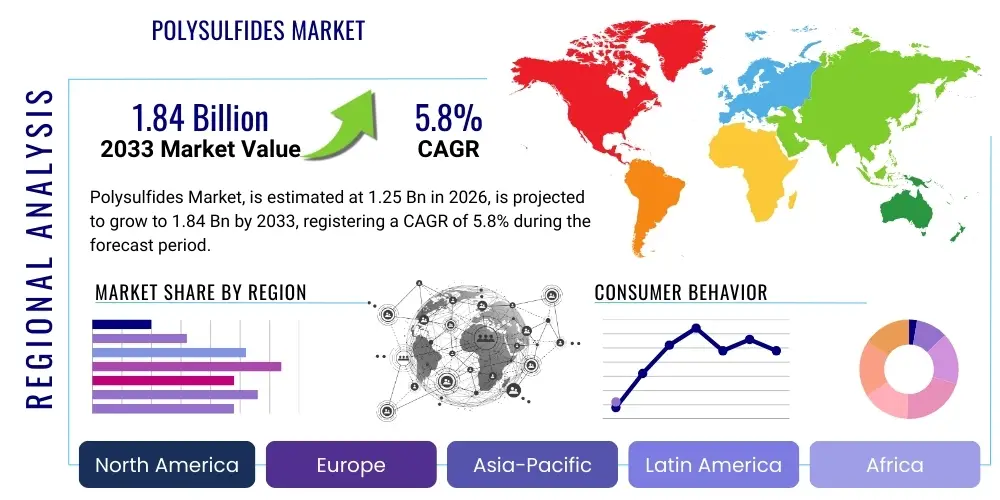

Polysulfides Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439489 | Date : Jan, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Polysulfides Market Size

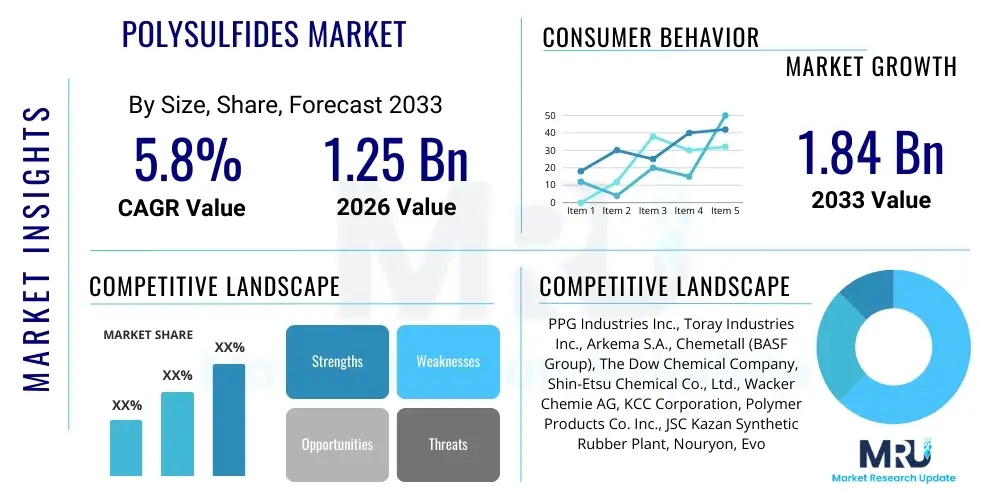

The Polysulfides Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 billion in 2026 and is projected to reach USD 1.84 billion by the end of the forecast period in 2033.

Polysulfides Market introduction

The polysulfides market encompasses a specialized segment within the broader chemicals industry, focusing on synthetic polymers distinguished by their unique sulfur-sulfur linkages. These polymers, available in various forms such as liquid polysulfide polymers (LPs) and solid polysulfide rubbers, are highly valued for an exceptional combination of properties including superior chemical resistance, impermeability to gases, excellent resistance to solvents, and remarkable flexibility even at very low temperatures. This distinct chemical profile makes them indispensable across a multitude of high-performance applications where conventional elastomers or sealants might fail. The fundamental chemistry behind polysulfides provides them with inherent advantages in challenging environments, enabling their use in critical infrastructure and advanced technological products. Their resilience against degradation from oils, fuels, and many industrial chemicals underscores their strategic importance in specialized industrial contexts.

The primary applications of polysulfides are extensive and diverse, spanning vital sectors such as construction, aerospace, automotive, marine, and insulating glass manufacturing. In construction, they are widely utilized as high-performance sealants for expansion joints, pavements, and waterproofing applications due to their durability and long-term elasticity. Within the aerospace industry, polysulfides are crucial for integral fuel tank sealants and fuselage sealing, where their fuel resistance and ability to withstand extreme temperatures and pressures are paramount for safety and operational integrity. The automotive sector leverages polysulfides for various sealing and adhesive needs, particularly in components requiring resistance to harsh fluids and vibration. Moreover, in marine environments, they provide reliable waterproofing and corrosion protection, resisting saltwater degradation and UV exposure. These broad applications are driven by the inherent benefits of polysulfides, which include exceptional weatherability, robust UV resistance, strong adhesion to diverse substrates, and an extended service life, contributing significantly to the longevity and reliability of the end products.

The growth trajectory of the polysulfides market is substantially propelled by several key factors. A major driver is the accelerating expansion of the global construction sector, particularly in emerging economies, which necessitates high-quality, durable sealants and adhesives for modern infrastructure projects and residential developments. Concurrently, the increasing demand from the automotive and aerospace industries for advanced materials that can enhance vehicle performance, fuel efficiency, and safety also fuels market growth. The continuous innovation in these sectors, including the rise of electric vehicles and more advanced aircraft designs, presents new opportunities for polysulfides with enhanced properties. Furthermore, the inherent benefits of polysulfides, such as their superior chemical resistance and environmental resilience, position them as a preferred choice over alternative materials in demanding applications, reinforcing their market penetration and contributing to a steady increase in demand across various critical industries globally.

Polysulfides Market Executive Summary

The polysulfides market is currently shaped by a confluence of evolving business trends, distinct regional dynamics, and significant shifts within its core application segments. Overall, the market demonstrates a strategic pivot towards innovation, sustainability, and efficiency driven by an increasingly competitive landscape. Key business trends include a heightened focus on mergers, acquisitions, and strategic partnerships as companies seek to consolidate market share, expand product portfolios, and achieve economies of scale. There is also a pronounced emphasis on research and development initiatives aimed at producing next-generation polysulfides with improved environmental profiles, such as lower VOC (Volatile Organic Compound) emissions and potential bio-based alternatives, responding to stricter global regulations and growing environmental consciousness among consumers and industries. Furthermore, manufacturers are exploring advanced manufacturing techniques and automation to optimize production processes, reduce operational costs, and enhance product consistency, thereby driving competitive advantage and market resilience.

Regional dynamics play a pivotal role in the polysulfides market's growth and distribution. The Asia-Pacific region, spearheaded by rapidly industrializing economies like China and India, continues to be the dominant market, primarily owing to robust growth in its construction, automotive, and manufacturing sectors. Significant infrastructure development projects and increasing urbanization in this region fuel a consistent demand for high-performance sealants and adhesives. In contrast, North America and Europe represent mature markets characterized by stringent environmental regulations and a strong focus on high-value, specialized applications, particularly in aerospace, high-end construction, and advanced automotive manufacturing. These regions are also at the forefront of adopting sustainable and eco-friendly polysulfide solutions. The Middle East and Africa (MEA) and Latin America are emerging as promising markets, driven by increasing investments in infrastructure, oil and gas, and construction projects, signaling potential for future expansion as industrialization progresses across these territories. Each region presents unique opportunities and challenges, requiring tailored market strategies to effectively navigate their distinct regulatory frameworks and industrial requirements.

Segmentation trends within the polysulfides market highlight specific areas of accelerated growth and strategic focus. The building and construction sector remains a cornerstone, consistently driving demand for polysulfide sealants in various applications, from expansion joints to architectural glazing, due to their unmatched durability and weather resistance. The aerospace industry, characterized by its rigorous performance requirements, continues to be a premium segment for polysulfides, particularly for fuel tank sealants and structural adhesives where material integrity under extreme conditions is non-negotiable. Similarly, the automotive sector is witnessing an increasing adoption of polysulfides, especially with the surge in electric vehicle (EV) production, which requires specialized sealing solutions for battery packs and critical electronic components against moisture and thermal variations. There is also a growing emphasis on polysulfide formulations that offer enhanced processing ease, quicker cure times, and superior adhesion to complex substrates, reflecting an industry-wide push towards efficiency and high-performance product differentiation. The demand for specific polysulfide types, such as liquid polysulfide polymers, continues to dominate due to their versatility and ease of application in various end-use industries.

AI Impact Analysis on Polysulfides Market

The influence of Artificial Intelligence (AI) on the Polysulfides Market is anticipated to be profoundly transformative, primarily by enhancing the efficiency and innovation capacity across the entire value chain. Users are keenly interested in how AI can optimize complex chemical synthesis processes, leading to faster development cycles for novel polysulfide formulations with superior performance characteristics and reduced environmental footprints. There is a strong expectation that AI will play a critical role in predicting material behaviors under diverse operational conditions, thus minimizing the need for extensive physical testing and accelerating product validation. Furthermore, industry stakeholders are looking to AI for streamlining supply chain management, improving inventory forecasting, and enabling more agile responses to market fluctuations in raw material availability and pricing. The overarching theme among user inquiries revolves around leveraging AI to achieve higher operational efficiency, cost reduction, product innovation, and more sustainable practices within the highly specialized domain of polysulfide manufacturing and application.

Specific concerns and expectations often center on how AI can address persistent challenges within the market, such as the variability in raw material quality, the intricate nature of polymerization processes, and the need for precision in formulating polysulfide compounds for specific applications. Users frequently query AI's capability in identifying optimal reaction parameters for polysulfide synthesis, potentially leading to higher yields and purer products. Another significant area of interest is the deployment of AI in quality control, where advanced machine learning algorithms can detect minute defects or inconsistencies in material properties that might be missed by traditional methods, thereby ensuring product reliability and reducing waste. The integration of AI for predictive maintenance in manufacturing facilities handling polysulfides is also a prominent expectation, aiming to reduce downtime, extend equipment lifespan, and ensure continuous, efficient production.

Moreover, the strategic application of AI is expected to extend beyond operational enhancements to impact market analysis and competitive intelligence. Stakeholders are exploring how AI-driven analytics can provide deeper insights into market trends, customer preferences, and competitor strategies, enabling companies to make more informed business decisions and identify untapped opportunities. This includes the use of natural language processing for analyzing vast amounts of technical literature, patent databases, and customer feedback to pinpoint emerging needs or technological advancements relevant to polysulfides. The long-term vision involves AI fostering a data-centric culture within the polysulfides market, where every stage, from conceptualization and research to production and market delivery, is optimized through intelligent algorithms and predictive models, leading to a more innovative, efficient, and responsive industry landscape.

- Enhanced R&D for novel formulations: AI algorithms can analyze vast datasets of chemical structures and properties to predict and design new polysulfide variants with improved performance, such as better adhesion, enhanced flexibility, or superior chemical resistance. This significantly shortens the discovery phase and reduces experimental trial-and-error.

- Predictive modeling for material performance: Machine learning models can simulate how polysulfides will perform under various environmental stressors (temperature extremes, chemical exposure, UV radiation) without extensive physical testing, enabling faster product development and validation cycles.

- Optimization of manufacturing processes: AI-driven systems can monitor and control polymerization reactors and compounding equipment in real-time, adjusting parameters to maintain optimal conditions for yield, quality, and energy efficiency, thereby minimizing waste and operational costs.

- Supply chain and logistics optimization: AI algorithms can forecast demand fluctuations, predict raw material availability and pricing, and optimize logistics routes, leading to reduced inventory costs, improved on-time delivery, and enhanced supply chain resilience.

- Quality control and defect detection: Computer vision and machine learning can be employed for automated inspection of polysulfide products during manufacturing, identifying even subtle defects or inconsistencies in real-time, ensuring higher product quality and reducing recalls.

- Market analysis and demand forecasting: AI tools can process extensive market data, including economic indicators, industry trends, and consumer behavior, to provide accurate demand forecasts, helping manufacturers align production with market needs and identify growth opportunities.

- Predictive maintenance of equipment: AI-powered sensors and analytics can monitor the health of manufacturing machinery, predicting potential failures before they occur. This allows for proactive maintenance, reduces unexpected downtime, and extends the lifespan of critical production assets.

DRO & Impact Forces Of Polysulfides Market

The polysulfides market is influenced by a dynamic interplay of various forces, encompassing significant drivers propelling its expansion, inherent restraints limiting its growth, and emerging opportunities shaping its future trajectory. A primary driver for market growth is the escalating demand from the global construction industry, particularly in developing economies, for durable and high-performance sealants and adhesives capable of withstanding harsh environmental conditions and ensuring long-term structural integrity. The inherent chemical resistance, low-temperature flexibility, and excellent adhesion properties of polysulfides make them an ideal choice for critical infrastructure projects, residential and commercial buildings, and specialized architectural applications. Simultaneously, the burgeoning automotive and aerospace sectors contribute substantially to market expansion, driven by the continuous need for advanced sealing and bonding solutions that can endure extreme operational environments, improve fuel efficiency, and enhance passenger safety. These industries rely on polysulfides for their robustness against fuels, oils, and hydraulic fluids, as well as their resilience to vibrations and thermal cycling.

Despite these significant tailwinds, the polysulfides market faces several restraining factors that could impede its growth. Chief among these is the volatility and unpredictability of raw material prices, such as those for sodium polysulfide and dichloroethyl formal, which are derived from petroleum. Fluctuations in crude oil prices directly impact production costs, potentially leading to increased product prices and affecting profitability margins for manufacturers. Furthermore, growing environmental concerns regarding certain traditional polysulfide variants, particularly those containing volatile organic compounds (VOCs) or requiring specific handling protocols, pose a challenge. Stringent regulatory frameworks in regions like North America and Europe are pushing for the development and adoption of greener, low-VOC, or bio-based alternatives, which necessitates significant R&D investment and can slow market penetration for existing products. Competition from alternative sealant and adhesive materials, such as silicones, polyurethanes, and modified silane polymers, also acts as a restraint, as these alternatives often offer competitive advantages in specific applications or cost structures, compelling polysulfide manufacturers to continuously innovate and differentiate their offerings.

However, the market is also characterized by substantial opportunities that promise future growth and innovation. The development of bio-based polysulfides, utilizing sustainable raw materials, presents a significant avenue for market expansion, addressing environmental concerns and aligning with global sustainability initiatives. This innovation not only helps mitigate regulatory pressures but also opens up new market segments for eco-conscious consumers and industries. The rapid industrialization and infrastructure development in emerging economies across Asia-Pacific, Latin America, and the Middle East and Africa provide vast untapped potential for polysulfide applications in construction, automotive, and industrial manufacturing. Furthermore, ongoing technological advancements in polymerization techniques and compounding technologies are leading to the creation of polysulfides with enhanced performance characteristics, such as faster cure times, improved adhesion to challenging substrates, and greater thermal stability, thereby broadening their applicability in specialized, high-value sectors like electric vehicle battery sealing and advanced renewable energy infrastructure. Strategic investments in these areas, coupled with robust market penetration strategies in high-growth regions, are pivotal for capitalizing on these emerging opportunities and ensuring sustained market growth.

Segmentation Analysis

The Polysulfides Market is comprehensively segmented to provide a detailed understanding of its diverse landscape and to identify key growth pockets and strategic opportunities. This segmentation typically involves categorizing the market based on various critical attributes, including product type, application, end-use industry, and geographical region. Each segment offers distinct insights into consumption patterns, technological preferences, and market demand drivers, reflecting the varied requirements of different industrial sectors and geographical areas. Analyzing these segments helps stakeholders, from raw material suppliers to end-product manufacturers, to tailor their strategies, optimize product development, and allocate resources effectively. The intricate interplay between these segments defines the market's overall structure and its potential for expansion, highlighting areas where polysulfides provide unique value propositions compared to alternative materials. Understanding these delineations is crucial for accurate market forecasting and strategic planning.

By classifying polysulfides based on their specific characteristics and primary functions, a clearer picture emerges of how demand is distributed across the industrial spectrum. For instance, the distinction between liquid polysulfide polymers and solid polysulfide rubbers underscores differences in processing methods, application versatility, and end-product properties. Liquid polysulfides, often used as sealants and coatings, offer flexibility and ease of application, making them dominant in construction and aerospace. Solid polysulfides, as elastomers, find niches where robust mechanical properties are required. Similarly, segmenting by application, such as sealants, adhesives, or coatings, directly reflects their functional roles and allows for a granular analysis of market penetration within specific industrial processes. The end-use industry segmentation further refines this perspective, showing how sectors like construction, aerospace, automotive, and marine leverage polysulfides for their distinct operational requirements, from ensuring fuel tank integrity in aircraft to providing waterproof barriers in building envelopes. This multi-faceted approach to segmentation provides a robust framework for assessing market dynamics.

This comprehensive segmentation not only helps in understanding the current market landscape but also aids in projecting future trends and identifying white space opportunities. For example, growth in a particular end-use industry, such as the electric vehicle sector, directly translates into increased demand for specific polysulfide applications like battery sealing. Conversely, regulatory shifts affecting VOC emissions might accelerate the adoption of low-VOC or bio-based polysulfide types, influencing the product type segment. Regional segmentation is equally vital, as it highlights differences in economic development, regulatory environments, and industrial activity levels that dictate regional demand and market maturity. Together, these segmentation categories offer a holistic view of the polysulfides market, allowing businesses to pinpoint the most lucrative segments, adapt to evolving market needs, and strategically position themselves for sustainable growth in an increasingly specialized and demanding global marketplace.

- By Product Type:

- Liquid Polysulfide Polymers (LPs)

- Solid Polysulfide Rubbers

- By Application:

- Sealants

- Adhesives

- Coatings

- Potting Compounds

- Others (e.g., molding compounds, specialized elastomers)

- By End-Use Industry:

- Building & Construction

- Aerospace

- Automotive

- Marine

- Insulating Glass

- Electrical & Electronics

- Industrial

- Others (e.g., defense, pharmaceutical packaging)

Value Chain Analysis For Polysulfides Market

The value chain for the polysulfides market is a complex network that begins with the sourcing of fundamental raw materials and extends through various stages of manufacturing, formulation, distribution, and ultimately, to the end-user. The upstream segment primarily involves the procurement and supply of key chemical precursors essential for polysulfide synthesis. These typically include sodium polysulfide, dichloroethyl formal (or similar bifunctional halogen compounds), and various polyols or thiols, which serve as backbone components or crosslinking agents. Suppliers in this upstream phase are often large chemical companies specializing in basic and intermediate chemicals, and their operational efficiency, pricing strategies, and reliability directly impact the cost structure and production stability of polysulfide manufacturers. The quality and consistent availability of these raw materials are paramount, as they directly influence the final properties and performance characteristics of the polysulfide polymers, demanding strong relationships and robust supply chain management between polysulfide producers and their upstream partners.

Midstream activities in the polysulfides value chain are centered on the actual manufacturing process, which involves complex polymerization reactions to synthesize liquid polysulfide polymers or solid polysulfide rubbers, followed by compounding and formulation. Polysulfide manufacturers convert these raw materials into various grades and forms, often incorporating additives such as fillers, plasticizers, curing agents, and adhesion promoters to tailor the properties for specific applications. This stage requires significant technical expertise, advanced chemical engineering processes, and specialized equipment to ensure precise molecular weight control, desired viscosity, cure characteristics, and overall performance. The output from this stage includes bulk polymers or pre-formulated compounds ready for distribution. Downstream in the value chain, these polysulfide products are channeled towards various end-use industries. This involves either direct distribution to large industrial clients like aerospace original equipment manufacturers (OEMs) or major construction contractors, or indirect distribution through a network of specialty chemical distributors, formulators, and local suppliers who often customize or repackage products for smaller clients or niche applications.

The distribution channels for polysulfides are critical in ensuring market reach and efficient delivery. Direct sales are often preferred for large-volume customers and specialized applications where technical support and custom formulations are required, fostering direct relationships between manufacturers and end-users. This approach allows for close collaboration on product specifications and performance requirements. Conversely, indirect channels, involving a network of wholesalers, distributors, and agents, play a crucial role in reaching a broader customer base, particularly small to medium-sized enterprises (SMEs) across diverse geographical regions. These intermediaries often provide local warehousing, logistical support, and technical services, effectively bridging the gap between manufacturers and dispersed end-users. The choice between direct and indirect distribution strategies often depends on factors such as market maturity, customer size, product complexity, and geographical scope. Effective management of these distribution networks is vital for optimizing market penetration, ensuring timely product availability, and maintaining competitive pricing within the dynamic global polysulfides market, ultimately delivering value from raw material extraction to final application.

Polysulfides Market Potential Customers

The potential customers for polysulfide products represent a diverse array of industries and specialized sectors, all united by a critical need for high-performance sealing, bonding, and coating solutions that can withstand challenging environmental and operational conditions. The primary end-users or buyers are those entities that incorporate polysulfides into their manufactured goods, infrastructure projects, or maintenance operations, where the unique properties of these polymers offer indispensable advantages. Prominent among these are construction contractors and developers, who utilize polysulfide sealants extensively for expansion joints, waterproofing membranes, and architectural glazing in commercial, residential, and industrial buildings. Their demand is driven by the need for durable, long-lasting materials that can accommodate structural movement, resist weathering, and maintain integrity over decades, thereby reducing maintenance costs and enhancing building longevity.

Another significant customer base resides within the highly regulated and demanding aerospace and automotive industries. Aerospace manufacturers, including major aircraft OEMs and maintenance, repair, and overhaul (MRO) providers, are key consumers of polysulfides, particularly for integral fuel tank sealants, fuselage sealing, and cabin interior applications. Their purchasing decisions are heavily influenced by stringent safety standards, material certifications, and the absolute necessity for fuel, oil, and chemical resistance, along with performance across extreme temperature fluctuations. Similarly, automotive OEMs and component manufacturers leverage polysulfides for various sealing applications within vehicles, especially in areas exposed to aggressive fluids or requiring vibration dampening, increasingly so in electric vehicles for battery pack sealing and critical electronic component protection against moisture ingress and thermal runaway. These customers prioritize materials that contribute to vehicle safety, reliability, and extended operational life, alongside regulatory compliance and ease of integration into manufacturing processes.

Beyond these major sectors, the polysulfides market also serves a range of other specialized industrial customers. Marine vessel builders and maintenance companies rely on polysulfides for their exceptional saltwater resistance, UV stability, and adhesion to various substrates, using them for hull sealing, deck caulking, and corrosion protection to ensure the longevity and seaworthiness of ships and boats. Manufacturers of insulating glass units (IGUs) are crucial buyers, as polysulfide sealants provide the necessary hermetic seal to prevent moisture ingress and maintain the thermal performance of double- and triple-glazed windows. Furthermore, the electrical and electronics industry utilizes polysulfide potting compounds and encapsulants for protecting sensitive components from moisture, chemicals, and physical shock. Industrial fabricators, infrastructure developers (for bridges, roads, and pipelines), and even defense contractors comprise additional segments of potential customers, all seeking polysulfides for their robust performance under specific, often extreme, application requirements where material failure is unacceptable. The diverse and critical nature of these applications underscores the broad customer base and essential role of polysulfides across various global industries.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 billion |

| Market Forecast in 2033 | USD 1.84 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PPG Industries Inc., Toray Industries Inc., Arkema S.A., Chemetall (BASF Group), The Dow Chemical Company, Shin-Etsu Chemical Co., Ltd., Wacker Chemie AG, KCC Corporation, Polymer Products Co. Inc., JSC Kazan Synthetic Rubber Plant, Nouryon, Evonik Industries AG, Momentive Performance Materials Inc., Solvay S.A., LANXESS AG, Kaneka Corporation, Trelleborg AB, M.G.S. General Industries, Mitsubishi Chemical Corporation, Sumitomo Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Polysulfides Market Key Technology Landscape

The polysulfides market is continuously evolving, driven by advancements in material science and chemical engineering, leading to a dynamic technological landscape. Key technological developments focus on enhancing material properties, optimizing manufacturing processes, and addressing environmental sustainability concerns. At the core are various polymerization techniques used to synthesize polysulfide polymers, including condensation polymerization and radical polymerization. Ongoing research aims to refine these processes to achieve precise control over molecular weight, branching, and end-group functionalities, which directly influence the final polymer's viscosity, cure rate, and mechanical properties. Innovations in catalyst systems and reaction conditions are also crucial for improving polymerization efficiency, reducing reaction times, and minimizing unwanted byproducts, thereby leading to higher yields and purer polysulfide resins suitable for demanding applications.

Beyond basic polymerization, advancements in compounding technologies play a vital role in developing high-performance polysulfide formulations. This involves the judicious selection and integration of various additives, such as reinforcing fillers (e.g., carbon black, fumed silica), plasticizers, adhesion promoters (e.g., silanes), antioxidants, and UV stabilizers. These additives are critical for tailoring properties like tensile strength, elongation, tear resistance, adhesion to diverse substrates, and UV stability, ensuring the polysulfide product meets the specific requirements of various end-use applications, from aerospace sealants to construction adhesives. Moreover, the development of sophisticated curing systems is paramount. While traditional curing agents like peroxides and amine-based compounds are common, there is a growing trend towards developing novel, faster-curing systems that can reduce production cycle times and improve application efficiency, particularly in fast-paced manufacturing environments or on-site construction projects where rapid setting is beneficial.

A significant area of technological focus and innovation is the drive towards developing more sustainable and environmentally friendly polysulfide solutions. This includes intensive research into low-VOC (Volatile Organic Compound) and VOC-free formulations to comply with increasingly stringent environmental regulations and meet the demand for greener products. Furthermore, the exploration of bio-based polysulfides, derived from renewable resources rather than petrochemicals, represents a frontier for sustainable innovation, offering a pathway to reduce the carbon footprint of polysulfide production and enhance market appeal. Alongside material innovation, advancements in application equipment and techniques are also important. This encompasses automated dispensing systems, robotic application solutions, and improved mixing equipment that enhance the precision, consistency, and efficiency of applying polysulfide sealants and adhesives in industrial settings. These technological strides collectively aim to improve product performance, reduce environmental impact, and streamline manufacturing and application processes across the polysulfides market, ensuring its continued relevance and growth.

Regional Highlights

- North America: This region represents a mature and technologically advanced market for polysulfides, characterized by a strong emphasis on high-performance and specialized applications. The aerospace industry, particularly in the United States, is a dominant consumer, utilizing polysulfides for critical fuel tank sealants and structural bonding due to stringent safety and performance requirements. The construction sector, while mature, consistently demands durable sealants for commercial and infrastructure projects, with a growing focus on sustainable and low-VOC formulations. Canada and Mexico also contribute to the regional market, particularly in automotive and industrial applications. Strict environmental regulations continue to drive innovation towards greener polysulfide solutions, fostering a market that values product quality, technical support, and environmental compliance.

- Europe: The European polysulfides market is highly influenced by rigorous environmental regulations, particularly concerning VOC emissions and hazardous substance control. This regulatory landscape has propelled significant investment in research and development for eco-friendly polysulfide formulations, including low-VOC and bio-based alternatives. Key end-use industries include automotive, where polysulfides are used for sealing and bonding in electric vehicles and traditional automobiles, and construction, particularly for high-performance architectural applications and infrastructure projects. Countries like Germany, France, and the UK are prominent contributors, showcasing strong manufacturing capabilities and a preference for advanced material solutions. Innovation and sustainability are core tenets driving market dynamics in this region.

- Asia Pacific (APAC): The Asia Pacific region is the largest and fastest-growing market for polysulfides globally, driven by rapid industrialization, burgeoning construction activities, and significant growth in the automotive manufacturing sector, especially in countries like China, India, and Japan. Massive infrastructure development projects, coupled with increasing urbanization, fuel a high demand for polysulfide sealants and adhesives. The expanding middle class and rising disposable incomes in many APAC nations are also contributing to increased demand for automobiles and consumer electronics, further boosting the market. While cost-effectiveness remains a significant factor, there is also a growing awareness and adoption of higher-performance and more sustainable polysulfide products as regulatory environments evolve.

- Latin America: This region is an emerging market for polysulfides, showing steady growth propelled by increasing investments in infrastructure development, residential and commercial construction, and expansion in the automotive industry. Countries such as Brazil and Mexico are leading the market, driven by urbanization and industrialization efforts. The demand for polysulfides is linked to projects in transport infrastructure, housing, and general manufacturing. While the market is still developing compared to APAC or North America, there is significant potential for growth as economic stability improves and industrial output increases, leading to a greater adoption of advanced chemical solutions like polysulfides.

- Middle East and Africa (MEA): The MEA region presents a promising market for polysulfides, primarily fueled by extensive construction activities, particularly in the Gulf Cooperation Council (GCC) countries, and ongoing investments in oil and gas infrastructure. Mega-projects related to urban development, tourism, and economic diversification in countries like Saudi Arabia and the UAE are generating substantial demand for high-performance sealants and coatings. In Africa, growing industrialization and infrastructure projects also contribute to market expansion. The harsh climatic conditions in many parts of the MEA region necessitate materials with superior resistance to heat, UV radiation, and environmental stressors, making polysulfides an attractive choice for various applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Polysulfides Market.- PPG Industries Inc. (PRC-DeSoto)

- Toray Industries Inc.

- Arkema S.A. (Thiokol)

- Chemetall (BASF Group)

- The Dow Chemical Company

- Shin-Etsu Chemical Co., Ltd.

- Wacker Chemie AG

- KCC Corporation

- Polymer Products Co. Inc.

- JSC Kazan Synthetic Rubber Plant

- Nouryon

- Evonik Industries AG

- Momentive Performance Materials Inc.

- Solvay S.A.

- LANXESS AG

- Kaneka Corporation

- Trelleborg AB

- M.G.S. General Industries

- Mitsubishi Chemical Corporation

- Sumitomo Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Polysulfides market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are polysulfides and what are their primary uses?

Polysulfides are synthetic polymers known for their excellent chemical resistance, impermeability to gases, and flexibility at low temperatures. They are primarily used as high-performance sealants, adhesives, and coatings in demanding applications across the construction, aerospace, automotive, and marine industries.

What are the key factors driving the growth of the polysulfides market?

The market growth is primarily driven by the expanding global construction sector, increasing demand from the automotive and aerospace industries for durable sealing solutions, and the inherent superior chemical resistance of polysulfides, making them indispensable for high-performance applications.

What challenges does the polysulfides market face?

The market faces challenges such as volatility in raw material prices, environmental concerns related to VOC emissions in traditional formulations, increasingly stringent regulations, and intense competition from alternative sealant and adhesive materials like silicones and polyurethanes.

How do polysulfides compare to other common sealants like silicones and polyurethanes?

Polysulfides generally offer superior resistance to fuels, oils, and many industrial chemicals compared to silicones and polyurethanes. While silicones excel in UV stability and high-temperature resistance, and polyurethanes offer good adhesion and mechanical strength, polysulfides are preferred for applications requiring specific solvent and chemical impermeability and excellent low-temperature flexibility.

What are the emerging technological trends in the polysulfides market?

Key technological trends include the development of low-VOC and bio-based polysulfide formulations to enhance sustainability, innovations in polymerization and compounding techniques for improved material properties, and advancements in faster-curing systems and automated application technologies to boost efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager