Refractory Materials Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439851 | Date : Jan, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Refractory Materials Market Size

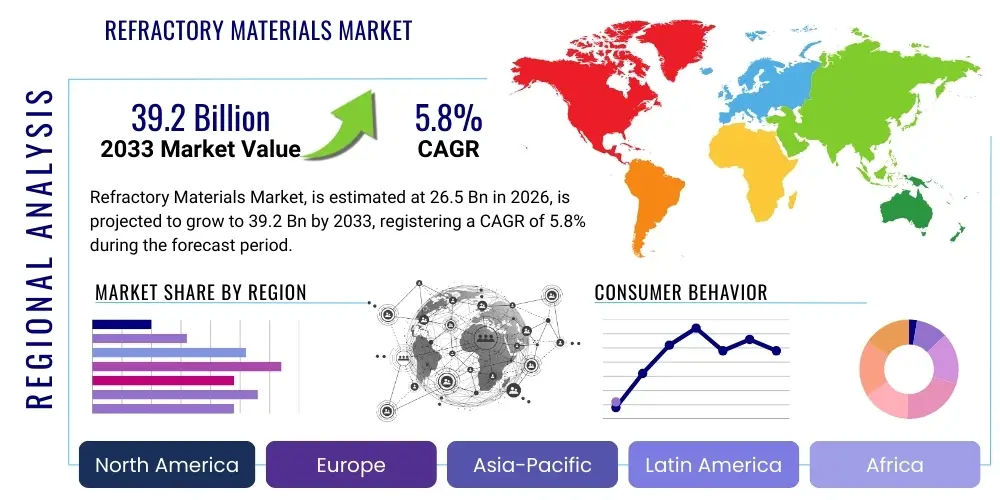

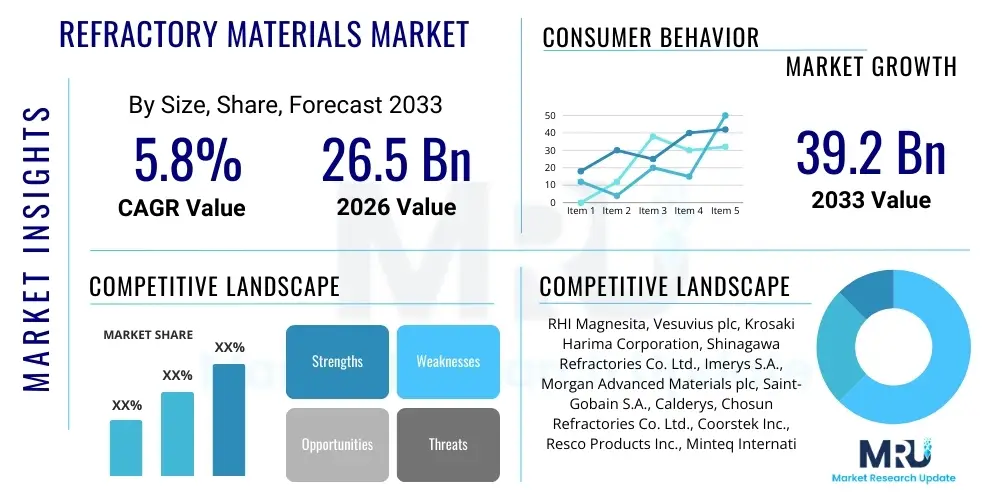

The Refractory Materials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 26.5 billion in 2026 and is projected to reach USD 39.2 billion by the end of the forecast period in 2033.

Refractory Materials Market introduction

The refractory materials market is a cornerstone of global industrial infrastructure, providing essential high-temperature resistant ceramic materials and composites crucial for manufacturing processes across various heavy industries. These materials are engineered to withstand extreme temperatures, thermal shock, chemical attack, and abrasion, thereby protecting industrial furnaces, kilns, reactors, and other high-temperature processing equipment from degradation. Their primary function is to contain heat and molten materials, ensuring operational efficiency, energy conservation, and safety in demanding environments. Refractories are indispensable for maintaining the integrity and longevity of critical industrial assets, enabling continuous production cycles and reducing maintenance downtime.

The product portfolio within the refractory materials market encompasses a wide array of compositions and forms, including shaped products like bricks, blocks, and pre-formed shapes, as well as unshaped or monolithic refractories such as castables, ramming mixes, gunning mixes, and mortars. Each type is tailored to specific application requirements based on material composition (e.g., alumina, silica, magnesia, zirconia, silicon carbide) and structural characteristics. These materials are extensively utilized in major applications including the iron and steel industry, where they line blast furnaces, ladles, and converters; in cement manufacturing for kilns; in glass production for melting furnaces; and across non-ferrous metals, ceramics, petrochemicals, and power generation sectors. The versatility and customization capabilities of refractory materials allow them to meet diverse operational challenges and performance demands across this broad industrial spectrum.

The market's sustained growth is fundamentally driven by several critical factors, prominently including the continuous expansion of industrial activities, particularly in emerging economies, and significant investments in infrastructure development globally. Refractory materials offer substantial benefits, such as extending the operational life of high-temperature equipment, improving process efficiency through superior insulation properties, reducing energy consumption, and enhancing worker safety by preventing heat loss and containing hazardous molten substances. Moreover, ongoing technological advancements focused on developing higher performance, more durable, and environmentally friendly refractory solutions are further propelling market expansion. The imperative for industries to minimize operational costs, maximize productivity, and comply with increasingly stringent environmental regulations underscores the enduring demand for advanced refractory materials.

Refractory Materials Market Executive Summary

The global refractory materials market is experiencing dynamic business trends, characterized by a dual focus on innovation and sustainability. Manufacturers are increasingly investing in research and development to produce advanced refractory solutions that offer enhanced performance characteristics, such as superior thermal shock resistance, improved corrosion resistance, and extended service life. There is a discernible shift towards lightweight, energy-efficient, and environmentally friendly refractory products, driven by the need for industries to reduce carbon footprints and adhere to stricter environmental regulations. Additionally, consolidation through mergers and acquisitions is a prominent trend, as key players seek to expand their product portfolios, strengthen market presence, and achieve economies of scale, particularly in specialized or high-growth segments. The digitalization of manufacturing processes, including AI-driven quality control and predictive maintenance, is also beginning to influence production and application methodologies.

Regionally, the market exhibits varied growth trajectories influenced by industrialization levels and economic development. Asia Pacific continues to dominate the market in terms of consumption and production, primarily due to the robust growth of its iron and steel, cement, and glass industries, especially in countries like China and India. This region benefits from significant infrastructure investments and expanding manufacturing bases. North America and Europe, while mature markets, are experiencing demand driven by the modernization of existing industrial facilities, the adoption of advanced refractory technologies, and stringent environmental compliance. Latin America, the Middle East, and Africa are showing steady growth, fueled by nascent industrialization, particularly in the metals, mining, and energy sectors, presenting new opportunities for refractory manufacturers.

Segmentation trends within the refractory materials market highlight distinct areas of growth and technological evolution. By type, monolithic refractories (unshaped) are gaining traction over traditional shaped refractories due to their ease of installation, versatility, and cost-effectiveness in certain applications, although shaped refractories remain critical for structural integrity in high-wear zones. In terms of application, the iron and steel industry consistently remains the largest end-user segment, with demand intrinsically linked to global steel production rates. However, other sectors like cement, glass, and non-ferrous metals are also demonstrating stable growth, necessitating specialized refractory solutions. Material-wise, high-alumina and magnesia-based refractories continue to be pivotal due to their excellent high-temperature performance, while silicon carbide and zirconia-based products are seeing increased adoption in niche applications requiring extreme resistance to corrosion and thermal shock. The market is evolving towards custom-engineered solutions that cater to the unique operational demands of each industry, fostering innovation across all segments.

AI Impact Analysis on Refractory Materials Market

Common user questions regarding AI's impact on the Refractory Materials Market often revolve around how artificial intelligence can enhance material quality, optimize production processes, improve predictive maintenance, and facilitate new material discovery. Users are keenly interested in the practical applications of AI for reducing manufacturing costs, increasing operational efficiency in end-use industries, and addressing challenges related to raw material variability and product consistency. There are also significant inquiries about AI's role in developing sustainable refractory solutions, minimizing waste, and extending the lifespan of refractory linings through advanced analytics. Expectations are high for AI to transform the entire value chain, from raw material sourcing and design to manufacturing and end-user application, thereby leading to more intelligent, resilient, and high-performance refractory systems.

The integration of AI technologies across the refractory materials market promises to revolutionize various aspects of the industry, offering significant advancements in both manufacturing and application. In the production phase, AI can optimize mix designs, predict material performance based on raw material characteristics, and control manufacturing parameters with unprecedented precision, leading to higher quality and more consistent refractory products. Machine learning algorithms can analyze vast datasets from past production runs to identify optimal processing conditions, minimizing defects and reducing energy consumption during firing and drying. This analytical capability allows manufacturers to fine-tune their operations, leading to substantial cost savings and improved resource utilization. Furthermore, AI-powered vision systems can conduct real-time quality inspections, identifying flaws at early stages of production, which ensures that only high-quality products reach the market.

Beyond manufacturing, AI significantly enhances the application and performance monitoring of refractory materials in end-use industries. Predictive maintenance, powered by AI and IoT sensors embedded within refractory linings, can monitor temperature profiles, wear patterns, and structural integrity in real-time. By analyzing this data, AI can accurately predict potential failures or the optimal time for maintenance interventions, thereby preventing costly unplanned shutdowns and extending the operational life of industrial equipment. This not only improves productivity but also enhances safety by mitigating the risks associated with refractory failures. Moreover, AI accelerates the discovery and development of novel refractory materials by simulating material properties and performance under extreme conditions, drastically shortening the R&D cycle and fostering innovation for next-generation, high-performance, and sustainable refractory solutions tailored to emerging industrial demands.

- Enhanced predictive maintenance and failure detection in industrial furnaces using IoT and AI analytics.

- Optimized refractory mix designs and manufacturing processes through machine learning algorithms, improving material consistency and performance.

- Real-time quality control and defect detection during refractory production via AI-powered computer vision systems.

- Accelerated discovery and development of novel refractory materials and formulations using AI-driven simulation and data analysis.

- Improved supply chain efficiency and raw material sourcing through AI-powered forecasting and logistics optimization.

- Reduced energy consumption in refractory production processes by AI-driven process optimization.

- Customized refractory solutions and application strategies based on AI analysis of specific industrial operational parameters.

DRO & Impact Forces Of Refractory Materials Market

The Refractory Materials Market is profoundly shaped by a confluence of drivers, restraints, opportunities, and powerful impact forces that dictate its trajectory and evolution. Key drivers include the robust expansion of global industrial output, particularly in sectors such as iron and steel, cement, glass, and non-ferrous metals, which are intrinsically reliant on refractory products for their high-temperature processes. Infrastructure development projects in emerging economies further stimulate demand for basic materials like steel and cement, consequently boosting the need for refractories. Additionally, the increasing focus on energy efficiency and operational longevity in industrial facilities drives the adoption of advanced, high-performance refractory materials that can withstand more severe conditions for longer periods, ultimately reducing energy consumption and maintenance costs.

Conversely, several significant restraints challenge market growth. The volatility in raw material prices, such as bauxite, magnesia, and graphite, directly impacts production costs and profit margins for refractory manufacturers. Stringent environmental regulations and growing concerns over carbon emissions compel industries to seek more sustainable and eco-friendly refractory solutions, which often involve higher initial R&D and production costs. The cyclical nature of the end-user industries, particularly the steel sector, can lead to fluctuations in demand, making market forecasting and long-term planning complex. Furthermore, the availability and cost of skilled labor for refractory installation and maintenance, coupled with the capital-intensive nature of refractory production, pose additional hurdles to market expansion and competitiveness.

Despite these restraints, numerous opportunities abound for innovation and market expansion. The development of advanced and specialized refractory materials, including nanotechnology-enhanced composites and materials designed for extreme operating conditions (e.g., ultra-high temperature or highly corrosive environments), presents significant growth avenues. The circular economy model, emphasizing recycling and reuse of refractory waste, offers opportunities for sustainable product development and resource efficiency, appealing to environmentally conscious industries. Moreover, the increasing adoption of Industry 4.0 technologies, such as AI, IoT, and automation, in refractory manufacturing and end-use applications (e.g., for predictive maintenance and process optimization) is poised to unlock new efficiencies and value propositions. Geographically, emerging markets in Asia Pacific, Latin America, and Africa, with their rapid industrialization and urbanization, represent untapped potential for significant market penetration and growth in the coming years.

Segmentation Analysis

The refractory materials market is comprehensively segmented to cater to the diverse needs of various industrial applications and operational environments. This segmentation provides a granular view of the market dynamics, allowing for a deeper understanding of demand patterns, technological preferences, and competitive landscapes across different product types, material compositions, forms, and end-use industries. Analyzing these segments helps stakeholders identify specific growth opportunities and tailor product development strategies to address niche market requirements effectively.

- By Type:

- Shaped Refractories: Bricks, Blocks, Pre-formed shapes, Tiles.

- Unshaped (Monolithic) Refractories: Castables, Ramming Mixes, Gunning Mixes, Mortars, Plastics, Patching Mixes.

- By Material:

- Alumina (Al2O3) Based: High-Alumina, Corundum.

- Silica (SiO2) Based: Silica Bricks, Silica Fused.

- Magnesia (MgO) Based: Magnesia, Magnesia-Carbon, Magnesia-Chrome.

- Zirconia (ZrO2) Based.

- Silicon Carbide (SiC) Based.

- Fireclay Based.

- Others (Chromite, Dolomite, Carbon, etc.).

- By Application:

- Iron & Steel Industry: Blast Furnaces, Basic Oxygen Furnaces (BOF), Electric Arc Furnaces (EAF), Ladles, Tundishes, Continuous Casting.

- Cement Industry: Rotary Kilns, Preheaters, Coolers.

- Glass Industry: Glass Melting Furnaces, Regenerators.

- Non-Ferrous Metals: Aluminum, Copper, Lead, Zinc production.

- Chemicals & Petrochemicals: Reactors, Incinerators.

- Power Generation: Boilers, Incinerators.

- Ceramics: Kilns, Furnaces.

- Others (Pulp & Paper, Waste Incineration, etc.).

- By Form:

- Dense Refractories.

- Insulating Refractories.

- By End-use Industry:

- Metal & Metallurgy.

- Ceramics & Building Materials.

- Glass & Fibers.

- Chemicals & Petrochemicals.

- Energy & Power Generation.

- Environmental Protection.

- Others.

Value Chain Analysis For Refractory Materials Market

The value chain for the refractory materials market is an intricate network of activities, commencing with the sourcing of raw materials and extending to the ultimate application of the finished products in diverse industrial settings. Upstream activities are centered on the extraction and processing of critical minerals such as bauxite (for alumina), magnesite (for magnesia), silica, zircon, and graphite. Key players in this segment include mining companies and specialized mineral processors who supply refined raw materials to refractory manufacturers. The quality, purity, and consistent supply of these raw materials are paramount, directly influencing the performance and cost-effectiveness of the final refractory products. Relationships with reliable raw material suppliers are therefore crucial for ensuring stability and competitive advantage in the market.

Moving downstream, the value chain encompasses the manufacturing, distribution, and installation phases. Refractory manufacturers process the raw materials through various stages, including crushing, grinding, mixing, forming (pressing, casting, extrusion), and firing, to produce shaped and unshaped refractories. These manufacturers often engage in extensive research and development to innovate new formulations and production techniques that enhance product durability, thermal efficiency, and environmental sustainability. Distribution channels are varied, involving both direct sales to large industrial customers (e.g., steel mills, cement plants) and indirect sales through a network of specialized distributors, agents, and local stockists who provide regional market access and technical support. Direct distribution allows for customized solutions and closer client relationships, while indirect channels provide broader market reach and efficient logistics for smaller orders or standard products.

The final stage of the value chain involves the installation, application, and maintenance of refractory linings within industrial furnaces and equipment. This segment often includes specialized service providers and contractors who possess expertise in selecting, installing, repairing, and maintaining refractory materials, ensuring optimal performance and extending equipment lifespan. Post-application, there is an increasing focus on services such as refractory inspection, monitoring, and even recycling initiatives to align with circular economy principles. The effectiveness of the entire value chain hinges on seamless collaboration and communication between raw material suppliers, manufacturers, distributors, and end-users, ensuring that the right refractory solutions are delivered efficiently and perform optimally throughout their lifecycle, thereby maximizing value for all stakeholders involved.

Refractory Materials Market Potential Customers

The potential customer base for the refractory materials market is inherently broad and diverse, primarily comprising industries that operate high-temperature processes and require robust protection for their critical equipment. The most significant segment of end-users are heavy industries where materials are subjected to extreme heat, abrasion, and chemical attack. These include the iron and steel industry, which relies heavily on refractories for lining blast furnaces, basic oxygen furnaces, electric arc furnaces, ladles, and tundishes, essential for molten metal containment and processing. The continuous demand for steel globally, driven by infrastructure development, automotive production, and manufacturing, ensures a consistent need for high-performance refractory solutions within this sector.

Beyond the steel sector, the cement industry represents another substantial customer segment, utilizing refractories extensively in rotary kilns, preheaters, and coolers for clinker production. The demand here is linked to global construction activities and urbanization trends. Similarly, the glass industry is a key consumer, requiring specialized refractories for glass melting furnaces, regenerators, and forehearths, designed to withstand high temperatures and corrosive glass melts. The non-ferrous metals industry, encompassing aluminum, copper, zinc, and lead production, also heavily depends on refractories for melting, refining, and holding furnaces. These industries demand refractories with specific properties such as resistance to specific metal corrosions and thermal cycling stability.

Furthermore, the chemical and petrochemical industries utilize refractory materials in reactors, incinerators, and reformers where corrosive gases and high temperatures are prevalent. The power generation sector, particularly in coal-fired power plants and waste-to-energy facilities, employs refractories in boilers and incinerators to manage combustion processes effectively. The ceramics and environmental protection industries also serve as important customers, requiring refractories for kilns, incinerators, and waste processing units. In essence, any industrial operation involving temperatures exceeding 1000°C is a potential customer for refractory materials, highlighting the market's fundamental importance to modern industrial production and infrastructure development across the globe.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 26.5 billion |

| Market Forecast in 2033 | USD 39.2 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | RHI Magnesita, Vesuvius plc, Krosaki Harima Corporation, Shinagawa Refractories Co. Ltd., Imerys S.A., Morgan Advanced Materials plc, Saint-Gobain S.A., Calderys, Chosun Refractories Co. Ltd., Coorstek Inc., Resco Products Inc., Minteq International Inc., Corning Incorporated, INTOCAST AG, Allied Mineral Products Inc., Zircar Refractories Inc., Premier Refractories International, Plibrico Company LLC, Magnezit Group, IFGL Refractories Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Refractory Materials Market Key Technology Landscape

The refractory materials market is continuously evolving, driven by the imperative to enhance performance, extend product lifespan, and meet increasingly stringent environmental standards. A central technological focus is on the development of advanced material compositions. This includes innovating high-purity raw materials, incorporating nanotechnology to create refractories with superior mechanical strength and thermal shock resistance, and developing novel binder systems that improve material integrity and reduce harmful emissions during processing and use. The emphasis is on multi-functional refractories that can perform optimally under diverse and extreme operating conditions, such as ultra-high temperatures, highly corrosive environments, and rapid thermal cycling, thereby maximizing operational efficiency and equipment uptime in end-user industries.

Another significant aspect of the technology landscape involves the adoption of sophisticated manufacturing processes and digital technologies. Automation and robotics are increasingly being integrated into refractory production facilities to enhance precision, consistency, and worker safety, while also optimizing energy consumption. Advanced forming techniques, such as vibratory casting and 3D printing, are emerging for producing complex shapes and customized refractory components with superior density and structural integrity. Furthermore, the application of computational materials science and simulation tools plays a crucial role in predicting material performance, optimizing designs, and accelerating the R&D cycle for new refractory formulations, enabling manufacturers to bring innovative products to market more rapidly and efficiently.

The drive towards sustainability also profoundly influences technological advancements in the refractory market. This encompasses the development of eco-friendly refractories that utilize recycled content, employ low-carbon manufacturing processes, and are designed for easier recyclability at the end of their service life. Innovations in refractory coatings and repair technologies are also pivotal, aiming to extend the lifespan of existing linings and reduce the frequency of full refractory replacements, thereby minimizing waste and resource consumption. Furthermore, the integration of smart refractory systems, embedded with sensors and connected through the Internet of Things (IoT), enables real-time monitoring of temperature, wear, and structural health, facilitating data-driven predictive maintenance and further optimizing operational efficiency and safety in industrial applications. These technological advancements collectively contribute to more durable, efficient, and environmentally responsible refractory solutions.

Regional Highlights

- Asia Pacific: Dominant market due to robust growth in the iron & steel, cement, and glass industries in China, India, and Southeast Asian countries, driven by rapid industrialization and infrastructure development. Significant investments in manufacturing capacity and urbanization fuel demand.

- Europe: Mature market characterized by a focus on high-performance and environmentally compliant refractories. Germany, Italy, and France are key contributors, driven by advanced manufacturing sectors, modernization of existing facilities, and strong emphasis on R&D for sustainable solutions.

- North America: Stable market with demand stemming from the automotive, aerospace, and metallurgy industries. The U.S. and Canada are major players, investing in advanced refractory technologies, energy-efficient solutions, and automation in production.

- Latin America: Emerging market with growth potential, particularly in Brazil and Mexico, driven by increasing industrial output in metals, mining, and cement sectors. Regional infrastructure projects and industrial expansion are key demand drivers.

- Middle East & Africa (MEA): Growing market influenced by investments in oil & gas, petrochemicals, and basic metal industries. Saudi Arabia, UAE, and South Africa are prominent, with nascent industrialization creating new opportunities for refractory material suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Refractory Materials Market.- RHI Magnesita

- Vesuvius plc

- Krosaki Harima Corporation

- Shinagawa Refractories Co. Ltd.

- Imerys S.A.

- Morgan Advanced Materials plc

- Saint-Gobain S.A.

- Calderys (part of Imerys)

- Chosun Refractories Co. Ltd.

- Coorstek Inc.

- Resco Products Inc.

- Minteq International Inc.

- Corning Incorporated

- INTOCAST AG

- Allied Mineral Products Inc.

- Zircar Refractories Inc.

- Premier Refractories International

- Plibrico Company LLC

- Magnezit Group

- IFGL Refractories Ltd.

Frequently Asked Questions

What are refractory materials and why are they important?

Refractory materials are ceramic-based products designed to withstand extremely high temperatures, thermal shock, chemical attack, and abrasion. They are crucial for lining industrial furnaces, kilns, reactors, and other high-temperature processing equipment, enabling industries like steel, cement, and glass to operate efficiently, conserve energy, and ensure safety by containing heat and molten materials.

Which industries are the primary consumers of refractory materials?

The iron and steel industry is the largest consumer of refractory materials, followed by the cement, glass, non-ferrous metals, chemicals, and power generation sectors. Any industry requiring high-temperature processing equipment heavily relies on these materials for operational integrity and performance.

What are the main types of refractory materials?

Refractory materials are broadly classified into two main types: shaped refractories, which include pre-formed bricks and blocks, and unshaped or monolithic refractories, such as castables, ramming mixes, and gunning mixes. They are also categorized by their chemical composition, including alumina, magnesia, silica, zirconia, and silicon carbide based materials.

What factors are driving the growth of the refractory materials market?

Market growth is primarily driven by global industrial expansion, particularly in emerging economies, significant infrastructure development, and increasing demand for energy-efficient and high-performance industrial processes. Technological advancements in material science and increasing focus on product longevity also contribute significantly.

How is sustainability impacting the refractory materials market?

Sustainability is a major impact force, driving innovations towards eco-friendly refractory solutions that incorporate recycled content, reduce carbon emissions during production, and are designed for end-of-life recyclability. There's also a growing emphasis on extending product lifespan to minimize waste and resource consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Industrial Refractory Materials Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Non-Spherical Aluminum Powder Market Statistics 2025 Analysis By Application (Paint and Pigment Industry, Photovoltaic Electronic Paste Industry, Refractory Materials Industry, Others), By Type (High Purity Aluminum Powder, Low Purity Aluminum Powder), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Industrial Refractory Materials Market Statistics 2025 Analysis By Application (Iron & Steel, Cement/Lime, Nonferrous Metals, Glass, Ceramics), By Type (Shaped Industrial Refractory Materials, Unshaped Industrial Refractory Materials), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Ultra-pure Industrial Powdered Aluminium Market Statistics 2025 Analysis By Application (Photovoltaic Electronic Paste Industry, Paint and Pigment Industry, Refractory Materials Industry), By Type (Steelmaking Powdered Aluminium, Ball Milled Powdered Aluminium), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Shaped Refractory Materials Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Standard shapes, Special shapes), By Application (Refractory for Steel Industry, Refractory for Glass Industry, Refractory for Cement Industry), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager