Sodium Hexametaphosphate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432341 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Sodium Hexametaphosphate Market Size

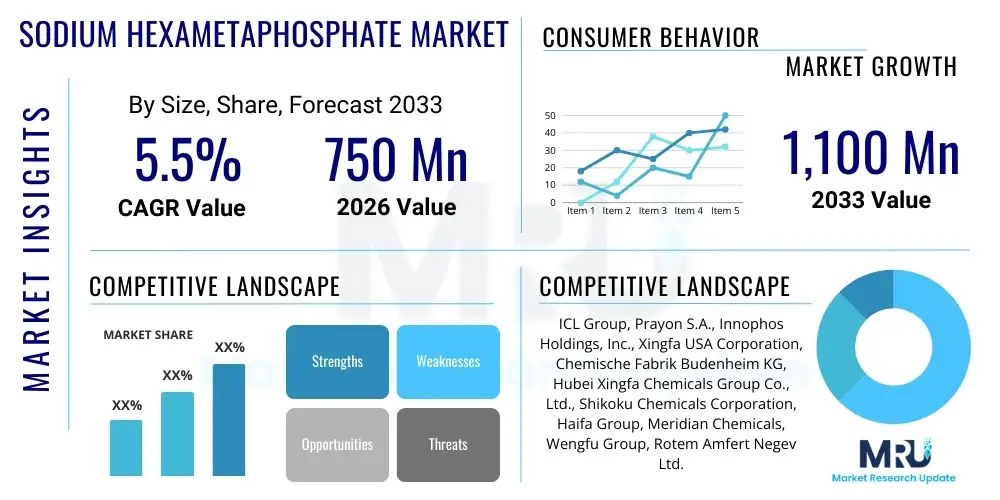

The Sodium Hexametaphosphate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 750 Million in 2026 and is projected to reach USD 1,100 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily underpinned by the increasing global demand for advanced water treatment solutions, coupled with the expanding application scope of SHMP as a highly effective sequestrant and preservative within the burgeoning food and beverage industry across developing economies.

Sodium Hexametaphosphate Market introduction

Sodium Hexametaphosphate (SHMP), represented by the chemical formula (NaPO3)6, is an inorganic compound utilized extensively across various industrial and commercial sectors due to its superior chelating, sequestering, and dispersing properties. As a polyphosphate glass, SHMP exhibits a high affinity for divalent and trivalent metal ions, notably calcium and magnesium, making it indispensable in water softening and preventing scale formation in industrial processes. Its efficacy as a water conditioner and corrosion inhibitor cements its foundational role in municipal and private water management systems globally.

The product is widely marketed in granular or powdered forms, offering high solubility and stability. Major applications span industrial water treatment, where it minimizes fouling and improves system efficiency; the food industry, where it functions as an emulsifier, thickening agent, and preservative (E452i) to enhance texture and prolong shelf life in processed meats, dairy, and seafood; and in detergents and cleaning formulations, where it acts as a water softener, boosting surfactant performance. The versatility of SHMP, coupled with stringent quality requirements in its end-use sectors, drives innovation in production technologies focused on achieving higher purity grades.

Driving factors propelling market expansion include rapid global industrialization, which escalates the requirement for efficient boiler feed water treatment and cooling systems, particularly in the manufacturing and power generation sectors. Furthermore, the rising consumer demand for packaged and processed foods, necessitating effective preservation techniques, heavily relies on SHMP to maintain product quality and safety. Heightened regulatory focus on water quality standards across developed nations also mandates the systematic use of phosphates like SHMP for scale and corrosion control in public infrastructure.

Sodium Hexametaphosphate Market Executive Summary

The Sodium Hexametaphosphate market demonstrates robust growth driven by accelerating industrial water management needs and expansion within the global food processing sector. Business trends indicate a strong focus on capacity expansion, particularly in the Asia Pacific region, where rapid urbanization and infrastructural development are creating substantial demand for industrial-grade SHMP. Key players are investing in vertical integration and optimizing supply chains to manage volatility in raw material costs, primarily phosphoric acid and soda ash. Furthermore, the shift towards higher purity, food-grade SHMP is a notable trend, responding to increasing regulatory oversight and consumer preference for quality ingredients in processed foods, pushing manufacturers to refine production processes and minimize heavy metal content.

Regional trends highlight the Asia Pacific (APAC) as the dominant and fastest-growing region, fueled by massive industrial expansion in countries such as China and India, alongside significant investments in water infrastructure projects. North America and Europe maintain stable markets characterized by strict environmental regulations regarding wastewater discharge and high demand for food-grade SHMP in sophisticated food applications. Segmentation trends emphasize the dominance of the industrial grade segment by volume, predominantly utilized in water treatment for boiler and cooling tower operations. However, the food grade segment is projected to exhibit a marginally higher CAGR, reflecting the sustained growth of the global processed food industry and the adoption of SHMP as a versatile functional additive.

A crucial segment trend involves the increasing utilization of SHMP in metal surface treatment and mining sectors, leveraging its dispersing properties to manage complex slurries and improve ore flotation efficiency. Market participants are increasingly focusing on sustainable sourcing and production methods to align with global environmental mandates. The competitive landscape remains moderately fragmented, with large established chemical manufacturers focusing on economies of scale, while specialized producers concentrate on niche applications requiring high-purity or custom formulations. Strategic mergers, acquisitions, and long-term supply agreements with major end-users define the current competitive strategy.

AI Impact Analysis on Sodium Hexametaphosphate Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Sodium Hexametaphosphate market predominantly center around three core themes: optimizing complex chemical synthesis processes, predicting and managing raw material supply chain fluctuations, and enhancing application efficiency, particularly in precise dosing for water treatment and food formulation. Users are keen to understand how AI-driven predictive modeling can reduce manufacturing energy consumption and improve yield purity, addressing the high-energy nature of polyphosphate production. Furthermore, there is significant interest in utilizing machine learning algorithms to analyze large datasets from municipal water systems, allowing for optimized, real-time SHMP dosage adjustments that minimize overuse while ensuring maximum efficacy against scale and corrosion, thereby driving cost savings and environmental compliance across end-user industries.

- AI-driven optimization of furnace temperature and reaction kinetics during thermal polyphosphate synthesis, leading to improved yield and reduced energy consumption.

- Predictive supply chain analytics using machine learning to forecast demand for phosphoric acid and soda ash, mitigating price volatility and ensuring consistent raw material availability.

- Implementation of smart sensor systems and AI algorithms in municipal water treatment plants for real-time monitoring and autonomous adjustment of SHMP dosing for optimal scale inhibition.

- Enhanced quality control and impurity detection (e.g., heavy metals) in food-grade SHMP production through computer vision and deep learning analysis of product samples.

- Simulation models for developing new, custom SHMP formulations tailored for specific industrial cooling systems or unique food processing requirements, accelerating product innovation.

- Automated market surveillance and trend analysis to identify emerging application areas and regulatory changes impacting SHMP usage globally.

DRO & Impact Forces Of Sodium Hexametaphosphate Market

The dynamics of the Sodium Hexametaphosphate market are shaped by a complex interplay of robust market drivers, significant regulatory and competitive restraints, and substantial opportunities arising from technological advancements and regional development. The primary driving force remains the increasing severity of water scarcity globally, which mandates efficient reuse and recycling, thereby expanding the need for high-performance scale and corrosion inhibitors like SHMP in cooling, boiler, and municipal water systems. Conversely, the market faces strong headwinds from strict environmental regulations concerning phosphate discharge into water bodies, particularly in Europe and North America, necessitating the exploration of alternative, non-phosphate-based sequestering agents. Opportunities lie predominantly in developing high-purity food-grade products for rapidly expanding Asian consumer markets and utilizing advanced manufacturing techniques to lower the environmental footprint of production.

Drivers: The global expansion of the processed food and beverage industry, driven by demographic shifts and urbanization, significantly boosts the demand for SHMP as an effective preservative, stabilizer, and texture modifier. Additionally, the proliferation of large-scale industrial infrastructure, including power plants, refineries, and manufacturing hubs, necessitates continuous maintenance of heat exchangers and pipelines, where SHMP plays a critical role in preventing operational downtimes caused by mineral scaling. Furthermore, the inherent stability and cost-effectiveness of SHMP compared to certain specialized alternatives ensure its sustained preference in bulk industrial applications.

Restraints: The most significant restraint is the environmental concern related to nutrient enrichment (eutrophication) caused by phosphate runoff, which has spurred regulatory bodies, notably the EU, to impose limits or outright bans on phosphate use in consumer products such as detergents. Furthermore, the market faces intense competition from alternative scale inhibitors, including phosphonates, organic polymers, and other inorganic compounds like Sodium Tripolyphosphate (STPP) in certain cost-sensitive applications. Volatility in the pricing of key raw materials, particularly elemental phosphorus and phosphoric acid, also poses a cost constraint for manufacturers.

Opportunities: Emerging economies in Latin America and Southeast Asia present untapped potential due to rapid infrastructural development and increasing investments in municipal water treatment facilities. The development of specialized, low-sodium or high-purity SHMP variants tailored for niche markets, such as pharmaceutical excipients or advanced food applications, opens new revenue streams. Moreover, improving the efficiency of SHMP production processes through advanced crystallization and calcination technologies to achieve lower energy consumption and better environmental performance represents a critical opportunity for competitive advantage and market penetration.

- Drivers: Increasing demand for industrial and municipal water treatment; growth in the global processed food and beverage sector; SHMP's superior sequestering capabilities; rapid industrialization in developing countries.

- Restraints: Stringent environmental regulations limiting phosphate discharge; competition from phosphonate and organic polymer alternatives; raw material price volatility; health concerns regarding high sodium intake from additives.

- Opportunity: Expansion into high-growth Asian markets; development of high-purity, specialized grades (e.g., electronic grade); adoption in new applications like mineral processing and oilfield operations; implementation of sustainable production technologies.

- Impact Forces: Demand pull from municipal authorities (scale inhibition); regulatory push towards sustainable alternatives; cost pressures from energy-intensive production; consumer demand for safe, long-shelf-life food products.

Segmentation Analysis

The Sodium Hexametaphosphate market is meticulously segmented based on Grade, Application, and Region, reflecting the diverse requirements of its end-user industries. Segmentation by Grade—Food Grade and Industrial Grade—is the most crucial differentiator, primarily dictating pricing, purity requirements, and regulatory compliance complexity. Industrial grade SHMP, utilized extensively in water treatment, detergents, and industrial cleaning, constitutes the largest volume share due to the sheer scale of global manufacturing and utility operations. Conversely, Food Grade SHMP, requiring higher purity standards and specific certifications (e.g., FCC, Kosher, Halal), commands a premium price and is expected to grow robustly in alignment with global trends in processed food consumption and safety standards.

Segmentation by Application reveals the dominance of Water Treatment, encompassing municipal systems, cooling towers, and boiler systems, where SHMP's anti-scaling and anti-corrosion functions are vital. The Food & Beverage segment follows closely, utilizing SHMP as an effective texturizer, emulsifier, and metal ion sequestrant in applications ranging from meat curing to dairy stabilization. Other significant applications include detergents, metal finishing, and mineral processing, each leveraging specific chemical properties of SHMP, such as its dispersing capability in highly concentrated slurries or its stabilizing role in electroplating baths. Understanding the dynamics within these segments is essential for manufacturers tailoring product specifications and market strategies.

The regional segmentation clearly highlights the disparity in demand patterns, driven by varying regulatory landscapes and industrial maturity levels. Asia Pacific leads both in production and consumption due to massive industrial investments and large-scale agricultural and food processing operations. North America and Europe emphasize quality and regulatory adherence, focusing on high-end industrial and food-grade applications, while simultaneously addressing environmental concerns related to phosphate discharge through specialized formulations and improved application technologies. The sustained growth of the market relies heavily on capitalizing on the volumetric requirements of the industrial segment while navigating the high-value potential of the strictly regulated food grade segment.

- By Grade:

- Food Grade

- Industrial Grade

- By Application:

- Water Treatment (Municipal, Boiler, Cooling Tower)

- Food & Beverage (Meat, Dairy, Seafood, Beverages)

- Detergents and Cleaning Agents

- Metal Treatment and Coating

- Mineral Processing and Mining

- Others (Oilfield, Textiles)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Sodium Hexametaphosphate Market

The value chain for Sodium Hexametaphosphate begins with the extraction and refining of foundational raw materials: phosphate rock, which is processed into phosphoric acid, and soda ash (sodium carbonate). These upstream activities are highly capital-intensive and subject to geopolitical and energy price fluctuations, significantly impacting the final product cost. Manufacturers of SHMP typically employ thermal processes involving the dehydration and polymerization of monosodium orthophosphate, a complex, energy-intensive step requiring specialized high-temperature furnaces. Efficiency and control during this manufacturing phase are critical determinants of the final product's grade and purity, particularly for premium food-grade variants, making process optimization a central competitive factor for manufacturers.

The midstream involves the distribution and logistics of the finished product. SHMP is typically transported in bulk bags or specialized containers depending on the grade and quantity. The distribution channel is bifurcated into direct and indirect routes. Direct sales are common for large volume industrial consumers, such as major municipal water authorities, chemical producers, and large food processing conglomerates, where long-term contracts ensure supply stability. Indirect channels involve regional distributors and specialty chemical traders who serve smaller manufacturers, local water treatment contractors, and regional food processors. The efficiency of the distribution network, including proximity to ports and storage capabilities, is vital for maintaining product quality and reducing transportation costs, particularly in a globally traded commodity market.

Downstream activities center on integration into end-user applications. In the water treatment sector, SHMP is incorporated directly into dosing systems, often requiring technical support and precise application knowledge from the supplier. In the food industry, SHMP integrates into complex formulations requiring regulatory expertise and quality assurance. The close collaboration between SHMP manufacturers and major industrial and food end-users is crucial for customizing product specifications (e.g., particle size, dissolution rate) and ensuring regulatory compliance across different geographic markets. The end-user demand acts as the final pull factor, driving the entire value chain and necessitating continuous technical service and product innovation to meet evolving regulatory and functional requirements.

Sodium Hexametaphosphate Market Potential Customers

The primary consumers and end-users of Sodium Hexametaphosphate are diverse, spanning essential industrial, public utility, and consumer goods sectors, driven by its versatile chemical properties as a sequestrant, dispersant, and emulsifier. Municipal water treatment authorities and private industrial water management companies represent the largest volume buyers, utilizing SHMP primarily for sequestering hardness minerals (calcium and magnesium) in potable water distribution systems, thereby preventing scale buildup, reducing pipe corrosion, and ensuring system longevity. These customers prioritize consistency, bulk supply capacity, and competitive pricing, often engaging in long-term procurement contracts to ensure supply stability for public services.

The second major group of customers comprises manufacturers within the Food and Beverage (F&B) industry. This segment includes large-scale meat and poultry processors, dairy product manufacturers (especially cheese and processed milk), seafood processors, and beverage and canned food companies. For F&B customers, the high-purity Food Grade SHMP is essential, utilized as a stabilizing agent to prevent fat separation, enhance protein binding (especially in cured meats), maintain texture, and act as a buffering agent. These customers demand strict compliance with food safety regulations, traceability, and high quality assurance certifications, such as ISO 22000 and HACCP.

Other key potential customers include detergent formulators and specialized chemical companies focused on metal surface treatment and mining. Detergent manufacturers use SHMP to soften wash water, maximizing the efficiency of surfactants in cleaning products. Mining operations rely on its strong dispersing capabilities to effectively separate minerals in flotation processes, handling high-solid slurries efficiently. These technical applications require customized specifications tailored to specific operational parameters, demanding a high level of technical support from the SHMP supplier.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1,100 Million |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ICL Group, Prayon S.A., Innophos Holdings, Inc., Xingfa USA Corporation, Chemische Fabrik Budenheim KG, Hubei Xingfa Chemicals Group Co., Ltd., Shikoku Chemicals Corporation, Haifa Group, Meridian Chemicals, Wengfu Group, Rotem Amfert Negev Ltd., Nanjing Jiayi Sunway Chemical Co., Ltd., Recochem Inc., Tianjin Xingyuan Chemical Co., Ltd., Zhuhai Kingo Chentical Co. Ltd., Jiangsu Liansheng Chemical Co., Ltd., China Phosphate Chemical Co., Ltd., Aditya Birla Chemicals, Nippon Chemical Industrial Co., Ltd., Shifang Changfeng Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sodium Hexametaphosphate Market Key Technology Landscape

The core technology for Sodium Hexametaphosphate production relies on the thermal process, involving the heating and dehydration of sodium orthophosphates, typically derived from the reaction of phosphoric acid with soda ash. The technological landscape is currently centered on optimizing this energy-intensive thermal process to enhance product quality and purity while minimizing operational costs and environmental impact. Advancements focus heavily on precision control of the polymerization furnace temperatures and reaction times, which directly influence the chain length and homogeneity of the resulting polyphosphate glass. Improved cooling and grinding technologies are also critical to ensure desired particle size distribution and minimize dust formation, particularly for food-grade products where texture and dissolution rate are crucial functional characteristics.

A significant area of technological focus is the development of continuous process reactors and fluidized bed systems as alternatives to traditional rotary kilns. These newer systems offer better heat transfer efficiency, leading to lower specific energy consumption per ton of SHMP produced and greater consistency in the final product. Furthermore, post-processing technologies are continually being refined, including advanced crystallization and purification techniques aimed at removing trace heavy metals and fluorides, essential steps for meeting the increasingly strict regulatory standards of the global food and pharmaceutical industries. Innovations in filtration and ion-exchange methods are being adopted to ensure the production of SHMP with exceptionally low levels of impurities, opening doors to high-value niche applications.

Sustainability is increasingly driving technological investment. Manufacturers are exploring methods to utilize by-products and minimize waste streams, particularly phosphorus sludge, aligning with circular economy principles. Furthermore, there is ongoing research into producing SHMP precursors using non-traditional, potentially bio-based sources of phosphate, though these are still largely nascent. The integration of sensor technologies and industrial Internet of Things (IIoT) platforms is also transforming the production floor, enabling real-time monitoring and predictive maintenance, thereby reducing unexpected downtime and improving overall manufacturing throughput and reliability, ensuring efficient supply to high-demand sectors like municipal utilities.

Regional Highlights

The market dynamics of Sodium Hexametaphosphate exhibit significant regional variations, influenced by industrial development, regulatory frameworks, and demographic shifts. The Asia Pacific (APAC) region dominates the global market both in consumption volume and production capacity. This supremacy is attributed to extensive industrial expansion, particularly in China and India, necessitating vast quantities of industrial-grade SHMP for boiler water treatment, power generation, and textile industries. Furthermore, the massive and growing population in APAC drives robust growth in the processed food sector, creating sustained high demand for food-grade polyphosphates. Favorable government policies supporting infrastructure development and urbanization further propel the need for municipal water treatment chemicals.

North America and Europe represent mature markets characterized by stringent environmental regulations and high-value applications. While phosphate use in household detergents has been significantly curtailed in these regions, the demand for SHMP remains robust in highly controlled environments. In North America, SHMP consumption is strongly driven by sophisticated municipal water systems requiring corrosion control and the large-scale, technologically advanced food processing industry (especially in poultry and meat preservation). European markets prioritize sustainable sourcing and high-purity standards, demanding specialized SHMP grades compliant with strict REACH and EU food additive directives. Growth in these regions is stable, focusing more on quality premiumization and technical innovation rather than volumetric expansion.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions poised for rapid growth. LATAM's market expansion is linked to increasing industrialization and investments in mining and water infrastructure, particularly in countries like Brazil and Mexico. The MEA region is witnessing high demand, especially in the Gulf Cooperation Council (GCC) countries, due to massive desalination projects that require specialized chemical treatments for scale inhibition. The reliance on water conservation and re-use technologies across arid regions makes SHMP an indispensable chemical for optimizing industrial water cycles, positioning MEA as a key future growth driver for industrial-grade polyphosphates.

- Asia Pacific (APAC): Market leader by volume; driven by rapid industrialization, large population base, and high demand from water treatment and food processing sectors in China, India, and Southeast Asia.

- North America: Mature market focused on high-purity food grade applications and stringent municipal water quality standards; strong adoption in oilfield chemical and specialty manufacturing.

- Europe: Characterized by strict environmental regulatory pressure (phosphate limits in discharge); sustained demand in industrial cooling, niche food applications, and premium metal surface treatment.

- Latin America (LATAM): Emerging market growth driven by mining sector expansion (dispersing agents) and increasing public investment in infrastructure and potable water systems.

- Middle East & Africa (MEA): High growth potential linked to water scarcity issues, significant investment in desalination plants, and industrial development in energy and petrochemical sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sodium Hexametaphosphate Market.- ICL Group

- Prayon S.A.

- Innophos Holdings, Inc.

- Hubei Xingfa Chemicals Group Co., Ltd.

- Chemische Fabrik Budenheim KG

- Shikoku Chemicals Corporation

- Haifa Group

- Wengfu Group

- Meridian Chemicals

- Rotem Amfert Negev Ltd.

- Nanjing Jiayi Sunway Chemical Co., Ltd.

- Tianjin Xingyuan Chemical Co., Ltd.

- Xingfa USA Corporation

- Recochem Inc.

- Zhuhai Kingo Chentical Co. Ltd.

- Jiangsu Liansheng Chemical Co., Ltd.

- China Phosphate Chemical Co., Ltd.

- Aditya Birla Chemicals

- Nippon Chemical Industrial Co., Ltd.

- Shifang Changfeng Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Sodium Hexametaphosphate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Sodium Hexametaphosphate (SHMP) primarily used for?

SHMP is primarily used as a high-performance sequestering agent in industrial and municipal water treatment to prevent scale and corrosion; it is also widely used in the food industry as an emulsifier, thickening agent, and preservative (E452i) to enhance texture and stability in processed foods.

How do environmental regulations impact the SHMP market?

Strict environmental regulations, particularly in Europe and North America, aim to limit phosphate discharge into waterways due to eutrophication concerns. This restrains the use of SHMP in high-volume, runoff-prone applications like detergents, simultaneously driving demand for high-efficiency, targeted application methods in core industrial uses.

Which application segment holds the largest market share?

The Water Treatment application segment currently holds the largest market share by volume. This dominance is due to the mandatory requirement for scale and corrosion control in municipal water distribution, industrial boilers, and cooling systems globally, where SHMP offers cost-effective performance.

What is the main difference between Food Grade and Industrial Grade SHMP?

Food Grade SHMP requires significantly higher purity standards, stringent heavy metal control, and compliance with international food additive regulations (like FCC), making it more costly. Industrial Grade SHMP is used for bulk applications like water treatment where purity requirements, while high, are less critical than the standards mandated for human consumption.

Which geographic region exhibits the fastest market growth?

The Asia Pacific (APAC) region is projected to exhibit the fastest market growth, fueled by rapid urbanization, massive infrastructural investments in water management, and the expanding industrial and processed food sectors in economies such as China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Sodium Hexametaphosphate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Sodium Hexametaphosphate Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Food Grade, Technical Grade), By Application (Food Application, Indusial Application), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager