Radio Broadcasting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434226 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Radio Broadcasting Market Size

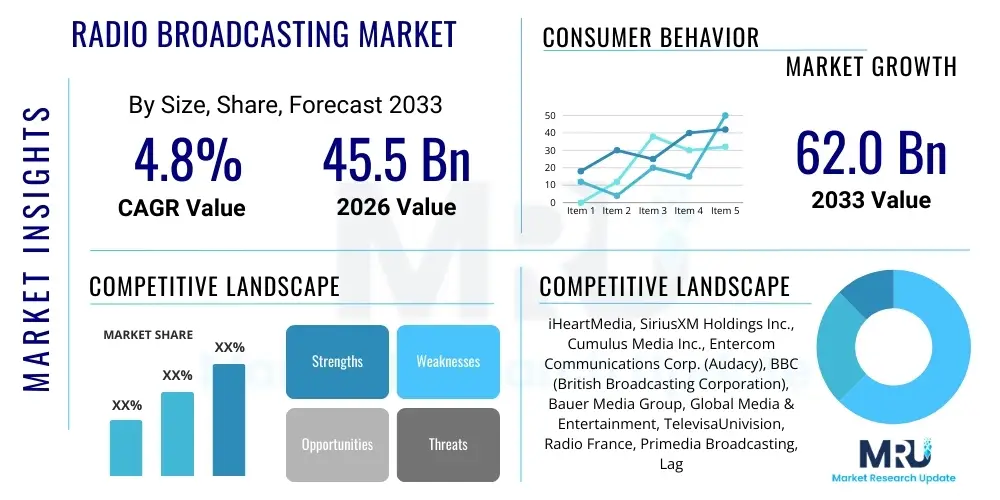

The Radio Broadcasting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 45.5 Billion in 2026 and is projected to reach USD 62.0 Billion by the end of the forecast period in 2033.

Radio Broadcasting Market introduction

The Radio Broadcasting Market encompasses the transmission of audio signals, traditionally via analog frequency modulation (FM) and amplitude modulation (AM), and increasingly through digital platforms such as Digital Audio Broadcasting (DAB), satellite radio, and internet protocol (IP) streaming. This sector provides information, entertainment, and public services, maintaining its relevance despite intense competition from other digital media formats. The foundational product remains the broadcast content itself, which is monetized primarily through advertising revenue, subscriptions, and public funding models. Traditional radio infrastructure is undergoing a significant transformation, integrating digital transmission capabilities to offer enhanced audio quality and supplementary data services, catering to shifting listener preferences and the ubiquity of mobile connectivity.

Major applications of radio broadcasting include news dissemination, musical entertainment, talk shows, and specialized niche programming aimed at specific demographic or cultural groups. The primary benefit of radio lies in its wide reach, accessibility (particularly in mobile and rural environments), and its ability to offer free, real-time localized information. Furthermore, radio remains a highly effective medium for local advertisers seeking to engage community audiences rapidly. Key driving factors propelling market evolution include the global push for digitalization, which improves signal quality and expands service offerings; the rapid growth of the connected car ecosystem, which makes in-vehicle radio consumption seamless; and the increasing consumer appetite for personalized audio content, including the convergence of traditional radio services with on-demand podcasting platforms.

The industry is characterized by significant capital investment in transmission infrastructure and content production, coupled with ongoing regulatory oversight regarding spectrum allocation and public service obligations. While traditional AM/FM remains dominant in terms of reach, the growth segments are heavily concentrated in digital distribution channels, which enable sophisticated data collection and targeted advertising capabilities, mirroring trends observed across the broader digital media landscape. Maintaining audience loyalty in the face of competition from streaming music services and personalized playlists requires broadcasters to innovate continuously in content curation and listener engagement strategies, ensuring that the unique value proposition of live, linear audio content is preserved and enhanced.

Radio Broadcasting Market Executive Summary

The global Radio Broadcasting Market exhibits resilience, pivoting successfully through the convergence of traditional terrestrial broadcasting and modern digital distribution. Current business trends indicate a critical shift towards hybrid models where broadcasters utilize both traditional frequencies and IP-based streaming to maximize reach and monetize diverse audience segments. A primary financial trend involves the migration of advertising spending towards programmatic audio advertising, which leverages listener data derived from digital platforms, offering higher precision and return on investment for advertisers compared to traditional spot buying. Furthermore, strategic alliances between large broadcasting networks and telecommunication providers are becoming common, facilitating better mobile integration and data usage optimization, thereby supporting the transition to digital-first operating procedures.

Regionally, North America and Europe remain the largest revenue contributors, defined by mature digital audio infrastructure and high penetration rates of connected devices, coupled with early adoption of DAB and HD Radio standards. However, the Asia Pacific (APAC) region is projected to demonstrate the fastest growth rate, fueled by substantial investments in public and private broadcasting infrastructure, rising disposable incomes, and the massive scale of mobile-first listeners across developing economies like India and China. Latin America also presents significant growth opportunities, driven by local content demand and increased penetration of low-cost digital receivers, despite historical challenges related to regulatory fragmentation and diverse language requirements across the continent. These regional dynamics necessitate tailored content strategies and localized technological deployment.

Segmentation analysis reveals that the Digital Broadcasting segment, encompassing DAB, HD Radio, and satellite radio, is accelerating faster than the traditional Analog segment, primarily due to superior signal quality and multimedia data capabilities. In terms of revenue stream, the Advertising segment continues its dominance, but the Subscription segment, particularly satellite and premium internet radio, is showing robust expansion, reflecting consumer willingness to pay for ad-free or specialized content. Technology trends emphasize the integration of artificial intelligence (AI) for playlist curation and ad insertion optimization, significantly enhancing operational efficiency and listener experience, transforming the landscape from mass communication to personalized audio engagement, further solidifying the market's long-term stability and profitability.

AI Impact Analysis on Radio Broadcasting Market

User inquiries regarding the impact of AI on the Radio Broadcasting Market primarily center on three core themes: content automation, personalized advertising efficacy, and the future role of human DJs and programmers. Users frequently question how AI can generate music playlists, news summaries, and even voice-tracked segments without compromising the quality or local relevance that listeners value. A major concern revolves around whether increased automation will lead to job displacement or if AI tools will merely augment human creativity, allowing staff to focus on higher-value tasks such as community engagement and investigative reporting. Furthermore, significant interest exists in understanding how AI-driven programmatic advertising can enable hyper-local and highly targeted ad delivery, increasing monetization rates and competing effectively with social media giants for advertising budgets.

AI's integration is fundamentally reshaping the operational framework of radio broadcasting, transitioning it from a labor-intensive scheduling process to a data-driven content delivery system. By deploying sophisticated machine learning algorithms, broadcasters can analyze vast datasets concerning listener habits, engagement metrics, and time-of-day preferences to dynamically adjust programming. This shift allows for content optimization in real-time, resulting in improved listener retention and reduced churn. Additionally, AI tools are critical in complying with increasingly complex regulatory requirements related to music licensing and content filtering, ensuring that broadcasters maintain legal compliance while rapidly scaling their digital offerings, particularly across international boundaries where different legal frameworks apply.

The long-term expectation is that AI will democratize high-quality content production and distribution, allowing smaller, independent stations access to sophisticated tools traditionally reserved for large media conglomerates. This includes AI-powered mastering tools that ensure consistent audio levels across diverse content sources, and virtual DJ capabilities that maintain a station’s on-air personality even during off-peak hours without extensive human oversight. However, successful integration hinges on maintaining transparency regarding AI usage and ensuring that automated systems retain the necessary cultural sensitivity and local flavor essential for maintaining audience trust, thereby avoiding the pitfalls of generic, algorithmically generated content that lacks human connection.

- AI-powered playlist generation and music scheduling optimization.

- Implementation of dynamic ad insertion (DAI) for hyper-targeted advertising across streaming platforms.

- Automation of routine news aggregation and weather updates via synthetic voice technology.

- Enhanced content discovery and recommendation systems for personalized listener experience.

- Use of machine learning for predictive analysis of listener engagement and churn rates.

- Improved spectrum efficiency and signal optimization through intelligent network management.

- Automated compliance monitoring for licensing, regulatory restrictions, and indecent language filters.

- Development of virtual, localized radio personalities utilizing advanced text-to-speech models.

- Integration of AI tools for detailed listener data analysis to inform content strategy.

DRO & Impact Forces Of Radio Broadcasting Market

The Radio Broadcasting Market is significantly influenced by a dynamic interplay of driving forces (D), restrictive factors (R), and strategic opportunities (O), which collectively determine market trajectory and competitive intensity. A primary driver is the pervasive adoption of connected technologies, notably in automobiles and mobile devices, ensuring radio remains accessible and convenient to listeners across diverse environments. This is augmented by the cost-effectiveness and localized reach of radio advertising, which appeals strongly to small and medium-sized enterprises (SMEs). However, the market faces strong restraints, chiefly the fierce competition from global on-demand music streaming services (e.g., Spotify, Apple Music) and user-generated content platforms (e.g., YouTube, TikTok), which capture significant attention share and advertising budgets, challenging radio's traditional linear model. Regulatory complexity, particularly regarding spectrum allocation and intellectual property rights across different regions, also restricts rapid expansion and technological harmonization.

Strategic opportunities are heavily concentrated in the digital realm. The rapid proliferation of podcasting presents a substantial avenue for broadcasters to repurpose existing content, develop new intellectual property, and capture a younger, digitally native audience segment, extending the brand footprint beyond traditional airwaves. Furthermore, the global transition to digital broadcasting standards (DAB, HD Radio) offers opportunities for enhanced data services, including traffic information, program guides, and interactive features, creating a more engaging and marketable product. Investing in advanced programmatic advertising technology allows broadcasters to maximize inventory yield and compete directly with digital media giants by offering granular targeting capabilities, thus stabilizing and growing advertising revenues in a competitive digital landscape. The synergy between radio and smart home devices also opens new consumption points.

The impact forces exerted on the market structure are predominantly driven by technological evolution and changes in consumer behavior. Technological substitution, where personalized digital audio replaces linear radio listening, poses a high threat. Conversely, the low entry barrier for digital content creators increases competitive pressure. The negotiating power of major content producers (music labels, news agencies) remains moderate but is increasingly balanced by the power of large broadcasting groups that control access to mass audiences. The overall impact assessment suggests that while the traditional analog segment faces long-term structural decline, the overall broadcasting market remains robust due to successful digital transformation, strategic content diversification, and the enduring localized trust associated with established radio brands.

Segmentation Analysis

The Radio Broadcasting Market is comprehensively segmented based on technology, revenue stream, and application, providing granular insights into growth areas and strategic priorities. Understanding these segments is crucial for stakeholders to allocate resources effectively and tailor business strategies to specific market demands. The technological segmentation highlights the ongoing migration from analog systems towards high-efficiency digital standards, reflecting investments in future-proof infrastructure. Revenue stream analysis clarifies the evolving monetization methods, where advertising remains primary but is increasingly challenged and supplemented by subscription and syndication models. Application segmentation identifies the varied end-user environments and content formats that drive listener engagement and commercial viability across diverse demographics.

The market structure reflects a dual landscape: mature segments providing stable revenue flow and emerging digital segments offering rapid expansion potential. For instance, the transition within the Technology segment from FM/AM to DAB+ requires significant capital expenditure but unlocks multi-channel broadcasting capabilities and superior data delivery, appealing directly to modern advertisers seeking detailed performance metrics. Similarly, within the Application segment, the growth of news and talk programming signifies a public preference for timely, localized information and debate, contrasting with the entertainment focus of music radio, requiring different operational scales and content production expertise. This diverse segmentation ensures market resilience, allowing broadcasters to hedge against volatility in specific content or technology areas.

Strategic success in the coming years will depend heavily on segment convergence, particularly leveraging digital platforms to integrate different revenue streams. For example, using the reach of traditional broadcasting to promote premium, ad-free podcast subscriptions (a blend of advertising and subscription models) is a key strategy for maximizing lifetime customer value. Geographic segmentation is also implicitly tied to technological standards, as certain regions have mandated specific digital adoption timelines, directly influencing the growth rates of corresponding technology segments. Overall, the dynamic nature of these segments underscores the need for continuous investment in flexible, scalable digital infrastructure capable of supporting future content innovation and monetization models.

- Technology:

- Analog Broadcasting (AM, FM)

- Digital Broadcasting (DAB/DAB+, HD Radio, DRM)

- Satellite Radio

- Internet Radio (Streaming/IP-based)

- Revenue Stream:

- Advertising (Spot, Programmatic, Sponsorships)

- Subscription Fees (Satellite, Premium Internet)

- Public Funding/Government Grants

- Syndication and Licensing

- Application:

- Music Radio

- News and Talk Radio

- Sports Radio

- Educational/Public Service Radio

- Religious Radio

Value Chain Analysis For Radio Broadcasting Market

The value chain of the Radio Broadcasting Market is complex, involving content creation, distribution, technology providers, and end-user consumption. The upstream analysis begins with content creation, involving music rights holders (record labels, publishers), news agencies, independent producers, and internal talent. This phase is capital-intensive, focusing on talent acquisition, studio production, and securing necessary licensing rights, which represents a significant cost driver. Technology manufacturers, including suppliers of transmitters, consoles, studio equipment, and digital coding infrastructure, also reside upstream, providing the critical hardware and software necessary for signal origination and processing. Efficiency at this stage is measured by the ability to rapidly produce high-quality, legally compliant content ready for transmission.

The midstream segment is dominated by distribution and transmission activities. This involves the core broadcasting companies that own the transmission towers, manage spectrum allocation, and operate the digital streaming servers. Distribution channels are bifurcated into direct and indirect routes. Direct distribution involves the broadcaster transmitting the signal straight to the listener’s device via terrestrial airwaves or proprietary digital streaming applications. Indirect distribution involves third-party platforms, such as satellite radio providers (e.g., SiriusXM), aggregators (e.g., TuneIn), and telecommunication carriers who bundle or host the broadcast content, extending its reach to devices like smart speakers and connected cars.

Downstream analysis focuses on monetization and consumption. The primary source of value capture is advertising, where agencies and programmatic platforms connect advertisers with the station's inventory. Effective downstream management involves analyzing listener data to optimize ad placement and pricing. End-users (listeners) complete the chain, accessing content via various receiving devices (traditional receivers, smartphones, smart speakers, car stereos). The flow is characterized by content moving from creation to distribution, monetized through advertising or subscription fees, culminating in consumer engagement. Optimization across the chain targets reducing operational latency and enhancing the precision of advertising delivery through digital integration.

Radio Broadcasting Market Potential Customers

The primary customers of the Radio Broadcasting Market are twofold: the listeners, who consume the product, and the advertisers, who fund the operations. Listeners represent the core audience base, spanning diverse demographics across all age groups, economic strata, and geographic locations, utilizing radio for entertainment, news, and community connection. This includes traditional listeners accessing AM/FM receivers, technologically advanced users utilizing streaming apps on smartphones and smart speakers, and captive audiences such as daily commuters relying on in-car audio systems. The potential customer base is highly segmented by lifestyle, leading to specialized programming tailored to groups like young urban professionals (podcast-integrated content), rural agricultural communities (localized news and markets), and the elderly (relying on traditional, free-to-air broadcasting).

The second, commercially critical set of potential customers are the advertisers. These include large national brands requiring broad reach and high frequency, particularly those targeting mass market demographics or seasonal campaigns. However, a significant potential customer base lies within Small and Medium-sized Enterprises (SMEs) and local businesses, for whom radio offers a cost-effective and hyper-localized marketing channel unmatched by many global digital platforms. The growth in digital broadcasting enhances the appeal to national advertisers by enabling programmatic buying and detailed performance metrics, increasing the attractiveness of radio inventory compared to less measurable traditional media.

Furthermore, institutions such as governmental bodies and non-profit organizations represent key customers for public service airtime, utilizing radio’s high penetration for public safety announcements, educational campaigns, and civic engagement initiatives, especially during emergencies. As the market evolves, the potential customer base expands to include technology developers and content aggregators seeking partnerships to integrate radio services into new platforms, such as vehicle infotainment systems, ensuring seamless integration and continued accessibility across emerging consumption environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 62.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | iHeartMedia, SiriusXM Holdings Inc., Cumulus Media Inc., Entercom Communications Corp. (Audacy), BBC (British Broadcasting Corporation), Bauer Media Group, Global Media & Entertainment, TelevisaUnivision, Radio France, Primedia Broadcasting, Lagardère News, Canadian Broadcasting Corporation (CBC), Emmis Communications, Mediacorp, MBN (Middle East Broadcasting Networks) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Radio Broadcasting Market Key Technology Landscape

The technology landscape of the Radio Broadcasting Market is characterized by a rapid evolution from purely analog systems to sophisticated digital and IP-based distribution networks. The migration to Digital Audio Broadcasting (DAB and DAB+) is a critical technological shift, particularly prevalent in Europe and parts of Asia, offering superior audio quality, multi-channel capacity, and supplementary data services such as scrolling text, traffic updates, and program information (known as Programme Associated Data or PAD). In North America, the parallel technology, HD Radio (In-Band On-Channel or IBOC digital radio), allows broadcasters to transmit analog and digital signals simultaneously over the same frequency, facilitating a smoother transition while maintaining compatibility with legacy receivers. These digital standards are essential for improving spectrum efficiency and providing a more modern user experience capable of competing with digital media.

Another pivotal technological component is the rise of Internet Protocol (IP) streaming infrastructure. This technology underpins internet radio and mobile application listening, offering broadcasters unlimited geographic reach and detailed listener analytics not possible with terrestrial broadcasting. Advanced streaming technologies require robust content delivery networks (CDNs) and sophisticated server-side infrastructure to handle concurrent listener load and ensure low latency. Furthermore, the integration of Dynamic Ad Insertion (DAI) technology, often powered by AI algorithms, is transforming monetization. DAI allows broadcasters to swap out generic network ads for highly targeted, personalized advertisements in the streaming feed based on the listener's demographic data, location, and listening history, significantly increasing the value of digital inventory.

Looking forward, key technology areas include the continued development of software-defined radio (SDR) and virtualization of broadcast infrastructure, enabling greater flexibility and reduced operational costs by replacing dedicated hardware with versatile software running on commercial off-the-shelf (COTS) servers. The reliance on metadata management systems is also growing, as accurate tagging and categorization of content are vital for searchability across smart speaker platforms and integration within connected car environments. Finally, the ongoing refinement of voice recognition and natural language processing (NLP) is crucial for enhancing listener interaction, enabling hands-free content requests and interactive features, thereby solidifying radio’s position in the rapidly expanding smart home ecosystem.

Regional Highlights

Regional dynamics play a crucial role in shaping the global Radio Broadcasting Market, reflecting varying levels of technological maturity, regulatory frameworks, and consumer preferences for content. The market is broadly categorized into North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa (MEA), each presenting unique opportunities and challenges for broadcasters and technology providers. Strategic investments are often localized based on specific government mandates regarding digital radio adoption and the concentration of media ownership.

North America, led by the United States, represents a highly mature and competitive market characterized by the widespread adoption of HD Radio technology and the dominance of satellite radio through providers like SiriusXM. The region boasts advanced programmatic audio advertising capabilities and high penetration rates of connected cars, making in-vehicle listening a key consumption channel. The competitive landscape is defined by major national networks and strong local content differentiation, with significant revenue generated from national and regional spot advertising. Investment focus here is centered on technology integration, improving digital streaming quality, and monetizing listener data.

Europe stands out due to the high regulatory impetus toward digital migration, primarily driven by the mandatory adoption of DAB/DAB+ standards in countries like Norway (which decommissioned FM nationally) and the UK. This forced migration has accelerated infrastructure upgrades and broadened the range of available digital radio services, leading to greater spectrum efficiency. Key markets such as the UK, Germany, and France are characterized by a mix of powerful public service broadcasters (PSBs) and commercial entities. The European market emphasizes multi-platform distribution and cross-media content production, often utilizing radio brands to launch successful podcast franchises and online video content.

Asia Pacific (APAC) is projected to be the fastest-growing region, driven by immense population size, rapid urbanization, and increasing access to affordable mobile devices. The market here is highly fragmented in terms of language and content, necessitating hyper-localized broadcasting strategies. While many emerging economies in APAC still rely heavily on traditional analog broadcasting, significant governmental push in countries like South Korea, Australia, and India towards digital standards (DAB and DRM – Digital Radio Mondiale) promises substantial future growth in digital receiver sales and advertising spend. The rapid deployment of 5G infrastructure across key urban centers in APAC further supports high-quality mobile audio streaming.

Latin America and the Middle East & Africa (MEA) present markets with immense potential, albeit facing challenges related to economic volatility and infrastructure gaps. Latin America relies strongly on FM broadcasting, but internet radio adoption is rising rapidly, particularly in Brazil and Mexico, due to high smartphone penetration. Content is strongly culturally resonant and localized. In MEA, radio remains a vital source of information and communication, particularly in rural and low-connectivity areas. The market here is heavily influenced by government regulation and public funding, with a gradual but crucial technological shift towards digital standards, often leapfrogging older technologies directly to digital IP delivery where fixed infrastructure is lacking.

- North America: Dominance of HD Radio and Satellite Radio; focus on programmatic advertising and connected car integration.

- Europe: Leader in mandated DAB/DAB+ migration; high emphasis on public service broadcasting and cross-platform content.

- Asia Pacific (APAC): Highest growth potential driven by mobile-first consumption and large populations; increasing adoption of DRM and localized content strategy.

- Latin America: Strong reliance on FM, but rapid growth in internet radio fueled by smartphone penetration; high demand for local cultural content.

- Middle East & Africa (MEA): Radio essential for information dissemination in low-connectivity areas; governmental influence and transition to digital (often IP-based) slowly progressing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Radio Broadcasting Market.- iHeartMedia

- SiriusXM Holdings Inc.

- Cumulus Media Inc.

- Entercom Communications Corp. (Audacy)

- BBC (British Broadcasting Corporation)

- Bauer Media Group

- Global Media & Entertainment

- TelevisaUnivision

- Radio France

- Primedia Broadcasting

- Lagardère News

- Canadian Broadcasting Corporation (CBC)

- Emmis Communications

- Mediacorp

- MBN (Middle East Broadcasting Networks)

- Grupo Jovem Pan

- Zentraler Radio-Dienst (ZRD)

- Rádio Gaúcha

- Australian Broadcasting Corporation (ABC)

- Rheinische Post Mediengruppe

Frequently Asked Questions

Analyze common user questions about the Radio Broadcasting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary revenue source for the Radio Broadcasting Market today?

The primary revenue source remains advertising, although the mechanism is shifting rapidly from traditional spot ads to programmatic audio advertising delivered through digital streaming platforms, enabling hyper-targeted ad placement based on listener data.

How is the adoption of Digital Audio Broadcasting (DAB) affecting market growth?

DAB adoption, particularly in Europe, drives market growth by enhancing signal quality, increasing the number of available channels, and supporting multimedia data services, thus future-proofing the technology and appealing to modern consumers and advertisers.

Will podcasting eventually replace traditional radio listening?

Podcasting is more accurately viewed as a complementary opportunity rather than a replacement. Radio broadcasters leverage their existing content creation expertise and brand recognition to launch successful podcasts, extending their reach to on-demand listeners and creating hybrid revenue streams.

What role does the connected car play in the future of radio broadcasting?

The connected car ecosystem is crucial for radio's resilience, as it maintains the car as a primary consumption environment. Modern infotainment systems integrate traditional AM/FM, digital radio standards, and IP streaming seamlessly, ensuring high accessibility for commuters.

How do artificial intelligence and machine learning technologies impact radio operations?

AI significantly impacts radio by optimizing music scheduling, automating routine content (like weather and news), enabling highly effective dynamic ad insertion (DAI), and providing detailed listener analytics for better content strategy and increased operational efficiency.

Which regions are leading the technological transition in radio broadcasting?

Europe, specifically countries mandating DAB/DAB+ switchovers (like Norway and the UK), and North America, with its established HD Radio and strong satellite infrastructure, are leading the technological transition and setting global digital standards.

What is the difference between Analog and Digital broadcasting in terms of consumer experience?

Analog (AM/FM) offers broad, free accessibility but is limited by static and single-channel transmission. Digital broadcasting (DAB/HD Radio) offers superior, static-free audio quality, the capacity for multiple channels per frequency, and associated data services like song titles and traffic updates.

What regulatory challenges face global radio broadcasters?

Key regulatory challenges include managing complex and varying spectrum allocation rules across different countries, navigating diverse intellectual property and music licensing requirements, and adhering to strict content and public service obligations unique to each regional jurisdiction.

How are radio stations monetizing their content beyond traditional advertising spots?

Beyond traditional spots, radio stations monetize content through subscription models for ad-free streaming or satellite services, revenue generated from podcast content and branded merchandise, syndication fees for popular programs, and hosting sponsored live events.

What technological innovation is most critical for future radio growth?

The most critical innovation is the widespread adoption of robust IP-based streaming infrastructure coupled with Dynamic Ad Insertion (DAI), which allows radio to combine its traditional mass-reach strength with the precision targeting capabilities demanded by modern digital advertisers.

How does competition from streaming giants like Spotify affect the radio market?

Streaming services increase competitive pressure by capturing significant listener attention and advertising dollars, forcing radio broadcasters to differentiate themselves by focusing on local content, real-time news delivery, and unique human-driven content curation.

What is the significance of the shift to Digital Radio Mondiale (DRM) in emerging markets?

DRM is significant in emerging markets (particularly Asia Pacific and Africa) because it provides highly efficient, high-quality digital broadcasting over long distances, often utilizing existing AM infrastructure, making it a cost-effective path to digitalization in vast geographical areas.

Do smart speakers represent a threat or an opportunity for radio?

Smart speakers represent a major opportunity. They have transformed the home into a new prime listening location for radio by offering hands-free, easy access to IP streams and traditional stations, increasing overall listenership time in domestic settings.

How important is localized content for the stability of radio broadcasting?

Localized content is extremely important; it is radio's key competitive differentiator against global streaming platforms. Local news, traffic, weather, and community events create a unique sense of connection and relevance that drives consistent listenership and local advertiser loyalty.

What measures are radio broadcasters taking to attract younger audiences?

Broadcasters are attracting younger audiences by integrating heavily into mobile apps, developing successful podcast lineups, utilizing social media for audience engagement, and offering specialized, niche digital-only channels that cater to specific music genres or subcultures preferred by youth demographics.

What is spectrum scarcity and how does it affect the market?

Spectrum scarcity refers to the limited availability of radio frequencies for broadcasting. It restrains market growth by limiting the ability of new entrants to launch traditional stations and drives the mandatory shift towards digital technologies that allow for greater channel multiplexing and efficiency.

Is satellite radio growth still relevant amidst widespread internet streaming?

Yes, satellite radio remains relevant due to its strong subscription model, unique exclusive content offerings (particularly live sports and specialized talk), and its ability to provide seamless, consistent coverage across vast geographical areas where internet connectivity might be unreliable.

How is programmatic buying changing the relationship between radio stations and advertisers?

Programmatic buying streamlines the ad purchasing process, allowing advertisers to buy inventory efficiently based on real-time data and specific audience demographics rather than relying on manual negotiations, thus increasing the attractiveness and competitiveness of radio inventory.

What financial metrics are key indicators of a radio broadcaster's health?

Key financial indicators include Net Advertising Revenue (NAR), Digital Revenue Growth Rate (reflecting successful transformation), Station Operating Expense (SOE) control, and Audience Share (Cume and Average Quarter Hour - AQH), which directly impacts ad pricing power.

How are content licensing costs impacting the market value chain?

Content licensing costs, particularly for music royalties, are substantial expenses that impact the upstream part of the value chain. As consumption shifts to digital platforms, licensing negotiations become more complex, often requiring separate agreements for terrestrial, satellite, and streaming rights, influencing overall profitability.

What role do public service broadcasters (PSBs) play in the overall market?

PSBs, funded typically by government grants or license fees (e.g., BBC), play a vital role by providing non-commercial content, educational programming, and comprehensive national news coverage, ensuring universal access and often setting high standards for digital technology adoption.

Is there a noticeable consolidation trend among major radio groups?

Yes, the market has seen significant consolidation, particularly in North America and Europe, driven by the need for economies of scale, debt restructuring, and the imperative to pool resources for investing in expensive digital transformation and competitive content production.

How are broadcasters managing the technical challenges of hybrid broadcasting?

Broadcasters manage hybrid challenges by adopting standardized technologies like Hybrid Digital Radio (HDR) and RadioDNS, which allow seamless switching between traditional terrestrial signals and IP streams, ensuring continuity and enriched user data regardless of the device or location.

What is the long-term outlook for the traditional AM frequency band?

The long-term outlook for AM is challenging due to inherent audio quality issues and high operating costs. Many stations are transitioning AM programming to digital simulcasts (HD Radio or DRM) or focusing AM usage specifically on high-power talk and news formats that rely less on high-fidelity music transmission.

How does the shift to 5G technology benefit radio broadcasting?

The shift to 5G significantly benefits IP-based radio broadcasting by providing the necessary bandwidth and low latency for high-quality, uninterrupted mobile audio streaming and enabling richer data services associated with the broadcast content, improving the digital listener experience.

Why is the Asia Pacific region projected to have the highest CAGR?

The APAC region's high CAGR is attributed to massive population growth, increased mobile internet penetration, rising consumer spending on media, and large-scale governmental initiatives in key nations to upgrade outdated analog infrastructure to modern digital broadcasting standards.

What distinguishes the Revenue Stream Segmentation in the radio market?

The segmentation highlights the duality of free, ad-supported content (the largest segment) versus premium, paid content (subscriptions). The growth in the subscription segment indicates audience willingness to pay for specialized, ad-free, or exclusive content, diversifying overall income stability.

What is the primary constraint related to infrastructure investment in the market?

The primary constraint is the significant capital expenditure required for the mandated transition from established analog transmission towers and studio equipment to new, complex digital infrastructure (DAB transmitters, streaming servers, and IP networking gear), representing a major financial hurdle.

How does data analytics inform content strategy in modern radio?

Data analytics, derived from digital streams and connected devices, informs content strategy by providing granular insights into listener demographics, preferred music tracks, drop-off points during shows, and optimal times for news breaks, allowing programmers to make data-driven decisions that maximize engagement.

What are the key differences between Satellite Radio and Internet Radio?

Satellite radio requires proprietary receivers and offers consistent, national coverage via satellite signal, often based on a paid subscription. Internet radio uses standard internet connectivity and offers global reach and high personalization, but is dependent on network quality.

What opportunities exist in the application segment of News and Talk radio?

News and Talk radio presents strong opportunities for revenue stability and audience loyalty, particularly in the production of high-value, exclusive local content and the monetization of dedicated, engaged audiences through targeted sponsorship and high-rate spot advertising.

How do broadcasters ensure their content is discoverable on smart devices?

Broadcasters ensure discoverability by maintaining accurate metadata (station name, genre, location), registering with major aggregators (TuneIn, iHeart), and developing platform-specific skills or apps for smart speakers and vehicle operating systems, optimizing for voice search queries.

What is the role of technology vendors in the radio value chain?

Technology vendors are critical upstream partners, supplying everything from high-power transmitters and studio consoles to specialized software for scheduling, playout, archiving, and compliance monitoring, facilitating the entire broadcast process from content ingest to transmission.

How is the market adapting to increasing demands for personalized content?

The market adapts by utilizing AI algorithms to create personalized streaming channels, integrating podcasting features that allow on-demand listening, and deploying dynamic advertising that caters specifically to individual listener profiles, bridging the gap between linear content and personalized experiences.

What are the implications of the shift from analog to digital for regulatory bodies?

The shift necessitates regulatory bodies to manage spectrum re-allocation, establish new licensing frameworks for digital channels, ensure universal service obligations are met in the digital realm, and potentially manage the eventual decommissioning of analog frequencies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- TV and Radio Broadcasting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Radio Broadcasting Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (AM, FM, Satellite Radio), By Application (Commercial, Residential, Government, Airports, Hospitals, Institutes, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager