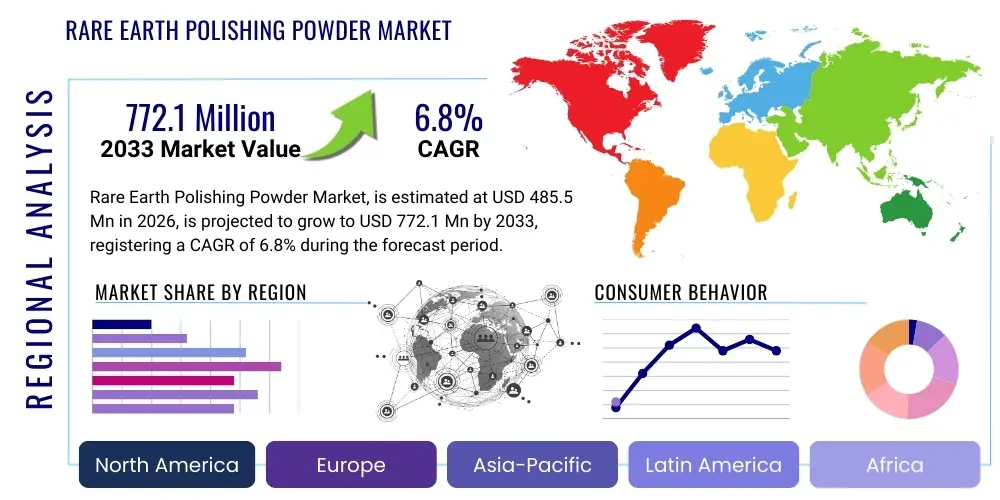

Rare Earth Polishing Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434438 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Rare Earth Polishing Powder Market Size

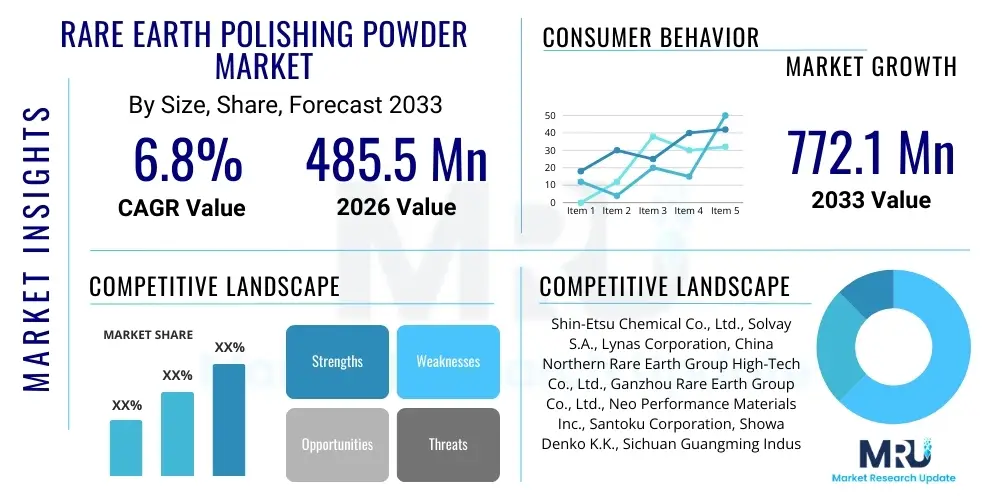

The Rare Earth Polishing Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 485.5 Million in 2026 and is projected to reach USD 772.1 Million by the end of the forecast period in 2033.

Rare Earth Polishing Powder Market introduction

The Rare Earth Polishing Powder market encompasses materials derived primarily from cerium oxide (CeO2) and occasionally lanthanum oxide (La2O3), engineered specifically for achieving high-precision surface finishes on various substrates. These specialized powders are critical components in the manufacturing processes of high-definition displays, precision optics, architectural glass, and electronic components, owing to their superior chemical reactivity and mechanical properties. The unique crystalline structure and controlled particle size distribution of rare earth polishing powders allow for the simultaneous mechanical abrasion and chemical reaction with glass surfaces, enabling ultra-smooth, scratch-free finishes essential for modern technological requirements, particularly in consumer electronics and high-throughput data processing industries.

Product descriptions vary based on the ceria concentration, purity levels, particle morphology, and preparation methods (such as precipitation or calcination). Cerium oxide remains the dominant type due to its unparalleled efficiency and cost-effectiveness compared to alternative polishing agents. Major applications span the high-technology sectors, including the stringent requirements of semiconductor fabrication, the production of flat panel displays (FPDs) like OLEDs and LCDs, and advanced optical components used in aerospace and medical devices. The intrinsic benefits of using these materials include achieving high removal rates, minimizing subsurface damage, and delivering superior surface quality that is difficult to replicate using non-rare earth alternatives.

The market is primarily driven by the relentless demand for thinner, larger, and higher-resolution displays in smartphones, televisions, and automotive systems. Furthermore, the expansion of high-speed communication infrastructure necessitates increased production of optical fibers and precision lenses, where rare earth polishing powders are indispensable for maintaining signal integrity and clarity. Growth is also bolstered by advancements in automated polishing equipment and slurry recycling technologies, which improve process efficiency and reduce operational costs, thereby making rare earth polishing solutions more economically viable across diverse manufacturing environments globally. The stringent quality standards in industries like aerospace and defense further solidify the essential nature of these specialized polishing materials.

Rare Earth Polishing Powder Market Executive Summary

The Rare Earth Polishing Powder market is characterized by robust growth, largely fueled by the exponential expansion of the consumer electronics sector, particularly the global proliferation of advanced display technologies. Business trends indicate a strategic focus among major producers on securing stable rare earth supply chains, as the market is highly sensitive to geopolitical factors and raw material sourcing volatility, predominantly concentrated in specific regions. Producers are increasingly investing in proprietary manufacturing processes to refine particle size distribution and purity levels, aiming to meet the escalating technical specifications required by next-generation display manufacturers, such as those transitioning to advanced gorilla glass and ultra-thin substrates. Furthermore, consolidation activities are observed in the upstream supply segment, ensuring specialized technical know-how and material quality control remain concentrated among a few key global players.

Regional trends highlight the Asia Pacific (APAC) region, specifically China, South Korea, Taiwan, and Japan, as the undisputed epicenter of both production and consumption. China dominates the supply chain, accounting for a substantial majority of global rare earth material refinement and downstream polishing powder production, benefiting from extensive domestic reserves and established processing infrastructure. However, North America and Europe demonstrate sustained demand driven by high-value applications in precision optics, aerospace instrumentation, and specialized automotive glass. These Western markets prioritize high-purity, premium-grade powders, often necessitating specialized certification and tighter quality control parameters, thereby supporting differentiated pricing strategies for specialized product lines outside the standard electronics grade.

Segmentation trends reveal Cerium Oxide Polishing Powder remains the largest segment by type, valued for its optimal balance of chemical and mechanical polishing attributes, while the Application segment is overwhelmingly led by Glass Polishing, which includes flat panel displays and architectural glass. A notable trend is the accelerated demand from the Electronic Components sub-segment, particularly due to the rising requirements for wafer and substrate finishing in semiconductor manufacturing processes, which requires ultra-high purity materials. Companies are also developing customized slurry formulations optimized for specific polishing machine types and materials, moving away from generic powder sales toward integrated polishing solutions to capture higher value in the complex manufacturing ecosystem.

AI Impact Analysis on Rare Earth Polishing Powder Market

Common user questions regarding AI's influence typically revolve around how artificial intelligence and machine learning (ML) can optimize the polishing process itself, rather than directly impacting rare earth sourcing. Users are concerned about improving efficiency, reducing material waste, and enhancing surface quality consistency. Key themes include the implementation of ML algorithms for real-time monitoring and adaptive control of polishing slurry parameters—such as concentration, pH, and flow rate—to counteract process variability. Users anticipate that AI can dramatically reduce the need for manual intervention and minimize costly errors associated with suboptimal polishing conditions, leading to significant material savings and faster yield optimization in complex manufacturing environments, particularly in precision optics and semiconductor fabrication where tolerances are extremely narrow.

- AI algorithms enable real-time analysis of surface metrology data, allowing for immediate adjustments to slurry composition and polishing pressure, minimizing material usage.

- Machine learning models are deployed to predict optimal polishing endpoint detection, reducing processing time and ensuring superior surface finish consistency across batches.

- AI-driven supply chain optimization enhances the forecasting of rare earth material demand, improving inventory management for polishing powder manufacturers and mitigating procurement risks.

- Predictive maintenance schedules for polishing equipment (e.g., pads and carriers) are established using AI, reducing unplanned downtime and improving overall manufacturing throughput.

- AI supports advanced quality control systems that use computer vision to rapidly detect microscopic defects (scratches, haze) that are typically polish-related, leading to faster root cause analysis in the production line.

- Neural networks can be utilized in R&D to simulate and model new rare earth compound formulations and particle morphologies, accelerating the development of higher-efficiency polishing powders.

DRO & Impact Forces Of Rare Earth Polishing Powder Market

The market dynamics are defined by a complex interplay of increasing technological demand (Drivers), concentrated supply chain vulnerabilities (Restraints), and the emergence of new high-tech applications (Opportunities). The primary driver is the pervasive demand for high-quality, high-resolution screens and precision optics, which necessitates the unparalleled efficiency of rare earth materials for achieving perfect surface finishes. Conversely, geopolitical instability and the near-monopoly in raw material supply act as significant restraints, forcing manufacturers to seek material security through long-term contracts or diversification attempts. Opportunities lie in developing advanced formulations optimized for emerging materials like specialized ceramic substrates and ultra-thin flexible glass, expanding the applicability of rare earth polishing powders beyond traditional electronics.

The impact forces influencing the Rare Earth Polishing Powder market are substantial, extending beyond mere economic factors. Supplier bargaining power is exceptionally high due to the limited number of companies possessing the sophisticated technology and resources to refine rare earth oxides into high-purity polishing grades. Furthermore, buyer bargaining power is moderately high, particularly from major FPD and semiconductor manufacturers who purchase in massive volumes and demand strict adherence to quality specifications and competitive pricing. The threat of substitutes is relatively low; while alternative polishing agents like alumina or silica exist, they generally fail to match the combined mechanical and chemical efficacy of cerium oxide for critical high-precision applications, thereby maintaining the market necessity for rare earth powders.

Technological impact is constant, driven by the demand for finer particle sizes and tighter distribution controls to prevent micro-scratching on delicate substrates. Environmental regulations, particularly concerning wastewater management and the handling of rare earth residues, are increasingly impacting operational costs and requiring investments in sustainable processing technologies. These external pressures mandate continuous process innovation and strategic alignment with global regulatory frameworks to maintain market access and operational viability, especially in regulated Western markets.

Segmentation Analysis

The Rare Earth Polishing Powder market is comprehensively segmented based on the type of rare earth material used, the specific application of the polishing process, and the ultimate end-use industry utilizing the finished components. Understanding these segments is crucial for strategic market positioning, as performance requirements and pricing structures vary significantly between, for instance, the bulk polishing of architectural glass and the ultra-precision finishing of semiconductor wafers. The Type segmentation primarily highlights the dominance of cerium oxide due to its superior efficiency, while the Application segment distinguishes between standard glass finishing and highly specialized optics production.

- By Type

- Cerium Oxide Polishing Powder (Dominant segment due to superior chemical-mechanical polishing efficiency)

- Lanthanum Oxide Polishing Powder (Used in niche applications and specific slurry formulations)

- Other Rare Earth Compounds

- By Application

- Glass Polishing (FPDs, Architectural, Automotive)

- Electronic Components (Semiconductor Wafers, HDD components)

- Optics (Lenses, Prisms, Optical Fibers)

- Others (e.g., Ceramics, Metal Finishing)

- By End-Use Industry

- Consumer Electronics (Smartphones, Tablets, TVs)

- Automotive (Windshields, Display screens, Headlamps)

- Healthcare (Medical Imaging Lenses, Endoscopes)

- Aerospace and Defense (Specialized lenses, Sensors)

Value Chain Analysis For Rare Earth Polishing Powder Market

The value chain for Rare Earth Polishing Powder begins with the upstream activities centered around the mining and extraction of rare earth ores, followed by complex separation and refinement processes to produce high-purity rare earth oxides (REOs), predominantly cerium oxide. This initial phase is highly capital-intensive and geographically concentrated, making the upstream segment a significant choke point in the supply chain. Key players in this segment manage extensive mining operations and chemical processing facilities to achieve the requisite purity levels (often 99.9% or higher) essential for subsequent polishing powder manufacturing. Efficiency gains at this stage directly influence the cost and quality of the final polishing product, highlighting the strategic importance of vertical integration or secure long-term sourcing agreements.

The midstream involves the transformation of raw rare earth oxides into functional polishing powders, requiring specialized metallurgical and chemical engineering expertise to control particle size, morphology, and surface activity. Manufacturers employ techniques like controlled precipitation, calcination, and milling to achieve narrow particle size distributions (often sub-micron) crucial for precision polishing applications. Distribution channels are varied: direct sales dominate the supply to large, technologically sophisticated end-users (such as major display manufacturers) who require customized slurry formulations and technical support. Indirect channels, utilizing specialized chemical distributors and regional agents, serve smaller volume buyers and geographically dispersed customers, especially in emerging markets.

The downstream analysis focuses on the end-use consumption, primarily driven by high-volume manufacturing sectors like consumer electronics and automotive glass production. The polishing powder is typically integrated into a liquid slurry delivered directly to automated polishing machines. End-users evaluate suppliers based not only on price but critically on technical support, consistency of product quality, and the ability to rapidly develop custom solutions for new materials (e.g., highly scratch-resistant surfaces). This emphasizes a high degree of technical collaboration between the polishing powder producer and the end-user, often resulting in strong partnership dependencies and a reliance on proven supplier performance for critical manufacturing yields.

Rare Earth Polishing Powder Market Potential Customers

The primary customers for Rare Earth Polishing Powder are large-scale manufacturing entities that require high-precision surface finishing on transparent or semi-transparent materials, characterized by high volume throughput and stringent quality specifications. These include manufacturers operating in the display industry, such as producers of flat panel displays (LCD, OLED, MicroLED) for consumer devices and automotive interfaces, where surface uniformity and defect minimization are paramount for product acceptance. Furthermore, major producers of architectural and specialty automotive glass, particularly those manufacturing sophisticated laminated or chemically strengthened glasses, represent a significant customer base requiring consistent, cost-effective polishing solutions to meet escalating aesthetic and structural demands.

A second crucial segment comprises the advanced optics and semiconductor industries. Customers here include companies fabricating precision lenses, prisms, and mirrors for high-end digital cameras, projection systems, medical diagnostic equipment, and defense applications, where even microscopic surface imperfections can compromise performance. In the semiconductor realm, polishing powders are used for Chemical Mechanical Planarization (CMP) of wafers, though specialized CMP slurries often incorporate rare earth compounds for enhanced material removal rates and superior planarity required for advanced chip architectures. These customers prioritize ultra-high purity, batch-to-batch consistency, and require extensive technical documentation and application support from their polishing powder suppliers.

The market also serves smaller, niche manufacturers focused on high-value, low-volume components, such as producers of fiber optics, specialty filters, and complex ceramic parts used in industrial machinery. These buyers may utilize distributors (indirect channels) but demand premium-grade materials optimized for challenging substrates. The common characteristic across all potential customers is the essential nature of the rare earth polishing powder in achieving the final product quality, making them reliant stakeholders in the reliability and innovation of the upstream market suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 485.5 Million |

| Market Forecast in 2033 | USD 772.1 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shin-Etsu Chemical Co., Ltd., Solvay S.A., Lynas Corporation, China Northern Rare Earth Group High-Tech Co., Ltd., Ganzhou Rare Earth Group Co., Ltd., Neo Performance Materials Inc., Santoku Corporation, Showa Denko K.K., Sichuan Guangming Industrial Co., Ltd., Treibacher Industrie AG, Jiangyin Hefeng Industrial Co., Ltd., Grirem Advanced Materials Co., Ltd., Jinhui Rare Earth New Material Co., Ltd., Baotou Steel Rare Earth (Group) Hi-Tech Co., Ltd., Arafura Resources Limited, Shenghe Resources Holding Co., Ltd., Inner Mongolia Baotou Hefa Rare Earth Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rare Earth Polishing Powder Market Key Technology Landscape

The technological landscape in the Rare Earth Polishing Powder market is driven by precision engineering aimed at optimizing the particle characteristics essential for achieving ultra-smooth surfaces with minimal defectivity. Key advancements focus heavily on controlled synthesis methods, primarily precipitation and hydrothermal techniques, which allow manufacturers to meticulously manage the size distribution and morphology of cerium oxide crystals. The goal is to produce materials with a narrow particle size range, typically measured in nanometers or sub-microns, which significantly minimizes the risk of micro-scratching while maximizing the chemical mechanical action necessary for efficient material removal, particularly crucial for highly sensitive substrates like chemically strengthened glass and silicon wafers in advanced electronics.

A second major technological area involves the development and optimization of rare earth polishing slurries. Manufacturers are moving toward ready-to-use, stabilized liquid formulations rather than dry powders, as slurries offer superior handling, reduced dust contamination, and immediate quality consistency. Advanced slurry technology includes incorporating various dispersants, pH stabilizers, and rheology modifiers to ensure the cerium particles remain uniformly suspended and maintain optimal performance parameters throughout the polishing process. Furthermore, significant research is being dedicated to developing efficient methods for slurry recycling and conditioning within the manufacturing plant, reducing both material consumption and environmental impact while maintaining stringent technical performance metrics.

The integration of advanced analytical and quality control technologies also defines the current landscape. High-resolution microscopy, dynamic light scattering (DLS) for particle size analysis, and X-ray diffraction (XRD) are standard tools used by leading players to characterize the powders precisely. This meticulous quality control ensures batch-to-batch consistency—a non-negotiable requirement for high-volume end-users like FPD producers. Future technological development is anticipated in surface modification techniques of the rare earth particles themselves, potentially coating them or altering their surface chemistry to enhance chemical selectivity towards specific substrate materials, thereby further improving polishing efficiency and reducing processing costs.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC remains the dominant region in the Rare Earth Polishing Powder market, driven by the massive concentration of consumer electronics, automotive manufacturing, and flat panel display production facilities, especially in Greater China, South Korea, Japan, and Taiwan. China specifically controls the vast majority of rare earth raw material extraction and refinement, ensuring competitive pricing and preferential access to feedstock for regional polishing powder producers. This region is the primary consumer of high-volume, standard-grade cerium oxide for general glass polishing, while also serving as a critical hub for high-purity material required by advanced FPD and semiconductor foundries.

- North American Precision Demand: The North American market is characterized by high demand for premium, ultra-high-purity polishing powders, primarily serving specialized segments such as aerospace optics, advanced medical devices, and sophisticated research instrumentation. Although volume consumption is lower than in APAC, the value realization per unit is significantly higher due to stringent technical specifications, complex certification requirements, and the necessity for superior consistency in high-value applications. Technological innovation in polishing equipment and integrated process control systems also drives specialized demand here.

- European Specialty Applications: Europe represents a mature market focusing on high-quality automotive glass (particularly high-end vehicles) and sophisticated industrial optics. Environmental regulations are particularly stringent in Europe, forcing regional suppliers and distributors to adhere to strict guidelines regarding chemical composition and waste disposal. This regulatory environment encourages the adoption of environmentally friendly polishing formulations and closed-loop slurry recycling systems, creating a niche market for sustainable and high-efficiency polishing solutions.

- Latin America, Middle East & Africa (LAMEA) Growth Potential: These regions represent emerging markets with lower current consumption but high growth potential, primarily driven by increasing localized manufacturing capabilities in automotive assembly and regional construction booms requiring architectural glass. Demand growth is closely tied to foreign direct investment in local manufacturing plants and the expansion of consumer electronics markets, leading to increased localized processing needs and reliance on imported polishing powders from global key players.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rare Earth Polishing Powder Market.- Shin-Etsu Chemical Co., Ltd.

- Solvay S.A.

- Lynas Corporation

- China Northern Rare Earth Group High-Tech Co., Ltd.

- Ganzhou Rare Earth Group Co., Ltd.

- Neo Performance Materials Inc.

- Santoku Corporation

- Showa Denko K.K.

- Sichuan Guangming Industrial Co., Ltd.

- Treibacher Industrie AG

- Jiangyin Hefeng Industrial Co., Ltd.

- Grirem Advanced Materials Co., Ltd.

- Jinhui Rare Earth New Material Co., Ltd.

- Baotou Steel Rare Earth (Group) Hi-Tech Co., Ltd.

- Arafura Resources Limited

- Shenghe Resources Holding Co., Ltd.

- Inner Mongolia Baotou Hefa Rare Earth Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Rare Earth Polishing Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of the Rare Earth Polishing Powder Market?

The primary driver is the exponentially increasing global demand for high-resolution, high-quality displays (LCD, OLED) used in consumer electronics such as smartphones, tablets, and advanced automotive infotainment systems, all of which require ultra-smooth, defect-free glass surfaces achievable only with rare earth polishing materials, predominantly cerium oxide.

How does Cerium Oxide Polishing Powder differ from traditional polishing agents like alumina or silica?

Cerium oxide provides a superior polishing action by leveraging both mechanical abrasion and a unique chemical interaction with the glass surface (softening the silica bonds). This combination results in faster material removal rates and higher surface quality with minimal subsurface damage compared to purely mechanical abrasives like alumina or silica, making it indispensable for precision applications.

What major risks are associated with the Rare Earth Polishing Powder supply chain?

The major risks stem from geopolitical concentration, as the vast majority of rare earth elements required for production are sourced and refined in a single region (China). This concentration leads to high supply chain volatility, potential export restrictions, and price instability, pressuring manufacturers to secure diversified and stable sourcing agreements globally.

Which application segment holds the largest share in the Rare Earth Polishing Powder Market?

The Glass Polishing application segment, encompassing the production of flat panel displays (FPDs) and general architectural/automotive glass, holds the largest market share due to the massive volume of glass requiring high-precision finishing processes globally for consumer and industrial products.

How is technological innovation affecting the quality of polishing powders?

Technological innovation is focused on producing rare earth polishing powders with ultra-narrow particle size distributions (sub-micron range) and optimized particle morphology. This precision engineering reduces the incidence of micro-scratching on sensitive substrates and enhances the overall efficiency of the chemical-mechanical polishing (CMP) process, aligning with the increasingly stringent quality requirements of high-end electronics and optics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager