Proportional Valve Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432583 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Proportional Valve Market Size

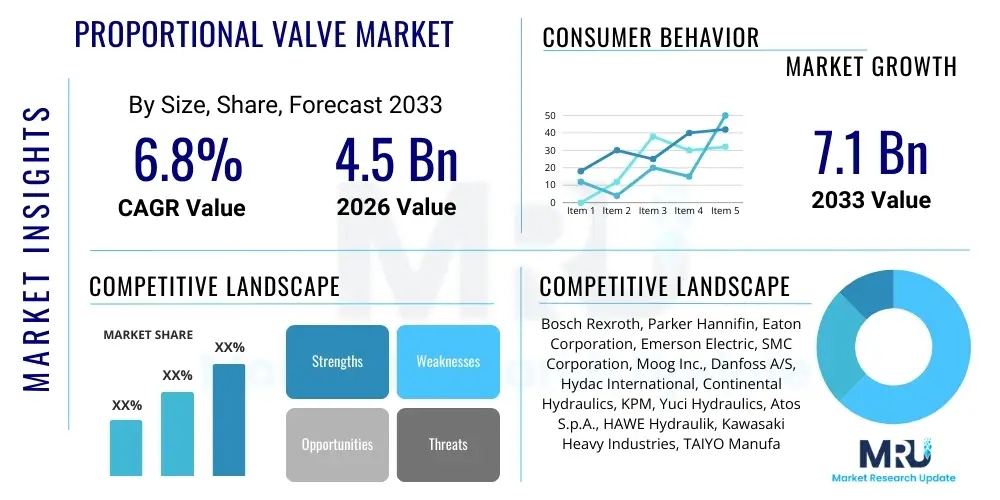

The Proportional Valve Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.1 Billion by the end of the forecast period in 2033.

Proportional Valve Market introduction

The Proportional Valve Market encompasses specialized fluid control devices engineered to modulate the flow or pressure of hydraulic or pneumatic fluids continuously and precisely, based on an electrical input signal. Unlike conventional on/off solenoid valves, proportional valves offer infinite resolution control, enabling sophisticated machinery to achieve high accuracy, repeatability, and dynamic response in demanding industrial and mobile applications. These components are critical for optimizing efficiency and performance in complex systems where exact control over speed, force, and position is paramount. The increasing complexity of automated machinery and the stringent performance requirements in sectors such as construction, agriculture, and manufacturing are fundamentally driving the adoption of these advanced control elements.

Proportional valves are defined by their ability to translate a variable electrical signal (typically current or voltage) into a corresponding hydraulic or pneumatic output. This functionality is achieved through sophisticated internal mechanics, often involving high-precision spools and feedback systems, which ensure the valve position directly correlates with the input command, irrespective of load variations. Key product types include proportional directional control valves, proportional pressure relief valves, and proportional flow control valves, each tailored for specific functions within a fluid power circuit. The integration of advanced electronics and microprocessors further enhances their capabilities, facilitating seamless interfacing with Programmable Logic Controllers (PLCs) and industrial control systems, which is essential for Industry 4.0 initiatives.

Major applications of proportional valves span a wide range of capital equipment, including high-performance injection molding machines, metal forming presses, aerospace test rigs, and large-scale construction excavators. The primary benefits derived from using these valves include enhanced system efficiency due to optimized energy usage, reduced cycle times, and superior quality control of the end product through precise motion management. Driving factors propelling this market growth include the global push toward industrial automation, the need for energy-efficient fluid power systems, and the relentless demand for higher productivity and accuracy in manufacturing processes, especially in rapidly industrializing economies across Asia Pacific.

Proportional Valve Market Executive Summary

The Proportional Valve Market is experiencing robust growth driven by accelerating industrial automation and the pervasive integration of advanced fluid control systems across key manufacturing and mobile sectors. Current business trends indicate a strong shift towards smart, electro-hydraulic solutions featuring integrated electronics, fieldbus compatibility, and diagnostic capabilities, allowing for predictive maintenance and enhanced operational transparency. Manufacturers are heavily investing in developing compact, energy-efficient valve designs that can operate effectively under extreme pressure and temperature conditions, catering to niche markets such as deep-sea exploration and specialized aerospace equipment. Mergers, acquisitions, and strategic collaborations focused on expanding digital capabilities and regional distribution networks characterize the competitive landscape, aiming to solidify market dominance in high-growth application areas.

Regionally, Asia Pacific (APAC) dominates the market, propelled by rapid industrialization, extensive capital expenditure in infrastructure, and the continuous expansion of the automotive and heavy machinery manufacturing bases, particularly in China, Japan, and India. North America and Europe, while mature, exhibit strong demand for high-specification proportional valves used in advanced robotics, precision medical devices, and stringent aerospace applications, focusing on reliability and regulatory compliance. Emerging economies in Latin America and the Middle East and Africa (MEA) present significant growth opportunities due to burgeoning oil & gas investments and the modernization of their industrial infrastructure, albeit from a smaller base. The regulatory environment, particularly concerning energy efficiency standards in Europe, further dictates product innovation, favoring advanced proportional technologies that minimize power consumption.

Segmentation analysis highlights the Hydraulic Proportional Valves segment as the largest revenue generator due to their critical role in heavy-duty, high-force applications prevalent in construction and manufacturing. However, the Pneumatic Proportional Valves segment is projected to witness the fastest growth, fueled by their increasing use in smaller scale automation, packaging, and sorting applications requiring high-speed operation and less force. In terms of technology, the shift from traditional analog control to digital interfaces with integrated sensors is a crucial trend, enhancing performance parameters and enabling seamless integration into Industrial Internet of Things (IIoT) frameworks. The end-user segment of Industrial Machinery, encompassing machine tools and material handling equipment, remains the largest consumer, reflecting the pervasive need for precise motion control in global manufacturing.

AI Impact Analysis on Proportional Valve Market

User queries regarding the impact of Artificial Intelligence (AI) on the Proportional Valve Market primarily revolve around themes of predictive maintenance, optimization of system performance, and the development of autonomous fluid power systems. Users frequently ask how AI can diagnose valve faults before catastrophic failure, whether AI-driven control loops can improve energy efficiency beyond traditional PID control, and what role AI plays in the design and calibration of next-generation proportional valves. The overarching expectation is that AI integration will transform these discrete components into intelligent subsystems capable of self-optimization and real-time adaptation to changing operational loads, thereby reducing downtime and extending equipment lifespan.

The integration of AI, particularly machine learning algorithms, promises to revolutionize the operational lifespan and efficiency of proportional valves. By continuously monitoring operational parameters such as input current, spool position, pressure fluctuations, and temperature through integrated sensors, AI models can establish robust baseline performance metrics. Any significant deviation or pattern indicative of wear, contamination, or impending failure can be identified instantly, allowing for highly accurate predictive maintenance scheduling, significantly reducing unexpected downtime and maximizing resource utilization. This shift from reactive or time-based maintenance to condition-based monitoring is critical for industries relying on high capital equipment utilization, such as steel production and large-scale mining operations.

Furthermore, AI-powered control algorithms can dynamically fine-tune valve responses in real-time, optimizing energy consumption and improving motion precision beyond the static tuning capabilities of traditional control systems. For instance, in complex hydraulic applications like flight simulators or heavy lifting equipment, AI can learn the system dynamics and environmental factors to command the valve with greater nuance, ensuring smoother transitions, minimizing pressure spikes, and reducing overall system noise. This advancement is moving proportional valves from simple control elements to active, decision-making components within the fluid power ecosystem, crucial for achieving the high standards of performance and sustainability required by modern industrial benchmarks.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data (vibration, temperature, current) to forecast valve failure with high accuracy.

- Real-Time Performance Optimization: Machine learning models dynamically adjust valve control parameters for optimal energy efficiency and motion precision.

- Autonomous System Integration: Enabling proportional valves to function as smart nodes within IIoT networks, facilitating system-wide self-diagnosis and calibration.

- Digital Twin Development: AI aids in creating accurate digital representations of valve performance, optimizing design and simulating complex operating conditions.

- Fault Detection and Isolation (FDI): Automated identification and localization of valve anomalies, reducing human intervention and diagnostic time.

DRO & Impact Forces Of Proportional Valve Market

The Proportional Valve Market growth is significantly propelled by key drivers (D) such as the relentless expansion of industrial automation globally and the increasing demand for precision control systems in high-performance machinery. Restraints (R) primarily include the high initial cost associated with complex electro-hydraulic systems, requiring specialized training for installation and maintenance, and the susceptibility of sensitive electronic components to harsh industrial environments. Opportunities (O) are plentiful, centered around the development of highly energy-efficient valves, miniaturization for mobile robotics, and penetration into niche application areas like additive manufacturing and specialized medical equipment. These internal forces are augmented by powerful external impacts, including stringent environmental regulations mandating efficient fluid power, fluctuating raw material costs (especially for specialized alloys), and the rapid pace of digital transformation across manufacturing sectors, collectively shaping the market's trajectory.

Drivers: The fundamental driver is the ongoing transition from manual and rudimentary control systems to highly automated, digitalized manufacturing processes (Industry 4.0). Proportional valves are indispensable in advanced machine tools, plastic injection molding, and large-scale automation lines where precise speed and force control are non-negotiable for product quality and throughput. Furthermore, the burgeoning demand for mobile hydraulic equipment in construction and agriculture, requiring sophisticated load-sensing and proportional control for complex functions (e.g., boom positioning, traction control), strongly dictates market expansion. The necessity for fluid power systems to comply with modern safety standards and operational repeatability further solidifies the market's growth foundation.

Restraints: The primary restraining factor involves the complexity and resulting high capital expenditure required for integrating proportional valve technology, which often surpasses the investment for standard on/off valves. This cost barrier can deter small and medium-sized enterprises (SMEs) from adoption. Additionally, the need for specialized technical expertise for calibration, diagnostics, and maintenance of electro-proportional systems presents a logistical challenge, especially in regions with a deficit of skilled labor. Reliability issues related to contamination sensitivity—where fine particles can impair the precise movement of the spool—also represent a constant challenge, necessitating rigorous filtration systems which add to the overall system cost and maintenance complexity.

Opportunities: Significant market opportunities lie in the development of next-generation proportional valves that incorporate standardized industrial communication protocols (e.g., EtherCAT, PROFINET) directly into the valve body, simplifying integration and offering enhanced diagnostic data. Miniaturization, driven by the expanding robotics and medical device markets, offers a lucrative avenue for specialized product development. Moreover, the push for sustainable manufacturing opens up opportunities for manufacturers to innovate in energy recovery systems and develop proportional flow control solutions that minimize pump usage and subsequent power draw, thereby appealing to organizations prioritizing environmental compliance and long-term operating cost reduction. The integration of sensors for condition monitoring and the enablement of predictive maintenance services also provide substantial value-added opportunities.

Segmentation Analysis

The Proportional Valve Market is extensively segmented based on the type of operation, the medium of fluid utilized, and the specific application industries they serve. This segmentation provides a granular view of market dynamics, revealing varying growth rates and demand profiles across different product categories and end-user sectors. Key differentiation occurs between proportional directional control, pressure control, and flow control valves, reflecting the diversity of tasks required within fluid power circuits. Furthermore, the critical distinction between hydraulic and pneumatic valves defines the market landscape, with hydraulics dominating high-power, heavy-duty applications, while pneumatics cater to lighter, faster automation requirements.

Geographic segmentation is crucial, with mature markets in North America and Europe prioritizing high-specification, premium products with advanced digital interfaces, while the rapidly growing APAC region drives volume demand across standard and mid-range proportional valve categories, focusing on cost-efficiency and robust performance. Understanding these segmented demands allows market participants to tailor their product offerings—for example, developing ruggedized proportional valves for mining in MEA or highly precise, clean-room compatible valves for medical devices in North America. This targeted approach ensures maximum penetration and relevance across the heterogenous global industrial landscape.

The application segmentation is the most telling of underlying economic activity, with the Industrial Machinery segment, covering plastics, forming, and metalworking, remaining foundational. However, segments like Mobile Equipment (agricultural, construction, and mining vehicles) are exhibiting accelerated adoption due to the increasing sophistication and automation of off-highway vehicles. The trend towards electro-hydraulic systems in mobile machinery, replacing manual lever controls with joystick proportional control, is a significant volume driver, emphasizing precision, operator comfort, and safety across these dynamic environments.

- By Type:

- Proportional Directional Control Valves

- Proportional Pressure Control Valves

- Proportional Flow Control Valves

- By Operation:

- Direct-Operated Proportional Valves

- Pilot-Operated Proportional Valves (Two-Stage)

- By Medium:

- Hydraulic Proportional Valves (Oil-based)

- Pneumatic Proportional Valves (Air/Gas)

- By Application:

- Industrial Machinery (Machine Tools, Presses, Injection Molding)

- Mobile Equipment (Construction, Agriculture, Mining)

- Oil & Gas and Marine

- Aerospace & Defense

- Medical and Pharmaceutical Devices

- By End-User Industry:

- Automotive

- Manufacturing

- Energy and Utilities

- Others (Food & Beverage, Packaging)

Value Chain Analysis For Proportional Valve Market

The value chain for the Proportional Valve Market starts with upstream analysis, which involves the sourcing and preparation of highly specialized raw materials, including high-grade steels, corrosion-resistant alloys, and specialized seals necessary for high-pressure and dynamic applications. Key upstream activities include precision machining of spools and valve bodies, manufacturing sensitive electronic components (solenoids, position transducers, and integrated control PCBs), and rigorous quality control for sub-components. The competitive advantage upstream is often tied to proprietary material science and sophisticated manufacturing processes (e.g., micro-machining and specialized coatings) that enhance valve durability and response time.

The midstream focuses on the assembly, integration, and testing of the final proportional valve unit. Leading manufacturers invest heavily in automated assembly lines and advanced testing rigs to ensure that the valves meet stringent performance specifications for linearity, hysteresis, and frequency response. Distribution channels form a critical interface between manufacturers and end-users, encompassing both direct sales forces, especially for large OEMs requiring customized solutions, and indirect channels such as industrial distributors, system integrators, and value-added resellers (VARs). VARs often provide critical pre-sales support, application engineering, and post-sales maintenance, which are essential given the complexity of electro-hydraulic systems.

Downstream analysis centers on the installation, system integration, and servicing of the valves within the end-user application, spanning sectors from machine builders (OEMs) to end-user operators (MRO). Direct distribution is favored when OEMs require deep technical collaboration during the design phase of a new machine platform, ensuring optimized valve selection and integration. Indirect distribution, leveraging established industrial supply networks, provides rapid accessibility for replacement parts and smaller projects. Successful value delivery downstream hinges on providing comprehensive technical documentation, accessible training resources, and robust post-warranty support, solidifying long-term customer relationships and ensuring the sustained operational efficiency of the installed base.

Proportional Valve Market Potential Customers

Potential customers for the Proportional Valve Market are primarily comprised of Original Equipment Manufacturers (OEMs) who integrate these precision components into complex industrial machinery and mobile equipment, alongside Maintenance, Repair, and Operations (MRO) divisions of large industrial users who require replacement parts or system upgrades. Key buyer categories include manufacturers of injection molding machines and die-casting equipment, where extremely precise control over speed and pressure profiles is essential for product quality. Another major customer base is the heavy machinery sector, including manufacturers of excavators, cranes, agricultural tractors, and forestry equipment, which increasingly rely on proportional hydraulics for safety, fuel efficiency, and multi-functional operation.

Beyond traditional industrial and mobile users, specialized sectors represent high-value potential customers. These include the aerospace industry, requiring high-reliability proportional valves for actuator control and testing rigs, and the medical device sector, where miniature, non-magnetic proportional valves are critical for sophisticated applications like respirator control and precise fluid dosing in laboratory automation. The energy sector, specifically oil & gas exploration and renewable energy infrastructure (e.g., wind turbine pitch control systems), also constitutes a critical customer segment demanding highly durable, ATEX-certified, and high-pressure proportional valves capable of withstanding extreme environmental conditions. The buying decision across all segments is strongly influenced by factors such as valve response time, integrated diagnostics capability, long-term reliability, and overall total cost of ownership (TCO).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Rexroth, Parker Hannifin, Eaton Corporation, Emerson Electric, SMC Corporation, Moog Inc., Danfoss A/S, Hydac International, Continental Hydraulics, KPM, Yuci Hydraulics, Atos S.p.A., HAWE Hydraulik, Kawasaki Heavy Industries, TAIYO Manufacturing Co., Ltd., Argo-Hytos, Nordson Corporation, Bürkert Fluid Control Systems, ASCO (Emerson), Festo SE & Co. KG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Proportional Valve Market Key Technology Landscape

The Proportional Valve Market is characterized by continuous technological evolution, primarily focusing on enhancing dynamic response, improving energy efficiency, and integrating advanced digital capabilities. A critical technological cornerstone is the refinement of LVDT (Linear Variable Differential Transformer) or proprietary position sensors embedded within the valve body, providing highly accurate feedback on spool position. This closed-loop control mechanism is essential for achieving the necessary precision and repeatability required by sophisticated motion control applications. Furthermore, the shift towards voice coil actuation systems, particularly in smaller, high-speed pneumatic and hydraulic valves, offers superior dynamic performance and lower hysteresis compared to traditional solenoid-based actuators, significantly improving overall system performance in applications requiring high frequency response.

Another major technological trend is the pervasive integration of microelectronics and standardized digital communication interfaces. Next-generation proportional valves are increasingly featuring onboard microprocessors that handle complex control algorithms, diagnostics, and self-calibration functions, moving intelligence closer to the point of actuation. Fieldbus protocols such as IO-Link, CANopen, and EtherCAT are becoming standard, enabling seamless integration into factory-wide control architectures (IIoT). This digital transformation facilitates remote monitoring, parameter modification, and sophisticated diagnostics, crucial for modern smart factory environments and optimizing production uptime. Manufacturers are also developing proportional valves with integrated safety functions (e.g., redundant sensors, safe torque off capability) to comply with Machine Safety Directives.

Material science and manufacturing precision also remain pivotal technologies. Advances in ceramic components, specialized coatings (e.g., diamond-like carbon, DLC), and new sealing technologies are enabling proportional valves to operate reliably in extremely challenging environments, including high temperatures, aggressive fluids, and high-contamination systems. The development of cartridge-style proportional valves is another key trend, offering compact form factors, simplified manifold mounting, and ease of service, crucial for mobile and space-constrained applications. Overall, the technological trajectory points toward smaller, faster, more reliable, and significantly smarter proportional valves that act as integral, intelligent components of the digitized industrial ecosystem, fundamentally altering how fluid power systems are designed and managed.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing and largest regional market, primarily driven by massive capital investment in infrastructure, automotive production, and industrial machinery manufacturing, particularly in China and India. The region's focus on high-volume manufacturing and automation uptake provides immense demand for hydraulic and pneumatic proportional valves, emphasizing cost-effectiveness and scalability.

- North America: This region is characterized by high demand for premium, high-performance proportional valves used in aerospace, medical devices, and advanced agricultural equipment. Focus areas include IIoT integration, high-reliability requirements, and a preference for products with integrated diagnostics and connectivity features.

- Europe: Europe maintains a robust market fueled by strict regulatory requirements regarding energy efficiency (e.g., the European Green Deal) and the strength of its advanced manufacturing sectors, notably Germany's machine tool industry. European demand leans towards sophisticated electro-hydraulic proportional valves that offer best-in-class precision and power-saving features.

- Latin America: Growth in this region is primarily linked to recovering investments in mining, construction, and agriculture sectors. While the market size is smaller than mature regions, the increasing modernization of mobile fleets presents significant, albeit geographically fragmented, opportunities for proportional valve suppliers.

- Middle East and Africa (MEA): Market growth is dependent on capital projects in the oil & gas sector, demanding robust, high-pressure, and often explosion-proof (ATEX/IECEx certified) proportional valves for critical process control applications. Infrastructure development and desalination projects also contribute to niche demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Proportional Valve Market.- Bosch Rexroth AG

- Parker Hannifin Corporation

- Eaton Corporation plc

- Emerson Electric Co.

- SMC Corporation

- Moog Inc.

- Danfoss A/S

- Hydac International GmbH

- Continental Hydraulics, Inc.

- KPM - Kawasaki Precision Machinery (Kawasaki Heavy Industries)

- Yuci Hydraulics Co., Ltd.

- Atos S.p.A.

- HAWE Hydraulik SE

- Kawasaki Heavy Industries, Ltd.

- TAIYO Manufacturing Co., Ltd.

- Argo-Hytos Gmbh

- Nordson Corporation

- Bürkert Fluid Control Systems

- ASCO (Emerson)

- Festo SE & Co. KG

Frequently Asked Questions

Analyze common user questions about the Proportional Valve market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a proportional valve and a standard solenoid valve?

A proportional valve offers continuous, variable control over fluid flow or pressure, translating an analog input signal into a modulated output, whereas a standard solenoid valve operates only in an on/off (discrete) manner.

Which end-user segment drives the highest demand for proportional valves globally?

The Industrial Machinery segment, including injection molding, metal forming, and machine tools, currently drives the highest volume and value demand due to the critical need for precise motion and force control in these applications.

How does proportional valve technology contribute to energy efficiency in fluid power systems?

Proportional valves enable systems to adjust pump output or flow rates dynamically based on actual load requirements, preventing wasted energy associated with running pumps at full capacity unnecessarily, leading to significant power savings.

Is the integration of electronics a mandatory requirement for modern proportional valves?

Yes, modern proportional valves almost universally incorporate integrated electronics (transducers, controllers) for closed-loop control, advanced diagnostics, self-monitoring, and seamless integration into digital control systems (IIoT protocols).

Which geographical region is forecast to exhibit the highest growth rate in the market?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), driven by large-scale automation projects and robust expansion in automotive and construction machinery manufacturing across the region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Piezoelectric Proportional Valve Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Electromagnetic Proportional Valve Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Electromagnetic Proportional Valve Market Statistics 2025 Analysis By Application (Industrial Equipment, Medical Equipment, Instrument and Meter), By Type (Direct, Pilot), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Pneumatic Proportional Valve Market Statistics 2025 Analysis By Application (Petrochemical, Food, Tobacco, Medical), By Type (Spherical, V Shape, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager