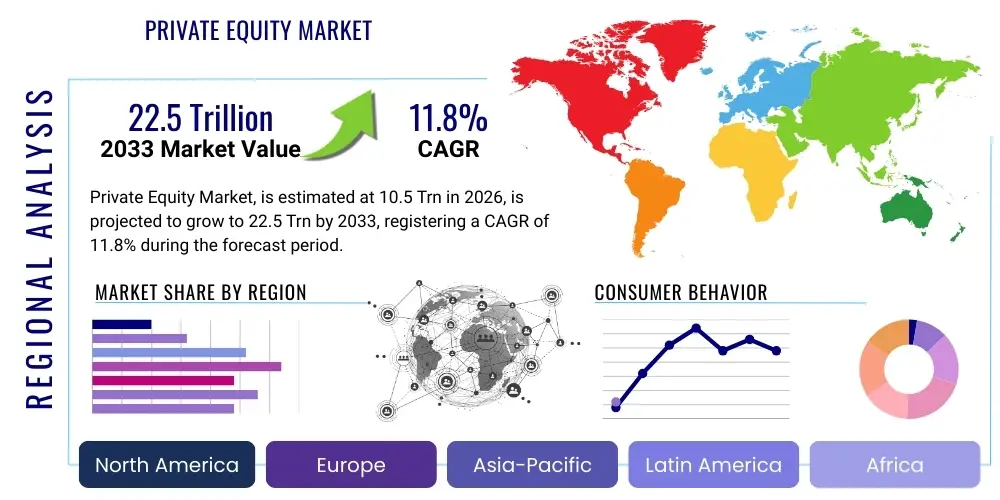

Private Equity Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440430 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Private Equity Market Size

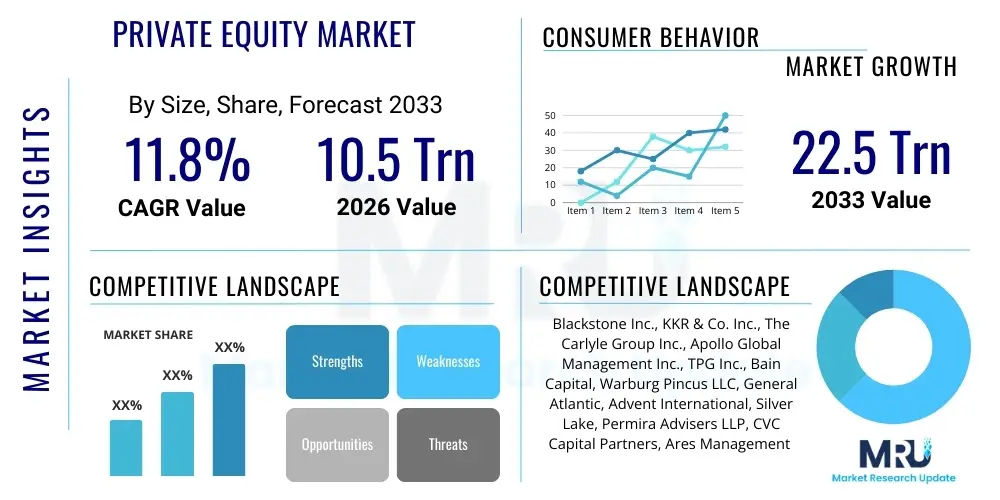

The Private Equity Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at USD 10.5 Trillion in 2026 and is projected to reach USD 22.5 Trillion by the end of the forecast period in 2033. This robust growth is fueled by a confluence of factors including sustained institutional investor interest in alternative assets offering superior returns, an increasing appetite for strategic acquisitions across diverse industries, and the expanding availability of dry powder awaiting deployment. The market continues to evolve, adapting to new economic paradigms and regulatory landscapes while consistently seeking out innovative value creation opportunities.

Private Equity Market introduction

The Private Equity (PE) market encompasses an expansive financial sector dedicated to investing directly in private companies or engaging in buyouts of public companies, resulting in their delisting from public stock exchanges. Fundamentally, PE firms raise capital from institutional and accredited investors, known as Limited Partners (LPs), and deploy this capital into various types of companies with the strategic objective of increasing their value over a holding period, typically 3 to 7 years. This value creation is achieved through a combination of operational improvements, strategic initiatives, financial restructuring, and growth acceleration, ultimately leading to an exit via an initial public offering (IPO), trade sale, or secondary sale. The market's product description is broadly categorized into several core strategies: leveraged buyouts (LBOs), where a significant amount of the purchase price is financed through debt; growth equity, involving minority investments in mature, high-growth companies; venture capital, focusing on early-stage, high-potential startups; and distressed investing, targeting companies facing financial difficulties.

Major applications of private equity capital span across virtually every industry vertical, including technology, healthcare, consumer goods, industrials, financial services, energy, and infrastructure. PE investments are critical in fostering innovation, supporting business expansion, facilitating corporate transformations, and providing liquidity for founders and early investors. The benefits derived from private equity interventions are manifold, encompassing enhanced corporate governance, access to strategic expertise and networks, accelerated product development, market expansion, and the implementation of operational efficiencies that might be difficult to achieve under public market scrutiny or without significant capital infusion. For investors, private equity offers diversification benefits, the potential for outsized returns compared to traditional asset classes, and access to unique investment opportunities.

Driving factors propelling the private equity market's growth are diverse and interconnected. A persistent low-interest-rate environment, although recently shifting, historically made debt financing for buyouts attractive, amplifying returns. The ever-increasing sophistication and capital pools of institutional investors, such as pension funds, endowments, and sovereign wealth funds, continue to fuel fundraising efforts, as these LPs seek higher returns and portfolio diversification. Furthermore, robust M&A activity, globalization, technological advancements creating new industries and opportunities for disruption, and the growing complexity of business operations requiring specialized financial and strategic input, all contribute significantly to the dynamism and expansion of the private equity landscape. Regulatory frameworks, while sometimes posing challenges, also help to define the market's operational boundaries and foster investor confidence, ensuring a degree of stability amidst its inherent risks.

Private Equity Market Executive Summary

The private equity market is currently navigating a complex yet dynamic landscape characterized by evolving business trends, significant regional shifts, and nuanced segment-specific developments. Business trends reveal a pronounced shift towards value creation through operational improvements and strategic initiatives, moving beyond mere financial engineering. Firms are increasingly prioritizing Environmental, Social, and Governance (ESG) factors, integrating them into investment theses and portfolio management to enhance long-term sustainability and mitigate risks. Digital transformation, leveraging data analytics and artificial intelligence, is becoming central to deal sourcing, due diligence, and portfolio optimization. Despite periods of economic uncertainty, dry powder – capital committed but not yet invested – remains at historically high levels, indicating substantial future deployment potential, although deal making may become more selective and valuation-sensitive. Consolidation among general partners (GPs) and the emergence of multi-strategy firms are also prominent trends, as firms seek scale and diversified offerings.

Regionally, the market continues to be dominated by North America and Europe, which possess mature ecosystems of established firms, experienced limited partners, and sophisticated advisory networks. However, the Asia Pacific (APAC) region is demonstrating exceptional growth, driven by burgeoning economies, a rapidly expanding middle class, and increasing entrepreneurial activity, particularly in China and India. Latin America and the Middle East & Africa (MEA) are also attracting greater attention, with investments focusing on infrastructure, natural resources, and growing consumer markets, albeit with higher geopolitical and economic risks. The cross-border flow of capital and expertise is intensifying, reflecting a globalized approach to sourcing opportunities and diversifying portfolios, with firms establishing local presences to tap into specific regional dynamics and regulatory environments. This global expansion necessitates a deeper understanding of local market nuances and cultural sensitivities for successful deal execution and value realization.

Segment trends within private equity show a vibrant and diversified approach to investing. While traditional leveraged buyouts remain a cornerstone, there has been a significant surge in growth equity investments, targeting high-growth companies that require capital for expansion without ceding majority control. Venture capital continues to be a critical driver of innovation, particularly in technology and biotech, although fundraising and valuation cycles can be highly volatile. Infrastructure and real estate funds are attracting substantial capital due to their stable, long-term return profiles and inflation-hedging qualities. Distressed debt and special situations funds are gaining prominence during periods of economic downturn or market dislocation, capitalizing on opportunities to acquire undervalued assets. This segmentation reflects the market's adaptability and its capacity to cater to a wide spectrum of risk appetites and return objectives, continuously optimizing strategies to unlock value across different asset classes and company life cycles.

AI Impact Analysis on Private Equity Market

Common user questions regarding AI's impact on the Private Equity Market frequently revolve around how artificial intelligence can enhance deal sourcing, optimize due diligence processes, improve portfolio company performance, and mitigate investment risks. Users are keen to understand the practical applications of AI in identifying undervalued assets, predicting market trends, automating repetitive analytical tasks, and providing data-driven insights for strategic decision-making. Concerns often center on the accuracy and bias of AI algorithms, data privacy issues, the need for specialized talent to implement and manage AI solutions, and the potential for job displacement within PE firms. Expectations are high for AI to revolutionize the industry by delivering superior returns, increasing operational efficiency, and enabling more informed and agile investment strategies, thereby creating a competitive edge for early adopters.

- Enhanced Deal Sourcing: AI algorithms can analyze vast datasets, including news articles, industry reports, company financials, and social media, to identify potential investment targets that align with a firm's investment thesis, often spotting opportunities overlooked by traditional methods. This allows for more efficient screening and a broader reach in discovering promising companies.

- Optimized Due Diligence: Machine learning models can process and extract critical information from complex legal documents, financial statements, and market research reports much faster than human analysts, identifying red flags, assessing market potential, and validating business models with greater accuracy and speed.

- Improved Portfolio Performance: AI tools can provide real-time insights into portfolio company operations, identify areas for operational improvement, optimize pricing strategies, forecast demand, and monitor competitor activities, enabling PE firms to proactively support and enhance their investments.

- Advanced Risk Management: Predictive analytics powered by AI can assess various risks, including market volatility, credit risk, operational risk, and geopolitical risk, providing early warning signals and enabling firms to model different scenarios for more robust risk mitigation strategies.

- Automated Market Analysis: AI can rapidly aggregate and interpret market data, economic indicators, and consumer behavior trends, offering a deeper understanding of market dynamics and helping PE firms make more informed investment decisions and exit timing.

- Personalized Investor Relations: AI-driven CRM systems can help PE firms better understand LP preferences, tailor communication, and optimize fundraising efforts by identifying potential investors whose profiles align with specific fund strategies.

- Operational Efficiency within PE Firms: Automation of back-office functions, compliance monitoring, and administrative tasks using AI can free up human capital, allowing investment professionals to focus on higher-value activities.

DRO & Impact Forces Of Private Equity Market

The Private Equity market is profoundly shaped by a dynamic interplay of Drivers, Restraints, and Opportunities, all underpinned by significant Impact Forces. Key drivers include the persistent demand from institutional investors for diversified portfolios and higher returns, particularly in a landscape where traditional assets yield modest results. The availability of substantial dry powder, a result of successful fundraising cycles, ensures a robust capital base ready for deployment. Moreover, the increasing recognition of private equity firms' capability for operational value creation, rather than merely financial engineering, attracts more target companies seeking strategic partners for growth and transformation. Technological advancements creating new industries and business models also present fertile ground for private equity investment, alongside the globalization of markets which expands the universe of potential targets and investors. Furthermore, a well-developed ecosystem of advisory services, debt providers, and legal frameworks supports complex deal execution.

However, the market also faces considerable restraints. Elevated asset valuations across many sectors make attractive acquisition targets more expensive, compressing potential returns and increasing investment risk. Regulatory scrutiny has intensified globally, particularly concerning leverage levels, transparency, and systemic risk, adding compliance burdens and potentially limiting certain investment strategies. Economic uncertainties, such as inflationary pressures, interest rate hikes, and geopolitical instability, can dampen investor confidence, reduce corporate earnings, and complicate exit strategies. The fierce competition for quality assets among a growing number of private equity firms also drives up prices and can lead to less favorable deal terms. Furthermore, the inherent illiquidity of private equity investments and the long holding periods can be a restraint for some investors, requiring a long-term capital commitment.

Opportunities within the private equity market are abundant and diverse. Emerging markets, particularly in Asia Pacific, Latin America, and parts of Africa, offer significant growth potential due to expanding economies, rising consumer classes, and underserved sectors. The rapid pace of technological innovation, including areas like artificial intelligence, biotechnology, cybersecurity, and renewable energy, creates new frontiers for specialized funds. The increasing focus on Environmental, Social, and Governance (ESG) criteria presents opportunities for impact investing and for firms to enhance value by improving the sustainability profiles of their portfolio companies. Furthermore, periods of economic dislocation or industry restructuring can create opportunities for distressed asset acquisitions, turnaround investments, and carve-outs from large corporations seeking to streamline operations. The secondary market for private equity interests also offers liquidity and new avenues for investors seeking to manage portfolio exposures.

Impact forces represent the broader macro-environmental factors that exert significant influence on the private equity market. Global economic cycles, including periods of expansion and contraction, directly affect corporate earnings, valuations, and the availability of debt financing. Changes in interest rates, dictated by central banks, have a profound impact on the cost of leverage for buyouts and the attractiveness of alternative investments. Geopolitical events, such as trade wars, regional conflicts, and policy shifts, can create market volatility, disrupt supply chains, and alter investment landscapes. Technological disruption, while offering opportunities, can also render existing business models obsolete, requiring PE firms to be agile and forward-looking in their investment choices. Demographic shifts, regulatory changes, and broader societal trends suchvering sustainability and digitalization further shape the market's trajectory, compelling firms to adapt their strategies and operations to remain competitive and relevant.

Segmentation Analysis

The private equity market is highly fragmented yet meticulously segmented to cater to diverse investor mandates, risk appetites, and industry-specific opportunities. This segmentation allows for specialized expertise, tailored investment strategies, and optimized capital deployment across various stages of a company's lifecycle and across different asset classes. Understanding these segments is crucial for both investors seeking appropriate allocations and firms aiming to define their competitive niche. The market can be broadly segmented by fund type, offering distinct risk-reward profiles; by the sector of investment, reflecting industry-specific knowledge; and by investor type, highlighting the diverse sources of capital fueling the industry.

- By Fund Type:

- Leveraged Buyout (LBO) Funds: These are the most common type, acquiring mature companies using a significant amount of borrowed money. The aim is to improve operations and management, then sell for a profit.

- Growth Equity Funds: Focus on minority investments in relatively mature, high-growth companies that require capital to scale operations, expand into new markets, or develop new products, without taking full control.

- Venture Capital (VC) Funds: Invest in early-stage, high-potential startups with innovative technologies or business models, aiming for high returns on successful exits, though with significant risk of failure.

- Mezzanine Funds: Provide a hybrid form of financing, typically unsecured subordinated debt with equity features, bridging the gap between senior debt and equity.

- Distressed Debt/Special Situations Funds: Invest in financially troubled companies or undervalued assets that are experiencing operational or financial distress, with the goal of restructuring and turning them around.

- Real Estate Funds: Focus on acquiring, developing, and managing various types of real estate properties, including commercial, residential, industrial, and retail.

- Infrastructure Funds: Invest in large-scale infrastructure projects such as transportation networks, energy facilities, communication systems, and utilities, characterized by stable, long-term cash flows.

- By Sector:

- Technology: Software, SaaS, FinTech, Cybersecurity, AI/ML, E-commerce, Hardware.

- Healthcare: Pharmaceuticals, Biotech, Medical Devices, Healthcare Services, Health IT.

- Consumer Goods & Retail: Food & Beverage, Apparel, E-commerce Retailers, Consumer Services.

- Financial Services: Banking, Insurance, Asset Management, Lending Platforms.

- Industrial & Manufacturing: Aerospace & Defense, Automotive, Chemicals, Heavy Machinery, Logistics.

- Energy & Utilities: Oil & Gas, Renewable Energy, Power Generation, Water Utilities.

- Business Services: IT Consulting, Human Resources, Marketing Agencies, Facilities Management.

- By Investor Type:

- Institutional Investors: Pension funds, endowments, sovereign wealth funds, insurance companies, foundations.

- High Net Worth Individuals (HNWIs) & Family Offices: Wealthy individuals and private wealth management entities.

- Fund-of-Funds: Investment vehicles that primarily invest in other private equity funds.

- Corporate Investors: Large corporations that invest directly or through corporate venture arms.

Value Chain Analysis For Private Equity Market

The private equity value chain is a complex, multi-stage process designed to identify, acquire, optimize, and exit investments, thereby creating value for limited partners. It begins with the upstream activities centered on fundraising and meticulous deal sourcing. General partners (GPs) actively engage with institutional investors, high-net-worth individuals, and family offices to raise capital for new funds, a process that can take months or even years. Simultaneously, sophisticated deal sourcing mechanisms are employed, including proprietary networks, investment banks, brokers, and increasingly, advanced data analytics and artificial intelligence to identify potential target companies that fit the fund's investment thesis. Following initial identification, a rigorous due diligence phase commences, involving detailed financial analysis, market research, operational assessments, legal reviews, and environmental impact studies to thoroughly evaluate the target's risks and opportunities. This comprehensive upstream phase is critical as it lays the foundation for all subsequent value creation.

Moving downstream, the core of the value chain revolves around portfolio management and strategic value creation. Once an acquisition is complete, the private equity firm typically takes an active role in the governance and strategic direction of the portfolio company. This often involves appointing new management, implementing operational improvements, optimizing cost structures, enhancing sales and marketing strategies, facilitating mergers and acquisitions for bolt-on growth, and investing in new technologies or product development. The PE firm leverages its industry expertise, financial resources, and extensive network to transform the company, aiming for significant growth in earnings and market share. This active ownership model distinguishes private equity from passive investing, as the firms are deeply involved in driving operational excellence and strategic transformations to achieve their investment objectives. The ultimate goal of these downstream activities is to significantly increase the company's enterprise value over the investment horizon.

The final stage of the value chain involves the exit strategy, where the private equity firm liquidates its investment to realize returns for its limited partners. The primary distribution channels for these exits include initial public offerings (IPOs), where the company is listed on a public stock exchange; trade sales, involving the sale of the company to a strategic corporate buyer; and secondary buyouts, where the company is sold to another private equity firm. Direct and indirect distribution channels are evident throughout the value chain. Fundraising occurs through direct relationships between GPs and LPs, or indirectly via placement agents and fund-of-funds. Deal sourcing can be direct through proprietary channels or indirect through intermediaries. Exit strategies are also executed through established direct market mechanisms (IPOs, trade sales) or secondary market transactions. The successful navigation of this entire value chain, from initial capital raise to final exit, dictates the profitability and reputation of a private equity firm, demonstrating its ability to consistently identify, grow, and monetize investments effectively.

Private Equity Market Potential Customers

The primary potential customers, or limited partners (LPs), in the private equity market are sophisticated institutional investors seeking to diversify their portfolios and generate superior, risk-adjusted returns that often outperform traditional public market investments over the long term. These LPs commit capital to private equity funds, entrusting the general partners (GPs) with the responsibility of identifying, investing in, and managing private companies. Pension funds represent a significant segment of these customers, as they have long-term liabilities and mandates to generate stable, high returns to meet their obligations to retirees. Similarly, university endowments and charitable foundations, with their perpetual investment horizons, are keen investors, leveraging private equity for capital appreciation and income generation to support their missions. These entities value the potential for uncorrelated returns, access to private market growth, and the expertise of specialized PE firms.

Sovereign wealth funds (SWFs), managing national savings for future generations, are another crucial customer segment. They typically possess vast capital reserves and long-term investment horizons, making them ideal LPs for large-scale private equity funds, particularly those focused on infrastructure, natural resources, and emerging markets. Insurance companies, with their need for stable long-term assets to match their liabilities, also allocate a portion of their portfolios to private equity, benefiting from its potential for attractive yields and diversification. These institutional buyers prioritize robust risk management frameworks, transparency, and a proven track record from private equity firms, ensuring their fiduciary duties are met while maximizing investment performance. The sheer scale of capital these customers control makes them indispensable to the growth and sustainability of the private equity market.

Beyond large institutions, high-net-worth individuals (HNWIs) and family offices are increasingly becoming significant potential customers in the private equity market. These sophisticated private investors are drawn to private equity for its potential to generate substantial wealth, diversify away from public markets, and gain exposure to unique investment opportunities not accessible to retail investors. Family offices, in particular, often have a long-term, multi-generational investment philosophy that aligns well with the typical holding periods of private equity. While their individual allocations may be smaller than those of large institutional investors, their collective capital contribution is substantial and growing. These private customers often seek bespoke solutions, co-investment opportunities alongside PE funds, and a greater degree of control or influence over their investments, highlighting a demand for personalized engagement from private equity firms. Fund-of-funds also serve as indirect customers, aggregating capital from various LPs and investing it across multiple private equity funds, providing a diversified and professionally managed entry point for smaller or less experienced institutional investors into the complex private equity landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.5 Trillion |

| Market Forecast in 2033 | USD 22.5 Trillion |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Blackstone Inc., KKR & Co. Inc., The Carlyle Group Inc., Apollo Global Management Inc., TPG Inc., Bain Capital, Warburg Pincus LLC, General Atlantic, Advent International, Silver Lake, Permira Advisers LLP, CVC Capital Partners, Ares Management Corporation, Vista Equity Partners, Thoma Bravo, Welsh, Carson, Anderson & Stowe, EQT AB, CD&R (Clayton, Dubilier & Rice), Hellman & Friedman, Berkshire Partners |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Private Equity Market Key Technology Landscape

The private equity market is increasingly leveraging a sophisticated array of technologies to gain a competitive edge, enhance operational efficiency, and drive superior investment outcomes. At the forefront is the adoption of advanced data analytics and big data processing capabilities. PE firms are using these tools to analyze vast, unstructured datasets from various sources—including financial markets, industry reports, social media, and proprietary databases—to identify investment trends, conduct predictive modeling for market movements, and uncover hidden value in potential target companies. This data-driven approach allows for more informed deal sourcing, precise due diligence, and robust risk assessment, moving away from purely intuition-based decisions towards evidence-backed strategies. The ability to quickly process and interpret complex information offers a significant advantage in a fast-paced and highly competitive environment.

Artificial Intelligence (AI) and Machine Learning (ML) are rapidly transforming how private equity firms operate across their entire value chain. AI-powered algorithms are deployed for automated deal screening, enabling firms to filter through thousands of potential targets based on predefined criteria, thereby saving considerable time and resources. During due diligence, ML models can analyze legal documents, financial statements, and operational data to identify anomalies, predict future performance, and assess market attractiveness with greater accuracy. Post-acquisition, AI is used to optimize portfolio company operations, providing real-time performance insights, identifying areas for cost reduction or revenue growth, and even automating certain business processes. Natural Language Processing (NLP) is also critical for extracting insights from textual data, such as earnings call transcripts, news articles, and customer reviews, offering a deeper qualitative understanding of market sentiment and company health.

Beyond analytics, cloud computing provides the scalable infrastructure necessary to support these data-intensive technologies, offering flexibility, cost efficiency, and enhanced collaboration capabilities for globally dispersed teams. Modern CRM (Customer Relationship Management) platforms, often integrated with AI, are essential for managing investor relations, tracking limited partner engagements, and optimizing fundraising efforts through personalized communication. Furthermore, advancements in cybersecurity are paramount to protect sensitive financial data and intellectual property across the PE firm's digital ecosystem. While not yet mainstream, blockchain technology is being explored for its potential to enhance transparency, streamline capital calls and distributions, and reduce administrative costs within fund management. The continuous evolution and integration of these technologies are fundamentally reshaping private equity, enabling firms to operate with greater agility, insight, and efficiency, ultimately contributing to more effective value creation and stronger returns for investors.

Regional Highlights

- North America: The most mature and largest private equity market globally, characterized by a deep pool of institutional investors, a highly developed advisory infrastructure, and a vibrant entrepreneurial ecosystem, particularly in technology and healthcare. The U.S. remains the epicenter, with robust fundraising, active deal flow across all segments, and sophisticated exit opportunities. Canada also plays a significant role with strong pension fund participation.

- Europe: A diverse and fragmented market, with strong regional hubs in the UK, France, Germany, and the Nordics. European private equity often focuses on mid-market buyouts, reflecting the region's prevalence of family-owned businesses. The market is subject to varying regulatory landscapes and economic conditions across different countries. ESG considerations are highly prioritized in European private equity strategies.

- Asia Pacific (APAC): The fastest-growing private equity market, driven by rapid economic expansion, a burgeoning middle class, and increasing innovation, particularly in China, India, Japan, and Southeast Asia. The region offers immense opportunities in venture capital and growth equity, capitalizing on digital transformation and consumer market growth, though it presents unique challenges related to regulatory complexities and geopolitical dynamics.

- Latin America: An emerging private equity market with significant potential, primarily focused on Brazil, Mexico, and Colombia. Investments often target infrastructure, natural resources, and growing consumer sectors. The market is characterized by higher macroeconomic volatility and political risks compared to more developed regions, but offers attractive returns for firms with local expertise and long-term commitment.

- Middle East and Africa (MEA): A region gaining increasing attention, particularly the GCC countries (Saudi Arabia, UAE) with their sovereign wealth funds driving significant capital deployment into both regional and global private equity. Africa presents frontier market opportunities in sectors like fintech, renewables, and consumer goods, albeit with elevated risk profiles. Infrastructure and energy remain key investment areas across the broader MEA region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Private Equity Market.- Blackstone Inc.

- KKR & Co. Inc.

- The Carlyle Group Inc.

- Apollo Global Management Inc.

- TPG Inc.

- Bain Capital

- Warburg Pincus LLC

- General Atlantic

- Advent International

- Silver Lake

- Permira Advisers LLP

- CVC Capital Partners

- Ares Management Corporation

- Vista Equity Partners

- Thoma Bravo

- Welsh, Carson, Anderson & Stowe

- EQT AB

- CD&R (Clayton, Dubilier & Rice)

- Hellman & Friedman

- Berkshire Partners

Frequently Asked Questions

Analyze common user questions about the Private Equity market and generate a concise list of summarized FAQs reflecting key topics and concerns.What exactly is Private Equity and how does it differ from traditional public market investing?

Private Equity (PE) involves investment in companies that are not publicly traded on a stock exchange. Unlike public market investing, where investors buy shares of publicly listed companies, PE firms acquire private businesses, or take public companies private, with the goal of improving their operations and increasing their value over a medium-to-long-term holding period, typically 3-7 years, before exiting the investment. This approach offers the potential for higher returns but also comes with greater illiquidity and typically requires a longer commitment.

Who are the primary investors (Limited Partners) in Private Equity funds?

The primary investors in Private Equity funds, known as Limited Partners (LPs), are predominantly large institutional investors. This includes pension funds, university endowments, sovereign wealth funds, insurance companies, and foundations, all of whom seek diversified portfolios and attractive long-term returns. High-net-worth individuals and family offices also represent a growing segment of LPs, contributing substantial capital to the market. These investors commit capital to PE funds, which are then managed by General Partners (GPs) who make the actual investment decisions.

What are the main types of Private Equity strategies and what kind of companies do they target?

The main types of Private Equity strategies include Leveraged Buyouts (LBOs), which typically acquire mature companies using significant debt; Growth Equity, involving minority investments in rapidly expanding, established companies; and Venture Capital (VC), focused on early-stage, high-potential startups. Other strategies include distressed debt investing for troubled companies, and funds dedicated to real estate or infrastructure. Each strategy targets companies at different stages of their lifecycle, with varying risk profiles and return expectations, allowing PE firms to specialize and investors to diversify.

How do Private Equity firms generate returns and create value for their investors?

Private Equity firms generate returns primarily through a combination of operational improvements, strategic initiatives, and financial restructuring of their portfolio companies. They actively work with management teams to enhance efficiency, expand market reach, introduce new products, and optimize capital structures. Value creation is also driven by sourcing companies at attractive valuations and successfully exiting investments through an IPO, sale to a strategic buyer, or sale to another PE firm at a higher valuation. The goal is to grow the company's profitability and overall enterprise value, ultimately leading to significant capital gains for LPs.

What are the key risks associated with investing in the Private Equity market?

Key risks in the Private Equity market include illiquidity, as investments are typically locked up for several years, making capital access difficult during the holding period. There's also market risk, where economic downturns can negatively impact portfolio company performance and exit valuations. Operational risks arise from the challenges of improving and managing acquired companies. Furthermore, the reliance on debt in many PE strategies introduces financial leverage risk. High management fees and carried interest structures can also impact net returns for LPs, while regulatory changes and geopolitical events pose additional external risks that can affect investment outcomes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager