Solvent Recycling Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433737 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Solvent Recycling Market Size

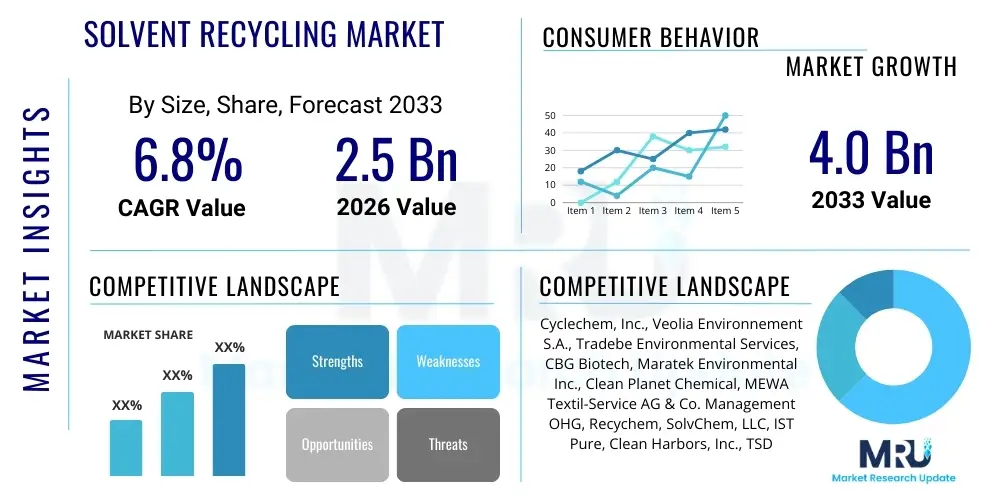

The Solvent Recycling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.0 Billion by the end of the forecast period in 2033.

Solvent Recycling Market introduction

The Solvent Recycling Market encompasses the industrial activities involved in recovering waste solvents through distillation, filtration, or other purification processes, allowing them to be reused in manufacturing operations. This practice is crucial for reducing hazardous waste generation, minimizing the environmental footprint, and achieving significant cost savings by decreasing the reliance on virgin solvent purchases. Solvents, which are widely utilized across industries such as pharmaceuticals, automotive, printing, coatings, and electronics for cleaning, extraction, and dilution purposes, inevitably become contaminated during use. The recycling process transforms these contaminated materials back into high-purity solvents, thereby closing the loop in industrial resource management.

Major applications driving the demand for solvent recycling include the efficient recovery of acetone, toluene, xylene, isopropyl alcohol (IPA), and various chlorinated solvents used in surface preparation, painting, and chemical synthesis. The pharmaceutical and chemical manufacturing sectors, which rely heavily on high-purity solvents for complex synthesis steps, represent core application areas. Furthermore, the stringent regulatory environment governing volatile organic compound (VOC) emissions and hazardous waste disposal mandates that industries seek sustainable alternatives, positioning recycling as an essential operational component rather than a discretionary option. The benefits derived from solvent recycling are multi-faceted, ranging from improved environmental compliance to enhanced supply chain resilience against fluctuating raw material prices.

Key driving factors accelerating market adoption include the increasing global focus on sustainability and circular economy models, coupled with rising costs associated with virgin solvents and waste disposal fees. Technological advancements in fractional distillation and thin-film evaporation are improving the efficiency and purity of recovered solvents, broadening the scope of materials that can be economically recycled. Additionally, governmental incentives and subsidies aimed at promoting green manufacturing practices, particularly in developed economies, further solidify the market's trajectory towards sustained growth. The imperative to reduce operational expenses while adhering to demanding environmental standards ensures a stable and increasing demand profile for solvent recycling services and equipment.

Solvent Recycling Market Executive Summary

The Solvent Recycling Market is experiencing robust expansion, driven primarily by evolving regulatory frameworks emphasizing environmental stewardship and the undeniable economic benefits of resource recovery. Current business trends indicate a strong shift towards integrated waste management solutions, where solvent recycling is often bundled with overall chemical lifecycle management services. Key market players are investing heavily in advanced distillation technologies, such as vacuum distillation and multi-column systems, to handle complex mixed waste streams and achieve higher purity output, making recycled solvents acceptable for highly sensitive industries like electronics and specialty chemicals. Furthermore, the trend toward decentralized recycling units, located near major industrial clusters, is optimizing logistics and reducing transportation costs associated with hazardous waste.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily due to rapid industrialization, increasing environmental awareness, and the implementation of stricter pollution control norms in nations like China and India. North America and Europe, while being mature markets, continue to lead in technological adoption, particularly concerning automation and integration with Industry 4.0 standards for real-time monitoring of purity and efficiency. European policies, such as the Waste Framework Directive, impose high recovery targets, ensuring continuous investment in advanced recycling infrastructure. This global dichotomy—rapid volume growth in APAC balanced by technological sophistication in Western markets—defines the current geographical landscape.

Segmentation trends reveal that the distillation segment dominates the market based on technology, owing to its effectiveness and scalability across diverse solvent types. However, emerging technologies like supercritical fluid extraction are gaining traction for specific high-value, heat-sensitive solvents. In terms of end-use, the printing and coatings sector remains a massive consumer and recycler, driven by the sheer volume of solvents used for equipment cleaning and formulation dilution. Concurrently, the electronics industry segment, demanding ultra-high purity recovered solvents, is projected to exhibit the highest CAGR, fueling innovation in post-processing filtration and purification techniques. Overall, the market is structurally characterized by technological refinement aimed at enhancing purity, reducing energy consumption, and expanding the range of recoverable materials.

AI Impact Analysis on Solvent Recycling Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Solvent Recycling Market typically center on operational optimization, predictive maintenance, and quality control automation. Users are keen to understand how AI algorithms can enhance the notoriously complex distillation processes, which require precise temperature and pressure control based on varying waste composition. Common questions involve the application of machine learning (ML) to predict optimal separation parameters for mixed solvent streams, thereby minimizing energy consumption and maximizing yield. Furthermore, there is significant interest in using AI for regulatory compliance monitoring and automated hazardous waste documentation, streamlining audit processes and ensuring adherence to increasingly complex global standards. The core themes revolve around using intelligent systems to move the industry away from reliance on manual operator expertise towards predictive, data-driven recycling operations.

AI’s primary leverage in this domain is its ability to analyze continuous input streams—including solvent composition, temperature profiles, and energy consumption data—to make instantaneous adjustments to distillation equipment. This capability significantly improves recovery efficiency, especially when processing complex blends of halogenated and non-halogenated solvents. Traditional recycling processes often suffer from inefficiencies due to compositional variability; AI-driven control systems, using ML models trained on historical performance data, can anticipate phase changes and control column operations with far greater precision than conventional PID controllers. This predictive capability translates directly into higher purity levels, lower operational downtime, and reduced overall utility costs, making the recycling operation economically superior.

Beyond process control, AI is poised to revolutionize the maintenance and logistics aspects of solvent recycling. Predictive maintenance models analyze sensor data from pumps, valves, and heat exchangers to forecast equipment failures before they occur, drastically reducing unscheduled downtime—a critical factor in capital-intensive recycling facilities. In supply chain management, AI algorithms can optimize waste solvent collection routes and schedules based on real-time inventory levels at customer sites, reducing transportation emissions and costs. The integration of AI tools, therefore, positions solvent recycling not merely as a necessary environmental step, but as a high-tech, efficiency-driven industrial service capable of providing consistent, high-quality output.

- AI-driven optimization of distillation parameters for maximizing solvent purity and yield.

- Machine learning models predicting optimal energy input based on real-time waste composition analysis.

- Implementation of predictive maintenance systems to minimize operational downtime in recycling equipment.

- Automated regulatory compliance monitoring and documentation generation using natural language processing (NLP).

- AI optimization of logistics and route planning for efficient waste solvent collection and transfer.

- Enhanced quality control through continuous spectroscopic analysis linked to AI classification algorithms.

DRO & Impact Forces Of Solvent Recycling Market

The Solvent Recycling Market is propelled by a confluence of powerful drivers, primarily centered on escalating environmental regulations and the substantial economic impetus provided by operational cost reduction. Governments worldwide are imposing increasingly strict regulations on the disposal of hazardous waste, particularly volatile organic compounds (VOCs) and spent industrial solvents, pushing industries towards mandatory recycling or recovery. This regulatory pressure, combined with rising landfill fees and disposal costs, makes in-house or outsourced recycling an economically compelling choice. Furthermore, volatility in the prices of virgin petrochemical-derived solvents provides a strong market signal, encouraging companies to secure their supply chain by recovering and reusing valuable materials internally.

However, the market faces significant restraints that temper its growth trajectory. The initial capital investment required for high-efficiency distillation and purification equipment can be substantial, posing a barrier, particularly for small and medium-sized enterprises (SMEs). A key technical restraint is the complexity involved in handling diverse and highly contaminated solvent mixtures; if the waste composition is too complex or contaminated with non-distillable solids, the recycling process may become economically unviable or technically challenging to achieve high purity levels. Additionally, concerns remain regarding the consistency and purity of recovered solvents, which sometimes necessitates blending with virgin materials to meet the stringent specifications required by industries such as electronics or pharmaceuticals.

Opportunities for market growth are abundant, particularly in emerging economies where industrialization is accelerating, but environmental infrastructure is still developing. The development of advanced, low-energy recycling technologies, such as membrane separation and continuous flow processes, presents a major opportunity to improve efficiency and reduce the carbon footprint associated with recycling. Moreover, the opportunity exists to expand recycling services into specialized, high-pvalue solvent streams (e.g., electronic-grade solvents, bio-based solvents) where the potential savings and environmental benefits are maximized. The collective impact forces—economic efficiency, technological progress, and regulatory stringency—create a favorable environment, where the drivers significantly outweigh the restraints, ensuring sustained market expansion throughout the forecast period.

- Drivers: Stringent environmental regulations concerning VOC emissions and hazardous waste; high cost and volatility of virgin solvents; strong corporate sustainability mandates (ESG); advancements in energy-efficient recycling technologies.

- Restraints: High initial capital expenditure for advanced recycling infrastructure; challenges in achieving ultra-high purity levels for sensitive applications; technical complexity in processing highly mixed or contaminated waste streams; regulatory variability across different jurisdictions.

- Opportunities: Expansion into developing markets with growing industrial bases; technological leap towards modular, automated, and energy-saving recycling units; integration with broader chemical management services; recovery of high-value specialty solvents.

- Impact Forces: Regulation and economics are the strongest forces, compelling large-scale industrial adoption, while technological innovation continuously addresses purity and efficiency challenges.

Segmentation Analysis

The Solvent Recycling Market is comprehensively segmented based on three primary categories: Technology, Solvent Type, and End-User Industry. This segmentation provides a granular view of market dynamics, highlighting areas of high growth and technological focus. The technology segment is crucial, as it dictates the efficiency, purity output, and capital expenditure required for recycling operations, encompassing mature methods like distillation and emerging processes like solvent extraction. The segmentation by solvent type reflects the vast chemical diversity, ranging from commodity hydrocarbon solvents to specialized oxygenated or halogenated compounds, each requiring tailored recycling approaches. Finally, the end-user segmentation underscores where the primary demand originates, showing critical dependencies within manufacturing sectors such as pharmaceuticals, automotive, and printing, all of which generate significant volumes of spent solvents needing recovery.

Understanding these segments is essential for strategic planning. For instance, while traditional distillation dominates the volume segment, membrane separation techniques are projected to grow faster due to their lower energy consumption and suitability for heat-sensitive solvents. Similarly, the demand for recycling aromatic solvents is massive due to their use in coatings and adhesives, whereas the demand for recycling electronic-grade solvents, though smaller in volume, mandates the highest level of purification technology, commanding premium services. The interrelation between a specific solvent type and its end-user application determines the necessary technological investment and the resulting market value proposition.

The continuous push toward sustainability means that cross-segment innovations are becoming common. Companies are developing hybrid systems that combine pre-treatment filtration with advanced fractional distillation and post-processing adsorption to handle the complex, multi-component waste streams increasingly produced by sophisticated manufacturing processes. This drive for integrated solutions aims to address the limitations of single-technology approaches, ensuring that a broader range of spent materials can be economically and reliably recycled back into the production loop, thereby maximizing resource efficiency across the industrial spectrum.

- By Technology:

- Distillation (Fractional Distillation, Simple Distillation, Thin-Film Evaporation, Vacuum Distillation)

- Filtration

- Solvent Extraction

- Membrane Separation

- Other Technologies (e.g., Activated Carbon Adsorption, Ion Exchange)

- By Solvent Type:

- Hydrocarbon Solvents (Toluene, Xylene, Mineral Spirits)

- Oxygenated Solvents (Acetone, Methyl Ethyl Ketone (MEK), Ethyl Acetate, Isopropyl Alcohol (IPA))

- Halogenated Solvents (Trichloroethylene, Methylene Chloride)

- Other Specialty Solvents (Bio-based Solvents, Glycol Ethers)

- By End-User Industry:

- Chemical & Pharmaceutical (API Manufacturing, Extraction)

- Printing & Flexible Packaging (Inks, Cleaning)

- Automotive & Aerospace (Coatings, Degreasing)

- Electronics (Cleaning, Etching)

- Paints, Coatings, and Adhesives

- Oil & Gas

- Others (Cosmetics, Textiles)

Value Chain Analysis For Solvent Recycling Market

The value chain for the Solvent Recycling Market begins with the upstream procurement and generation of spent solvents by various end-user industries. This upstream segment is characterized by the diverse and highly variable nature of the waste stream, influenced by the manufacturing processes of pharmaceutical companies, printing houses, and coating manufacturers. Efficiency at this stage relies heavily on internal segregation and initial handling of the waste solvent to prevent unnecessary contamination, which significantly impacts the downstream recycling cost and difficulty. Key activities involve inventory management of virgin solvents and strict procedural controls to minimize mixed waste generation, often necessitating specialized storage containers and preliminary filtration before collection.

The core of the value chain is the solvent recycling and purification stage, which involves transportation, analysis, and the application of complex recovery technologies (distillation, filtration, etc.). This middle segment is capital-intensive, requiring specialized recycling facilities, robust analytical labs for purity testing, and skilled operators. The key value additions here include enhancing the purity to meet required industrial specifications, minimizing energy consumption during recovery, and achieving regulatory compliance for waste processing. Major players in the market strive for economies of scale and technological superiority to maximize the percentage of recovered solvent that can be resold or returned to the customer.

The downstream component involves the distribution and reuse of the recovered solvents, either back to the original generator (closed-loop system) or sold to other industrial consumers (open-market recycling). Distribution channels are critical, often involving specialized logistics for handling hazardous materials, ensuring safe transportation and delivery. Direct distribution often occurs in a closed-loop system for large generators like major pharmaceutical companies, ensuring a continuous supply of their specific recycled solvent. Indirect channels utilize distributors or brokers to sell the recovered material into the broader market. Success in the downstream market hinges on establishing high trust in the consistent quality and purity of the recovered solvents, often supported by rigorous batch certification and quality assurance protocols comparable to virgin solvent standards.

Solvent Recycling Market Potential Customers

The Solvent Recycling Market targets industrial entities that rely heavily on solvents for their core operations, subsequently generating significant volumes of spent material. The primary group of potential customers includes large-scale manufacturers in the Chemical and Pharmaceutical sectors, particularly those engaged in Active Pharmaceutical Ingredient (API) synthesis, fine chemical production, and extraction processes. These companies use high volumes of specialized, often expensive, solvents (such as IPA, methanol, and acetonitrile) and demand exceptional purity in the recovered materials, making them ideal candidates for specialized, closed-loop recycling services that offer guaranteed quality assurance and cost savings.

A secondary, high-volume segment consists of the Paints, Coatings, and Printing industries. These sectors utilize massive quantities of aromatic and oxygenated solvents (like toluene, xylene, and MEK) for thinning, mixing, and cleaning printing presses or paint lines. While purity requirements might sometimes be less stringent than pharmaceuticals, the sheer volume of spent solvent generated drives demand for bulk, cost-effective recycling solutions, often relying on large-capacity distillation units. The economic pressure from fluctuating petrochemical prices and waste disposal fees strongly compels these end-users towards recycling programs.

Emerging segments of potential customers include the Electronics and Semiconductor manufacturing industries, particularly for wafer cleaning and etching processes. Although they generate smaller overall volumes, the specialized, high-grade nature of their solvents (like electronic-grade IPA and acetone) means that their recycling yields extremely high value. These buyers prioritize technological capabilities—such as advanced filtration and post-processing—that can meet ultra-low particulate and metal contamination specifications, demonstrating a strong willingness to invest in premium recycling services to secure their specialized solvent supply chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cyclechem, Inc., Veolia Environnement S.A., Tradebe Environmental Services, CBG Biotech, Maratek Environmental Inc., Clean Planet Chemical, MEWA Textil-Service AG & Co. Management OHG, Recychem, SolvChem, LLC, IST Pure, Clean Harbors, Inc., TSD Technology, Safety-Kleen Systems, Inc., Solvents & Petroleum Services, Inc., KCM Solvent Recycling, Phoenix Technologies, Inc., Highland Tank & Manufacturing Company, Detrex Corporation, ENVA, and Miracon Solvent Recyclers. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solvent Recycling Market Key Technology Landscape

The Solvent Recycling Market is defined by a mature but evolving technological landscape, where distillation remains the foundational and most widely adopted method. Fractional distillation, in particular, is the backbone of high-volume recycling operations, allowing for the precise separation of solvent mixtures based on distinct boiling points. Advances in vacuum distillation technology are paramount, as they allow temperature-sensitive and high-boiling point solvents to be recovered at lower operating temperatures, minimizing thermal degradation and reducing energy consumption significantly. Thin-film evaporation techniques are also gaining prominence, especially for highly viscous or heat-sensitive waste streams containing solids, as they minimize the residence time of the solvent on the heated surface, preventing coking and maximizing recovery rates.

Beyond thermal separation, non-thermal technologies are becoming increasingly sophisticated to handle challenging waste streams and meet ultra-high purity requirements. Membrane separation technology, utilizing specialized polymer or ceramic membranes, offers a low-energy alternative for separating solvents from dissolved non-volatile components or for separating azeotropic mixtures where distillation is complex. Reverse osmosis, nanofiltration, and pervaporation membranes are critical for achieving the high purity standards needed in the electronics and specialized chemical industries. While capital costs for membrane systems can be high, their efficiency and modular nature make them attractive for targeted applications.

Furthermore, complementary technologies like adsorption and extraction play a supporting role. Activated carbon adsorption is widely used as a polishing step post-distillation to remove trace impurities, odors, or color-causing contaminants, ensuring the recovered solvent meets stringent quality benchmarks. Liquid-liquid extraction is utilized when the solvent of interest is soluble with non-volatile components, allowing for separation before the distillation process, thereby enhancing overall efficiency. The future technological landscape emphasizes the integration of these methods—hybrid systems combining filtration, vacuum distillation, and membrane polishing—to create highly flexible, automated, and energy-efficient units capable of processing the increasingly complex industrial waste profiles.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of growth in the Solvent Recycling Market, driven by unprecedented industrial expansion in China, India, and Southeast Asian nations. The region’s rapid urbanization and establishment of massive manufacturing hubs (electronics, automotive, textiles) generate colossal volumes of spent solvents. While historically pollution standards were lax, recent years have seen aggressive enforcement of environmental protection laws, compelling industries to invest in recycling infrastructure. China’s "Ecological Civilization" initiative and stricter waste import bans have localized the demand for recycling services, making the APAC market highly volume-driven and focusing on optimizing cost-effective, high-capacity distillation solutions.

- North America: North America represents a technologically mature market characterized by stringent federal and state-level regulations (EPA, RCRA). The U.S. market is dominated by large, integrated waste management companies offering sophisticated recycling services, often under full-service contracts that manage the entire solvent lifecycle. Key drivers include the high cost of hazardous waste disposal and strong corporate Environmental, Social, and Governance (ESG) commitments. The region leads in the adoption of automated, vacuum distillation technologies and the development of closed-loop recycling programs, particularly within the automotive and aerospace maintenance sectors, prioritizing reliability and verifiable purity.

- Europe: Europe exhibits strong market growth spurred by proactive legislative frameworks like the EU Waste Framework Directive and REACH regulations, which mandate resource efficiency and chemical safety. European countries, particularly Germany, France, and the UK, have well-established recycling infrastructures and high rates of adoption for advanced, energy-efficient recycling equipment. The market is characterized by a high preference for sustainable and circular economy models. Innovation in Europe is often focused on reducing the carbon footprint of the recycling process itself, including the use of renewable energy sources for distillation and the development of high-performance membrane separation techniques for specialized chemical recovery.

- Latin America (LATAM): The Solvent Recycling Market in LATAM is emerging, concentrated mainly in industrialized nations like Brazil and Mexico. Market growth is closely tied to the expansion of the regional automotive and chemical manufacturing bases. While regulatory enforcement can be variable, increasing global trade and corporate presence are pushing local companies towards sustainable practices. The market is highly sensitive to capital expenditure, favoring modular, simpler distillation units initially, with long-term potential for advanced technology adoption as regulatory certainty improves and solvent costs rise.

- Middle East and Africa (MEA): The MEA market is still nascent but poised for growth, primarily driven by the expansion of the petrochemical, oil & gas, and construction sectors in the Gulf Cooperation Council (GCC) countries. Recycling demand is concentrated in large industrial zones seeking to manage substantial waste streams cost-effectively. Infrastructure development is a priority, and foreign investment often drives the establishment of high-capacity recycling centers. Long-term market potential hinges on regulatory development concerning industrial waste handling and the diversification of regional economies away from primary resource extraction.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solvent Recycling Market.- Cyclechem, Inc.

- Veolia Environnement S.A.

- Tradebe Environmental Services

- CBG Biotech

- Maratek Environmental Inc.

- Clean Planet Chemical

- MEWA Textil-Service AG & Co. Management OHG

- Recychem

- SolvChem, LLC

- IST Pure

- Clean Harbors, Inc.

- TSD Technology

- Safety-Kleen Systems, Inc.

- Solvents & Petroleum Services, Inc.

- KCM Solvent Recycling

- Phoenix Technologies, Inc.

- Highland Tank & Manufacturing Company

- Detrex Corporation

- ENVA

- Miracon Solvent Recyclers

Frequently Asked Questions

Analyze common user questions about the Solvent Recycling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary economic benefits of implementing solvent recycling?

The primary economic benefits of solvent recycling include substantial reduction in operational costs, achieved by decreasing the need to purchase expensive virgin solvents and minimizing the escalating fees associated with hazardous waste disposal. Recycling also stabilizes supply chain costs, insulating manufacturers from volatility in petrochemical prices.

Which technological method dominates the industrial solvent recycling sector?

Distillation, particularly fractional and vacuum distillation, dominates the industrial solvent recycling sector. Distillation is highly effective and scalable for separating volatile solvents from non-volatile contaminants like oils, resins, and polymers, enabling high-purity recovery across various chemical types.

How does the electronics industry influence the demand for advanced solvent recycling?

The electronics and semiconductor industries drive demand for advanced recycling by requiring ultra-high purity solvents (often achieving specifications similar to virgin solvents). This necessity pushes innovation in purification technologies, such as advanced membrane separation and multiple-stage polishing systems, to ensure zero-tolerance for particulate or metal contamination.

What are the main regulatory pressures driving the growth of the Solvent Recycling Market?

Regulatory pressures, such as stringent limits on Volatile Organic Compound (VOC) emissions, the mandate for responsible hazardous waste management (e.g., EPA and REACH standards), and rising landfill taxes, compel industries globally to adopt closed-loop and solvent recovery solutions to maintain legal compliance and avoid heavy fines.

Is in-house (on-site) solvent recycling preferred over outsourced services?

The preference between in-house and outsourced recycling depends on volume and purity needs. Large manufacturers with consistent, high-volume, and specific solvent streams often prefer on-site, closed-loop systems for maximum control and immediate reuse. SMEs or those with highly complex/varied waste streams typically opt for specialized outsourced services provided by major waste management firms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Solvent Recycling Technology Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Industrial Vacuum Evaporation Systems Market Size Report By Type (Equipment Type, (Water Fracturing Evaporation Equipment, Water Atomization Evaporation Equipment), Phase Type (One Phase, Two-Phase, Three Phase), By System Type, Mechanical Vapor Recompression Evaporator, Heat Pump Evaporator, Co-Generation Hot and Cold Evaporator, Rotary Evaporator, Thermal Evaporator, Multiple Effect, Single Effect), By Application (Wastewater Treatment and Recycling, Solvent Recycling and Purification, Distillation, Synthesis, Concentration, Drying Recrystallization), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Solvent Recycling Market Statistics 2025 Analysis By Application (Printing, Painting & Coating, Oil & Chemical, Pharmaceuticals), By Type (On-Site Solvent Recycling, Off-Site Solvent Recycling), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Solvent Recycling Machines Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Semi-automatic Solvent Recycling Machines, Fully automatic Solvent Recycling Machines), By Application (Car parts, Electronic product, Painted gold, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager