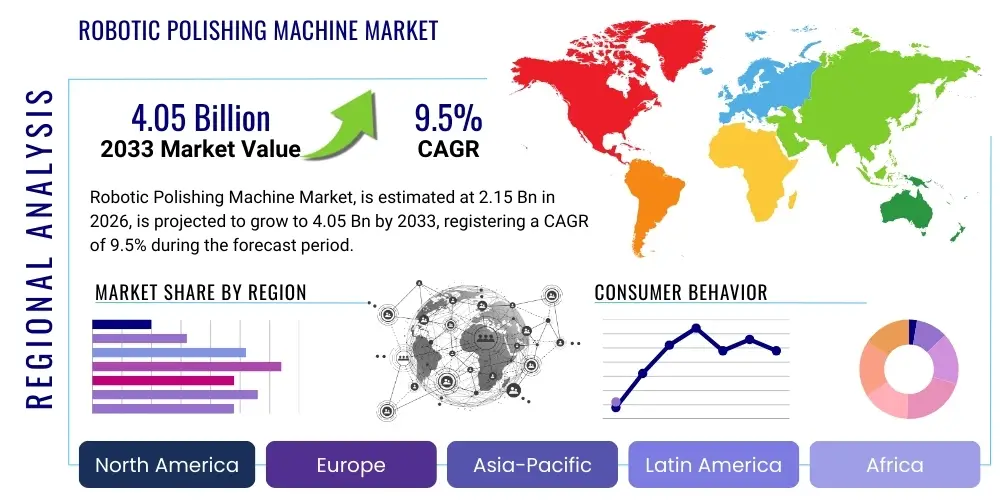

Robotic Polishing Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439573 | Date : Jan, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Robotic Polishing Machine Market Size

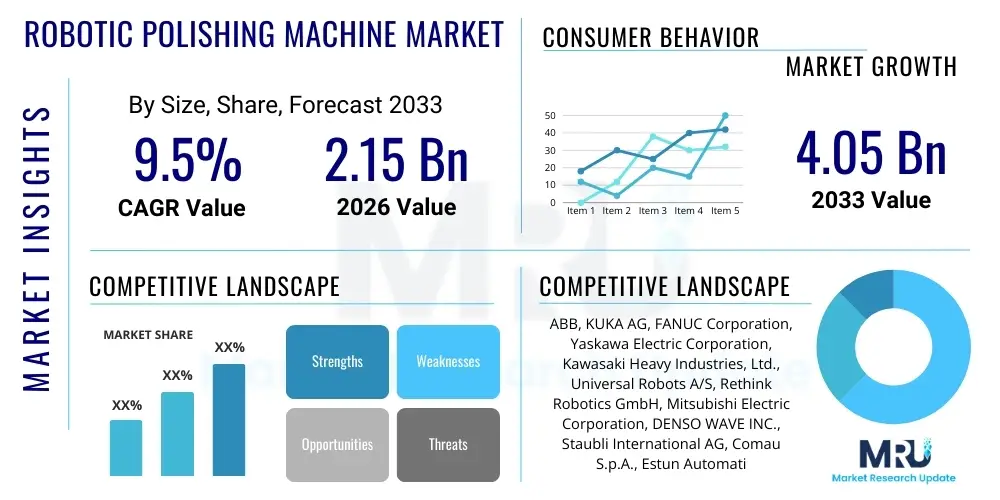

The Robotic Polishing Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 2.15 Billion in 2026 and is projected to reach USD 4.05 Billion by the end of the forecast period in 2033. This substantial growth is driven by increasing automation across various industrial sectors, heightened demand for precision finishing, and the continuous evolution of robotic capabilities, which collectively enhance manufacturing efficiency, consistency, and worker safety across global production lines.

Robotic Polishing Machine Market introduction

The Robotic Polishing Machine Market encompasses automated systems designed to perform intricate surface finishing tasks, including polishing, grinding, deburring, and buffing, with high precision and consistency. These systems integrate advanced robotic arms, specialized end-effectors, sophisticated control software, and sometimes vision systems to achieve superior surface quality on diverse materials and complex geometries. The core product offering typically includes articulated robots, collaborative robots, or SCARA robots equipped with abrasive tools, force sensors, and programming interfaces that allow for meticulous path planning and adaptive polishing processes. These machines are increasingly deployed across manufacturing sectors where manual polishing is labor-intensive, inconsistent, or hazardous, providing a reliable solution for achieving uniform and high-quality finishes, thus addressing critical production challenges and elevating product aesthetics and functionality.

Major applications of robotic polishing machines span a wide array of industries, each benefiting from enhanced automation and precision. In the automotive sector, they are crucial for polishing components like engine parts, molds, and exterior body panels, ensuring both functional integrity and aesthetic appeal. The aerospace industry utilizes these robots for critical surface finishing on turbine blades, structural components, and landing gear, where absolute precision directly impacts performance and safety. Medical and pharmaceutical manufacturers deploy them for polishing surgical instruments, prosthetics, and implants, where sterile, smooth, and precise surfaces are paramount. Beyond these, electronics manufacturing, metal fabrication, and general manufacturing sectors leverage robotic polishing for consumer goods, tooling, and industrial equipment, consistently improving product quality and reducing defects. The inherent benefits of these systems, such as unparalleled accuracy, repeatability, increased throughput, reduced labor costs, and improved worker safety by minimizing exposure to hazardous environments, are significant driving factors fueling their widespread adoption and market expansion.

The robust growth of the Robotic Polishing Machine Market is underpinned by several key driving factors. Foremost among these is the escalating global demand for industrial automation, as companies strive to optimize production processes, mitigate labor shortages, and maintain competitive advantages. The increasing complexity of manufactured parts, particularly in advanced industries, necessitates precision finishing that manual methods often struggle to achieve consistently. Furthermore, a rising emphasis on product quality and aesthetic appeal across consumer and industrial goods markets compels manufacturers to invest in advanced polishing solutions. The continuous technological advancements in robotics, including improvements in robot dexterity, sensor integration, artificial intelligence, and user-friendly programming interfaces, are making these systems more versatile, efficient, and accessible to a broader range of enterprises, significantly expanding their market potential and applicability.

Robotic Polishing Machine Market Executive Summary

The Robotic Polishing Machine Market is currently experiencing dynamic business trends characterized by a strong push towards enhanced automation, particularly in industries facing skilled labor shortages and increasing production demands. Key business trends include the rising integration of Industry 4.0 technologies, such as the Internet of Things (IoT) and cloud connectivity, which enable real-time monitoring, predictive maintenance, and seamless data exchange for optimized polishing operations. There is a discernible shift towards collaborative robots (cobots) that can work safely alongside human operators, making automation more accessible for small and medium-sized enterprises (SMEs) and in applications requiring human-robot interaction. Furthermore, customization and modularity are gaining traction, allowing manufacturers to tailor robotic polishing solutions to specific production needs and adapt to changing product lines more efficiently. The market is also witnessing a surge in demand for comprehensive turnkey solutions that include not just the robot and end-effector but also integrated software, vision systems, and peripheral equipment, simplifying deployment and reducing operational complexities for end-users.

Regionally, the market exhibits varied growth trajectories and adoption patterns. Asia Pacific (APAC) stands out as the fastest-growing region, primarily driven by rapid industrialization, burgeoning manufacturing sectors in China, India, and South Korea, and significant investments in automation technologies across automotive, electronics, and general manufacturing industries. North America and Europe, while representing mature markets, continue to demonstrate steady growth, fueled by the demand for advanced manufacturing techniques, reshoring initiatives, and a strong focus on high-quality precision engineering. These regions are also at the forefront of technological innovation, particularly in AI-driven robotic solutions and collaborative robotics. Emerging economies in Latin America, the Middle East, and Africa are gradually increasing their adoption of robotic polishing machines, spurred by improving industrial infrastructure, foreign direct investments, and a growing recognition of the benefits of automation in improving product quality and efficiency, albeit from a smaller base compared to their developed counterparts.

Segmentation trends within the Robotic Polishing Machine Market reveal distinct patterns of growth and technological preference. By component, the demand for sophisticated end-effectors, force/torque sensors, and advanced software for path planning and adaptive control is experiencing robust growth, reflecting the need for greater precision and flexibility. In terms of robot types, articulated robots continue to dominate due to their versatility and reach, but collaborative robots are rapidly gaining market share, especially in applications requiring operator interaction and ease of programming. Application-wise, polishing and deburring remain the largest segments, though grinding and buffing applications are also seeing increased automation. The automotive industry consistently accounts for the largest share of end-user adoption, driven by stringent quality requirements and high-volume production. However, the electronics, medical, and aerospace sectors are demonstrating significant expansion, investing heavily in robotic polishing to meet the exacting standards for their specialized products, showcasing a diversification of end-user industries.

AI Impact Analysis on Robotic Polishing Machine Market

Artificial Intelligence (AI) is poised to fundamentally transform the Robotic Polishing Machine Market by addressing critical user questions related to precision, adaptability, and operational efficiency. Users are keenly interested in how AI can move beyond pre-programmed paths to enable robots to "learn" and adapt to variations in workpieces, material properties, and environmental conditions, much like a skilled human craftsman. They seek solutions that can dynamically adjust polishing force, speed, and trajectory in real-time based on sensory feedback, ensuring consistent quality even with imperfect input components. Concerns also revolve around the ability of AI to simplify complex programming, reduce setup times for new tasks, and enable predictive maintenance to minimize downtime. The overarching expectation is that AI integration will lead to smarter, more autonomous polishing systems capable of delivering unprecedented levels of accuracy, speed, and cost-effectiveness, thereby expanding the applicability of robotic polishing to more intricate and varied manufacturing scenarios that were previously deemed too challenging for conventional automation.

- Enhanced Adaptive Polishing: AI algorithms enable robots to learn from real-time sensory data (force, vision, tactile) and dynamically adjust polishing parameters such as pressure, speed, and angle to achieve optimal surface finish on irregular or variable workpieces, surpassing the limitations of fixed programming.

- Improved Quality Control and Consistency: AI-driven vision systems can inspect surface quality during and after polishing, identifying defects with higher accuracy than human inspection and feeding back data to the robot for immediate correction, ensuring consistent, defect-free output across entire production runs.

- Predictive Maintenance: AI analyzes operational data from motors, sensors, and tooling to predict potential equipment failures, allowing for proactive maintenance scheduling, minimizing unplanned downtime, and extending the lifespan of robotic polishing systems.

- Simplified Programming and Setup: Machine learning techniques can enable robots to learn new polishing tasks from demonstrations or CAD models, significantly reducing complex manual programming efforts and setup times, making robotic polishing more accessible and efficient for small batch production and diverse product lines.

- Optimized Path Planning: AI can generate more efficient and effective polishing paths, considering factors like material removal rates, tool wear, and surface geometry, leading to faster processing times and reduced consumption of abrasive materials and energy.

- Advanced Force Control: Integration of AI with force/torque sensors allows robots to mimic human dexterity, applying precise and consistent pressure for delicate polishing tasks, which is critical for achieving high-quality finishes on sensitive components without damage.

- Autonomous Problem Solving: AI-powered systems can autonomously detect and diagnose issues during the polishing process, such as tool wear or material inconsistencies, and suggest or implement corrective actions, increasing operational independence and reducing the need for constant human supervision.

- Data-Driven Process Optimization: AI continuously collects and analyzes performance data, providing insights into process bottlenecks, material compatibility, and optimal parameters, driving continuous improvement in efficiency and quality over time.

DRO & Impact Forces Of Robotic Polishing Machine Market

The Robotic Polishing Machine Market is significantly influenced by a complex interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the accelerating demand for industrial automation across manufacturing sectors globally, spurred by rising labor costs, a shortage of skilled manual laborers for delicate finishing tasks, and the imperative to boost productivity. Manufacturers are increasingly seeking solutions that offer consistent quality, high repeatability, and faster cycle times, all of which robotic polishing machines deliver. Furthermore, the growing focus on stringent quality standards and aesthetic requirements for consumer and industrial products, particularly in automotive, aerospace, medical, and electronics industries, necessitates precision finishing that often exceeds human capabilities, thereby fueling the adoption of these advanced robotic systems. The continuous evolution of robot technology, including advancements in dexterity, sensor integration, and user-friendly programming, also serves as a strong driver, making these solutions more versatile and accessible to a wider range of industries.

Despite the strong growth drivers, several restraints pose challenges to market expansion. The high initial capital investment required for robotic polishing systems, including the robot arm, specialized end-effectors, software, and integration costs, can be prohibitive for small and medium-sized enterprises (SMEs) with limited budgets. The complexity of programming, particularly for highly intricate or variable geometries, can also be a barrier, requiring specialized technical expertise that may not be readily available. While AI is mitigating this, the learning curve and integration challenges can slow adoption. Furthermore, safety concerns, especially when collaborative robots are not employed, necessitate comprehensive safety infrastructure and protocols, adding to overall project costs and implementation timelines. The perceived lack of flexibility for very small batch production or highly customized one-off tasks, where the setup time for a robot might outweigh the benefits, also acts as a restraint, though advancements in rapid programming and adaptable tooling are gradually addressing this limitation.

Opportunities for growth in the Robotic Polishing Machine Market are abundant and diverse. The emergence of collaborative robots (cobots) represents a significant opportunity, as they lower the entry barrier for automation by offering easier programming, greater flexibility, and safe human-robot collaboration, making robotic polishing viable for a broader range of applications and businesses. The increasing integration of artificial intelligence (AI) and machine learning (ML) capabilities holds immense potential, enabling robots to perform adaptive polishing, intelligent path planning, and autonomous quality control, which will significantly enhance their versatility and performance. Furthermore, the expansion into new application areas and materials, such as composites, ceramics, and intricate 3D-printed parts, presents untapped market potential. The growth of smart factories and Industry 4.0 initiatives provides a fertile ground for the seamless integration of robotic polishing solutions into interconnected production ecosystems, enabling optimized workflow and data-driven decision-making. External impact forces, such as global economic trends, trade policies, and supply chain disruptions, can influence raw material costs and market demand, while technological advancements from competing automation solutions continue to shape the competitive landscape. Increased environmental regulations for manual polishing processes may also accelerate the shift towards cleaner, more efficient robotic alternatives.

Segmentation Analysis

Segmentation analysis of the Robotic Polishing Machine Market provides a comprehensive understanding of its diverse components, technological applications, and end-user adoption patterns. This granular breakdown is crucial for identifying key growth areas, understanding customer needs, and strategizing market penetration. The market is primarily segmented based on the components that constitute the robotic system, the type of robot employed, the specific application it performs, the end-user industries it serves, the material type being processed, and the payload capacity of the robot, allowing for a multifaceted view of market dynamics and opportunity identification across various dimensions.

- By Component

- Robot Arm: The core robotic manipulator, including articulated, SCARA, Cartesian, and collaborative robot arms, varying in degrees of freedom and reach.

- End-Effectors/Tools: Specialized polishing tools, abrasive belts, buffing wheels, brushes, grinding discs, and other attachments specific to the finishing task.

- Controllers: The hardware and software systems that manage robot movements, coordinate tasks, and interface with other equipment, crucial for precision and repeatability.

- Software: Programming interfaces, simulation software, path planning algorithms, force control software, and AI/ML modules for adaptive polishing and process optimization.

- Vision Systems: Cameras and image processing software used for workpiece detection, defect inspection, part localization, and real-time surface quality assessment.

- Sensors: Force/torque sensors for adaptive polishing, proximity sensors for safety, and other environmental sensors for operational intelligence and feedback.

- By Robot Type

- Articulated Robots: Multi-jointed robots (typically 4-7 axes) offering high flexibility, reach, and payload capacity, suitable for complex polishing tasks.

- SCARA Robots: Selective Compliance Assembly Robot Arm robots, known for speed and precision in a horizontal plane, often used for smaller, flat polishing applications.

- Collaborative Robots (Cobots): Designed for safe interaction with humans, offering ease of programming and deployment, growing rapidly in diverse polishing environments.

- Cartesian Robots: Robots operating on X-Y-Z axes, providing high rigidity and accuracy, often used for linear or planar polishing tasks.

- Delta Robots: Parallel robots known for high speed and precision, typically used for light-payload, high-speed polishing of small parts.

- By Application

- Polishing: Achieving a smooth, reflective surface finish, often involving multiple stages with progressively finer abrasives.

- Deburring: Removing sharp edges or burrs left after machining, ensuring safety and functional integrity of parts.

- Grinding: Abrasive material removal process used to achieve precise dimensions or prepare surfaces for subsequent finishing.

- Buffing: Final surface treatment to enhance luster and smoothness, typically using soft materials and fine compounds.

- Finishing: A broad category encompassing various surface treatments, including cleaning, sanding, and surface preparation.

- By End-User Industry

- Automotive: Polishing of engine components, body panels, molds, and interior parts to meet aesthetic and functional standards.

- Aerospace & Defense: High-precision finishing of turbine blades, structural components, and landing gear, critical for performance and safety.

- Electronics: Polishing of casings, screens, and components for smartphones, laptops, and other consumer electronic devices.

- Medical & Pharmaceutical: Surface finishing of surgical instruments, implants, prosthetics, and pharmaceutical equipment requiring sterile, smooth surfaces.

- Metal Fabrication: Deburring, grinding, and polishing of metal parts, castings, and welds for various industrial applications.

- General Manufacturing: Broad range of applications in consumer goods, furniture, tooling, and other industrial machinery.

- Others: Includes applications in jewelry, eyewear, construction, and research & development.

- By Material Type

- Metals: Ferrous and non-ferrous metals, including steel, aluminum, brass, titanium, and alloys.

- Plastics: Various polymer types used in consumer goods, automotive, and electronics industries.

- Composites: Advanced materials like carbon fiber reinforced polymers, increasingly used in aerospace and automotive.

- Ceramics: High-performance ceramics used in medical, electronics, and industrial applications requiring extreme precision.

- Wood & Stone: For furniture, decorative items, and architectural elements requiring smooth finishes.

- By Payload Capacity

- Low (1-5 kg): Suitable for small, lightweight parts and intricate detailing.

- Medium (5-20 kg): Versatile for a wide range of components, balancing reach and handling capability.

- High (>20 kg): Used for heavy, large workpieces or applications requiring significant force.

Value Chain Analysis For Robotic Polishing Machine Market

The value chain for the Robotic Polishing Machine Market begins with upstream activities, primarily involving the sourcing and manufacturing of essential raw materials and core components. This segment includes suppliers of advanced metals, plastics, and composite materials for robotic arms and end-effectors, as well as manufacturers specializing in high-precision electronic components such as motors, drives, sensors (force/torque, vision, proximity), and sophisticated controllers. Software developers providing operating systems, simulation tools, and AI/ML algorithms also form a critical part of the upstream segment, contributing intellectual property that enhances the robot's capabilities. Key suppliers of abrasive materials, polishing compounds, and specialized tooling are also integral, as the quality and type of these consumables directly impact the efficacy and outcome of the polishing process. The efficiency and reliability of these upstream suppliers are fundamental to the overall quality, performance, and cost-effectiveness of the final robotic polishing solution.

Midstream activities involve the design, assembly, and integration of these components into complete robotic polishing systems. This stage is dominated by major robot manufacturers who develop and assemble the core robot arms and their proprietary controllers. System integrators play a crucial role here, specializing in configuring the robot arm with appropriate end-effectors, developing custom software solutions, and integrating the entire system into the client's existing production line. These integrators often provide application-specific engineering expertise, ensuring that the robotic solution is optimized for the unique polishing requirements of different industries and materials. This segment also includes manufacturers of peripheral equipment such as safety enclosures, workpiece fixtures, and material handling systems that are necessary for a complete and operational robotic polishing cell. The collaborative efforts between robot manufacturers and system integrators are vital for delivering tailored, efficient, and robust solutions to end-users.

The downstream segment primarily focuses on market reach, sales, implementation, and post-sales support. Distribution channels are typically a mix of direct sales by major robot manufacturers for large industrial clients, and indirect channels through a network of distributors and system integrators who serve smaller businesses or offer specialized services. System integrators, in particular, often act as the primary point of contact for end-users, providing consultation, installation, programming, commissioning, and training. Post-sales services, including maintenance, spare parts supply, software updates, and technical support, are critical for ensuring the longevity and optimal performance of robotic polishing machines. The direct channel allows for closer relationships with key accounts and greater control over brand image and service quality, while indirect channels provide broader market penetration and specialized regional support. Effective downstream operations, particularly robust after-sales support, are paramount for customer satisfaction and long-term market competitiveness, driving repeat business and positive referrals.

Robotic Polishing Machine Market Potential Customers

The Robotic Polishing Machine Market caters to a diverse range of potential customers, primarily encompassing manufacturing entities across various industrial sectors that require high-precision surface finishing. The largest segment of end-users includes automotive manufacturers and their tier-1 suppliers, who utilize these robots for polishing engine components, molds, exterior body panels, and interior decorative elements to meet stringent quality and aesthetic standards. The aerospace and defense industry represents another critical customer base, demanding robotic solutions for the precise finishing of high-value components such as turbine blades, structural airframe parts, and landing gear, where surface integrity directly impacts safety and performance. These sectors prioritize consistency, traceability, and the ability to process complex geometries with extreme accuracy, making robotic polishing an indispensable investment for maintaining competitive edge and compliance with regulatory requirements.

Beyond heavy industries, the medical and pharmaceutical sectors are rapidly expanding their adoption of robotic polishing machines. Manufacturers of surgical instruments, orthopedic implants, prosthetics, and pharmaceutical equipment are keen on achieving ultra-smooth, sterile, and precise surfaces to ensure product safety, biocompatibility, and functional efficacy. Robotics in this domain helps in eliminating human error, improving hygiene, and handling delicate components with care, which is vital for regulatory compliance and patient outcomes. Similarly, the electronics industry, particularly manufacturers of smartphones, tablets, and other consumer devices, are significant buyers. They employ robotic polishing for finishing casings, screens, and intricate internal components to achieve flawless aesthetics and tactile feel, crucial for consumer appeal in a highly competitive market, while also handling high-volume production with consistent quality.

Furthermore, general manufacturing and metal fabrication industries form a broad base of potential customers, ranging from small workshops to large-scale industrial plants. These include producers of industrial tools, molds, dies, consumer appliances, and decorative metalwork. Robotic polishing machines are utilized here for deburring, grinding, and surface preparation, enhancing the durability, appearance, and functional fit of components. The continuous evolution of collaborative robots is also opening up new avenues within small and medium-sized enterprises (SMEs) that previously found traditional automation too complex or costly. These SMEs are increasingly investing in more accessible robotic polishing solutions to improve product quality, increase efficiency, and address skilled labor shortages, signifying a growing and dynamic customer segment across a wide spectrum of manufacturing operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 4.05 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Kawasaki Heavy Industries, Ltd., Universal Robots A/S, Rethink Robotics GmbH, Mitsubishi Electric Corporation, DENSO WAVE INC., Staubli International AG, Comau S.p.A., Estun Automation Co., Ltd., Seiko Epson Corporation, Omron Corporation, Nachi-Fujikoshi Corp., Elite Robots, Techman Robot Inc., F&P Robotics AG, TM Robotics (Toshiba Machine), AUBO Robotics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Robotic Polishing Machine Market Key Technology Landscape

The Robotic Polishing Machine Market is characterized by a rapidly evolving technology landscape, with continuous innovations driving improvements in precision, flexibility, and autonomy. A core technological advancement is the integration of advanced force/torque sensors directly into the robot's wrist or polishing tool. These sensors provide real-time feedback on the contact force between the tool and the workpiece, enabling the robot to maintain consistent pressure regardless of variations in part geometry or material, which is critical for achieving uniform surface finishes. This force control capability closely mimics the dexterity of a human operator, allowing for delicate and adaptive polishing that was previously challenging for traditional industrial robots. Furthermore, the development of specialized end-effectors and quick-change tooling systems allows robots to rapidly switch between different abrasive materials or polishing techniques, enhancing versatility and reducing setup times for diversified production lines.

Another pivotal technological area is the integration of sophisticated machine vision systems and artificial intelligence (AI) into robotic polishing cells. Vision systems, often employing 2D or 3D cameras, are used for precise workpiece localization, allowing the robot to accurately identify parts even if they are not perfectly positioned. More advanced applications involve defect detection and real-time surface quality assessment, where AI algorithms analyze visual data to identify imperfections and guide the robot to re-polish specific areas, ensuring an exceptionally high standard of finish. AI and machine learning are also revolutionizing path planning and programming. Instead of laborious manual teaching, AI can generate optimized polishing paths based on CAD models or by learning from human demonstrations, significantly reducing the complexity and time required for job setup. This adaptive intelligence makes robotic polishing more viable for small batch production and complex, custom parts.

The rise of collaborative robotics (cobots) represents a transformative shift, bringing automation closer to human workspaces with inherent safety features. Cobots designed for polishing tasks are typically lighter, easier to program, and can operate without extensive safety guarding, reducing overall installation costs and footprint. Their intuitive programming interfaces, often involving lead-through teaching, make them accessible to operators without specialized robotics expertise, democratizing robotic polishing for small and medium-sized enterprises. Moreover, connectivity solutions like Industrial IoT (IIoT) and cloud integration are becoming standard, enabling remote monitoring, data analytics, and predictive maintenance for robotic polishing systems. This network capability facilitates data-driven process optimization, allows for proactive servicing, and integrates the polishing cell seamlessly into a broader smart factory ecosystem, enhancing overall operational efficiency and productivity across the manufacturing value chain.

Regional Highlights

- North America: A mature market characterized by high adoption rates in automotive, aerospace, and medical industries, driven by advanced manufacturing initiatives, skilled labor shortages, and a strong emphasis on precision and quality. The U.S. leads in R&D and technological innovation, particularly in AI-driven and collaborative robotic solutions.

- Europe: A significant market with high industrial automation in countries like Germany, Italy, and France. Strong presence in automotive, metal fabrication, and general manufacturing sectors, focusing on high-quality production and energy efficiency. Growing interest in collaborative robots for small and medium-sized enterprises (SMEs).

- Asia Pacific (APAC): The fastest-growing and largest market globally, primarily fueled by robust industrial expansion in China, Japan, South Korea, and India. Driven by high-volume manufacturing in electronics, automotive, and consumer goods, coupled with government support for automation and Industry 4.0 initiatives.

- Latin America: An emerging market with increasing investments in industrialization, particularly in Brazil and Mexico, driven by foreign direct investments in automotive and general manufacturing. Adoption is growing as industries seek to improve efficiency and product quality to compete globally.

- Middle East and Africa (MEA): A nascent but growing market, with increasing automation adoption in industries such as oil & gas, metal fabrication, and automotive (e.g., in South Africa and Saudi Arabia). Investments in infrastructure and diversification of economies are driving demand for advanced manufacturing technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Robotic Polishing Machine Market.- ABB

- KUKA AG

- FANUC Corporation

- Yaskawa Electric Corporation

- Kawasaki Heavy Industries, Ltd.

- Universal Robots A/S

- Rethink Robotics GmbH

- Mitsubishi Electric Corporation

- DENSO WAVE INC.

- Staubli International AG

- Comau S.p.A.

- Estun Automation Co., Ltd.

- Seiko Epson Corporation

- Omron Corporation

- Nachi-Fujikoshi Corp.

- Elite Robots

- Techman Robot Inc.

- F&P Robotics AG

- TM Robotics (Toshiba Machine)

- AUBO Robotics

Frequently Asked Questions

What are the primary benefits of implementing robotic polishing machines in manufacturing?

Robotic polishing machines deliver substantial benefits including unparalleled consistency and repeatability in surface finish, leading to higher product quality and reduced rework. They significantly increase production throughput and efficiency, reduce labor costs by automating labor-intensive tasks, and enhance worker safety by minimizing exposure to hazardous environments and repetitive strain injuries. These systems also offer precision for complex geometries and allow for continuous operation, contributing to overall operational excellence.

How does artificial intelligence (AI) enhance the capabilities of robotic polishing machines?

AI significantly elevates robotic polishing capabilities by enabling adaptive control, allowing robots to adjust polishing parameters in real-time based on sensory feedback from force, vision, and tactile sensors, thereby handling workpiece variations dynamically. AI-driven vision systems improve quality control through autonomous defect detection and correction. Furthermore, AI simplifies complex programming through learning from demonstrations or CAD models, optimizes polishing paths for efficiency, and supports predictive maintenance, making robots smarter, more versatile, and easier to deploy for intricate tasks.

Which industries are the largest adopters of robotic polishing technology?

The automotive industry is the largest adopter, utilizing robotic polishing for engine components, body panels, and molds to meet high aesthetic and functional standards. The aerospace and defense sector is another major user, requiring extreme precision for critical parts like turbine blades. Other significant industries include electronics (for consumer device casings), medical and pharmaceutical (for surgical instruments and implants), and metal fabrication, all demanding superior surface quality, consistency, and efficient production processes.

What are the main challenges hindering the widespread adoption of robotic polishing?

Key challenges include the high initial capital investment required for robotic polishing systems, which can be prohibitive for small and medium-sized enterprises. The complexity of programming for highly intricate or variable parts and the need for specialized technical expertise can also be a barrier. Additionally, safety concerns necessitate robust safety measures, and while improving, a perceived lack of flexibility for very small batch production or one-off custom tasks can sometimes outweigh the benefits of automation, impacting broader market penetration.

What is the future outlook for the Robotic Polishing Machine Market, considering emerging trends?

The future outlook for the Robotic Polishing Machine Market is highly positive, driven by accelerating trends in industrial automation, AI and machine learning integration, and the proliferation of collaborative robots (cobots). These advancements will lead to more intelligent, flexible, and user-friendly systems capable of handling even greater complexity and variability. The market is expected to expand into new materials and application areas, with growing adoption in SMEs and emerging economies, ultimately fostering increased efficiency, higher quality standards, and enhanced safety across global manufacturing sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Robotic Polishing Machine Sales Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Robotic Polishing Machine Market Size Report By Type (Robotic Polishing Machine with Polishing Tools, Robotic Polishing Machine with Workpiece), By Application (Automotive, Electronics, Hardware & Tool, Household Products, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager