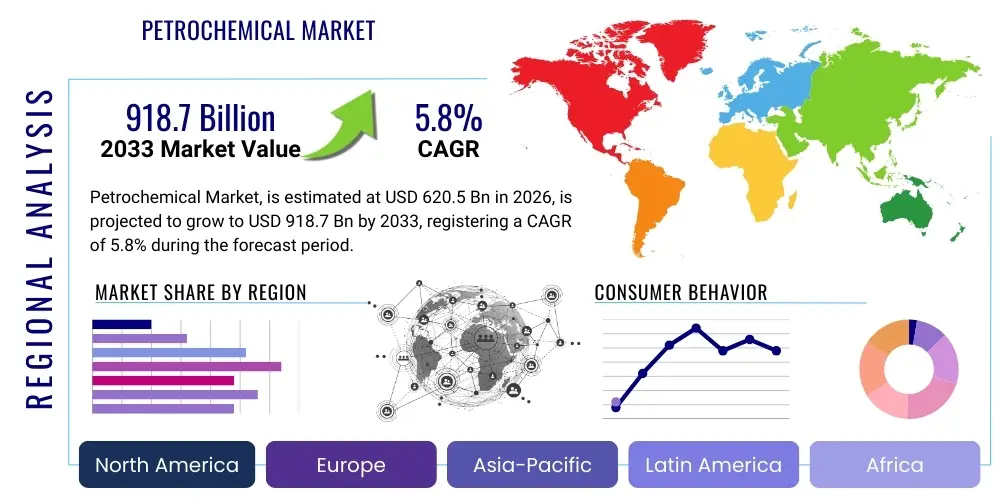

Petrochemical Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436754 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Petrochemical Market Size

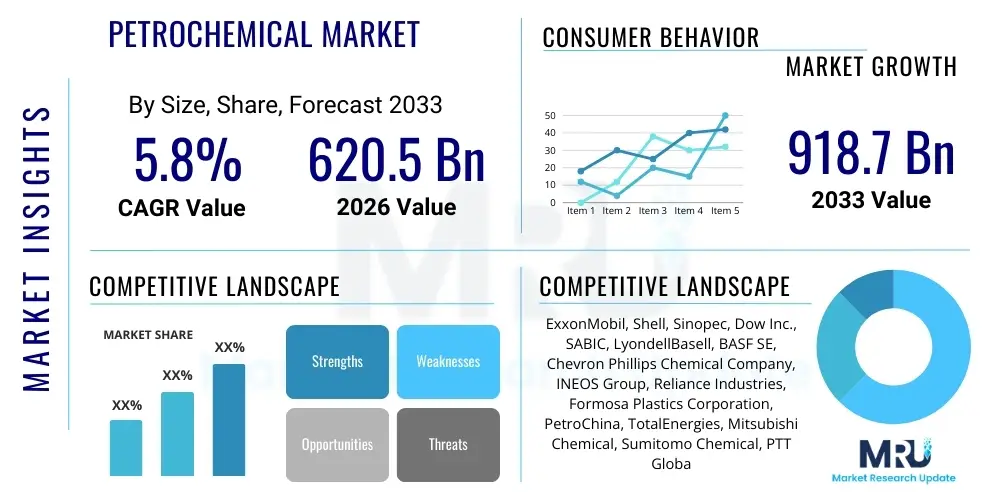

The Petrochemical Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 620.5 Billion in 2026 and is projected to reach USD 918.7 Billion by the end of the forecast period in 2033.

This robust growth trajectory is primarily underpinned by relentless demand from key downstream industries, notably packaging, automotive, construction, and textiles. Petrochemicals, derived primarily from crude oil and natural gas, form the foundational building blocks for almost all modern materials, including plastics, resins, fibers, and synthetic rubber. The expanding middle class in developing economies, particularly across Asia Pacific, is fueling an unprecedented need for consumer goods, infrastructure development, and sophisticated medical supplies, all of which rely heavily on petrochemical derivatives, thereby ensuring sustained market expansion throughout the forecast horizon.

Furthermore, shifts in feedstock preference, moving towards lighter and more cost-effective sources like ethane and propane, especially in regions with abundant shale gas reserves such as North America, are enhancing production margins and encouraging capital investment in new cracking capacity. While price volatility in crude oil remains a significant factor influencing operational costs and profitability across the value chain, the structural integration of refining and petrochemical complexes (integrated downstream operations) is helping major players mitigate risk and achieve greater economies of scale. Sustainability pressures are also catalyzing innovation, driving R&D into bio-based plastics and chemical recycling technologies, which will incrementally contribute to market value over the long term.

Petrochemical Market introduction

The Petrochemical Market encompasses the vast production of essential chemical building blocks derived from hydrocarbon sources, primarily naphtha, natural gas, and liquefied petroleum gas (LPG). Key foundational products include olefins (ethylene, propylene, butadiene) and aromatics (benzene, toluene, xylenes), which are indispensable intermediates for manufacturing polymers, synthetic fibers, detergents, solvents, and fertilizers. These chemicals underpin critical industrial applications, serving as vital components in automotive parts, electronic casings, medical devices, and construction materials. The intrinsic benefits of petrochemical products—such as lightweight properties, durability, cost-effectiveness, and versatility—make them irreplaceable in modern manufacturing and consumption patterns, driving substantial industrial activity worldwide.

Major applications of petrochemicals span diverse economic sectors. Polyethylene and polypropylene are dominant in packaging and consumer goods; PVC is crucial for piping and construction; while specialized chemicals like glycols and synthetic rubber are essential for the automotive sector and manufacturing of performance components. The global population growth, coupled with rapid urbanization and industrialization in emerging markets, acts as a primary driving factor. Furthermore, technological advancements leading to superior material performance (e.g., high-performance engineering plastics) and increasing adoption of petrochemical-derived products in sustainable energy infrastructure, such as composites for wind turbine blades and battery components, continue to amplify demand.

However, the industry faces structural challenges, including stringent environmental regulations concerning plastic waste and carbon emissions. In response, market participants are heavily investing in circular economy models, focusing on chemical recycling methods, and exploring alternative, renewable feedstocks derived from biomass. The interplay between feedstock availability, geopolitical stability impacting energy prices, and increasing consumer focus on sustainable sourcing dictates the strategic direction of market players. Overall, the market remains cyclical yet fundamentally crucial to the global economy, characterized by continuous capacity expansion and strategic integration to maintain competitive advantage.

Petrochemical Market Executive Summary

The Petrochemical Market Executive Summary highlights a period of strategic integration and geographical realignment, driven by significant shifts in global feedstock dynamics and increasing regulatory scrutiny. Business trends indicate a strong move towards massive, integrated refining and petrochemical complexes, particularly in the Middle East and Asia, designed to maximize efficiency and capture value across the hydrocarbon chain. Companies are prioritizing operational resilience against oil price volatility through diversification of feedstocks, favoring abundant and cheaper natural gas liquids (NGLs) over traditional crude oil derivatives. Furthermore, strategic mergers and acquisitions focusing on specialization (e.g., performance plastics or specialty chemicals) are prevalent, aiming to create high-margin revenue streams independent of commodity cycles. Investment in digitalization and automation of production processes is also accelerating, enhancing plant safety, optimizing energy consumption, and reducing overall manufacturing costs, directly impacting bottom-line performance across the industry.

Regionally, Asia Pacific maintains its undisputed position as the engine of demand growth, led by China, India, and Southeast Asian nations, where rapid infrastructure development and manufacturing expansion drive the consumption of polymers and intermediates. North America, capitalizing on the shale gas revolution, has cemented its status as a highly competitive, low-cost producer, leading to significant export capabilities, especially in ethylene and derivatives. Europe, constrained by high energy costs and strict environmental mandates, is shifting focus from basic commodities to high-value, sustainable specialty chemicals and advanced recycling technologies. The Middle East remains critical, leveraging its vast hydrocarbon reserves for large-scale production of base chemicals, focusing on securing long-term supply agreements with Asian consumers, solidifying global trade flows.

In terms of segments, the polymer segment, dominated by polyethylene (PE) and polypropylene (PP), retains the largest market share due to ubiquitous use in packaging and consumer goods. However, the specialty petrochemicals segment—including advanced engineering plastics, elastomers, and functional additives—is exhibiting the highest growth rate, fueled by demand from the electric vehicle (EV) sector, sophisticated electronics, and high-performance medical applications. Feedstock analysis reveals a consistent trend towards gas-based feedstocks (ethane, propane) where economically viable, yet naphtha remains essential for producing specific aromatics required for high-grade textiles and composite materials. Future growth hinges on successful implementation of sustainability mandates and commercialization of bio-based substitutes, transforming the segment structure gradually over the next decade.

AI Impact Analysis on Petrochemical Market

Common user questions regarding AI's influence in the Petrochemical Market predominantly revolve around operational efficiency, safety enhancement, and carbon reduction strategies. Users frequently inquire about how AI-driven predictive maintenance can reduce unplanned downtime in complex crackers, the extent to which machine learning algorithms can optimize feedstock blending for fluctuating energy prices, and the role of AI in complex process control systems to maximize yield and purity. Significant concerns also focus on the financial justification and return on investment (ROI) for implementing advanced AI solutions, given the high upfront cost, and the need for specialized data infrastructure and skilled personnel to manage these new systems. Another key theme is the application of AI in chemical research, specifically speeding up the discovery and scaling of sustainable and circular chemistry pathways, such as developing novel catalysts for chemical recycling or bio-based chemical production.

AI's introduction signifies a paradigm shift from reactive maintenance and standardized operational procedures to highly dynamic, predictive, and autonomous control systems within petrochemical facilities. Predictive analytics, utilizing massive sensor data streams from production units, enables early detection of equipment failure, minimizing catastrophic risks and extending asset lifecycles, which is crucial in high-temperature, high-pressure environments. Furthermore, AI models are essential for optimizing complex supply chains, managing fluctuating inventory levels, and forecasting demand patterns with greater accuracy than traditional statistical models. This optimization leads directly to reductions in working capital and minimizes waste generation across the extensive petrochemical logistics network.

Moreover, AI contributes significantly to environmental stewardship and meeting corporate ESG (Environmental, Social, and Governance) targets. Machine learning algorithms can precisely model and control reactor conditions to minimize byproduct formation and optimize energy use, directly lowering the operational carbon footprint. Data-driven insights derived from AI systems are also informing corporate strategies regarding sustainable product development, helping to identify economically viable routes for integrating recycled or bio-based content into mass-produced polymers. Although implementation faces hurdles related to data integration across legacy systems and ensuring cybersecurity in operational technology (OT) environments, the long-term benefits in safety, cost reduction, and sustainability are driving widespread adoption among global market leaders.

- AI-driven Predictive Maintenance: Reduces unplanned downtime and operational risks in cracking units and polymerization reactors.

- Process Optimization: Utilizes Machine Learning (ML) to dynamically adjust temperature, pressure, and catalyst ratios, maximizing product yield and purity.

- Supply Chain Management: Enhances logistics efficiency, feedstock procurement, and inventory forecasting based on real-time market signals.

- Energy Efficiency: Optimizes utility consumption and plant-wide energy systems, significantly reducing operating expenditures and carbon emissions.

- Catalyst Discovery: Accelerates R&D efforts in developing high-performance, sustainable catalysts for novel chemical processes and recycling.

- Safety and Risk Management: Implements real-time monitoring and anomaly detection to enhance worker safety and prevent environmental incidents.

DRO & Impact Forces Of Petrochemical Market

The Petrochemical Market is shaped by a powerful confluence of drivers (D), restraints (R), and opportunities (O), whose collective influence determines the competitive landscape and future investment decisions (Impact Forces). Key drivers include the exponential growth in demand from end-use sectors like construction, automotive, and fast-moving consumer goods (FMCG), particularly in rapidly industrializing regions. The accessibility and competitive pricing of abundant natural gas liquids (NGLs), especially in North America and the Middle East, provide a sustained cost advantage for large-scale production. Counterbalancing these are significant restraints, notably the volatile price fluctuations of crude oil and natural gas, which directly impact feedstock costs and operational profitability. Furthermore, increasing global regulatory pressures targeting plastic waste reduction, imposing bans on single-use plastics, and stringent environmental compliance standards across production facilities pose substantial technical and financial challenges to industry players.

Opportunities for growth are robustly anchored in the transition towards a circular economy and technological innovation. The development and scaling of advanced chemical recycling technologies present a massive opportunity to tap into the waste stream as a secondary feedstock, aligning with sustainability mandates and reducing reliance on virgin fossil fuels. The burgeoning electric vehicle (EV) sector creates demand for specialized, high-performance engineering plastics and lighter composite materials, opening new, high-margin product avenues. Moreover, the exploration and commercialization of bio-based and renewable petrochemical alternatives offer a pathway for long-term supply resilience and differentiation in environmentally conscious markets. Strategic capital expenditure focused on modernization and integration of complexes to improve energy efficiency further strengthens the market’s underlying economics.

The primary impact forces in this sector are the intense global competition resulting from continuous capacity additions in Asia and the Middle East, which keeps pricing pressure high, and the structural necessity to decarbonize operations. The combination of mandatory governmental regulations concerning emissions and growing shareholder and consumer demand for ESG compliance forces rapid innovation in process technology (e.g., carbon capture utilization and storage - CCUS) and product design (design for recyclability). These forces necessitate massive capital outlay but ultimately dictate market leadership, favoring companies that can successfully manage the balance between low-cost production efficiency and advanced sustainable practices. Geopolitical stability, especially concerning global energy transport and infrastructure, also exerts a strong, cyclical impact on the market's trajectory.

Segmentation Analysis

Segmentation analysis of the Petrochemical Market reveals a highly diversified structure classified primarily by product type (Olefins, Aromatics, Methanol, etc.), feedstock (Naphtha, Ethane, Propane, etc.), and end-use application (Packaging, Construction, Automotive, Textiles, etc.). This segmentation is critical for understanding market dynamics, as profitability and growth rates vary significantly based on the inherent volatility of the input materials and the maturity or specialization level of the downstream products. For instance, basic olefins and aromatics segments are characterized by high volume, commodity pricing, and strong reliance on global trade balances, whereas the specialized derivatives segment often enjoys superior margins due to proprietary technology and application specificity in niche markets like aerospace or high-end medical devices. Analyzing these segments provides strategic insights into investment opportunities and helps market players optimize their product portfolios and operational footprint based on regional feedstock availability and demand centers.

The segmentation by feedstock remains a dominant factor influencing regional competitive parity. Regions leveraging abundant natural gas reserves (like North America and the Middle East) focus heavily on ethane cracking for ethylene production, maintaining a substantial cost advantage. Conversely, regions like Europe and Asia, which rely more on imported crude oil, utilize naphtha as the primary feedstock, enabling them to produce a broader range of products, including heavier olefins and essential aromatics, although typically at a higher operating cost. The ongoing shift toward flexible feed crackers capable of processing both gas liquids and liquid feedstocks represents a strategic move to hedge against volatility and maximize utilization rates across the diverse global production base. Understanding this feedstock flexibility is key to forecasting global supply movements and competitive price points for fundamental petrochemical commodities.

Furthermore, the end-use segmentation highlights where future growth will be concentrated. The packaging sector, particularly flexible packaging, driven by e-commerce expansion, remains the largest volume consumer. However, the fastest growth is observed in technical textiles, high-performance composites for lighter vehicles, and specialized polymers for advanced electronic components and renewable energy technologies (e.g., solar panel frames and battery casings). The increasing demand for sustainable materials is also driving a new segmentation layer related to recycled and bio-based content polymers. Companies that successfully differentiate their offerings based on superior performance, compliance with circular economy standards, and documented low-carbon footprint will capture disproportionate market share in these emerging high-growth end-use segments.

- By Product Type:

- Olefins (Ethylene, Propylene, Butadiene)

- Aromatics (Benzene, Toluene, Xylenes, Styrene)

- Methanol

- Synthetic Rubber

- Plastics (Polyethylene, Polypropylene, PVC, PET)

- Others (Acrylonitrile, EO/EG, Phenol, Acetone)

- By Feedstock:

- Naphtha

- Ethane

- Propane

- Butane

- Gas Oil

- Others (Bio-based and Recycled Streams)

- By End-Use Application:

- Packaging (Flexible and Rigid)

- Construction

- Automotive and Transportation

- Textiles and Apparel

- Consumer Goods

- Industrial and Manufacturing

- Agriculture

- Pharmaceutical and Healthcare

Value Chain Analysis For Petrochemical Market

The Petrochemical Market value chain initiates with the Upstream segment, dominated by the exploration and production of crude oil and natural gas, the primary raw materials. This segment involves large integrated energy companies or national oil companies (NOCs) that secure and process feedstock (naphtha, ethane, propane, butane). Availability, purity, and cost of these feedstocks are the most critical factors determining the competitiveness of subsequent operations. Major infrastructure investments in pipelines, gas processing plants, and port facilities are essential components of the upstream phase, ensuring a stable and cost-effective supply to the crackers and reformers. Geopolitical stability and long-term supply contracts heavily influence the economic viability of the entire chain at this foundational stage.

The Midstream component involves the core transformation processes, primarily thermal cracking (steam crackers) for olefins and catalytic reforming for aromatics. This stage is capital-intensive and technologically sophisticated, converting basic hydrocarbons into chemical intermediates. Major integrated complexes often house both refining and petrochemical units, optimizing energy use and material transfer, which reduces logistical costs. Once the base chemicals are produced, they enter the Downstream manufacturing phase, where they are converted into a vast array of derivatives such as polymers (plastics), synthetic fibers, resins, and specialty chemicals. Companies involved in this phase focus heavily on polymerization technology, material science innovation, and customized product formulations to meet the stringent specifications of various end-use industries like automotive and construction.

Distribution Channel analysis reveals a complex network involving direct sales to large industrial customers (e.g., automotive OEMs or major packaging producers), sales through regional distributors for smaller batches, and an increasingly sophisticated logistics system for global bulk transport. Direct distribution ensures quality control and strong customer relationships, particularly for specialty chemicals. Indirect channels, relying on third-party chemical distributors, are crucial for market penetration in fragmented geographical areas and servicing small-to-medium enterprises (SMEs). Given the nature of petrochemicals, regulatory compliance regarding transportation, handling, and storage of hazardous materials is paramount across all distribution methodologies. E-commerce platforms are also beginning to emerge for specialized chemical intermediates, streamlining procurement for smaller, technical buyers, although bulk commodities remain traded via traditional contracts and futures markets.

Petrochemical Market Potential Customers

The potential customer base for the Petrochemical Market is exceptionally broad, spanning nearly every major manufacturing and service sector globally. End-users are primarily categorized by their industrial application, reflecting high volume demand for commodity polymers and specific requirements for specialized intermediates. Major bulk buyers include large multinational packaging conglomerates that utilize polyethylene (PE), polypropylene (PP), and PET for consumer goods containment and preservation. Similarly, the global construction industry is a foundational consumer, relying heavily on PVC, insulation materials (polyurethanes), and protective coatings derived from petrochemicals for modern infrastructure development, pipe systems, and housing components. These industries require consistent supply, stringent quality control, and often engage in long-term procurement contracts directly with major producers to secure favorable pricing and volume stability.

Beyond these foundational sectors, high-growth, high-value potential customers reside in the advanced manufacturing and technology industries. The automotive sector, undergoing a massive shift towards electrification and lightweighting, requires advanced engineering plastics (like polycarbonates, nylons, and ABS) and high-performance elastomers for battery casings, internal components, and body panels that improve fuel efficiency and EV range. The electronics sector utilizes specialized petrochemical derivatives, such as high-purity solvents, photoresists, and advanced resins for manufacturing semiconductors, circuit boards, and device casings, demanding materials with extreme thermal stability and electrical insulation properties. These customers prioritize innovation, material performance, and supply chain transparency, often forming collaborative research partnerships with petrochemical producers.

Furthermore, emerging customer segments offering significant future potential include the healthcare and pharmaceutical industries, which require ultra-pure, sterile polymers for medical devices, drug delivery systems, and sophisticated diagnostic equipment. The agriculture sector utilizes petrochemicals for fertilizers (ammonia/urea), pesticides, and irrigation piping, driving sustainable food production. Finally, the growing market for specialized lubricants and functional fluids across industrial machinery and aerospace applications represents a niche, yet consistently high-margin, customer group. Successful market players focus on tailoring their product development and regulatory compliance capabilities to meet the stringent quality and safety requirements inherent in serving these diverse and exacting industrial customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 620.5 Billion |

| Market Forecast in 2033 | USD 918.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ExxonMobil, Shell, Sinopec, Dow Inc., SABIC, LyondellBasell, BASF SE, Chevron Phillips Chemical Company, INEOS Group, Reliance Industries, Formosa Plastics Corporation, PetroChina, TotalEnergies, Mitsubishi Chemical, Sumitomo Chemical, PTT Global Chemical, Eni S.p.A., Braskem, Sasol, LG Chem |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Petrochemical Market Key Technology Landscape

The Petrochemical Market is undergoing continuous technological evolution driven by the need for cost reduction, process efficiency, and environmental sustainability. A cornerstone of this landscape is the development and adoption of high-selectivity catalysts, which enable producers to convert feedstocks into target chemicals with higher yield and purity, minimizing energy consumption and waste. Innovations in catalyst science are particularly critical for advanced processes like metathesis and selective oxidation, essential for creating niche specialty chemicals. Additionally, the proliferation of flexible feed crackers represents a major technological advancement, allowing plants to switch seamlessly between heavier naphtha and lighter NGLs based on economic signals, significantly enhancing asset utilization and mitigating the risk associated with feedstock price volatility across global markets.

Sustainability technologies are rapidly reshaping the investment priorities within the sector. Key technologies include advanced chemical recycling (pyrolysis, gasification, and depolymerization), which aims to break down waste plastics into chemical feedstock that can be re-introduced into the cracker, completing the circular loop. Furthermore, Carbon Capture, Utilization, and Storage (CCUS) technologies are becoming essential for large-scale complexes to meet decarbonization goals, capturing CO2 emissions from cracking and reforming processes and either storing them permanently or utilizing them in downstream production, such as methanol or urea synthesis. These environmental technologies, while requiring substantial capital investment, are increasingly viewed not just as regulatory compliance tools but as strategic competitive differentiators.

The implementation of advanced process control (APC) and digitalization, often leveraging Artificial Intelligence (AI) and the Industrial Internet of Things (IIoT), represents a third critical pillar of the current technology landscape. Sensors embedded throughout the plant generate vast quantities of data, which AI algorithms analyze to predict equipment failure, optimize reactor conditions in real-time, and detect subtle operational deviations far more effectively than human operators. This technological convergence enables dynamic optimization of complex multi-variable processes, leading to enhanced safety, higher throughput, and demonstrable reductions in energy intensity, pushing the industry towards the goal of creating 'smart' and autonomous manufacturing facilities globally.

Regional Highlights

Regional analysis underscores the diverse dynamics and production capabilities shaping the global Petrochemical Market, driven primarily by feedstock economics, local demand maturity, and regulatory environments. Asia Pacific (APAC) currently dominates the market both in terms of consumption and production capacity expansion. This region, spearheaded by China, India, and Southeast Asia, exhibits insatiable demand fueled by robust economic expansion, urbanization, and continuous infrastructure projects. Companies are heavily investing in new mega-complexes in coastal areas of China and India to meet domestic plastic, fertilizer, and fiber demand. APAC’s production landscape relies heavily on imported feedstock (naphtha and LPG), though some regions are increasingly tapping into domestic gas resources, resulting in intense intra-regional competition and significant influence on global trade balances.

North America, benefiting from the sustained shale gas revolution, stands out as the world’s most cost-competitive producer of fundamental olefins, particularly ethylene. The abundance of low-cost ethane has catalyzed massive investment in new cracker capacity along the U.S. Gulf Coast, transforming the region from a net importer to a significant global exporter of polyethylene and other derivatives. This structural advantage gives North American producers resilient profit margins, enabling them to aggressively compete in global commodity markets, especially in Asia. Future regional growth is likely centered around debottlenecking existing assets and strategic expansion into high-value specialty petrochemicals that utilize locally abundant intermediates.

Europe, facing high energy costs and mature demand for commodity plastics, is pivoting its strategy towards high-value specialty chemicals, innovation, and leadership in circular economy technologies. The region is characterized by stringent environmental regulations, which are driving investment into chemical recycling infrastructure, bio-based chemical platforms, and sustainable process innovation (e.g., green hydrogen utilization). European producers maintain strong expertise in complex chemical synthesis and advanced polymers required by sectors like aerospace, performance automotive, and pharmaceuticals. Meanwhile, the Middle East, leveraging its integrated oil and gas reserves, focuses on large-scale, cost-effective production of base chemicals and intermediates, primarily targeting export markets in Asia and Africa, solidifying its role as the global foundational supplier for bulk petrochemicals.

- Asia Pacific (APAC): Dominates consumption and capacity expansion; high demand driven by urbanization, infrastructure, and manufacturing growth in China and India.

- North America: Cost leader in olefins (ethylene) due to low-cost shale gas (ethane); significant exporter of polymers and intermediates globally.

- Europe: Focuses on high-value specialty chemicals, advanced material science, and leading the implementation of chemical recycling and bio-based plastics due to stringent regulations.

- Middle East and Africa (MEA): Major global exporter of basic chemicals; integrates refining and petrochemical operations for feedstock advantage; strategic tie-ups secure Asian market access.

- Latin America: Characterized by significant domestic demand potential, but growth is often hampered by local economic volatility and dependence on commodity imports, with Brazil being the key regional producer.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Petrochemical Market.- ExxonMobil Corporation

- Shell plc

- China Petrochemical Corporation (Sinopec)

- Dow Inc.

- Saudi Basic Industries Corporation (SABIC)

- LyondellBasell Industries N.V.

- BASF SE

- Chevron Phillips Chemical Company LLC

- INEOS Group Holdings S.A.

- Reliance Industries Limited

- Formosa Plastics Corporation

- PetroChina Company Limited

- TotalEnergies SE

- Mitsubishi Chemical Group Corporation

- Sumitomo Chemical Co., Ltd.

- PTT Global Chemical Public Company Limited

- Eni S.p.A.

- Braskem S.A.

- Sasol Limited

- LG Chem Ltd.

- Borealis AG

- Equate Petrochemical Company K.S.C.C.

- Adani Group

Frequently Asked Questions

Analyze common user questions about the Petrochemical market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Petrochemical Market?

Market growth is primarily driven by escalating global demand for polymers in packaging, construction, and automotive industries, especially across emerging economies. Favorable access to low-cost natural gas liquid (NGL) feedstocks in North America and the Middle East also substantially boosts production capacity and competitive advantage.

How is plastic waste regulation impacting the future of petrochemical production?

Stringent regulations on single-use plastics and waste are fundamentally reshaping the industry, necessitating heavy investment in advanced chemical recycling technologies (e.g., pyrolysis) and the development of bio-based substitutes. This drives a shift toward circular economy models and higher value specialty chemicals.

Which feedstock dominates the market, and how is the trend changing?

While naphtha remains crucial for producing essential aromatics and heavier derivatives, there is a dominant global trend toward utilizing lighter, gas-based feedstocks like ethane and propane, particularly in the U.S. and the Middle East, due to their significant cost advantages and abundance from shale gas extraction.

What role does Artificial Intelligence (AI) play in modern petrochemical operations?

AI is crucial for enhancing operational efficiency, safety, and sustainability. It is used extensively for predictive maintenance to prevent plant failures, optimizing complex process control systems to maximize yield, and improving energy management to lower the overall carbon footprint of large integrated complexes.

Which geographical region represents the largest market share and why?

Asia Pacific (APAC), led by China and India, holds the largest market share. This dominance is attributed to high population density, rapid industrialization, massive infrastructure investment, and significant expansion in domestic manufacturing capabilities, driving unprecedented demand for polymers and derivatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Petrochemical Pumps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Chemical & Petrochemical IECS Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Chlorine Compressors Market Size Report By Type (Liquid Ring Compressors, Centrifugal Compressors), By Application (Chemical and Petrochemical Industries, Pharmaceutical, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Process Chemicals For Water Treatment Market Size Report By Type (.), By Application (Sugar & Ethanol, Biocides, Flocculants, Viscosity Reducer, Anti-foaming Agents, Deposit Control, Ethanol Neutralizer, Decoloring Agents, Others, Fertilizers, Defoamers, pH Boosters, Granulation Aids, Sludge Conditioners, Antiscalants, Phosphates, Biocides, Silica Dispersants, Strength Agents, Anti-caking Agents, Wetting Agents, Others, Geothermal Power Generation, Defoamers, pH Boosters, Antiscalants, Biocides, Dewatering Aids, Silica Scale Control, Calcium Carbonate scale control, Others, Petrochemical Manufacturing, Defoamers, pH Boosters, Antiscalants, Biocides, Solvents, Others, Refining, Catalysts, pH Boosters, Solvents, Corrosion Inhibitors, Oxidizers, Coagulants & Flocculants, Demulsifiers, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Frp Dual Laminate Tank Market Size Report By Type (Polypropylene & GRP, PVC-U & GRP, PVC-C & GRP, PVDF & GRP, ECTFE & GRP, Others), By Application (Irritating chemicals, Petrochemical products, High purity products, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager