Riveting Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433006 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Riveting Machine Market Size

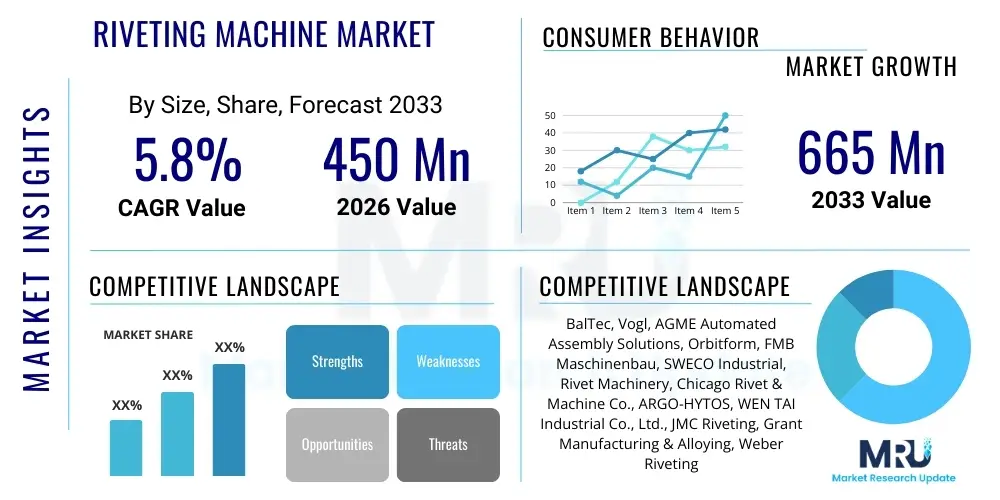

The Riveting Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 665 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing global demand for high-strength, durable fastening solutions across critical manufacturing sectors, particularly automotive assembly and aerospace component fabrication. The precision and consistency offered by modern automated riveting systems are driving their adoption over traditional manual methods, contributing significantly to the market valuation expansion.

The valuation reflects sustained investments in sophisticated riveting technologies such as orbital and radial riveting machines, which offer superior joint integrity and aesthetic finishes compared to conventional impact riveting. Furthermore, emerging markets are rapidly industrializing, leading to expanded manufacturing capabilities and necessitating the procurement of efficient, high-throughput machinery. Regulatory requirements mandating safer and more robust product assemblies, especially in transportation and defense sectors, also bolster the demand for certified riveting equipment capable of meeting stringent quality control standards.

Riveting Machine Market introduction

The Riveting Machine Market encompasses the manufacturing, distribution, and utilization of specialized industrial equipment designed to form permanent mechanical joints using rivets. These machines operate across various mechanisms—including pneumatic, hydraulic, electro-mechanical, orbital, and impact methods—to deform the rivet shank, securing multiple components together. Riveting processes are crucial in applications where vibration resistance, material integrity, and structural strength are paramount, making the machinery essential for sectors ranging from heavy fabrication to delicate electronics assembly. The primary function is to ensure a permanent, reliable, and fatigue-resistant connection without resorting to welding or threading.

Major applications of riveting machines span core industrial verticals. In the automotive industry, they are indispensable for assembling brake components, chassis elements, and interior fittings. The aerospace sector relies heavily on high-precision riveting machines for fuselage and wing assembly, demanding complex automation due to stringent safety protocols. Beyond transportation, these machines are widely utilized in general manufacturing for products like consumer appliances, luggage, and structural steel components. The benefit derived from using advanced riveting technology includes enhanced production throughput, improved joint quality consistency, reduced material heat stress compared to welding, and the ability to join dissimilar materials effectively.

The driving factors for market expansion are multifaceted, anchored by the rapid advancement of automated riveting systems integrating robotics and computer numerical control (CNC). The global push toward lightweight materials, especially in the automotive and aerospace industries to meet fuel efficiency standards, increases the necessity for riveting solutions suitable for joining composite materials and high-strength aluminum alloys. Furthermore, the growing focus on automation within Industry 4.0 paradigms mandates the adoption of smart riveting machines capable of real-time monitoring, quality assurance checks, and seamless integration into automated production lines, collectively stimulating market growth and technological innovation across the value chain.

Riveting Machine Market Executive Summary

The Riveting Machine Market exhibits robust business trends driven by the migration towards highly automated and precision-focused manufacturing practices. Key business dynamics include strategic mergers and acquisitions among established players to consolidate technological expertise, particularly in orbital and radial riveting technologies. There is a discernible shift in demand from standard pneumatic impact machines towards advanced hydraulic and servo-electric variants, which offer greater control over the riveting process, crucial for quality-sensitive applications. Manufacturers are also increasingly offering tailored, modular systems that can be easily integrated into existing production cells, enhancing operational flexibility for end-users and fostering strong partnerships with robotics and automation integrators.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive expansion in automotive and electronics manufacturing, particularly in China and India. North America and Europe maintain dominance in the high-precision segment, driven by the stringent quality demands of the aerospace and defense industries, necessitating investment in specialized, large-scale, automated gantry riveting systems. Latin America and the Middle East & Africa (MEA) are emerging as significant markets due to infrastructure development projects and increasing localization of manufacturing, leading to steady demand for general-purpose riveting machinery used in structural steel and construction applications.

Segment trends reveal that the orbital riveting segment is projected to experience the fastest growth due to its capability to produce strong, aesthetically pleasing joints with minimal material stress. By end-user, the automotive segment retains the largest market share, driven by continuous production volume growth and the necessity for reliable fastening in safety-critical vehicle components. The hydraulic segment, categorized by operation type, is gaining traction due to its ability to handle high forces and thicker materials with superior control and noise reduction compared to traditional pneumatic systems, indicating a premiumization of equipment preference among major industrial clients focused on performance and operational environment improvement.

AI Impact Analysis on Riveting Machine Market

User inquiries regarding AI's influence on the Riveting Machine Market primarily center on how artificial intelligence enhances quality control, predictive maintenance, and operational efficiency. Common questions address the feasibility of using computer vision and machine learning (ML) algorithms for real-time defect detection in rivet joints, the potential for AI to optimize machine parameters (force, dwell time, stroke length) based on material variations, and the development of self-diagnosing riveting systems. Users are keenly interested in reducing downtime and minimizing scrap rates through intelligent monitoring. This indicates a key expectation that AI will transition riveting from a purely mechanical process to a data-driven, closed-loop quality assurance operation, significantly increasing reliability and reducing reliance on manual inspection or destructive testing methods.

- AI-powered Machine Vision Systems: Deployment of high-speed cameras and ML algorithms to instantaneously analyze rivet head geometry, flushness, and joint integrity, ensuring zero-defect manufacturing output.

- Predictive Maintenance (PdM): Utilization of AI to analyze vibration, pressure, and temperature data from machine sensors to predict component failure, scheduling maintenance preemptively and minimizing costly unplanned downtime.

- Process Optimization and Adaptive Control: AI algorithms automatically adjust riveting parameters in real-time based on variations in material thickness, hardness, or batch specifications, ensuring consistent joint quality across diverse inputs.

- Autonomous System Integration: Enabling robotic riveting cells to self-calibrate and troubleshoot minor operational anomalies using integrated AI controllers, improving overall equipment effectiveness (OEE).

- Digital Twin Modeling: Creation of virtual representations of riveting processes using AI to simulate various operational conditions and stress factors, optimizing machine design and application engineering before physical deployment.

DRO & Impact Forces Of Riveting Machine Market

The Riveting Machine Market is fundamentally influenced by robust drivers, counteracted by specific restraints, and supported by significant opportunities, all contributing to a complex array of impact forces shaping its trajectory. Key drivers include the escalating demand for highly durable and lightweight assemblies in the aerospace and automotive sectors, coupled with the global expansion of manufacturing automation seeking consistent fastening results. Restraints often involve the high initial capital investment required for advanced automated riveting cells, the technical complexity of integrating these systems into diverse production environments, and the competitive threat posed by alternative fastening technologies such as advanced adhesives and self-piercing riveting (SPR) systems, particularly in large-scale sheet metal applications.

Opportunities for growth are concentrated in the increasing adoption of orbital and radial forming technologies due to their superior performance characteristics and lower material stress. Furthermore, the development of specialized riveting solutions for electric vehicle (EV) battery pack assembly and the joining of dissimilar materials presents lucrative avenues for market expansion. The impact forces are characterized by moderate technological disruption, primarily stemming from Industry 4.0 integration, and high competitive intensity, driven by the global footprint of machinery manufacturers. The balance between the necessity for permanent, reliable joints in safety-critical applications (a strong driver) and the cost implications of high-precision machinery (a significant restraint) defines the market's current dynamic state.

The macroeconomic environment, including global supply chain stability and industrial output levels, exerts a substantial impact force. Periods of economic uncertainty may delay major capital expenditure on new machinery, while sustained recovery stimulates rapid adoption. Furthermore, environmental regulations demanding lighter vehicle structures create an opportunity for manufacturers specializing in advanced riveting solutions for aluminum and composite materials. Conversely, the skilled labor shortage required to operate and maintain sophisticated CNC riveting machines acts as a subtle restraint, pushing manufacturers to develop more user-friendly, automated interfaces and sophisticated remote diagnostics capabilities to mitigate operational complexity.

Segmentation Analysis

The Riveting Machine Market segmentation provides a granular view of equipment types, operational mechanisms, and end-user applications, essential for strategic market planning. Equipment is primarily categorized by the operating mechanism, which dictates the force application and resulting joint characteristics, ranging from high-speed impact methods to controlled forming techniques like orbital riveting. This structural breakdown helps identify specialized niche markets, such as those requiring noise reduction (favoring hydraulic/servo) or high volume throughput (favoring automated pneumatic systems).

Further segmentation by end-user industry highlights the critical dependence of the market on key manufacturing sectors. The automotive sector, being volume and safety-driven, requires high-reliability, automated systems, whereas aerospace demands extreme precision, traceability, and robust quality documentation, driving demand for specialized gantry and robotic systems. Geographic segmentation is pivotal, reflecting regional industrial maturity and investment capacities, with APAC dominating volume, and North America and Europe leading technological advancement and high-value equipment procurement.

- By Type:

- Impact Riveting Machines

- Orbital Riveting Machines

- Radial Riveting Machines

- Hydraulic Riveting Machines

- Pneumatic Riveting Machines

- Electro-Mechanical/Servo Riveting Machines

- By Operation Mode:

- Manual

- Semi-Automatic

- Fully Automatic (CNC and Robotic Systems)

- By End-User Industry:

- Automotive (Chassis, Brakes, Interior)

- Aerospace and Defense (Fuselage, Wing Assembly, Engine Components)

- General Manufacturing (Appliances, Consumer Goods, Luggage)

- Construction and Infrastructure (Structural Steel)

- Electrical and Electronics

- Others (Medical Devices, Toys)

Value Chain Analysis For Riveting Machine Market

The value chain for the Riveting Machine Market begins with upstream activities involving raw material procurement, primarily high-grade steel, aluminum, and advanced alloys for machine frame fabrication and critical tool components like anvils and forming tools. Specialized component suppliers, including manufacturers of high-pressure hydraulic pumps, precision pneumatic actuators, and advanced servo motors, form the next crucial link. These suppliers must adhere to strict quality standards as the performance and longevity of the riveting machine are directly dependent on the reliability of these core mechanical and electrical components. Research and Development (R&D) activities, focused on improving forming kinematics and integrating sensor technology, are critical upstream investments that define technological competitiveness.

The core manufacturing and assembly stage involves the integration of these sophisticated components into the final riveting machine systems. Original Equipment Manufacturers (OEMs) handle complex processes such as CNC machining of machine bases, assembly of hydraulic power units, and installation of control systems. Distribution channels are varied: direct sales are prevalent for high-value, customized robotic or gantry systems destined for Tier 1 automotive and aerospace firms, ensuring direct customer support and application engineering expertise. Conversely, standardized, smaller benchtop pneumatic machines often utilize indirect channels, relying on regional distributors and industrial equipment resellers to reach smaller manufacturing operations and general workshops.

Downstream activities focus heavily on installation, calibration, operator training, and post-sales support, which is a major value differentiator in this market. Given the precision required, effective maintenance and the timely supply of wear parts, such as forming tools and dies, are essential for maximizing the lifespan and operational effectiveness of the equipment. End-users’ feedback loop into the R&D cycle is also a critical downstream function, driving continuous product improvement and the development of application-specific solutions, thereby closing the loop and sustaining long-term customer relationships and repeat business for major manufacturers.

Riveting Machine Market Potential Customers

Potential customers for riveting machines are predominantly concentrated within high-volume and high-reliability manufacturing sectors that require permanent, robust mechanical fastening solutions. The primary end-users, or buyers of the product, include major automotive OEMs and their extensive network of Tier 1 and Tier 2 suppliers who utilize these machines for structural body assembly, brake systems, clutch assemblies, and specialized components like seat tracks and window regulators. The high production volumes and strict safety standards in this industry necessitate investment in fully automatic, often robotic, riveting cells capable of rapid cycle times and integrated quality assurance features.

The aerospace industry constitutes a highly lucrative, albeit smaller volume, segment demanding ultra-precise, large-format gantry riveting systems for wing and fuselage construction. These customers prioritize machine accuracy, traceability features, and the ability to handle complex materials like titanium and carbon fiber composites. Other significant customer bases include manufacturers of large white goods and consumer appliances, requiring robust benchtop and semi-automatic machines for assembling durable products like washing machines, refrigerators, and ovens, focusing on cost-effectiveness and consistent cosmetic finish.

Furthermore, the electrical and electronics assembly sector utilizes smaller, high-speed riveting machines for miniature components, connectors, and switchgear, where precision force control is paramount to avoid damaging delicate circuitry. General heavy fabrication workshops, construction contractors involved in structural steel assembly, and specialized defense contractors also represent consistent buyers, collectively driving demand for a broad range of riveting equipment from portable handheld devices to fixed industrial installations, ensuring a diverse and resilient customer portfolio across various levels of industrial sophistication.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 665 Million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BalTec, Vogl, AGME Automated Assembly Solutions, Orbitform, FMB Maschinenbau, SWECO Industrial, Rivet Machinery, Chicago Rivet & Machine Co., ARGO-HYTOS, WEN TAI Industrial Co., Ltd., JMC Riveting, Grant Manufacturing & Alloying, Weber Riveting Systems, SPIROL International, C-Type Riveting Systems, Starlinger, Rivetking, Fastening Systems International (FSI), Gesipa, Promess Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Riveting Machine Market Key Technology Landscape

The technological landscape of the Riveting Machine Market is characterized by a strong move towards enhanced control, automation, and data integration. Traditional pneumatic and hydraulic impact riveting systems, while still widely used for high-speed, high-volume, standard applications, are increasingly being supplemented or replaced by advanced servo-electric and orbital technologies. Servo-electric riveting machines offer unparalleled precision in controlling both force and displacement during the forming process, providing real-time quality assurance data and enabling highly repeatable results crucial for safety-critical components in the aerospace and medical device industries. This shift emphasizes process monitoring over mere mechanical forming, ensuring zero-defect manufacturing.

Orbital and radial riveting technologies represent another key area of innovation, focusing on forming joints with minimal lateral force and material deformation, resulting in aesthetically superior and structurally sound joints. These technologies are particularly valuable when joining sensitive or pre-finished materials where traditional impact methods could cause damage or excessive stress. Furthermore, the integration of Industry 4.0 elements, including advanced sensor packages, IoT connectivity, and predictive maintenance capabilities, is standardizing across premium equipment. These "smart" machines allow for remote diagnostics, real-time performance tracking (OEE measurement), and automatic adjustment of tooling compensation to maintain consistent output quality throughout extended production cycles.

Robotics and automation are perhaps the most influential technological drivers. Fully automated riveting cells, utilizing six-axis robots integrated with advanced vision systems, are essential in handling large or complex components, especially in the automotive body-in-white and aircraft fuselage assembly. These robotic systems provide the necessary flexibility to handle varied assembly geometries without extensive manual intervention. Emerging research focuses on developing self-piercing riveting (SPR) and flow drill fastening (FDF) systems that are optimized for high-strength aluminum and multi-material stacks, offering alternatives to traditional solid riveting in applications focused on lightweighting and cost reduction, thereby broadening the technical scope of the fastening market.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for volume consumption, driven by exponential growth in automotive manufacturing (especially China and India), electronics assembly, and consumer goods production. The region's focus is on cost-effective, high-throughput machines, though demand for high-precision orbital and robotic systems is accelerating due to the increasing sophistication of local manufacturing bases. Government policies supporting large-scale infrastructure projects also stimulate demand for heavy-duty structural riveting equipment.

- North America: This region maintains market leadership in high-value, technologically advanced systems, particularly those dedicated to the aerospace, defense, and heavy machinery sectors. Demand is characterized by strict quality requirements, necessitating investments in advanced robotic gantry systems, sophisticated servo-controlled machines, and integrated monitoring software for rigorous traceability and compliance with FAA and DoD standards. The rapid expansion of electric vehicle (EV) manufacturing is also a significant growth factor.

- Europe: Europe is characterized by a strong focus on automation, energy efficiency, and ergonomic design, driven by stringent labor and environmental regulations. Germany, Italy, and France are key markets, prioritizing orbital and hydraulic riveting systems for automotive assembly and precision engineering. European manufacturers lead in developing specialized machinery for joining advanced composite materials and innovative lightweight alloys, emphasizing high precision and minimal noise operation.

- Latin America: This region presents a steady, growing market primarily driven by expanding infrastructure development, localized automotive assembly plants (Brazil and Mexico), and general industrial refurbishment. The market often favors robust, easy-to-maintain pneumatic and hydraulic machines, with increasing procurement of semi-automatic systems to boost productivity over purely manual operations.

- Middle East and Africa (MEA): Growth in MEA is spurred by diversification away from oil economies, leading to increased investment in defense manufacturing, aerospace maintenance (MRO), and localized assembly operations. Demand is currently concentrated on reliable, general-purpose machinery, but large-scale strategic investments, particularly in the UAE and Saudi Arabia, suggest future potential for high-end robotic riveting solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Riveting Machine Market.- BalTec

- Vogl

- AGME Automated Assembly Solutions

- Orbitform

- FMB Maschinenbau

- SWECO Industrial

- Rivet Machinery

- Chicago Rivet & Machine Co.

- ARGO-HYTOS

- WEN TAI Industrial Co., Ltd.

- JMC Riveting

- Grant Manufacturing & Alloying

- Weber Riveting Systems

- SPIROL International

- C-Type Riveting Systems

- Starlinger

- Rivetking

- Fastening Systems International (FSI)

- Gesipa

- Promess Inc.

Frequently Asked Questions

Analyze common user questions about the Riveting Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Riveting Machine Market?

The Riveting Machine Market is projected to experience a robust CAGR of 5.8% between the forecast years of 2026 and 2033, driven primarily by the escalating demand for automated fastening solutions in the automotive and aerospace sectors.

Which riveting technology is expected to see the fastest market growth?

The Orbital Riveting Machine segment is anticipated to witness the fastest growth, largely due to its capacity for producing highly reliable, structurally sound, and aesthetically pleasing joints while minimizing material stress, making it ideal for precision manufacturing applications.

How is Industry 4.0 influencing the design of modern riveting machines?

Industry 4.0 is driving the integration of sophisticated sensors, AI-powered process monitoring, and IoT connectivity into riveting machines, enabling real-time quality assurance, predictive maintenance, and seamless integration into fully automated robotic production lines for enhanced operational efficiency.

Which region holds the largest market share for riveting machines and why?

Asia Pacific (APAC) currently holds the largest volume market share, primarily fueled by the extensive scale of its automotive, electronics, and general manufacturing industries, requiring large volumes of both standard and advanced high-throughput riveting equipment.

What are the main advantages of using servo-electric riveting systems over traditional hydraulic systems?

Servo-electric systems offer superior control over the riveting process, providing precise management of force, displacement, and speed. This results in higher joint quality consistency, reduced energy consumption, lower noise levels, and the capability for full process traceability and data logging critical for compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager