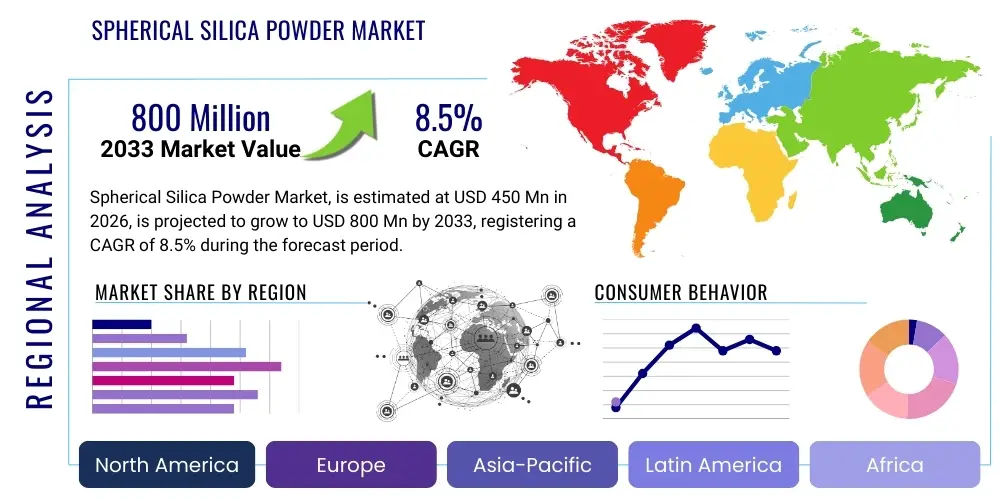

Spherical Silica Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438652 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Spherical Silica Powder Market Size

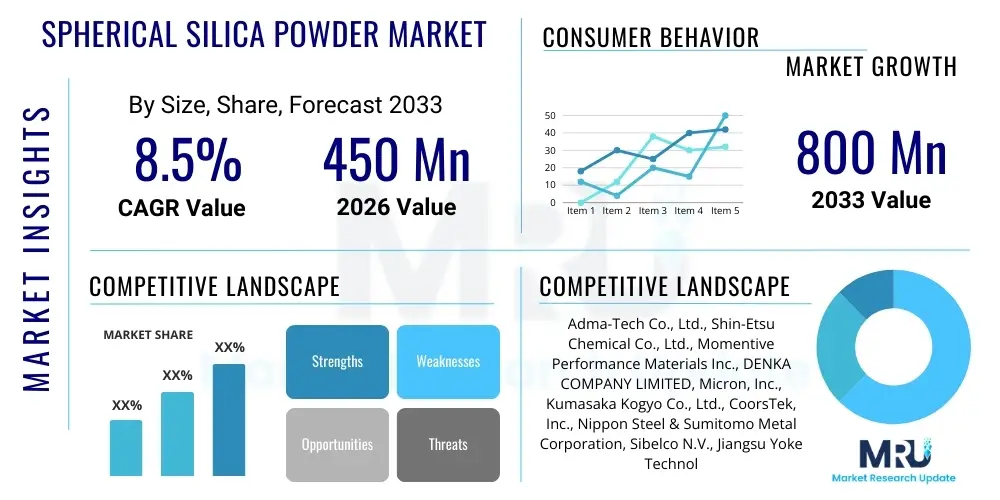

The Spherical Silica Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 800 Million by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the accelerating global demand for advanced electronic packaging materials, particularly in the semiconductor and 5G infrastructure sectors, where high thermal conductivity and low dielectric constant materials are critical for performance and reliability.

Spherical Silica Powder Market introduction

Spherical silica powder, characterized by its highly regular spherical shape, extremely tight particle size distribution, and high purity, is an advanced functional material derived predominantly from quartz or synthetic methods like the sol-gel process. Its unique morphology distinguishes it from irregular or crushed silica, offering superior flow properties, minimum wear on processing equipment, and exceptional packing density. These characteristics are indispensable in applications demanding flawless performance and dimensional stability, such as epoxy molding compounds (EMCs) used for semiconductor encapsulation, high-performance thermal interface materials (TIMs), and specialized composite fillers.

Major applications of spherical silica powder span across the electronics, automotive, aerospace, and coatings industries. In electronics, it serves as a critical filler material in EMCs to reduce the coefficient of thermal expansion (CTE) of the composite, thereby minimizing stress on delicate chips during thermal cycling and enhancing device longevity. The high purity levels, often exceeding 99.9%, ensure minimal contamination risk to sensitive components. Beyond encapsulation, it is increasingly utilized in advanced substrate materials and printed circuit board (PCB) laminates requiring excellent dielectric properties at high frequencies, supporting the proliferation of artificial intelligence hardware and data centers.

The primary benefits driving market adoption include enhanced thermal management capabilities due to its high thermal conductivity, superior dimensional stability, and excellent electrical insulation properties. Key driving factors encompass the global trend towards miniaturization in electronics, necessitating advanced materials that can handle increasing power density within smaller footprints; the explosive growth of the semiconductor industry driven by IoT, automotive electronics, and 5G technology; and increasing investments in high-density packaging solutions like Fan-Out Wafer Level Packaging (FOWLP) and System-in-Package (SiP). Furthermore, stringent quality requirements in the aerospace and automotive sectors for robust electronic control units (ECUs) are contributing significantly to market expansion, demanding ever-purer and finer spherical silica grades.

Spherical Silica Powder Market Executive Summary

The global Spherical Silica Powder market is characterized by intense technological competition and a strong correlation with the macroeconomic cycles of the electronics industry. Current business trends indicate a pivot towards ultra-fine, high-purity grades (sub-micron particles) specifically designed for advanced semiconductor packaging, driven by the shift from traditional packaging methods to wafer-level and 3D packaging technologies. Strategic investments are concentrated in expanding production capacities using the specialized sol-gel process, which yields the highest purity and spherical uniformity required for sensitive applications. Manufacturers are focusing on backward integration to secure stable access to high-quality quartz raw materials and optimizing milling and classification processes to achieve tighter particle distribution profiles, enhancing market differentiation.

Regionally, Asia Pacific maintains its dominance, primarily due to the concentration of major semiconductor fabrication plants (fabs) and outsourced semiconductor assembly and test (OSAT) operations in countries like China, Taiwan, South Korea, and Japan. This region is the epicenter of demand for epoxy molding compounds (EMCs) and advanced substrate materials. North America and Europe, while smaller in production capacity, represent high-value markets focusing on specialty applications in aerospace, defense electronics, and advanced thermal management solutions, driving demand for specialized, low alpha radiation spherical silica powders. The rapid industrialization and governmental support for domestic electronics manufacturing in China further solidify APAC’s forecasted growth leadership.

Segment trends highlight the significant growth of the Electronics Encapsulation segment, which consumes the largest volume of spherical silica, particularly within the 5 to 50 micrometer particle range. However, the fastest growth is observed in the Thermal Management segment, fueled by the necessity for highly efficient heat dissipation in high-performance computing (HPC) and electric vehicle (EV) batteries, where spherical silica is used in thermal grease and gap fillers. Furthermore, the segmentation by purity level shows that High Purity (>99.99%) grades are capturing premium pricing and exhibiting accelerated growth compared to Standard Grade materials, reflecting the increasing technical demands across all critical end-user applications requiring minimal trace elements to prevent performance degradation over the operational life cycle of the device.

AI Impact Analysis on Spherical Silica Powder Market

The proliferation of Artificial Intelligence (AI) hardware, particularly specialized high-performance computing (HPC) chips, Graphical Processing Units (GPUs), and high-bandwidth memory (HBM), profoundly influences the Spherical Silica Powder market dynamics. User inquiries frequently center on how AI demands affect material purity requirements, thermal management complexity, and supply chain readiness. Users express concern regarding whether existing spherical silica grades can meet the stringent thermal dissipation and coefficient of thermal expansion (CTE) control required by densely packed AI accelerator modules operating at extremely high power densities. The consensus expectation is that AI acceleration will necessitate a complete overhaul of packaging materials, favoring ultra-high thermal conductivity fillers that maintain excellent dielectric properties at elevated operating temperatures. This translates directly into heightened demand for bespoke, narrow-distribution, ultra-pure spherical silica, pushing manufacturers towards more advanced, cost-intensive production techniques like the sol-gel method to minimize particle irregularity and achieve superior filler loading.

- AI drives demand for ultra-high purity (>99.999%) silica to prevent ionic contamination in sensitive AI chip packages.

- Increased heat generation in AI processors mandates spherical silica with optimized particle packing density for enhanced thermal interface material (TIM) performance.

- Adoption of AI-driven simulations in materials science accelerates the development of novel spherical silica compositions and surface treatments.

- AI manufacturing intelligence improves quality control and reduces batch-to-batch variation in spherical silica production.

- Miniaturization induced by AI hardware packaging (e.g., chiplets) increases the need for sub-micron spherical silica grades.

- AI deployment in autonomous vehicles significantly boosts demand for robust electronic encapsulation materials that utilize spherical silica.

- Supply chain risk optimization using AI enhances predictive modeling for sourcing raw materials (quartz) and managing inventory for key electronic component manufacturers.

DRO & Impact Forces Of Spherical Silica Powder Market

The market for Spherical Silica Powder is fundamentally shaped by a delicate balance between persistent demand from the high-growth electronics sector and challenges associated with raw material sourcing and manufacturing precision. Drivers primarily revolve around the technological imperative of miniaturization and enhanced performance in consumer electronics, 5G infrastructure, and advanced automotive systems, all of which require superior thermal and mechanical stability provided by spherical fillers. Restraints include the extremely high capital expenditure required for establishing and maintaining high-purity production facilities, particularly those utilizing the advanced sol-gel technique, and the inherent volatility in the pricing and availability of high-grade quartz, the foundational raw material. Opportunities lie in the untapped potential within niche applications such as medical devices requiring bio-inert materials, advanced 3D printing composites, and the burgeoning electric vehicle battery management system market.

Key impact forces influencing market direction include the stringent regulations governing hazardous substances in electronics (like RoHS), forcing material suppliers to continuously certify ultra-low heavy metal content, which spherical silica inherently supports due to its pure composition. Furthermore, the intensity of competitive rivalry is high, particularly in the Asian market, where numerous regional players compete fiercely on price for standard-grade material, while premium players differentiate based on technical specifications like controlled particle size distribution (PSD) and superior surface modification capabilities. Supplier power remains moderate to high, as the availability of specific, high-quality quartz resources is limited, creating bottlenecks and influencing production costs, especially for ultra-fine grades requiring specific milling processes.

The collective impact of these forces dictates that market growth will be concentrated among players who can consistently deliver ultra-high-purity, custom-engineered spherical silica grades, especially those capable of serving the most demanding segments such as advanced logic packaging and aerospace electronics. While volume growth is steady, value growth is highly dependent on innovation in particle modification and purification techniques. Technological substitution risk is relatively low in core applications like epoxy molding compounds, given spherical silica’s unique combination of low dielectric constant, low CTE, and high thermal conductivity, characteristics that are difficult to replicate cost-effectively with alternative inorganic fillers like alumina or boron nitride, though these substitutes do compete fiercely in specific thermal management niches.

Segmentation Analysis

The Spherical Silica Powder market is extensively segmented based on particle size, purity level, manufacturing method, and specific end-use application, providing a nuanced view of demand drivers and competitive landscapes. Segmentation by purity (High Purity vs. Standard Grade) is crucial as it reflects the suitability for sensitive electronics; High Purity grades (>99.99%) command significant premiums and are essential for advanced semiconductor encapsulation where even trace impurities can cause device failure. Particle size segmentation (e.g., Sub-micron, 1-10 μm, 10-50 μm, >50 μm) directly correlates with the final application requirement, where sub-micron powders are necessary for filling extremely small gaps in advanced packaging, while larger particles are used in bulk composites or thermal pads.

Application segmentation reveals that Electronics Encapsulation dominates the market share, providing the necessary mechanical protection and thermal stability for chips. However, the fastest expansion is anticipated in Thermal Management, driven by the increasing power demands in data centers and electric vehicle infrastructure requiring superior heat dissipation materials. The segmentation based on the manufacturing method (Fused Silica vs. Sol-Gel Silica) highlights the technical complexity, with the Sol-Gel process yielding the highest sphericity and purity, making it vital for ultra-high-end applications despite its higher production cost. Understanding these segment trends allows manufacturers to strategically allocate resources towards R&D for customized solutions tailored to emerging industry needs, particularly those related to 5G deployment and AI processing hardware.

- By Type:

- High Purity Spherical Silica (>99.99% SiO2)

- Standard Grade Spherical Silica (99.5% - 99.9% SiO2)

- By Particle Size:

- Sub-Micron (<1 µm)

- Fine (1 µm to 10 µm)

- Medium (10 µm to 50 µm)

- Coarse (>50 µm)

- By Application:

- Electronics Encapsulation (Epoxy Molding Compounds)

- Thermal Management Materials (Thermal Interface Materials, Greases, Pads)

- Coatings and Paints

- Composites and Adhesives

- Others (e.g., 3D Printing, Healthcare)

- By End-Use Industry:

- Semiconductors and Electronics

- Automotive (EV Batteries and ECUs)

- Aerospace and Defense

- Industrial and Construction

- Healthcare and Medical Devices

Value Chain Analysis For Spherical Silica Powder Market

The value chain for the Spherical Silica Powder market commences with the upstream acquisition of high-purity raw materials, predominantly natural quartz or specialized precursor chemicals for synthetic production methods. High-quality quartz mining and purification are critical steps, as the purity of the final product is heavily dependent on the raw material source. Suppliers of advanced processing equipment, such as specialized melting furnaces (for fused silica), reaction vessels (for sol-gel), and ultra-fine milling and classification systems, also constitute a vital part of the upstream segment. Cost control and resource stability at this stage are paramount, as the high energy consumption during the fusion process and the proprietary nature of the sol-gel technology significantly influence manufacturing costs and product specifications.

The core manufacturing stage involves the conversion of raw silica into perfectly spherical particles, followed by surface treatment processes (silane coupling agents) that enhance compatibility with organic resins used in downstream applications. This stage, dominated by specialized producers like Adma-Tech and Shin-Etsu Chemical, involves high barriers to entry due to required technical expertise in controlling sphericity, particle size distribution, and surface functionalization. Distribution channels are typically specialized and bifurcated: direct sales channels are employed for large-volume customers like major Epoxy Molding Compound (EMC) manufacturers and thermal material formulators, ensuring technical support and customized supply agreements. Indirect channels, often utilizing technical distributors or local agents, cater to smaller or niche customers in regions requiring localized inventory and technical assistance for composite or coating applications.

The downstream segment involves the primary end-users, mainly formulators who integrate spherical silica into final products, such as OSAT companies manufacturing encapsulated components, and automotive suppliers producing thermal management assemblies. Direct consumption by large semiconductor companies for internal R&D or specialty material formulation also occurs. The market power dynamics favor downstream formulators when procuring standard grades, but the technical material suppliers hold significant leverage when supplying proprietary, ultra-high-purity, or customized sub-micron powders required for cutting-edge technologies. The efficiency of the distribution network, particularly the ability to handle and transport highly sensitive, ultra-fine powders without contamination or agglomeration, is a major factor in maintaining product quality and optimizing the overall value delivery to the end consumer.

Spherical Silica Powder Market Potential Customers

The primary end-users and buyers of Spherical Silica Powder are concentrated within sophisticated manufacturing sectors that require materials offering superior thermal, electrical, and mechanical properties unattainable with conventional fillers. The largest consumer base resides in the semiconductor industry, specifically companies involved in packaging and testing (OSAT players) that utilize the powder extensively in epoxy molding compounds (EMCs). These customers prioritize low coefficient of thermal expansion (CTE) and high thermal conductivity to protect silicon dies during extreme operating conditions. Additionally, manufacturers of high-performance printed circuit board (PCB) laminates, especially those catering to 5G infrastructure and data center equipment, constitute a growing customer group demanding low dielectric loss characteristics.

Another significant customer segment is the automotive industry, driven by the electrification trend. Electric Vehicle (EV) manufacturers and their Tier 1 suppliers purchase spherical silica for high-efficiency thermal interface materials (TIMs) used in battery thermal management systems and power electronics (inverters, converters). In this application, chemical inertness, thermal stability, and reliable heat transfer are the primary purchasing criteria. Finally, specialty chemicals and advanced materials companies that formulate customized coatings, structural adhesives, and highly durable composites for aerospace and defense applications represent high-value, albeit smaller volume, buyers. These customers typically demand unique particle surface modifications and extremely strict quality assurance, pushing the boundaries of material specification and requiring close collaboration with spherical silica producers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Adma-Tech Co., Ltd., Shin-Etsu Chemical Co., Ltd., Momentive Performance Materials Inc., DENKA COMPANY LIMITED, Micron, Inc., Kumasaka Kogyo Co., Ltd., CoorsTek, Inc., Nippon Steel & Sumitomo Metal Corporation, Sibelco N.V., Jiangsu Yoke Technology Co., Ltd., Suzhou Nano-Silica Co., Ltd., Fujimi Corporation, PSS High-Tech GmbH, Tokai Carbon Co., Ltd., Ta-I Technology Co., Ltd., Qingdao Ruisai Materials Technology Co., Ltd., Zhuzhou Keneng New Material Co., Ltd., Hubei Huifu Nanomaterial Co., Ltd., Sun-Yat Technology Co., Ltd., Fuso Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spherical Silica Powder Market Key Technology Landscape

The technology landscape governing the production of Spherical Silica Powder is bifurcated into two dominant methodologies: the traditional Fused Silica method and the advanced Sol-Gel process. The Fused Silica method involves melting high-purity crystalline quartz at extremely high temperatures (around 2000°C) and then utilizing atomization techniques or plasma methods to create spherical droplets which are rapidly cooled. While this method is cost-effective for large-volume, standard-grade powders, it often results in broader particle size distribution and slightly lower overall purity compared to synthetic routes. Technological improvements in this sector focus on plasma spheroidization and specialized classification systems to tighten the Particle Size Distribution (PSD), which is crucial for maximizing filler loading in epoxy systems.

The Sol-Gel process represents the cutting edge of manufacturing technology for this market, enabling the creation of ultra-high purity (>99.999%), highly uniform sub-micron spherical silica particles. This synthetic wet chemical route involves hydrolyzing and condensing silane precursors, followed by aging, filtration, and calcination. The precise control over chemical reactions at the nano-scale allows for unparalleled consistency in particle morphology and purity, making Sol-Gel derived spherical silica indispensable for advanced IC packaging and low alpha radiation applications. Current R&D efforts are heavily focused on optimizing the Sol-Gel process to reduce production cycle times, lower energy consumption, and manage the high cost associated with the specialized precursor chemicals, aiming to make these premium materials more accessible for mass-market applications like advanced automotive power modules.

Beyond core manufacturing, surface modification technology plays a critical role. Manufacturers apply specific silane coupling agents to the surface of the spherical silica powder to ensure excellent adhesion and compatibility with various organic resins, such as epoxy, polyester, and polyimide. The successful functionalization of the particle surface directly determines the mechanical strength, moisture resistance, and processing viscosity of the final composite material. Innovations in this area include developing multifunctional coupling agents and utilizing plasma surface treatment technologies to achieve a more uniform and chemically robust interface, addressing the evolving needs of high-frequency electronics that demand low dielectric constants and superior hydrolytic stability under harsh environmental operating conditions.

Regional Highlights

The regional analysis of the Spherical Silica Powder market reveals distinct patterns of demand, production concentration, and technological adoption shaped by local industrial ecosystems, particularly the semiconductor manufacturing base. The Asia Pacific (APAC) region stands as the undisputed market leader, accounting for the largest share of both consumption and production capacity globally. This dominance is attributable to the concentration of the world's largest Foundries, OSAT companies, and major PCB manufacturers in countries such as China, Taiwan, South Korea, and Japan. Japan and China host major global producers, driving technological innovation and supply volume, while Taiwan and South Korea represent critical consumption hubs driven by cutting-edge memory and logic chip production. The rapid expansion of electric vehicle manufacturing and 5G infrastructure development across East Asia further entrenches APAC's leading position, demanding massive volumes of both standard and high-purity grades.

North America holds a strong position in the high-value, specialty end of the market, driven by significant R&D investment in advanced packaging, aerospace, and defense electronics. While manufacturing volumes are lower than in APAC, demand focuses almost exclusively on ultra-high purity, low alpha radiation spherical silica powders used in critical military and high-reliability commercial applications. The region benefits from a robust ecosystem of thermal management material formulators and advanced materials research institutions, pushing the envelope for next-generation material specifications. Europe, similarly, emphasizes high-quality materials, with strong demand originating from the automotive sector (Germany, France) for EV power electronics and industrial applications, along with niche aerospace projects. European regulations concerning material traceability and sustainability influence procurement, leading to a preference for established suppliers with transparent and robust quality control systems.

Latin America and the Middle East and Africa (MEA) currently represent emerging markets, with demand primarily confined to industrial applications, construction coatings, and general electronics assembly. Growth in MEA is expected to accelerate, linked to developing domestic solar and smart city infrastructure projects that require stable electronic components and protective coatings. However, these regions rely heavily on imports from Asia and Europe for specialized spherical silica grades. Future growth in these emerging regions will be contingent upon increased foreign direct investment in localized electronics manufacturing and the subsequent adoption of advanced packaging technologies requiring high-performance fillers.

- Asia Pacific (APAC): Dominates the market due to the massive semiconductor manufacturing base (Taiwan, South Korea, China, Japan). Drives demand for both high-volume standard grades and advanced Sol-Gel materials for advanced packaging.

- North America: Key market for high-reliability applications, including aerospace, defense, and high-performance computing (HPC). Focus on ultra-high purity and low alpha radiation grades.

- Europe: Strong consumption driven by the automotive industry (EV power electronics) and industrial applications. Prioritizes material quality, traceability, and environmental compliance.

- Latin America (LATAM): Emerging market, primarily focused on industrial coatings and general electronics. Growth trajectory tied to regional industrialization efforts.

- Middle East and Africa (MEA): Smallest current market share, expected growth linked to infrastructure development and localized electronic assembly initiatives. Dependent on imports for specialized materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spherical Silica Powder Market.- Adma-Tech Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Momentive Performance Materials Inc.

- DENKA COMPANY LIMITED

- Micron, Inc.

- Kumasaka Kogyo Co., Ltd.

- CoorsTek, Inc.

- Nippon Steel & Sumitomo Metal Corporation (Nippon Steel Materials)

- Sibelco N.V.

- Jiangsu Yoke Technology Co., Ltd.

- Suzhou Nano-Silica Co., Ltd.

- Fujimi Corporation

- PSS High-Tech GmbH

- Tokai Carbon Co., Ltd.

- Ta-I Technology Co., Ltd.

- Qingdao Ruisai Materials Technology Co., Ltd.

- Zhuzhou Keneng New Material Co., Ltd.

- Hubei Huifu Nanomaterial Co., Ltd.

- Sun-Yat Technology Co., Ltd.

- Fuso Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Spherical Silica Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for ultra-high purity spherical silica powder?

The primary driver is the accelerating complexity and miniaturization within the semiconductor industry, particularly in advanced packaging (like FOWLP and SiP), which requires fillers with extremely low impurity levels and controlled coefficients of thermal expansion (CTE) to prevent ionic contamination and thermal stress in high-performance chips.

How does the Sol-Gel manufacturing method differ from the Fused Silica method?

The Sol-Gel method is a wet chemical, synthetic process that provides superior control over particle shape, purity, and size distribution, yielding ultra-fine, highly spherical powders suitable for demanding electronic applications. The Fused Silica method relies on melting quartz and atomization, offering cost-effectiveness for large volumes but generally resulting in slightly lower purity and broader particle size ranges.

Which application segment holds the largest market share for spherical silica powder?

The Electronics Encapsulation segment, primarily utilizing spherical silica in Epoxy Molding Compounds (EMCs), holds the largest volume share due to the necessity of protecting and insulating integrated circuits (ICs) used across consumer electronics, computing, and telecommunications equipment.

What role does spherical silica powder play in thermal management systems?

Spherical silica significantly enhances thermal management by acting as a highly efficient filler in Thermal Interface Materials (TIMs), such as thermal grease and gap fillers. Its high packing density and intrinsic thermal conductivity allow for superior heat transfer away from hot components like CPUs, GPUs, and EV battery cells, improving overall device longevity and performance.

Is the market experiencing supply chain vulnerability due to raw material sourcing?

Yes, the market faces vulnerability, especially for ultra-high-grade products, as the production relies on accessing limited reserves of high-purity quartz. This requirement, coupled with the high energy intensity of the fusion process and proprietary Sol-Gel precursor chemicals, introduces potential volatility and increases manufacturing complexity and cost pressures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager