Process Instrumentation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431595 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Process Instrumentation Market Size

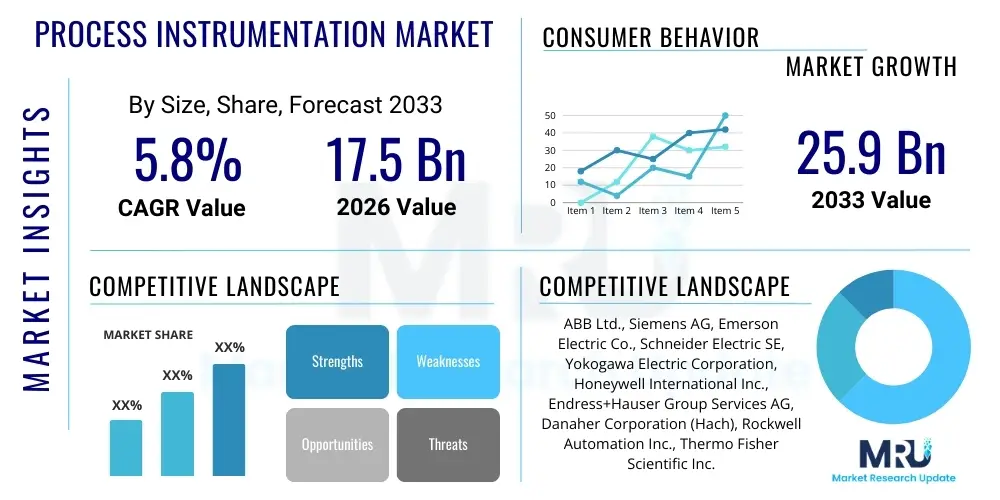

The Process Instrumentation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 17.5 Billion in 2026 and is projected to reach USD 25.9 Billion by the end of the forecast period in 2033.

Process Instrumentation Market introduction

Process instrumentation refers to a comprehensive suite of devices and systems used for measuring, controlling, and monitoring various physical and chemical process variables within industrial settings. These instruments are fundamental to ensuring efficiency, quality control, safety, and environmental compliance across diverse manufacturing and processing sectors. Key products include sensors for flow, pressure, temperature, level, and analytical composition, along with transmitters, controllers, and final control elements like valves and actuators. The robustness and precision of these instruments are crucial for automating complex industrial processes, reducing manual intervention, and maintaining operations within tightly defined parameters, particularly in hazardous or high-variability environments.

Major applications for process instrumentation span high-capital expenditure industries such as oil and gas exploration and refining, chemical manufacturing, power generation (including nuclear and renewable sources), and water and wastewater treatment. The instruments provide real-time data crucial for supervisory control and data acquisition (SCADA) systems and Distributed Control Systems (DCS), allowing operators to make informed decisions and execute precise control actions. The increasing global focus on resource optimization and energy conservation further accentuates the need for advanced instrumentation capable of providing highly accurate measurements, thereby minimizing waste and maximizing throughput.

The market benefits significantly from several macro-level driving factors. These include the rapid global adoption of Industry 4.0 principles, demanding greater sensor deployment and connectivity, and the continuous necessity for replacing aging analog infrastructure with modern, digital, and smart field devices. Furthermore, stringent safety and environmental regulations imposed by international bodies necessitate continuous and reliable monitoring of emissions, effluents, and operational integrity, thereby driving constant demand for highly sophisticated analytical and safety instrumentation across all major industrial verticals.

Process Instrumentation Market Executive Summary

The Process Instrumentation Market is poised for substantial expansion driven primarily by the global digitalization push and significant capital investments in modernizing industrial infrastructure, particularly across the Asia Pacific region. Business trends indicate a strong shift towards intelligent, connected field devices leveraging Industrial Internet of Things (IIoT) capabilities. Manufacturers are focusing heavily on developing wireless instrumentation solutions that offer lower installation costs, enhanced data accessibility, and predictive maintenance features. The integration of advanced diagnostics and calibration features into instruments is becoming a standard market expectation, streamlining maintenance workflows and improving overall system reliability. Mergers and acquisitions remain a key strategy for major market players seeking to expand their technological portfolios, especially in specialized areas like high-precision analytical instrumentation and cybersecurity-enhanced measurement devices.

Regionally, the market dynamics are highly heterogeneous. Asia Pacific is forecasted to exhibit the highest growth rate, fueled by massive industrialization projects in China, India, and Southeast Asian nations, particularly in chemical processing and power generation sectors. North America and Europe, while representing mature markets, maintain high demand driven by regulatory compliance mandates related to emissions and safety, coupled with ongoing efforts to upgrade existing legacy systems. Restructuring within the European energy sector, prioritizing renewable sources, also generates demand for specialized flow and temperature measurement equipment suitable for complex green energy processes. Investment in localized manufacturing capabilities is a developing trend, particularly in response to geopolitical instability and supply chain vulnerabilities observed in recent years.

Segment trends highlight the increasing prominence of analytical instruments, crucial for quality control and environmental monitoring, specifically pH/ORP sensors, conductivity meters, and gas analyzers. Within the technology segment, smart sensors equipped with proprietary algorithms and edge computing capabilities are seeing rapid adoption, enabling decentralized data processing and quicker response times. The Oil and Gas industry, despite periodic volatility, remains the largest revenue contributor due to the intensive monitoring required in upstream, midstream, and downstream operations. However, the fastest growth is observed in the Water and Wastewater treatment segment, driven by global scarcity issues and stricter governmental regulations regarding water quality management and reuse.

AI Impact Analysis on Process Instrumentation Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Process Instrumentation Market overwhelmingly center on themes of predictive maintenance, autonomous operation, and data integration efficiencies. Users frequently question how AI algorithms can enhance the lifespan and accuracy of deployed instruments, move operational strategies beyond simple threshold monitoring to true predictive failure analysis, and what skill sets will be required for technicians managing AI-integrated systems. Key concerns revolve around data privacy, the reliability of AI recommendations in safety-critical applications, and the initial complexity and cost associated with integrating AI platforms with existing legacy control systems. Overall expectations are high, focusing on AI’s potential to revolutionize efficiency by optimizing control loops, reducing downtime, and enabling true self-calibration capabilities, thereby significantly lowering Total Cost of Ownership (TCO) for end-users.

- AI enables predictive maintenance scheduling by analyzing sensor drift, vibration patterns, and operational data, extending instrument lifespan and reducing unplanned outages.

- Optimization of control strategies using machine learning models to dynamically adjust Process Control Variables (PCVs) for maximum throughput and energy efficiency.

- Implementation of advanced pattern recognition for anomaly detection, identifying incipient equipment failures far sooner than traditional alarm limits.

- Enhanced data correlation and fusion from multiple instrument types (e.g., combining flow and temperature data with material composition) to improve process insights and accuracy.

- Development of autonomous calibration and self-diagnosing instruments, minimizing manual intervention and required maintenance trips.

- Improved safety management through AI models that process complex situational data to anticipate and mitigate hazardous operational conditions proactively.

DRO & Impact Forces Of Process Instrumentation Market

The Process Instrumentation Market is characterized by robust drivers, structural restraints, and significant long-term opportunities, collectively shaping its trajectory. The principal drivers include the relentless global pursuit of industrial efficiency and automation (Industry 4.0), mandating highly accurate, real-time data collection across manufacturing floors. Secondly, stringent international and national regulatory standards concerning safety, emissions, and environmental protection require continuous deployment of advanced analytical and safety-instrumented systems (SIS). Furthermore, rapid infrastructure development and capacity expansion in emerging economies, particularly in energy, chemical, and pharmaceutical sectors, necessitate new installations of advanced process control equipment, offering substantial market uplift.

Conversely, several restraints impede faster market penetration. The primary restraint is the substantial initial capital expenditure required for sophisticated digital instrumentation, alongside the high costs associated with integrating these devices into complex, often proprietary, legacy control infrastructure. Additionally, the increasing reliance on networked and connected smart instruments introduces significant cybersecurity vulnerabilities, requiring substantial investment in protection protocols, which can deter some conservative industries. A structural challenge also exists in the form of a persistent shortage of highly skilled technical personnel capable of installing, maintaining, and troubleshooting complex smart instrumentation and the associated data analytics platforms.

Opportunities for long-term growth are abundant, primarily centered around the pervasive integration of Industrial Internet of Things (IIoT) technologies. This allows for greater remote monitoring, data centralization, and cloud-based analytics, broadening the scope of instrument deployment. The shift towards sustainable energy sources (e.g., hydrogen, bio-fuels) and resource management (e.g., smart water networks) requires specialized instrumentation optimized for these novel applications and environments. The ongoing miniaturization and development of Non-Invasive Measurement Technologies (NIMTs) present opportunities to address demanding applications where process integrity cannot be compromised, leading to broader adoption across various sensitive industries.

Segmentation Analysis

The Process Instrumentation Market is broadly segmented based on the type of instrument, the industry vertical applying the technology, and the specific application within the industrial process. This segmentation allows for a granular understanding of the diverse requirements and technological adoption rates across the global industrial landscape. The fundamental segments, such as flow, pressure, and temperature measurement, represent the core traditional market, while analytical instruments and level measurement solutions are increasingly driving growth due to enhanced regulatory requirements and quality control demands across critical sectors like pharmaceuticals and chemicals. Understanding these distinct segments is essential for market participants to tailor their offerings and strategic investments toward high-growth niches and technologically evolving applications.

- By Instrument Type:

- Flow Instruments

- Pressure Instruments

- Level Instruments

- Temperature Instruments

- Analytical Instruments (pH/ORP meters, Conductivity meters, Gas Analyzers, Liquid Analyzers)

- Control Valves and Actuators

- By Industry Vertical:

- Oil and Gas

- Chemical and Petrochemical

- Water and Wastewater Treatment

- Power Generation (Thermal, Nuclear, Renewables)

- Food and Beverage

- Pharmaceutical and Biotechnology

- Pulp and Paper

- Metals and Mining

- By Application:

- Monitoring and Control

- Safety and Interlock Systems

- Calibration and Diagnostics

- Data Acquisition and Analytics

Value Chain Analysis For Process Instrumentation Market

The value chain for the Process Instrumentation Market is complex, involving several distinct phases starting from upstream component manufacturing through to downstream installation, maintenance, and end-of-life services. The upstream analysis focuses heavily on raw material sourcing (metals, polymers, and specialized ceramics) and the manufacturing of high-precision components such as sensors, microprocessors, and dedicated Application-Specific Integrated Circuits (ASICs). Key upstream challenges revolve around maintaining robust supply chains for specialized electronic components, ensuring traceability, and adhering to strict material quality standards necessary for instruments operating in harsh industrial environments, such as high-pressure or corrosive media applications. Efficiency in this segment is dictated by precision engineering and the ability to leverage economies of scale in component fabrication.

The midstream segment involves the core activities of the major Original Equipment Manufacturers (OEMs), encompassing instrument assembly, software integration, calibration, and rigorous quality testing. This phase adds significant value through intellectual property embodied in proprietary algorithms, communication protocols (like HART, FOUNDATION Fieldbus, and Profibus), and device design suitable for specific process applications. Distribution channels are varied, incorporating a blend of direct sales (especially for large, complex projects like new refinery constructions) and indirect sales through specialized distributors, system integrators, and independent representatives. System integrators play a vital role by combining instruments from various manufacturers into a cohesive, functional process control system, adding integration services and application-specific knowledge.

Downstream analysis focuses on installation, commissioning, maintenance, and lifecycle support. Post-sales services, including calibration services, repair contracts, and spare parts management, represent a critical revenue stream and competitive differentiator for market leaders. Direct sales and service teams handle complex installations and high-value contracts with major industrial clients, ensuring seamless integration with existing DCS and SCADA systems. Indirect channels, often local specialized service providers, handle routine maintenance and calibration needs for smaller enterprises. The efficacy of the downstream activities directly impacts the customer's operational efficiency and longevity of the instruments, making responsive technical support and robust documentation essential components of the overall market offering.

Process Instrumentation Market Potential Customers

The primary consumers and end-users of process instrumentation are capital-intensive industries that rely on continuous, optimized, and safe manufacturing or processing operations. The Oil and Gas sector, encompassing upstream drilling, midstream transportation, and downstream refining, constitutes a major buyer segment due to the inherent complexity, scale, and high-risk nature of their processes, requiring extensive instrumentation for flow, pressure, and gas analysis. Similarly, the Chemical and Petrochemical industries are heavy consumers, utilizing analytical instruments for reaction control and composition verification, coupled with temperature and pressure sensors essential for preventing catastrophic failures in exothermic processes. These industries prioritize reliability, certification (e.g., explosion-proof ratings), and long-term service agreements.

Another rapidly expanding segment of potential customers is the Water and Wastewater Treatment sector. Municipal and industrial utilities require precise level, flow, and analytical instrumentation (especially pH and conductivity) to manage treatment quality, optimize chemical dosing, and ensure compliance with strict discharge regulations. The Power Generation sector, spanning traditional thermal power plants to advanced renewable facilities (solar, wind, geothermal), demands highly resilient temperature, pressure, and flow instruments to monitor boiler efficiency, turbine performance, and heat exchange systems. The consistent global necessity for power and clean water ensures stable, long-term demand growth from these utility segments.

Furthermore, specialized segments such as Pharmaceuticals and Food and Beverage industries represent high-value customer bases prioritizing extreme accuracy and hygiene. Pharmaceutical manufacturing requires highly accurate temperature and pressure sensors for batch control and sterilization processes, alongside advanced analytical tools for quality assurance, demanding instruments compliant with standards like FDA validation requirements. The Food and Beverage sector requires hygienic design instrumentation, often stainless steel, for continuous process monitoring (e.g., pasteurization temperatures, mixing flow rates), focusing heavily on minimizing contamination risk and maintaining batch consistency, thus driving demand for non-contact and clean-in-place (CIP) compatible sensors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 17.5 Billion |

| Market Forecast in 2033 | USD 25.9 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, Emerson Electric Co., Schneider Electric SE, Yokogawa Electric Corporation, Honeywell International Inc., Endress+Hauser Group Services AG, Danaher Corporation (Hach), Rockwell Automation Inc., Thermo Fisher Scientific Inc., WIKA Alexander Wiegand SE & Co. KG, Fuji Electric Co., Ltd., General Electric (GE), Mettler-Toledo International Inc., Vega Grieshaber KG, Pentair plc, Brooks Instrument (ITW), Badger Meter, Inc., Rotork plc, Krohne Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Process Instrumentation Market Key Technology Landscape

The Process Instrumentation Market is rapidly evolving, driven by the integration of digital technologies designed to enhance accuracy, connectivity, and diagnostic capabilities. One of the most significant technological trends is the pervasive shift toward smart field devices, which incorporate built-in microprocessors, memory, and digital communication capabilities (e.g., utilizing protocols like WirelessHART and ISA100.11a). These smart instruments not only provide measured process data but also offer crucial device diagnostics, historical performance logs, and self-calibration status reports. This intelligence at the device level is foundational for predictive maintenance programs and remote asset management strategies, significantly reducing the necessity for physical check-ups and simplifying regulatory compliance reporting by automating data logging.

Further technological advancements center on non-invasive and non-contact measurement techniques, addressing challenging applications such as high-purity fluid handling in the pharmaceutical industry or erosive slurry measurement in mining. Technologies like ultrasonic flow meters, radar level transmitters, and specialized analytical techniques (e.g., spectroscopic analysis for composition) minimize contact with the process media, thereby reducing instrument wear, maintenance frequency, and contamination risk. The continuous refinement of sensor materials, including advanced ceramics and composite alloys, is also critical, enabling instruments to withstand extreme temperatures, pressures, and highly corrosive chemical environments without compromising measurement integrity or long-term operational life.

Connectivity and data integration represent the pinnacle of current technological development. The proliferation of IIoT gateways and Edge Computing capabilities allows instruments to process complex data locally before transmitting only critical information to the central control system or the cloud. This decentralized intelligence reduces network bandwidth requirements and decreases latency, which is essential for rapid-response safety instrumented systems (SIS). Furthermore, open platform architectures and standardized communication interfaces are increasing, enabling easier integration of instruments from multiple vendors into single, unified control environments, simplifying system upgrades and fostering greater interoperability across heterogeneous industrial plants.

Regional Highlights

The global Process Instrumentation Market exhibits distinct growth patterns and maturity levels across key geographical regions, reflecting differences in industrial development, regulatory enforcement, and technological adoption rates. Understanding these regional dynamics is crucial for strategic market planning and investment allocation.

- Asia Pacific (APAC): APAC represents the fastest-growing region in the global market, primarily driven by rapid urbanization, massive investments in infrastructure (including power, water, and transportation), and extensive capacity expansions in manufacturing sectors, particularly in China, India, South Korea, and Southeast Asian nations. The region is seeing significant adoption of modern instrumentation as new industrial complexes are built, leapfrogging older technologies used in Western markets. The high demand for energy and the increasing focus on localized chemical production contribute heavily to the demand for flow, level, and analytical instruments. Governments are also tightening environmental regulations, necessitating investments in advanced water and air quality monitoring systems.

- North America: North America is characterized by high technological maturity and a strong focus on automation and digitalization. The market here is driven by the replacement and upgrade of aging infrastructure with smart, IIoT-enabled instrumentation, particularly in the oil and gas (shale operations) and chemical processing sectors. Stringent safety and environmental compliance mandates (e.g., related to fugitive emissions and operational safety) ensure sustained demand for high-end analytical instruments and SIS-certified sensors. High labor costs also accelerate the adoption of automated monitoring solutions and predictive maintenance software integrated with process instrumentation data.

- Europe: The European market is stable and mature, defined by strict quality standards, advanced manufacturing processes, and a strong emphasis on sustainability and energy transition. The shift towards renewable energy sources and decarbonization initiatives drives specialized demand for instrumentation suitable for hydrogen production, carbon capture, and complex bio-processing. European industries, particularly pharmaceuticals, benefit from high-precision, validated instrumentation. Regulatory frameworks like REACH and various EU environmental directives ensure constant investment in monitoring and control technologies to maintain compliance.

- Latin America (LATAM): Growth in LATAM is primarily focused on key industrial nations like Brazil and Mexico, driven by expansion in the mining, oil and gas, and food and beverage sectors. While often budget-conscious, there is a rising trend toward adopting modern digital instrumentation to improve operational efficiencies and maximize resource recovery, particularly in remote drilling and extraction sites. Political and economic stability can intermittently affect large-scale project investments, but core infrastructural needs provide consistent underlying demand.

- Middle East and Africa (MEA): MEA is dominated by substantial capital expenditure in the oil, gas, and petrochemical sectors, particularly in the Gulf Cooperation Council (GCC) countries. These markets demand large volumes of robust, high-performance instrumentation designed to handle extreme desert temperatures and specialized high-pressure applications. Investments in diversification, including water desalination projects and new chemical hubs, are also generating significant long-term demand for advanced analytical and flow measurement technologies necessary for maximizing yields and ensuring operational safety within these high-value assets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Process Instrumentation Market.- ABB Ltd.

- Siemens AG

- Emerson Electric Co.

- Schneider Electric SE

- Yokogawa Electric Corporation

- Honeywell International Inc.

- Endress+Hauser Group Services AG

- Danaher Corporation (Hach)

- Rockwell Automation Inc.

- Thermo Fisher Scientific Inc.

- WIKA Alexander Wiegand SE & Co. KG

- Fuji Electric Co., Ltd.

- General Electric (GE)

- Mettler-Toledo International Inc.

- Vega Grieshaber KG

- Pentair plc

- Brooks Instrument (ITW)

- Badger Meter, Inc.

- Rotork plc

- Krohne Group

Frequently Asked Questions

Analyze common user questions about the Process Instrumentation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Process Instrumentation Market?

The market growth is primarily driven by the global push for industrial automation (Industry 4.0), stringent regulatory requirements concerning safety and environmental protection, and significant capital expenditure in modernizing infrastructure, particularly in developing economies.

Which segment of the Process Instrumentation Market is projected to see the highest growth?

The Analytical Instruments segment is projected for substantial growth due to increasing demands for real-time quality control, regulatory compliance in highly regulated industries (e.g., Pharma, Water & Wastewater), and the necessity for advanced emission monitoring systems.

How does the integration of IIoT technology affect traditional process instrumentation?

IIoT integration transforms traditional instruments into smart devices by adding wireless connectivity, advanced diagnostics, and edge computing capabilities. This facilitates predictive maintenance, remote monitoring, and seamless data transmission to centralized control and analytic platforms.

What challenges face the adoption of advanced process instrumentation in the industrial sector?

Key challenges include the high initial cost of digital and smart instrumentation, the complexity involved in integrating new technologies with existing legacy control systems, and ongoing concerns regarding cybersecurity vulnerabilities in connected industrial environments.

Which geographical region holds the most opportunity for market expansion in the near term?

The Asia Pacific (APAC) region is expected to present the most significant market opportunities due to extensive ongoing industrialization projects, rapid expansion in the chemical and power sectors, and increasing government focus on environmental monitoring infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Process Instrumentation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Process Instrumentation Equipments Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (SCADA, DCS, PLS, MES), By Application (Household, Automotive, Aircraft, Laboratory Instrumentation, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager