Signage Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436829 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Signage Market Size

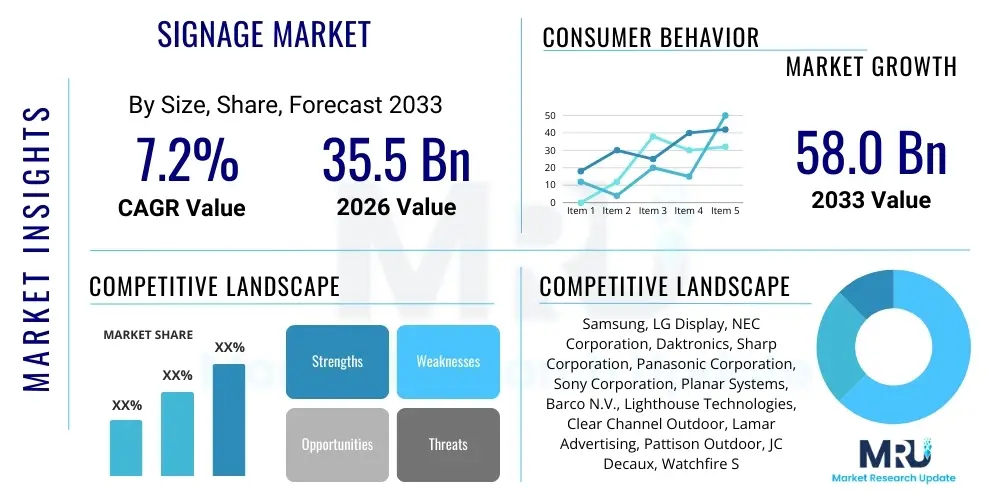

The Signage Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 58.0 Billion by the end of the forecast period in 2033.

Signage Market introduction

The Signage Market encompasses a broad spectrum of visual communication products, ranging from traditional printed posters and static billboards to advanced, dynamic digital displays (digital signage). These systems serve critical functions in marketing, information dissemination, navigation, and regulatory compliance across diverse sectors. Digital signage, utilizing technologies like LCD, LED, and projection, forms the rapidly expanding core of the market, offering features such as real-time content updates, interactivity, and integration with data analytics platforms. This shift is primarily driven by the increasing demand for personalized consumer experiences and the need for flexible, high-impact advertising solutions in crowded urban and retail environments.

Major applications of signage span retail environments for point-of-sale advertising, the transportation sector for scheduling and wayfinding, corporate offices for internal communications, and the hospitality industry for guest information. The primary benefit of modern digital signage is its ability to engage audiences more effectively than static media, providing superior return on investment (ROI) through dynamic content scheduling and targeted messaging based on demographic data or time of day. Furthermore, digital infrastructure significantly reduces the operational costs and environmental impact associated with printing and physical installation updates inherent to traditional signage.

Driving factors for sustained market growth include rapid urbanization globally, infrastructure development (smart cities), and the declining cost of high-definition display technology. The expansion of retail and QSR (Quick Service Restaurant) chains, coupled with technological advancements like 4K and 8K resolution displays, miniaturized LEDs (MicroLEDs/MiniLEDs), and enhanced connectivity solutions (5G), fuel the adoption across all regional markets. Regulatory requirements concerning public information displays, particularly in transit and emergency services, also necessitate investment in reliable and dynamically updatable signage infrastructure.

Signage Market Executive Summary

The global Signage Market is characterized by a significant transition from static display methods to dynamic digital platforms, setting the dominant business trends for the forecast period. Technological innovation, particularly in LED and display processing capabilities, is accelerating adoption across commercial and public infrastructures. Key segments, especially Retail and Corporate communication, are heavily investing in interactive digital menu boards and large format displays to enhance customer engagement and streamline internal operations. Business models are also evolving, favoring Software as a Service (SaaS) and managed service agreements over outright hardware purchases, providing recurring revenue streams for system integrators and content management vendors.

Geographically, North America and Europe currently represent the largest revenue generators, attributed to early technology adoption and significant investment in smart retail and smart city projects. However, the Asia Pacific (APAC) region is poised for the highest growth rate, fueled by massive infrastructural spending, rapid commercialization, and increasing consumer disposable income in emerging economies like China and India. Regional trends highlight that while developed markets focus on enhancing display quality (e.g., high resolution, interactivity) and connectivity, emerging markets prioritize the foundational installation of large outdoor LED screens and entry-level digital menu boards to modernize existing advertising infrastructure.

Segment trends underscore the dominance of the Digital Signage sub-segment, particularly systems integrating Internet of Things (IoT) sensors and Artificial Intelligence (AI) for audience measurement and content optimization. The technology segment is led by LED displays due to their superior brightness, energy efficiency, and modular flexibility, making them ideal for large-scale outdoor and high-ambient-light indoor installations. In terms of application, the Retail sector remains the largest consumer, leveraging signage for promotional campaigns, dynamic pricing, and enhancing the overall in-store experience, closely followed by the high-growth transportation sector utilizing digital displays for critical real-time passenger information.

AI Impact Analysis on Signage Market

User inquiries regarding AI's influence on the Signage Market frequently center on automation capabilities, enhanced personalization, and the integration of predictive analytics. Common questions involve how AI can optimize content scheduling based on real-time audience data, whether facial recognition technology will raise privacy concerns, and the extent to which generative AI tools will reduce the cost and complexity of content creation. Users are keenly interested in moving beyond simple dynamic content to achieve truly contextual advertising, where the message changes instantly based on specific viewer profiles, ambient factors, or current stock levels, aiming for maximum efficiency and engagement.

AI is fundamentally transforming the digital signage ecosystem from passive display infrastructure into an intelligent, responsive communication channel. Machine learning algorithms are now deployed to analyze vast datasets derived from CCTV footage, proximity sensors, Wi-Fi data, and point-of-sale systems. This analysis allows signage networks to execute highly sophisticated campaigns by determining optimal display times, calculating dwell time, and accurately measuring the effectiveness of specific creative assets. This capability shifts signage expenditure from a fixed cost to a performance-driven marketing investment, providing advertisers with demonstrable ROI metrics previously unavailable in static or non-AI-integrated digital platforms.

The most significant impact of AI lies in personalization and operational efficiency. By automating content management systems (CMS) and integrating predictive maintenance diagnostics, AI minimizes downtime and reduces the human effort required for campaign execution. Furthermore, generative AI tools are emerging to automate the scaling and modification of digital content, rapidly adapting visuals and text to fit different display sizes, regional languages, or compliance regulations instantly. While privacy concerns remain a critical factor, advancements in anonymization and edge computing processing (processing data locally without cloud transmission) are being utilized to uphold regulatory compliance while still deriving actionable insights.

- AI enables real-time, context-aware content adjustment based on audience demographics, weather, or current events.

- Machine learning algorithms optimize programmatic advertising schedules for maximal viewability and conversion rates.

- Predictive maintenance analytics minimize system downtime by identifying potential hardware failures proactively.

- Integration of computer vision allows for accurate, anonymous audience measurement and dwell time analysis.

- Generative AI tools accelerate the creation and localization of complex digital signage content, reducing production costs.

- AI facilitates deep integration with inventory systems, enabling dynamic displays of product availability and pricing instantly.

DRO & Impact Forces Of Signage Market

The Signage Market is primarily propelled by the relentless technological migration towards dynamic digital solutions, fueled by the demand for highly engaging and measurable advertising media. Key drivers include the decreasing cost of high-resolution display panels (LED and LCD) and the ubiquitous rollout of high-speed internet and 5G networks, enabling seamless content distribution and cloud management across geographically dispersed screens. Opportunities are abundant in niche markets such as interactive kiosks, transparent LED screens, and specialized medical and educational displays. However, market growth is significantly restrained by high initial capital investment costs required for large-scale digital network deployment, particularly in outdoor environments, and persistent concerns surrounding data privacy and content security within integrated smart signage systems. These forces collectively dictate the adoption pace and investment priorities across end-user industries.

The driving forces are particularly evident in the convergence of physical and digital retail (phygital), where dynamic signage serves as a critical bridge, allowing brick-and-mortar stores to mimic the personalized responsiveness of e-commerce platforms. This necessitates continuous innovation in display technology, focusing on brighter, more robust displays suitable for 24/7 operation and outdoor use (impact resistance, temperature tolerance). Furthermore, legislative support for public information systems and emergency broadcast integration drives mandatory installations across government and transportation sectors. The high ROI potential, contrasting with the diminishing effectiveness of traditional static media, reinforces the business case for digital investment, cementing the trend toward modernization.

Restraints are complex, involving not only the cost of hardware but also the complexity of operating sophisticated content management software (CMS) and ensuring content compliance across various jurisdictions. The lack of standardized protocols for integrating different signage components (hardware, software, sensors) often complicates large-scale installations, requiring specialized system integration expertise. The impact forces indicate that the market is currently experiencing high disruptive power from technology, medium influence from economic factors (capex concerns), and growing regulatory pressure related to environmental sustainability (power consumption of displays) and audience data protection (GDPR, CCPA), necessitating a strategic focus on energy-efficient displays and robust cybersecurity measures.

Segmentation Analysis

The Signage Market is highly diversified, segmented primarily by technology type (driving the functional capability), application (determining end-user industry demand), and location (affecting robustness and complexity requirements). The major technological split exists between traditional static signage (printed, non-printed physical signs) and the rapidly expanding digital signage segment (LED, LCD, Projection). Analyzing these segments provides deep insights into where capital expenditure is concentrated, revealing that while digital segments drive high revenue growth, the low-cost traditional segments maintain significant volume, especially in developing regions and for regulatory requirements where dynamic content is not mandatory. The ongoing trend involves the cannibalization of the traditional market share by digital alternatives.

- By Technology:

- Digital Signage (LED, LCD/TFT, Plasma, Projection)

- Traditional Signage (Printed Signs, Non-Printed/Static Signs, Vinyl Graphics)

- By Component:

- Hardware (Displays, Media Players, Projectors, Mounts, Accessories)

- Software (Content Management Systems, Scheduling Software, Analytics Software)

- Services (Installation, Maintenance, Content Creation & Management)

- By Application/End-User:

- Retail & QSR (Quick Service Restaurants)

- Hospitality (Hotels, Resorts)

- Corporate & Business Offices

- Healthcare

- Transportation (Airports, Rail Stations, Public Transit)

- Education

- Public Places & Infrastructure (Smart Cities)

- By Location:

- Indoor Signage

- Outdoor Signage

Value Chain Analysis For Signage Market

The Signage Market value chain is multi-layered, beginning with upstream raw material and component manufacturers, flowing through specialized display hardware producers, and culminating in highly fragmented downstream system integration and content provision services. Upstream activities involve the production of semiconductor chips, glass substrates, LED diodes, and panel backlighting systems, areas dominated by large technological conglomerates in Asia Pacific. Midstream activities focus on the assembly and manufacturing of display panels (OEMs like Samsung, LG) and media players, where quality control and scale efficiencies are paramount. The complexity of digital signage necessitates robust partnerships between display manufacturers and software developers, ensuring seamless integration between hardware capabilities and CMS functionality.

Downstream activities are highly customized and localized. These include distribution channels (direct sales to large enterprises, indirect through value-added resellers (VARs) and distributors), installation specialists, and, crucially, creative content agencies and managed service providers (MSPs). The shift towards digital signage has elevated the importance of software and services; consequently, distribution channels are increasingly focused on providing total solutions rather than just hardware sales. Direct distribution is common for large, high-value public infrastructure projects, whereas indirect channels serve the vast SMB and smaller retail sectors, offering localized support and customized integration services.

The industry is moving toward an integrated model where major hardware players are acquiring or partnering with software companies to offer end-to-end solutions, simplifying the procurement process for end-users. The profitability within the value chain has migrated from the commoditized display hardware to the recurring revenue derived from software licenses, cloud services, and ongoing maintenance contracts. Successful market participants are those who can effectively manage these complex partnerships and deliver both cutting-edge display technology and robust, user-friendly content management platforms.

Signage Market Potential Customers

Potential customers for the Signage Market are diverse, spanning virtually every sector requiring communication with employees, customers, or the public. The primary buyers are large retail chains, which utilize sophisticated digital signage networks for dynamic pricing, promotional updates, and interactive self-service kiosks. These retailers seek solutions that enhance the customer journey and provide measurable sales lift. Following closely are the transportation authorities (airports, train stations), governmental bodies, and municipal operators who procure robust, highly reliable displays for critical public information dissemination, wayfinding, and emergency alerts, prioritizing durability and 24/7 operational capability.

The hospitality sector, including major hotel chains and entertainment venues, represents a significant growth area, utilizing digital screens for dynamic event schedules, guest messaging, and upscale advertising to enhance the ambiance. Corporate clients, ranging from financial institutions to technology firms, are adopting digital signage for internal communications, video conferencing displays, and brand identity reinforcement within modern office spaces, focusing on seamless network integration and security. Furthermore, educational institutions and healthcare providers are increasing their adoption for campus-wide announcements, directory services, and patient flow management, requiring systems that are easy to update and adhere to specific accessibility standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 58.0 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung, LG Display, NEC Corporation, Daktronics, Sharp Corporation, Panasonic Corporation, Sony Corporation, Planar Systems, Barco N.V., Lighthouse Technologies, Clear Channel Outdoor, Lamar Advertising, Pattison Outdoor, JC Decaux, Watchfire Signs, Absen, Leyard, Christie Digital Systems, D-NEX, BenQ. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Signage Market Key Technology Landscape

The technological landscape of the Signage Market is dominated by Light Emitting Diode (LED) and Liquid Crystal Display (LCD) technologies, which dictate the visual performance and energy efficiency of the displays. LED technology is increasingly preferred for large format outdoor displays and high-brightness indoor video walls due to its superior brightness, scalability, and long lifespan. Recent innovations include MicroLED and MiniLED technologies, which offer enhanced contrast ratios and color fidelity, challenging traditional OLED displays while providing greater longevity and power efficiency, making them ideal for premium retail and broadcast environments. The continued miniaturization of LED pitches allows for ultra-high-resolution imagery even at close viewing distances.

Beyond the display panels themselves, crucial technological advancements are occurring in supporting infrastructure. Cloud-based Content Management Systems (CMS) are becoming the industry standard, providing remote management, real-time diagnostics, and API integration capabilities necessary for large, distributed signage networks. Furthermore, the integration of 5G connectivity is pivotal, ensuring high-bandwidth, low-latency communication necessary for streaming 4K and 8K video content and enabling real-time interactivity across the network without relying solely on localized Wi-Fi or fixed infrastructure. This network capability is essential for leveraging sophisticated, data-driven content delivery models.

The shift toward interactivity is driven by the deployment of touch screen capabilities, integrated sensors (proximity, ambient light), and edge computing devices. Edge computing allows for local data processing, crucial for AI-driven audience analysis and dynamic content triggering without substantial latency, addressing both performance and data privacy requirements. Moreover, advances in projection technology, particularly laser projection, offer high-impact, non-traditional display solutions suitable for large architectural mapping and unique spatial advertising installations, further diversifying the technological options available to advertisers and infrastructure developers.

Regional Highlights

- North America: This region holds a significant share of the global signage market, characterized by high disposable income, early adoption of cutting-edge display technology, and strong demand from the organized retail, corporate, and transportation sectors. The market here is mature and focuses heavily on digital transformation, including the widespread deployment of interactive kiosks, AI-enabled audience measurement, and integration into comprehensive smart building management systems. High competition among display manufacturers and sophisticated system integrators ensures continuous innovation.

- Europe: The European market is robust, driven by strict regulatory requirements for public information displays (PID) and substantial investment in modernization programs for transport hubs and smart city infrastructure. Countries like the UK, Germany, and France are leaders in adopting environmentally conscious and energy-efficient digital signage solutions. The General Data Protection Regulation (GDPR) heavily influences the development of audience measurement technologies, requiring strong emphasis on anonymization and consent management.

- Asia Pacific (APAC): APAC is anticipated to exhibit the highest CAGR during the forecast period. This growth is fueled by massive urbanization, rising infrastructure development projects (e.g., in China, India, and Southeast Asia), and the rapid expansion of organized retail and Quick Service Restaurants (QSRs). While the focus remains on large-scale LED outdoor advertising initially, particularly in emerging economies, developed markets like Japan and South Korea are pushing boundaries in high-resolution, specialized displays (e.g., OLED signage).

- Latin America (LATAM): This region shows steady growth, primarily driven by the modernization of retail infrastructure and increasing government spending on public security and transportation displays in major economies like Brazil and Mexico. Price sensitivity remains a key factor, favoring cost-effective, durable LED solutions over premium, high-resolution LCD installations in many segments, although demand for sophisticated digital menu boards is accelerating.

- Middle East and Africa (MEA): Growth in the MEA region is strongly tied to large-scale infrastructure projects, mega-events (like the World Expo and global sporting events), and substantial investment in hospitality and luxury retail sectors, particularly in the UAE, Saudi Arabia, and Qatar. The demand here is for high-end, bespoke digital signage solutions, often requiring extremely high brightness and durability to withstand harsh climatic conditions (high heat and dust).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Signage Market.- Samsung Electronics Co., Ltd.

- LG Display Co., Ltd.

- NEC Corporation

- Daktronics, Inc.

- Sharp Corporation

- Panasonic Corporation

- Sony Corporation

- Planar Systems (acquired by Leyard)

- Barco N.V.

- Lighthouse Technologies

- Clear Channel Outdoor Holdings, Inc.

- Lamar Advertising Company

- Pattison Outdoor Advertising

- JC Decaux SA

- Watchfire Signs

- Absen Co., Ltd.

- Leyard Optoelectronic Co., Ltd.

- Christie Digital Systems USA, Inc.

- D-NEX Co., Ltd.

- BenQ Corporation

Frequently Asked Questions

Analyze common user questions about the Signage market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from traditional to digital signage?

The primary driver is the need for dynamic, real-time content updates and measurable advertising effectiveness. Digital signage offers flexibility, reduced long-term operational costs (no printing), superior engagement through interactive features, and integration with data analytics for targeted messaging, surpassing the capabilities of static media.

Which technology segment dominates the Signage Market?

Digital Signage, particularly LED technology, dominates the market in terms of revenue growth. LED displays are preferred due to their high brightness, energy efficiency, scalability for large installations (video walls and billboards), and reduced operational lifecycles compared to older display technologies.

How does AI contribute to the profitability of digital signage networks?

AI significantly enhances profitability by optimizing content scheduling based on real-time audience metrics (viewership, demographics, dwell time), ensuring that the most relevant advertisement is displayed at the optimal moment. This improves campaign ROI and allows for dynamic pricing models for advertising slots, increasing revenue per display unit.

What are the primary challenges facing the widespread adoption of outdoor digital signage?

Key challenges include the high initial capital expenditure for durable, weather-resistant hardware, the substantial power consumption required for high brightness displays, and managing content security and connectivity across vast geographic areas. Regulatory restrictions on light pollution and display size also pose hurdles in urban centers.

Which end-user segment is the largest consumer of signage solutions?

The Retail and Quick Service Restaurant (QSR) sector is the largest end-user segment. This industry leverages signage for crucial functions such as dynamic menu boards, promotional displays, brand reinforcement, and enhancing the in-store customer experience through interactive kiosks and point-of-sale displays.

The rapid evolution of display technologies, coupled with sophisticated content management and data analytics, positions the Signage Market for sustained, robust growth over the forecast period. Investment will continue to prioritize network reliability, content personalization, and the integration of smart sensors to convert passive displays into active data-gathering and communication hubs. The convergence of 5G, AI, and specialized display hardware is set to unlock significant new revenue streams in public infrastructure and personalized retail environments, emphasizing a strong market preference for scalable and future-proof digital solutions. Competitive advantage will be secured by companies providing holistic, secure, and energy-efficient end-to-end solutions that minimize complexity for end-users while maximizing communication effectiveness.

Future market trajectory is highly dependent on addressing cybersecurity concerns and ensuring compliance with evolving global data privacy regulations, especially as AI-driven audience measurement becomes standard practice. Manufacturers are expected to heavily invest in developing ultra-low power consumption displays and modular designs that simplify maintenance and upgrades. Furthermore, the expansion of interactive applications, such as large-format multi-touch video walls and immersive spatial displays in experience centers and corporate lobbies, indicates a movement toward high-impact, technologically advanced visual communication strategies, moving far beyond basic static visual aids.

The Signage Market, particularly its digital components, will increasingly merge with the broader IoT and smart city ecosystems. Signage screens will not merely display information; they will function as networked endpoints collecting environmental data, providing emergency communication relays, and serving as interactive touchpoints for municipal services. This integration necessitates strong collaboration across technology providers, city planners, and advertising agencies to capitalize on the transformative potential of unified, intelligent visual communication infrastructure across the global economy.

The retail environment continues to champion innovation within the signage sector. The shift towards omnichannel retail strategies places immense pressure on physical stores to deliver experiences that justify the consumer's visit. Digital signage, therefore, must provide more than just advertisements; it needs to offer navigational assistance, product recommendations based on real-time inventory checks, and integration with mobile applications, creating a seamless 'phygital' journey. This necessity drives the adoption of advanced solutions like transparent OLED displays in window fronts and interactive fitting room mirrors that double as digital signage, further blurring the lines between information display and experiential technology.

In the corporate and enterprise segment, the demand is moving toward unified communication displays. Modern offices require large-format displays for hybrid meeting environments, interactive whiteboards for collaboration, and centralized digital signs for employee engagement and safety messages. The driving factor here is workplace efficiency and the need to maintain cohesive corporate culture across geographically dispersed teams. Security and network management are paramount in this sector, favoring enterprise-grade CMS platforms with robust authentication and remote diagnostic capabilities to ensure critical information integrity and network uptime.

Technologically, advancements in display durability and modularity are crucial, particularly for outdoor and transportation applications. New display coatings and materials are being developed to resist vandalism, extreme temperatures, and high humidity, significantly extending the operational lifespan and reducing maintenance costs. This focus on reliability ensures that signage networks in public, high-traffic environments remain functional and accurate, which is essential for passenger safety and public trust in digital infrastructure. The transition to higher refresh rates and wider color gamuts is also critical for maintaining visual quality and attracting advertiser investment in premium digital out-of-home (DOOH) advertising spots.

Service provision within the market is evolving rapidly. Beyond basic installation and repair, managed services are now key differentiators. These services often encompass content scheduling optimization, regulatory compliance checks, data analytics reporting, and continuous software updates. Many businesses, especially small to medium enterprises (SMEs) that lack dedicated IT teams for display management, prefer outsourcing the entire signage operation to managed service providers (MSPs). This trend validates the growing revenue contribution of the service segment within the overall market structure and highlights the complexity inherent in running modern digital communication networks effectively.

Finally, sustainability is emerging as a non-negotiable factor. As governments and corporations prioritize environmental, social, and governance (ESG) metrics, the energy consumption of digital signage—especially large LED installations—comes under scrutiny. This pushes manufacturers to innovate in energy-saving modes, efficient power supply designs, and the use of recyclable materials in display construction. Signage solutions that offer lower Total Cost of Ownership (TCO) over their lifecycle, including reduced energy bills and waste from frequent content changes, are gaining a competitive edge, aligning market growth with global ecological responsibility efforts.

The integration of the signage ecosystem with data platforms is enhancing the strategic value of installations. By leveraging anonymized data from mobile devices, sensors, and cameras, signage systems can function as powerful consumer behavior analytic tools, providing valuable intelligence back to marketers and retailers. This capability turns a communication medium into a vital piece of business intelligence infrastructure, justifying substantial investment in high-end, network-enabled displays that are capable of complex data processing and content triggering. This move from simple display to intelligent platform is the definitive market characteristic of the current decade.

The competitive landscape is defined by the ongoing battle between display hardware giants (Samsung, LG) and specialized system integrators/software providers (like Stratacache, Scala). While hardware players focus on technological superiority (brighter, thinner, higher resolution), software vendors differentiate themselves through advanced CMS features, robust cloud infrastructure, and superior integration capabilities with third-party systems like ERPs (Enterprise Resource Planning) and POS (Point-of-Sale) terminals. Partnerships between these two groups are essential for delivering seamless, highly functional solutions to large enterprise customers across verticals.

Future growth geographically will be significantly concentrated in the APAC region, where rapid mass transit expansion and the development of entirely new smart cities create greenfield opportunities for large-scale digital deployments. Investment policies in these regions increasingly favor digitalization of public services and advertising media, promoting the quick installation of sophisticated, networked LED screens across transport networks and commercial zones. This regional expansion offers vast potential for both hardware suppliers and content management service providers seeking scale.

In terms of regulatory impact, standardization of content protocols, particularly for emergency broadcasting systems (EBS) integration, is a growing necessity. Signage systems must be capable of overriding scheduled content instantly with critical safety information. This demands high reliability in network connectivity and compliance with national and international standards for public warning systems. Meeting these non-negotiable requirements opens up significant public sector and infrastructure contracts for compliant signage manufacturers and system providers.

The specialized signage segments, such as transparent LED film, holographic projection, and flexible OLED displays, represent high-value niches. These technologies cater to high-end retail, architectural installations, and experiential marketing campaigns where unique visual impact is prioritized over cost efficiency. While these segments do not generate the volume of standard LCD or LED panels, they drive premium pricing and are essential for showcasing technological leadership and establishing brand presence in elite commercial spaces globally.

The Signage Market's resilience during economic fluctuations is partly attributed to its versatility. During periods of economic strength, businesses invest heavily in advertising and experiential displays. During downturns, the focus shifts to operational efficiency, driving demand for digital solutions that can quickly adjust dynamic pricing and reduce waste associated with printed materials, ensuring continuous demand across varying economic cycles, albeit with shifting investment priorities.

Ultimately, the market trajectory is fixed on intelligence and interactivity. Future signage will not just deliver information; it will engage, measure, and adapt in real-time. This holistic, data-driven approach to visual communication ensures the Signage Market remains a vital and expanding component of the broader digital transformation landscape, offering significant long-term growth prospects for stakeholders across the entire value chain.

The integration of augmented reality (AR) capabilities is emerging as a key development, particularly in retail and entertainment sectors. AR-enabled signage allows consumers to interact with the display using their smartphones, overlaying digital content onto the physical world, offering enhanced product visualization and gaming experiences. While still nascent, this technology signifies the shift towards hybrid display environments that engage consumers across multiple personal devices simultaneously, multiplying the potential reach and depth of signage-driven communication campaigns.

Addressing the maintenance and reliability component, modular design principles are being universally adopted by leading hardware manufacturers. This approach allows for quicker repair times by facilitating the easy replacement of individual LED modules or power supply units without dismantling the entire display. For large-scale outdoor installations, reduced service downtime is critical, directly influencing the total revenue generated from advertising space, thereby making modularity a strong selling point for system integrators and asset owners.

Furthermore, the competitive edge is increasingly held by companies that offer comprehensive Content-as-a-Service (CaaS) models. This package includes content creation, scheduling, optimization based on AI analytics, and managed hardware maintenance, simplifying the process for businesses that wish to leverage the power of digital signage without internal creative or technical overhead. The shift towards CaaS models highlights the market maturity where the value proposition is moving away from the physical display and towards the intellectual property and continuous management of the communication network.

The education sector's adoption rate is accelerating, driven by the need for clear campus navigation, emergency alerts, and displaying real-time class schedules. Modern educational institutions are adopting interactive digital whiteboards and video walls that function both as teaching aids and campus-wide communication platforms. This necessity is universal across developed and developing nations, guaranteeing sustained institutional investment in durable and user-friendly digital signage solutions customized for high-traffic student environments.

Finally, the long-term outlook for the traditional (static) signage segment remains stable but niche. While digital displays command higher value, traditional printed signs are still essential for regulatory warnings, low-cost temporary promotions, and environments where power access is unavailable or prohibitive. The traditional market will continue to exist, but its growth will be flat, with its primary role shifting to complementing large-scale digital campaigns rather than acting as the primary communication medium, solidifying the dominance of the digital segment in future market valuation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Printed Signage Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Digital Signage Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Digital Signage Media Player Market size was valued at over USD 950 million with a global shipment of over 2.5 million units in 2016. .. Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Polymethyl Methacrylate (Pmma) Film & Sheet Market Size Report By Type (Polymethyl Methacrylate Film, Polymethyl Methacrylate Sheet), By Application (Construction, Automotive Parts, Consumer Electronics, Signage & Displays, Others, Construction, Furniture, Automotive Parts, Consumer Electronics, Signage & Displays, Medical & Healthcare, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Flexible Electronic Paper Market Size Report By Type (Organic Material, Substrate, Conductive Layer, Backlight Panel, Others), By Application (Smartphone and Tablet, Smartwatches and Wearables, Television and Digital Signage Systems, PC Monitors and Laptops, E-reader, Electronic Shelf Labels (ESLS), Vehicles and Public Transports, Smart Home Appliances), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager