Refurbished Medical Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433459 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Refurbished Medical Devices Market Size

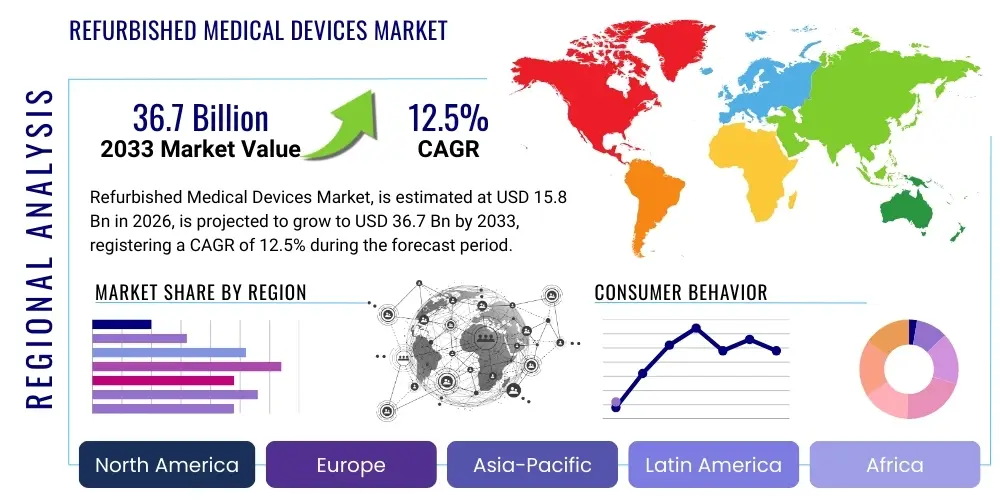

The Refurbished Medical Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $15.8 Billion in 2026 and is projected to reach $36.7 Billion by the end of the forecast period in 2033.

Refurbished Medical Devices Market introduction

The Refurbished Medical Devices Market encompasses the trade of previously used medical equipment that has been restored, repaired, and certified to meet original manufacturer specifications and performance standards, often mandated by regulatory bodies like the FDA or CE Mark requirements. These devices span a wide range of categories, including sophisticated imaging systems, patient monitoring equipment, surgical tools, and diagnostic laboratory instruments. The primary appeal of refurbished devices lies in their cost-effectiveness, offering high-quality technology at a significantly reduced price compared to new equipment. This financial advantage is particularly critical for healthcare providers in emerging economies and budget-constrained institutions in developed markets, enabling broader access to essential medical infrastructure.

Major applications of refurbished medical devices are found in diagnostic imaging—such as MRI, CT scanners, and ultrasound systems—as well as in critical care and operating room environments. The lifecycle of high-value capital equipment in hospitals necessitates a robust secondary market, which is supported by specialized third-party refurbishers and Original Equipment Manufacturers (OEMs) who have recognized the strategic importance of this segment. Benefits extend beyond immediate cost savings to include environmental sustainability, as refurbishing extends the life of complex machinery, reducing electronic waste. Furthermore, the quick availability of refurbished units allows healthcare facilities to rapidly upgrade their technology base or replace failed equipment without long lead times associated with new device procurement.

The market is predominantly driven by the increasing financial pressure on global healthcare systems to optimize capital expenditure, coupled with the rapid obsolescence cycle of medical technology. Developing regions, characterized by rising healthcare spending and insufficient infrastructure, exhibit a high demand for reliable, affordable equipment. Regulatory stringency regarding quality assurance and standardization in the refurbishment process has elevated consumer confidence, further fueling market expansion. As supply chain maturity improves and transparency increases, the perceived risk associated with purchasing refurbished equipment diminishes, solidifying its role as a fundamental component of the global medical technology landscape.

Refurbished Medical Devices Market Executive Summary

The global Refurbished Medical Devices Market is characterized by robust business trends driven primarily by economic pressures on healthcare providers and accelerated technological turnover among OEMs. A significant trend involves the increasing participation of OEMs in the refurbishment space, often referred to as certified pre-owned programs, which enhances credibility and offers higher guarantees compared to independent third-party refurbishers. The business model is shifting towards comprehensive service contracts that include installation, maintenance, and warranty extensions, mitigating institutional concerns regarding long-term device reliability. Furthermore, standardization bodies are actively working to harmonize cross-border regulations, simplifying the logistics and certification required for international trade of refurbished equipment, particularly high-demand items like diagnostic imaging units.

Regional trends indicate that North America and Europe remain mature markets, focusing heavily on quality accreditation and stringent adherence to regulatory standards (e.g., FDA 510(k) requirements for significant alterations). The Asia Pacific (APAC) region, however, is emerging as the fastest-growing market due to rapid infrastructure development, large patient populations requiring extensive imaging and treatment, and significant government initiatives aimed at universal healthcare coverage. Countries like China and India are prioritizing cost-effective methods to equip new hospitals and clinics. Latin America and the Middle East and Africa (MEA) are also demonstrating accelerated uptake, driven by affordability and the need to quickly deploy advanced medical capabilities in underserved areas.

Segmentation trends highlight that the Diagnostic Imaging segment holds the largest market share, predominantly due to the high capital cost of new MRI, CT, and PET systems, making refurbishment a highly appealing alternative. Within segmentation by end-user, hospitals and clinics remain the primary consumers, but ambulatory surgical centers and specialty clinics are showing rapid growth as they seek to establish high-standard, cost-efficient operations. Product segmentation analysis suggests sustained demand for high-complexity, high-value devices, where the savings achieved through refurbishment are most substantial, though smaller segments like operating room and surgical devices are gaining traction as refurbishment techniques become more advanced and encompassing.

AI Impact Analysis on Refurbished Medical Devices Market

User queries regarding AI's influence on the Refurbished Medical Devices Market predominantly focus on how advanced analytics and machine learning will affect the valuation, testing, and longevity of used equipment. Key concerns center around the ability of AI to accurately predict component failure, optimize refurbishment timelines, and certify the performance of older hardware designed without integrated AI capabilities. Users expect AI to revolutionize quality control by automating intensive diagnostic processes, thereby reducing human error and increasing the speed of market readiness for refurbished units. Furthermore, there is significant interest in how AI tools can assist in determining the fair market price of retired assets based on real-time usage data and projected operational lifespan, bringing greater transparency to the secondary market.

The integration of AI technologies will critically impact the testing and quality assurance phase of the refurbishment process. Algorithms can analyze historical failure data across thousands of similar devices to identify components most likely to require proactive replacement, moving the process from reactive repair to predictive maintenance. This shift significantly enhances the reliability and perceived value of the refurbished product. For complex imaging modalities, AI-powered quality checks can automatically compare post-refurbishment image outputs against rigorous baseline standards, ensuring that the restored device performs functionally equivalent to its new counterpart, thereby boosting buyer confidence and expanding the segment's acceptance in highly regulated environments.

Moreover, AI is expected to streamline inventory and supply chain management within the refurbishment sector. Machine learning models can forecast demand for specific refurbished devices based on regional healthcare capital expenditure cycles, technological obsolescence rates, and regulatory changes, allowing refurbishers to optimize their acquisition strategy. The ability to track the usage patterns and wear-and-tear history of devices in the field using AI-driven telemetry data before they enter the refurbishment stream will be invaluable, providing highly granular data necessary for precise valuation and efficient resource allocation during the restoration phase.

- AI enhances predictive maintenance modeling, identifying failure-prone components early.

- Automated diagnostic testing using machine learning reduces refurbishment time and cost.

- AI algorithms facilitate accurate valuation of used devices based on performance metrics and usage history.

- Improved supply chain efficiency through AI-driven demand forecasting for specific modalities.

- Machine vision systems assist in high-speed, non-destructive quality inspection of components.

- AI-powered tools ensure refurbished software components meet updated security and operational standards.

DRO & Impact Forces Of Refurbished Medical Devices Market

The dynamics of the Refurbished Medical Devices Market are heavily influenced by a convergence of economic drivers, strict regulatory constraints, and technological opportunities, encapsulated by the complex interplay of DRO (Drivers, Restraints, Opportunities) and external impact forces. A primary driver is the pervasive need for cost reduction across global healthcare systems, especially post-pandemic, where capital budgets remain constrained but the need for advanced diagnostic and treatment tools persists. This economic incentive is coupled with the growing awareness of environmental sustainability, prompting institutions to favor circular economy models that minimize medical e-waste. Restraints primarily revolve around the perceived lack of warranty and reliability compared to new devices, although this is rapidly being addressed by OEM-certified programs. Regulatory fragmentation across international borders also complicates global trade and certification processes, requiring refurbishers to navigate multiple compliance frameworks, which increases operational overhead.

Opportunities in the market are abundant, notably stemming from the expansion of healthcare infrastructure in emerging economies where new hospital establishment necessitates immediate, large-scale equipment procurement under strict budget limitations. Technological advancements, particularly in non-invasive cleaning, advanced component testing, and software updating, allow a wider array of sophisticated devices, such as robotic surgical systems and high-field strength MRI units, to be successfully refurbished. Furthermore, the rise of specialized leasing and financing models tailored specifically for refurbished equipment reduces the upfront financial burden for end-users, transforming capital expenditure into operational expenditure and thereby broadening market accessibility.

Impact forces acting on this market include intense competition from low-cost new device manufacturers, which pressures pricing, and the rapid pace of technological innovation that can quickly render older refurbished models less desirable. Crucially, the increasing scrutiny from regulatory bodies concerning patient safety and device integrity acts as both a restraining force (due to compliance costs) and an accelerating force (by boosting consumer trust in certified products). The successful integration of robust quality management systems and transparent certification processes is essential for neutralizing the negative impact forces and capitalizing on the growth drivers. The overall trajectory is positive, supported by global macroeconomic trends favoring efficiency and circular resource management.

Segmentation Analysis

The Refurbished Medical Devices Market is highly fragmented, necessitating detailed segmentation across product type, end-user, and component type to accurately assess market dynamics and future growth vectors. Product segmentation provides crucial insights into which types of capital equipment yield the highest returns and possess the most robust secondary markets. The Diagnostic Imaging segment, encompassing modalities such as CT, MRI, and X-ray systems, consistently dominates due to the extremely high initial cost of these devices and their long useful life, making the economic savings from refurbishment profound. However, niche segments like Operating Room and Surgical Devices are witnessing faster proportional growth as refurbishment techniques become suitable for high-precision, low-volume instruments, addressing sterilization and regulatory concerns effectively.

Segmentation by end-user illustrates the evolving procurement landscape. Hospitals, traditionally the largest consumers, continue to drive volume, but the market is experiencing significant decentralization. The rapid proliferation of diagnostic centers, ambulatory surgical centers (ASCs), and specialized clinics is creating new pockets of demand. These smaller facilities prioritize flexibility, rapid deployment, and affordability, often preferring certified refurbished equipment to optimize initial investments and maintain competitive pricing for patient services. Additionally, research and academic institutions often procure refurbished high-end laboratory and imaging equipment for teaching purposes, balancing quality requirement with educational budgets.

Further analysis by component type—ranging from electrical components, display components, imaging tubes, and system software—helps refurbishers strategically manage their inventory and sourcing operations. The availability and cost of high-quality replacement parts, particularly imaging tubes and proprietary software licenses, are critical factors influencing the feasibility and final price of the refurbished unit. Effective segmentation allows companies to tailor their services, offering customized solutions like partial upgrades or software-only refurbishment packages, thereby capturing diverse needs within the expansive global healthcare ecosystem and ensuring market resilience against technological advancements.

- By Product Type:

- Diagnostic Imaging Equipment (MRI Systems, CT Scanners, Ultrasound, X-ray Systems)

- Cardiology Equipment (ECG Systems, Defibrillators, Electrophysiology Devices)

- Operating Room & Surgical Devices (Anesthesia Machines, Endoscopes, Monitors)

- Patient Monitoring Devices

- Neurology Devices

- Other Medical Equipment

- By End User:

- Hospitals and Clinics

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers

- Specialty Clinics

- Academic and Research Institutions

- By Component:

- Electrical and Mechanical Components

- Software and Control Systems

- Display Units and Interfaces

- System Housings and Peripherals

Value Chain Analysis For Refurbished Medical Devices Market

The value chain for refurbished medical devices is intricate, beginning with the upstream analysis involving the sourcing and acquisition of used equipment. This crucial initial phase relies on effective disposal and trade-in programs facilitated by hospitals, clinics, and leasing companies. OEMs often possess a competitive advantage here due to established trade-in networks during new device sales cycles. Independent refurbishers must navigate complex logistics to acquire high-quality, high-value core devices, which significantly determines the final cost structure and profitability. Key activities upstream involve meticulous asset valuation, secure de-installation, and compliant transportation, ensuring device integrity is maintained prior to the refurbishment process.

The central phase of the value chain is the refurbishment process itself, which involves stringent cleaning, inspection, repair, replacement of worn components, software updating, and comprehensive functional testing. This phase requires specialized technical expertise, access to proprietary parts (especially for OEM models), and adherence to strict regulatory standards (e.g., ISO 13485 certification). Successful refurbishers invest heavily in certification and testing protocols to ensure the restored device is functionally equivalent and safe. The distribution channel then connects the newly certified device to the end-user, often involving a mix of direct sales and indirect channels.

Downstream analysis focuses on market reach and post-sale support. Direct distribution channels, typically favored by large OEMs and established third-party refurbishers, allow for greater control over pricing, installation, and customized support packages. Indirect channels, involving brokers, dealers, and regional distributors, are vital for penetrating smaller markets and international regions, though they introduce complexities related to maintaining consistent quality and warranty fulfillment. Post-sale activities, including extended warranties, maintenance contracts, and technical support, are paramount in the refurbished market, significantly influencing customer loyalty and the long-term perceived value of the acquired device.

Refurbished Medical Devices Market Potential Customers

The primary customers for refurbished medical devices are healthcare institutions operating under strict budget constraints but requiring access to advanced technological capabilities. This encompasses small to medium-sized private hospitals, particularly those focused on cost-efficiency while seeking competitive diagnostic tools. Public sector hospitals in many developing nations constitute a significant buyer demographic, where large tenders often mandate the procurement of certified equipment at the lowest possible cost to extend healthcare access across vast populations. These buyers prioritize devices with proven track records of reliability and those accompanied by robust, long-term service agreements to mitigate operational risks.

Beyond traditional hospitals, the expansion of specialized healthcare delivery models has broadened the customer base. Ambulatory Surgical Centers (ASCs) and standalone diagnostic centers are rapidly growing segments that utilize refurbished equipment to achieve favorable financial metrics. ASCs, focused on high-volume, streamlined procedures, often require high-quality surgical and imaging equipment but face pressure to minimize capital outlay. Similarly, independent cardiology or radiology clinics often use refurbished high-end systems (like advanced ultrasound or catheterization lab equipment) to offer competitive services without the massive debt associated with new equipment purchases. The reliability and regulatory compliance of the refurbished units are non-negotiable for these end-users, demanding high-level certification.

Finally, academic and research institutions, particularly those in biomedicine and clinical trials, represent niche but high-value customers. They often require specialized or previous-generation equipment for specific research protocols, teaching laboratories, or historical data comparability studies. Their procurement criteria are driven less by routine patient volume and more by technical specifications and budget adherence for grant-funded projects. Furthermore, government-funded initiatives aimed at equipping rural health clinics or mobile medical units worldwide frequently rely on the affordability and readily available stock provided by the refurbished medical device market to ensure swift deployment of necessary healthcare technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $15.8 Billion |

| Market Forecast in 2033 | $36.7 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Healthineers, GE Healthcare, Philips Healthcare, Agito Medical A/S, Soma Technology, Inc., Block Imaging International, Inc., Integrity Medical Systems, Inc., US Med-Equip, Inc., Canon Medical Systems Corporation, Konica Minolta, Inc., Shimadzu Corporation, EverX GmbH, DRE Medical, Inc., Pacific Medical Group, United Imaging Healthcare |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Refurbished Medical Devices Market Key Technology Landscape

The technology landscape for the Refurbished Medical Devices Market is defined not by the devices themselves, but by the processes and tools used to restore them to optimal condition. A critical aspect involves advanced diagnostic and testing software, which is proprietary to OEMs but increasingly accessible or reverse-engineered by high-end third-party refurbishers. This software is essential for running comprehensive system checks, calibrating complex sensors, and ensuring that all parameters meet the original equipment specifications after component replacement. Furthermore, specialized cleaning and sterilization technologies, including advanced plasma sterilization for heat-sensitive surgical instruments and high-grade chemical processes for large imaging components, are non-negotiable for regulatory compliance and patient safety.

A significant technological development involves the management and updating of embedded software and cybersecurity features in devices. Many modern medical devices rely heavily on operating systems and network connectivity, making them vulnerable to security threats if not properly maintained. Refurbishers are now required to implement rigorous protocols for updating firmware, patching security vulnerabilities, and ensuring compliance with healthcare privacy regulations (like HIPAA or GDPR). This necessitates close collaboration with software developers or the employment of specialized IT security teams, transforming the refurbishment process from a purely mechanical task into a highly sophisticated software engineering and compliance exercise.

Furthermore, the increased use of sophisticated component-level refurbishment techniques minimizes waste and reduces costs. Instead of replacing entire complex assemblies, companies are adopting micro-repair and calibration technologies for intricate parts like gradient coils in MRI machines or high-voltage generators in CT systems. This technical expertise allows for greater financial efficiency and reduces dependency on new OEM parts, addressing supply chain bottlenecks. Additionally, advanced tracking technologies, such as RFID tagging and digital twin modeling, are being implemented to maintain a transparent, verifiable service history for every refurbished unit, enhancing accountability and market trust throughout the equipment's extended lifecycle.

Regional Highlights

Regional dynamics play a vital role in shaping the Refurbished Medical Devices Market, heavily influenced by local economic conditions, regulatory environments, and the maturity of healthcare infrastructure. North America, driven primarily by the United States, represents a highly established market segment where demand is sustained by the continuous upgrade cycles of large hospital systems and the proliferation of certified pre-owned programs offered by major OEMs. While cost consciousness is a factor, the paramount concerns in this region are regulatory compliance, extended warranty coverage, and rigorous quality certification, leading to higher average prices for refurbished goods compared to other global markets. The strong presence of leading refurbishers and robust infrastructure for technical support further solidify this region's market value.

Europe mirrors North America in terms of regulatory rigor (CE marking), yet market growth is often fragmented across the continent, with Western European countries exhibiting high maturity and Eastern European nations showing higher growth potential due to infrastructure modernization efforts. The implementation of strict WEEE directives related to electronic waste management subtly encourages the circular economy model, benefiting the refurbishment industry. A key differentiator in Europe is the diverse structure of national healthcare systems; centralized government procurement in certain countries often favors bulk purchasing of cost-effective, certified refurbished equipment to optimize public budgets.

The Asia Pacific (APAC) region stands out as the primary growth engine for the refurbished devices market, characterized by immense unmet demand for affordable, functional healthcare technology. Rapid urbanization, increasing disposable incomes, and substantial government investments in expanding healthcare access across nations like China, India, and Southeast Asia are fueling explosive market expansion. Here, affordability is the dominant purchasing criterion, often prioritizing reliable third-party refurbished units to rapidly equip new clinics. However, regulatory frameworks are often less harmonized than in Western markets, leading to variations in quality assurance standards. Latin America and the Middle East and Africa (MEA) offer substantial long-term potential, driven by currency volatility making new equipment prohibitively expensive, leading to a strong reliance on value-driven refurbished assets for capital expenditure management.

- North America: Mature market characterized by high regulatory standards, strong OEM presence in certified pre-owned programs, and sustained demand from large Integrated Delivery Networks (IDNs).

- Europe: Growth driven by economic efficiency, strong focus on environmental sustainability (WEEE compliance), and varied adoption rates between Western and Eastern countries.

- Asia Pacific (APAC): Highest growth market propelled by rapid healthcare infrastructure expansion, massive volume demand, and affordability as the critical purchasing factor in countries like India and China.

- Latin America: Demand concentrated around affordability and high cost-savings, supported by government initiatives to equip public health services.

- Middle East and Africa (MEA): Emerging market where refurbished devices provide essential access to high-end technology (especially imaging) that is otherwise unaffordable, constrained by logistical challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Refurbished Medical Devices Market.- Siemens Healthineers

- GE Healthcare

- Philips Healthcare

- Agito Medical A/S

- Soma Technology, Inc.

- Block Imaging International, Inc.

- Integrity Medical Systems, Inc.

- US Med-Equip, Inc.

- Canon Medical Systems Corporation

- Konica Minolta, Inc.

- Shimadzu Corporation

- EverX GmbH

- DRE Medical, Inc.

- Pacific Medical Group

- United Imaging Healthcare

- Atlantis Worldwide

- Mediproma B.V.

- BTT Corporation

- Rennes Health Equipment, Inc.

- Venture Medical ReQuip, Inc.

Frequently Asked Questions

Analyze common user questions about the Refurbished Medical Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between refurbished and used medical devices?

Refurbished devices have undergone a rigorous, standardized process of restoration, repair, component replacement, and software updates, certified to meet the original manufacturer's specifications and performance standards. Used devices are sold as is, without guaranteed inspection or certification of quality.

Are refurbished medical devices subject to the same regulatory standards as new equipment?

Yes, in most major economies like the U.S. (FDA) and Europe (CE Mark), if a refurbishment changes the original device's specifications or intended use, the device must comply with relevant medical device regulations, often requiring new pre-market notification or certification (e.g., FDA 510(k)).

Which segment holds the largest share in the Refurbished Medical Devices Market?

The Diagnostic Imaging segment, including MRI, CT, and advanced ultrasound systems, consistently holds the largest market share due to the extremely high capital cost of new equipment and the significant cost savings achieved through certified refurbishment.

How does the involvement of Original Equipment Manufacturers (OEMs) impact the refurbishment market?

OEM participation through certified pre-owned programs increases market credibility, offers stronger warranties, and ensures access to proprietary parts and software updates, often setting a higher benchmark for quality and reliability compared to independent refurbishers.

What is the main driver for the adoption of refurbished medical equipment in emerging economies?

The primary driver is the need for cost-effective acquisition of advanced technology. Refurbished devices allow healthcare providers in emerging markets to rapidly upgrade or establish high-quality infrastructure while operating within severely constrained capital expenditure budgets and addressing high patient volumes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager