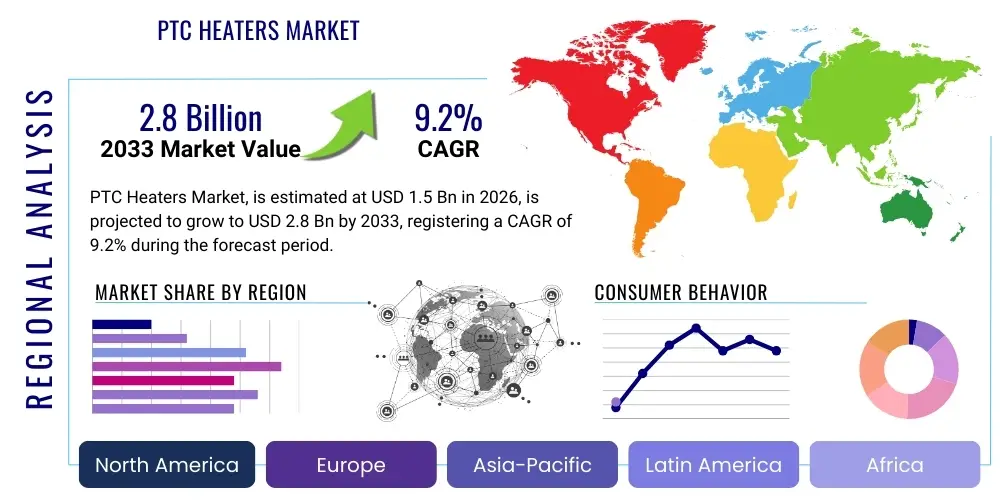

PTC Heaters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438006 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

PTC Heaters Market Size

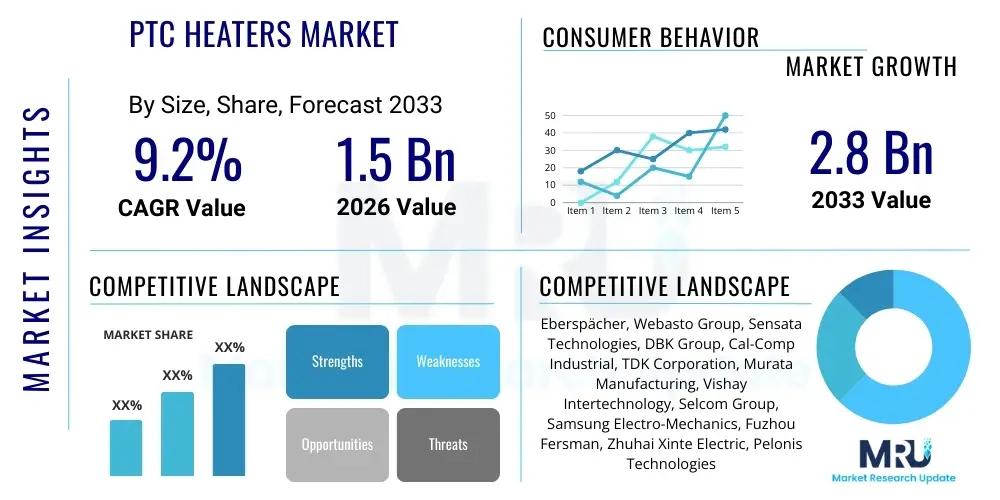

The PTC Heaters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.2% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

PTC Heaters Market introduction

The Positive Temperature Coefficient (PTC) Heaters Market encompasses advanced heating elements utilizing specialized ceramic compounds whose resistance increases significantly with temperature rise. This self-regulating property is the core technological advantage, eliminating the need for external thermostats in many applications, thereby enhancing safety, reliability, and energy efficiency. These heating solutions are highly versatile, finding extensive use across consumer electronics, industrial processing, and, most prominently, the automotive sector, particularly in electric and hybrid vehicles for cabin heating and battery thermal management.

The primary applications driving market growth include rapid heating systems in automotive climate control, supplemental heating in household appliances like hair dryers and coffee makers, and industrial process heating where precise temperature control and inherent safety are paramount. Key benefits of PTC technology include rapid heat-up time, compact size, high efficiency, and prevention of overheating due to the intrinsic physics of the material. This combination of features makes them superior to traditional resistive heating wires in environments requiring dynamic and safe thermal management.

Driving factors propelling the expansion of the PTC heaters market are predominantly centered around stringent energy efficiency regulations globally and the accelerated shift toward electric vehicles (EVs). The demand for efficient battery thermal management systems (BTMS) and reliable, lightweight cabin heaters in EVs provides a massive, sustained growth trajectory. Furthermore, their application in medical devices and specialized industrial equipment requiring fail-safe heating contributes significantly to market resilience and expansion into niche high-value segments.

PTC Heaters Market Executive Summary

The PTC Heaters Market is characterized by robust growth underpinned by technological maturity and escalating demand from the automotive and consumer electronics sectors. Business trends indicate a focus on developing specialized high-voltage PTC solutions tailored for high-performance EV platforms, alongside miniaturization efforts to integrate these components seamlessly into compact consumer devices. Market participants are increasingly investing in proprietary ceramic formulations to optimize heat output and lifetime performance, resulting in a competitive landscape where efficiency and durability are key differentiators. Strategic collaborations between PTC component manufacturers and Tier 1 automotive suppliers are becoming standard practice to secure long-term supply contracts.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive EV production expansion in China and the adoption of energy-efficient appliances across India and Southeast Asia. North America and Europe maintain a strong hold, driven by stringent safety standards and high consumer willingness to pay for premium, safe, and efficient climate control systems in residential and commercial buildings, alongside significant penetration in premium automotive segments. Regulatory harmonization regarding energy efficiency is further accelerating global adoption rates.

Segmentation trends highlight the supremacy of the Air Heating PTC segment in terms of volume due to widespread use in HVAC and consumer goods, while the Liquid Heating PTC segment is experiencing the fastest revenue growth, attributed directly to its critical role in sophisticated battery cooling/heating circuits in electric vehicles. In terms of application, automotive dominance is undeniable, although industrial and medical applications are showing consistent, high-margin expansion. The shift towards higher voltage (400V to 800V) systems in automotive technology is reshaping the product type segmentation dramatically, necessitating innovation in power handling capabilities.

AI Impact Analysis on PTC Heaters Market

User queries regarding AI's impact on the PTC Heaters Market frequently focus on how predictive maintenance and smart thermal management systems, enabled by AI algorithms, will influence heater design and market dynamics. Key themes include the integration of machine learning for optimizing energy consumption in HVAC systems utilizing PTC elements, the role of AI in analyzing real-time thermal data within electric vehicle batteries to modulate PTC heater output precisely, and concerns about whether AI-driven demand forecasting will streamline or disrupt existing supply chains for ceramic materials. Users expect AI to transform passive PTC components into integral parts of an intelligent thermal network, demanding higher levels of connectivity and responsiveness.

- AI optimizes energy efficiency by predicting thermal load requirements, reducing unnecessary operation cycles of PTC heaters.

- Machine learning algorithms enhance battery thermal management (BTM) by fine-tuning liquid PTC heater output based on driving patterns and environmental conditions, extending battery life.

- Predictive maintenance schedules for industrial PTC systems are generated by AI, minimizing downtime and reducing operational costs.

- AI-driven sensor fusion integrates PTC heating data with overall vehicle or building energy consumption profiles for holistic resource management.

- Optimization of manufacturing processes, including sintering and component quality control using computer vision and ML, improves consistency and reduces material waste in PTC element production.

- Smart home integration allows AI assistants to regulate residential PTC-based supplementary heating, maximizing user comfort while adhering to predefined energy caps.

DRO & Impact Forces Of PTC Heaters Market

The trajectory of the PTC Heaters Market is strongly influenced by a combination of powerful driving factors, specific constraints inherent to the technology or market structure, and significant emerging opportunities. The primary driver is the global electrification of the transportation sector, mandating highly efficient thermal management solutions for critical components like batteries and cabins. However, this growth is tempered by the volatility and increasing cost of specialized raw materials, primarily barium titanate and specific ceramic composites, which act as a key restraint. The impact forces indicate a high degree of technological substitution risk from alternatives like heat pumps, necessitating continuous innovation in PTC design to maintain market share.

Market growth is significantly bolstered by regulatory pressures, particularly the tightening of vehicle emission standards and the push for higher energy ratings in consumer appliances, where PTC heaters offer a compelling self-regulating, high-safety advantage. Opportunities exist prominently in the untapped potential for high-voltage PTC applications in commercial electric vehicles (trucks and buses) and in sophisticated medical devices requiring ultra-precise and reliable heating elements, such as laboratory equipment and specialized incubators. Navigating the intellectual property landscape surrounding ceramic formulations and manufacturing patents remains a competitive imperative.

The major impact forces shaping this market include the substitution threat posed by advanced refrigerant-based heat pump systems, particularly in large-scale automotive and residential HVAC applications. While PTC heaters offer instant heat, heat pumps provide superior overall energy efficiency in moderate climates. Furthermore, the bargaining power of major automotive OEMs dictates pricing strategies and demands high volume, reliable supply chains, pressuring component manufacturers on margins. Success hinges on focusing R&D on achieving even faster thermal response times and higher power densities without compromising inherent safety features.

- Drivers:

- Accelerated global adoption of Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs).

- Stringent regulatory mandates promoting energy efficiency and safety in industrial and consumer heating applications.

- Inherent self-regulating property eliminates the need for complex, costly external controls.

- Increasing demand for fast and reliable spot heating solutions across various industrial processes.

- Restraints:

- High upfront material costs and reliance on specialized ceramic components (e.g., barium titanate).

- Potential technological substitution risks from high-efficiency heat pump systems in large-scale applications.

- Operating temperature limitations and lower overall efficiency compared to some centralized heating methods.

- Intense price competition, especially in commodity consumer electronics segments.

- Opportunities:

- Development of high-voltage (800V) PTC solutions optimized for next-generation EV platforms.

- Expansion into niche markets such as medical devices, aerospace, and specialized laboratory equipment.

- Integration of smart sensing and IoT capabilities into PTC systems for advanced thermal management.

- Growing aftermarket demand for efficient auxiliary heaters in commercial fleets and heavy machinery.

- Impact Forces:

- Substitution Threat: Medium to High (due to heat pumps).

- Bargaining Power of Buyers: High (dominated by large automotive OEMs).

- Bargaining Power of Suppliers: Medium to High (due to specialized material dependency).

- Intensity of Competition: High (focus on differentiation through material science).

Segmentation Analysis

The PTC Heaters Market segmentation provides a crucial framework for understanding the diverse applications and technological variations within the sector. The market is primarily segmented based on product type (Air Heating vs. Liquid Heating), application (Automotive, Consumer Electronics, Industrial), and voltage range (Low, Medium, High Voltage). This granular analysis helps identify key growth pockets, revealing that while air heaters dominate the mass market due to their simplicity and low cost, liquid heaters command premium pricing and higher growth rates driven by complex battery and fluid heating requirements in advanced automotive systems.

The application segmentation clearly indicates the automotive sector as the primary revenue engine, specifically auxiliary cabin heaters and critical components within the battery thermal management system (BTMS). The demand here is non-negotiable for vehicle performance and safety. Contrastingly, the industrial segment, though smaller in volume, demands highly robust, custom-engineered PTC solutions for applications like cabinet heaters, drying equipment, and temperature stabilization in sensitive manufacturing processes, leading to higher average selling prices and stronger margins.

Analyzing the segmentation by voltage reveals a significant technological migration. Traditional PTC applications primarily used Low Voltage DC, suitable for small appliances. However, the burgeoning demand for high-performance EVs necessitates the shift toward High Voltage (400V and 800V) PTC heaters, capable of managing substantial power loads quickly and safely. This transition requires significant investment in component design, insulation, and power electronics, differentiating manufacturers capable of meeting these specialized high-voltage engineering requirements.

- By Product Type:

- Air Heating PTC Heaters (Used widely in cabin heating, hair dryers, industrial cabinet heating)

- Liquid Heating PTC Heaters (Crucial for battery thermal management, engine fluid preheating, and domestic water heating systems)

- By Application:

- Automotive (EV/HEV BTMS, Cabin Heating, Auxiliary Heating)

- Consumer Electronics (Hair styling tools, humidifiers, small space heaters, coffee makers)

- Industrial (Drying equipment, switch cabinet heating, anti-condensation systems)

- Medical & Healthcare (Incubators, sterilizers, blood warmers)

- By Voltage Type:

- Low Voltage PTC Heaters (Less than 100V)

- Medium Voltage PTC Heaters (100V to 300V)

- High Voltage PTC Heaters (400V to 800V+)

Value Chain Analysis For PTC Heaters Market

The value chain for the PTC Heaters Market begins with the highly specialized Upstream Analysis, which focuses on the sourcing and processing of raw ceramic materials, predominantly Barium Carbonate, Titanium Dioxide, and various dopants, which determine the resistivity characteristics. This stage is critical as the quality and stability of the raw material directly influence the final heating element's Positive Temperature Coefficient behavior, safety, and lifespan. Manufacturing involves sophisticated processes, including powder mixing, pressing, sintering (high-temperature firing), and electrode attachment, demanding rigorous quality control to ensure uniform resistance properties across large production batches. Key manufacturers often maintain tight vertical integration or long-term partnerships with specialized materials suppliers to mitigate price volatility and ensure material specification adherence.

The Midstream component involves the assembly and integration of the core PTC elements (thermistors) into complete heating modules, including housing, heat sinks, control electronics, and connectors specific to the end application (e.g., highly insulated units for high-voltage automotive use or compact designs for consumer devices). Distribution Channel Analysis highlights a dual pathway: Direct distribution is preferred for large volume, customized orders, particularly in the automotive and industrial sectors, where manufacturers engage directly with Tier 1 suppliers or OEMs under long-term contracts. This channel necessitates specialized technical support and rigorous qualification processes.

The Indirect distribution pathway is more common for standardized, off-the-shelf PTC components and consumer-facing products, utilizing specialized electronic component distributors and regional resellers. The Downstream Analysis focuses on the final integration into the end-user application (e.g., installation into an EV's cooling circuit or assembly into a household appliance). Success at this stage relies heavily on post-sales support and the ability of manufacturers to comply with diverse global certifications (UL, CE, TUV). The complexity and high stakes of automotive applications necessitate extremely high reliability rates, which often drives manufacturers to focus heavily on failure analysis and continuous product improvement based on field data.

PTC Heaters Market Potential Customers

Potential customers for PTC heaters are highly diversified across industries but share the common need for reliable, self-regulating, and safe thermal solutions. The largest and most influential customer segment is the global automotive industry, specifically manufacturers of Electric Vehicles (EVs), Plug-in Hybrid Electric Vehicles (PHEVs), and high-end conventional vehicles requiring supplemental heating. These OEMs rely on liquid PTC heaters for crucial battery thermal management (BTMS) to ensure optimal battery performance and longevity, alongside air PTC heaters for fast cabin conditioning.

The second major group includes manufacturers in the consumer electronics and appliance sectors, purchasing high volumes of standardized air PTC elements for products ranging from portable heaters, hair styling tools, and clothes dryers, where the inherent safety and lack of exposed glowing elements are significant marketing advantages. The third category, industrial and specialized users, comprises HVAC system integrators, electrical cabinet manufacturers (using PTCs for anti-condensation), and specialized medical equipment producers (buying customized, highly precise heating pads and elements for laboratory and patient care devices). These buyers prioritize customization, long life, and compliance with rigorous industrial and medical standards over initial cost.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 9.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eberspächer, Webasto Group, Sensata Technologies, DBK Group, Cal-Comp Industrial, TDK Corporation, Murata Manufacturing, Vishay Intertechnology, Selcom Group, Samsung Electro-Mechanics, Fuzhou Fersman, Zhuhai Xinte Electric, Pelonis Technologies, Keystone Thermometrics, YAGEO Corporation, Infineon Technologies, Delta Electronics, Bosch Thermotechnology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PTC Heaters Market Key Technology Landscape

The core technology underpinning the PTC Heaters Market involves the use of polycrystalline ceramic materials, predominantly Barium Titanate (BaTiO3), which exhibit the Positive Temperature Coefficient effect—a steep increase in electrical resistance above a critical Curie temperature. Continuous innovation in the technology landscape is focused on modifying the ceramic composition through doping with elements like Strontium and Lead to precisely control the Curie point, allowing engineers to tailor the self-regulating temperature for specific application requirements, ensuring optimal thermal output without exceeding safety thresholds. Advanced manufacturing techniques, such as thin-film deposition and multilayer chip PTCs (MLCC-PTCs), are being developed to create smaller, higher-power-density heating elements for miniaturized electronics and precise medical devices, increasing efficiency and integration flexibility.

A critical technological evolution is the development of High Voltage (HV) PTC Heaters, specifically designed to operate safely and reliably at 400V and 800V DC typically found in modern EV architectures. This advancement requires significant material science improvements to enhance dielectric strength, ensuring insulation integrity under high electrical stress, and optimized thermal interfaces to dissipate heat effectively. Manufacturers are utilizing advanced bonding technologies and highly corrosion-resistant housings for liquid-heating units to ensure compatibility with various coolants and extended product lifetime in demanding automotive environments. Furthermore, incorporating integrated control modules and specialized sensor arrays directly into the heater unit enhances precision and facilitates seamless integration with the overall vehicle thermal management system.

Another crucial technological focus area is the optimization of the thermal stack and interface materials, including highly conductive aluminum alloys and specialized thermal pastes, to maximize the heat transfer rate from the ceramic element to the surrounding air or fluid. Research is also directed toward developing polymer-based PTC materials, offering flexibility and potentially lower manufacturing costs for certain low-power applications, although ceramic remains the dominant choice for high-power demanding uses like automotive climate control. The shift towards "smart" PTC systems involves embedding diagnostic capabilities and communication interfaces (e.g., CAN bus connectivity in EVs) to provide real-time operational feedback, moving PTC technology beyond simple resistance heating into sophisticated thermal modules.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the dominant region in terms of production volume and the fastest-growing market by value, largely driven by China's aggressive investment and policy push in Electric Vehicle manufacturing. China accounts for a significant share of global battery production and EV sales, creating immense demand for liquid PTC heaters used in BTMS. Additionally, rapid urbanization and expanding middle-class disposable income in countries like India, South Korea, and Japan fuel the consumption of advanced consumer appliances and efficient residential HVAC systems incorporating PTC technology. The presence of major electronic component manufacturing hubs further solidifies APAC's leadership.

- North America: North America holds a substantial market share, characterized by a focus on premium and high-performance applications. The rigorous winter conditions necessitate robust supplemental heating solutions in vehicles and homes, favoring the high-output, reliable performance of PTC heaters. The region is witnessing significant investments in EV assembly plants, driving demand for high-voltage PTC solutions. Furthermore, strict safety regulations governing consumer electronics and industrial equipment ensure consistent adoption of self-regulating PTC technology over traditional resistive alternatives, prioritizing safety and reliability.

- Europe: Europe is a mature market distinguished by stringent energy efficiency directives (e.g., EcoDesign) and early adoption of hybrid and electric vehicle technologies. The region's market is highly specialized, focusing on sophisticated fluid heating systems for industrial processes and premium automotive components. Germany, France, and Scandinavia are key markets, driven by high manufacturing quality standards and the necessity for effective cold-weather thermal management. The emphasis on sustainable energy use also promotes the integration of PTC elements in auxiliary heating within energy-efficient buildings.

- Latin America (LATAM) & Middle East and Africa (MEA): These regions represent emerging opportunities. Growth in LATAM is driven by increasing industrialization and expanding automotive manufacturing bases, particularly in Brazil and Mexico. The MEA region is showing promising growth, particularly in specific segments: industrial cabinet heating (for protection against high dust/humidity in infrastructure projects) and niche automotive applications, though overall penetration remains lower compared to established markets. The adoption rate is strongly correlated with investments in localized renewable energy infrastructure and the growth of local manufacturing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PTC Heaters Market.- Eberspächer Climate Control Systems GmbH & Co. KG

- Webasto Group

- Sensata Technologies Inc.

- DBK Group (DBK David + Baader GmbH)

- Cal-Comp Industrial Co., Ltd.

- TDK Corporation

- Murata Manufacturing Co., Ltd.

- Vishay Intertechnology, Inc.

- Selcom Group

- Samsung Electro-Mechanics Co., Ltd.

- Fuzhou Fersman Thermal Tech Co., Ltd.

- Zhuhai Xinte Electric Co., Ltd.

- Pelonis Technologies, Inc.

- Keystone Thermometrics, Inc.

- YAGEO Corporation

- Infineon Technologies AG

- Delta Electronics, Inc.

- Bosch Thermotechnology GmbH

- Lord Corporation (Parker Hannifin)

- Hebei Tianshuai Electronics Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the PTC Heaters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes PTC heaters from traditional resistive heating elements?

PTC (Positive Temperature Coefficient) heaters are inherently self-regulating; their resistance drastically increases above a set temperature (Curie point), limiting current flow and preventing overheating without external controls, offering superior safety and energy efficiency compared to traditional fixed-resistance wires.

How significant is the automotive sector's demand for PTC heaters?

The automotive sector is the largest and most critical revenue segment, particularly driven by Electric Vehicles (EVs) where PTC heaters are essential for both rapid cabin heating (due to lack of engine waste heat) and precise thermal management of high-voltage battery packs (BTMS) to ensure safety and optimal range.

What is the primary constraint impacting the profitability of PTC heater manufacturers?

The primary constraint is the volatility and high cost associated with sourcing specialized raw ceramic materials, particularly high-purity barium titanate and specific dopants, which are crucial for achieving stable and predictable PTC characteristics necessary for high-performance applications.

Are 800V PTC heaters becoming the industry standard in the EV market?

Yes, 800V PTC heaters are rapidly emerging as the necessary standard for next-generation, high-performance EV platforms. These systems enable significantly faster battery charging and lighter electrical architecture, necessitating PTC components capable of handling substantially higher operational voltages safely.

Which geographic region demonstrates the highest growth potential for PTC heater adoption?

The Asia Pacific (APAC) region, spearheaded by manufacturing expansion in China and Southeast Asia, exhibits the highest growth potential, fueled by massive government investment in EV infrastructure and the rapid penetration of energy-efficient consumer electronics across the area.

The PTC Heaters Market remains a critical domain within the broader thermal management industry, distinguished by its intrinsic safety features and adaptability across highly diverse applications, from critical automotive components to domestic appliances. The future trajectory is inextricably linked to the success of global electrification efforts, which continues to mandate lighter, faster, and safer heating solutions. The technological shift towards higher voltage systems (400V to 800V) in mobility presents both a significant engineering challenge and a lucrative revenue stream for manufacturers capable of mastering specialized ceramic formulations and advanced power handling integration. Furthermore, the convergence of PTC technology with AI and IoT-enabled thermal control modules promises to enhance system efficiency far beyond traditional capabilities, ensuring the technology's relevance in smart industrial and residential settings for the coming decade. Sustained investment in material science R&D, focusing on reducing component size while increasing power density and lifespan, will be the key determinant of competitive advantage in this rapidly evolving market landscape.

In the industrial sphere, PTC heaters are becoming standard for preventative maintenance and ensuring equipment longevity, especially in sensitive electrical enclosures where condensation control is vital. The self-regulating nature minimizes the risk of fire and component damage, making them indispensable in telecommunications, renewable energy infrastructure (wind turbines, solar inverters), and sophisticated control cabinets. This high-reliability, low-maintenance profile guarantees a steady, albeit less volatile, demand stream compared to the cyclical automotive market. Addressing sustainability concerns, manufacturers are also exploring methods to optimize energy conversion and minimize the environmental footprint associated with ceramic production, adding another layer of complexity to the value chain but simultaneously enhancing the market's long-term attractiveness through eco-friendly product differentiation.

Market consolidation is expected to continue as smaller players struggle to meet the stringent quality and volume requirements of major automotive OEMs, leading to strategic acquisitions by large multinational technology corporations aiming to secure expertise in high-voltage thermal solutions. The dynamic interplay between material cost inflation, regulatory pressure for higher efficiency, and the accelerating pace of technological innovation positions the PTC Heaters Market as one of the most exciting and essential segments within the thermal components industry. Companies that can effectively balance cost control in the upstream segment with cutting-edge customization in the downstream integration will be best positioned to capture maximum market share through 2033 and beyond, leveraging the foundational safety inherent in PTC technology to solve complex modern thermal challenges.

The high-growth narrative surrounding liquid heating PTC components is particularly notable. Unlike their air-heating counterparts, liquid heaters face greater environmental stressors, including exposure to various aggressive coolants and antifreeze mixtures, demanding specialized sealing and housing materials. Innovations here focus on microchannel fluid flow designs to maximize thermal exchange efficiency and minimize pressure drop within the vehicle’s cooling loop. This requires complex finite element analysis (FEA) during the design phase to predict thermal stress and fatigue, ensuring that the components endure the demanding operational cycles of an electric powertrain. The specialized intellectual property associated with these durable, highly efficient liquid heating modules provides manufacturers with significant entry barriers against low-cost competitors.

Furthermore, the segmentation by application highlights emerging markets that are increasingly relying on PTC technology. The medical device segment, for instance, requires highly localized and extremely precise temperature control, often in sterile environments. PTC heating elements are ideal for blood warming, surgical tool sterilization systems, and diagnostics equipment due to their rapid response time and inherent safety features that prevent thermal runaway. Compliance with ISO 13485 and FDA regulations adds another layer of complexity, favoring experienced component suppliers who can guarantee trace ability and consistent manufacturing quality. This high-value, low-volume segment offers superior profit margins compared to the mass consumer market.

In summary, the market's future vitality is not just about producing more heaters but producing smarter, more resilient, and context-aware thermal management units. The fusion of material science excellence (ceramic optimization) with power electronics and embedded software will define the next generation of PTC solutions, shifting the focus from simply being a heating element to being an integrated thermal control subsystem. This evolution guarantees continued strong growth, particularly in the premium and safety-critical application domains globally, securing the market's trajectory towards the projected USD 2.8 Billion valuation by 2033.

Elaborating on the technological specifics, the development of integrated electronic controls within the PTC module itself is a significant trend. Rather than relying solely on the material's Curie point, modern automotive and industrial systems incorporate microcontrollers that monitor current draw, temperature sensors (thermocouples or RTDs), and input voltage fluctuations. This integration allows for predictive adjustments and enhanced diagnostic capabilities. For high-voltage applications, challenges include managing electromagnetic interference (EMI) and ensuring adequate isolation distances, demanding specialized encapsulation materials, often involving highly resilient epoxies and ceramics that minimize thermal leakage while maximizing electrical safety under transient conditions. These advanced engineering requirements raise the technological barrier to entry substantially.

The concept of flexible PTC heaters, utilizing conductive polymers or specialized printing techniques, is also gaining traction, particularly in wearable technology and certain low-power heating applications where conformability is essential. While these polymer-based solutions typically cannot handle the high power density of ceramic units, they offer flexibility, lightness, and ease of mass production via roll-to-roll processes. This segment diversification allows PTC technology to capture market share previously held by traditional etched foil heaters, emphasizing the versatility and expansive application scope of the core PTC principle when adapted using modern material science.

Regulatory scrutiny is a silent but potent driver. As global efforts mandate phasing out refrigerants with high Global Warming Potential (GWP), the shift away from reliance on compressor-based heating cycles—especially in auxiliary systems—indirectly boosts the adoption of electric resistance heaters like PTCs, particularly when paired with highly efficient primary heating systems like heat pumps. The inherent safety of PTCs also makes them favorable in regions with strict fire safety codes, such as certain European and North American urban centers, influencing procurement decisions in commercial building and infrastructure projects.

Furthermore, the competitive strategy for leading players centers on securing patents related to doping profiles and sintering processes, which directly influence the heater's temperature coefficient curve. A flatter curve near the desired operating temperature is often sought after, ensuring stable thermal output under varying ambient conditions. Companies are also leveraging proprietary simulation software to accelerate the design cycle for custom components, allowing for rapid prototyping and validation of thermal and electrical performance, a necessity when dealing with demanding OEM specifications that require fast turnaround times for new vehicle platforms. The focus remains on durability, safety, and energy conversion efficiency above all else, positioning the PTC element as a premium, high-tech component rather than a commodity heating solution.

The supply chain risk associated with upstream material sourcing necessitates robust risk mitigation strategies. Fluctuations in the global market for titanium and barium compounds, often sourced from geopolitical hot spots, require manufacturers to establish geographically diverse sourcing contracts and maintain substantial strategic reserves. This complexity, coupled with the specialized nature of the processing equipment required for high-purity ceramic synthesis, reinforces the barrier to entry for new competitors and favors established companies with deep supply chain resilience. This operational challenge adds a premium to the final component cost but ensures the reliability demanded by safety-critical applications like automotive BTMS.

The future evolution of the market will likely see increased integration of communication interfaces, turning PTC heaters into active data nodes within the overall energy management network. For example, in an industrial setting, a PTC anti-condensation heater might report its operational health and internal temperature profile directly to a centralized maintenance system, enabling just-in-time component replacement before catastrophic failure occurs. This move toward smart components aligns perfectly with broader industry trends towards Industry 4.0 and predictive maintenance paradigms, ensuring that the PTC heater market not only grows in size but also in sophistication and value proposition.

The ongoing push for greater power density—the ability to generate significant heat output from a smaller physical package—is paramount, particularly for integration into crowded engine bays or compact consumer devices. Manufacturers are exploring layered and stacked PTC designs, utilizing advanced insulation and thermal potting techniques to manage heat dissipation effectively without compromising the self-regulating function. Success in achieving superior power density is a key competitive differentiator, particularly in the space-constrained EV market where every kilogram and cubic centimeter counts toward maximizing vehicle range and passenger space.

Finally, the demand from medical and laboratory equipment manufacturers is expected to grow steadily, driven by an aging global population and increased investment in advanced diagnostics. PTC elements are valued here for their precise temperature control, reliability, and speed, critical features in applications such as DNA sequencing thermal cyclers and portable emergency medical devices. Meeting the stringent traceability and certification requirements for this sector ensures high margins and stable, long-term contracts, further diversifying the revenue streams away from dependence solely on the automotive cycles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager