Spherical Silica Powder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440554 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Spherical Silica Powder Market Size

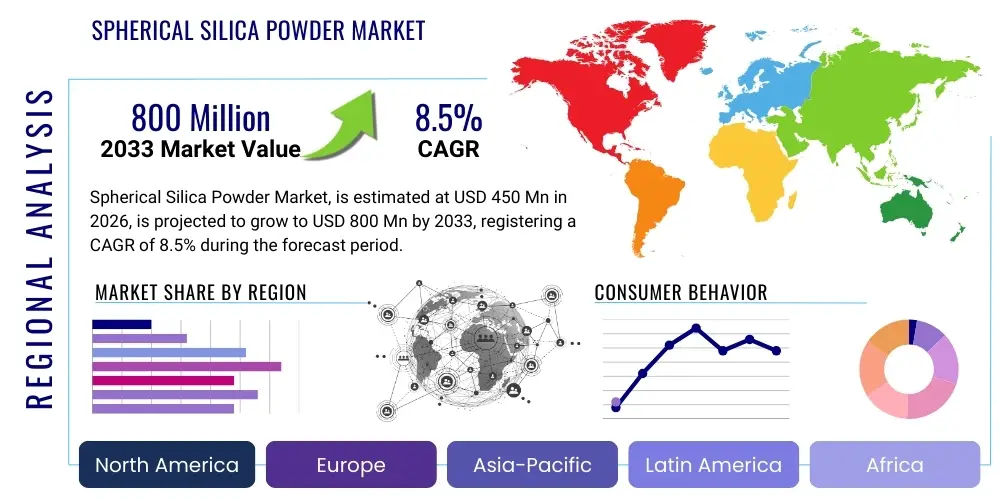

The Spherical Silica Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.35 Billion in 2026 and is projected to reach USD 2.30 Billion by the end of the forecast period in 2033.

Spherical Silica Powder Market introduction

The spherical silica powder market encompasses the production, distribution, and application of high-purity, synthetic amorphous silicon dioxide characterized by its distinctive spherical particle morphology. This advanced material is specifically engineered to offer superior performance attributes compared to conventional irregular or crushed silica, making it indispensable in various high-tech industries. Its unique spherical shape contributes to exceptionally low coefficient of thermal expansion (CTE), high heat resistance, excellent electrical insulation properties, superior flowability, reduced abrasiveness, and high packing density, which are critical for enhancing the performance and longevity of end products. The market's evolution is intrinsically linked to advancements in material science and the increasing demand for miniaturized, high-performance electronic components and robust industrial materials.

Major applications for spherical silica powder span across the electronics sector, primarily in epoxy molding compounds (EMC) for semiconductor packaging, thermal interface materials (TIMs), and substrate materials, where it plays a crucial role in managing heat dissipation, reducing stress, and improving reliability. Beyond electronics, it finds significant utility in advanced ceramics, aerospace components, sophisticated coatings, and more recently, in specialized 3D printing applications for high-performance resins. The benefits derived from using spherical silica powder include enhanced thermal conductivity, improved dielectric properties, superior mechanical strength, reduced warpage, and increased filler loading, all contributing to the overall reliability and efficiency of integrated devices and complex structures. Its uniform particle distribution minimizes defects and optimizes material performance across a broad spectrum of demanding environments.

Several driving factors are propelling the growth of this market. The relentless pursuit of miniaturization and increased functionality in electronic devices, coupled with the exponential growth of the semiconductor industry, is a primary catalyst. The proliferation of 5G technology, electric vehicles (EVs), and advanced driver-assistance systems (ADAS) further fuels demand for materials with superior thermal management and electrical insulation capabilities. Moreover, the expanding aerospace and defense sectors, requiring lightweight yet robust materials capable of withstanding extreme conditions, along with the burgeoning medical device industry seeking biocompatible and high-performance fillers, are significant contributors to the market's upward trajectory. The continuous innovation in material science and manufacturing processes to produce even purer and more uniformly spherical particles also serves as a crucial market driver, enabling new applications and enhancing existing ones.

Spherical Silica Powder Market Executive Summary

The Spherical Silica Powder Market is experiencing robust growth, primarily driven by accelerated technological advancements and the increasing demand for high-performance materials across diverse industries. Key business trends indicate a strong focus on research and development to innovate new grades of spherical silica with tailored properties for specific applications, alongside strategic collaborations and mergers & acquisitions aimed at consolidating market share and expanding geographical reach. Manufacturers are investing in advanced production technologies to enhance purity, uniformity, and cost-effectiveness, while also exploring sustainable manufacturing practices. Supply chain optimization remains a critical area of focus, especially given the specialized nature of raw material sourcing and processing for ultra-high purity grades, leading to efforts in vertical integration and long-term supplier agreements to ensure material availability and quality consistency.

Regionally, the Asia-Pacific continues to dominate the market, largely due to its unparalleled manufacturing capabilities in electronics, semiconductors, and consumer goods, particularly in countries like China, Japan, South Korea, and Taiwan. This region benefits from a well-established industrial ecosystem, significant government investments in technological infrastructure, and a large consumer base driving electronics demand. North America and Europe, while smaller in production volume, are crucial hubs for advanced research and development, particularly in high-end applications such as aerospace, medical devices, and next-generation automotive electronics. These regions focus on specialized, high-value spherical silica products, often catering to niche markets that demand stringent quality and performance specifications, propelling innovation and premiumization within the industry.

Segment-wise, the electronics sector, particularly epoxy molding compounds (EMCs) and thermal interface materials (TIMs) for semiconductor packaging, stands as the largest and most significant application area, consistently driving market demand for spherical silica powder. The relentless miniaturization of electronic components, coupled with the need for enhanced heat dissipation and electrical insulation, ensures continued growth in this segment. The market for finer particle sizes and ultra-high purity grades is expanding rapidly to meet the stringent requirements of advanced semiconductor devices. Furthermore, emerging segments like 3D printing for high-performance polymers and advanced ceramics are presenting substantial growth opportunities, as spherical silica improves material properties such as dimensional stability, mechanical strength, and thermal resistance in additive manufacturing applications. This diversification of applications underscores the versatile utility and growing market penetration of spherical silica powder beyond its traditional strongholds.

AI Impact Analysis on Spherical Silica Powder Market

Common user questions regarding AI's impact on the Spherical Silica Powder Market frequently revolve around its potential to revolutionize material discovery, optimize manufacturing processes, enhance quality control, and streamline supply chains. Users are keen to understand if AI can accelerate the development of novel spherical silica grades with specific performance characteristics, predict optimal synthesis parameters, or improve the efficiency of existing production lines. There is also significant interest in AI's role in predictive maintenance for complex machinery used in spheroidization processes and its capability to analyze vast datasets for demand forecasting and market trend identification. The overarching theme is an expectation that AI will bring unprecedented levels of precision, efficiency, and innovation to a market that relies heavily on material purity and precise particle morphology.

- Process Optimization: AI algorithms can analyze real-time data from manufacturing processes (e.g., plasma or flame spheroidization) to optimize parameters like temperature, gas flow, and feed rate, thereby improving yield, uniformity, and energy efficiency.

- Material Discovery & Design: Machine learning models can predict the properties of novel spherical silica compositions or structures based on raw material inputs and synthesis conditions, significantly reducing trial-and-error in R&D and accelerating new product development for specific applications.

- Quality Control & Inspection: AI-powered vision systems can conduct rapid, high-precision inspection of spherical silica particles for size, shape, and defect detection, ensuring stringent quality standards are met more efficiently than traditional methods.

- Predictive Maintenance: AI can monitor the performance of manufacturing equipment, predicting potential failures before they occur, thus minimizing downtime, reducing maintenance costs, and ensuring continuous production.

- Supply Chain Optimization: AI can analyze global market trends, raw material availability, and logistics data to optimize sourcing strategies, manage inventory levels, and predict demand fluctuations, leading to more resilient and efficient supply chains.

- Sustainability Enhancement: AI can help identify opportunities for reducing waste, optimizing energy consumption, and improving the overall environmental footprint of spherical silica production by simulating and evaluating various process modifications.

- Market Trend Analysis & Forecasting: AI-driven analytics can process vast amounts of market data, including economic indicators, technological advancements, and competitor activities, to provide highly accurate demand forecasts and identify emerging application areas.

DRO & Impact Forces Of Spherical Silica Powder Market

The Spherical Silica Powder market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, alongside significant impact forces. Key drivers include the escalating demand for high-performance materials in the electronics industry, particularly for advanced semiconductor packaging where miniaturization and efficient thermal management are paramount. The rapid expansion of 5G infrastructure, electric vehicles (EVs), and advanced driver-assistance systems (ADAS) creates a substantial need for materials offering superior thermal conductivity, electrical insulation, and low coefficient of thermal expansion (CTE). Additionally, the unique properties of spherical silica, such as its excellent flowability and high packing density, make it ideal for high-filler loading applications, further propelling its adoption across various industrial sectors. The continuous innovation in material science also contributes to discovering new applications and improving existing product formulations, cementing spherical silica's role in next-generation technologies.

However, the market faces notable restraints. The high production cost associated with manufacturing ultra-high purity spherical silica powder, primarily due to specialized processing techniques like plasma or flame spheroidization, poses a significant barrier to entry and can impact price competitiveness against alternative fillers. The complexity of the manufacturing process itself, requiring sophisticated equipment and precise control, contributes to higher operational expenses. Furthermore, the reliance on high-purity raw materials, such as specific grades of quartz or fused silica, can lead to supply chain vulnerabilities and price volatility. Competition from alternative materials, such as crystalline silica (in less demanding applications), fused silica (though often irregular in shape), or alumina, also presents a challenge, as end-users may opt for lower-cost alternatives if their performance requirements are less stringent. Price sensitivity in certain application segments can also restrict wider adoption, pushing manufacturers to continuously seek cost reduction strategies.

Despite these challenges, the market presents lucrative opportunities. Emerging applications in additive manufacturing (3D printing), where spherical silica can enhance the mechanical and thermal properties of resins, represent a significant growth avenue. The demand for advanced ceramics in industrial and defense applications, coupled with the increasing use of spherical silica in specialized medical devices requiring biocompatible and high-strength fillers, also opens new market frontiers. Geographical expansion into developing economies, particularly those investing heavily in electronics manufacturing and infrastructure, offers substantial growth prospects. Moreover, ongoing research and development efforts aimed at producing customized spherical silica grades with enhanced functionalities, such as surface modifications for better resin compatibility or even smaller particle sizes for ultra-fine applications, are creating novel market niches and driving product innovation. Strategic collaborations between material producers and end-users to develop application-specific solutions further unlock market potential, fostering innovation and broadening the material's industrial footprint.

Value Chain Analysis For Spherical Silica Powder Market

The value chain for the Spherical Silica Powder market is a complex network spanning from raw material extraction and processing to end-product integration and final consumption. The upstream segment primarily involves the sourcing and initial processing of high-purity silica raw materials, such as natural quartz or synthetic fused silica. This stage demands stringent quality control to ensure the chemical purity and consistency of the feedstock, which is critical for achieving the desired properties of the final spherical silica powder. Raw material suppliers play a crucial role, often specializing in high-grade silica extraction and initial purification processes. Investment in R&D at this stage focuses on enhancing raw material purity and developing cost-effective pre-processing techniques, laying the foundation for high-quality spherical silica production.

Midstream activities encompass the core manufacturing processes, predominantly spheroidization. This involves sophisticated technologies like plasma spheroidization, flame spheroidization, or advanced chemical synthesis methods (e.g., sol-gel). These processes transform irregular silica particles into highly uniform spherical shapes with controlled particle size distribution and surface characteristics. Manufacturers in this segment typically possess specialized expertise, significant capital investment in advanced machinery, and proprietary technological know-how. Post-spheroidization, further processing steps such as classification, washing, and surface treatment are undertaken to meet specific application requirements for purity, particle size, and surface functionality, ensuring the spherical silica powder is optimized for various end-use industries.

The downstream segment focuses on distribution and the integration of spherical silica powder into final products. Distribution channels can be direct, where manufacturers supply large quantities directly to key end-users like semiconductor fabrication plants or major electronics companies. Alternatively, indirect channels involve specialized distributors or agents who cater to a wider range of smaller or geographically dispersed customers, providing technical support and local inventory. End-users, including manufacturers of epoxy molding compounds, thermal interface materials, advanced ceramics, and specialized coatings, integrate spherical silica powder as a critical filler to enhance product performance. The success in the downstream segment relies on strong customer relationships, technical service capabilities, and the ability to tailor product specifications to meet the evolving demands of diverse application areas.

Spherical Silica Powder Market Potential Customers

The primary potential customers for spherical silica powder are diverse and span across high-technology and performance-driven industries, largely driven by the material's unique properties such as low thermal expansion, high electrical insulation, and superior flowability. At the forefront are semiconductor manufacturers and electronics assembly companies, which utilize spherical silica extensively in epoxy molding compounds (EMC) for encapsulating integrated circuits, protecting them from environmental factors and mechanical stress. These customers demand ultra-high purity and precisely controlled particle sizes to ensure the reliability and performance of advanced microelectronic devices. Additionally, manufacturers of thermal interface materials (TIMs) are key buyers, as spherical silica significantly enhances heat dissipation in power electronics and high-performance computing components, which is critical for preventing overheating and ensuring device longevity.

Beyond the core electronics sector, the market for advanced ceramics producers represents a significant customer base. These companies incorporate spherical silica into ceramic formulations to improve mechanical strength, thermal shock resistance, and dimensional stability for applications in aerospace, defense, and industrial equipment. The aerospace and defense industry itself constitutes a direct customer segment, utilizing spherical silica in composite materials and specialized coatings where lightweight, high-strength, and thermally stable components are essential. Similarly, the automotive industry, particularly in the production of electronic control units (ECUs) and power modules for electric vehicles (EVs), is increasingly adopting spherical silica to manage thermal loads and enhance the durability of sensitive electronic components under harsh operating conditions.

Emerging customer segments include medical device manufacturers, who are exploring spherical silica for biocompatible fillers in implants, dental materials, and diagnostic equipment due to its inertness and ability to impart specific mechanical properties. The burgeoning 3D printing industry is another promising area, with manufacturers of high-performance resins and filaments using spherical silica to improve the thermal stability, printability, and mechanical integrity of additively manufactured components. Furthermore, specialized coatings and paints industries, particularly those requiring scratch resistance, chemical inertness, and precise optical properties, also represent a niche but growing customer base. The broad applicability of spherical silica across these sectors underscores its versatility and critical importance as a high-performance additive.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.35 Billion |

| Market Forecast in 2033 | USD 2.30 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shin-Etsu Chemical Co., Ltd., Denka Company Limited, Tatsumori Ltd., Imerys S.A., Micronsil Global, CoorsTek Inc., Quarzwerke GmbH, Sibelco, Tosoh Corporation, Momentive Performance Materials Inc., HPF Quarzglas GmbH, AGC Inc., Elkem ASA, Reade Advanced Materials, Saint-Gobain, Jiangsu Yoke Technology Co., Ltd., Wacker Chemie AG, Heraeus, Fujimi Corporation, Admatechs Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spherical Silica Powder Market Key Technology Landscape

The Spherical Silica Powder market is characterized by a sophisticated technological landscape, driven by the imperative to produce materials with exceptional purity, precise particle size distribution, and superior sphericity. The core of this landscape lies in advanced manufacturing processes, with plasma spheroidization being a prominent technology. This method involves feeding irregular silica particles into an inductively coupled plasma torch, where extreme temperatures (up to 10,000°C) melt the particles, which then reform into perfect spheres upon cooling. Flame spheroidization is another critical technique, utilizing high-temperature flames to achieve similar results, often preferred for its cost-effectiveness in certain applications. Beyond these thermal methods, mechanical attrition combined with chemical surface treatments and advanced sol-gel processes are also employed to achieve specific particle characteristics, offering versatility in tailoring spherical silica for diverse industrial requirements. These technologies are continually being refined to improve energy efficiency, yield, and consistency of the final product.

Further technological advancements in the market are concentrated on meticulous particle characterization and post-processing techniques. Sophisticated analytical instruments, such as scanning electron microscopes (SEM), transmission electron microscopes (TEM), and laser diffraction particle size analyzers, are crucial for verifying particle morphology, size distribution, and surface topography. X-ray diffraction (XRD) and specific surface area (BET) analysis are employed to ensure the amorphous nature and surface activity, respectively. Post-processing technologies include advanced classification methods, such as air classifiers and sieving techniques, to achieve narrow particle size ranges, and surface modification techniques like silane coupling agents to enhance compatibility with various polymer matrices. These steps are vital for optimizing spherical silica's performance in end-use applications, particularly in demanding fields like semiconductor manufacturing where even minute variations can impact device reliability.

The technology landscape also encompasses application-specific innovations that leverage spherical silica's unique properties. In the electronics sector, significant R&D is focused on developing novel epoxy molding compound formulations that can accommodate higher filler loading of spherical silica, leading to superior thermal conductivity and lower CTE for advanced integrated circuits. For thermal interface materials, innovations revolve around creating high-performance composites that efficiently transfer heat away from sensitive components. In additive manufacturing, new resin systems are being engineered to seamlessly incorporate spherical silica, enhancing the mechanical strength, thermal stability, and dimensional accuracy of 3D-printed parts. This continuous evolution in both manufacturing techniques and application-specific formulations highlights a dynamic technological environment aimed at pushing the boundaries of material performance and enabling next-generation products across numerous high-tech industries.

Regional Highlights

- Asia Pacific (APAC): Dominates the spherical silica powder market, primarily driven by its robust electronics and semiconductor manufacturing hubs in countries like China, Japan, South Korea, and Taiwan. The region benefits from substantial investments in advanced manufacturing, a large consumer electronics market, and rapid industrialization, leading to high demand for high-performance fillers. Government initiatives supporting technological advancements and a competitive manufacturing ecosystem further solidify APAC's leading position, with significant R&D efforts also focused on developing new application areas.

- North America: Represents a significant market characterized by strong R&D capabilities and a demand for high-end, specialized spherical silica products, particularly in the aerospace, defense, and advanced medical device sectors. The region’s focus on innovation and the presence of leading technology companies drive the adoption of spherical silica for cutting-edge applications requiring stringent performance specifications, including next-generation electronics and advanced composites.

- Europe: A mature market with a strong emphasis on automotive electronics, industrial applications, and advanced materials research. Countries like Germany, France, and the UK are key contributors, driven by stringent quality standards and a focus on sustainable manufacturing. The region's robust automotive industry, particularly its push towards electric vehicles, fuels the demand for spherical silica in thermal management and electronic packaging applications.

- Latin America: An emerging market for spherical silica powder, with growing industrial and manufacturing bases, particularly in Brazil and Mexico. While smaller than established markets, increasing foreign investment in electronics assembly and automotive production, coupled with infrastructure development, is gradually driving demand for high-performance materials. The region offers future growth potential as its industrial sectors mature and integrate advanced materials.

- Middle East and Africa (MEA): A developing market that is witnessing gradual adoption of spherical silica powder, primarily influenced by investments in industrial infrastructure, oil & gas technologies, and nascent electronics manufacturing. Demand is expected to grow as economic diversification efforts in countries like UAE and Saudi Arabia lead to increased industrial output and a greater need for advanced materials in construction, energy, and localized manufacturing initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spherical Silica Powder Market.- Shin-Etsu Chemical Co., Ltd.

- Denka Company Limited

- Tatsumori Ltd.

- Imerys S.A.

- Micronsil Global

- CoorsTek Inc.

- Quarzwerke GmbH

- Sibelco

- Tosoh Corporation

- Momentive Performance Materials Inc.

- HPF Quarzglas GmbH

- AGC Inc.

- Elkem ASA

- Reade Advanced Materials

- Saint-Gobain

- Jiangsu Yoke Technology Co., Ltd.

- Wacker Chemie AG

- Heraeus

- Fujimi Corporation

- Admatechs Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Spherical Silica Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is spherical silica powder and what are its primary characteristics?

Spherical silica powder is a high-purity, synthetic amorphous silicon dioxide with uniformly round particles. Key characteristics include low coefficient of thermal expansion (CTE), high heat resistance, excellent electrical insulation, superior flowability, and high packing density, making it ideal for high-performance applications where thermal and electrical stability are crucial.

How does spherical silica powder differ from other silica types, like fumed or precipitated silica?

Spherical silica distinguishes itself through its distinct spherical particle shape, which provides benefits like improved flowability, higher packing density, and reduced abrasion. Fumed silica, characterized by its extremely small, highly branched particles, is primarily used for thickening and thixotropy, while precipitated silica, with its irregular porous structure, is often used as a reinforcing filler or abrasive agent, none offering the same thermal and electrical properties derived from sphericity.

What are the main applications driving the demand for spherical silica powder?

The primary demand driver is the electronics industry, particularly for epoxy molding compounds (EMC) in semiconductor packaging and thermal interface materials (TIMs). Other significant applications include advanced ceramics, aerospace components, specialized coatings, and emerging uses in high-performance 3D printing resins, all benefiting from its superior thermal, electrical, and mechanical properties.

What challenges does the spherical silica powder market face?

The market faces challenges such as high production costs due to complex manufacturing processes like plasma spheroidization, which require significant capital investment. Additionally, ensuring the consistent supply of ultra-high purity raw materials and managing competition from alternative fillers in less demanding applications present ongoing hurdles for manufacturers.

Which geographical region holds the largest share in the spherical silica powder market and why?

The Asia-Pacific region holds the largest market share, predominantly due to its leading role in global electronics and semiconductor manufacturing. Countries like China, Japan, South Korea, and Taiwan house extensive production facilities and technological innovation centers, driving robust demand for spherical silica in their high-volume electronics output and advanced material development.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager