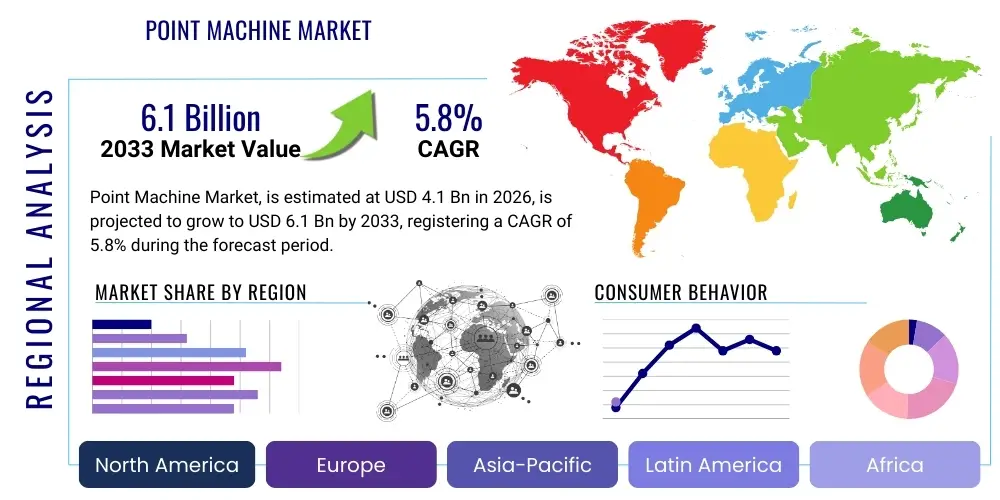

Point Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437532 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Point Machine Market Size

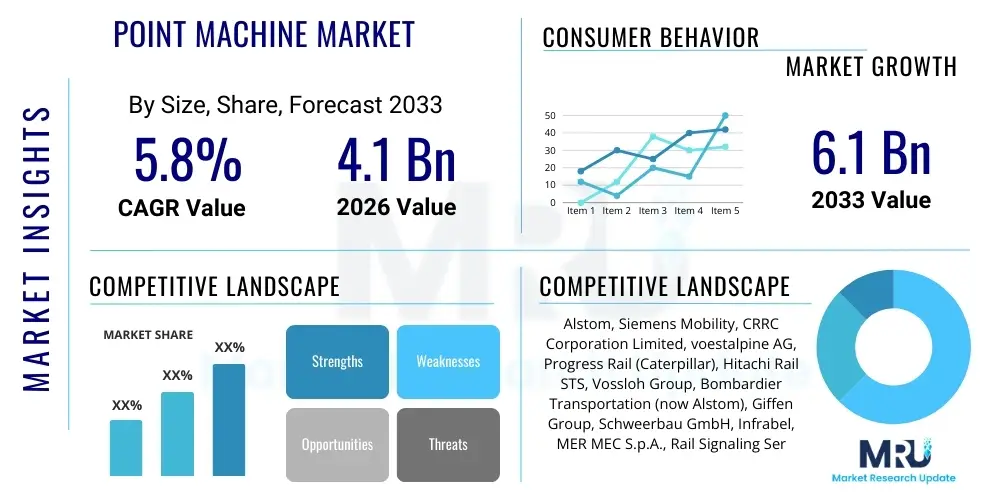

The Point Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fundamentally supported by the global imperative to enhance railway safety infrastructure, coupled with extensive governmental investments in high-speed rail networks and urban mass transit systems across key economic regions, particularly in Asia Pacific and Europe.

Point Machine Market introduction

The Point Machine Market centers around electromechanical or electro-hydraulic devices used in railway signaling systems to move the switch rails to the desired position, ensuring the safe and efficient routing of rolling stock from one track to another. These critical components are foundational to modern railway operations, functioning as the interface between the central interlocking system and the track infrastructure. Reliability and precision are paramount, as any failure in the point machine mechanism can lead to catastrophic derailments or severe operational delays. Modern point machines are designed to meet stringent Safety Integrity Levels (SIL 4) requirements, emphasizing robustness, quick operation, and the incorporation of remote diagnostic capabilities to minimize maintenance downtime and maximize track availability.

Product sophistication in this domain spans several types, including trailable point machines designed for urban transit environments where operational flexibility is critical, and specialized high-speed point machines capable of handling immense dynamic loads and ensuring instantaneous locking mechanisms necessary for high-velocity rail traffic. Major applications encompass mainline networks, marshalling yards, sidings, and increasingly, complex junctions within metropolitan areas where traffic density necessitates rapid switching cycles. The core benefit provided by advanced point machines is the assurance of safety and operational throughput, allowing network operators to manage complex scheduling and movement sequences with high dependability, thereby maximizing the return on massive infrastructure investments.

Driving factors for market expansion are multifaceted, primarily centered on global urbanization trends necessitating expanded and upgraded commuter rail lines, and the continuing development of global freight corridors requiring robust, high-durability track infrastructure. Furthermore, regulatory mandates concerning railway safety, such as the deployment of European Rail Traffic Management System (ERTMS) standards globally, compel rail authorities to upgrade existing, aging mechanical or legacy electrical point machines with modern, electronically controlled units. This transition fuels the aftermarket and retrofit segments, while new high-speed projects provide a continuous stream of demand for cutting-edge technological solutions that offer enhanced speed and reliability.

Point Machine Market Executive Summary

The Point Machine Market is characterized by robust technological development and significant geographical shifts in demand, driven predominantly by national infrastructure priorities focusing on high-speed rail and urban mass transit expansion. Current business trends indicate a strong move toward digitalization, wherein major players are integrating Internet of Things (IoT) sensors and connectivity modules into point machine designs. This allows for real-time condition monitoring, predictive maintenance scheduling, and remote diagnostics, fundamentally shifting maintenance strategies from reactive to proactive models. This integration is crucial for maintaining high operational standards, especially in densely utilized rail corridors where track possession time for maintenance is severely limited. Competition is intensifying among global signaling technology giants, leading to strategic acquisitions and partnerships aimed at consolidating market share and achieving vertical integration, specifically targeting software-defined signaling solutions.

Regional trends highlight the Asia Pacific (APAC) as the epicenter of new infrastructure development, particularly led by massive railway projects in China, India, and Southeast Asian nations focused on establishing cross-country economic corridors. These regions represent the primary source of volume demand for new installations. Conversely, Europe, a mature market, exhibits high demand for modernization and replacement of existing assets to comply with standardized European regulations like ERTMS, driving the need for technically advanced, highly certified products. North America’s growth is steady, focusing heavily on freight rail applications and the modernization of older commuter systems, often requiring heavy-duty, robust point machines capable of handling extreme environmental conditions and high axle loads typical of freight operations. The Middle East and Africa (MEA) represent emerging opportunities, propelled by large-scale, greenfield railway developments connecting ports and major cities, often relying on turnkey solutions provided by established European and Chinese vendors.

Segment trends reveal that the Electro-mechanical point machines segment maintains dominance due to their robust design and widespread adoption history, although the Electro-hydraulic segment is gaining traction, particularly in high-speed applications where rapid, high-force operation is required. The most significant trend within segmentation is the increasing requirement for specialized point machines designed for high-speed lines, driven by governmental emphasis on reducing inter-city travel times and enhancing connectivity. Furthermore, the market for point machines integrated with centralized interlocking systems that utilize advanced communication protocols is expanding rapidly. This convergence of hardware and software signaling components ensures seamless operation and enhances the overall safety architecture of the rail network.

AI Impact Analysis on Point Machine Market

Common user questions regarding AI’s influence on the Point Machine Market primarily revolve around operational efficiency, maintenance cost reduction, and the feasibility of autonomous operation. Users are keenly interested in how Artificial Intelligence can utilize the vast amounts of telemetry data generated by modern point machines—including motor current, switch position, temperature, and vibration signatures—to predict component failure before it occurs, thereby mitigating service interruptions. Concerns also center on the validation and certification of AI algorithms within safety-critical systems like railway points, questioning the regulatory framework for deploying predictive models that directly influence train movement safety. There is a clear expectation that AI will standardize and optimize maintenance windows, extending the lifespan of the assets while demanding less manual inspection time, leading to lower total cost of ownership for rail operators.

The implementation of machine learning models allows for the development of sophisticated health monitoring systems that move beyond simple threshold alarms. AI algorithms analyze subtle deviations in operational signatures, comparing real-time performance against baseline profiles developed over millions of operational cycles across diverse environmental conditions. This capability transforms routine maintenance tasks, allowing maintenance teams to focus precisely on points showing the highest risk probability, rather than adhering to rigid, calendar-based schedules. Furthermore, AI contributes significantly to route optimization and energy efficiency by calculating the quickest, safest, and most energy-efficient switching sequences in complex interlocking zones, dynamically responding to changes in real-time traffic flow.

While the benefits are substantial, market concerns regarding cybersecurity and data integrity are growing. As point machines become interconnected IoT devices, they present potential vulnerability points in the rail network infrastructure. AI solutions must incorporate robust security protocols to prevent unauthorized access or manipulation of critical switching operations. Additionally, the development requires large, high-quality datasets for training, which necessitates standardized data collection procedures across various rail operators. The long-term trajectory suggests that AI will eventually facilitate highly automated and even fully autonomous rail operations, where the point machine's role is governed by immediate, data-driven decisions made by the central nervous system of the rail network, thereby elevating reliability standards significantly above current human-managed levels.

- AI enables predictive maintenance by analyzing motor current and vibration patterns, minimizing unexpected failures.

- Machine learning optimizes switching sequences in high-density corridors, improving traffic throughput.

- Advanced diagnostics utilize AI for early anomaly detection, exceeding traditional fault threshold alarms.

- AI supports remote condition monitoring (RCM) systems, reducing the need for costly physical inspections.

- Data security and robust certification (SIL compliance) for AI algorithms remain key challenges for adoption.

DRO & Impact Forces Of Point Machine Market

The Point Machine Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), underpinned by powerful long-term impact forces related to global infrastructure spending and technological mandates. Primary drivers include the massive global capital expenditure on new high-speed rail lines, particularly in Asia and the Middle East, coupled with the increasing necessity for modernization and replacement of aging signaling infrastructure in mature markets like North America and Western Europe. Furthermore, the stringent enforcement of global safety standards, such as adherence to CENELEC standards for railway applications and specific Safety Integrity Levels (SIL 4), mandates the deployment of advanced, fail-safe point machine technologies. These regulatory pressures, combined with the operational necessity of minimizing track downtime, strongly favor modern electro-mechanical and electro-hydraulic solutions featuring remote monitoring capabilities.

Restraints largely stem from the inherent characteristics of railway infrastructure procurement: exceptionally high initial investment costs for signaling systems, coupled with very long asset lifecycles (often 30–40 years), which slows down the adoption of newer technologies once a system is installed. The market also faces constraints related to technical standardization; while global efforts exist, regional variations in gauge, operating environment, and historical signaling practices require extensive customization, raising production costs and complexity. Moreover, the integration of new digital point machines with existing legacy interlocking and control systems often presents significant interoperability challenges, requiring complex and expensive systems integration projects that deter faster technological turnover.

Opportunities are prominently visible in two areas: the rapidly developing markets of Southeast Asia, Latin America, and Africa, where greenfield projects provide opportunities for immediate deployment of cutting-edge technology; and the expanding role of data analytics and IoT integration. The integration of sensors into point machines for real-time condition monitoring opens up the lucrative service and software market segment, offering recurring revenue streams through predictive maintenance contracts and data-driven optimization services. The ongoing pressure to reduce energy consumption also drives innovation towards more energy-efficient point machine motor designs. The collective impact forces push the market toward digital resilience, requiring manufacturers to provide solutions that are not only physically robust but also digitally secure and highly integrable within complex, centralized traffic management systems.

Segmentation Analysis

The Point Machine Market is strategically segmented based on several critical dimensions including the operational mechanism type, the speed of the rail line where it is deployed, and the specific application environment. This segmentation helps manufacturers tailor their products to the precise performance and safety requirements of diverse railway environments, ranging from heavy-duty freight operations to ultra-high-speed passenger services. Understanding these segments is vital for stakeholders, as procurement decisions are highly dependent on factors such as required Safety Integrity Level (SIL), operating speed, installation environment (e.g., subterranean, open-air), and maintenance accessibility. The Electro-mechanical type remains the volume leader, but the specialized high-speed segment drives revenue growth due to the higher unit cost and complex technology associated with rapid actuation and sophisticated locking mechanisms required for velocities exceeding 250 km/h.

- By Type:

- Electro-mechanical Point Machines

- Electro-hydraulic Point Machines

- By Application:

- Main Lines

- High-Speed Rail Lines

- Marshalling Yards and Sidings

- Urban Transit Systems (Metro, Tram)

- By Operating Speed:

- Standard Speed (Up to 160 km/h)

- High Speed (Above 160 km/h)

- By Sales Channel:

- Direct Sales (Government Tenders)

- System Integrators and Distributors

Value Chain Analysis For Point Machine Market

The Point Machine Market value chain begins with highly specialized Upstream analysis, involving the sourcing of critical components. These components include high-torque electric motors (often brushless DC motors for efficiency and reliability), sophisticated electronic control units (ECUs) compliant with stringent safety standards (e.g., SIL 4 certified microprocessors), robust steel casings and gear mechanisms, and highly accurate position sensors. Component suppliers must meet rigorous quality checks, as component failure directly impacts train safety. Manufacturers often prefer long-term, certified suppliers to ensure consistency and compliance. The cost of raw materials, particularly specialized metals and electronic components, significantly influences the final manufacturing cost of the point machine unit. Furthermore, proprietary software and firmware development for the electronic control system forms a key part of the upstream intellectual property.

The Core Manufacturing stage involves the precision assembly, calibration, and rigorous testing of the point machines. Given the safety-critical nature, mandatory type testing, compliance certification (e.g., EN standards, specific national rail standards), and factory acceptance tests (FAT) are integral. Market leaders often invest heavily in highly automated manufacturing facilities to ensure precision and reduce human error, especially in the assembly of the mechanical linkages and the secure housing of the electronic components. Post-production, the Downstream phase focuses on delivery, installation, and integration. This phase is dominated by large System Integrators who manage the entire signaling project, integrating the point machines with the interlocking, signaling, and traffic management systems of the rail operator.

Distribution channels are bifurcated into Direct and Indirect sales. Direct sales are predominant for large-scale, national infrastructure projects where government railway authorities issue competitive tenders. These tenders often require direct engagement with the manufacturer for customization, installation supervision, and long-term maintenance contracts. Indirect distribution involves partnering with specialized System Integrators (SIs) and local distributors, especially in regional markets or for smaller modernization projects. SIs are crucial as they possess the necessary expertise to interface the complex point machine technology with the existing or new signaling architecture. Long-term profitability in this market is increasingly realized through the service segment, involving maintenance, remote monitoring subscriptions, and spare parts supply throughout the long operational lifecycle of the asset.

Point Machine Market Potential Customers

Potential customers in the Point Machine Market primarily consist of governmental entities and quasi-governmental organizations responsible for national rail infrastructure and urban transit operations. The principal end-users are National Railway Authorities (NRAs) such as Deutsche Bahn (Germany), Network Rail (UK), Indian Railways, and China Railway, which are responsible for the vast network of mainline and freight rail tracks. These NRAs are high-volume buyers, purchasing equipment through large, multi-year framework contracts and demanding robust compliance with national and international safety regulations, often prioritizing durability and standardization across their massive networks. Their procurement decisions are heavily influenced by the ability of the supplier to provide certified solutions, guaranteed spare parts availability over decades, and integrated remote monitoring technologies.

A second major segment comprises Urban Transit Operators, including municipal metro authorities and light rail/tram operators across major global cities. These customers, such as New York MTA, London Underground, or major Asian subway operators, require specialized point machines designed for high-frequency usage, complex junction layouts, and often, restricted installation envelopes common in underground or densely built-up areas. For this segment, the focus shifts slightly toward trailable point machines that can be traversed in the wrong direction without damage, thus enhancing operational flexibility and reducing recovery time after human error or emergency maneuvers. Reliability in high-frequency environments is non-negotiable, driving demand for low-maintenance, electro-mechanical systems.

Finally, the customer base includes Private Freight Rail Operators and large Infrastructure Development Contractors (EPC firms). While less prevalent globally than state-owned entities, private freight companies in North America (e.g., BNSF, Union Pacific) and specific industrial railways require heavy-duty point machines capable of enduring the high axle loads and harsh operational environments associated with bulk goods transport. Infrastructure contractors serve as intermediaries, procuring point machines as part of a larger, integrated signaling solution for new rail line constructions, often favoring vendors that offer ease of installation and proven integration capability with diverse signaling platforms, positioning them as essential decision-makers in greenfield projects.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alstom, Siemens Mobility, CRRC Corporation Limited, voestalpine AG, Progress Rail (Caterpillar), Hitachi Rail STS, Vossloh Group, Bombardier Transportation (now Alstom), Giffen Group, Schweerbau GmbH, Infrabel, MER MEC S.p.A., Rail Signaling Services, TATA Steel, Efacec Power Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Point Machine Market Key Technology Landscape

The technological landscape of the Point Machine Market is rapidly evolving, driven by the need for enhanced safety, reliability, and reduced maintenance costs. A pivotal technology advancement is the widespread adoption of non-trailing detection systems, which utilize sophisticated sensors and electronic feedback mechanisms to continuously verify the position and locking status of the switch rails without relying solely on mechanical linkages. This digital feedback loop ensures immediate detection of even slight rail displacements or tampering, significantly contributing to SIL 4 compliance. Furthermore, modern point machines are increasingly integrating brushless DC (BLDC) motor technology, replacing older AC or brushed DC motors. BLDC motors offer superior energy efficiency, higher torque density, and critically, a much longer lifespan with reduced component wear, thereby minimizing required intervention and increasing mean time between failures (MTBF).

Another dominant trend is the proliferation of Remote Condition Monitoring (RCM) and diagnostic tools. Contemporary point machines are equipped with embedded IoT modules that continuously measure and transmit key operational parameters, including motor current profile, temperature fluctuations, power consumption, and vibration analysis. This telemetry data feeds into centralized asset management systems, enabling proactive intervention and predictive maintenance scheduling. This capability drastically improves asset utilization and minimizes disruptive corrective maintenance. The shift towards robust, low-maintenance designs also involves sealed, environmentally protected casings and improved lubrication systems capable of operating reliably in extreme weather conditions, from desert heat to arctic cold, ensuring operational consistency globally.

Moreover, the integration protocols are becoming standardized and highly secure, aligning with Communication Based Train Control (CBTC) and European Rail Traffic Management System (ERTMS) architectures. Point machines now communicate using high-integrity, secure data links, eliminating the reliance on older, analog wiring systems. The movement mechanism itself is subject to innovation, with increasing research into alternative actuation methods, such as hybrid electro-hydraulic systems, especially for high-speed lines where immense forces are required to move heavy rails quickly and lock them securely under extreme dynamic stress. This focus on high-speed capability, reliability, and seamless digital integration represents the core technological mandate shaping the future product development in this critical market sector.

Regional Highlights

The Point Machine Market exhibits significant regional disparities in terms of growth rates, technological adoption levels, and investment priorities, making geographical analysis crucial for market strategy. Asia Pacific (APAC) currently dominates the market in terms of new installations and overall market size potential. This dominance is propelled by ambitious national railway expansion projects, particularly China’s massive high-speed rail network expansion (which continues to require thousands of new point machines annually) and India's extensive network modernization and dedicated freight corridor projects. Government funding for infrastructure in Southeast Asian nations (Vietnam, Indonesia, Thailand) further boosts demand, often favoring established global suppliers through large public tenders. The APAC region is a primary driver for volume demand, often prioritizing cost-effective and highly robust solutions suitable for diverse operating environments.

Europe represents a highly mature yet technologically demanding market. Growth here is primarily driven by replacement demand, asset modernization programs, and the continuous harmonization of signaling systems under the European Rail Traffic Management System (ERTMS) mandate. European rail operators demand the highest safety certifications (SIL 4) and are early adopters of advanced digital technologies like predictive maintenance and IoT-enabled point machines. Countries like Germany, France, and the UK are investing heavily in digital railway initiatives, ensuring continuous demand for sophisticated, integrated point machine solutions that offer enhanced diagnostics and seamless communication with centralized traffic control systems. European suppliers maintain a strong competitive edge due to proximity to demanding regulatory bodies and long-standing relationships with national operators.

North America, characterized by a dominant freight rail segment, maintains a steady, cyclical demand driven by infrastructure replacement and upgrades focused on ensuring network resilience and efficiency. Point machines here must withstand heavy axle loads and operate reliably over long, geographically isolated distances. The metropolitan areas are also undergoing modernization of their commuter and subway systems, driving demand for specialized urban transit point machines. The Middle East and Africa (MEA) region is emerging as a critical growth area due to large-scale infrastructure investments in Saudi Arabia, UAE, and Egypt, often involving greenfield development of high-speed passenger and heavy freight lines, presenting lucrative opportunities for comprehensive, turnkey signaling solutions from international vendors.

- Asia Pacific (APAC) is the largest market, fueled by high-speed rail expansion in China and India.

- Europe drives demand for sophisticated replacements and digital integration compliant with ERTMS standards.

- North America focuses heavily on robust, heavy-duty point machines for extensive freight operations.

- Middle East and Africa (MEA) offer high-growth opportunities through new national railway construction projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Point Machine Market.- Alstom

- Siemens Mobility

- CRRC Corporation Limited

- voestalpine AG

- Progress Rail (Caterpillar)

- Hitachi Rail STS

- Vossloh Group

- Pandrol

- Giffen Group

- Schweerbau GmbH & Co. KG

- Infrabel

- MER MEC S.p.A.

- Rail Signaling Services

- TATA Steel

- Efacec Power Solutions

- Kawasaki Heavy Industries

- CAF Signalling

- MTR Corporation Limited

- Ansaldo STS (now Hitachi Rail STS)

- Unifeeder AS

Frequently Asked Questions

Analyze common user questions about the Point Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Point Machine Market?

The Point Machine Market is projected to grow at a CAGR of 5.8% between the forecast period of 2026 and 2033. This growth is primarily driven by global railway safety mandates and extensive government investments in high-speed rail infrastructure.

Which technology is currently dominating the Point Machine segment?

Electro-mechanical point machines currently hold the largest market share due to their proven reliability, cost-effectiveness, and broad applicability across various track types. However, electro-hydraulic systems are growing rapidly in the high-speed rail segment where quick, powerful switching is essential.

How does AI technology impact the maintenance lifecycle of point machines?

AI significantly impacts maintenance by enabling advanced predictive maintenance capabilities. By analyzing real-time data from sensors (motor current, vibration), AI algorithms can anticipate potential failures, allowing operators to schedule proactive maintenance and substantially reduce unplanned downtime and operational costs.

What are the primary regulatory requirements governing the production of modern point machines?

Modern point machines must primarily comply with stringent international standards, most notably achieving Safety Integrity Level 4 (SIL 4) compliance as defined by CENELEC standards. This certification is mandatory across most major global markets to ensure the device operates safely and predictably in all failure scenarios.

Which regional market offers the highest growth potential for new point machine installations?

The Asia Pacific (APAC) region offers the highest growth potential for new installations, largely attributed to the continuous execution of massive new high-speed rail projects in countries such as China and India, coupled with widespread modernization efforts across Southeast Asian urban transit networks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager