common for large-volume purchases or specialized applications, where membrane manufacturers and MEA integrators establish direct relationships with major automotive OEMs, energy companies, and industrial gas producers. This allows for customized product development, technical support, and long-term supply agreements. Indirect channels involve a network of specialized distributors and sales agents who cater to smaller volume buyers, research institutions, and niche markets. These distributors often provide localized support, warehousing, and logistical services, broadening market reach. The entire value chain is characterized by a high degree of technical expertise, stringent quality control, and a strong emphasis on R&D, as continuous innovation is essential to address performance demands, reduce costs, and enhance the sustainability of PFSA PEM technologies across various critical applications in the hydrogen economy and beyond.

Perfluorosulfonic Acid Proton Exchange Membrane Market Potential Customers

The potential customers for Perfluorosulfonic Acid Proton Exchange Membranes (PFSA PEMs) are incredibly diverse, spanning across multiple high-growth industries that are actively pursuing clean energy and advanced electrochemical solutions. The primary end-users and buyers of these critical components are typically manufacturers of fuel cell systems and electrolyzers. Within the automotive sector, this includes major vehicle Original Equipment Manufacturers (OEMs) that are developing and mass-producing hydrogen Fuel Cell Electric Vehicles (FCEVs) such as passenger cars, buses, and heavy-duty trucks. These companies seek high-performance, durable, and cost-effective membranes to power their next-generation clean transportation solutions. Beyond direct vehicle manufacturers, other automotive-related entities, such as forklift manufacturers and specialized vehicle developers for mining or port operations, also represent significant potential customers, requiring robust PEM technology for their industrial fleet electrification initiatives.

Another substantial customer base resides within the energy and power generation sector. This encompasses large industrial gas producers and chemical companies investing heavily in the production of green hydrogen through water electrolysis, utilizing PEM electrolyzer technology. These firms are critical for scaling up renewable hydrogen supply chains, and their demand for PFSA PEMs is driven by the need for high efficiency, operational flexibility, and long-term reliability in large-scale hydrogen plants. Utility companies and independent power producers focusing on grid modernization and decarbonization also represent key buyers, as they implement stationary fuel cells for distributed power generation, combined heat and power (CHP) systems, and backup power solutions for critical infrastructure. For these customers, the stability, power density, and longevity of the membranes are paramount. Furthermore, companies involved in advanced energy storage, particularly those developing redox flow batteries for grid-scale applications, require PFSA membranes for their superior ion exchange properties and chemical resistance.

Beyond these major segments, a growing number of diverse industries constitute potential customers for PFSA PEMs. This includes manufacturers of portable electronic devices and specialized industrial equipment seeking compact and efficient power sources, as well as companies in the aerospace and defense sectors developing fuel cell systems for drones, auxiliary power units, and other specialized applications requiring high power-to-weight ratios. Research institutions, universities, and government laboratories engaged in fundamental and applied research in electrochemistry, materials science, and energy systems are consistent buyers of PFSA membranes for experimental purposes, prototype development, and characterization studies. Moreover, specific sectors within chemical processing and environmental technology that require advanced separation processes or electrochemical reactors also leverage PFSA membranes for their unique properties. The expansion into these varied applications underscores the broad utility and growing market penetration of PFSA PEM technology across a spectrum of industries committed to innovation and sustainability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 10.5 Billion |

| Growth Rate | 14.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont, Asahi Kasei Corporation, Solvay S.A., W. L. Gore & Associates, Inc., 3M Company, AGC Inc., Sinope, FuelCell Energy, Inc., Ballard Power Systems Inc., Plug Power Inc., Freudenberg Sealing Technologies, Toray Industries, Inc., Sumitomo Chemical Co., Ltd., Daikin Industries, Ltd., FUMATECH GmbH, EKAT Co., Ltd., NEES Co., Ltd., Shenzhen Wotai Advanced Material Co., Ltd., Suzhou CSFC Membrane Technology Co., Ltd., Giner Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Perfluorosulfonic Acid Proton Exchange Membrane Market Key Technology Landscape

The Perfluorosulfonic Acid Proton Exchange Membrane (PFSA PEM) market is characterized by a sophisticated and evolving technological landscape, driven by continuous innovation aimed at enhancing performance, durability, and cost-effectiveness. At its core, the technology relies on advanced polymer synthesis techniques to produce fluorinated monomers and subsequently, the PFSA ionomer resin. This involves highly specialized chemical processes to ensure the desired molecular weight, purity, and distribution of sulfonic acid groups, which are critical for proton conductivity. Key advancements in this area focus on developing alternative, more environmentally benign synthesis routes and optimizing reaction conditions to control polymer architecture. Following polymer synthesis, various membrane fabrication technologies are employed, including solution casting, extrusion, and dispersion coating. These processes are constantly being refined to produce ultra-thin, mechanically robust, and defect-free membranes with precise thickness control, essential for maximizing power density and minimizing material usage in electrochemical devices.

Beyond the fundamental membrane material, a significant portion of the technological landscape is dedicated to improving the overall Membrane Electrode Assembly (MEA). This involves developing advanced methods for integrating the PFSA membrane with catalyst layers (typically composed of platinum nanoparticles dispersed on carbon supports) and gas diffusion layers (GDLs). Innovations include novel catalyst support materials to reduce platinum loading, ionomer-catalyst interfacial engineering to optimize proton transport to reaction sites, and advanced hot-pressing techniques to ensure excellent adhesion and electrical contact between layers. The development of composite membranes is another crucial technological trend, where PFSA is combined with reinforcing materials like ePTFE (expanded PTFE) or inorganic fillers (e.g., silica, ceria) to enhance mechanical strength, reduce swelling, improve high-temperature performance, and mitigate radical attack, thereby extending membrane lifespan. These composite structures address some of the inherent limitations of pure PFSA membranes, enabling operation under more challenging conditions.

Furthermore, the technology landscape includes significant efforts in developing diagnostic and characterization tools to better understand membrane degradation mechanisms and performance limitations, leading to the design of more durable materials. This involves advanced electrochemical testing, in-situ and operando spectroscopy, and sophisticated imaging techniques to analyze changes in membrane structure and properties during operation. New approaches to manufacturing scalability, such as continuous roll-to-roll processing for membrane and MEA production, are also critical for bringing down costs and meeting the rapidly expanding demand from fuel cell and electrolyzer industries. Recycling and recovery technologies for PFSA membranes are an emerging area, driven by sustainability goals and the need to manage fluoropolymer waste. The integration of artificial intelligence and machine learning for material design, process optimization, and predictive maintenance further signifies the cutting-edge nature of the technological advancements defining the PFSA PEM market, collectively striving for higher efficiency, lower cost, and extended operational life across diverse applications.

Regional Highlights

- Asia Pacific: This region stands as the dominant force in the PFSA PEM market, primarily driven by robust government support for hydrogen energy initiatives and the rapid expansion of the electric vehicle market, particularly in China, Japan, and South Korea. These countries are leaders in both fuel cell vehicle deployment and large-scale green hydrogen production projects, fostering significant demand for high-performance membranes. Significant investments in manufacturing infrastructure and an aggressive push for decarbonization across industrial sectors further solidify APAC's leading position. The region also benefits from a strong base of chemical manufacturers and a burgeoning research ecosystem focused on advanced materials.

- Europe: Europe is experiencing substantial growth, propelled by ambitious policies such as the European Green Deal and national hydrogen strategies (e.g., Germany's National Hydrogen Strategy). These initiatives are accelerating the deployment of PEM electrolyzers for renewable hydrogen production and fuel cells for heavy-duty transport and stationary applications. Strong regulatory frameworks, significant public and private investments in hydrogen infrastructure, and a focus on circular economy principles are key drivers. Countries like Germany, France, and the UK are at the forefront of this regional expansion, driven by a collective commitment to achieving climate neutrality.

- North America: The North American market, particularly the United States, is undergoing a resurgence due to supportive government policies like the Inflation Reduction Act (IRA) and the Infrastructure Investment and Jobs Act. These legislative frameworks provide substantial incentives for clean hydrogen production, fuel cell manufacturing, and the deployment of hydrogen infrastructure. The region benefits from a strong R&D base, a growing number of fuel cell and electrolyzer manufacturers, and increasing adoption in heavy-duty transportation and industrial applications. Canada and Mexico are also exploring hydrogen pathways, contributing to regional growth.

- Latin America: While currently a smaller market, Latin America presents significant long-term growth potential, particularly in countries like Brazil, Chile, and Argentina, which possess abundant renewable energy resources ideal for green hydrogen production. Early-stage pilot projects and emerging national hydrogen strategies are laying the groundwork for future market expansion. The focus is primarily on industrial decarbonization and the potential for hydrogen exports, gradually increasing demand for PEM technologies.

- Middle East & Africa (MEA): The MEA region is emerging as a critical player, especially driven by countries like Saudi Arabia and the UAE, which are investing heavily in large-scale green hydrogen projects, leveraging their vast solar energy potential. These nations aim to become global leaders in hydrogen exports, creating substantial demand for PEM electrolyzers. South Africa is also exploring hydrogen fuel cell applications for mining and transportation. The region's strategic location and commitment to diversifying its energy economy position it for significant future growth in the PFSA PEM market.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Perfluorosulfonic Acid Proton Exchange Membrane Market.- DuPont

- Asahi Kasei Corporation

- Solvay S.A.

- W. L. Gore & Associates, Inc.

- 3M Company

- AGC Inc.

- Sinope

- FuelCell Energy, Inc.

- Ballard Power Systems Inc.

- Plug Power Inc.

- Freudenberg Sealing Technologies

- Toray Industries, Inc.

- Sumitomo Chemical Co., Ltd.

- Daikin Industries, Ltd.

- FUMATECH GmbH

- EKAT Co., Ltd.

- NEES Co., Ltd.

- Shenzhen Wotai Advanced Material Co., Ltd.

- Suzhou CSFC Membrane Technology Co., Ltd.

- Giner Inc.

Frequently Asked Questions

What are Perfluorosulfonic Acid Proton Exchange Membranes (PFSA PEMs)?

PFSA PEMs are specialized ion-conducting polymers, typically derived from fluoropolymers with sulfonic acid functional groups, designed to efficiently conduct protons while being electronically insulating and chemically stable. They are the core electrolyte in fuel cells and electrolyzers.

What are the primary applications of PFSA PEMs?

The main applications include Proton Exchange Membrane Fuel Cells (PEMFCs) for automotive (FCEVs) and stationary power, and Proton Exchange Membrane Electrolyzers (PEMELs) for green hydrogen production. They are also used in redox flow batteries and various electrochemical sensors.

What factors are driving the growth of the PFSA PEM market?

Key drivers include global decarbonization efforts, increasing investments in the hydrogen economy, supportive government policies and incentives for clean energy, and the growing adoption of fuel cell electric vehicles and green hydrogen technologies worldwide.

What are the main challenges faced by the PFSA PEM market?

Significant challenges include the high manufacturing cost of PFSA membranes, issues related to membrane durability and long-term stability under harsh operating conditions, and supply chain vulnerabilities for specialized fluorinated raw materials.

How is Artificial Intelligence (AI) impacting the PFSA PEM market?

AI is accelerating material discovery and design, optimizing manufacturing processes for cost reduction and consistency, enabling predictive modeling for enhanced durability, and improving real-time operational efficiency of fuel cell and electrolyzer systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager