Plastic Drums Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440242 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Plastic Drums Market Size

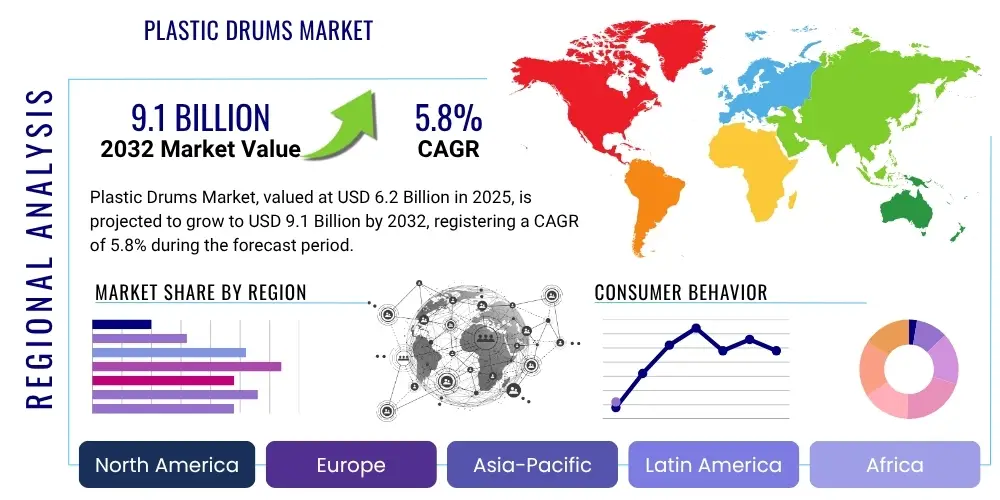

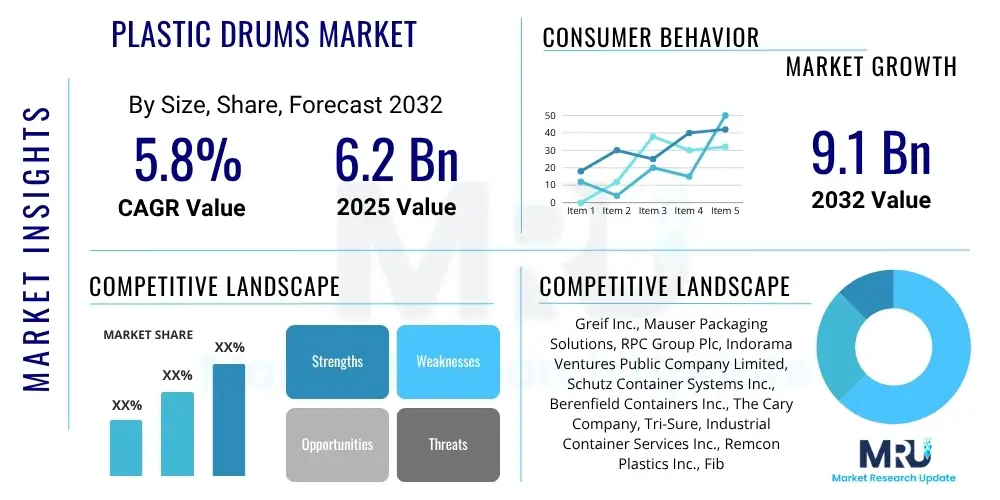

The Plastic Drums Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.54 Billion in 2026 and is projected to reach USD 3.78 Billion by the end of the forecast period in 2033.

Plastic Drums Market introduction

The plastic drums market encompasses the manufacturing, distribution, and sale of cylindrical containers primarily made from high-density polyethylene (HDPE) or other robust plastics. These drums are crucial for the safe and efficient storage and transportation of a wide range of materials, including chemicals, petroleum products, food ingredients, pharmaceuticals, and various industrial liquids. Their inherent durability, resistance to corrosion, and relatively light weight make them a preferred choice over traditional metal drums in numerous applications, offering significant logistical and cost advantages. The product's versatility allows for different capacities and designs, such as open-head for solids and viscous liquids, and tight-head for liquids, ensuring suitability for diverse industrial requirements.

Major applications for plastic drums span across several critical industries. In the chemical sector, they are indispensable for transporting corrosive acids, solvents, and hazardous materials, where their chemical inertness prevents contamination and ensures safety. The food and beverage industry utilizes them for bulk storage and transport of edible oils, syrups, concentrates, and flavorings, often with specific food-grade certifications. Additionally, pharmaceutical manufacturers rely on plastic drums for active pharmaceutical ingredients (APIs) and intermediates, ensuring sterile and secure containment. Their use extends to lubricants, paints, coatings, and agricultural chemicals, underscoring their broad utility.

The primary benefits driving the adoption of plastic drums include their superior chemical resistance, which makes them impervious to many corrosive substances that would degrade metal containers. They are also lighter, reducing shipping costs and making handling easier. Plastic drums are typically reusable and recyclable, aligning with increasing sustainability initiatives and offering a more environmentally conscious packaging solution over their lifecycle. Furthermore, they are less prone to denting or rusting compared to steel drums, contributing to a longer service life and maintaining product integrity. These compelling advantages, coupled with stringent regulations on material transport, act as significant driving factors for the market's sustained growth.

Plastic Drums Market Executive Summary

The plastic drums market is currently experiencing robust growth, propelled by expanding industrial output across various sectors and an increasing global emphasis on safe and efficient material handling. Key business trends indicate a strong focus on product innovation, particularly in enhancing durability, barrier properties, and incorporating recycled content to meet sustainability goals. Manufacturers are also investing in automated production processes to improve efficiency and consistency, while strategically expanding their global footprint to cater to burgeoning demand in emerging economies. The competitive landscape is characterized by both large, established players leveraging economies of scale and specialized manufacturers focusing on niche applications and custom solutions, creating a dynamic market environment.

Regionally, the market exhibits diverse growth patterns. Asia Pacific stands out as the fastest-growing region, driven by rapid industrialization, burgeoning chemical and food processing industries, and increasing foreign direct investment in manufacturing. North America and Europe, while more mature, demonstrate consistent demand, influenced by stringent regulatory frameworks for hazardous material transport and a strong push towards sustainable packaging solutions. These developed regions are at the forefront of adopting advanced manufacturing technologies and recycling infrastructure, setting benchmarks for global practices. Latin America and the Middle East & Africa are also showing promising growth, fueled by infrastructure development and a rising need for industrial packaging solutions to support their developing economies and resource-intensive industries.

Segmentation trends highlight a significant demand for high-capacity drums, particularly in the chemicals and petroleum sectors, reflecting the need for bulk transport solutions. The tight-head drum segment continues to dominate due to its suitability for liquid containment, while the open-head segment sees steady growth in applications requiring easier access for viscous or solid materials. In terms of end-use industries, chemicals and pharmaceuticals remain the largest consumers, driven by safety and regulatory compliance requirements. However, the food and beverage sector is also a rapidly expanding segment, with growing demand for food-grade plastic drums. Furthermore, the market is witnessing a shift towards customized solutions tailored to specific industry needs, including varying capacities, colors, and branding options, reflecting a more nuanced approach to client requirements.

AI Impact Analysis on Plastic Drums Market

User inquiries concerning AI's impact on the plastic drums market frequently revolve around operational efficiency, supply chain optimization, and sustainable practices. Key themes emerging from these questions include the potential for AI to enhance manufacturing processes, predict demand fluctuations, improve logistics, and facilitate advanced recycling methods. Users are particularly interested in how AI can contribute to cost reduction through predictive maintenance, waste minimization, and smarter inventory management. There is also a keen interest in AI's role in quality control, ensuring compliance with evolving regulations, and potentially enabling the development of "smart drums" with integrated sensors for real-time monitoring of contents and conditions. Concerns often touch upon the initial investment costs, data privacy, and the need for skilled personnel to implement and manage AI-driven systems within a traditionally manufacturing-heavy industry.

- AI can optimize production schedules and machine maintenance, reducing downtime and improving manufacturing efficiency.

- Predictive analytics powered by AI can forecast demand more accurately, minimizing overproduction and inventory holding costs.

- AI-driven supply chain management enhances logistics, routing, and fleet optimization for plastic drum transport, reducing fuel consumption and delivery times.

- Advanced AI algorithms can improve waste sorting and recycling processes for plastic materials, boosting the circular economy for drums.

- Quality control can be automated using AI vision systems to detect defects in plastic drums during manufacturing, ensuring product integrity.

- Smart sensors integrated with AI can monitor drum contents (temperature, pressure, fill level) in real-time, improving safety and preventing spoilage.

- AI can personalize customer experiences by analyzing purchasing patterns and recommending customized drum solutions and services.

- Regulatory compliance can be streamlined through AI-powered data analysis, ensuring drums meet evolving safety and environmental standards.

DRO & Impact Forces Of Plastic Drums Market

The plastic drums market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, collectively shaping its growth trajectory. Key drivers include the robust expansion of end-use industries such as chemicals, food and beverage, and pharmaceuticals, which consistently require safe and efficient packaging solutions for their products. The inherent advantages of plastic drums, such as their chemical resistance, lighter weight, and durability compared to traditional metal alternatives, further fuel their adoption. Additionally, stringent regulations governing the transport and storage of hazardous and sensitive materials often mandate the use of specific, certified plastic drums, thereby creating a steady demand. The continuous innovation in plastic material science, leading to enhanced barrier properties and strength, also contributes to market growth by expanding application possibilities and improving product performance.

However, several restraints pose challenges to the market's unfettered expansion. Growing environmental concerns regarding plastic waste and pollution represent a significant hurdle, pushing for greater sustainability and circular economy initiatives. This often translates into stricter regulations on plastic production and disposal, as well as increasing consumer and corporate preference for alternative, more sustainable packaging materials. Volatility in the prices of raw materials, primarily crude oil derivatives like HDPE, can impact manufacturing costs and profit margins. Furthermore, intense competition from other packaging solutions, including intermediate bulk containers (IBCs) and flexible packaging, along with the saturation of certain developed markets, can limit growth potential and necessitate continuous product differentiation and cost optimization strategies for market players.

Despite these challenges, the market presents substantial opportunities for growth and innovation. The increasing demand for plastic drums in emerging economies, driven by rapid industrialization and infrastructural development, offers vast untapped potential. Advancements in recycling technologies and the development of bio-based or recycled content plastic drums align with sustainability goals and can open new avenues for market penetration, catering to environmentally conscious consumers and regulations. Customization options, including specific colors, branding, and integrated features like IoT sensors for smart drums, provide opportunities for manufacturers to add value and differentiate their offerings. Furthermore, strategic partnerships and collaborations across the value chain, from raw material suppliers to end-users, can foster innovation, streamline operations, and collectively address market challenges, propelling the industry forward.

Segmentation Analysis

The plastic drums market is segmented to provide a granular understanding of its diverse components, allowing for targeted strategic planning and analysis. These segmentations typically categorize the market based on product type, capacity, material, and end-use industry, each reflecting distinct characteristics and demand patterns. Analyzing these segments helps stakeholders identify key growth areas, competitive landscapes, and evolving customer preferences, thereby informing product development, marketing strategies, and investment decisions. The interplay between these segments often reveals opportunities for cross-sector innovation and market expansion, driven by specific industrial needs and regulatory environments across different geographic regions.

- By Product Type:

- Open Head Drums

- Tight Head Drums

- By Capacity:

- Up to 100 Liters

- 101-250 Liters

- Above 250 Liters

- By Material:

- High-Density Polyethylene (HDPE)

- Polypropylene (PP)

- Other Plastics (e.g., PVC)

- By End-Use Industry:

- Chemicals & Solvents

- Food & Beverages

- Pharmaceuticals

- Petroleum & Lubricants

- Paints, Inks & Coatings

- Agriculture

- Other Industrial

Value Chain Analysis For Plastic Drums Market

The value chain for the plastic drums market is a multi-stage process, beginning with the sourcing of raw materials and culminating in the delivery of finished drums to end-users. Upstream activities primarily involve the petrochemical industry, which supplies the essential polymer resins like High-Density Polyethylene (HDPE) and Polypropylene (PP). These raw material suppliers form the foundation of the value chain, as their production capacities, pricing structures, and technological advancements directly influence the cost and quality of the final plastic drums. Relationships with these suppliers are crucial for drum manufacturers to ensure a stable and cost-effective supply, often necessitating long-term contracts and strategic partnerships to mitigate price volatility and secure material availability for continuous production.

Midstream activities encompass the core manufacturing processes, where plastic resins are converted into drums through methods such as blow molding, injection molding, or rotational molding. This stage involves significant capital investment in machinery, skilled labor, and quality control measures to produce drums that meet specific industry standards and regulatory requirements. Manufacturers often specialize in certain drum types or capacities, leveraging proprietary technologies to enhance product features like chemical resistance, impact strength, and stackability. Innovation in manufacturing techniques, such as incorporating recycled content or developing lighter-weight designs, plays a critical role in optimizing production costs and aligning with sustainability objectives, creating a competitive edge within the market.

Downstream analysis focuses on the distribution channels and the end-use industries. Once manufactured, plastic drums are transported through a network of distributors, wholesalers, and sometimes directly to large industrial customers. The distribution channel can be direct, where manufacturers sell directly to major clients, offering customized solutions and bulk pricing. Alternatively, indirect channels involve third-party logistics providers and regional distributors who cater to smaller businesses and diverse geographical markets. The effectiveness of these channels, including warehousing, transportation efficiency, and customer service, directly impacts market reach and customer satisfaction. The end-users, spanning chemicals, food and beverage, pharmaceuticals, and petroleum industries, drive demand based on their packaging needs, regulatory compliance, and operational requirements, making their purchasing decisions pivotal for market dynamics.

Plastic Drums Market Potential Customers

The primary potential customers and end-users of plastic drums are diverse industrial sectors that require robust, reliable, and chemically resistant containers for storing and transporting a wide array of liquids, semi-solids, and granular materials. The chemical industry stands as a cornerstone segment, utilizing plastic drums extensively for acids, alkalis, solvents, and other hazardous and non-hazardous chemicals. Their demand is driven by stringent safety regulations, the need for chemical compatibility, and the economic benefits of bulk packaging. Manufacturers of industrial chemicals, specialty chemicals, and agricultural chemicals consistently represent a significant portion of the customer base, often requiring drums designed to meet specific UN packaging codes and safety certifications for dangerous goods.

Another major segment comprises the food and beverage industry, which relies on food-grade plastic drums for the hygienic storage and transport of edible oils, syrups, fruit concentrates, dairy products, and food additives. These customers prioritize materials that prevent contamination, maintain product integrity, and comply with strict food safety regulations such as FDA and EU standards. The pharmaceutical sector also constitutes a vital customer group, using plastic drums for active pharmaceutical ingredients (APIs), intermediates, and bulk drug formulations. For pharmaceutical clients, sterility, material purity, and robust sealing mechanisms are paramount to prevent contamination and ensure product efficacy, making specialized, high-quality drums essential for their operations.

Beyond these core industries, other significant end-users include the petroleum and lubricants sector, which utilizes plastic drums for motor oils, greases, and other petroleum-based products due to their resistance to hydrocarbon degradation. The paints, inks, and coatings industry also procures plastic drums for various pigments, resins, and finished products, valuing their durability and ability to prevent rust or material reactions. Furthermore, segments like agricultural products (e.g., pesticides, fertilizers), cosmetics, and water treatment chemicals also contribute significantly to the demand. Each of these end-user categories has unique requirements regarding drum capacity, material specifications, and regulatory compliance, necessitating a diverse product offering from plastic drum manufacturers to cater to their specific operational needs and ensure safe handling of their respective products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.54 Billion |

| Market Forecast in 2033 | USD 3.78 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Greif Inc., Mauser Packaging Solutions, RPC Group Plc, Brambles Ltd. (CHEP), Schutz Container Systems, Inc., Industrial Container Services (ICS), Sonoco Products Company, Berry Global Inc., Schoeller Allibert, Plastipak Holdings, Inc., Time Technoplast Ltd., P. Van De Bunt B.V., Sicagen India Limited, Myers Container, Inc., Comar, Inc., FDL Packaging, Remcon Plastics, Inc., Great Western Containers Inc., CL Smith Company, Texmo Pipes and Products Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plastic Drums Market Key Technology Landscape

The plastic drums market leverages several key manufacturing technologies to produce a diverse range of containers that meet stringent industrial requirements. Blow molding is one of the most prevalent techniques, particularly for producing tight-head drums. This process involves extruding a molten plastic parison, which is then inflated inside a mold to take its shape. Advancements in blow molding include multi-layer co-extrusion, allowing for drums with enhanced barrier properties, critical for preserving sensitive contents or containing aggressive chemicals. Continuous innovation focuses on optimizing wall thickness distribution, reducing material usage while maintaining structural integrity, and increasing production speed and efficiency. Robotics and automation are increasingly integrated into blow molding lines to minimize labor costs, improve consistency, and enhance safety in high-volume production environments.

Another crucial technology is injection molding, primarily used for manufacturing open-head drum lids, closures, and occasionally smaller drum bodies. This process involves injecting molten plastic into a mold cavity, which then cools and solidifies. Recent technological advancements in injection molding include faster cycle times, multi-cavity molds for higher output, and precision control systems that ensure consistent part quality and tight tolerances. The development of advanced polymer formulations, including high-performance HDPE grades with improved impact resistance and stress-crack resistance, further contributes to the robustness and longevity of plastic drums. The incorporation of recycled content into these formulations, without compromising performance, is also a significant technological trend driven by sustainability goals and regulatory pressures, necessitating sophisticated material science and processing expertise.

Beyond core manufacturing, ancillary technologies play a vital role in enhancing product functionality and market competitiveness. Technologies for improving drum sealing mechanisms, such as advanced gasket materials and precision-engineered closures, are critical for preventing leaks and ensuring product security, especially for hazardous materials. Surface treatment and labeling technologies, including in-mold labeling (IML) and advanced printing techniques, provide opportunities for branding, regulatory compliance information, and enhanced aesthetics. Furthermore, the burgeoning field of smart packaging is beginning to influence the plastic drums market, with the potential integration of IoT sensors for real-time monitoring of temperature, pressure, fill levels, and GPS tracking. These intelligent features promise to revolutionize supply chain management, improve product safety, and offer greater transparency, representing a forward-looking technological frontier for the industry.

Regional Highlights

- North America: A mature market characterized by stringent environmental regulations and a strong demand from the chemical, pharmaceutical, and food & beverage industries. Innovation in sustainable packaging solutions and automation in manufacturing are key trends. The United States and Canada are primary contributors.

- Europe: Driven by a focus on circular economy principles, high recycling rates, and robust demand from the chemical, automotive, and agricultural sectors. Germany, France, and the UK are leading markets, with a strong emphasis on eco-friendly and reusable packaging.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid industrialization, expanding manufacturing bases in China, India, and Southeast Asian countries, and increasing demand from diverse end-use industries like chemicals, food processing, and petroleum. Economic growth and favorable government policies for manufacturing drive significant market expansion.

- Latin America: Showing steady growth, particularly in Brazil, Mexico, and Argentina, driven by investments in agricultural chemicals, food & beverage processing, and industrial expansion. The region presents opportunities for manufacturers due to developing infrastructure and increasing industrial output.

- Middle East and Africa (MEA): Emerging markets with significant potential, especially in countries like Saudi Arabia, UAE, and South Africa. Growth is spurred by developments in the oil & gas industry, water treatment, and infrastructure projects, creating a demand for industrial packaging solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plastic Drums Market.- Greif Inc.

- Mauser Packaging Solutions

- RPC Group Plc

- Brambles Ltd. (CHEP)

- Schutz Container Systems, Inc.

- Industrial Container Services (ICS)

- Sonoco Products Company

- Berry Global Inc.

- Schoeller Allibert

- Plastipak Holdings, Inc.

- Time Technoplast Ltd.

- P. Van De Bunt B.V.

- Sicagen India Limited

- Myers Container, Inc.

- Comar, Inc.

- FDL Packaging

- Remcon Plastics, Inc.

- Great Western Containers Inc.

- CL Smith Company

- Texmo Pipes and Products Ltd.

Frequently Asked Questions

Analyze common user questions about the Plastic Drums market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of plastic drums over metal drums?

Plastic drums offer superior chemical resistance, lighter weight for reduced shipping costs, resistance to corrosion and dents, and often better reusability and recyclability compared to traditional metal drums, making them ideal for a wide range of industrial applications.

Which industries are the largest consumers of plastic drums?

The chemical & solvents, food & beverages, and pharmaceutical industries are the largest consumers, driven by the need for safe, compliant, and cost-effective containment solutions for various liquids, powders, and hazardous materials.

What material is commonly used for manufacturing plastic drums?

High-Density Polyethylene (HDPE) is the most commonly used material due to its excellent chemical resistance, durability, impact strength, and ability to be recycled. Polypropylene (PP) is also used for specific applications.

What are the main types of plastic drums available?

The two main types are Open Head Drums, featuring a fully removable lid secured by a bolt ring, ideal for solids and viscous liquids; and Tight Head Drums, with non-removable tops and small openings, primarily used for free-flowing liquids.

How do sustainability concerns impact the plastic drums market?

Sustainability concerns drive innovation towards using recycled content, developing bio-based plastics, and enhancing recyclability. Regulations also push for extended product lifecycles and responsible end-of-life management, influencing design and material choices in the market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager