Scanning Rangefinder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437726 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Scanning Rangefinder Market Size

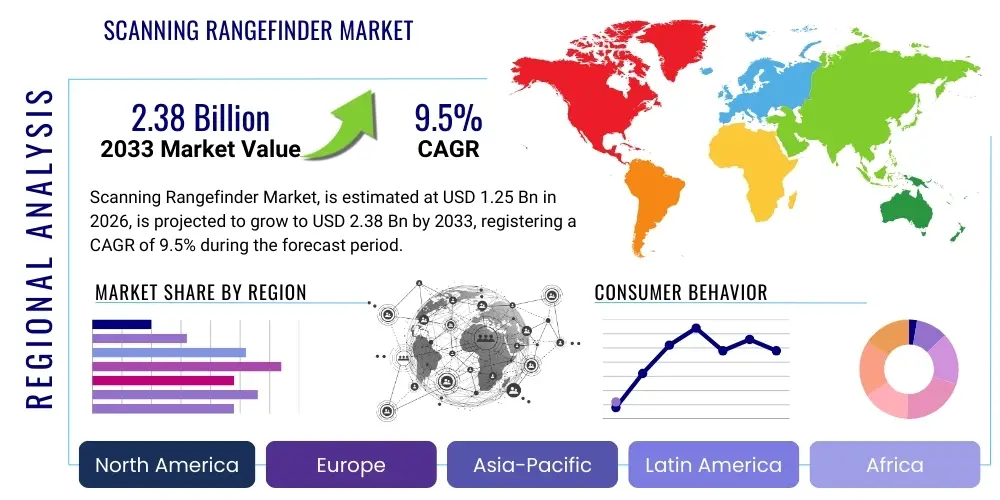

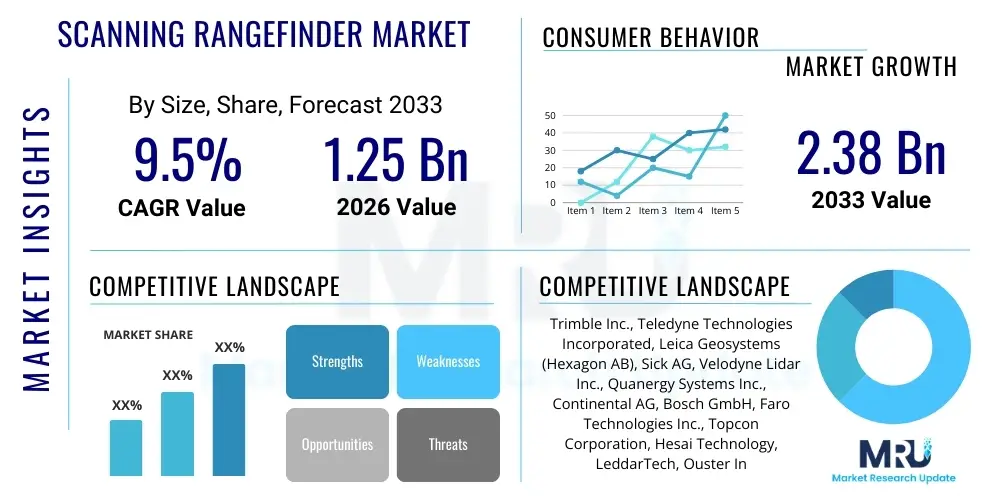

The Scanning Rangefinder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.38 Billion by the end of the forecast period in 2033.

Scanning Rangefinder Market introduction

The Scanning Rangefinder Market encompasses advanced electro-optical devices designed to accurately measure the distance to a target or surface by emitting and receiving energy pulses, such as lasers or ultrasonic waves, while simultaneously scanning across a defined field of view. These devices move beyond simple point-to-point measurement by creating detailed, three-dimensional spatial data, often referred to as point clouds. Products within this market segment, including sophisticated Lidar systems, are critical for applications demanding high spatial resolution, real-time data acquisition, and automated navigation capabilities across various operating environments. Key applications span industrial automation, advanced driver-assistance systems (ADAS), surveying, construction monitoring, and critical defense and aerospace operations, where precision and speed are paramount to mission success and operational efficiency.

The core benefit derived from utilizing scanning rangefinders lies in their unparalleled accuracy and speed in digitalizing physical environments, significantly reducing manual effort and potential human error associated with traditional measurement techniques. Driving factors for market expansion are fundamentally rooted in the global push toward automation and the development of intelligent systems, particularly within the manufacturing sector and emerging mobility solutions. Furthermore, increasing government investment in infrastructure projects, which necessitate detailed geospatial mapping and monitoring, significantly bolsters the demand for high-performance scanning technology. The versatility of these systems, capable of operating effectively in complex and dynamic settings, positions the scanning rangefinder as an indispensable tool for future industrial and technological advancement, promising substantial growth across both established and developing economies worldwide.

Scanning Rangefinder Market Executive Summary

The Scanning Rangefinder Market trajectory is defined by robust technological innovation, particularly the rapid adoption and miniaturization of Light Detection and Ranging (Lidar) systems for commercial integration. Key business trends indicate a strong focus on strategic mergers and acquisitions among major technology providers aimed at consolidating intellectual property related to solid-state Lidar and advanced software algorithms for point cloud processing. The competitive landscape is shifting toward providing integrated solutions that combine hardware excellence with software analytics, moving away from simple component supply. Regionally, the Asia Pacific (APAC) region is poised for the fastest growth, primarily fueled by massive infrastructure development projects, surging investment in smart city initiatives, and the establishment of robust manufacturing hubs requiring automated quality control and precision measurement tools. Concurrently, North America maintains its dominance in revenue share, largely due to high defense expenditure, advanced R&D activities in robotics, and significant early adoption of autonomous vehicle technologies.

Segment trends reveal that the Lidar technology segment is experiencing exponential demand growth due to its superior resolution and long-range capabilities, making it essential for complex 3D mapping and high-level autonomous navigation. Within the application landscape, the Automotive/ADAS segment is the foremost driver of volume, as stringent safety regulations and consumer expectations accelerate the integration of high-definition scanning rangefinders into production vehicles. Conversely, the defense and aerospace segment, while lower in volume, contributes significantly to market value due to the high unit cost and specialized performance requirements for military-grade equipment. Manufacturers are strategically focusing on reducing the cost per unit of scanning components while simultaneously enhancing data processing speeds, thereby making these previously niche technologies accessible to broader industrial and consumer markets, promising sustained market expansion through the forecast period.

AI Impact Analysis on Scanning Rangefinder Market

Common user questions regarding AI's influence often revolve around whether artificial intelligence can truly enhance the raw accuracy of distance measurement, how AI enables real-time interpretation of massive point cloud data, and its role in reducing false positives in autonomous systems. Users frequently inquire about the transition from passive data collection to active, predictive environment understanding enabled by machine learning. The consensus themes indicate high expectations for AI to transform scanning rangefinders from mere sensors into intelligent perception systems. Key concerns center on the computational requirements and data security challenges associated with processing and storing petabytes of 3D spatial information generated by high-resolution scanners, highlighting the necessity for edge computing capabilities and robust algorithmic efficiency to unlock the full potential of integrated rangefinder data analysis.

AI integration fundamentally enhances the utility of scanning rangefinders by providing superior processing capabilities that extend beyond simple geometric mapping. Machine learning algorithms are crucial for tasks such as noise reduction, identifying specific objects within cluttered environments (classification), and generating predictive models of dynamic environments—essential for autonomous navigation and robotic manipulation. Furthermore, AI facilitates predictive maintenance for the rangefinder hardware itself, optimizing performance and reducing downtime. The application of deep learning allows systems to recognize subtle patterns in terrain or structural integrity that are imperceptible to human operators, thus elevating the role of scanning rangefinders in safety-critical applications like structural health monitoring and collision avoidance systems.

- AI algorithms improve point cloud processing speed and volumetric accuracy.

- Machine learning enables real-time object classification and segmentation for autonomous systems.

- AI reduces data noise and handles sensor fusion across multiple ranging modalities.

- Predictive maintenance models based on AI optimize rangefinder operational lifespan and reliability.

- Deep learning enhances environmental awareness, crucial for Lidar integration in ADAS and robotics.

DRO & Impact Forces Of Scanning Rangefinder Market

The market dynamics are governed by a complex interplay of powerful growth drivers stemming from industrial digitalization and significant constraints related to cost and regulatory complexity. A primary driver is the accelerating demand for high-precision 3D mapping and modeling across construction, mining, and city planning sectors, fueled by global urbanization trends and infrastructure investment. Restraints largely center on the relatively high initial capital expenditure required for sophisticated Lidar and laser scanning rangefinder systems, particularly impacting small and medium-sized enterprises (SMEs). Opportunities are concentrated in the rapidly expanding drone and Unmanned Aerial Vehicle (UAV) market, where integrated miniaturized scanning rangefinders offer new capabilities for aerial surveying and logistics. These forces collectively shape the competitive strategy, pushing manufacturers towards cost-effective solid-state solutions while maintaining high performance standards demanded by safety-critical applications like automotive autonomy.

The overarching impact forces steering this market involve the relentless pursuit of automation and efficiency across global industrial processes. Regulatory impact forces, especially concerning automotive safety standards (e.g., Euro NCAP requirements emphasizing robust sensing), directly stimulate technological advancement and market adoption. Furthermore, the constraint of environmental conditions—where fog, rain, or dust can interfere with optical sensing—drives innovation toward multispectral or Frequency Modulated Continuous Wave (FMCW) technologies that offer improved resilience. This necessity for robust performance in diverse operational environments pushes up R&D costs but simultaneously establishes higher barriers to entry for new competitors, contributing to market concentration among established technology leaders.

Key Drivers include the global proliferation of autonomous vehicles and ADAS technology requiring reliable, long-range environmental awareness. The defense sector’s modernization efforts, requiring precise targeting and surveillance capabilities, also significantly boost demand. Restraints include the complexity of integrating rangefinder data into existing enterprise resource planning (ERP) systems and the shortage of skilled professionals capable of operating and maintaining advanced scanning equipment. The most compelling opportunities lie in the development of low-cost, mass-produced solid-state scanning units suitable for consumer electronics and widespread robotics integration, ensuring sustained, broad-based market growth over the next decade.

Segmentation Analysis

The Scanning Rangefinder Market is structurally segmented based on the core technology employed, the measurement range capabilities, and the diverse applications it serves. Analyzing these segments provides strategic insights into investment priorities and areas of rapid technological disruption. The segmentation by technology clearly distinguishes between traditional laser-based systems, ultrasonic solutions, and advanced Lidar systems, with Lidar currently commanding substantial research and investment due to its unparalleled resolution and data density capabilities. Application segmentation, particularly Automotive/ADAS, Surveying & Mapping, and Industrial Automation, dictates volume demand and specific technological requirements, such as ruggedization for industrial use or speed and precision for autonomous driving, thereby influencing product design and market positioning strategies globally.

Further analysis of range segmentation reveals distinct markets: short-range scanners (typically used for indoor robotics or simple distance measurement) prioritize low power consumption and high portability, while long-range systems (crucial for military targeting and large-scale geological surveys) emphasize high laser power output and robustness against environmental interference. The industrial segmentation often focuses on fixed, high-throughput systems used for quality control, volume measurement, and safety monitoring in hazardous environments. This detailed market breakdown allows key stakeholders to tailor their product offerings, sales channels, and marketing campaigns to specific high-growth verticals, ensuring efficient resource allocation and maximization of revenue potential across the diverse landscape of scanning rangefinder applications.

- By Technology:

- Laser Scanning Rangefinders

- Lidar (Light Detection and Ranging)

- Ultrasonic Rangefinders

- By Range:

- Short Range (Up to 100 meters)

- Medium Range (100 meters to 1 kilometer)

- Long Range (Above 1 kilometer)

- By Application:

- Automotive/ADAS

- Surveying and Mapping

- Industrial Automation and Robotics

- Defense and Aerospace

- Construction and Infrastructure

- Mining and Excavation

- By Output Type:

- 2D Scanners

- 3D Scanners

Value Chain Analysis For Scanning Rangefinder Market

The Scanning Rangefinder value chain is characterized by highly specialized components at the upstream level, moving through complex integration and software development during manufacturing, and concluding with specialized system integrators at the downstream level. Upstream analysis focuses on suppliers of critical components, including high-power semiconductor lasers (e.g., VCSELs or edge-emitting lasers), sensitive photoreceivers (SPADs or APDs), specialized optics, and sophisticated Micro-Electro-Mechanical Systems (MEMS) mirrors or rotating platforms crucial for achieving scanning capability. These component suppliers, often highly concentrated and serving multiple high-tech industries, dictate the performance metrics and cost base of the final rangefinder units. Maintaining strong relationships with these suppliers is essential for mitigating supply chain risks and accessing the latest technological iterations, such as solid-state components which significantly reduce cost and size.

Midstream activities involve the design, manufacturing, assembly, and rigorous calibration of the scanning rangefinder systems. This stage is heavily reliant on proprietary software development for processing raw sensor data into meaningful, actionable point clouds, often requiring advanced AI/ML algorithms for noise reduction and object recognition. The distribution channel is segmented into direct sales, primarily used for large-volume industrial contracts or defense procurement where high customization is necessary, and indirect sales, utilizing specialized distributors and value-added resellers (VARs) who provide localized technical support and system integration services. Indirect channels are crucial for reaching fragmented markets like small construction firms and regional surveying companies, ensuring broader market penetration and accessible maintenance support for complex hardware and software solutions.

Downstream analysis centers on the end-user integration and service phase. Downstream players include system integrators specializing in marrying the rangefinder hardware with the end application’s platform, such as integrating Lidar units onto autonomous vehicles (OEMs and Tier 1 suppliers), drones, or robotic arms. These integrators provide the crucial link between the raw technology and the operational environment, tailoring the data output format and communication protocols to fit specific customer needs (e.g., connecting a scanner to a building information modeling (BIM) system). The revenue generated at this stage often includes lucrative post-sale software update agreements, calibration services, and data analytics consultation, emphasizing that the long-term value proposition is increasingly shifting from the hardware unit itself to the accompanying analytical capabilities and customer support ecosystem.

Scanning Rangefinder Market Potential Customers

The potential customer base for the Scanning Rangefinder Market is exceptionally diverse, spanning capital-intensive industries that prioritize safety, precision, and efficiency through automation. Primary end-users include governmental and defense agencies requiring long-range, ruggedized systems for surveillance, targeting, and boundary enforcement, often prioritizing durability and superior operational resilience over cost. Commercial potential customers include automotive manufacturers (OEMs and Tier 1 suppliers) who procure high-definition Lidar units in massive volumes for integration into ADAS and fully autonomous vehicle platforms, where the driving factors are reliability, size reduction, and affordability for mass production deployment. These customers are highly sensitive to technological maturity and supplier stability due to the criticality of the safety functions performed by the sensors.

The surveying, construction, and geospatial industries represent a foundational segment, utilizing scanning rangefinders, particularly terrestrial and drone-mounted Lidar, for detailed terrain mapping, asset management, volumetric calculations in mining, and monitoring structural integrity over time. For these buyers, the speed of data acquisition and the resulting point cloud density are crucial metrics, directly impacting project turnaround times and cost efficiency. Furthermore, the industrial automation sector, including robotics manufacturers and large-scale material handling facilities, represents a rapidly growing customer segment. They utilize short-to-medium range scanners for object detection, precise positioning of robotic arms, quality inspection on production lines, and ensuring safety zones around heavy machinery, demonstrating a clear pivot toward sensor-driven, fully autonomous factory environments requiring minimal human intervention.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.38 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Trimble Inc., Teledyne Technologies Incorporated, Leica Geosystems (Hexagon AB), Sick AG, Velodyne Lidar Inc., Quanergy Systems Inc., Continental AG, Bosch GmbH, Faro Technologies Inc., Topcon Corporation, Hesai Technology, LeddarTech, Ouster Inc., Zoller + Fröhlich GmbH, Riegl Laser Measurement Systems GmbH, Raytheon Technologies, Lockheed Martin, General Dynamics, Mitsubishi Electric, Cepton, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Scanning Rangefinder Market Key Technology Landscape

The technological evolution of scanning rangefinders is centered on achieving higher resolution, greater measurement speed, and significant component miniaturization, primarily driven by the automotive sector’s need for affordable, robust sensors. Traditional mechanical scanning systems, while highly accurate, are gradually being superseded by solid-state technologies, such as Micro-Electro-Mechanical Systems (MEMS) Lidar and Optical Phased Arrays (OPA). MEMS technology uses tiny mirrors to steer the laser beam rapidly and reliably without the wear associated with bulky mechanical rotation, drastically reducing the sensor footprint and improving overall durability. OPA systems, utilizing phase modulation to steer the beam electronically, represent the pinnacle of solid-state innovation, promising true beam steering with no moving parts, thus offering optimal longevity and ease of mass production, which is essential for achieving cost parity with traditional camera sensors.

A critical technology gaining traction is Frequency Modulated Continuous Wave (FMCW) Lidar. Unlike traditional Time-of-Flight (ToF) systems which measure pulse return time, FMCW Lidar measures the frequency shift (Doppler effect) of the returning light. This provides not only distance but also instantaneous velocity information for every point, a crucial advantage in preventing collisions and predicting object movement in high-speed autonomous applications. Furthermore, FMCW systems offer superior interference rejection capabilities, crucial when multiple rangefinders are operating simultaneously in close proximity (e.g., in dense traffic environments), addressing a significant limitation of existing pulse-based technologies. The shift toward integrated photonics and silicon chip-based rangefinders is accelerating the commercial viability of these advanced technologies.

Complementary technologies essential for market growth include advanced sensor fusion software and specialized data processing hardware. The raw data output (point clouds) generated by high-resolution scanners is immense; thus, the development of specialized Application-Specific Integrated Circuits (ASICs) and high-performance Field-Programmable Gate Arrays (FPGAs) dedicated to real-time processing and compression is critical for practical deployment. Furthermore, algorithms enabling effective sensor fusion—integrating data from rangefinders with inputs from cameras, radar, and inertial measurement units (IMUs)—are required to create a robust and comprehensive environmental model. This holistic technological ecosystem, encompassing improved optics, solid-state scanning mechanisms, and AI-powered processing, defines the current competitive advantage within the scanning rangefinder manufacturing industry.

Regional Highlights

The global Scanning Rangefinder Market demonstrates significant regional variation in both demand drivers and technological adoption rates, heavily influenced by local economic structures, regulatory environments, and investment priorities. North America commands a substantial market share, primarily driven by consistently high defense budgets necessitating cutting-edge surveillance and targeting systems, robust investment in commercial robotics, and accelerated R&D for autonomous vehicle testing and deployment. The presence of major technology developers and strong government support for technological innovation position the United States and Canada as leaders in both production and consumption of high-end, long-range scanning rangefinders. Market activities here are characterized by a focus on integrating Lidar technology into critical infrastructure monitoring and advanced aerial mapping projects.

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid expansion is underpinned by exponential growth in construction and infrastructure development, particularly in emerging economies such as China, India, and Southeast Asian nations, where large-scale projects demand accurate, rapid surveying and monitoring solutions. Furthermore, APAC is solidifying its position as a global manufacturing hub for electronics and automotive components, driving massive investment in industrial automation and quality control systems that rely heavily on 3D scanning rangefinders. Government-led initiatives promoting smart cities and advanced manufacturing techniques further cement APAC’s role as the primary engine for future market growth.

Europe represents a mature market characterized by strong regulatory emphasis on industrial safety and stringent automotive standards, fostering continuous demand for high-quality scanning rangefinders. Germany, with its dominant automotive industry, is a central hub for the adoption of ADAS-integrated Lidar systems. Scandinavian countries, known for their environmental technology focus, utilize rangefinders extensively in forestry and geological surveying. While growth rates might be slightly lower than APAC, European demand remains consistent, concentrating on technological sophistication, reliability, and compliance with high European Union industrial automation and machinery directives, particularly favoring systems designed for functional safety applications.

- North America: Market leader in defense spending and autonomous vehicle R&D; high adoption of advanced Lidar in Silicon Valley and related tech clusters.

- Asia Pacific (APAC): Fastest growing region due to massive infrastructure development, smart city initiatives, and expanding industrial automation in China, Japan, and India.

- Europe: Strong focus on industrial safety compliance (Industry 4.0) and high integration of ADAS technologies in premium automotive manufacturing sectors.

- Latin America (LATAM): Growing market driven by large-scale mining operations (Chile, Brazil) and oil & gas exploration requiring specialized geological mapping and asset management.

- Middle East and Africa (MEA): Demand concentrated in critical infrastructure protection, energy sector monitoring, and defense applications, particularly in the GCC countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Scanning Rangefinder Market.- Trimble Inc.

- Teledyne Technologies Incorporated

- Leica Geosystems (Hexagon AB)

- Sick AG

- Velodyne Lidar Inc.

- Quanergy Systems Inc.

- Continental AG

- Bosch GmbH

- Faro Technologies Inc.

- Topcon Corporation

- Hesai Technology

- LeddarTech

- Ouster Inc.

- Zoller + Fröhlich GmbH

- Riegl Laser Measurement Systems GmbH

- Raytheon Technologies

- Lockheed Martin

- General Dynamics

- Mitsubishi Electric

- Cepton, Inc.

Frequently Asked Questions

Analyze common user questions about the Scanning Rangefinder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a scanning rangefinder and a standard distance sensor?

A scanning rangefinder utilizes a moving mechanism (mechanical or solid-state) to measure distance across a defined field of view, generating a comprehensive 2D or 3D point cloud, whereas a standard distance sensor provides only a single point-to-point measurement.

How is Lidar technology changing the competitive landscape of the scanning rangefinder market?

Lidar, especially miniaturized solid-state Lidar, is driving significant market expansion by offering higher resolution and superior data density necessary for autonomous systems (ADAS and robotics) while simultaneously reducing system cost and physical footprint for mass commercial deployment.

Which application segment accounts for the highest volume demand for scanning rangefinders?

The Automotive/ADAS segment currently accounts for the highest volume demand, primarily driven by global governmental regulations and consumer expectations mandating the integration of reliable 3D sensing technology for enhanced vehicle safety features.

What major technological innovation is improving rangefinder performance in adverse weather conditions?

Frequency Modulated Continuous Wave (FMCW) Lidar technology is significantly improving performance in challenging weather, such as fog or rain, by utilizing the Doppler effect for velocity measurement and offering superior interference rejection compared to standard Time-of-Flight systems.

Where are the main growth opportunities concentrated for rangefinder manufacturers?

The main growth opportunities are concentrated in the integration of rangefinders onto Unmanned Aerial Vehicles (UAVs) for aerial mapping and inspection, and the increasing demand for robotic vision systems in advanced manufacturing and warehousing automation globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Spiral Laser Scanning Rangefinder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Laser Scanning Rangefinder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager