Reactive Alumina Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431605 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Reactive Alumina Market Size

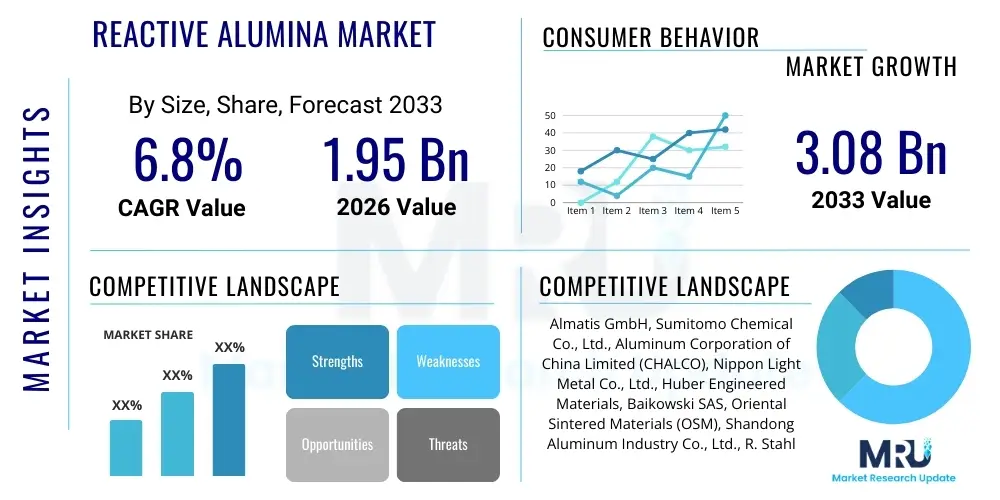

The Reactive Alumina Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 3.08 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by increasing demand from high-performance ceramic manufacturing, particularly in industries requiring exceptional wear resistance, thermal stability, and mechanical strength, such as electronics, automotive, and heavy engineering. The Asia Pacific region, led by China and India, is expected to be the dominant growth engine due to rapid industrialization and significant investments in infrastructure and specialized manufacturing capabilities.

Reactive Alumina Market introduction

The Reactive Alumina Market encompasses high-purity aluminum oxide characterized by high surface area, controlled particle size distribution, and elevated reactivity, achieved through specialized calcination processes. This material, distinct from standard calcined alumina, is engineered for superior performance as a filler, matrix material, or refractory component. Its primary function is to enhance densification, reduce porosity, and improve the mechanical and thermal properties of final products, particularly ceramics and refractories, often allowing sintering at lower temperatures due to its finely divided nature and high chemical activity. Reactive alumina typically features purity levels exceeding 99.5% and extremely fine particle sizes, sometimes down to the submicron or nanoscale range, making it indispensable in high-end applications where precision and durability are paramount.

Major applications of reactive alumina span high-performance refractory monolithic products, advanced technical ceramics used in electronic substrates and aerospace components, polishing compounds requiring high hardness and consistency, and as a critical ingredient in specialized cements and abrasive materials. The benefits derived from using reactive alumina include enhanced strength, superior resistance to chemical corrosion and thermal shock, improved dielectric properties, and optimization of processing parameters, such as reduced firing shrinkage. This material facilitates the creation of lighter, stronger, and more durable components essential for modern industrial processes, driving efficiency and reliability across diverse sectors. The capability of reactive alumina to promote the formation of complex crystal structures and achieve near-theoretical density is a key differentiator in its market value.

The market is predominantly driven by the escalating demand for advanced ceramics in the electronics industry, particularly for components used in 5G infrastructure, electric vehicles (EVs), and semiconductor manufacturing, where thermal management and electrical insulation are critical. Furthermore, the global shift towards high-quality, energy-efficient refractory linings in steel, cement, and glass manufacturing necessitates the use of high-reactivity alumina to prolong equipment life and reduce downtime. Regulatory pressures emphasizing sustainable manufacturing and the subsequent need for materials that optimize resource use also contribute significantly to the market expansion. Technological advancements in synthesis methods, leading to higher purity and more consistent ultrafine particle size, are opening new application avenues, especially in biomedical and defense sectors.

Reactive Alumina Market Executive Summary

The Reactive Alumina Market is characterized by robust growth driven by accelerating industrial demand for advanced technical ceramics and specialized refractory systems, particularly across Asia Pacific and North America. Key business trends include aggressive capacity expansion by major manufacturers focusing on ultra-high purity grades suitable for electronic applications, coupled with strategic mergers and acquisitions aimed at securing raw material supplies and expanding geographical footprints. The market is witnessing a strong preference for tailored particle distributions and customized grades optimized for specific end-use sectors like lithium-ion battery separators and high-density grinding media, indicating a shift toward niche specialization and value-added product offerings to differentiate competitive positioning. Furthermore, sustainability is becoming a central theme, prompting research into energy-efficient production methods, thereby influencing procurement decisions among large industrial buyers.

Regionally, the Asia Pacific dominates the consumption landscape, primarily due to the massive scale of steel production, the burgeoning electronics assembly sector in countries like Taiwan and South Korea, and immense investments in renewable energy infrastructure requiring high-durability components. North America and Europe demonstrate mature market characteristics, focusing on innovation and high-specification products for aerospace, defense, and high-temperature filtration, emphasizing quality and performance over volume. The Middle East and Africa (MEA) are emerging regions, driven by expansion in petrochemical refining and primary aluminum production, where demand for high-performance refractories and specialized catalyst support materials is increasing, creating fertile ground for market penetration by international suppliers offering specialized technical support and customized logistical solutions.

Segmentation trends highlight the increasing dominance of the sub-micron and nanoscale particle size segments, crucial for achieving extreme densification and transparency in advanced ceramic manufacturing, thus fetching premium prices. By application, the refractories segment remains the largest consumer, benefiting from continuous upgrades in furnace technology across metallurgical and glass industries requiring materials that withstand harsher operating conditions and extended life cycles. Conversely, the technical ceramics segment is registering the highest growth rate, fueled by the accelerating transition to electric mobility and the expansion of the semiconductor fabrication industry. These segments are intensely focused on high-purity alpha alumina and specialized calcined forms, demanding tighter quality control and consistency from suppliers across the value chain to meet stringent performance requirements.

AI Impact Analysis on Reactive Alumina Market

Common user questions regarding AI's influence on the Reactive Alumina Market revolve around optimizing manufacturing efficiency, predicting raw material fluctuations, and accelerating R&D for novel formulations. Users are keen to understand how AI-driven predictive maintenance can reduce downtime in capital-intensive calcination plants and how machine learning algorithms can be utilized to model the complex relationship between precursor purity, sintering temperature, and final ceramic performance metrics. The prevailing expectation is that AI will revolutionize process control, allowing for real-time adjustments to maintain particle consistency and surface area characteristics, thereby reducing batch variability and improving overall product yield, which is critical for high-purity, high-cost materials. Furthermore, there is significant interest in how AI can enhance the digital twin modeling of new refractory lining designs, simulating thermal stress cycles and material fatigue before physical prototypes are created, ultimately speeding up product development cycles and lowering design costs for end-users.

AI's impact is expected to manifest strongly in advanced material design and quality assurance processes. Machine learning models are increasingly being deployed to analyze large datasets derived from X-ray diffraction, scanning electron microscopy, and surface area analysis, enabling manufacturers to rapidly correlate processing parameters (like milling time and temperature profiles) with final product attributes (such as reactivity and bulk density). This data-driven approach allows for precise tuning of the calcination process to produce reactive alumina with specific, desired characteristics, minimizing off-spec batches. Moreover, AI-powered systems are being integrated into supply chain logistics to forecast demand accurately based on macroeconomic indicators and predict geopolitical risks that might affect bauxite and precursor material availability, ensuring a stable and efficient supply flow necessary for this specialized chemical market.

In the short term, AI is instrumental in streamlining operational costs through optimized energy consumption during high-temperature processing, a major cost component in reactive alumina production. Looking forward, AI will likely play a pivotal role in designing next-generation reactive alumina materials, perhaps by modeling the creation of structured, porous materials or composite precursors that exhibit enhanced reactivity or allow for lower-temperature synthesis. This acceleration of material innovation, coupled with enhanced operational precision, will solidify reactive alumina’s role in future high-tech applications, ensuring that production capabilities consistently match the rapidly evolving performance requirements of advanced end-user industries like aerospace and advanced electronics fabrication.

- AI optimizes calcination process parameters (temperature, residence time) for consistent particle size distribution and high reactivity.

- Predictive maintenance algorithms reduce unplanned downtime in production facilities, ensuring higher operational efficiency.

- Machine learning accelerates R&D by modeling structure-property relationships in ceramic formulations, speeding up new material discovery.

- AI-driven quality control systems perform real-time image analysis of particles, reducing batch variability and ensuring ultra-high purity specifications.

- Advanced forecasting tools improve supply chain stability for precursor materials (bauxite/aluminum hydroxide) by predicting market volatility.

DRO & Impact Forces Of Reactive Alumina Market

The Reactive Alumina Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and growth trajectory. The primary driver is the rapid global expansion of high-end manufacturing sectors, including semiconductor fabrication and electric vehicle components, which require materials offering superior thermal stability, dielectric performance, and mechanical durability beyond what standard materials can provide. This inherent need for high-performance materials in critical applications creates inelastic demand for reactive alumina. Simultaneously, the market faces significant restraints, chiefly high energy consumption during the calcination process and intense competition from substitutes like high-purity fused silica or specialized zirconia in certain refractory or ceramic applications, forcing manufacturers to continuously innovate and optimize cost structures.

Driving forces center on the technological leap towards advanced ceramics used in structural applications where lightweighting and high strength are paramount, such as advanced aerospace components and medical implants. The refractory industry's continuous pivot towards monolithic refractories over conventional bricks, demanding highly reactive binders and matrix components, also acts as a powerful driver. Furthermore, environmental regulations demanding improved energy efficiency in industrial furnaces indirectly boost demand for reactive alumina, as it enables the formulation of high-insulation, long-lasting refractory linings, reducing fuel consumption and minimizing maintenance intervals. These drivers ensure that reactive alumina remains a strategic material for industrial evolution globally, underpinning infrastructure reliability and technological advancement.

Opportunities for market growth lie in the emerging fields of nanotechnology and energy storage. Reactive alumina, especially in its nanoscale form, shows immense potential in lithium-ion battery separators to enhance thermal runaway protection and in advanced catalytic converter supports. Geographical expansion into developing economies in Southeast Asia and Latin America, coupled with strategic partnerships targeting local industrial clusters (like glass manufacturing or primary metal production), presents clear avenues for market penetration. However, the impact forces of high manufacturing complexity and stringent regulatory requirements for purity in electronics and medical applications act as restraints, compelling market players to invest heavily in advanced processing technologies and comprehensive quality assurance systems to mitigate risks and maintain market credibility.

- Drivers:

- Accelerated demand for high-performance technical ceramics in electronics, automotive (EVs), and aerospace.

- Increasing preference for advanced monolithic refractories requiring high-reactivity binders in metallurgy and glass industries.

- Global infrastructure development boosting demand for construction materials and abrasive applications.

- Technological advancements allowing for highly customized particle size and surface area for niche applications.

- Restraints:

- High energy intensity and operating costs associated with the ultra-high-temperature calcination process.

- Volatility in the prices and supply of key raw material precursors (aluminum hydroxide).

- Competition from advanced alternative materials such as silicon carbide or specialized magnesium oxide in certain refractory contexts.

- Need for substantial capital investment in quality control and specialized milling equipment.

- Opportunities:

- Growing application in lithium-ion battery separators and solid-state battery electrolytes.

- Expansion into biomedical applications (bioceramics, orthopedic implants) requiring ultra-high purity and biocompatibility.

- Development of innovative, highly porous reactive alumina structures for advanced filtration and catalyst support.

- Market penetration into emerging industrial hubs in Southeast Asia and Africa.

- Impact Forces:

- Supply Chain Disruption Risk (Medium to High): Dependencies on stable bauxite mining and refining operations.

- Technology Substitution Threat (Medium): Continuous innovation required to maintain superiority over newer composite materials.

- Environmental and Energy Cost Pressure (High): Strict carbon emission regulations impacting production costs significantly.

Segmentation Analysis

The Reactive Alumina Market is meticulously segmented based on attributes such as type, which is generally categorized by crystalline phase and processing method; application, highlighting the diverse end-use industries; and particle size, a critical determinant of performance in final products. The segmentation provides crucial insights into specialized market dynamics, allowing stakeholders to identify high-growth niches. Analyzing these segments reveals a strategic focus by manufacturers on ultra-fine and nanoscale grades, which command premium pricing due to their ability to facilitate dense sintering at reduced temperatures, leading to superior mechanical and electrical performance in advanced products, particularly in the electronics and aerospace sectors. The dominance of the refractories application segment ensures market volume, while the technical ceramics segment drives innovation and value growth.

Further breakdown by type often distinguishes between standard reactive alumina and specialized grades, such as high-purity transition aluminas (like gamma or delta phases) used primarily for catalyst support, and alpha alumina, which is the cornerstone of structural and refractory applications due to its hardness and stability. The application landscape is broad, encompassing heavy industrial use (refractories, abrasives) and high-tech manufacturing (technical ceramics, polishing). The functional characteristics required by each application dictate the required purity level, particle morphology, and surface chemistry of the reactive alumina utilized. For instance, pharmaceutical polishing demands spherical, highly consistent particles, while refractory casting requires specific surface chemistries to react effectively with cement binders.

Geographical segmentation demonstrates the profound influence of regional industrial policies and manufacturing concentration, with APAC serving as the primary manufacturing and consumption base due to high volumes of steel and electronic production. Segmentation analysis is paramount for market participants to tailor their marketing strategies, optimize production capacities, and allocate R&D resources effectively, focusing on regions and applications that promise the highest returns and alignment with global technological megatrends, such as electrification and digitalization, which inherently rely on high-performance materials like reactive alumina.

- By Type:

- Standard Reactive Alumina (Typically 99.5% Al2O3)

- High Purity Reactive Alumina (Above 99.8% Al2O3)

- Ultra-Fine Reactive Alumina (Sub-micron)

- Nano Reactive Alumina

- Transition Reactive Alumina (Gamma, Delta)

- By Application:

- Refractories (Monolithics, Castables, Mortars, Gunning mixes)

- Technical Ceramics (Wear parts, Substrates, Electrical insulators, Sealing rings)

- Abrasives and Polishing Media (Grinding wheels, Slurries, Lapping compounds)

- Specialty Fillers (Paints, Coatings, Polymers)

- Catalyst Supports

- Others (Glass, Cements, Filtration)

- By Particle Size:

- Micronized (1-10 µm)

- Sub-micron (0.1-1 µm)

- Nanoscale (Below 100 nm)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Southeast Asia)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of MEA)

Value Chain Analysis For Reactive Alumina Market

The value chain of the Reactive Alumina Market begins with the upstream sourcing of bauxite, which is processed via the Bayer process into aluminum hydroxide (gibbsite), serving as the primary precursor material. The purity and cost structure of the bauxite significantly influence the final cost of reactive alumina, making reliable, high-quality mining operations crucial. Manufacturers often integrate backward or establish long-term procurement contracts to manage supply volatility. Subsequent value addition occurs during the highly specialized processing stage, involving controlled calcination at specific temperatures (often 1200°C to 1600°C) to achieve the desired alpha-alumina phase, followed by intensive milling and classification (such as air classification or fine grinding) to attain the required sub-micron particle size and controlled distribution, a process demanding high energy input and specialized equipment.

The midstream phase involves the formulation and manufacturing of the specialized reactive alumina grades. Quality control is paramount here, as minor variations in particle size, surface area, or trace impurities can critically impact the performance in advanced end-use applications like semiconductor substrates or aerospace ceramics. Manufacturers must invest heavily in sophisticated analytical techniques and precise process controls to meet stringent customer specifications. Downstream analysis reveals that reactive alumina products are primarily sold as B2B commodities, categorized into standard industrial grades for refractories (high volume) and specialty, ultra-fine grades for technical ceramics and polishing (high value). This necessitates a differentiated distribution strategy based on product type and required technical support.

Distribution channels for reactive alumina are characterized by a mix of direct sales and indirect representation. Large, integrated manufacturers typically use direct channels to serve major, consistent volume consumers in the refractory and metallurgical industries, allowing for direct technical support and customized product development. Conversely, smaller customers or those requiring highly localized inventory in fragmented markets are often served through specialized chemical distributors and agents. These indirect channels provide essential logistical flexibility and local expertise, particularly in rapidly growing regions like Southeast Asia. Effective management of these channels, ensuring timely delivery and maintaining product integrity, is vital, given that the performance of reactive alumina is highly sensitive to storage and handling conditions.

Reactive Alumina Market Potential Customers

Potential customers for reactive alumina are primarily found in sectors that require materials capable of withstanding extreme thermal, mechanical, or electrical stress. The largest segment of buyers consists of refractory manufacturers who purchase high volumes of reactive alumina to produce castables, insulating bricks, and monolithic linings for high-temperature industrial furnaces used in steel production, cement kilns, glass melting tanks, and non-ferrous metal processing. These customers value the material's ability to enhance densification, improve hot strength, and extend the service life of their refractory products, leading to reduced maintenance and operational costs in highly capital-intensive operations. Their purchasing decisions are heavily influenced by technical specifications, stability of supply, and competitive pricing, typically requiring standard to high-purity grades.

A second crucial group of buyers comprises technical ceramic manufacturers, including producers of electronic substrates, semiconductor handling equipment, ballistic armor, biomedical implants (e.g., hip replacements), and aerospace components. These customers require ultra-high purity (99.8%+) and ultra-fine reactive alumina, often specified in the sub-micron or nano range, to achieve near-theoretical density, specific dielectric properties, and exceptional wear resistance. This segment places a premium on consistency, tight particle size distribution control, and specialized surface treatment options, as any variation directly impacts the function and reliability of their high-precision components. The purchasing process here is characterized by extensive qualification trials and long-term supplier partnerships based on mutual technical development and stringent quality audits.

Other significant end-users include producers of specialty abrasives and polishing media, particularly those catering to the electronics (silicon wafer polishing), optics, and pharmaceutical industries, who utilize the material for its superior hardness and chemical stability in slurry applications. Chemical and petrochemical companies also constitute potential customers, utilizing reactive alumina as a catalyst support or component in advanced filtration systems. These diverse buyer groups underscore the material's versatility, ranging from bulk commodity consumption in heavy industry to highly technical, niche application requirements in microelectronics, demanding a tailored sales approach and technical engagement across the entire customer spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 3.08 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Almatis GmbH, Sumitomo Chemical Co., Ltd., Aluminum Corporation of China Limited (CHALCO), Nippon Light Metal Co., Ltd., Huber Engineered Materials, Baikowski SAS, Oriental Sintered Materials (OSM), Shandong Aluminum Industry Co., Ltd., R. Stahl AG, Zibo Alumina Chemical Co., Ltd., KC Corporation, Vesuvius plc, Minelco, Hindalco Industries Limited, Washington Mills, Saint-Gobain, Nabaltec AG, Sasol, Showa Denko K.K., Imerys S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Reactive Alumina Market Key Technology Landscape

The technological landscape of the Reactive Alumina Market is primarily focused on enhancing purity, achieving uniform and extremely fine particle size distribution, and improving energy efficiency during the high-temperature synthesis process. The core technology remains controlled calcination, often utilizing rotary kilns or fluidized bed reactors, where precise temperature profiles and residence times are maintained to ensure the complete transformation of aluminum hydroxide precursors into the desirable alpha-alumina crystal phase while preventing excessive crystal growth. Advanced technologies, such as plasma calcination or flash calcination, are being explored to achieve faster conversion and reduce the energy footprint, yielding reactive alumina with enhanced surface properties critical for modern applications. The uniformity of the resulting powder is frequently analyzed using advanced instrumentation, including laser diffraction and BET surface area analysis, to ensure conformance to stringent industry standards for reactivity.

Post-calcination processing heavily relies on advanced milling and classification technologies. High-energy attrition milling, jet milling, and sophisticated air classification systems are deployed to break down agglomerates and separate particles to achieve sub-micron and nanoscale distributions without introducing critical impurities. A key technological advancement in this space involves surface modification techniques, where manufacturers utilize various organic or inorganic coatings post-milling to prevent re-agglomeration of ultra-fine particles, stabilize suspensions (slurries), and improve dispersion characteristics when the alumina is mixed into ceramic matrices or polishing compounds. This surface engineering is crucial for maximizing the reactivity and homogeneity of the final product, directly impacting the densification behavior during sintering processes conducted by end-users.

Furthermore, R&D is increasingly focused on developing specialized precursor synthesis methods, such as hydrothermal synthesis or chemical precipitation techniques, to produce aluminum hydroxide with inherent uniformity and purity that minimizes the challenges in the subsequent high-temperature treatment. This upstream technological focus aims to bypass some of the difficulties associated with milling and classification, delivering "designer" alumina particles with engineered morphologies, such as spherical or platelet forms, optimized for specific functions like high-density packing or anisotropic ceramic properties. The integration of process control optimization, often utilizing AI and advanced sensors, forms a critical technology layer, ensuring batch consistency and maximizing throughput in complex, energy-intensive production lines globally.

Regional Highlights

The Reactive Alumina Market exhibits significant geographical variation, driven by regional industrial concentration, regulatory frameworks, and technological maturity across end-use sectors. Asia Pacific (APAC) stands out as the undisputed leader in both production capacity and consumption volume, largely fueled by the exponential growth of its primary manufacturing sectors, particularly steel, cement, and consumer electronics, which are the largest consumers of high-volume reactive alumina for refractories and abrasive applications. China and India, with their massive industrial bases and ambitious infrastructure projects, are the principal growth engines within APAC. Furthermore, the region is home to leading semiconductor and display panel manufacturers (South Korea, Taiwan, Japan) who drive the demand for ultra-high purity, sub-micron grades used in sophisticated technical ceramics and polishing compounds. This intensive industrial activity necessitates continuous expansion and specialization in regional manufacturing capabilities to meet diverse, high-volume, and high-specification demand.

North America and Europe represent mature, high-value markets characterized by demand for specialized, high-performance reactive alumina grades tailored for niche applications in aerospace, defense, automotive electric mobility (EVs), and advanced medical implants. The focus in these regions is less on volume and more on material purity, consistency, and compliance with stringent environmental and technical standards. Europe, particularly Germany and France, has a strong refractory and technical ceramics heritage, with manufacturers emphasizing innovative composite materials and environmentally compliant processes. The presence of major research institutions and a highly regulated environment pushes local suppliers toward continuous technological refinement, often prioritizing customized products that enhance energy efficiency and material lifespan in critical industrial systems, thereby maintaining a premium price point compared to standard grades.

Latin America and the Middle East & Africa (MEA) are characterized as high-potential emerging markets. Latin America, specifically Brazil, shows strong demand linked to its large steel, mining, and petrochemical industries, requiring reactive alumina for furnace linings and catalyst preparation. The MEA region's growth is predominantly anchored by the expansion of its oil and gas processing infrastructure, large-scale primary aluminum smelting operations, and growing construction sector. These industries require reliable, corrosion-resistant refractories capable of withstanding harsh operating conditions. While local production capacity is growing, these regions still heavily rely on imports from APAC, North America, and Europe, creating opportunities for global players seeking to establish distribution networks and offer localized technical expertise to address specific regional industrial challenges.

- Asia Pacific (APAC): Dominates the market due to large-scale steel and cement production; highest growth rate driven by electronics manufacturing (semiconductors, displays) and infrastructure development, demanding both volume and high purity grades.

- North America: Mature market characterized by high R&D intensity; strong demand from aerospace, defense, and electric vehicle battery components, focusing on ultra-fine and customized technical ceramic grades.

- Europe: Stable market with a strong emphasis on sustainability and high-performance, long-lasting refractories; key consumption in automotive, specialty glass, and sophisticated refractory monolithics.

- Latin America (LATAM): Growth driven by regional metallurgical industries, mining operations, and petrochemical sector expansion, importing specialized grades to upgrade industrial facilities.

- Middle East & Africa (MEA): Emerging consumer market fueled by investments in oil & gas refining, primary aluminum smelting, and infrastructure projects, generating steady demand for high-temperature refractory materials and catalyst components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Reactive Alumina Market.- Almatis GmbH

- Sumitomo Chemical Co., Ltd.

- Aluminum Corporation of China Limited (CHALCO)

- Nippon Light Metal Co., Ltd.

- Huber Engineered Materials

- Baikowski SAS

- Oriental Sintered Materials (OSM)

- Shandong Aluminum Industry Co., Ltd.

- R. Stahl AG

- Zibo Alumina Chemical Co., Ltd.

- KC Corporation

- Vesuvius plc

- Minelco

- Hindalco Industries Limited

- Washington Mills

- Saint-Gobain

- Nabaltec AG

- Sasol

- Showa Denko K.K.

- Imerys S.A.

Frequently Asked Questions

Analyze common user questions about the Reactive Alumina market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes reactive alumina from standard calcined alumina?

Reactive alumina is differentiated by its significantly finer particle size (often sub-micron), higher surface area, and exceptional chemical purity. These characteristics enable superior densification and reactivity at lower sintering temperatures, making it essential for high-performance applications like technical ceramics and advanced refractory monolithics where extreme strength and reduced porosity are required.

Which end-use industry drives the highest demand volume for reactive alumina?

The refractories industry consistently drives the highest demand volume for reactive alumina. The material is critical for manufacturing advanced monolithic castables and insulating products used in high-temperature environments, specifically in steel production, cement kilns, and glass melting furnaces, where it significantly improves thermal stability and operational lifespan.

How is the market for ultra-high purity reactive alumina performing?

The market for ultra-high purity reactive alumina (typically >99.8%) is experiencing the highest growth rate and commands premium pricing. This segment is highly reliant on the semiconductor, electronics, and aerospace industries, which require materials with minimal trace elements for use in sensitive applications such as electronic substrates, ceramic components in EVs, and high-precision polishing slurries.

What role does particle size play in the performance of reactive alumina?

Particle size is the most critical determinant of reactive alumina performance. Ultra-fine particles (sub-micron to nanoscale) increase the surface energy, allowing ceramic bodies to achieve near-theoretical density during sintering at lower temperatures. This mechanism reduces porosity and enhances the mechanical, thermal, and electrical properties of the final product, directly impacting material strength and wear resistance.

What is the primary restraint facing manufacturers in the reactive alumina market?

The primary restraint is the extremely high energy consumption and operating cost associated with the controlled, high-temperature calcination process required to produce the alpha-alumina phase with precise crystal structure. Fluctuations in natural gas and electricity prices directly impact production economics, necessitating continuous investment in energy-efficient processing technologies to maintain competitiveness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Reactive Alumina Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Reactive Alumina Market Statistics 2025 Analysis By Application (Fluoride Adsorbent, Desiccant, Catalyst, Refractory Additives), By Type (Powdered Form Reactive Alumina, Sphered Form Reactive Alumina), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager