Saccharin Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440244 | Date : Jan, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Saccharin Market Size

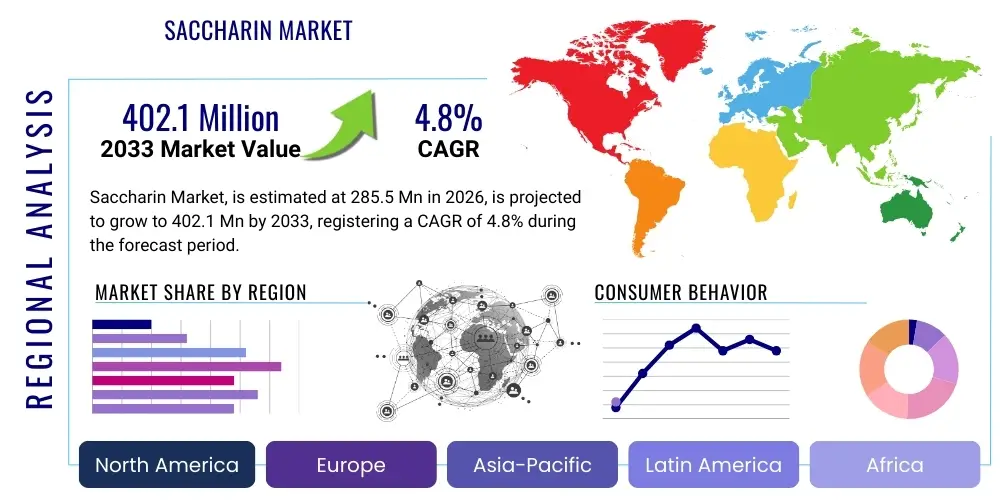

The Saccharin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 285.5 Million in 2026 and is projected to reach USD 402.1 Million by the end of the forecast period in 2033. This substantial growth trajectory is primarily driven by the escalating global demand for low-calorie and sugar-free food and beverage products, a direct response to rising health consciousness among consumers worldwide. As the prevalence of chronic diseases such as obesity and diabetes continues to increase, there is a sustained shift towards dietary alternatives that offer sweetness without contributing to caloric intake or blood sugar spikes. Saccharin, with its distinct advantages of being a zero-calorie, non-cariogenic, and highly cost-effective sweetener, positions itself as a critical ingredient in this evolving market landscape. Furthermore, supportive regulatory frameworks in many countries, which acknowledge saccharin's long-standing safety profile, coupled with its exceptional stability across various processing conditions, solidify its indispensability for manufacturers seeking reliable and economical sugar substitutes. The continuous innovation in food formulation and the expansion of the pharmaceutical sector into palatable sugar-free medications further bolster this market's upward trend, ensuring its robust growth throughout the forecast period.

Saccharin Market introduction

The Saccharin Market encompasses the global commercial ecosystem involved in the synthesis, distribution, and utilization of saccharin, an intensely sweet artificial compound derived from toluene or phthalic anhydride. Discovered in 1879 by Constantin Fahlberg, saccharin holds a distinguished place as one of the earliest and most extensively studied synthetic sweeteners, renowned for its profound sweetness intensity, which is approximately 300 to 400 times greater than that of sucrose, yet it contributes absolutely no dietary calories or carbohydrates. The primary product form dominating the market is sodium saccharin, favored for its superior solubility in water and remarkable thermal stability, making it suitable for a wide array of industrial applications, including baking and high-temperature processing. Complementary forms, such as calcium saccharin, address specific dietary requirements by offering a sodium-free alternative, while acid saccharin finds specialized uses as an intermediate in chemical syntheses or in formulations demanding particular pH characteristics. The major applications of saccharin are vast and diverse, spanning critical sectors such as the food and beverage industry, where it is a staple in diet soft drinks, sugar-free confectioneries, baked goods, canned fruits, and tabletop sweeteners, enabling consumers to enjoy sweet treats without the associated caloric burden. Beyond edibles, saccharin is indispensable in pharmaceuticals for taste-masking bitter active ingredients in syrups, chewable tablets, and oral suspensions, significantly improving patient compliance, especially among pediatric and geriatric populations. In the personal care domain, it is incorporated into toothpastes and mouthwashes to impart sweetness without promoting dental caries, aligning with oral hygiene objectives. Moreover, its role extends to animal feed as a palatability enhancer, encouraging feed intake in livestock. The principal benefits of saccharin are multifold: its non-caloric nature makes it ideal for weight management and diabetic diets; its non-cariogenic property contributes to dental health; and its exceptional stability under various pH and temperature conditions ensures consistent performance across diverse product formulations. These inherent advantages, coupled with its economic viability, render saccharin a highly attractive and versatile sweetener. The market's dynamic expansion is fundamentally propelled by several potent driving factors, including the escalating global health crisis characterized by rising rates of obesity and type 2 diabetes, which necessitate effective sugar reduction strategies. Increased consumer awareness regarding the health implications of excessive sugar intake further fuels the demand for sugar substitutes. Furthermore, supportive and evolving regulatory landscapes in key global markets, which increasingly promote sugar reduction initiatives and approve the safe use of high-intensity sweeteners, provide a fertile ground for saccharin's continued market penetration. The inherent cost-effectiveness of saccharin compared to many other high-intensity sweeteners also makes it a preferred choice for manufacturers, especially in highly competitive and price-sensitive markets, solidifying its pivotal role in the global sweetener industry and ensuring its sustained growth and innovation.

Saccharin Market Executive Summary

The global Saccharin Market is currently characterized by a vibrant interplay of evolving business trends, significant regional shifts, and nuanced segment-specific dynamics, all converging to shape a robust growth trajectory. In terms of business trends, the industry is witnessing a pronounced focus on strategic partnerships and collaborations among manufacturers and food and beverage companies, aimed at developing innovative product formulations that leverage saccharin's sweetness while addressing consumer preferences for cleaner taste profiles and blends with other high-intensity sweeteners. There is an increasing investment in research and development to enhance saccharin's sensory attributes and to explore its synergistic potential when combined with sweeteners like stevia or erythritol, reducing any potential metallic aftertaste and achieving a more sugar-like flavor. Furthermore, manufacturers are prioritizing sustainable and environmentally friendly production processes, driven by growing corporate social responsibility demands and stricter environmental regulations, leading to investments in greener chemical synthesis routes and waste reduction technologies. Supply chain optimization, incorporating digital tools for better inventory management and logistics, is also a critical business trend, ensuring resilience against disruptions and improving cost-efficiency across the value chain. Regionally, the Asia Pacific continues to emerge as the undisputed powerhouse of saccharin consumption and production, spearheaded by economic giants like China and India. This dominance is attributable to rapid urbanization, expanding middle-class populations with increasing disposable incomes, and the growing influence of Western dietary habits which often include diet and processed foods. The region also benefits from a large manufacturing base for various food ingredients. North America and Europe, while being mature markets, exhibit stable and consistent demand, driven by well-established health and wellness trends and an aging demographic that often seeks sugar-reduced options. These regions are also characterized by rigorous regulatory oversight, which provides a framework for safe sweetener usage. Latin America and the Middle East & Africa are rapidly gaining prominence as high-growth potential markets, propelled by demographic expansion, rising health consciousness, and increasing awareness about the link between diet and non-communicable diseases, creating new avenues for market penetration. Segment-wise, the food and beverage sector remains the largest and most dynamic application area for saccharin, with particular growth observed in categories like diet sodas, functional beverages, sugar-free confectionery, and dairy alternatives, catering to a diverse range of consumer preferences. The pharmaceutical segment is experiencing steady, predictable growth, driven by an expanding global healthcare industry and the continuous demand for palatable drug formulations that are sugar-free. The personal care and animal feed segments, though smaller, are also demonstrating consistent expansion, underscoring saccharin's versatile utility. Overall, the market's executive overview highlights a resilient and adaptable industry, actively responding to consumer demands for healthier food options, embracing technological advancements, and strategically navigating a diverse global regulatory and competitive landscape to ensure sustained growth and market relevance.

AI Impact Analysis on Saccharin Market

The integration of Artificial Intelligence (AI) is poised to exert a transformative influence across multiple facets of the Saccharin Market, fundamentally reshaping production methodologies, supply chain resilience, and innovative product development. Users frequently express interest in how AI could revolutionize the efficiency and purity of saccharin synthesis, envisioning AI-powered predictive models that optimize reaction conditions, minimize energy consumption, and reduce waste streams, thereby leading to more cost-effective and environmentally sustainable manufacturing processes. There is also significant anticipation regarding AI's capability to enhance quality control, with inquiries focusing on automated inspection systems capable of real-time impurity detection and quality assurance, surpassing traditional manual methods. Furthermore, the role of AI in accelerating the discovery and formulation of novel sweetener blends, particularly those that synergistically combine saccharin with other high-intensity sweeteners to achieve a more balanced and sugar-like taste profile without an undesirable aftertaste, is a key area of user curiosity. Market participants are also keen to understand how AI-driven market intelligence can provide granular insights into consumer preferences, demand forecasting, and competitive landscapes, enabling more targeted product innovation and strategic market positioning for saccharin-containing products. Concerns, however, are not negligible; they often center on the substantial upfront capital investment required for implementing sophisticated AI infrastructure, the complexities associated with integrating AI systems into existing legacy manufacturing environments, and the critical need for developing a skilled workforce proficient in AI operations and data analytics. Data privacy and security, especially concerning sensitive market and consumer data utilized by AI algorithms, also represent pertinent anxieties within the industry. Despite these challenges, the overwhelming expectation is that AI will be a pivotal enabler for greater operational precision, accelerate the pace of product innovation by streamlining R&D cycles, create more adaptive and resilient supply chains that can swiftly respond to market dynamics, and ultimately foster a new era of competitiveness within the saccharin industry, ensuring higher quality products and more efficient resource utilization for both manufacturers and end-users.

- Optimized Chemical Synthesis and Production Efficiency: AI algorithms can analyze vast datasets from chemical reactions to identify optimal parameters for saccharin synthesis, including temperature, pressure, and catalyst concentrations, thereby maximizing yield, reducing reaction times, and minimizing raw material waste. This leads to substantial cost reductions and improved resource utilization.

- Advanced Quality Control and Purity Assurance: Leveraging machine learning models, AI-powered vision systems and spectroscopic analysis can conduct continuous, real-time monitoring of saccharin during various production stages. This enables instant detection of impurities, off-spec products, or inconsistencies, ensuring superior product purity and compliance with stringent food and pharmaceutical standards with unprecedented accuracy.

- Predictive Analytics for Supply Chain Management: AI systems can analyze historical sales data, seasonal trends, macroeconomic indicators, and even real-time news to forecast demand for saccharin and its raw materials with high precision. This facilitates optimized procurement, inventory management, and logistics, reducing lead times, preventing stockouts, and mitigating supply chain risks effectively.

- Accelerated Research and Development of Novel Formulations: AI-driven computational chemistry and molecular modeling can simulate interactions between saccharin and other compounds, rapidly identifying potential synergistic sweetener blends that offer improved taste profiles, stability, and functional properties. This significantly shortens the R&D cycle for new saccharin-based products or applications.

- Personalized Nutrition and Custom Product Development: AI can analyze individual dietary needs, health conditions, and taste preferences to recommend customized food and beverage formulations that incorporate saccharin as a sugar substitute. This opens avenues for bespoke products tailored to specific consumer segments, enhancing market responsiveness and product relevance.

- Automated Manufacturing Processes and Process Control: Robotic process automation (RPA) integrated with AI can manage and control various stages of saccharin production, from automated weighing and mixing of ingredients to crystallization and packaging. This reduces reliance on manual labor, minimizes human error, and ensures consistent product quality and throughput.

- Market Trend Analysis and Consumer Behavior Insights: AI-powered natural language processing (NLP) and sentiment analysis can process massive amounts of consumer feedback, social media data, and market reports to identify emerging trends, unmet needs, and public perceptions regarding saccharin. This valuable intelligence guides product innovation and targeted marketing strategies.

- Energy Consumption Optimization: AI algorithms can monitor and control energy usage across saccharin manufacturing facilities, optimizing heating, cooling, and ventilation systems. This leads to significant energy cost savings and a reduction in the carbon footprint, aligning with global sustainability goals.

- Enhanced Safety and Risk Management: AI can predict potential equipment failures or operational hazards by analyzing sensor data from production machinery, enabling proactive maintenance and preventing costly downtime or safety incidents. This contributes to a safer working environment and uninterrupted production.

- Data-Driven Regulatory Compliance: AI systems can assist manufacturers in navigating complex and evolving food additive regulations across different regions by quickly identifying relevant compliance requirements and ensuring that saccharin production and usage adhere to the latest international standards, thereby reducing legal risks.

DRO & Impact Forces Of Saccharin Market

The Saccharin Market's trajectory is critically influenced by a dynamic interplay of Drivers, Restraints, Opportunities (DRO), and a variety of inherent Impact Forces, each exerting significant pressure and shaping its evolutionary path. One of the most compelling Drivers is the widespread and escalating global health crisis, particularly the soaring prevalence of obesity and type 2 diabetes across all demographics. This critical public health concern compels consumers to actively seek out healthier dietary alternatives, with a strong preference for reduced-sugar or sugar-free products, thereby creating an immense and sustained demand for high-intensity, non-caloric sweeteners like saccharin. Concurrently, supportive regulatory environments in numerous countries play a pivotal role, as government bodies and health organizations worldwide increasingly advocate for sugar reduction initiatives and provide clear guidelines for the safe integration of artificial sweeteners into food and beverage formulations, further legitimizing saccharin's market position. Another potent driver is saccharin's exceptional cost-effectiveness, offering a sweetening solution that is significantly more economical than sucrose and many other high-intensity sweeteners, making it highly attractive for manufacturers seeking to maintain competitive pricing while meeting consumer demands for healthier products. The burgeoning growth of the processed food and beverage industry, especially in rapidly developing economies, also contributes substantially to market expansion, as these sectors continuously innovate to offer a wider array of dietetic and low-calorie options to an expanding consumer base. Furthermore, the inherent stability of saccharin across a wide range of temperatures and pH levels makes it an ideal ingredient for baked goods, heated beverages, and acidic formulations, ensuring consistent sweetness performance during production and throughout a product's shelf life. However, the market navigates significant Restraints that challenge its full growth potential. Foremost among these is persistent negative consumer perception and skepticism surrounding artificial sweeteners in general. Despite extensive scientific research affirming its safety, historical controversies and misinformed media narratives have fostered a segment of consumers who prefer 'natural' sweeteners or perceive artificial ones as unhealthy, impacting adoption rates. Intense competition from a growing portfolio of alternative high-intensity sweeteners, including sucralose, aspartame, and stevia, which often offer superior taste profiles, also limits saccharin's market share. Regulatory complexities and varying acceptable daily intake (ADI) levels across different regions can also create market fragmentation and compliance hurdles for global manufacturers. Nevertheless, the market is rich with Opportunities for strategic growth and innovation. Developing advanced taste-masking technologies represents a critical opportunity to overcome saccharin's aftertaste, thereby broadening its appeal and application scope. The creation of synergistic sweetener blends, combining saccharin with other sweeteners to achieve a more balanced and sugar-like flavor profile, is another promising avenue. Furthermore, expanding saccharin's utility into novel and emerging applications within the pharmaceutical industry for more palatable drug formulations, and in the burgeoning sports nutrition and dietary supplement sectors, provides fresh growth frontiers. Increasing penetration into underserved and developing markets, particularly in regions experiencing rapid urbanization and a nascent but growing health-conscious population, offers substantial long-term growth prospects. Impact forces such as rapidly changing global dietary patterns, influenced by cultural shifts and health trends, continuously reshape demand for sweeteners. Evolving regulatory frameworks for food additives, which can introduce new restrictions or approvals, directly affect market access and product innovation. Technological advancements in sweetener production methods, including more sustainable and efficient synthesis routes, play a crucial role in reducing costs and improving product quality. Lastly, geopolitical stability, which influences the availability and pricing of essential raw materials, can have a profound impact on the entire saccharin supply chain, necessitating robust risk management strategies for market participants to thrive in this dynamic environment.

Segmentation Analysis

The Saccharin Market is comprehensively segmented across several critical dimensions, enabling a granular understanding of its complex structure, diverse demand drivers, and competitive landscape. This detailed segmentation is instrumental for market participants to identify niche opportunities, tailor product offerings, and devise targeted marketing and distribution strategies that resonate with specific end-user needs and regional preferences. By dissecting the market along lines of product type, various applications, ultimate end-use industries, and specific functionalities, stakeholders can gain profound insights into consumer behaviors, technological adoption rates, and the impact of regulatory dynamics. Such an in-depth analytical approach allows for the precise allocation of resources, optimization of supply chains, and the development of innovative solutions that address the unique requirements of each market sub-segment, ensuring sustained growth and enhancing competitive advantage within the global saccharin industry, which is continuously evolving in response to health trends and technological advancements.

- By Type: This segmentation focuses on the chemical form in which saccharin is commercially available, each possessing distinct properties influencing its application.

- Sodium Saccharin: Represents the dominant market share due to its excellent water solubility, high stability across a broad pH range, and cost-effectiveness. It is widely used in soft drinks, confectionery, and pharmaceuticals. Its widespread acceptance is also due to its established safety profile and efficient production methods.

- Calcium Saccharin: Utilized as an alternative where sodium intake is a concern, such as in certain dietary or medical applications. It offers similar sweetness intensity and stability but without the sodium content, catering to specific health-conscious consumer segments.

- Acid Saccharin (Insoluble Saccharin): Less commonly used as a direct sweetener, it primarily serves as an intermediate in the production of other saccharin salts or in specialized applications where insolubility is desired. Its limited solubility restricts its use in many liquid formulations.

- By Application: This segment categorizes the market based on the diverse industries and product categories where saccharin is employed.

- Food & Beverages: The largest application segment, driven by global efforts to reduce sugar consumption.

- Diet Sodas and Carbonated Drinks: A primary user due to saccharin's high sweetness and stability, enabling zero-calorie beverage formulations.

- Baked Goods and Confectionery: Used in sugar-free cookies, cakes, candies, and chewing gums to cater to diabetic and weight-conscious consumers. Its heat stability is crucial here.

- Dairy Products: Incorporated into sugar-free yogurts, ice creams, and desserts, offering sweetness without added calories.

- Canned Fruits and Jams: Used to preserve and sweeten products without relying on high sugar content, extending shelf life and offering healthier options.

- Tabletop Sweeteners: Packaged for direct consumer use as a sugar substitute in coffee, tea, and other personal consumption.

- Snacks and Cereals: Integrated into dietetic snacks, granola bars, and breakfast cereals to provide sweetness with reduced caloric value.

- Sauces and Dressings: Used in sugar-free variants to enhance flavor profiles while adhering to dietary restrictions.

- Pharmaceuticals: Critical for improving patient compliance by masking the bitterness of active ingredients.

- Taste Masking in Medications: Essential for making bitter drugs palatable, particularly in pediatric and geriatric liquid formulations, chewable tablets, and oral suspensions.

- Sugar-Free Syrups and Tablets: Used in cough syrups, antacids, and vitamin supplements where sugar content needs to be avoided for diabetic patients or for dental health.

- Nutraceuticals and Dietary Supplements: Incorporated to enhance the taste of vitamin-mineral preparations and functional food products.

- Personal Care Products: Utilized for its sweetness and non-cariogenic properties.

- Toothpaste and Mouthwashes: Provides a pleasant taste, encouraging regular use, without contributing to tooth decay.

- Cosmetics: Found in certain lip care products and other cosmetic formulations for a sweet taste or flavor enhancement.

- Animal Feed: Employed to enhance palatability and encourage feed intake.

- Livestock Feed: Particularly used in feed for young animals to improve appetite and feed conversion rates.

- Pet Food: Incorporated into pet treats and specialized diets to make them more appealing to animals.

- Others: Encompassing niche industrial and chemical applications.

- Electroplating: Used as a brightening agent in metal plating baths to improve surface finish.

- Chemical Intermediates: Employed in various chemical syntheses due to its specific chemical properties.

- Food & Beverages: The largest application segment, driven by global efforts to reduce sugar consumption.

- By End-Use Industry: This segmentation classifies the market based on the primary industry that consumes saccharin.

- Food Processing Industry: Large-scale manufacturers producing a wide range of processed foods and ingredients.

- Beverage Industry: Companies specializing in soft drinks, juices, energy drinks, and other liquid consumables.

- Pharmaceutical Industry: Drug manufacturers, nutraceutical companies, and contract development and manufacturing organizations (CDMOs).

- Personal Care Industry: Producers of oral care, cosmetic, and personal hygiene products.

- Animal Feed Industry: Manufacturers of livestock feed, poultry feed, aquaculture feed, and pet food.

- Chemical Industry: Companies utilizing saccharin as a raw material or additive in non-food chemical processes.

- By Functionality: This segment categorizes saccharin based on its primary role or benefit in a product.

- High-Intensity Sweetener: Its primary function, providing intense sweetness with minimal quantity.

- Flavor Enhancer: Beyond pure sweetness, it can subtly enhance other flavors in a formulation.

- Non-Nutritive Additive: Valued for adding sweetness without caloric contribution or impacting glycemic index.

- Preservative (Ancillary Role): In some specific, minor applications, its antimicrobial properties can contribute to preservation.

Value Chain Analysis For Saccharin Market

The Saccharin Market's value chain is a multifaceted and intricately linked network that spans from the fundamental sourcing of raw materials to the ultimate consumption by end-users, with each stage adding incremental value and necessitating specific expertise and infrastructure. The initial phase, the upstream analysis, focuses on the procurement and processing of critical chemical precursors required for saccharin synthesis. These primarily include toluene, chlorosulfonic acid, phthalic anhydride, and ammonia, alongside other essential reagents and catalysts. Suppliers in this segment are typically large chemical companies, and their operational efficiencies, pricing strategies, and supply reliability directly impact the cost-effectiveness and stability of saccharin production. Manufacturers often engage in strategic sourcing, including long-term contracts and sometimes backward integration, to mitigate price volatility and ensure a consistent supply of these foundational inputs. The core manufacturing stage involves complex multi-step chemical reactions, predominantly the Remsen-Fahlberg process or the Maumee process, followed by rigorous purification steps such as crystallization, filtration, and drying. This stage demands sophisticated chemical engineering expertise, advanced processing equipment, stringent quality control measures, and adherence to international Good Manufacturing Practices (GMP) to produce high-purity saccharin that meets food-grade, pharmaceutical-grade, or industrial specifications. Manufacturers continuously invest in process optimization technologies, including automation and energy efficiency improvements, to reduce production costs and environmental footprint. Downstream analysis then addresses the distribution, marketing, and sales of the finished saccharin product to its diverse array of end-user industries. This critical phase involves strategic logistics to deliver saccharin, typically in powdered or granulated form, to large-scale food and beverage manufacturers, pharmaceutical companies, personal care product formulators, and animal feed producers globally. The distribution channel for saccharin is typically bifurcated into direct and indirect routes, each serving distinct market segments and customer needs. Direct distribution involves saccharin manufacturers selling and shipping their products directly to large volume industrial customers. This approach fosters closer client relationships, enables customized product specifications, and often provides technical support directly from the producer, particularly for key accounts or strategic partnerships. Conversely, indirect distribution channels leverage a network of specialized chemical distributors, ingredient suppliers, and wholesalers. These intermediaries play a crucial role in reaching smaller customers, consolidating orders from multiple manufacturers, managing inventory, providing localized warehousing, and offering just-in-time delivery services. They are particularly vital for market penetration in geographically dispersed regions or for customers requiring smaller batch sizes. Effective management of this entire value chain, from securing high-quality raw materials and optimizing production to establishing robust and efficient distribution networks and providing excellent post-sales support, is paramount for saccharin market players. It ensures product quality, competitive pricing, reliable supply, and customer satisfaction, all of which are critical for achieving and sustaining a competitive advantage in the dynamic global sweetener market.

Saccharin Market Potential Customers

The Saccharin Market caters to a broad and diversified base of potential customers, spanning numerous industries that increasingly prioritize low-calorie, sugar-free, and taste-enhanced product formulations. The largest and most influential segment of end-users originates from the expansive food and beverage industry. This includes major multinational corporations and regional players involved in the production of carbonated soft drinks, diet juices, functional beverages, and other sugar-free liquid consumables, all seeking to reduce sugar content in response to consumer demand and public health initiatives. Manufacturers of confectionery products, such as sugar-free candies, chewing gums, chocolates, and baked goods like diet cookies and cakes, also represent significant customers, leveraging saccharin's sweetness intensity without the added calories or glycemic impact. Additionally, producers of dairy products, including yogurts, ice creams, and desserts, integrate saccharin to offer healthier alternatives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 285.5 Million |

| Market Forecast in 2033 | USD 402.1 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Jiangsu Dongsheng Food Tech Co. Ltd., Salicylates and Chemicals Pvt. Ltd., Shandong Qilu Pharmaceutical Co. Ltd., JK Sucralose Inc., Gan & Lee Pharmaceuticals, Newtrend Group, Shree Vardhman Gum & Chemicals Pvt. Ltd., Kaifeng Xinghua Fine Chemical Factory, Hermes Sweeteners Ltd., The Sweetener Company, Spectrum Chemical Mfg. Corp., Merck KGaA, Cayman Chemical Company, TCI Chemicals (India) Pvt. Ltd., Tokyo Chemical Industry Co. Ltd., Sigma-Aldrich (Merck KGaA Subsidiary), Thermo Fisher Scientific, S. Zhaveri & Co., Parchem fine & specialty chemicals, Foodchem International Corporation, Hangzhou Focus Chem Co., Ltd., Jubilant Life Sciences Ltd., Sichuan Sanhuan Siyuan Technology Co., Ltd., Suzhou-Chem Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Saccharin Market Key Technology Landscape

The technological landscape underpinning the Saccharin Market is characterized by continuous innovation aimed at optimizing production efficiency, enhancing product purity, ensuring regulatory compliance, and broadening its application versatility. At the core of saccharin manufacturing are sophisticated chemical synthesis processes, primarily the Remsen-Fahlberg method and the Maumee method. These multi-step reaction sequences require precise control over parameters such as temperature, pressure, reactant ratios, and catalyst selection to maximize conversion rates, minimize by-product formation, and achieve desired yields. Advanced process engineering technologies, including continuous flow reactors and microreactor technology, are being explored and adopted to improve reaction kinetics, enhance safety, and reduce the overall footprint of production facilities, moving away from traditional batch processes. Critical to achieving the high purity levels demanded by food, pharmaceutical, and personal care industries are cutting-edge purification technologies. These include multi-stage crystallization processes, where precise temperature and solvent control dictate crystal size and purity; advanced filtration techniques, such as membrane filtration and activated carbon adsorption, for removing trace impurities; and chromatographic separations, particularly for highly specialized grades. Quality control is further ensured through the widespread use of Process Analytical Technology (PAT), which integrates real-time analytical measurements (e.g., FTIR, UV-Vis spectroscopy, Raman spectroscopy) into the manufacturing process, allowing for continuous monitoring and immediate adjustment of process parameters, thereby ensuring consistent product quality and reducing the need for extensive post-production testing.

Regional Highlights

- North America: This region represents a mature yet robust market for saccharin, characterized by sophisticated consumer preferences and a well-established regulatory environment. The United States and Canada are pivotal contributors, driven by a high prevalence of obesity and diabetes, strong consumer awareness regarding health and wellness, and a proactive shift towards low-calorie and sugar-free diets. Major food and beverage corporations actively incorporate saccharin into their extensive product portfolios, including diet sodas, sugar-free dairy products, and baked goods. The pharmaceutical sector also exhibits consistent demand, utilizing saccharin for palatable medication formulations. Innovation in ingredient blending, particularly with other high-intensity sweeteners to achieve a cleaner taste, and a focus on transparency in product labeling are significant trends. The market here is sustained by stable economic conditions, high purchasing power, and continuous product development efforts by key players.

- Europe: The European market for saccharin is well-developed and demonstrates stable growth, with Western European countries such as Germany, the United Kingdom, France, and Italy being key markets. This growth is predominantly fueled by an aging population, rising health consciousness, and government initiatives promoting sugar reduction to combat public health issues. European consumers, while increasingly favoring natural ingredients, continue to utilize saccharin due to its established safety record, cost-effectiveness, and versatility in a wide array of food, beverage, and pharmaceutical applications. The region benefits from harmonized regulatory frameworks set by the European Food Safety Authority (EFSA), providing clear guidelines for sweetener usage. There's a strong emphasis on clean label products and sustainable sourcing, influencing how saccharin is positioned and marketed within the region's competitive landscape, fostering a balance between artificial and natural alternatives.

- Asia Pacific (APAC): The Asia Pacific region stands out as the fastest-growing and most dynamic market for saccharin globally. This exponential growth is primarily attributed to its vast population base, rapidly expanding middle class, increasing disposable incomes, and the swift adoption of Western dietary patterns, which include a greater consumption of processed and convenience foods. Key markets such as China, India, Japan, and South Korea are experiencing significant industrialization and urbanization, leading to a surge in demand for dietetic and functional foods. China, in particular, is both a major producer and consumer of saccharin, driving regional market dynamics. Rising health awareness, coupled with the increasing incidence of lifestyle-related diseases, is prompting consumers to seek sugar alternatives. The region's relatively less stringent regulatory environments in some emerging economies, combined with competitive manufacturing costs, make it an attractive hub for both production and consumption, offering immense untapped potential for saccharin market expansion.

- Latin America: This region presents a significant and rapidly emerging market for saccharin, with Brazil, Mexico, and Argentina being the leading contributors to its growth. The market expansion is primarily propelled by increasing urbanization, evolving consumer dietary habits, and a growing awareness about health and wellness. The rising prevalence of obesity and diabetes across Latin American populations is a critical driver, stimulating demand for low-calorie and sugar-free food and beverage options. Economic development and the expansion of local food processing and pharmaceutical industries are also fostering the adoption of saccharin. While consumer education regarding artificial sweeteners is still evolving in some parts of the region, the cost-effectiveness of saccharin makes it a highly attractive option for manufacturers to meet the growing demand for healthier product formulations without significantly increasing production costs, thereby facilitating market penetration.

- Middle East and Africa (MEA): The MEA region is witnessing gradual but steady growth in the saccharin market, driven by changing lifestyle patterns, increasing urbanization, and a burgeoning focus on public health initiatives. Countries like Saudi Arabia, the UAE, and South Africa are leading the adoption, primarily due to growing disposable incomes and a rising awareness of the health implications of high sugar intake. The demand is particularly pronounced in the beverage and pharmaceutical sectors, where saccharin is utilized in diet drinks and sugar-free medications. Challenges such as political instability and varying economic conditions across different countries in the region can influence market dynamics; however, the ongoing efforts to diversify economies and improve healthcare infrastructure provide foundational support for sustained growth in the demand for sugar substitutes like saccharin, catering to a slowly but surely expanding health-conscious consumer base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Saccharin Market.- Jiangsu Dongsheng Food Tech Co. Ltd.

- Salicylates and Chemicals Pvt. Ltd.

- Shandong Qilu Pharmaceutical Co. Ltd.

- JK Sucralose Inc.

- Gan & Lee Pharmaceuticals

- Newtrend Group

- Shree Vardhman Gum & Chemicals Pvt. Ltd.

- Kaifeng Xinghua Fine Chemical Factory

- Hermes Sweeteners Ltd.

- The Sweetener Company

- Spectrum Chemical Mfg. Corp.

- Merck KGaA

- Cayman Chemical Company

- TCI Chemicals (India) Pvt. Ltd.

- Tokyo Chemical Industry Co. Ltd.

- Sigma-Aldrich (Merck KGaA Subsidiary)

- Thermo Fisher Scientific

- S. Zhaveri & Co.

- Parchem fine & specialty chemicals

- Foodchem International Corporation

- Hangzhou Focus Chem Co., Ltd.

- Jubilant Life Sciences Ltd.

- Sichuan Sanhuan Siyuan Technology Co., Ltd.

- Suzhou-Chem Co., Ltd.

Frequently Asked Questions

What is saccharin and what are its primary characteristics?

Saccharin is an artificial, non-nutritive sweetener, approximately 300-400 times sweeter than sucrose. It is characterized by its zero-calorie content, non-cariogenic properties, and exceptional heat and pH stability, making it suitable for a wide range of applications from diet beverages to baked goods and pharmaceuticals. Discovered in 1879, it remains one of the oldest and most extensively used high-intensity sweeteners globally.

Is saccharin considered safe for consumption, and what are the regulatory stances?

Yes, saccharin is widely considered safe for human consumption by leading global regulatory bodies. The U.S. FDA, European Food Safety Authority (EFSA), and the World Health Organization (WHO) have all affirmed its safety within established acceptable daily intake (ADI) levels. It was delisted from the U.S. National Toxicology Program's list of potential carcinogens in 2000, based on comprehensive scientific review, solidifying its safe status for general use.

In which industries and products is saccharin predominantly used?

Saccharin finds its primary applications in the food and beverage industry for diet carbonated drinks, sugar-free confectionery, baked goods, and tabletop sweeteners. It is also crucially used in the pharmaceutical sector for taste-masking bitter medications and in personal care products like toothpaste. Furthermore, it serves as a palatability enhancer in the animal feed industry to improve intake.

How does saccharin's taste profile and cost compare to other artificial sweeteners?

Saccharin offers a highly cost-effective solution for intense sweetness, making it economically attractive for manufacturers. While it delivers significant sweetness and is highly stable, some users may perceive a slight metallic or bitter aftertaste at higher concentrations, a characteristic less common in newer sweeteners like sucralose or natural ones like stevia. However, its blending capabilities with other sweeteners can often mitigate this.

What are the key drivers and restraints influencing the global saccharin market?

Key drivers include the surging global demand for low-calorie products due to rising obesity and diabetes rates, supportive government regulations promoting sugar reduction, and saccharin's inherent cost-effectiveness. Major restraints involve persistent negative consumer perceptions about artificial sweeteners, intense competition from alternative high-intensity sweeteners offering different taste profiles, and potential variations in international regulatory approvals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager