Sorting Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433728 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Sorting Equipment Market Size

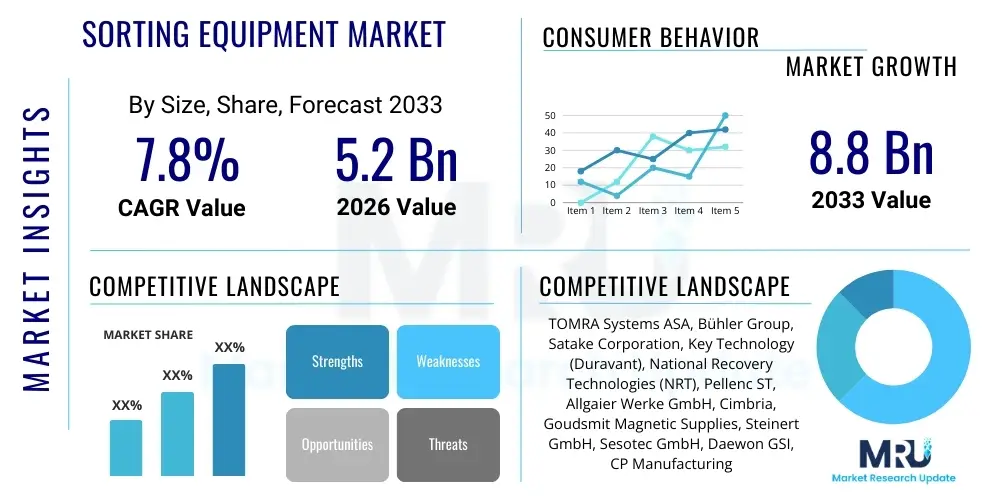

The Sorting Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 8.8 Billion by the end of the forecast period in 2033.

Sorting Equipment Market introduction

The Sorting Equipment Market encompasses a wide range of automated machinery and systems designed to separate items based on characteristics such as size, shape, color, material composition, density, and quality. These critical industrial automation tools are employed across numerous sectors, including food processing, waste management and recycling, mining, pharmaceuticals, and logistics. The primary function of sorting equipment is to enhance operational efficiency, ensure product quality compliance, minimize waste, and increase throughput, providing a reliable method for rapid and accurate material handling and categorization far exceeding human capabilities. This technology is foundational to modern manufacturing and resource recovery processes, enabling high standards of purity and material value preservation.

Sorting equipment utilizes advanced technologies, notably optical sensors, X-ray imaging, Near-Infrared (NIR) spectroscopy, and sophisticated machine vision systems, which are increasingly powered by Artificial Intelligence (AI) algorithms for real-time decision-making. These systems categorize heterogeneous streams of materials into defined, homogeneous outputs, crucial for subsequent processing or direct utilization. Major applications span from agricultural sorting (grains, fruits, vegetables) to industrial sorting (minerals, scrap metal) and postal/package sorting. The core benefit derived by end-users is the significant reduction in labor costs associated with manual sorting, coupled with unmatched precision that reduces costly errors and reworks, thereby driving sustainable economic models across various supply chains.

The market is predominantly driven by global trends toward stringent regulatory standards concerning product quality and environmental resource management, particularly in waste processing and food safety. Furthermore, the persistent shortage of skilled manual labor in developed economies accelerates the adoption of automated sorting solutions. The expansion of e-commerce and logistics networks also necessitates high-speed, accurate parcel sorting equipment. These driving factors, combined with ongoing technological advancements leading to more versatile and cost-effective sorting solutions, position the sorting equipment market for substantial growth and continued technological innovation throughout the forecast period.

Sorting Equipment Market Executive Summary

The global Sorting Equipment Market is undergoing rapid transformation, characterized by significant investment in AI-powered vision systems and hyperspectral imaging, predominantly driven by the surging need for purity in recycled materials and food safety compliance. Business trends indicate a strong shift toward modular and scalable sorting solutions that can be easily integrated into existing production lines, allowing manufacturers across varied sectors, particularly in packaging and logistics, to quickly adapt to evolving material streams and processing requirements. Major industry players are focusing on developing equipment capable of handling complex, mixed materials—such as multi-layer plastics or contaminated food products—which traditionally posed challenges for automated systems, leading to higher efficiency and reduced operational expenditures for end-users globally. The competitive landscape is marked by strategic mergers, acquisitions, and collaborative partnerships aimed at broadening technological portfolios, especially in software integration and data analytics capabilities.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive infrastructure development, rapid industrialization, and the introduction of strict governmental policies regarding waste management and recycling quotas in countries like China, India, and Japan. North America and Europe, representing mature markets, maintain dominance in terms of technology adoption, particularly leading the integration of deep learning and robotics into sorting processes to handle high-value or highly variable materials. In these regions, the emphasis is placed not just on speed, but on achieving unprecedented levels of sorting purity, essential for sectors such as high-grade metal recycling and pharmaceutical ingredient verification. Furthermore, emerging economies in Latin America and MEA are increasingly investing in bulk sorting equipment to optimize mining operations and large-scale agricultural commodity processing.

Segment trends reveal that the Optical Sorters segment, particularly those utilizing high-resolution cameras and NIR technology, holds the largest market share due to its versatility and precision in food and recycling applications. The application segment is dominated by the Food & Beverage industry, where quality control and contamination prevention are paramount, closely followed by the Recycling and Waste Management segment, which is experiencing explosive growth driven by global circular economy initiatives. Within technology, the demand for X-ray sorting equipment is witnessing significant growth, largely attributed to its effectiveness in identifying materials based on density, a crucial capability in mineral processing and packaged food inspection, ensuring the detection of foreign bodies such as glass or metal fragments, thereby securing consumer safety and brand reputation.

AI Impact Analysis on Sorting Equipment Market

User queries regarding the impact of Artificial Intelligence (AI) in the Sorting Equipment Market commonly revolve around achieving higher sorting accuracy, the ability of deep learning models to handle novel or contaminated material streams, and the economic viability of upgrading existing installed bases with AI software retrofits. Key themes identified include the expectation that AI should drastically reduce false-positive and false-negative sorting rates, particularly in complex applications like co-mingled municipal solid waste (MSW) or varied agricultural produce. Users are concerned about the necessary data infrastructure, computational power, and specialized maintenance required to implement these advanced vision systems effectively. The consensus is that AI, specifically through deep neural networks, transforms traditional sorting from a predefined rules-based task into an adaptive, real-time optimization process, significantly increasing throughput and material recovery value.

The integration of AI, machine learning (ML), and deep learning (DL) algorithms into sorting equipment is fundamentally disrupting the market dynamics, moving performance benchmarks beyond conventional limits. AI allows sorting machines to rapidly analyze high-dimensional data generated by multiple sensors (color, NIR, density) simultaneously, enabling the differentiation of materials with subtle differences—such as different polymer types (e.g., PET vs. HDPE) or minute defects on food items—that were previously impossible to distinguish automatically. This capability is crucial for achieving the high purity levels demanded by regulatory bodies and high-value secondary markets, directly impacting the profitability of recycling operations and the safety standards of food production facilities.

Moreover, AI systems facilitate predictive maintenance and continuous self-optimization of sorting parameters. The equipment can learn from operational data over time, automatically adjusting lighting, camera focus, and ejection mechanisms to compensate for wear, environmental variations (like dust or humidity), and changes in material input composition. This autonomous optimization reduces the need for manual calibration, minimizes downtime, and extends the operational lifespan of the machinery. This technological evolution effectively positions modern sorting equipment as intelligent industrial assets, providing data analytics crucial for broader supply chain visibility and resource planning, thereby maximizing the return on investment for end-users.

- AI-Powered Vision Systems: Drastic increase in sorting accuracy and speed, especially for recognizing complex, non-uniform, or heavily contaminated materials.

- Deep Learning Integration: Enables equipment to classify materials based on structural and compositional features beyond simple color or shape, crucial for mixed waste streams.

- Predictive Maintenance: AI algorithms analyze sensor data to forecast potential component failures, minimizing unplanned downtime and optimizing maintenance schedules.

- Adaptive Sorting: Real-time self-optimization capabilities allow sorters to automatically adjust operating parameters to handle variations in input material quality and volume.

- Enhanced Data Analytics: Generation of rich, actionable data on material throughput, composition, and purity levels, informing supply chain decisions and regulatory compliance reporting.

- Robotic Sorting Augmentation: AI provides sophisticated object recognition and path planning for robotic arms used in high-complexity or high-risk sorting environments.

- Hyperspectral Data Interpretation: ML models effectively process complex data from hyperspectral imaging to identify chemical signatures, improving polymer and mineral separation purity.

DRO & Impact Forces Of Sorting Equipment Market

The Sorting Equipment Market's growth trajectory is determined by a powerful interplay of Drivers, Restraints, and Opportunities, which collectively define the Impact Forces shaping industry investments and technology deployment. The primary drivers stem from global imperatives surrounding resource scarcity, requiring sophisticated recovery techniques, and consumer demand for impeccable product quality, particularly in food and pharmaceuticals. These drivers create a compelling economic argument for automation. Conversely, high initial capital expenditure (CAPEX) required for advanced sorting systems, coupled with the specialized training needed for operating and maintaining complex AI-driven machinery, acts as a significant restraint, particularly impacting smaller enterprises and developing economies attempting to modernize their infrastructure. The principal opportunity lies in the untapped potential of emerging markets adopting modern waste infrastructure and the continuous innovation in sensor fusion and machine learning, promising highly versatile and cost-efficient next-generation sorters.

Drivers fueling market expansion include the stringent global regulatory environment focused on reducing contamination and promoting recycling rates, such as the EU's Circular Economy Action Plan and various national food safety modernization acts. Furthermore, demographic shifts resulting in labor shortages necessitate automated solutions to maintain operational capacity in sectors traditionally reliant on manual labor, such as agriculture and logistics. The economic benefit derived from maximizing yields (e.g., high-quality agricultural commodities) and increasing the recovery rate and purity of secondary raw materials (e.g., plastics, metals) provides a strong financial incentive for adopting high-throughput sorting equipment. The expanding complexity of packaging materials, particularly the introduction of various bio-plastics and flexible films, also mandates the use of highly sophisticated, technology-intensive sorting solutions capable of distinguishing these nuanced materials.

Restraints, beyond the high initial investment, include technological limitations when dealing with highly wet, dirty, or variable material inputs which can interfere with optical or sensor performance, demanding expensive pre-processing stages. Market penetration is also challenged by the heterogeneity of global material streams; a system optimized for European recycling streams may not be optimally suited for mixed waste in Southeast Asia without substantial customization. Opportunities, conversely, include the development of mobile or modular sorting units that cater to smaller-scale operations or temporary processing needs. Furthermore, the integration of Industrial Internet of Things (IIoT) frameworks and cloud connectivity offers a significant avenue for manufacturers to provide value-added services such as remote diagnostics, performance monitoring, and subscription-based software updates, transforming the revenue model from purely hardware sales to integrated service solutions, thereby enhancing market penetration and resilience.

Segmentation Analysis

The Sorting Equipment Market is systematically segmented by Type (Mechanical, Optical, X-ray, etc.), Technology (Camera, Laser, NIR, etc.), End-User Application (Food & Beverage, Recycling, Mining, Pharmaceuticals, etc.), and Capacity (High, Medium, Low Throughput). This granular segmentation provides a critical framework for analyzing demand drivers and technological adoption patterns across diverse industrial ecosystems. The segmentation highlights the critical dependency of market growth on sector-specific needs, such as the preference for optical sorting in sensitive food handling environments versus the mandatory use of high-capacity mechanical screens and X-ray systems in high-volume mining or waste recovery operations. Understanding these segment dynamics is essential for market players to tailor product development and market penetration strategies, ensuring maximum relevance to the distinct quality, speed, and material handling requirements of each industry.

The dominant segmentation reflects the shift toward sensor-based sorting technologies, where equipment categorized by the detection mechanism (NIR, Hyperspectral Imaging, X-ray) often dictates performance ceiling and application suitability. For example, NIR technology is fundamental in classifying organic materials and various plastics, making it indispensable for food processing and plastic recycling. Conversely, applications involving dense, opaque, or metallic contamination, such as foreign material detection in packaged foods or heavy mineral separation, rely heavily on X-ray and induction sorting technologies. The market's future growth is expected to be propelled by the convergence of these technologies, leading to hybrid sorters that combine multiple detection methods and AI processing to achieve previously unattainable levels of separation fidelity across challenging material mixtures, thereby continuously raising the bar for industrial quality control standards.

The application segment remains the primary focus for revenue generation, with the Food & Beverage industry being the largest consumer, primarily purchasing optical sorters for defect removal, color grading, and foreign material control, critical for consumer safety and branding. The exponential growth witnessed in the Recycling and Waste Management sector, driven by global targets for material circularity, is rapidly closing this gap, demanding robust, high-throughput systems capable of operating in harsh environments with varying input quality. Specialized applications, such as sorting high-value diamonds in mining or verifying tablet quality in pharmaceuticals, though smaller in volume, represent high-margin niches that drive innovation in sensor resolution and precision engineering, demonstrating the market's reliance on both mass-volume industrial solutions and highly specialized precision tools.

- By Type:

- Optical Sorters (Color, Monochromatic, RGB)

- Mechanical Sorters (Sieves, Screens, Separators)

- X-ray Sorters (Density and Composition based)

- Near-Infrared (NIR) Sorters

- Magnetic/Induction Sorters

- Air Sorters/Gravity Separators

- By Technology:

- Camera and Vision Systems

- Laser Technology

- Hyperspectral Imaging (HSI)

- Acoustic Sorting

- Sensor Fusion Technology

- By Application/End-User:

- Food & Beverage Processing (Grains, Fruits, Vegetables, Nuts, Seafood)

- Recycling & Waste Management (Plastics, Metals, Paper, Glass, E-waste)

- Mining & Mineral Processing (Ores, Diamonds, Coal)

- Pharmaceuticals & Chemicals (Tablets, Powders, Raw Ingredients)

- Logistics & Packaging (Parcel, Post, Warehouse Automation)

- By Capacity/Speed:

- High Throughput (Industrial scale operations)

- Medium Throughput (Specialty processing lines)

- Low Throughput (Laboratory/R&D and small-batch processing)

Value Chain Analysis For Sorting Equipment Market

The value chain of the Sorting Equipment Market begins with upstream activities focused on the procurement of highly specialized components, primarily high-resolution sensors, industrial-grade cameras, NIR and X-ray sources, high-speed microprocessors, and sophisticated pneumatic ejection systems. Key upstream vendors include technology providers specializing in optics, AI software development, and precision mechanical engineering. The capital intensity and technological complexity of these components mean that system manufacturers often rely on a concentrated group of tier-one suppliers to maintain quality and performance specifications. This segment of the value chain is critical as innovation in sensor technology directly determines the accuracy and application range of the final sorting machine, establishing the core competitive advantage for system integrators.

Midstream activities involve the design, assembly, integration, and calibration of the complex sorting systems. Manufacturers take the advanced components and integrate them with proprietary control software and mechanical frameworks designed for specific applications, such as hygienic design for food processing or robust construction for mining environments. The distribution channel is segmented into direct sales models, particularly for high-value, customized industrial solutions where direct engineering consultation is necessary, and indirect channels relying on regional distributors, system integrators, and value-added resellers (VARs) who provide localized installation, maintenance, and technical support. Indirect channels are crucial for penetrating geographically dispersed markets and supporting small to medium-sized enterprises (SMEs) lacking dedicated in-house automation expertise. The effectiveness of after-sales service and remote diagnostic support via cloud-based platforms is increasingly becoming a defining factor in channel partner selection and customer satisfaction.

Downstream analysis focuses on the end-users and the service providers who maintain the equipment throughout its lifecycle. Installation, calibration specific to the material stream, operator training, and ongoing maintenance (both preventative and reactive) are essential services that lock in long-term revenue streams for manufacturers. The indirect value derived from sorting equipment adoption—such as the creation of higher purity secondary materials, which command premium prices, or the avoidance of costly product recalls due to contamination—is central to the economic justification for buyers. The increasing connectivity of modern sorting machines allows manufacturers to gather operational data, providing valuable feedback for future product design and enabling remote troubleshooting, thereby closing the loop between upstream technology providers and downstream customer needs, fostering continuous efficiency improvements across the entire market ecosystem.

Sorting Equipment Market Potential Customers

Potential customers for sorting equipment are diverse and span virtually every industry involved in processing, refining, or handling high volumes of varied materials, particularly where quality control, contamination removal, or resource recovery is paramount. The largest cohort of buyers resides within the Food & Beverage industry, including large-scale processors of grains, fruits, vegetables, nuts, and frozen foods, where sorters are essential tools for ensuring safety, meeting aesthetic standards, and complying with stringent international hygiene regulations. These buyers prioritize optical clarity, rapid throughput, and ease of cleaning to prevent cross-contamination, often requiring specialized IP69K-rated equipment. The second major customer group includes municipal waste facilities, private recycling companies, and material recovery facilities (MRFs) requiring robust, high-capacity systems capable of separating plastics, paper, metals, and glass from mixed streams, driven by governmental mandates and circular economy targets.

Beyond these two giants, the Mining and Mineral Processing sector represents significant customers, utilizing advanced sorting technologies, particularly X-ray transmission and sensor-based sorting (SBS), to pre-concentrate ore before milling. This pre-concentration significantly reduces energy consumption and chemical usage downstream, improving overall mine profitability and environmental footprint. These industrial buyers seek maximum durability and reliability in harsh operating conditions, coupled with highly specialized detection capabilities for low-grade ores or high-value materials like diamonds. Furthermore, the Logistics and E-commerce sector is a rapidly expanding customer base, demanding sophisticated, high-speed automatic parcel sorting systems to manage the massive influx of packages, requiring precision sorting based on destination, size, and weight, often integrated with robotic handling solutions to maximize warehouse efficiency.

Niche but high-value customer segments include pharmaceutical manufacturers, who deploy ultra-precise vision and X-ray systems to inspect tablets and capsules for defects, size variations, and foreign material inclusions, where zero tolerance for error is non-negotiable. Chemical and plastics manufacturers also purchase sorting equipment to ensure the purity of their polymers and raw materials before final processing. Ultimately, any organization involved in high-volume commodity transformation or waste stream management, where material value is directly linked to purity and uniformity, constitutes a high-potential customer for modern, automated sorting equipment. The increasing awareness of sustainability goals is expanding the customer base to include governments and large corporations seeking turnkey solutions for achieving their environmental, social, and governance (ESG) objectives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 8.8 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TOMRA Systems ASA, Bühler Group, Satake Corporation, Key Technology (Duravant), National Recovery Technologies (NRT), Pellenc ST, Allgaier Werke GmbH, Cimbria, Goudsmit Magnetic Supplies, Steinert GmbH, Sesotec GmbH, Daewon GSI, CP Manufacturing, Inc., Meyer, Hefei Meiya Optoelectronic Technology, MSS Optical Sorters, Barco NV, Unisorting S.r.l., Raytec Vision S.p.A., Binder+Co AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sorting Equipment Market Key Technology Landscape

The Sorting Equipment Market's technological landscape is defined by continuous evolution driven by the need for higher precision, speed, and material versatility, moving far beyond basic color cameras to multi-sensor fusion platforms. Key technologies currently dominating new installations include high-resolution monochromatic and RGB camera systems, capable of detecting minute surface defects and color variations at extremely high throughput rates, essential for tasks like detecting foreign material in rice or grading specialty coffee beans. Complementing visual systems, Near-Infrared (NIR) spectroscopy remains crucial, particularly for polymer identification (differentiating various plastic types like PVC, PS, and PET) and for organic matter sorting in food and agricultural products, leveraging unique light absorption characteristics to ascertain chemical composition and moisture content, providing data undetectable by conventional means.

A major technological advancement driving market differentiation is the widespread adoption of Hyperspectral Imaging (HSI) and X-ray Transmission (XRT) and X-ray Inspection (XRI) technologies. HSI captures and processes data across a very wide spectrum of light (hundreds of bands), enabling the identification of objects based on their specific chemical signatures, which is particularly vital for separating various types of wood, identifying low-grade ores, or detecting minute plastic contaminants within a paper stream. X-ray technologies, meanwhile, are indispensable for tasks requiring density-based sorting, such as detecting metallic or glass fragments in packaged goods, or separating heavy minerals and e-waste components, providing robust performance regardless of surface contamination or opacity. The ability of X-ray sorters to penetrate materials makes them superior for internal defect detection or separating materials with similar visual characteristics but differing densities.

The strategic future of the technology landscape lies in sensor fusion—the simultaneous deployment and AI-driven processing of data from multiple sensor types (e.g., combining RGB, NIR, Laser, and X-ray data) onto a single processing platform. This integrated approach drastically reduces false rejection rates and enhances the purity of the sorted output, particularly in highly complex mixtures like commingled packaging waste or complex food batches. Furthermore, pneumatic and mechanical ejection systems are constantly being refined, moving toward high-speed, precision valve systems and specialized air jets that minimize the loss of good material (carryover) while maintaining rapid cycle times. The increasing robustness and accuracy of these ejection mechanisms are crucial for translating sophisticated sensor detection into effective physical separation, ensuring the operational efficiency of the entire sorting line and maximizing the economic returns for the end-user.

Regional Highlights

The global sorting equipment market exhibits significant regional variations in growth momentum, technology maturity, and application focus, reflecting diverse economic structures and regulatory environments. North America and Europe stand as mature markets, characterized by high adoption rates of advanced, often expensive, AI-driven optical and X-ray sorting systems, primarily due to strict quality and environmental standards, and high labor costs that necessitate maximum automation. These regions are leaders in the implementation of sophisticated recycling infrastructure, demanding highly pure sorted fractions to feed robust secondary material markets. Europe, in particular, benefits from strong regulatory backing through EU directives pushing for circular economy goals and high material recovery targets, stimulating continuous investment in municipal and industrial waste sorting solutions. The focus in these developed regions is on incremental efficiency gains and handling increasingly complex and multi-layered packaging materials.

Asia Pacific (APAC) represents the dominant growth engine for the sorting equipment market, driven by rapid industrialization, massive urban population growth, and escalating investment in infrastructure, particularly in countries like China, India, and Southeast Asia. The adoption in APAC is primarily fueled by the establishment of new large-scale material processing facilities, both for commodities (rice, tea, minerals) and for addressing the immense challenge of urban waste management. Government initiatives in countries like China to enforce stricter waste segregation and recycling mandates are creating unprecedented demand for high-throughput, robust sorting machinery. While initial adoption often focuses on high-capacity mechanical and basic optical sorters due to cost sensitivities, the market is quickly moving toward integrating advanced NIR and sensor-based sorting as quality requirements and export standards rise, making APAC a critical region for future technological scaling and volume sales.

Latin America (LATAM), and the Middle East and Africa (MEA) are emerging markets showing promising growth, albeit from a smaller base. Growth in LATAM is concentrated in the large-scale agriculture sector (e.g., coffee, soybeans, mining), where sorting equipment enhances export quality and reduces post-harvest losses, improving international competitiveness. In MEA, the market is spurred by large-scale mining operations (especially in South Africa and Saudi Arabia) requiring advanced sensor-based sorting for pre-concentration, and strategic government investments in new waste management infrastructure, particularly in GCC countries, aimed at diverting waste from landfills. Although these regions face restraints related to capital availability and technical expertise, ongoing urbanization and industrial modernization efforts suggest strong long-term growth potential as the economic feasibility of automated sorting becomes clearer and localized service networks expand, facilitating easier adoption and maintenance.

- North America: Focus on integrating AI and robotics for maximum operational efficiency in logistics and food processing; strong demand for high-end optical and X-ray sorters due to stringent FDA regulations and high labor costs.

- Europe: Driven by strict Circular Economy mandates and high recycling purity targets; high adoption of NIR and hyperspectral technology for complex plastic waste and WEEE sorting; emphasis on sustainability and energy efficiency in equipment design.

- Asia Pacific (APAC): Highest volume growth due to rapid infrastructure development and new government recycling policies; dominant application in large-scale food processing and bulk material handling; increasing shift toward advanced sensor-based sorting in urban waste management.

- Latin America (LATAM): Growth centered around agricultural commodity sorting (improving export quality) and mining efficiency; adoption of rugged, high-capacity mechanical and sensor sorters suitable for bulk materials.

- Middle East and Africa (MEA): Key driver is investment in large mineral processing projects (XRT/SBS); nascent but accelerating development of automated municipal waste infrastructure; demand for reliable and durable equipment adapted to arid environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sorting Equipment Market.- TOMRA Systems ASA

- Bühler Group

- Satake Corporation

- Key Technology (Duravant)

- National Recovery Technologies (NRT)

- Pellenc ST

- Steinert GmbH

- Sesotec GmbH

- Cimbria

- Allgaier Werke GmbH

- Goudsmit Magnetic Supplies

- Daewon GSI

- CP Manufacturing, Inc.

- Meyer

- Hefei Meiya Optoelectronic Technology

- MSS Optical Sorters

- Raytec Vision S.p.A.

- Binder+Co AG

- TSI GmbH (part of Tomra)

- ZenRobotics Ltd. (part of Zakarian)

Frequently Asked Questions

What specific technological advances are currently driving efficiency in optical sorting?

The primary advances driving efficiency are the integration of Artificial Intelligence (AI) and Deep Learning algorithms with high-resolution multispectral cameras and Hyperspectral Imaging (HSI). These technologies enable sorting equipment to analyze material composition in real-time, accurately separating materials based on complex chemical signatures or subtle visual defects that conventional rule-based systems could not identify, leading to significantly higher sorting purity and reduced material loss.

How does the implementation of automated sorting equipment impact operational expenditure (OPEX) in recycling facilities?

Automated sorting equipment substantially reduces OPEX primarily by lowering labor costs, minimizing material loss (increasing recovery value), and reducing energy consumption associated with subsequent, less efficient downstream processing stages. While initial capital investment is high, the long-term gains from increased purity and operational speed typically yield a rapid return on investment, making operations more economically viable and competitive, especially in high-volume processing environments.

Which end-user application segment holds the largest market share for sorting equipment?

The Food and Beverage Processing industry currently holds the largest market share. Sorting equipment is non-negotiable in this sector for quality control, defect removal, and foreign material detection (metal, glass, plastic) to ensure consumer safety, comply with international regulatory standards (like HACCP and FDA rules), and maintain brand reputation. This segment consistently drives demand for high-precision optical and X-ray inspection systems.

What are the key challenges associated with adopting X-ray sorting technology in mining and waste management?

Key challenges include the high initial capital cost required for X-ray Transmission (XRT) equipment and the need for stringent safety protocols and specialized maintenance personnel due to the nature of the technology. Additionally, while highly effective for density separation, XRT’s sorting efficacy can be negatively impacted by material size distribution and throughput variations, requiring careful upstream material preparation to optimize performance and maximize material recovery yield.

In which region is the demand for sorting equipment experiencing the fastest Compound Annual Growth Rate (CAGR), and why?

Asia Pacific (APAC) is projected to exhibit the fastest CAGR. This accelerated growth is primarily attributed to rapid urbanization, massive government investments in new waste management infrastructure, stringent enforcement of domestic recycling mandates (particularly in China and India), and the exponential expansion of large-scale manufacturing and food processing facilities demanding modern, automated quality control systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Automated Food Sorting Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Tobacco Sorting Equipment Market Statistics 2025 Analysis By Application (Mixed Type, Cigar, Flue-cured Tobacco), By Type (Below 5 Tonnes/ Hour, 5 to 10 Tonnes/ Hour, Above 10 Tonnes/ Hour), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Sorting Equipment in Logistics Market Statistics 2025 Analysis By Application (Food Industry, Non-food Industry), By Type (Flat Sorters, Cross Belt Sorters, Tilt Tray Sorters), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager