Rotavator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434262 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Rotavator Market Size

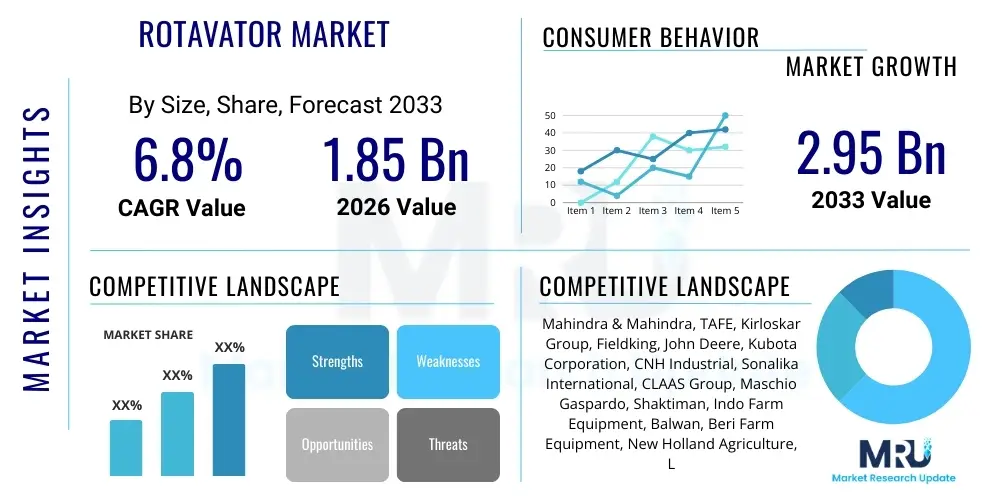

The Rotavator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.85 billion in 2026 and is projected to reach USD 2.95 billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the increasing global emphasis on agricultural mechanization, especially in emerging economies seeking to enhance farm productivity and efficiency. The shift from traditional manual and animal-drawn methods to mechanized soil preparation implements remains a core factor expanding the market size.

The valuation reflects robust demand across various farm sizes, with commercial farming operations being the primary consumers of high-capacity rotavators. Factors such as governmental subsidies aimed at promoting farm machinery adoption, particularly in key agricultural hubs like India and China, are accelerating market expansion. Furthermore, the necessity for timely and efficient seedbed preparation, crucial for maximizing crop yields and managing the tight windows between harvesting and planting, sustains the high adoption rate of these implements globally.

The projected increase in market size also incorporates the steady innovation within the segment, including the development of multi-speed gearboxes, lightweight yet durable materials, and tailored rotavators for specialized crops such as vineyards and orchards. Manufacturers are continuously focusing on improving power efficiency and reducing operational costs, making rotavators a more economically viable investment for small and medium-scale farmers, thus solidifying the market's upward trajectory towards the projected 2033 valuation.

Rotavator Market introduction

The Rotavator Market encompasses the manufacturing, distribution, and sale of engine-powered rotary tillage implements primarily used in agriculture for soil preparation. A rotavator, or rotary tiller, utilizes rotating blades to break up, aerate, and mix the soil, creating a fine seedbed ideal for planting. This mechanical process is significantly more efficient than traditional plowing methods, reducing the need for multiple passes and conserving soil moisture. The primary products within this market include tractor-mounted rotavators, power tillers, and specialized rotary cultivators tailored for specific soil types and crop requirements.

Major applications of rotavators span across diverse agricultural practices, including field preparation for cereals (wheat, rice), cash crops (sugarcane, cotton), vegetables, and horticultural planting. Key benefits derived from using rotavators include improved soil structure, effective weed control, better incorporation of crop residue and manure, and substantial savings in time and fuel consumption compared to conventional plowing and harrowing processes. Their versatility allows them to be used for initial primary tillage or secondary cultivation, depending on soil conditions and the depth required for planting.

The market is primarily driven by the escalating global population demanding higher food production, necessitating intensive and efficient farming practices. Other significant driving factors include increasing labor costs, which push farmers towards mechanization; governmental initiatives promoting farm equipment through subsidies and credit facilities; and the technological advancements leading to more durable, fuel-efficient, and versatile rotavator models suitable for varied terrain and operational requirements worldwide. These elements collectively reinforce the market's stability and future growth prospects.

Rotavator Market Executive Summary

The Rotavator Market is characterized by robust growth anchored in the global shift toward intensive and mechanized farming. Business trends indicate strong competition centered on product differentiation, particularly focusing on incorporating smart features, developing specialized implements for niche crops, and enhancing durability through advanced metallurgy. Key market participants are pursuing strategic mergers, acquisitions, and collaborations with regional distributors to secure wider market penetration, especially in the high-growth Asia Pacific region. Furthermore, there is an observable trend towards providing comprehensive after-sales service and extended warranties to bolster customer loyalty and perception of value.

Regionally, the Asia Pacific dominates the market due to the enormous agricultural land base, high population density, and significant governmental focus on boosting agricultural productivity through subsidies and schemes promoting farm mechanization in countries like India, China, and Southeast Asian nations. North America and Europe, while mature, exhibit steady demand driven by the replacement cycle of existing equipment and the adoption of advanced, high-precision rotavator technologies suited for large-scale corporate farming. Latin America and the Middle East & Africa (MEA) represent high-potential emerging markets where agricultural modernization efforts are steadily gaining momentum.

Segment trends reveal that the most significant growth is observed in the medium horsepower (40 HP to 60 HP) segment, as these models offer an optimal balance of power, versatility, and cost-effectiveness suitable for the majority of small and medium-sized farms globally. In terms of end-use, the market for rotavators used in general cultivation (cereals and pulses) holds the largest share, but rapid adoption is noted in specialized segments such as horticulture and plantation farming, necessitating custom-designed tillers. Material and design innovation, such as the increasing use of boron steel blades for enhanced longevity, is a critical segment trend influencing purchasing decisions.

AI Impact Analysis on Rotavator Market

Common user questions regarding AI's impact on the Rotavator Market frequently revolve around how artificial intelligence and associated technologies like IoT and machine learning can enhance tillage efficiency, predict maintenance needs, and optimize soil preparation based on real-time data. Users are primarily concerned with whether AI integration will lead to fully autonomous rotavating operations, improved fuel efficiency through automated depth and speed adjustments, and better integration with overall farm management systems. The key themes summarized from user intent point toward the expectation of transitioning rotavators from purely mechanical implements to smart, connected devices capable of dynamic, prescription-based soil tillage, ensuring maximum resource efficiency and minimizing operator intervention. This focus on automation and precision is expected to redefine the value proposition of modern rotavators, making them integral components of smart farming ecosystems.

- AI-powered systems enable predictive maintenance by analyzing sensor data (vibration, temperature, power draw) to forecast potential component failures, reducing downtime.

- Integration with GPS and machine learning algorithms allows for variable-rate tillage, adjusting the depth and speed of the rotavator dynamically based on soil composition, moisture content, and topography data gathered in real-time.

- AI supports the development of fully autonomous or semi-autonomous tractor-rotavator combinations, optimizing field coverage paths (path planning) and minimizing overlap, thereby saving fuel and time.

- Machine vision combined with AI can enhance weed recognition and targeted tillage in specialized applications, ensuring precision soil disturbance only where necessary.

- Data analytics driven by AI processes historical operation data to provide optimal settings recommendations to the farmer, maximizing the quality of the seedbed preparation.

DRO & Impact Forces Of Rotavator Market

The dynamics of the Rotavator Market are governed by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), forming potent Impact Forces. Key drivers propelling the market include government subsidies and incentive programs promoting agricultural machinery, the critical need for efficient and timely soil preparation to improve global food security, and the persistent shortage and rising cost of manual farm labor, pushing rapid adoption of mechanization. Conversely, restraints primarily involve the high initial capital investment required for heavy-duty machinery, the dependence of rotavators on tractor power units, and challenges associated with the fragmentation of land holdings, particularly in emerging economies, which complicates the use of large equipment. Opportunities lie in the increasing integration of precision farming technologies, the development of lighter, more robust materials, and the growing focus on energy-efficient and specialized rotavators tailored for minimum tillage practices and specific crop types.

The major impact forces shaping the competitive landscape include regulatory changes that mandate stricter emissions standards for agricultural machinery, pushing manufacturers towards cleaner technologies. Technological advancement acts as a positive force, driving innovation in blade design, gearbox technology (like multi-speed or heavy-duty gearboxes), and the incorporation of telematics for remote monitoring and diagnostics. Economic fluctuations, particularly commodity prices and farm incomes, exert a strong indirect impact, influencing farmers' purchasing power and willingness to invest in new equipment. The continuous pressure to enhance crop yield per unit area globally ensures sustained demand for high-efficiency tillage equipment, making productivity gains a foundational impact force.

The balance between these forces dictates market trajectory. While initial investment costs and land fragmentation serve as headwinds, the overwhelming global necessity for productivity enhancement, supported by enabling governmental policies and technological breakthroughs in automation and durability, significantly outweighs the restraints. This environment fosters a resilient market where manufacturers compete not just on price, but increasingly on the total cost of ownership, serviceability, and advanced features that contribute directly to farm profitability and sustainability efforts.

Segmentation Analysis

The Rotavator Market is comprehensively segmented based on several key criteria, including the mounting type, horsepower (HP) capacity of the compatible tractor, the type of drive system employed, and the end-use application. Understanding these segments is crucial for manufacturers tailoring product offerings and for stakeholders analyzing market penetration strategies. The dominant segmentation remains based on HP, as this parameter directly correlates with the size and operational capacity of the rotavator and its suitability for different farm sizes, ranging from compact models for small-scale farms to heavy-duty variants for large corporate operations. Geographical segmentation further defines market dynamics, highlighting key consumption patterns and specific product requirements across regions like Asia Pacific, North America, and Europe.

- By Mounting Type

- Tractor Mounted Rotavator (3-point linkage)

- Walk-Behind/Power Tiller Mounted Rotavator

- By Horsepower (HP) Capacity

- Below 40 HP (Light Duty)

- 40 HP to 60 HP (Medium Duty)

- Above 60 HP (Heavy Duty)

- By Drive Type

- Gear Drive Rotavators

- Chain Drive Rotavators

- By Blade Type

- L Type Blades

- C Type Blades

- J Type Blades

- By Application

- Cereals and Pulses Cultivation

- Cash Crops (Sugarcane, Cotton)

- Horticulture and Vegetables

- Orchard and Vineyard Tillage (Specialized)

Value Chain Analysis For Rotavator Market

The Value Chain of the Rotavator Market commences with upstream activities focusing on raw material procurement, primarily high-grade steel and specialized alloys required for manufacturing durable gearboxes, transmission components, and high-wear rotor blades. Key upstream suppliers include specialized steel mills and component manufacturers (bearings, seals, PTO shafts). Efficiency in this stage is critical, as material quality directly impacts the lifespan and performance of the final product. Strong relationships with reliable steel suppliers are essential to mitigate price volatility and ensure compliance with quality standards, such as those related to boron steel used for high-durability blades.

The manufacturing and assembly stage involves core processes such as forging, casting, machining, heat treatment of blades, and final assembly, often utilizing highly automated production lines to achieve economies of scale. Direct channels for distribution involve major manufacturers selling directly to large corporate farms or government entities procuring equipment in bulk. However, the indirect distribution channel remains dominant, utilizing an extensive network of regional dealers, authorized distributors, and local agricultural equipment stores. These intermediate players often provide essential functions such as localized marketing, inventory management, spare parts supply, and critical after-sales support and repair services, which are non-negotiable for farmers.

Downstream activities center on end-user adoption and post-sale services. The effectiveness of the indirect channel, characterized by strong dealer support and technical expertise, significantly influences farmer purchasing decisions. Post-sale services, including maintenance, warranty fulfillment, and the ready availability of genuine spare parts, complete the value chain, ensuring the sustained operational longevity of the equipment and minimizing farm downtime. Optimization across the entire value chain, from raw material sourcing to service delivery, is necessary for maintaining competitive advantage and maximizing customer lifetime value.

Rotavator Market Potential Customers

The primary potential customers and end-users of the Rotavator Market are diverse and segmented based on their farming scale, geographical location, and crop specialization. The largest demographic comprises small and medium-scale farmers, particularly prevalent in the Asia Pacific region, who require reliable, fuel-efficient rotavators (often in the 30-50 HP range) to replace labor-intensive methods and manage mixed cropping systems. These buyers are highly price-sensitive but prioritize durability and local availability of spare parts and maintenance services.

A second crucial customer segment involves large commercial and corporate farms, predominantly found in North America, Europe, and parts of Latin America. These operations demand heavy-duty, high-capacity rotavators (60+ HP) that are often integrated with advanced precision agriculture systems, focusing heavily on operational speed, efficiency, and data connectivity. Their purchasing decisions are driven by total cost of ownership and technological integration capabilities.

Finally, niche end-users include specialized agricultural entities such as fruit orchards, vineyards, and horticultural greenhouses, which require specialized, narrower, or adjustable-width rotavators for inter-row cultivation. Additionally, government agricultural departments and rental agencies also represent significant institutional buyers, purchasing large fleets of standard machinery to support community farming initiatives or offer equipment on hire to smaller landholders, thus acting as influential indirect purchasers in the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 billion |

| Market Forecast in 2033 | USD 2.95 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mahindra & Mahindra, TAFE, Kirloskar Group, Fieldking, John Deere, Kubota Corporation, CNH Industrial, Sonalika International, CLAAS Group, Maschio Gaspardo, Shaktiman, Indo Farm Equipment, Balwan, Beri Farm Equipment, New Holland Agriculture, Lemken, Roto Seed, VST Tillers Tractors, Same Deutz-Fahr, Vermeer Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rotavator Market Key Technology Landscape

The Rotavator Market's technological landscape is rapidly evolving, moving beyond simple mechanical tillage to incorporate advanced engineering and digital solutions aimed at maximizing soil health and operational efficiency. A core technological focus is on enhancing the durability and material science of the tilling components. This includes the widespread adoption of high-carbon boron steel alloys for manufacturing rotor blades, which significantly extends their lifespan and resistance to wear in abrasive soil conditions, reducing the frequency of replacement and maintenance costs for farmers.

Furthermore, transmission technology is undergoing substantial optimization. The shift towards multi-speed gearboxes in rotavators allows operators to select the optimal rotor speed independently of the tractor's PTO speed and ground speed. This versatility is crucial for achieving different soil tilth requirements (coarse for primary tillage, fine for seedbed preparation) and adapting to varying soil moisture levels, leading to better fuel economy and superior soil preparation results. Heavy-duty chain drives and specialized sealed gear drives are also being developed to handle the increasing horsepower capacity of modern tractors effectively.

The integration of IoT (Internet of Things) and telematics represents the future direction of rotavator technology. Sensor-based systems are being deployed to monitor key operational parameters such as depth, vibration levels, and instantaneous power consumption. This data can be transmitted to the farmer or fleet manager via cloud platforms, enabling remote diagnostics, tracking operational efficiency, and facilitating predictive maintenance schedules, thereby reducing unexpected breakdowns and increasing overall machine utilization rates within a sophisticated digital farming infrastructure.

Regional Highlights

Regional dynamics heavily influence the Rotavator Market, driven by climate, farm structure, and governmental support for agriculture.

- Asia Pacific (APAC) stands as the dominant and fastest-growing region, primarily fueled by massive government subsidies supporting agricultural mechanization in countries like India, China, and Indonesia. The need for compact and medium-duty rotavators suitable for small land holdings drives high volume demand.

- North America is characterized by high adoption of large, heavy-duty rotavators (Above 60 HP), often integrated with GPS guidance and sophisticated monitoring systems, catering to large-scale commodity farming operations and emphasizing precision agriculture practices.

- Europe represents a mature market focusing intensely on sustainable and minimum tillage solutions. Demand here is driven by technological replacement cycles and a preference for high-quality, specialized implements designed to meet stringent environmental regulations regarding soil erosion and structure preservation.

- Latin America, particularly Brazil and Argentina, shows significant potential due to the expansion of commercial farming operations and increasing investment in modernizing agricultural infrastructure, creating strong demand for durable and high-capacity equipment.

- Middle East and Africa (MEA) are emerging markets, where rapid population growth and initiatives to enhance local food security are accelerating the adoption of basic and semi-advanced mechanization, ensuring steady, albeit smaller, market growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rotavator Market.- Mahindra & Mahindra Ltd.

- TAFE - Tractors and Farm Equipment Limited

- Kirloskar Group (Kirloskar Oil Engines Ltd.)

- Fieldking (Balwan Implements)

- John Deere (Deere & Company)

- Kubota Corporation

- CNH Industrial N.V. (Case IH, New Holland)

- Sonalika International Tractors Ltd.

- CLAAS Group

- Maschio Gaspardo S.p.A.

- Shaktiman (Tirth Agro Technology)

- Indo Farm Equipment Limited

- Beri Farm Equipment (BFE)

- Lemken GmbH & Co. KG

- Roto Seed (Rotary Tillage Systems)

- VST Tillers Tractors Ltd.

- Same Deutz-Fahr Group

- Vermeer Corporation

- Yanmar Holdings Co., Ltd.

- Escorts Kubota Limited

Frequently Asked Questions

Analyze common user questions about the Rotavator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for rotavators globally?

The primary driver is the accelerating need for agricultural mechanization, particularly in developing nations, driven by increasing labor costs, government subsidies on farm equipment, and the imperative to achieve higher crop yields through efficient and timely soil preparation.

How does the type of drive system affect rotavator performance?

Rotavators primarily use gear drive or chain drive systems. Gear drive systems are generally preferred for heavy-duty applications and higher horsepower tractors due to their greater durability and lower maintenance requirements, offering more reliable power transmission in challenging soil conditions.

Which geographical region holds the largest market share in the Rotavator Market?

The Asia Pacific region, led by countries like India and China, holds the largest market share due to its vast agricultural land base, high volume of small and medium farms, and extensive governmental support for the adoption of farm machinery through subsidy schemes.

What are the key technological advancements observed in modern rotavators?

Key technological advancements include the use of durable boron steel blades, the integration of multi-speed gearboxes for versatile tillage control, and the deployment of telematics and IoT sensors for predictive maintenance and real-time operational monitoring within precision agriculture frameworks.

What is the estimated Compound Annual Growth Rate (CAGR) for the Rotavator Market from 2026 to 2033?

The Rotavator Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period from 2026 to 2033, reflecting consistent investment in agricultural efficiency and mechanization worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager