Social Trading Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432728 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Social Trading Market Size

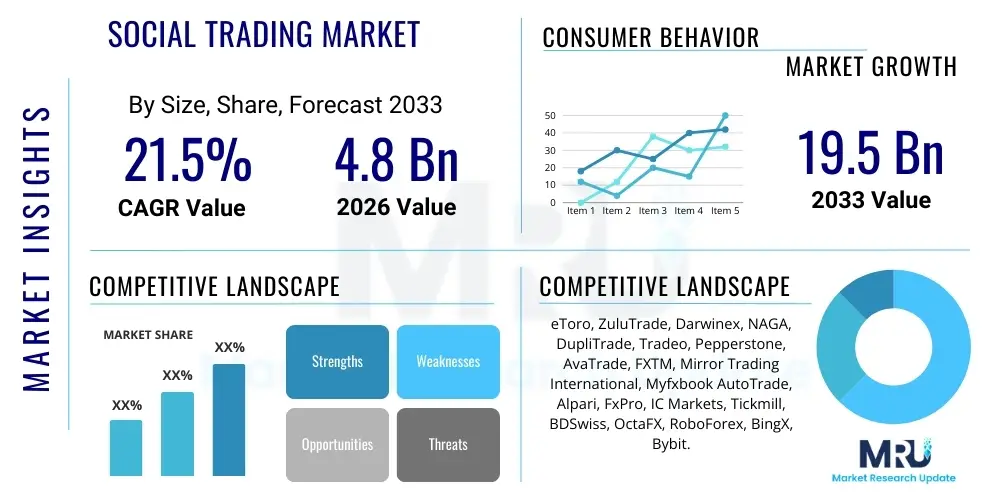

The Social Trading Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 19.5 Billion by the end of the forecast period in 2033.

Social Trading Market introduction

The Social Trading Market involves investment platforms that facilitate the sharing of trading insights, strategies, and actual trade execution data among users. This convergence of social networking features with traditional brokerage services allows novice traders to observe, learn from, and automatically copy the trades of experienced investors, known as 'signal providers' or 'popular investors.' The core product offering is a networked investment environment that democratizes access to sophisticated trading knowledge, lowering the barrier to entry for retail participants globally. Platforms typically offer access to various assets including Forex, stocks, cryptocurrencies, and commodities, integrating features such as real-time performance statistics, risk scores, and interactive community forums. The market growth is intricately linked to the rising adoption of Fintech solutions and the increasing global acceptance of fractional share ownership and diversified digital asset portfolios, driven primarily by the tech-savvy millennial and Gen Z populations seeking alternative income streams and transparent investment methods.

Major applications of social trading extend beyond simple copy trading. These platforms are increasingly utilized for educational purposes, providing verifiable track records that serve as practical learning tools for market analysis and risk management. Furthermore, they are becoming essential tools for experienced traders looking to monetize their expertise by attracting followers, thereby diversifying their income streams through commission or volume-based payouts offered by the platform. The seamless integration of mobile technology and high-speed execution capabilities ensures that trading can be conducted anytime and anywhere, catering to a diverse, global user base. This accessibility contrasts sharply with traditional advisory services, which often require significant capital and high consultation fees, positioning social trading as a revolutionary, low-cost alternative for portfolio diversification and active market participation.

The principal benefits driving market expansion include enhanced transparency in investment performance, the ability to automate complex trading strategies, and the empowerment of retail investors through shared knowledge. The major driving factors encompass the increasing penetration of the internet and smartphones in developing economies, the volatility and subsequent interest generated by cryptocurrency markets, and the strong consumer demand for user-friendly, peer-to-peer financial technologies. Regulatory frameworks, while evolving, are starting to provide clearer guidelines, which further legitimizes these platforms and encourages institutional involvement. Consequently, the social trading ecosystem is transforming from a niche offering to a fundamental pillar of the global retail investment landscape, offering superior engagement and immediate feedback loops compared to conventional passive investment routes.

Social Trading Market Executive Summary

The Social Trading Market is characterized by robust business trends centered on technological innovation, regulatory compliance, and strategic consolidation. Key trends include the integration of advanced Artificial Intelligence (AI) for risk scoring and predictive analytics, enhancing both the safety and profitability of copy-trading models. Business models are shifting towards a hybrid approach, combining zero-commission trading with premium subscription services for exclusive content or high-performing signals. Furthermore, partnerships between established brokers and dedicated social trading technology providers are accelerating market penetration, allowing traditional financial institutions to quickly adapt to the consumer demand for social interaction within investment spheres. The industry is seeing a consolidation phase where platforms are acquiring smaller technology providers to bolster their technological stack, particularly in areas like regulatory technology (RegTech) and algorithmic trading interfaces, ensuring future scalability and robust customer relationship management.

Regionally, the market exhibits divergent growth patterns. North America, driven by high disposable incomes and a mature technological infrastructure, shows significant uptake, particularly in equity and options-based social trading, closely followed by Europe, where favorable MiFID II regulations regarding transparency have boosted platform credibility. However, the Asia Pacific (APAC) region is poised for the most explosive growth, fueled by vast unbanked populations entering the investment sphere for the first time via mobile platforms, combined with widespread interest in Forex and cryptocurrency trading, particularly in Southeast Asia and India. Regulatory clarity in regions like Singapore and Australia is cementing APAC as a future hub for social trading innovation. Conversely, growth in the Middle East and Africa (MEA) remains constrained by variable regulatory environments and lower internet penetration, though certain Gulf Cooperation Council (GCC) countries show high potential due to affluent, digitally native populations seeking Shariah-compliant trading options.

Segmentation analysis highlights the dominance of the Retail Investor segment by volume, although institutional adoption, particularly among hedge funds using social data for sentiment analysis, represents the highest growth rate in terms of value. By asset class, Forex trading historically led the market, but Stock and Cryptocurrency social trading segments are rapidly gaining market share due to global asset appreciation and increased public awareness of digital currencies. Technology-wise, platforms offering advanced APIs for third-party developer integration and highly personalized risk management tools are commanding premium positioning. The mobile application channel continues to eclipse desktop access as the preferred method for monitoring and executing trades, emphasizing the necessity for seamless, highly optimized mobile user experience (UX) design across all platforms.

AI Impact Analysis on Social Trading Market

Common user questions regarding AI's impact on social trading frequently center on the trustworthiness of automated strategies, the transparency of AI-driven risk management tools, and whether AI will eventually replace human signal providers entirely. Users are concerned about 'black box' algorithms and seek reassurance that the use of machine learning (ML) maintains, rather than erodes, the core social element of the market. Key expectations revolve around AI enhancing trade copying efficiency, mitigating systemic risks associated with high-frequency trading, and personalizing the educational journey for novice traders. Specifically, users want AI to accurately vet and rank signal providers, differentiate between luck and sustainable strategy, and offer predictive warnings about market shifts that could affect copied portfolios, ensuring a safer and more optimized trading environment for the average retail participant.

The integration of AI and ML technologies is fundamentally restructuring the operational and strategic landscape of social trading platforms. AI-driven systems are now routinely employed to analyze millions of data points, including sentiment analysis from social feeds and historical performance metrics, providing a granular assessment of risk that far exceeds traditional metrics. This enhanced due diligence capability ensures that follower capital is allocated based on objectively sustainable strategies rather than purely anecdotal success. Furthermore, AI models are essential for anomaly detection, flagging potentially fraudulent activities or strategies involving excessive leverage and disproportionate risk taking, thereby protecting the integrity of the platform and the capital of the copy traders. This proactive risk management capability is a major differentiator in an increasingly competitive regulatory environment.

In terms of user experience, AI is pivotal in automating portfolio rebalancing and optimization based on predefined risk tolerance levels of the follower. When a signal provider makes a trade, AI algorithms can instantly assess the impact on the follower's specific portfolio size and automatically adjust the exposure, ensuring proportional and controlled execution. Beyond trade execution, machine learning is revolutionizing the platform’s marketing and personalization engines, recommending suitable signal providers to new users based on demographic data, investment goals, and demonstrated learning patterns. This high degree of personalization boosts user retention and engagement, transforming the platform into a curated investment ecosystem rather than a simple marketplace of strategies. The future trajectory suggests AI moving towards generating autonomous, fully managed copy portfolios where human interaction shifts from manual selection to oversight and fine-tuning of algorithmic parameters.

- AI-driven risk scoring and real-time performance validation of signal providers.

- Implementation of machine learning for personalized strategy recommendations and dynamic portfolio allocation.

- Automated sentiment analysis of market news and social feeds to preemptively adjust copy trades.

- Enhancement of regulatory compliance (RegTech) through AI-powered anomaly detection and anti-fraud monitoring.

- Development of proprietary trading bots that utilize deep learning models for optimal trade execution timing.

DRO & Impact Forces Of Social Trading Market

The Social Trading Market dynamics are propelled by strong technological adoption and demographic shifts, while simultaneously facing significant regulatory hurdles and competitive pressures. The primary drivers include the massive global accessibility provided by mobile trading applications and the inherent democratization of finance, allowing retail investors to bypass traditional financial gatekeepers. The opportunity lies in expanding into underserved geographical regions, particularly emerging markets with high mobile penetration, and integrating advanced asset classes like decentralized finance (DeFi) tokens and highly specialized derivatives. However, the market is restrained by the inherent risks associated with high leverage often used in Forex and CFD trading, the lack of standardized global regulation, and continuous operational challenges related to ensuring data privacy and preventing market manipulation among large networks of users. These impact forces necessitate continuous platform innovation and rigorous internal governance to sustain long-term growth and investor trust.

Key drivers creating a powerful impetus for market growth involve the increasing financial literacy of the young investor demographic who prefer transparent, community-driven investment models. The success stories of popular investors, often amplified through media channels, act as powerful organic marketing tools, attracting new users seeking similar rapid returns. Furthermore, the development of robust Application Programming Interfaces (APIs) has fostered an ecosystem of third-party tools and analytical dashboards, enriching the trading experience and adding layers of professional functionality that appeal to a more sophisticated user base. The competitive drive among traditional brokerage houses to capture this retail flow is forcing accelerated adoption of social features, validating the segment as a critical future revenue stream for the financial services industry.

Restraints fundamentally impacting market scalability include the persistent challenge of regulatory fragmentation; while some jurisdictions offer clear frameworks, many major economies lack specific licensing requirements for social trading platforms, leading to operational uncertainty. Moreover, the inherent risk that novice copy traders face—potential losses when replicating volatile strategies—requires platforms to invest heavily in robust risk disclosure and user education, increasing compliance costs. Opportunities are abundant in the integration of blockchain technology to create transparent, immutable track records for signal providers, eliminating potential manipulation concerns and boosting investor confidence. Additionally, the increasing demand for sustainable and ESG (Environmental, Social, and Governance) focused investment signals presents a nascent, high-value opportunity for platforms to curate specialized social portfolios, aligning investment with broader ethical consumer demands and attracting socially conscious capital.

Segmentation Analysis

The Social Trading Market is primarily segmented by Asset Type, Platform, Business Model, and End-User. Analyzing these segments provides strategic insights into consumer preferences and areas of high potential growth. While the End-User segmentation traditionally emphasizes the retail sector, the increasing adoption by smaller institutional entities seeking real-time sentiment data and alternative strategy sourcing is reshaping the value proposition. The segmentation by platform, particularly the distinction between dedicated social trading platforms and broker-integrated social features, highlights the current industry trend toward ecosystem integration and seamless user experience. Understanding these segment dynamics is crucial for developing targeted marketing strategies and optimizing technological investment based on the forecasted demand of high-growth asset classes such as cryptocurrencies and specialized derivatives.

- By Asset Type:

- Forex and Currency Pairs

- Stocks and Equities (including fractional shares)

- Cryptocurrency and Digital Assets

- Commodities

- Indices and ETFs

- By Platform:

- Dedicated Social Trading Networks

- Broker-Integrated Platforms (White-Label Solutions)

- Copy Trading APIs

- By Business Model:

- Commission-Based (Volume-based rebates to providers)

- Subscription-Based (Premium access to providers)

- Spread-Based (Platform receives spread margin)

- By End-User:

- Retail Investors (Novice, Intermediate)

- Professional Traders and Institutional Clients (Hedge Funds, Family Offices)

Value Chain Analysis For Social Trading Market

The value chain for the Social Trading Market is inherently digital and relies on seamless integration between multiple actors, beginning with upstream data and liquidity provision and extending through complex distribution channels to the end consumer. Upstream activities are dominated by liquidity providers, prime brokers, and financial data vendors (e.g., historical price data, real-time feeds) who supply the essential resources necessary for trade execution and accurate performance tracking. Robust, low-latency infrastructure and secure cloud computing services are also critical upstream inputs, ensuring the platform can handle massive simultaneous trade copying requests and high user traffic without degradation of service quality. The efficiency of this upstream supply chain directly determines the speed and reliability of the platform, which are critical competitive factors in attracting high-volume traders and professional signal providers.

The core value creation stage involves the platform provider itself, which develops and maintains the proprietary social network functionality, risk management algorithms (often AI-driven), and the trade execution engine. This stage transforms raw market data into actionable, shareable investment signals and automates the trade copying process. Downstream activities focus heavily on marketing, user acquisition, and providing robust customer support and localized educational content. The success of the downstream operation is measured by user engagement, conversion rates from followers to active traders, and the ability to retain high-performing signal providers. Strong compliance and regulatory technology (RegTech) also form a crucial downstream component, ensuring operations adhere to regional financial conduct authorities, protecting both the platform’s license and the user base.

Distribution channels are categorized into direct and indirect models. Direct distribution involves users accessing the platform via proprietary websites or dedicated mobile applications, offering the platform maximum control over the user experience and data. Indirect distribution channels include partnerships with independent financial advisors (IFAs), affiliate marketers, and white-label agreements where the social trading technology is integrated into a third-party broker’s existing infrastructure. While direct distribution yields higher margin and immediate customer feedback, indirect channels are critical for rapid geographical expansion and gaining immediate access to large, pre-existing customer bases managed by established financial entities. Optimizing this multi-channel distribution strategy requires advanced API capabilities and clear partnership terms regarding data sharing and regulatory liability.

Social Trading Market Potential Customers

The primary target demographic and largest potential customer segment for the Social Trading Market remains the retail investor, particularly the novice and intermediate trader who possesses discretionary capital but lacks the time, expertise, or confidence to execute independent market analysis. These customers are highly sensitive to user experience (UX), demand low entry barriers, and are driven by the desire for passive or semi-passive income generation. They value transparency and are inherently social, seeking community validation and peer-to-peer support in their investment decisions. Geographically, potential retail customers are increasingly concentrated in regions with rising wealth and high smartphone penetration, especially in APAC and parts of Latin America, where rapid digitalization makes mobile investment the default option.

A rapidly growing segment of potential customers includes professional traders and smaller institutional entities, such as family offices and emerging hedge funds. These sophisticated users are attracted not by the need to copy basic trades, but by the platform’s unique data aggregation capabilities. They utilize the social trading network as a massive, real-time sentiment analysis tool, observing the collective behavior and positioning of millions of retail participants to inform their proprietary strategies. For these customers, the value proposition lies in the API access, the ability to analyze aggregated market data, and the potential to generate high-quality, verified trading signals for monetization, positioning themselves as vetted experts on the platform to diversify their revenue streams and increase assets under management (AUM).

Furthermore, technology-focused finance companies and regional banks represent a significant B2B customer base, particularly for white-label solutions. These institutions recognize the necessity of offering social and copy trading capabilities to retain their younger clientele but prefer to outsource the complex technological development and regulatory overhead. By licensing established social trading technology, these institutions can quickly launch competitive retail investment products. The defining characteristic of these potential institutional partners is the need for highly customizable, modular software solutions that can seamlessly integrate with their legacy core banking systems while meeting stringent local regulatory requirements concerning client onboarding and transaction monitoring, driving significant demand for robust, enterprise-grade technology vendors within the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 19.5 Billion |

| Growth Rate | 21.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | eToro, ZuluTrade, Darwinex, NAGA, DupliTrade, Tradeo, Pepperstone, AvaTrade, FXTM, Mirror Trading International, Myfxbook AutoTrade, Alpari, FxPro, IC Markets, Tickmill, BDSwiss, OctaFX, RoboForex, BingX, Bybit. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Social Trading Market Key Technology Landscape

The technological foundation of the Social Trading Market relies heavily on sophisticated, low-latency connectivity, robust cloud infrastructure, and proprietary algorithms designed for efficient trade replication. Central to the landscape is the ultra-fast Execution Engine, which must instantaneously copy the trades of signal providers across potentially thousands of follower accounts, often handling multiple asset classes simultaneously with minimal slippage. This necessitates high-availability server architecture, often distributed geographically, coupled with advanced order routing systems that ensure best execution prices. Furthermore, the development of scalable APIs is critical, allowing platforms to integrate seamlessly with third-party brokers, analytical tools, and regulatory reporting systems, fostering an open ecosystem that drives feature innovation and user engagement.

Risk management technology constitutes the second pillar of the technology landscape. Platforms leverage Machine Learning (ML) and complex statistical modeling to calculate and display the real-time Risk Score of signal providers, which helps followers make informed decisions. Technologies such as automated stop-loss and drawdown monitoring systems are implemented on the follower side to protect capital, ensuring that copied trades adhere strictly to the follower’s preset risk parameters regardless of the provider’s actions. The reliance on AI for fraud detection and compliance monitoring (RegTech) is paramount, using behavioral analytics to identify and flag suspicious trading patterns or excessive risk-taking that could destabilize the platform or harm retail investors, thereby maintaining regulatory standing and investor confidence.

The future technology landscape is characterized by the increasing adoption of decentralized ledger technologies (DLT) and advanced user interface innovations. Blockchain technology is being explored to create immutable, transparent, and auditable track records of trading performance, resolving long-standing issues concerning the authenticity of past results. For user experience, the implementation of personalized, data-driven dashboards, often utilizing micro-interactions and gamification elements, is essential for keeping the highly mobile user base engaged. Furthermore, the integration of conversational AI (chatbots) and natural language processing (NLP) is improving customer support and providing on-demand market insights, transforming how users interact with complex financial data and positioning the platform at the forefront of financial technology adoption.

Regional Highlights

- North America: Market Maturity and Regulatory Clarity

North America, particularly the United States and Canada, represents a mature but rapidly evolving market. The region benefits from high levels of disposable income, a sophisticated understanding of financial instruments, and a strong culture of technological adoption. While regulatory bodies like the CFTC and SEC impose stringent requirements on brokers offering CFDs or high-leverage products, platforms focusing on equity, ETFs, and options social trading are seeing exponential growth. The key market driver here is the desire among younger investors (Millennials and Gen Z) for transparent, commission-free investment options that integrate community features. The competitive edge is often achieved through superior user interfaces and highly specific compliance features tailored to US federal and state regulations. The high concentration of tech companies also drives demand for sophisticated, API-driven institutional social trading data.

The U.S. market specifically favors platforms that can integrate seamlessly with major established financial institutions and offer low-latency access to major exchanges. Innovation is focused on integrating AI into compliance and risk mitigation systems due to the complex regulatory environment. The growth trajectory is stable and high-value, driven less by volume and more by the size and sophistication of the assets traded. Canada follows a similar pattern, with strong growth in platforms adhering to local regulatory requirements concerning investment solicitation and client risk disclosure. Investment in financial education tools and responsible trading initiatives is a significant characteristic of market competition in this region.

- Europe: Regulatory Harmonization and Multi-Asset Focus

Europe is a pivotal region for the Social Trading Market, largely due to the framework established by the Markets in Financial Instruments Directive (MiFID II), which mandates high transparency standards, inadvertently benefiting social trading platforms that naturally offer performance visibility. The European market is fragmented but highly active, with strong hubs in the UK, Germany, and Cyprus. The preference across Europe is strongly multi-asset, encompassing Forex, CFDs, and a significant portion of commodity trading. Regulatory bodies like the FCA (UK) and CySEC (Cyprus) have defined clear operational standards, which, despite reducing leverage caps, have increased platform credibility and attracted serious, long-term investors.

The market trend in Europe involves intense competition among platforms to offer the lowest spreads and highest quality signal providers, often cross-border. Growth is also being driven by the need for platforms to comply with complex data privacy laws (GDPR), pushing technological investments into secure and compliant data handling systems. Eastern and Southern Europe represent significant high-growth potential due to lower current market penetration and increasing digitalization, coupled with a growing interest in alternative investments spurred by economic fluctuations. Strategic localization of platform interfaces and customer support across numerous languages is essential for market dominance in this diverse region.

- Asia Pacific (APAC): Explosive Growth and Cryptocurrency Dominance

The APAC region is projected to register the fastest growth rate globally, making it a critical strategic focus for market players. This expansion is fueled by massive populations gaining access to smartphones and high-speed internet, coupled with a cultural propensity for peer learning and community interaction, which perfectly aligns with the social trading model. Countries such as India, Indonesia, and Vietnam are experiencing explosive growth driven by young, digitally native populations interested in generating supplementary income. The asset focus in APAC heavily leans toward Forex and, critically, Cryptocurrency trading, where regulatory ambiguity in some markets paradoxically facilitates rapid innovation and high-risk appetite among users.

Key challenges in APAC include regulatory diversity—ranging from the strict oversight in Singapore and Australia to less defined environments elsewhere—and the necessity of highly localized payment infrastructure. Platforms must customize offerings to adhere to varying local cultural norms and language requirements across markets like China, Japan, and South Korea. Strategic partnerships with local payment processors and mobile network operators are vital for efficient user acquisition and monetization. The region's growth will continue to be characterized by mobile-first strategies and the adoption of technologically advanced, often high-leverage, financial products, necessitating strong educational content focused on risk awareness.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Social Trading Market.- eToro

- ZuluTrade

- Darwinex

- NAGA

- DupliTrade

- Tradeo

- Pepperstone

- AvaTrade

- FXTM

- Mirror Trading International

- Myfxbook AutoTrade

- Alpari

- FxPro

- IC Markets

- Tickmill

- BDSwiss

- OctaFX

- RoboForex

- BingX

- Bybit

- WhaleFin

- PrimeXBT

- Trading 212

- Plus500

Frequently Asked Questions

Analyze common user questions about the Social Trading market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary risk associated with social trading and how is it managed by platforms?

The primary risk in social trading is the potential for significant financial loss due to the replication of high-risk or poorly performing trades, particularly when high leverage is involved. Platforms manage this risk through mandatory risk disclosure statements, implementation of automatic portfolio protection mechanisms like proportional copying and maximum drawdown limits, and the use of AI to calculate and display real-time, transparent risk scores for all signal providers, helping followers make risk-adjusted decisions before copying.

How does AI improve the reliability of signal providers on social trading platforms?

AI significantly improves reliability by applying machine learning models to analyze vast amounts of historical and real-time trading data, differentiating between strategies based on consistent, skill-based performance versus those driven by sheer luck or high-risk exposure. AI algorithms provide objective vetting, detect anomalies or potential manipulation, and offer dynamic risk adjustments, ensuring that the top-ranked signal providers demonstrate genuinely sustainable strategies, thereby boosting follower confidence and capital protection.

Is social trading regulated, and how does regulation differ across major regions?

Yes, social trading is regulated, although the specific frameworks vary significantly by region. In Europe, MiFID II ensures transparency and operational standards, while U.S. platforms face stringent oversight from the SEC and CFTC, often limiting CFD offerings. APAC regions have varied compliance requirements, with some jurisdictions actively licensing platforms while others remain ambiguous. Global platforms navigate this by obtaining multiple licenses in jurisdictions like the UK, Cyprus, Australia, and operating within strict regulatory adherence for each specific region.

What are the key technological factors driving the market growth beyond basic copy execution?

Beyond basic trade execution, market growth is driven by the integration of robust, low-latency APIs for ecosystem expansion, the utilization of decentralized ledger technology (DLT) for enhanced performance transparency, and advanced cybersecurity measures. Furthermore, personalized user experience driven by AI recommendations, highly sophisticated mobile platform optimization, and the integration of financial literacy tools are key technological differentiators that attract and retain new market participants.

Which asset classes are showing the fastest growth in the social trading ecosystem?

While Forex historically dominated, Cryptocurrency and Digital Assets currently exhibit the fastest growth within the social trading ecosystem, driven by high volatility and consumer interest in digital finance. Additionally, the Stocks and Equities segment, particularly those platforms offering fractional share trading, is seeing substantial uptake, especially in North America and Europe, as retail investors seek diversified, long-term accumulation strategies that leverage social insights.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Social Trading Platform Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Social Trading Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Copy trade, Mirror trade), By Application (Foreign currency, Futures, Stock), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager