Recombinant Protein Therapeutics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434392 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Recombinant Protein Therapeutics Market Size

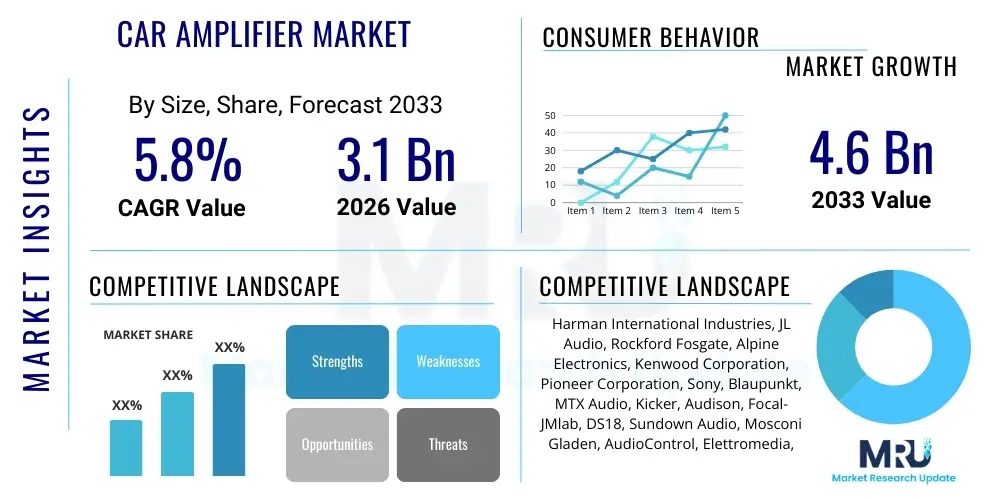

The Recombinant Protein Therapeutics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 135.5 Billion in 2026 and is projected to reach USD 240.8 Billion by the end of the forecast period in 2033.

Recombinant Protein Therapeutics Market introduction

The Recombinant Protein Therapeutics Market encompasses pharmaceutical products derived from genetically engineered cells that produce therapeutic proteins. These therapies represent a cornerstone of modern biotechnology, utilizing DNA technology to produce large quantities of highly specific proteins such as hormones, cytokines, enzymes, and monoclonal antibodies, which are essential for treating chronic and life-threatening diseases. The versatility and precision of recombinant proteins allow them to address diseases that traditional small-molecule drugs cannot effectively target, driving their rapid adoption across oncology, endocrinology, and infectious disease management. The development process, spanning gene cloning, vector creation, cell line development, and large-scale purification, requires significant technological sophistication and adherence to stringent regulatory standards.

Major applications of recombinant protein therapeutics span numerous clinical areas, including the treatment of diabetes (insulin), various cancers (monoclonal antibodies, immune modulators), autoimmune disorders, and rare genetic deficiencies (replacement enzymes). Their core benefit lies in their high efficacy, targeted action, and relatively lower toxicity profiles compared to traditional chemotherapies. Furthermore, these therapeutics can replace missing or defective endogenous proteins, offering curative or long-term management solutions for chronic conditions. The increasing global prevalence of chronic diseases, coupled with substantial advancements in biomanufacturing technologies and expression systems (such as microbial, mammalian, and plant cells), are foundational driving factors sustaining robust market expansion.

The market environment is characterized by intense research and development activities aimed at improving protein stability, reducing immunogenicity, and enhancing delivery mechanisms. Driving factors include favorable regulatory pathways for biologics, increasing healthcare expenditure in emerging economies, and the growing focus on personalized medicine where recombinant proteins often serve as highly tailored treatments. Patent expiration of originator biologics also fuels the rapid expansion of the biosimilars segment, increasing patient access and driving price competition, which further stimulates market volume growth globally.

Recombinant Protein Therapeutics Market Executive Summary

The recombinant protein therapeutics market is experiencing dynamic shifts, primarily driven by accelerated innovation in targeted oncology and advancements in expression systems that enhance yield and purity. Business trends indicate a strong focus on strategic mergers, acquisitions, and licensing agreements aimed at consolidating pipelines, particularly in specialized areas like gene therapy components and novel antibody formats. Pharmaceutical giants are heavily investing in robust biomanufacturing facilities, recognizing the importance of supply chain resilience and cost optimization in highly competitive therapeutic categories such as monoclonal antibodies and insulin analogues. The increasing entry of high-quality biosimilar products globally is profoundly reshaping pricing structures and necessitating refined commercial strategies for innovator companies to maintain market dominance through extended product life cycles and differentiated formulations.

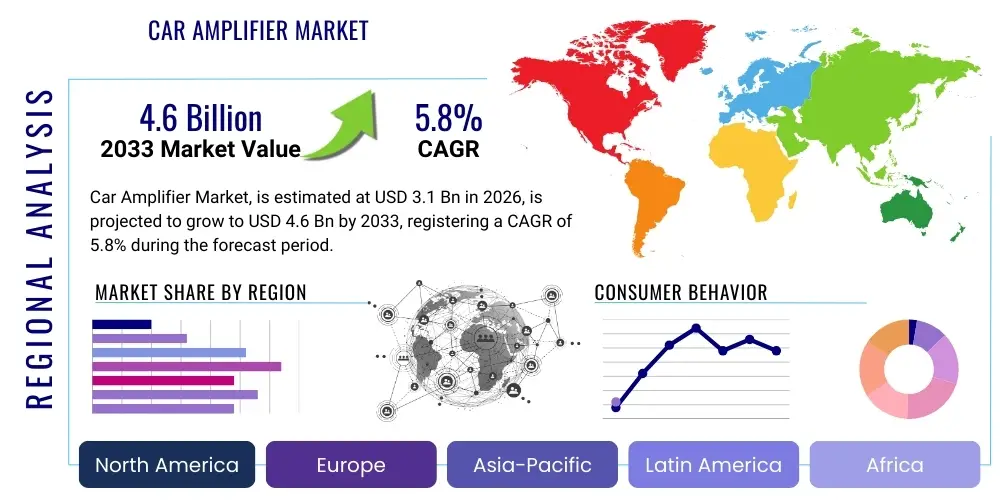

Regionally, North America maintains its dominance due to high healthcare expenditure, established R&D infrastructure, and favorable reimbursement policies for advanced biologics. However, the Asia Pacific region is rapidly emerging as the fastest-growing market segment, fueled by rising disposable incomes, expanding healthcare access, and proactive government initiatives supporting domestic biotechnology manufacturing and research. European markets continue to see significant uptake, particularly in biosimilars, driven by cost-containment measures enacted by national health systems. Segment trends highlight monoclonal antibodies as the dominant product type, sustained by their widening applicability in treating complex diseases like cancer and autoimmune disorders. Furthermore, therapeutics derived from mammalian cell sources command the largest share, preferred for their ability to produce complex, correctly folded proteins closely mimicking human biology.

Key market challenges revolve around the high cost associated with R&D, stringent regulatory approval processes, and the complexities inherent in large-scale biomanufacturing, including upstream yield optimization and downstream purification logistics. Despite these hurdles, the substantial unmet medical needs across various therapeutic areas, especially in chronic diseases and emerging infectious diseases, continue to provide significant opportunities for market penetration and innovation. The future trajectory of the market will be significantly influenced by the successful commercialization of next-generation protein therapeutics, including bispecific antibodies, antibody-drug conjugates (ADCs), and therapeutic proteins modified for extended half-lives, ultimately enhancing patient convenience and therapeutic outcomes.

AI Impact Analysis on Recombinant Protein Therapeutics Market

User queries regarding the impact of Artificial Intelligence (AI) on the Recombinant Protein Therapeutics Market frequently center on efficiency gains, drug discovery acceleration, and optimization of complex manufacturing processes. Users are keenly interested in how machine learning algorithms can predict the optimal folding structure of novel proteins, thereby reducing the high failure rates associated with early-stage drug development. A significant thematic concern relates to the application of AI in minimizing immunogenicity—predicting which protein sequences are likely to trigger adverse immune responses—a critical challenge in biologics design. Furthermore, there is substantial user expectation regarding AI's role in refining bioreactor operations, specifically using predictive modeling to manage fermentation conditions, ensuring maximal yield and product quality uniformity at lower operational costs, thereby addressing the high capital expenditure common in biomanufacturing.

AI's role is rapidly transitioning from a theoretical tool to a practical necessity, particularly in the complex domain of protein engineering. Machine learning algorithms are now being deployed to swiftly screen vast libraries of protein variants, identifying candidates with superior binding affinity and stability characteristics far quicker than traditional laboratory screening methods. This drastically shortens the lead optimization phase, accelerating the pipeline from target identification to preclinical development. Moreover, AI excels in analyzing multi-omic datasets, integrating genomic, proteomic, and clinical information to identify novel therapeutic targets that are highly specific to disease pathophysiology, which is crucial for developing highly effective, personalized recombinant protein treatments.

The transformative effect of AI extends beyond the laboratory and into the supply chain and post-market surveillance. Predictive maintenance models powered by AI are enhancing the operational efficiency of large-scale biomanufacturing, forecasting equipment failures, and optimizing batch scheduling, leading to reduced downtime and consistent supply. In pharmacovigilance, AI algorithms analyze real-world data and adverse event reports to detect subtle safety signals associated with specific recombinant therapeutics, ensuring enhanced patient safety and regulatory compliance. Consequently, AI is not merely automating tasks; it is integrating disparate processes, creating a more agile, data-driven, and ultimately more productive ecosystem for recombinant protein therapeutic development and commercialization.

- AI accelerates target identification and validation by analyzing complex biological pathways.

- Machine learning optimizes protein design for enhanced stability, efficacy, and reduced immunogenicity.

- Predictive modeling streamlines bioprocessing by optimizing bioreactor conditions (e.g., pH, temperature, feed rate) for maximum yield.

- AI algorithms assist in clinical trial design, patient stratification, and biomarker identification, enhancing therapeutic success rates.

- Automated image analysis and robotic systems, integrated with AI, improve quality control and purity assessment in manufacturing.

DRO & Impact Forces Of Recombinant Protein Therapeutics Market

The recombinant protein therapeutics market is heavily influenced by a balanced interplay of accelerating drivers and constraining factors, synthesized by significant market opportunities and pervasive impact forces. The primary drivers include the escalating global burden of chronic and complex diseases, particularly cancer and autoimmune disorders, which necessitate highly specific and effective biological treatments. Furthermore, substantial public and private investment in biotechnology research, coupled with favorable regulatory frameworks established by bodies like the FDA and EMA for fast-track approval of novel biologics, significantly propels market expansion. Technological breakthroughs in large-scale cell culture systems and protein purification methods are also instrumental in reducing manufacturing costs and increasing global accessibility. These forces collectively exert a powerful positive impact, driving innovation and expanding the therapeutic scope of recombinant proteins.

Conversely, the market faces notable restraints that moderate its growth trajectory. The exceptionally high cost associated with the research, development, and eventual commercialization of biologics remains a substantial barrier to entry for smaller firms and limits patient access in lower-income settings. The complex nature of manufacturing, requiring highly specialized infrastructure and stringent quality control, contributes significantly to operational expenditure. Moreover, regulatory complexities, including strict requirements for demonstrating comparability and safety for both novel biologics and biosimilars, introduce significant timelines and uncertainty. Patent expiry risks for blockbuster drugs necessitate continuous innovation, placing constant financial pressure on market leaders to sustain their pipelines and defend market share against emerging biosimilar competition. The sophisticated supply chain requirements for maintaining the integrity of these temperature-sensitive products globally also present logistical challenges.

The market opportunities are concentrated around the development of next-generation protein modalities, such as multi-specific antibodies and modified proteins with extended plasma half-lives, promising improved dosing regimens and patient compliance. The rapid growth of the biosimilars segment, especially in regions with government-mandated price constraints, presents a massive opportunity for increasing market volume and democratizing access to expensive treatments. Furthermore, the application of recombinant protein technology in emerging fields like gene therapy, personalized medicine, and infectious disease prophylaxis (advanced recombinant vaccines) opens extensive new revenue streams. These opportunities, when harnessed, amplify the overall positive impact forces, suggesting sustained long-term growth driven by both therapeutic necessity and technological progress. The impact forces are predominantly centered on the necessity of targeted therapy and the increasing global adoption of biosimilars as a sustainable alternative.

In summary, the market exhibits robust momentum driven by medical necessity and technological evolution, although constrained by economic and regulatory hurdles inherent to the biologics sector. Successful navigation requires strategic investment in biomanufacturing scale-up and focusing R&D on high-value, unmet medical needs, while actively engaging in cost-efficient production to counter competitive pressures from biosimilars. The interplay between accelerating innovation (driver) and managing costs (restraint) defines the competitive landscape.

Segmentation Analysis

The Recombinant Protein Therapeutics Market is highly segmented based on the product type, therapeutic application, source of expression, and end-user. This segmentation reflects the diversity of recombinant proteins and their widespread utility in treating various pathological conditions. Product type segmentation, encompassing key categories such as Monoclonal Antibodies, Insulin, and Growth Factors, highlights the specific therapeutic classes dominating market revenue. Monoclonal antibodies, utilized primarily in oncology and immunology, represent the largest segment due to their high specificity and continuous development of novel formats. The application segment reveals the critical importance of these therapeutics in chronic disease management, with Diabetes and Cancer being the most significant revenue contributors globally.

Analyzing the market by source provides crucial insights into manufacturing complexities and preferences. Mammalian cells remain the preferred expression system, particularly for complex glycosylated proteins like antibodies, owing to their capacity for correct post-translational modifications, ensuring therapeutic efficacy. However, microbial systems are often favored for simpler proteins like insulin due to their high yield, scalability, and cost efficiency. The end-user segmentation, dominated by hospitals and specialized clinics, underscores the necessity of professional administration and monitoring required for most advanced biologic therapies. Understanding these segments is vital for stakeholders to optimize production strategies, target specific therapeutic niches, and allocate R&D resources effectively across the diverse landscape of recombinant protein manufacturing.

The strategic differentiation within the market often relies on innovating therapeutic functionalities and improving bioavailability. For instance, the demand for fusion proteins and recombinant vaccines is steadily increasing, representing high-growth sub-segments. Furthermore, the geographical distribution of manufacturing capacity and consumption patterns heavily influences segment growth, with major companies increasingly localizing production to mitigate supply chain risks and comply with regional regulatory demands. The competition within each segment, especially the rapidly evolving biosimilars space, drives continuous price optimization and requires robust evidence of clinical interchangeability, profoundly impacting commercial strategies.

- Product Type: Monoclonal Antibodies (MABs), Hormones (e.g., Insulin, Growth Hormone), Fusion Proteins, Vaccines, Blood Factors, Enzymes, Others (Cytokines, Interferons).

- Application: Cancer, Diabetes, Infectious Diseases, Cardiovascular Diseases, Autoimmune Diseases, Hematological Disorders, Rare Genetic Disorders, Others.

- Source: Mammalian Cell Expression Systems (CHO, HEK), Microbial Expression Systems (E. coli, Yeast), Plant Systems, Insect Cells, Others.

- End-User: Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Research Institutes.

Value Chain Analysis For Recombinant Protein Therapeutics Market

The value chain for recombinant protein therapeutics is intricate, starting from upstream R&D and culminating in patient administration. Upstream activities involve extensive basic research, target identification, gene cloning, and the critical development of stable, high-yielding cell lines (e.g., CHO cells or E. coli strains). This phase is capital-intensive and highly specialized, relying on collaborations between academic institutions, biotech startups, and large pharmaceutical firms to develop novel protein candidates and optimize expression vectors. Key stakeholders in this stage include specialized contract research organizations (CROs) and suppliers of advanced molecular biology tools and media components, ensuring the integrity and scalability of the initial production system.

The midstream segment centers on manufacturing and purification, which is the most complex and regulated part of the value chain. This involves large-scale fermentation or cell culture (bioreactors), followed by sophisticated downstream processing, including multiple chromatography steps and filtration processes to ensure the high purity and stability required for clinical use. Manufacturing often relies on contract manufacturing organizations (CMOs) due to the need for specialized, Good Manufacturing Practice (GMP)-compliant facilities. Quality control and assurance are paramount at this stage, requiring rigorous testing for potential contaminants, aggregate formation, and maintenance of product stability across various storage conditions.

Downstream activities include formulation, fill-finish, packaging, and distribution. The distribution channel is bifurcated into direct and indirect routes. Direct distribution involves large pharmaceutical companies supplying their products directly to major institutional buyers like large hospital systems or government procurement agencies. Indirect channels involve wholesalers, distributors, and specialized logistics providers who handle the temperature-controlled supply chain (cold chain logistics) necessary for biologics, ensuring they reach pharmacies, specialty clinics, and smaller healthcare facilities. Sales and marketing efforts are highly targeted, focusing on specialized oncologists, endocrinologists, and immunologists. Reimbursement policies and access programs are critical determinants of the final market success of the therapeutic product.

Recombinant Protein Therapeutics Market Potential Customers

The primary customers and end-users of recombinant protein therapeutics are institutions and specialized medical practitioners who diagnose and treat chronic and complex diseases requiring biological intervention. Hospitals, particularly large tertiary care centers and university medical centers with specialized oncology, endocrinology, and rheumatology departments, constitute the largest segment of end-users. These facilities utilize recombinant proteins for infusion treatments, complex patient management, and surgical preparation, requiring high volumes and consistent supply of varied biological products, including monoclonal antibodies and blood factors.

Specialty clinics and ambulatory surgical centers (ASCs) represent another rapidly growing customer segment. These facilities focus on outpatient administration of high-cost biologics, often for conditions like rheumatoid arthritis, psoriasis, or specific cancer regimens that do not require extended inpatient stays. The increasing trend towards shifting treatments from hospital settings to these more cost-effective outpatient centers drives demand within this segment. Moreover, specialized pharmacies and mail-order pharmaceutical services catering to patients with chronic conditions, such as diabetes (insulin) and hemophilia, are crucial indirect buyers, ensuring patient access outside of clinical settings.

Research institutes, biotechnology firms, and contract research organizations (CROs) also form a critical customer base, purchasing recombinant proteins for use as research reagents, standards, or in preclinical testing and drug discovery efforts. Government agencies and non-governmental organizations involved in public health and vaccine procurement, especially in response to infectious disease outbreaks, constitute a periodic but significant customer segment, particularly for recombinant vaccines and specific therapeutic antibodies required for emergency use or stockpiling. The ultimate beneficiary remains the patient suffering from chronic or life-threatening conditions who relies on these therapies for improved quality of life and survival.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 135.5 Billion |

| Market Forecast in 2033 | USD 240.8 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Novo Nordisk A/S, Sanofi, Eli Lilly and Company, Merck & Co., Inc., Amgen Inc., F. Hoffmann-La Roche Ltd., Bayer AG, Johnson & Johnson, Pfizer Inc., Biogen Inc., Regeneron Pharmaceuticals, Inc., Bristol Myers Squibb Company, Genentech (Roche), Teva Pharmaceutical Industries Ltd., GlaxoSmithKline plc, CSL Behring, BioMarin Pharmaceutical Inc., AbbVie Inc., AstraZeneca PLC, Takeda Pharmaceutical Company Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Recombinant Protein Therapeutics Market Key Technology Landscape

The technological landscape of the Recombinant Protein Therapeutics Market is defined by continuous innovation aimed at enhancing protein function, improving expression yields, and reducing manufacturing costs. One of the primary technology focuses is on advanced expression systems. While Chinese Hamster Ovary (CHO) cells remain the gold standard for complex therapeutic protein production, new cell line engineering techniques, such as CRISPR-Cas9 genome editing, are being employed to optimize cellular machinery for higher productivity and improved glycosylation patterns. Similarly, microbial systems, especially optimized strains of E. coli and yeast, are undergoing metabolic engineering to increase the production efficiency of simpler, non-glycosylated proteins like growth factors and insulin, ensuring scalability and cost effectiveness.

Another crucial area is the development of next-generation protein engineering platforms. This includes technologies for designing novel therapeutic formats, such as bispecific and trispecific antibodies, which can simultaneously target multiple epitopes, thereby enhancing efficacy and addressing complex biological pathways. Antibody-Drug Conjugates (ADCs), which link highly potent cytotoxic drugs to targeted monoclonal antibodies, represent a sophisticated technological advancement, requiring complex linking chemistry and careful optimization of the drug-to-antibody ratio (DAR). Furthermore, technology focused on extending the half-life of proteins, often through fusion with inert carriers or site-specific PEGylation, minimizes dosing frequency, significantly improving patient compliance and therapeutic convenience.

Bioprocessing and purification technologies are equally critical. Continuous manufacturing processes, moving away from traditional batch methods, are gaining traction, promising smaller facility footprints, reduced contamination risks, and significant cost savings through enhanced automation and integrated monitoring. Single-use bioreactors (SUBs) are widely adopted across the industry for flexibility and faster turnaround times, particularly in multi-product facilities or small-scale clinical trial production. Downstream processing relies on highly specific affinity chromatography media and advanced filtration techniques, including tangential flow filtration (TFF), to ensure the final product meets the stringent purity requirements mandated by regulatory authorities, which is essential for minimizing potential immune reactions in patients.

Regional Highlights

- North America: Dominance in R&D and Consumption North America, particularly the United States, holds the largest market share in the recombinant protein therapeutics sector. This dominance is attributable to several key factors, including exceptionally high healthcare expenditure, the presence of major global biopharmaceutical players, and a robust, well-funded R&D ecosystem focused on cutting-edge biologics. Furthermore, advanced diagnostic technologies lead to earlier detection of diseases like cancer and diabetes, accelerating the demand for targeted protein therapies. Favorable reimbursement scenarios and a streamlined (though rigorous) regulatory environment through the FDA support rapid commercialization and adoption of novel treatments.

- Europe: Focus on Biosimilar Adoption and Market Penetration Europe represents the second-largest market, characterized by significant governmental pressure for cost containment within national healthcare systems. This environment has fostered the rapid and successful adoption of biosimilars, which provide high-quality, effective therapeutic alternatives at lower prices. Major European countries like Germany, France, and the UK are key centers for clinical trials and manufacturing, driven by strong regulatory support from the European Medicines Agency (EMA). Strategic investment in advanced biomanufacturing techniques, particularly in Ireland and Switzerland, further solidifies the region's position.

- Asia Pacific (APAC): Fastest Growth Trajectory and Manufacturing Hub The APAC region is anticipated to record the highest CAGR during the forecast period. This rapid growth is propelled by expanding healthcare infrastructure, rising prevalence of lifestyle diseases, and increasing disposable incomes, which improve access to advanced treatments in populous countries like China and India. Government initiatives promoting biotechnology investments and the establishment of domestic biomanufacturing capabilities are transforming APAC into a major global production hub. China, in particular, is aggressively investing in its biosimilars and novel biologics pipelines, challenging the traditional dominance of Western companies.

- Latin America (LATAM): Improving Access and Market Potential The LATAM region presents significant growth potential, albeit from a lower base, driven by improving healthcare access and increased focus on treating chronic diseases. Countries such as Brazil and Mexico are witnessing growing pharmaceutical expenditure and are actively working on regulatory harmonization to facilitate the import and local production of biologics and biosimilars. However, market growth in LATAM often faces hurdles related to complex regulatory processes, fragmented healthcare systems, and economic volatility affecting patient affordability.

- Middle East and Africa (MEA): Emerging Healthcare Investment and Demand The MEA market is gradually expanding, primarily fueled by substantial government investment in modernizing healthcare infrastructure in affluent Gulf Cooperation Council (GCC) countries. High prevalence of chronic diseases and increasing adoption of Western treatment protocols drive the demand for high-value biologics. Regional governments are incentivizing foreign investment and local pharmaceutical partnerships to build regional manufacturing capacity, reducing reliance on imported therapeutics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Recombinant Protein Therapeutics Market.- Novo Nordisk A/S

- Sanofi

- Eli Lilly and Company

- Merck & Co., Inc.

- Amgen Inc.

- F. Hoffmann-La Roche Ltd.

- Bayer AG

- Johnson & Johnson

- Pfizer Inc.

- Biogen Inc.

- Regeneron Pharmaceuticals, Inc.

- Bristol Myers Squibb Company

- Genentech (Roche)

- Teva Pharmaceutical Industries Ltd.

- GlaxoSmithKline plc

- CSL Behring

- BioMarin Pharmaceutical Inc.

- AbbVie Inc.

- AstraZeneca PLC

- Takeda Pharmaceutical Company Limited

Frequently Asked Questions

Analyze common user questions about the Recombinant Protein Therapeutics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers accelerating the growth of the Recombinant Protein Therapeutics Market?

The market growth is primarily driven by the escalating global incidence of chronic diseases, notably cancer and diabetes, necessitating advanced, targeted treatment options. Furthermore, continuous technological advancements in protein engineering and high-yield biomanufacturing processes, alongside favorable intellectual property protection and regulatory environments for biologics, are key acceleration factors.

How does the expansion of the biosimilars segment impact the overall market revenue?

The expansion of the biosimilars segment initially introduces price erosion for originator biologics, but it simultaneously drives market volume growth by increasing patient accessibility, particularly in price-sensitive regions and government-funded healthcare systems. While average selling prices may decrease, the overall treatment adoption rate rises, ultimately supporting sustained market expansion over the long term and forcing innovators to focus on novel therapies.

Which therapeutic application segment holds the largest share in the Recombinant Protein Therapeutics Market?

The Oncology segment currently holds the largest market share, predominantly due to the extensive use of monoclonal antibodies (MABs) and other recombinant immune modulators in various cancer treatments. High treatment costs, chronic nature of cancer, and continuous development of next-generation MABs contribute significantly to this segment’s revenue dominance and future pipeline growth.

What are the major technological challenges in the production of complex recombinant proteins?

Major challenges include ensuring correct protein folding and post-translational modifications, particularly glycosylation, which affects efficacy and immunogenicity. Maintaining product stability during large-scale manufacturing and throughout the cold chain logistics process, while managing high upstream processing costs and ensuring low batch-to-batch variability, also represents significant technical hurdles that require advanced analytical and engineering solutions.

How is Artificial Intelligence (AI) transforming the development lifecycle of recombinant protein therapeutics?

AI is transforming the lifecycle by accelerating target identification, optimizing protein sequences for enhanced stability and efficacy, and predicting potential immunogenicity issues in the early design phase. In manufacturing, AI optimizes bioreactor parameters for maximum yield and quality control, thereby reducing development timelines and lowering the operational costs associated with bioproduction.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager