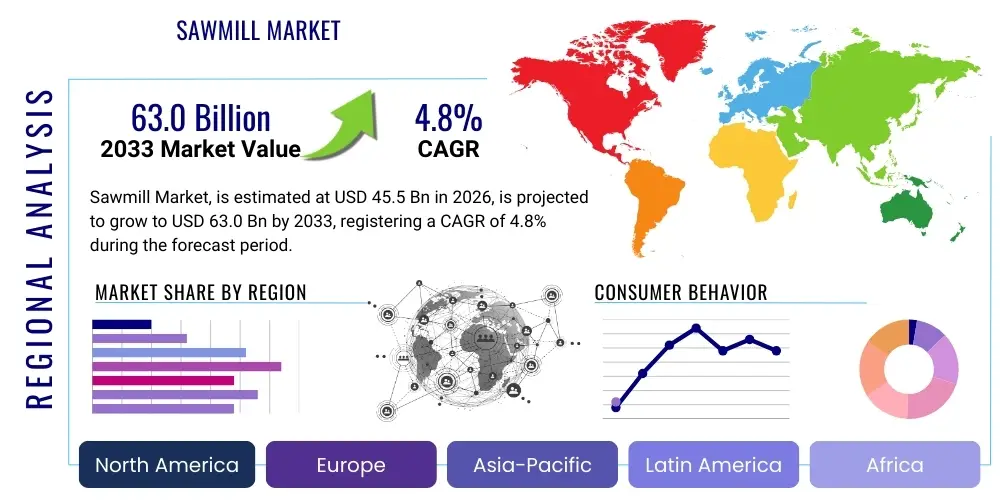

Sawmill Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438215 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Sawmill Market Size

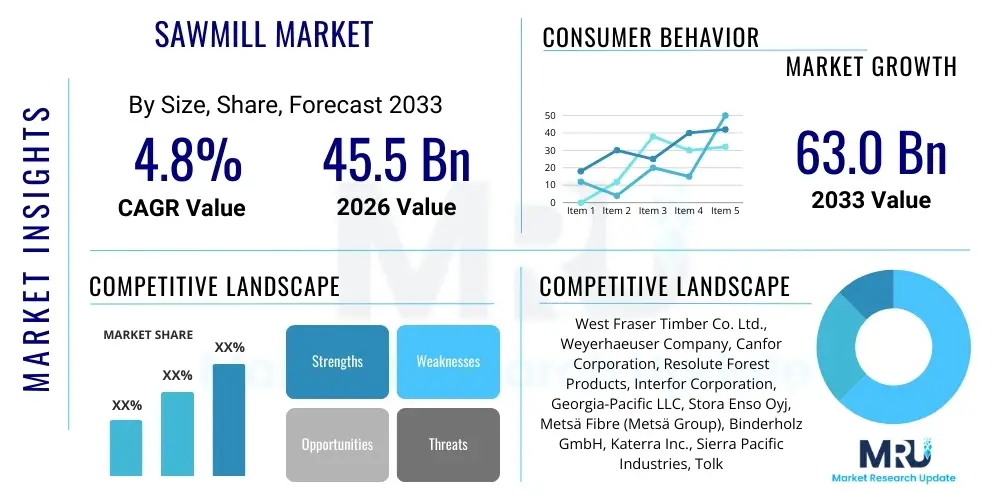

The Sawmill Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 45.5 Billion in 2026 and is projected to reach USD 63.0 Billion by the end of the forecast period in 2033.

Sawmill Market introduction

The Sawmill Market encompasses the industrial sector dedicated to processing raw timber logs into usable lumber, timber products, and various wood derivatives. This industry is fundamental to the global construction, furniture, packaging, and pulp and paper sectors, serving as the essential link between forestry and end-use manufacturing. Key products include dimensional lumber, structural beams, planks, boards, and specialized products like cross-laminated timber (CLT) and glulam. The market's operational scope spans large-scale, automated facilities focusing on high volume to specialized small-scale mills producing custom cuts.

Major applications of sawmill products are concentrated in residential and commercial construction, where sustainability and structural integrity are paramount. Furthermore, the growing trend toward sustainable building materials, coupled with governmental mandates promoting wood use in urban construction (wood-first policies), significantly drives market expansion. The core benefit derived from this market lies in providing an environmentally favorable alternative to steel and concrete, offering superior insulation properties and a lower embodied carbon footprint. The inherent renewability of wood resources positions the sawmill sector as a crucial component of the circular bio-economy.

Driving factors propelling market growth include rapid urbanization in developing regions, increased global demand for prefabricated and modular homes utilizing engineered wood products, and technological advancements such as high-speed scanning and optimization software that enhance yield and minimize waste. Additionally, the recovery of the global housing market following economic downturns contributes substantially to sustained demand for softwood and hardwood lumber, further solidifying the sawmill industry’s critical role in the global supply chain.

Sawmill Market Executive Summary

The global Sawmill Market is characterized by a strong shift toward automation and sustainable practices, driving significant investment in advanced processing technologies. Business trends indicate a consolidation among major players seeking to optimize global supply chains and achieve economies of scale, particularly in key exporting regions such as North America and Scandinavia. The adoption of smart factory solutions, including predictive maintenance and AI-driven log sorting, is becoming standard practice to address rising operational costs and volatile raw material prices. Furthermore, the market is experiencing strong demand diversification, moving beyond traditional applications into advanced wood products that offer superior performance and ecological benefits.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive infrastructure projects, rapid urbanization, and a burgeoning middle class demanding high-quality housing and furniture. North America remains a significant producer and consumer, emphasizing technological leadership and export optimization, while Europe leads in sustainable forestry management and the production of innovative engineered wood products like CLT, aligning with stringent EU Green Deal regulations. Emerging economies in Latin America and Africa offer long-term potential but face challenges related to illegal logging and fragmented distribution networks.

Segment trends reveal that Softwood Lumber continues to dominate the market volume due to its widespread use in framing and structural applications. However, the Engineered Wood Products segment is projected to exhibit the highest CAGR, driven by the increasing complexity and scale of modern construction projects that require laminated and composite wood solutions. The market’s segmentation by end-use highlights the dominance of the residential construction sector, followed closely by packaging and industrial uses, necessitating diverse production capabilities ranging from rough-sawn lumber to precision-cut pallets and crates.

AI Impact Analysis on Sawmill Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Sawmill Market center heavily on process efficiency, resource optimization, and quality control consistency. Common themes include the potential for AI algorithms to maximize lumber yield from irregularly shaped logs, the effectiveness of machine learning in predicting equipment failures (predictive maintenance), and how automation driven by computer vision can grade lumber defects with unprecedented accuracy, surpassing human capabilities. Users frequently express interest in the ROI derived from implementing these sophisticated systems, specifically addressing concerns about the initial investment cost versus the long-term savings in raw material utilization and labor efficiency.

The consensus among market participants is that AI is moving the sawmill industry away from traditional, manual optimization methods toward a data-centric model. AI algorithms, particularly those integrated into 3D scanners and high-speed sorting lines, enable real-time decision-making regarding cutting patterns, which significantly reduces waste and increases the overall value recovered from each log. This sophisticated optimization is crucial given the high cost and scarcity of quality timber resources globally. Furthermore, AI tools are essential for managing complex inventories, predicting demand fluctuations, and streamlining logistics, thereby stabilizing supply chains in a volatile commodity market.

Ultimately, the core expectation users have is that AI will be the pivotal technology enabling the sawmill industry to meet increasingly strict environmental standards while maintaining profitability. By providing enhanced transparency into material usage and operational efficiency, AI systems facilitate compliance with traceability mandates and support sustainability reporting, transforming mill operations from labor-intensive commodity production into highly efficient, high-tech manufacturing facilities.

- Enhanced Yield Optimization: AI-driven scanning and cutting optimization algorithms maximize lumber recovery from raw logs.

- Predictive Maintenance: Machine learning models anticipate equipment failure, minimizing unplanned downtime and maximizing asset lifespan.

- Automated Quality Grading: Computer vision systems accurately detect defects and grade lumber quality at high speeds, improving product consistency.

- Inventory and Supply Chain Forecasting: AI algorithms analyze market trends and operational data to optimize log procurement and finished product inventory levels.

- Energy Efficiency Management: Smart systems monitor and adjust energy consumption across machinery to reduce operational costs and carbon footprint.

- Workforce Safety Enhancements: AI-powered surveillance monitors operational zones, flagging potential safety hazards in real-time.

DRO & Impact Forces Of Sawmill Market

The dynamics of the Sawmill Market are governed by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and external Impact Forces. The primary drivers revolve around the global momentum towards sustainable construction and the widespread urbanization trend, particularly in emerging economies, creating persistent demand for structural wood products. This is counterbalanced by significant restraints, including the inherent volatility of timber prices and the increasing pressure from environmental regulatory bodies concerning sustainable harvesting practices and supply chain traceability. Opportunities lie primarily in the development and industrial adoption of engineered wood products (EWP) like Mass Timber, which opens new markets in high-rise and non-residential construction. These internal forces are continually shaped by external impact forces, notably technological shifts toward Industry 4.0 automation and global climate change policies that affect resource availability and forest management.

Drivers: The dominant driver is the escalating global focus on decarbonization and the preference for wood as a naturally renewable, low-carbon building material. Governments, particularly in Europe and North America, are actively promoting mass timber construction (e.g., Cross-Laminated Timber - CLT), which requires advanced processing capabilities from sawmills. Furthermore, demographic shifts, especially the need for affordable housing in densely populated areas, drive demand for prefabricated construction methods where precise, factory-cut lumber is essential. This continuous demand from the residential and commercial construction sectors provides a resilient foundation for market growth, encouraging sawmills to invest in modernizing their facilities to handle higher throughput and diverse product specifications. The superior thermal performance and aesthetic appeal of wood products further enhance their competitive advantage over conventional materials.

A secondary but crucial driver is the necessity for efficient resource utilization. With finite forest resources and increasing environmental stewardship, sawmills are forced to adopt high-precision scanning and optimization technology to maximize the recovery rate from every log. The economic incentive to reduce waste, coupled with the ability of advanced mills to generate value-added byproducts (such as wood chips for pulp or biomass energy), strengthens the market structure. This technological push is supported by a growing consumer and regulatory preference for sustainably sourced materials, demanding that sawmills adhere to certifications like FSC and PEFC, which inherently improves market transparency and operational quality.

Restraints: The market faces significant headwinds, primarily stemming from the inherent cyclical nature of the construction industry and the associated volatility in lumber pricing. Sudden shifts in global economic conditions, interest rate hikes, or housing market slowdowns can rapidly erode profit margins. Log procurement presents another major restraint; increased global competition for standing timber, coupled with environmental restrictions on harvesting certain forest areas, leads to supply constraints and elevated raw material costs. Furthermore, the industry is highly susceptible to logistical challenges, including transportation costs and bottlenecks, which impact profitability, especially for international trade. Operational restraints include the substantial capital investment required for implementing high-speed, automated sawmilling equipment, which often poses a barrier to entry for smaller or regional operators.

Moreover, skilled labor shortages present a persistent challenge across major producing regions. Modern sawmills require highly specialized technicians and operators capable of managing complex mechanical and software systems, a demographic often difficult to recruit and retain in remote operational locations. Safety concerns inherent in heavy machinery environments also necessitate stringent and costly operational standards. Finally, competition from alternative building materials, such as steel, concrete, and engineered composites, although facing their own sustainability scrutiny, continues to restrain the market share growth of traditional lumber products in specific, highly engineered applications, requiring continuous innovation within the sawmill sector to maintain competitiveness.

Opportunities: Significant growth opportunities are emerging through the continued commercialization of Engineered Wood Products (EWP). Mass Timber products, specifically Glulam and CLT, are gaining acceptance in mid-rise and even high-rise structures, offering sawmills a pathway to produce higher-value, specialized materials that command premium pricing. The regulatory environment, favoring fire-resistant and structurally sound wood solutions, is accelerating this trend. Furthermore, the opportunity for diversification into the bio-energy and bio-chemical sectors through advanced utilization of mill residues (sawdust, bark, and shavings) represents a substantial non-core revenue stream, enhancing the circular economy model of the industry.

Digital transformation offers crucial long-term opportunities. The implementation of IoT sensors, big data analytics, and cloud-based management systems allows sawmills to move toward predictive supply chain management and highly customized production runs. This includes optimizing inventory management and facilitating just-in-time delivery to large construction sites. Expansion into emerging markets, particularly rapidly industrializing regions in Southeast Asia and parts of Africa, where infrastructure development and new housing starts are soaring, provides new geographic avenues for major market players seeking to expand their operational footprint and distribution networks beyond saturated mature markets.

Impact Forces: External forces exert profound influence. Climate change is a critical impact force, leading to increased frequency of natural disasters (wildfires, insect infestations) that drastically affect timber supply quality and availability, necessitating adaptive forest management and sourcing strategies. Global trade policies, including tariffs and anti-dumping duties, can dramatically alter regional profitability and supply routes, forcing rapid adjustments in export strategies. Technological advancements, particularly in robotics and 3D printing for construction, are also impact forces; while disruptive, they necessitate more precise and high-specification lumber, driving the need for smarter processing equipment. Finally, public perception and NGO pressure regarding deforestation and sustainable sourcing act as powerful non-market forces, demanding verifiable transparency and ethical sourcing throughout the entire value chain.

Segmentation Analysis

The Sawmill Market is comprehensively segmented based on the type of wood processed (Softwood vs. Hardwood), the primary product form generated (Lumber, Engineered Wood, Byproducts), and the ultimate end-use application (Residential Construction, Non-Residential Construction, Packaging, and Industrial). This segmentation highlights the industry's diversity, ranging from high-volume standardized production (softwood lumber for framing) to niche, high-value manufacturing (hardwood for bespoke furniture or engineered beams). The analysis of these segments reveals varying growth trajectories, with high-tech Engineered Wood Products poised for rapid expansion due to their structural superiority and relevance in modern building codes, contrasting with the steady demand for traditional dimensional lumber driven by housing starts.

Understanding the market by segmentation is vital for investment strategies, as it dictates the required operational technology and logistical structure. For instance, mills specializing in softwood utilize high-speed continuous flow processes, while those focusing on hardwood often employ batch processing and meticulous quality control measures. Geographic factors also influence segment dominance; North America and Scandinavia are leaders in softwood production and Engineered Wood Products, whereas tropical regions predominantly handle specific hardwood species. The byproducts segment, though often secondary, is increasingly strategic due to its linkage with the growing global biomass energy and pulp markets, adding critical stability to the overall sawmill business model.

- By Wood Type:

- Softwood (Pine, Spruce, Fir, Douglas-fir)

- Hardwood (Oak, Maple, Cherry, Walnut)

- By Product Type:

- Dimensional Lumber

- Structural Timber

- Engineered Wood Products (CLT, Glulam, LVL)

- Wood Byproducts (Sawdust, Wood Chips, Bark)

- By End-Use Application:

- Residential Construction

- Non-Residential Construction (Commercial, Industrial)

- Furniture and Interior Design

- Packaging and Crates (Pallets)

- Industrial Uses (Railroad Ties, Mining Timber)

Value Chain Analysis For Sawmill Market

The Sawmill Market value chain is intricate, commencing with upstream activities focused on sustainable resource management and log procurement. Upstream analysis involves rigorous sustainable forestry operations, including harvesting, sorting, and primary transport of raw logs from the forest to the mill gate. Key factors at this stage include minimizing environmental impact, adhering to international certifications (FSC, PEFC), and utilizing advanced digital mapping and satellite technology to optimize harvesting efficiency. The procurement phase is highly competitive and dictated by species availability, quality grading, and volatile timber stumpage prices, making effective inventory management a critical success factor for mill profitability.

Midstream activities represent the core of the value chain: the transformation of raw logs into marketable wood products. This involves high-tech processing steps, starting with log scaling and 3D scanning, followed by optimization software that determines the optimal cutting pattern for maximum value yield. The subsequent sawing, drying (kiln drying is energy-intensive but essential for structural integrity), planing, and grading processes utilize automated machinery, robotics, and advanced quality control systems. Direct distribution channels often involve long-term contracts with large-volume buyers, such as national homebuilders or major industrial users, ensuring predictable sales volumes and streamlined logistics.

Downstream analysis focuses on the final distribution and end-use applications. Products are distributed through both direct and indirect channels. Indirect channels involve wholesalers, specialized lumber retailers, and distributors who manage regional inventory and supply smaller contractors and DIY markets. Direct channels are utilized for large, high-volume orders, especially for engineered wood products delivered straight to large construction sites. Effective downstream performance relies on timely delivery, efficient inventory turnover, and strong relationships with architects and engineers who specify the use of wood products, requiring continuous market education and product innovation support.

Sawmill Market Potential Customers

Potential customers for sawmill products are broadly categorized across the construction, manufacturing, and industrial sectors, with distinct purchasing requirements based on application. The primary segment comprises residential construction companies and homebuilders, who demand large volumes of standardized dimensional lumber (softwood) for framing, sheeting, and structural work. These buyers prioritize consistent quality, reliable delivery schedules, and price stability, often entering into futures contracts or long-term supply agreements to mitigate price volatility risks inherent in the commodity market.

A rapidly growing segment of end-users are specialized manufacturers of Engineered Wood Products (EWP) and mass timber construction firms, which require high-specification, precisely milled products like Glulam laminations or veneer for LVL production. These customers prioritize the mechanical properties, moisture content, and dimensional stability of the wood, often requiring bespoke milling services. Additionally, the furniture and interior design industries represent a key market for high-quality hardwood lumber, focusing heavily on species aesthetics, grain patterns, and finishing quality, making their purchasing decisions highly dependent on species availability and premium grading.

Finally, the industrial and packaging sectors, including companies producing pallets, crates, and specialized industrial timbers (e.g., railroad ties), form a significant volume-based customer base. These buyers prioritize durability, cost-effectiveness, and compliance with phytosanitary regulations (e.g., ISPM 15 standards for international shipping pallets). The diverse needs of these potential customers—ranging from high-volume commodity purchasers to specialized, quality-focused manufacturers—mandate that sawmills operate with flexible production capabilities and segmented sales strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 63.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | West Fraser Timber Co. Ltd., Weyerhaeuser Company, Canfor Corporation, Resolute Forest Products, Interfor Corporation, Georgia-Pacific LLC, Stora Enso Oyj, Metsä Fibre (Metsä Group), Binderholz GmbH, Katerra Inc., Sierra Pacific Industries, Tolko Industries, Hampton Lumber, Boise Cascade Company, Rayonier Inc., Svenska Cellulosa Aktiebolaget (SCA), LP Building Solutions, Timber Products Company, Klausner Lumber One, PFEIFER Holding GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sawmill Market Key Technology Landscape

The technological landscape of the Sawmill Market is undergoing a rapid transition, driven by the need for increased yield, higher throughput, and superior product quality. The most critical technological shift involves the integration of high-definition 3D log scanning and advanced optimization software. These systems use laser sensors and high-speed cameras to create precise profiles of each incoming log, allowing sophisticated algorithms to calculate the optimal cutting solution in milliseconds, thereby maximizing the usable lumber derived from irregular logs and significantly boosting resource recovery rates. This technology forms the backbone of the modern high-volume sawmill, directly influencing profitability and environmental efficiency.

Automation and robotics play an equally vital role, transforming material handling and processing. Automated log sorting lines, high-speed chippers, and automated stacking and packaging systems minimize manual intervention, reducing labor costs and improving operational safety. Furthermore, the adoption of Industry 4.0 principles, including the Internet of Things (IoT) sensors, allows for real-time monitoring of machinery performance, temperature, and vibration. This continuous data stream feeds into predictive maintenance programs, drastically reducing the occurrence of unexpected equipment failures and ensuring continuous operational uptime, which is essential in a sector dealing with high production volumes.

Beyond the primary processing line, key technologies include state-of-the-art kiln drying optimization systems, which use precise moisture control technology and data analytics to reduce drying time and energy consumption while preventing warping or checking in the lumber. In the realm of quality control, non-destructive testing (NDT) technologies, such as advanced stress grading and acoustic testing, are replacing traditional visual grading methods. These NDT systems accurately assess the mechanical strength and structural integrity of wood products, enabling sawmills to precisely grade lumber for high-stress applications like structural beams and ensuring compliance with stringent building codes globally.

Regional Highlights

- North America (United States and Canada): North America represents a global leader in sawmill technology and capacity, driven by vast sustainable forest resources and a consistently strong demand from the residential housing market. The region is pioneering the production of advanced Engineered Wood Products (EWP), particularly in British Columbia and the U.S. Pacific Northwest. The industry is characterized by large, highly automated mills focused on efficiency and export capabilities. Challenges include trade disputes, periodic market volatility influenced by housing starts and mortgage rates, and the imperative to manage forest health against threats like wildfires and pests. Government policies encouraging domestic lumber use and investment in sustainable timber harvesting continue to underpin market stability.

- Europe (Nordic Countries and Central Europe): Europe leads the global market in terms of sustainability and the implementation of bio-economy principles. Nordic countries (Sweden and Finland) are major exporters of high-quality softwood lumber, benefiting from mature, well-managed forests and high levels of mill digitalization (Industry 4.0). Central Europe (Germany, Austria) is dominant in the production of CLT and Glulam, serving a high-value, environmentally conscious construction market. Regulatory forces, such as the EU Timber Regulation and the Green Deal, strongly influence the market, mandating traceability and sustainable sourcing, thereby driving demand for certified lumber. Innovation in wood processing technology, especially low-energy drying and advanced residue utilization, is concentrated here.

- Asia Pacific (APAC) (China, Japan, Australia): APAC is the fastest-growing region, primarily driven by China’s massive infrastructure development and rapid urbanization, which generates immense demand for both imported and domestically produced lumber. Japan remains a crucial market, focusing on high-quality, specialized wood products for traditional housing and interior finishing. Australia, with its own significant resources, acts as a regional hub for softwood exports. The region is largely a net importer of raw logs and processed lumber from North America and Russia, making supply chain efficiency and international trade relationships critical. Growth is often challenged by logistics costs and varying local building codes.

- Latin America (Brazil, Chile): Latin America holds significant potential due to its vast, underexploited forest resources, particularly in Brazil (hardwood) and Chile (plantation pine). Chile is a major global exporter of plantation-grown softwood, benefiting from ideal growing conditions and competitive operational costs. Brazil’s market is characterized by strong domestic construction demand but faces intense international scrutiny regarding illegal logging and deforestation in the Amazon biome. The region's sawmill sector is highly dualistic, containing both advanced, export-oriented mills and numerous smaller, less automated domestic operators. Future growth hinges on improved governance and investment in sustainable, certified forestry practices.

- Middle East and Africa (MEA): The MEA region is predominantly a consumer and net importer of finished lumber, supporting large-scale construction projects in the Gulf Cooperation Council (GCC) countries (e.g., UAE, Saudi Arabia). Demand is strong but highly sensitive to oil prices and government spending on infrastructure. In Africa, the market is highly fragmented; while resource-rich, the sector often struggles with weak infrastructure, lack of industrial investment, and regulatory instability. Key focus areas for growth include importing high-quality structural lumber for prefabricated housing in urban centers and establishing processing capacity to utilize regional timber resources sustainably.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sawmill Market.- West Fraser Timber Co. Ltd.

- Weyerhaeuser Company

- Canfor Corporation

- Resolute Forest Products

- Interfor Corporation

- Georgia-Pacific LLC

- Stora Enso Oyj

- Metsä Fibre (Metsä Group)

- Binderholz GmbH

- Katerra Inc.

- Sierra Pacific Industries

- Tolko Industries

- Hampton Lumber

- Boise Cascade Company

- Rayonier Inc.

- Svenska Cellulosa Aktiebolaget (SCA)

- LP Building Solutions

- Timber Products Company

- Klausner Lumber One

- PFEIFER Holding GmbH

Frequently Asked Questions

Analyze common user questions about the Sawmill market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Engineered Wood Products (EWP) segment in the Sawmill Market?

The growth of EWP, such as Cross-Laminated Timber (CLT) and Glulam, is driven by their superior strength-to-weight ratio, consistency, and alignment with sustainable, low-carbon construction practices. EWP facilitates faster assembly in modular construction and is increasingly being specified for mid-rise and high-rise commercial buildings, expanding the traditional application scope of wood materials.

How significantly does raw material volatility impact the profitability of sawmills?

Raw material volatility, specifically fluctuating log prices, is the largest external threat to sawmill profitability. Since raw logs typically constitute 60% to 70% of the total production cost, sudden price spikes or supply shortages due to climate events (e.g., wildfires) necessitate sophisticated risk management, hedging strategies, and investment in highly efficient, yield-optimizing technology to maintain stable margins.

Which geographical region holds the highest potential for capacity expansion in the near future?

The Asia Pacific (APAC) region, particularly emerging economies like China and Southeast Asian countries, holds the highest potential for capacity expansion. This is attributed to massive urbanization trends, sustained government investment in infrastructure, and increasing domestic demand for housing, necessitating both significant local mill development and robust international supply agreements.

What role does digitalization, such as IoT and AI, play in modern sawmill operations?

Digitalization is crucial for maximizing efficiency and yield. IoT sensors provide real-time data for operational monitoring and predictive maintenance, minimizing expensive downtime. AI-driven optimization software analyzes 3D scans of logs to calculate the optimal cutting solution, ensuring maximum lumber recovery and consistency while significantly reducing material waste.

Are sustainability regulations a driver or a restraint for the Sawmill Market?

Sustainability regulations act as both a driver and a restraint. They are a driver by enhancing wood's competitiveness as a green material and creating demand for certified products (FSC, PEFC). However, they also act as a restraint by increasing compliance costs, restricting harvest areas, and demanding greater investment in traceability technologies and forest management practices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Sawmill Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Sawmill Market Size Report By Type (Softwood Lumber, Hardwood Lumber), By Application (Construction, Furniture, Packaging and Joinery Industries, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager