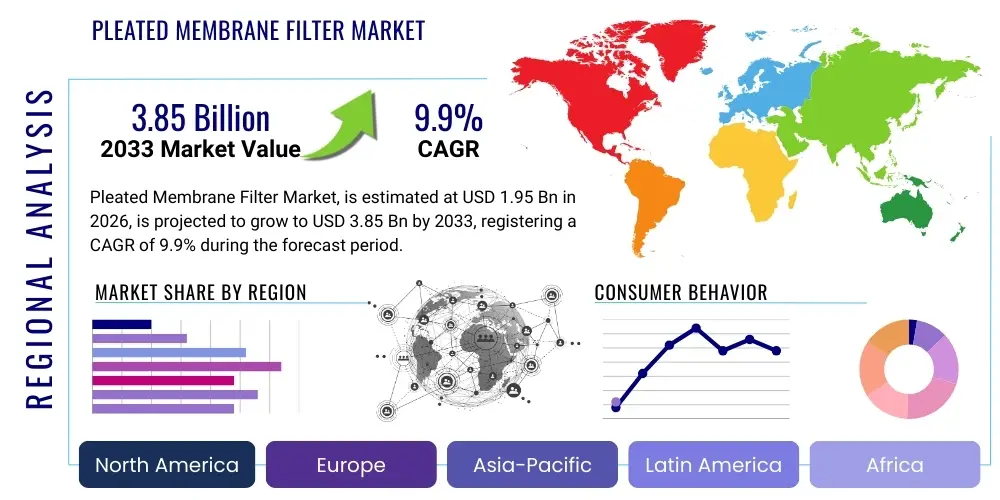

Pleated Membrane Filter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434875 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Pleated Membrane Filter Market Size

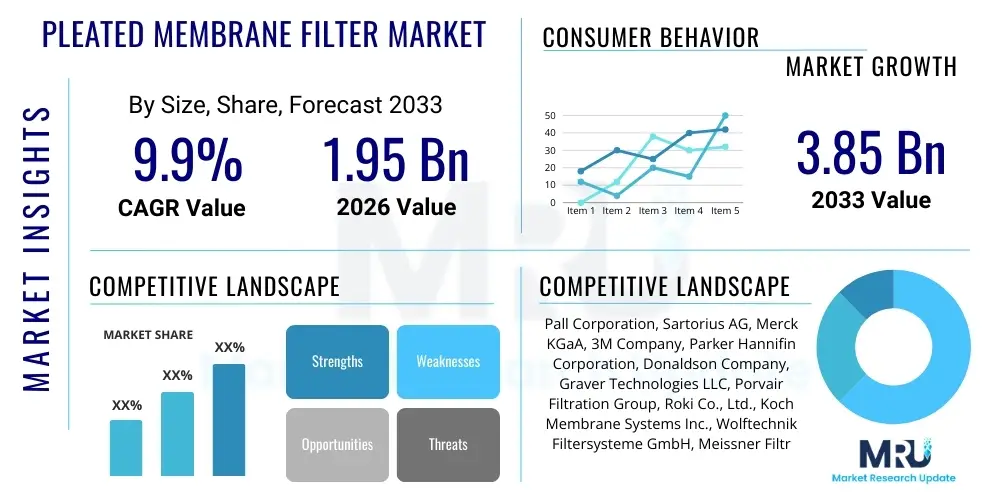

The Pleated Membrane Filter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.9% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $3.85 Billion by the end of the forecast period in 2033.

Pleated Membrane Filter Market introduction

The Pleated Membrane Filter Market encompasses the manufacture and distribution of filtration devices characterized by a membrane sheet folded into pleats, significantly increasing the effective filtration area within a compact housing. These filters are essential components in processes requiring high-efficiency particulate removal, sterilization, and clarification across various industries. The core mechanism leverages microfiltration or ultrafiltration membranes, typically made from polymers like Polypropylene (PP), Polytetrafluoroethylene (PTFE), Polyethersulfone (PES), or Nylon, tailored to specific retention requirements and chemical compatibility needs. The pleated design enhances throughput and extends service life compared to standard depth filters, making them economically viable for large-scale industrial applications where filter changeout frequency must be minimized.

Major applications of pleated membrane filters span critical sectors including pharmaceutical manufacturing, where they are indispensable for sterile filtration of biological products, active pharmaceutical ingredients (APIs), and buffer solutions. Furthermore, they play a crucial role in the food and beverage industry for clarification and microbial stabilization of products such as bottled water, beers, wines, and soft drinks. In the burgeoning microelectronics sector, these filters are vital for maintaining the ultra-purity required for process water and chemicals used in semiconductor and display manufacturing, where even minute particulate contamination can compromise product integrity and yield.

The key driving factors propelling market growth include the stringent regulatory environments mandating high-purity standards, particularly in the healthcare and water treatment sectors globally. The inherent benefits of pleated filters, such as superior dirt-holding capacity, high flow rates, and precise cut-off characteristics, position them as the preferred choice over traditional filtration media. Furthermore, continuous technological advancements in membrane polymer chemistry and housing design are contributing to the introduction of filters with enhanced durability and broader application ranges, facilitating sustained market expansion into novel industrial processes and complex fluid purification challenges.

Pleated Membrane Filter Market Executive Summary

The Pleated Membrane Filter Market is experiencing robust expansion driven by accelerated investment in biopharmaceutical production and the necessity for ultrapure water in industrial processes globally. Business trends indicate a strong move towards integrated systems and single-use technologies (SUTs) that incorporate pleated filters, streamlining validation and minimizing cross-contamination risks, particularly within contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs). Strategic mergers and acquisitions are common as major players seek to consolidate membrane technology expertise and expand geographical distribution networks, focusing on high-growth areas like Asian bioprocessing hubs. This strategic positioning is vital for maintaining competitive advantage and capturing the escalating demand for high-performance separation solutions.

Regionally, the market is spearheaded by North America and Europe, attributed to the presence of large, established pharmaceutical and biotechnology companies, coupled with rigorous regulatory oversight (e.g., FDA and EMA standards) that mandates high-level filtration protocols. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, primarily fueled by rapid industrialization, expanding healthcare infrastructure, and significant government initiatives promoting investment in water treatment and food safety technologies in countries such as China, India, and Japan. Latin America and the Middle East & Africa (MEA) are also showing promising growth, albeit starting from a smaller base, driven by increasing foreign direct investment in manufacturing and localized efforts to address potable water scarcity.

Segment trends highlight Polyethersulfone (PES) membranes as a dominant material due to their high flow rates, low protein binding characteristics, and broad pH compatibility, making them ideal for pharmaceutical and biological applications. In terms of application, the Pharmaceutical & Biotechnology segment maintains the largest market share, directly correlated with the global pipeline of biologics and biosimilars requiring sterile filtration. Concurrently, the Water Treatment segment is showing significant acceleration, necessitated by global population growth, urbanization, and the continuous depletion of clean water sources, driving demand for advanced filtration solutions for municipal and industrial water reuse.

AI Impact Analysis on Pleated Membrane Filter Market

User inquiries regarding AI's impact on the Pleated Membrane Filter Market frequently center on predictive maintenance, optimization of filter changeout schedules, and enhancement of quality control protocols. Users are keen to understand how AI-driven data analytics can minimize operational downtime associated with unexpected filter failures, thereby reducing total cost of ownership (TCO). Key themes emerging from these questions include the integration of machine learning algorithms with smart sensor technology embedded in filtration systems (IoT), the potential for AI to optimize production yields by ensuring consistent fluid purity, and the development of AI models for predicting the lifespan of specific membrane types under varied operating conditions. Users generally expect AI to transition filtration from a reactive maintenance activity to a proactive, highly efficient process.

The implementation of Artificial Intelligence and advanced analytical tools is fundamentally reshaping operational efficiencies within the Pleated Membrane Filter market, moving beyond simple component supply to comprehensive fluid management solutions. AI algorithms can process vast datasets generated by flow sensors, pressure monitors, and particle counters in real-time. This predictive capability allows end-users, particularly in high-volume manufacturing environments like microelectronics and biologics, to accurately determine the optimal moment for filter replacement. This precision optimization minimizes wasted service life (where filters are changed too early) and prevents costly contamination events (where filters fail prematurely), directly impacting profitability and operational sustainability. The adoption of AI is therefore viewed not just as a technology upgrade but as a critical competitive differentiator.

Furthermore, AI is instrumental in the research and development phase of new membrane technologies. Machine learning models can analyze the performance characteristics of novel polymer formulations and pore structures against simulated fluid dynamics and chemical interactions much faster than traditional laboratory testing. This accelerates the time-to-market for filters designed for challenging applications, such as high-viscosity fluids or extreme pH environments. As manufacturers increasingly transition towards intelligent manufacturing (Industry 4.0), AI integration into the supply chain also optimizes inventory management, predicting demand fluctuations for specific filter types based on global manufacturing trends in pharmaceuticals or semiconductor production, further cementing its role as an essential enabler of market efficiency and innovation.

- AI-powered Predictive Maintenance: Forecasting filter clogging and failure rates based on real-time operational data (pressure drop, flow rate) to optimize replacement cycles.

- Enhanced Quality Control: Utilizing computer vision and AI algorithms for automated inspection of pleated media integrity during manufacturing, ensuring zero defects.

- Process Optimization: Machine learning applications tuning filtration parameters (temperature, pressure, velocity) to maximize throughput and extend filter lifespan in complex industrial processes.

- Demand Forecasting: AI models analyzing global biopharma production trends and regulatory changes to optimize supply chain and inventory management for specific membrane types.

- R&D Acceleration: Simulation and analysis of new membrane materials and configurations using AI to predict performance characteristics before physical prototyping.

DRO & Impact Forces Of Pleated Membrane Filter Market

The dynamics of the Pleated Membrane Filter Market are shaped by a complex interplay of positive growth drivers, fundamental structural restraints, and evolving strategic opportunities, all moderated by significant external impact forces. The dominant driver remains the increasing global demand for sterile filtration and purification, largely stemming from the exponential growth of the biopharmaceutical sector, especially in gene therapies, mAb production, and vaccine development, which inherently rely on high-integrity pleated membrane filters for terminal sterilization and clarification. Coupled with this is the escalating scarcity of potable water, compelling municipal and industrial bodies worldwide to adopt advanced filtration solutions, including pleated membranes, for water recycling and tertiary treatment processes, providing a sustained infrastructural impetus to market expansion.

However, market growth faces notable restraints, primarily concerning the high initial capital expenditure required for installing high-end filtration systems, particularly for specific industry-grade applications like microelectronics, where validation and compliance costs are substantial. Furthermore, the issue of filter disposal poses an environmental challenge; most polymeric membranes are non-biodegradable, leading to increasing scrutiny regarding sustainability and waste management protocols. This regulatory pressure, combined with the volatility in the prices of raw polymer materials, occasionally limits profitability and creates supply chain uncertainties for manufacturers, requiring continuous innovation in product life extension and material efficiency to mitigate these constraints.

Opportunities for future expansion are predominantly found in the technological leap towards nanofiber-based pleated media, which promises enhanced flux rates and finer separation capabilities, broadening the applicability of these filters into novel areas like viral clearance and advanced gas filtration. Geographically, emerging economies in APAC offer significant untapped potential, driven by rapid infrastructural development in sanitation and manufacturing. The primary impact forces influencing the market trajectory include rapid technological shifts in bioprocessing—specifically the rise of continuous manufacturing—which necessitates the adaptation of filtration systems for continuous, uninterrupted operation. Additionally, increasing globalization and standardization of quality metrics (e.g., ISO, GMP) ensure continuous pressure on manufacturers to maintain strict product integrity, driving investment in superior manufacturing technologies and robust supply chain resilience.

Segmentation Analysis

The Pleated Membrane Filter Market is comprehensively segmented based on material, application, pore size, and end-user, enabling manufacturers to tailor products precisely to diverse operational requirements across critical industries. Understanding these segments is crucial for strategic market positioning, as each category responds differently to regulatory shifts and technological advancements. The material segmentation (PP, PES, PTFE, Nylon) dictates the filter's chemical compatibility, thermal resistance, and flow dynamics, directly influencing suitability for highly specialized processes like solvent filtration or high-temperature steam sterilization. The strategic importance of segmentation lies in identifying high-value niches, such as the ultra-fine pore size category essential for semiconductor fabrication, which commands premium pricing due to the critical nature of the application.

Application analysis confirms the market's reliance on sectors demanding absolute purity, with Pharmaceutical & Biotechnology dominating due to the mandatory requirement for particle and microbial control, driven by global health expenditures and the increasing complexity of biological drugs. This segment demands the highest levels of validation and traceability. Meanwhile, the robust growth of the Water Treatment segment reflects societal needs and regulatory pressures, focusing on large-volume, cost-effective solutions for municipal and industrial water recycling. The differentiation across end-user segments (Industrial, Academic & Research, Healthcare) also reflects varying procurement patterns and regulatory stringency, where industrial users prioritize longevity and flow rate, while healthcare buyers emphasize sterility and validation documentation.

- By Material: Polypropylene (PP), Polyethersulfone (PES), Polytetrafluoroethylene (PTFE), Nylon, Others (e.g., PVDF, Glass Fiber).

- By Application: Pharmaceutical & Biotechnology, Food & Beverage, Water Treatment, Chemical Processing, Microelectronics, Others.

- By Pore Size: 0.1 µm - 0.5 µm (Microfiltration), 0.5 µm - 10 µm (General Filtration), >10 µm (Pre-Filtration).

- By End-User: Industrial (Manufacturing, Power Generation), Healthcare (Hospitals, Clinics), Academic & Research Institutes, Municipal Water Utilities.

Value Chain Analysis For Pleated Membrane Filter Market

The value chain for the Pleated Membrane Filter Market begins with upstream activities focused on the procurement and preparation of specialized raw materials, primarily high-grade polymers such as PES, PP, PTFE, and PVDF, along with supportive components like filter cages, end caps, and gaskets. The upstream segment is capital-intensive, characterized by highly specialized polymer manufacturers and membrane casting facilities that must maintain exceptionally high quality and consistency standards to ensure pore size uniformity and structural integrity. Key challenges at this stage include managing raw material cost volatility and ensuring a secure, validated supply of medical or industrial-grade polymers, which are often subject to strict regulatory compliance requirements, especially for sterile applications.

The central manufacturing process involves membrane casting, pleating (folding the membrane material), assembling the pleated cartridge with supporting hardware, and meticulous quality control (QC) testing, often including bubble point tests and integrity testing to validate the filtration rating. This stage demands precision engineering and automation to minimize contamination risks and maximize filter surface area efficiency. The downstream analysis focuses on market access, distribution, and end-user engagement. Due to the technical nature of the product, distribution frequently utilizes a hybrid model comprising direct sales teams for major pharmaceutical and microelectronics clients, coupled with specialized, technically proficient distributors and third-party logistics (3PL) providers capable of managing temperature-sensitive or highly validated inventory.

The distribution channel is critical, involving both direct sales to large end-users (e.g., global water utilities or major biotech firms) who require detailed technical support and validation assistance, and indirect channels leveraging regional distributors to penetrate smaller industrial accounts and academic institutions. Direct channels allow for greater margin retention and deeper customer relationship management, crucial for customized solutions. Indirect channels provide broader geographical reach and specialized local market expertise. The final stage involves extensive post-sales support, including application engineering, regulatory documentation, and training, highlighting the need for highly skilled technical personnel throughout the distribution network, transforming the sale from a simple transaction into a long-term technical partnership.

Pleated Membrane Filter Market Potential Customers

The primary purchasers and end-users of pleated membrane filters are concentrated within highly regulated industries where fluid purity is paramount to product quality, safety, and regulatory compliance. The Pharmaceutical and Biotechnology sectors represent the most critical customer base, requiring filters for media preparation, buffer solutions, bulk drug purification, and final sterile filtration of injectable products. These customers prioritize validation documentation, consistency, and compliance with Good Manufacturing Practice (GMP) standards. Their purchasing decisions are heavily influenced by regulatory approvals, vendor audits, and the total cost of validation, rather than just the initial procurement price, emphasizing reliability and comprehensive technical support as key selection criteria.

The second major cohort of potential customers resides in the industrial segments, specifically Water Treatment and Microelectronics. Municipal water utilities and large industrial facilities (e.g., power generation, automotive plants) procure large volumes of pleated filters for pre-filtration, polishing, and wastewater reuse. These buyers are highly sensitive to operational costs, seeking filters offering high throughput, long service life, and robust performance against fluctuating feedstock quality. Conversely, the Microelectronics sector, including semiconductor manufacturers and flat-panel display producers, demands filters with ultra-fine pore sizes and extremely low extractables, often purchasing customized, proprietary membrane configurations to ensure the ultrapurity of chemicals and water critical to high-yield fabrication processes.

A growing customer segment includes the Food and Beverage industry, where pleated filters are used extensively for beverage clarification (e.g., beer, wine), microbial control, and ensuring the stability and shelf-life of products. This group seeks cost-effective solutions that meet food safety standards while maintaining the organoleptic properties of the final product. Additionally, academic research institutions and contract research organizations (CROs) serve as consistent buyers of smaller volumes, primarily for laboratory-scale filtration, pilot studies, and developing new separation techniques, contributing to the demand for specialized, smaller-format pleated cartridges and capsules for R&D purposes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $3.85 Billion |

| Growth Rate | 9.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pall Corporation, Sartorius AG, Merck KGaA, 3M Company, Parker Hannifin Corporation, Donaldson Company, Graver Technologies LLC, Porvair Filtration Group, Roki Co., Ltd., Koch Membrane Systems Inc., Wolftechnik Filtersysteme GmbH, Meissner Filtration Products Inc., Shelco Filters, GE Healthcare, Advanced Microdevices Pvt. Ltd., Classic Filters Ltd., PureFlow, Critical Process Filtration, Eaton Corporation, Sterlitech Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pleated Membrane Filter Market Key Technology Landscape

The technological landscape of the Pleated Membrane Filter Market is characterized by continuous innovation aimed at enhancing flow rates, reducing protein binding, and extending operational lifespan under challenging conditions. A core technological focus is the development of next-generation membrane polymers, such as asymmetric PES membranes and modified hydrophilic PTFE, which offer higher porosity and superior surface chemistry control. Asymmetric membranes feature a gradient pore structure, allowing for enhanced dirt-holding capacity and prolonged performance by gradually capturing particles across the depth, optimizing the balance between throughput and filtration efficiency. Furthermore, advanced pleating geometry techniques, including radial or crescent pleats, are employed to maximize the effective filtration surface area within standardized cartridge dimensions, leading to lower differential pressure and higher instantaneous flow rates, particularly critical in high-volume batch processing environments.

Another significant technological advancement involves the integration of nanotechnology, specifically the incorporation of nanofibers or specialized surface treatments to create highly specialized composite media. These composite filters leverage the high surface area-to-volume ratio of nanofiber layers to achieve sub-micron filtration with minimal pressure drop, offering highly efficient viral filtration or particle removal in highly viscous liquids. This innovation directly addresses the rising complexity of bioprocessing fluids. Parallel to material science, system integration technologies are paramount; the market is seeing a growing shift towards fully disposable, pre-validated single-use filter assemblies (SUFs). These SUFs minimize cleaning validation requirements, reduce capital investment in clean utilities, and accelerate process changeover times, fitting seamlessly into the continuous biomanufacturing paradigms increasingly adopted by major pharmaceutical firms.

Digitalization also constitutes a major technical shift, incorporating smart filtration systems equipped with Internet of Things (IoT) sensors. These sensors monitor real-time parameters such as temperature, pressure differential, and turbidity, transmitting data for AI-driven predictive maintenance and performance logging. This transformation ensures regulatory compliance through automated data recording and allows for proactive management of filter performance, moving away from time-based replacement schedules to condition-based monitoring. Collectively, these technological advancements—from polymer engineering and geometry optimization to system digitalization and single-use deployment—are collectively driving the market towards more efficient, reliable, and sustainable filtration solutions required by modern high-purity industries.

Regional Highlights

North America maintains a dominant position in the Pleated Membrane Filter Market, primarily due to the region's highly established and technologically advanced pharmaceutical and biotechnology sectors, especially within the United States. The high concentration of major biopharma R&D facilities, coupled with strict regulatory guidelines imposed by agencies like the FDA for sterile manufacturing and water quality, mandates the use of premium, validated pleated membrane filters. This region is a leader in adopting single-use technologies and advanced filtration monitoring systems, driving high per-capita spending on filtration consumables. The robust infrastructure supporting microelectronics manufacturing further contributes to the strong demand for ultra-pure filtration solutions.

Europe represents the second-largest market, characterized by significant investment in advanced manufacturing techniques and a strong presence of global players in the food and beverage industry (particularly brewing and wine production) and chemical manufacturing. European environmental regulations, such as those related to industrial wastewater discharge, are exceptionally stringent, ensuring sustained demand for high-efficiency filtration systems. Countries like Germany, France, and the UK are hubs for R&D in membrane technology and bioprocessing innovation. The emphasis on sustainable production and circular economy initiatives is also accelerating the adoption of filtration solutions designed for efficient resource management and recycling.

Asia Pacific (APAC) is projected to be the fastest-growing regional market throughout the forecast period. This explosive growth is attributed to rapid urbanization, increasing industrial output, and substantial governmental investments in improving public health infrastructure and expanding domestic pharmaceutical manufacturing capabilities in countries like China and India. The immense challenges related to water scarcity and pollution in Southeast Asia are fueling massive infrastructure projects in municipal and industrial water treatment, significantly boosting the demand for large-scale pleated membrane filtration solutions. Local manufacturing capabilities are also developing rapidly, although dependence on imported high-end specialty membranes remains for complex applications like semiconductor manufacturing.

- North America (U.S. and Canada): Dominance driven by extensive biopharmaceutical R&D, stringent FDA regulations, and high adoption rates of single-use filtration systems in clinical manufacturing and production.

- Europe (Germany, UK, France): Strong demand from chemical processing and the established food & beverage industry; market growth supported by rigorous EU water and environmental directives.

- Asia Pacific (China, India, Japan): Highest growth trajectory, fueled by rapid expansion of domestic manufacturing sectors (especially generics and biosimilars), major investments in water infrastructure, and flourishing microelectronics industry demand.

- Latin America (Brazil, Mexico): Emerging markets showing increasing penetration driven by modernization of local water utilities and foreign investment in food processing and localized drug manufacturing.

- Middle East & Africa (MEA): Growth focused on addressing critical water scarcity through desalination and advanced water recycling projects, coupled with developing healthcare systems requiring basic filtration solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pleated Membrane Filter Market.- Pall Corporation (a Danaher Company)

- Sartorius AG

- Merck KGaA

- 3M Company

- Parker Hannifin Corporation

- Donaldson Company Inc.

- Graver Technologies LLC

- Porvair Filtration Group

- Roki Co., Ltd.

- Koch Membrane Systems Inc.

- Wolftechnik Filtersysteme GmbH

- Meissner Filtration Products Inc.

- Shelco Filters

- Advanced Microdevices Pvt. Ltd.

- Critical Process Filtration

- Eaton Corporation plc

- Sterlitech Corporation

- PureFlow

- Classic Filters Ltd.

- GE Healthcare (Part of Danaher)

Frequently Asked Questions

Analyze common user questions about the Pleated Membrane Filter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between pleated membrane filters and depth filters?

Pleated membrane filters offer superior efficiency and absolute pore size ratings due to their uniform membrane structure, making them ideal for critical applications like sterilization. Depth filters primarily rely on a random fiber matrix to capture particles throughout the media, serving better as high-capacity pre-filters.

Which membrane material is most preferred for sterile filtration in biotechnology?

Polyethersulfone (PES) and Polyvinylidene Fluoride (PVDF) membranes are most commonly preferred for sterile filtration in biotechnology due to their naturally hydrophilic nature, high flow rates, low protein binding characteristics, and robustness during steam sterilization or gamma irradiation.

How does the pleated design enhance filter performance?

The pleated design significantly increases the effective surface area of the filter media packed into a standard cartridge size. This increase in area leads to a higher dirt-holding capacity, lower initial pressure drop, and substantially extended operational lifespan compared to non-pleated formats, optimizing cost-efficiency.

What is driving the high demand for pleated filters in the Microelectronics sector?

The Microelectronics sector, particularly semiconductor fabrication, requires ultra-pure process chemicals and water (ultrapure water, or UPW) to prevent defects at the nanoscale. Pleated filters with sub-micron ratings (e.g., 0.05 µm) are essential for achieving the required cleanliness standards, making them indispensable components in cleanroom environments.

What role do single-use pleated filters play in the market?

Single-use technology (SUT) incorporating pleated filters minimizes cross-contamination risk, eliminates the need for costly and time-consuming cleaning and sterilization validation, and reduces capital expenditure associated with stainless steel housing. SUT drives efficiency and flexibility, especially in biopharmaceutical and vaccine manufacturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Pleated Membrane Filter Cartridge Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Pleated Membrane Filter Market Statistics 2025 Analysis By Application (Food and Beverages, Pharmaceuticals, Water and Wastewater, Chemical Industry), By Type (PP Filter, PES Filter, PTFE Filter, Nylon Filter), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager