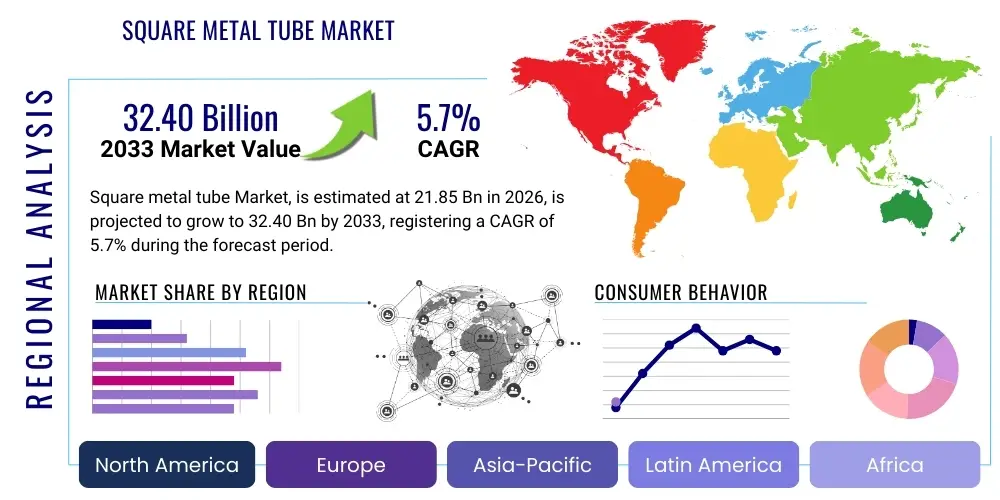

Square metal tube Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437514 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Square metal tube Market Size

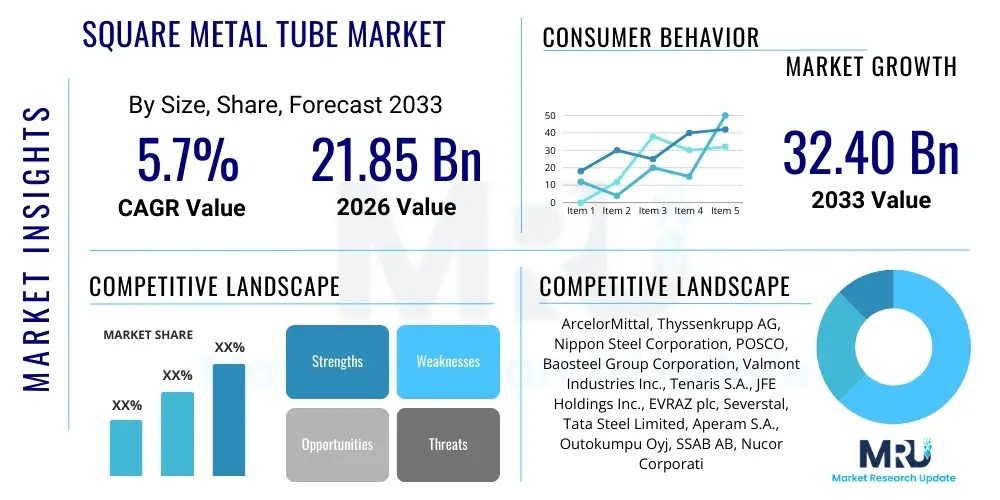

The Square metal tube Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $27.5 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the accelerating demands from the global construction sector, particularly in emerging economies undertaking large-scale infrastructure projects, where the structural integrity and aesthetic adaptability of square tubing are highly valued. Furthermore, the increasing adoption of these products in industrial machinery and material handling equipment, due to their favorable strength-to-weight ratio, significantly contributes to the overall market expansion.

The stability of the square metal tube market is underpinned by its wide application across several non-cyclical industries, including warehousing, furniture manufacturing, and automotive chassis components. While raw material price volatility, particularly for steel and aluminum, presents short-term challenges, the long-term trend remains positive due to persistent urbanization and the necessity for modernized structural frameworks. Technological advancements in welding techniques and corrosion-resistant coatings are enhancing the lifespan and performance characteristics of these tubes, making them a preferred choice over traditional structural shapes in various engineering designs, thereby ensuring sustained market valuation growth through 2033.

Square metal tube Market introduction

Square metal tubes, commonly referred to as Square Hollow Sections (SHS), are a fundamental product in the broader structural metal market, characterized by their flat surfaces and high tensile strength. They serve as essential load-bearing and framing components across myriad industrial and commercial applications. Manufactured primarily from materials such as carbon steel, stainless steel, and aluminum, these tubes offer superior torsional rigidity and are highly efficient for multi-axis loading applications compared to circular or rectangular hollow sections. The standardized geometry facilitates easier fabrication, welding, and attachment processes, leading to cost efficiencies and accelerated construction timelines in large-scale projects, positioning them as a critical material in modern engineering practices.

Major applications of square metal tubes span across critical infrastructure development, including bridges, highway guardrails, and telecommunication towers. In the building sector, they are extensively used for column supports, purlins, and truss structures due to their neat appearance and structural efficiency. Beyond construction, the automotive industry utilizes SHS for lightweight chassis and roll cages, aiming to improve fuel efficiency and safety standards. Key market benefits include high load-bearing capacity, uniform wall thickness, simplified connection methodology, and reduced surface area compared to open sections, which minimizes material usage and optimizes structural weight, driving their preferred status among engineers and architects globally.

The market is primarily driven by three key factors: escalating global construction activities driven by population growth and urbanization; the ongoing trend toward modular construction, which heavily relies on prefabricated SHS components; and the necessity for robust, durable materials in aggressive operational environments. These factors collectively create a persistent, high-volume demand cycle for square metal tubing, requiring manufacturers to continuously optimize production methods, enhance material sourcing strategies, and expand distribution capabilities to meet the diversified needs of end-user industries worldwide, thereby solidifying the market’s growth trajectory for the foreseeable future.

Square metal tube Market Executive Summary

The Square metal tube market is navigating a dynamic business landscape, marked by a strong rebound in global construction expenditure post-pandemic, coupled with significant investments in green infrastructure and energy transition projects. Current business trends emphasize sustainability, leading manufacturers to adopt cleaner production technologies and incorporate recycled materials, responding to increasingly stringent regulatory demands and shifting consumer preferences toward environmentally responsible sourcing. Mergers and acquisitions remain a key strategy for market consolidation, allowing leading players to secure raw material supplies, expand geographical footprints, and integrate advanced manufacturing technologies, particularly in seamless tubing production, to enhance product quality and performance across various load conditions.

Regionally, the Asia Pacific (APAC) continues to dominate the market, driven by massive urbanization projects in China, India, and Southeast Asian nations, positioning it as the primary engine for demand growth. North America and Europe, characterized by mature markets, exhibit steady demand, heavily focused on renovation, maintenance, and the upgrade of aging infrastructure, alongside specialized high-performance applications in the renewable energy sector, such as solar photovoltaic (PV) racking systems and specialized wind turbine components. Emerging markets in Latin America and the Middle East & Africa (MEA) are projected to demonstrate high growth rates, largely due to governmental initiatives aimed at diversifying industrial bases and improving national connectivity infrastructure, creating new avenues for market penetration.

Segment trends highlight a growing preference for high-strength, low-alloy (HSLA) steel square tubes, which offer superior mechanical properties while enabling structural weight reduction—a critical consideration in automotive and long-span construction. By material, carbon steel remains the largest segment due to its cost-effectiveness and widespread availability, but the aluminum segment is witnessing accelerated adoption, especially where weight reduction and corrosion resistance are paramount, such as in transportation and marine applications. Furthermore, the shift toward customized tubing dimensions and specifications, enabled by advanced computerized numeric control (CNC) cutting and shaping processes, is driving value addition and specialization within the competitive market landscape.

AI Impact Analysis on Square metal tube Market

Common user inquiries concerning AI's influence on the Square metal tube market frequently revolve around questions of optimizing production efficiency, predictive maintenance for high-value machinery, and enhancing supply chain resilience against material price volatility. Users are keen to understand how AI-driven predictive modeling can forecast demand fluctuations, thereby minimizing costly inventory holding and production bottlenecks, particularly regarding specialized SHS dimensions. Furthermore, significant interest lies in AI’s capability to monitor and adjust complex welding and forming processes in real-time, ensuring stringent quality control and reducing material scrap rates—key determinants of profitability in high-volume tubular product manufacturing. The overarching theme is the integration of smart factory concepts to achieve unprecedented levels of operational precision and resource optimization, directly impacting the cost structure and competitive positioning of square metal tube producers globally.

- AI-Powered Production Optimization: Utilizes machine learning algorithms to fine-tune milling, welding, and forming machinery settings, maximizing throughput and reducing energy consumption per unit length of tubing.

- Predictive Quality Control: Implements vision systems and sensor data analysis (AI/ML) to detect microscopic flaws or dimensional inconsistencies during the manufacturing line, ensuring tubes meet high structural standards before shipment.

- Supply Chain Forecasting: Employs sophisticated predictive analytics to model volatile raw material prices (e.g., steel coils, aluminum billets) and global logistics constraints, enabling strategic, optimized procurement decisions.

- Automated Inventory Management: AI algorithms track real-time stock levels of various SHS sizes and materials, automatically generating reorder points based on forecasted customer demand, minimizing obsolescence risk.

- Enhanced Robotics and Automation: Integration of AI-guided robotics for heavy lifting, stacking, and packaging of square tubes, improving worker safety and accelerating end-of-line processing speed.

DRO & Impact Forces Of Square metal tube Market

The market dynamics of the Square metal tube sector are governed by a complex interplay of internal and external forces summarized by Drivers, Restraints, and Opportunities (DRO). The primary drivers include robust governmental and private sector investments in infrastructure, exemplified by global initiatives such as the Belt and Road Initiative and localized urban renewal projects, which require vast quantities of reliable structural components. Furthermore, the square tube’s inherent advantages in structural efficiency, alongside advancements in corrosion protection methods, make it increasingly appealing over traditional open sections. However, this momentum is counterbalanced by significant restraints, predominantly the extreme price volatility of steel and other base metals, which introduces substantial cost uncertainty for manufacturers and end-users, alongside the high initial capital expenditure required for establishing large-scale, high-precision tube mills. These opposing forces dictate the pace and profitability of market expansion.

Opportunities for growth are abundant, focusing heavily on product innovation and diversification into niche applications. Specifically, the rising global adoption of solar energy infrastructure creates a massive requirement for specialized, often galvanized or coated, square metal tubing for ground mounting structures and solar tracker systems. The expanding prefabricated and modular construction sector also presents a strong opportunity, as square tubes are ideal for creating standardized, easily assembled structural frames, accelerating project completion times. The combination of sustained demand from construction (Driver) and the strategic pursuit of high-margin, specialized sectors (Opportunity) helps mitigate the risks posed by fluctuating raw material costs (Restraint), shaping the overall impact forces on the market. These forces necessitate strategic planning, robust supply chain management, and continuous process optimization among market participants to maintain competitive edge and profitability.

Segmentation Analysis

The Square metal tube market is comprehensively segmented based on material type, manufacturing process, end-use application, and region, allowing for granular analysis of market demand drivers and regional consumption patterns. Understanding these segments is crucial for strategic market positioning, enabling suppliers to tailor their product offerings, whether focusing on high-volume, low-cost carbon steel products for general construction or specialized, high-specification aluminum alloys for aerospace or high-end architectural projects. The manufacturing process segmentation differentiates between welded tubes, which dominate the high-volume market due to cost efficiency, and seamless tubes, which serve niche applications demanding superior pressure resistance and structural integrity, reflecting the diverse performance requirements across the broad spectrum of end-user industries.

- Material Type:

- Carbon Steel Square Tubes

- Stainless Steel Square Tubes

- Aluminum Square Tubes

- Alloy Steel Square Tubes

- Copper and Brass Square Tubes

- Manufacturing Process:

- Welded Square Tubes (ERW, EFW)

- Seamless Square Tubes

- End-Use Application:

- Construction and Infrastructure (Residential, Commercial, Industrial Buildings, Bridges)

- Automotive and Transportation (Chassis, Frames, Roll Cages)

- Industrial Machinery and Equipment

- Furniture and Fixtures

- Oil and Gas (Non-Structural/Support)

- Agriculture and Farming Equipment

- Dimension/Size:

- Small Bore (Up to 50mm)

- Medium Bore (50mm to 150mm)

- Large Bore (Above 150mm)

Value Chain Analysis For Square metal tube Market

The value chain for the Square metal tube market initiates with the upstream sector, primarily involving the mining and processing of raw materials, specifically iron ore, bauxite, nickel, and scrap metal, which are converted into primary products like steel coils or aluminum billets. Key upstream activities include smelting, refining, and continuous casting, which significantly dictate the final cost and quality of the raw input. Suppliers in this phase, such as integrated steel mills and aluminum producers, wield substantial bargaining power due to the capital-intensive nature of their operations and the global commodity pricing mechanisms that govern material costs, making strategic long-term sourcing contracts essential for tube manufacturers to stabilize their input expenditures.

The manufacturing stage involves the crucial transformation of raw coils or billets into finished square tubes through processes such as Electric Resistance Welding (ERW) or hot/cold forming for seamless products. This midstream phase is characterized by high technical expertise and operational precision, focusing on quality control, cutting, finishing, and applying protective coatings (e.g., galvanization, powder coating). The distribution channel encompasses both direct and indirect routes. Direct sales are often utilized for large, customized orders for major infrastructure projects or large-scale manufacturers (e.g., automotive OEMs). Indirect sales, involving metal service centers, wholesalers, and specialized distributors, handle standard sizes and smaller volumes, providing value-added services like cutting-to-length and immediate inventory access to local construction firms and fabricators.

The downstream analysis focuses on the final consumption by end-users—construction companies, engineering procurement and construction (EPC) firms, machinery manufacturers, and furniture makers. The proximity of distributors to these end-users is a key competitive factor, ensuring timely delivery and minimal transportation costs, which are substantial for bulky metal products. The ultimate success of the value chain relies on seamless integration between the primary producers and specialized service centers, ensuring that product specifications align perfectly with the rigorous demands of engineering and structural applications, maintaining material quality throughout processing, transport, and final installation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $27.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ArcelorMittal, Nippon Steel Corporation, Baowu Group, POSCO, Thyssenkrupp AG, Tata Steel, JFE Steel Corporation, Nucor Corporation, Vallourec, Tenaris S.A., Hyundai Steel Co., Ltd., Commercial Metals Company (CMC), Zamil Steel Industries, Sumitomo Metal Industries, Samuel, Son & Co., Ryerson Holding Corporation, Marcegaglia Spa, Yizeng Industry Co., Ltd., Steel & Tube Holdings Limited, Salzgitter AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Square metal tube Market Potential Customers

The primary consumers of square metal tubes are large-scale infrastructure developers and construction firms globally. These entities rely on the dimensional consistency and structural reliability of SHS for fundamental building elements, including load-bearing columns, roof trusses, and foundation supports in commercial, industrial, and residential projects. EPC (Engineering, Procurement, and Construction) companies represent significant buyers, often requiring tubes in high-strength grades and large volumes for complex projects like bridges, industrial complexes, and power plants. Their purchasing decisions are heavily influenced by material certification, supplier reliability, and the adherence to national and international building codes, prioritizing quality over marginal cost savings, especially in high-risk applications.

Beyond traditional construction, the automotive and heavy machinery manufacturing sectors constitute another critical segment of potential customers. Automotive Original Equipment Manufacturers (OEMs) utilize square metal tubes for manufacturing lightweight yet robust vehicle chassis, internal framing, and auxiliary structures, driven by strict fuel efficiency standards and evolving safety regulations. Similarly, industrial machinery manufacturers use SHS for fabricating machine frames, conveyor systems, and material handling equipment, valuing the material’s structural rigidity and ease of welding. These industrial buyers often seek customized tube profiles, specific metallurgical compositions, and surface treatments like galvanization to ensure longevity in demanding operational environments.

Furthermore, specialized segments such as solar energy developers and furniture manufacturers form growing customer bases. Solar farm developers purchase vast quantities of square tubes for fixed-tilt and tracker mounting systems due to their strength-to-weight efficiency and ability to withstand significant environmental loads (wind, snow). Furniture manufacturers, particularly those focusing on modern, functional designs, rely on smaller dimension, aesthetically pleasing square tubes for commercial and residential furniture frameworks, where precision and surface finish are paramount. These diverse end-user applications highlight the ubiquitous nature of square metal tubes, making the potential customer pool broad and resilient to single-industry cyclical downturns.

Square metal tube Market Key Technology Landscape

The technological landscape of the Square metal tube market is characterized by continuous refinement in manufacturing processes aimed at improving material yield, enhancing mechanical properties, and reducing production costs. Key technologies revolve around advanced forming and welding techniques. High-frequency Electric Resistance Welding (HFERW) dominates the welded segment, offering fast, cost-effective production with robust weld integrity. Newer iterations of HFERW incorporate real-time monitoring and adaptive control systems, minimizing weld imperfections and optimizing energy consumption. For seamless tubes, the push-bench and plug-mill processes are continuously optimized to produce large-diameter SHS with superior internal surface quality and uniform wall thickness, critical for high-pressure or extreme load applications.

In material science, the focus is on developing specialized High-Strength Low-Alloy (HSLA) steels and advanced aluminum alloys specifically tailored for tube production. These materials offer enhanced yield strength, allowing engineers to design lighter structures without compromising safety, directly addressing the demand for lightweighting in the transportation and modular construction sectors. Furthermore, advanced corrosion protection is a crucial technology; innovations in hot-dip galvanization (HDG) processes, coupled with specialized coatings (e.g., zinc-aluminum-magnesium alloys), are extending the lifespan of steel tubes in corrosive environments, significantly reducing maintenance costs and increasing the value proposition of the end product.

Digitalization and automation technologies are transforming the operational efficiency of tube mills. The implementation of Industry 4.0 concepts, including the integration of sensors, IoT devices, and robotic handling systems, allows for precise dimensional control, automated material tracking, and minimized human error in fabrication processes. Advanced non-destructive testing (NDT) techniques, such as phased array ultrasonic testing (PAUT) and eddy current testing, are increasingly used inline to ensure every manufactured tube adheres to stringent quality standards, further solidifying the reliability of SHS products in critical structural applications and driving technological competitive differentiation among key market players.

Regional Highlights

- Asia Pacific (APAC): APAC remains the dominant region globally, largely driven by aggressive infrastructure expansion and booming real estate markets in China, India, and ASEAN countries. The demand for structural steel and aluminum tubing is unprecedented, fueled by massive metropolitan development and the establishment of new industrial corridors. China, in particular, leads consumption, although growth is decelerating slightly, while India is emerging as the fastest-growing market due to sustained government investment in public infrastructure and manufacturing capacity expansion.

- North America: Characterized by strong demand for high-specification and specialized tubing, particularly in the energy (oil/gas and renewables) and automotive sectors. The US market emphasizes quality, precision, and adherence to stringent safety standards (e.g., ASTM standards). Investments in modernizing aging infrastructure and near-shoring manufacturing activities are key drivers, alongside significant uptake in prefabricated building systems that utilize SHS extensively.

- Europe: This mature market focuses heavily on sustainability, efficiency, and the adoption of high-value, corrosion-resistant materials, especially stainless steel and specialized aluminum tubes, driven by architectural applications and demanding European Union regulations. The region exhibits high consumption rates in industrial machinery, structural engineering, and the robust deployment of offshore wind and solar energy projects, requiring highly durable SHS components.

- Latin America (LATAM): Growth is steady but dependent on political and economic stability across major economies like Brazil and Mexico. The market is primarily driven by industrial expansion, mining operations, and critical residential construction initiatives. Price competitiveness is a major factor, leading to a high reliance on carbon steel SHS for general construction needs.

- Middle East and Africa (MEA): MEA showcases high growth potential, fueled by massive government investments in diversification projects, including Saudi Arabia's Vision 2030 and Qatar's long-term infrastructure plans. The requirement for tubes is immense, spanning across commercial towers, transportation networks, and oil/gas exploration support structures, often requiring highly specialized coatings due to severe environmental conditions (heat, salinity).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Square metal tube Market.- ArcelorMittal

- Nippon Steel Corporation

- Baowu Group

- POSCO

- Thyssenkrupp AG

- Tata Steel

- JFE Steel Corporation

- Nucor Corporation

- Vallourec

- Tenaris S.A.

- Hyundai Steel Co., Ltd.

- Commercial Metals Company (CMC)

- Zamil Steel Industries

- Sumitomo Metal Industries

- Samuel, Son & Co.

- Ryerson Holding Corporation

- Marcegaglia Spa

- Yizeng Industry Co., Ltd.

- Steel & Tube Holdings Limited

- Salzgitter AG

Frequently Asked Questions

Analyze common user questions about the Square metal tube market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Square metal tube market?

The Square metal tube market is projected to register a stable Compound Annual Growth Rate (CAGR) of 5.8% over the forecast period spanning from 2026 to 2033, driven primarily by infrastructure development globally.

Which end-use application dominates the consumption of Square metal tubes?

The Construction and Infrastructure sector is the primary consumer, utilizing square metal tubes extensively for structural support, framing, and load-bearing columns due to their superior strength-to-weight ratio and efficient sectional geometry.

What are the primary restraints affecting the profitability of the Square metal tube market?

The most significant restraints include the acute volatility of raw material prices, particularly for steel and aluminum, which complicates procurement planning, alongside high energy consumption costs associated with the tube manufacturing processes.

How does the manufacturing process segment the Square metal tube market?

The market is segmented into Welded Square Tubes (typically produced using ERW methods for cost-efficiency) and Seamless Square Tubes (used for critical, high-pressure, or structurally demanding applications requiring superior integrity).

Which geographical region is expected to demonstrate the highest market growth rate?

The Asia Pacific (APAC) region is projected to maintain dominance and exhibit the fastest growth, largely due to rapid urbanization, massive infrastructure projects in developing nations like India, and sustained industrial expansion across Southeast Asia.

Market Conclusion and Future Outlook

The Square metal tube market is positioned for sustained and robust expansion throughout the forecast period, underpinned by its essential role in global infrastructure and industrial modernization. The intrinsic structural advantages of SHS—including ease of connection, high torsional strength, and optimized material usage—ensure its continued preference over many traditional structural materials. While the market remains sensitive to fluctuations in global commodity prices, strategic shifts toward advanced, high-performance alloys and specialized corrosion treatments are driving premiumization and insulating specialized segments from base metal volatility. The competitive landscape is increasingly defined by technological adoption, with leading manufacturers investing heavily in Industry 4.0 principles to achieve higher operational efficiency, tighter quality control, and quicker response times to customized orders.

Looking ahead, the market's future growth will be significantly shaped by two major trends: the global energy transition and the rise of modular construction. The massive build-out of solar farms, requiring vast arrays of square tubing for mounting structures, presents a secular demand driver. Simultaneously, the modular construction method, which relies on standardized, pre-fabricated SHS frames for rapid assembly, is gaining traction in both developed and emerging markets, reducing construction timelines and labor costs. Manufacturers that successfully integrate supply chain resilience, sustainability practices (e.g., green steel sourcing), and sophisticated digital fabrication technologies will be best positioned to capture market share and solidify their long-term competitive standing in this vital sector.

Furthermore, regional dynamics will continue to favor the APAC region as the primary volume market, while North America and Europe will drive demand for innovative, specialized, and sustainable product variants. Successful navigation of this market requires a dual strategy: optimizing cost and scale for high-volume carbon steel segments, and simultaneously developing high-value product lines utilizing stainless steel and aluminum to cater to niche, high-margin applications in demanding environments such as marine, chemical processing, and advanced architectural design. This strategic diversification and focus on value-added services, like pre-cutting and precision machining, will be instrumental in sustaining high profitability amidst evolving global economic conditions and intensifying competitive pressures.

Impact of COVID-19 on the Square metal tube Market

The COVID-19 pandemic delivered a complex shock to the Square metal tube market, initially causing severe disruption through factory shutdowns, workforce limitations, and immediate project cancellations in early 2020. This led to a sharp, albeit temporary, contraction in demand, particularly in sectors dependent on physical construction sites. Supply chain integrity was heavily challenged as global logistics fractured, causing bottlenecks and significant delays in the movement of raw materials (steel coils and billets) and finished goods. Consequently, manufacturers faced increased operating uncertainty and temporary constraints on production capacity, impacting overall market revenue generation during the initial phase of the crisis.

However, the market demonstrated significant resilience and commenced a V-shaped recovery starting in late 2020 and accelerating through 2021. Government stimulus packages, particularly those aimed at infrastructure recovery and construction revitalization, provided a strong demand injection. Furthermore, the pandemic-driven shift toward localized and distributed manufacturing, coupled with the rapid expansion of warehousing and logistics facilities (which rely heavily on steel structural frames), generated unforeseen, high-volume demand for SHS. This surge in demand, combined with reduced supply capacity, led to dramatic spikes in steel and other commodity prices, subsequently driving up the overall market value despite initial volume setbacks.

In the longer term, the pandemic reinforced the critical need for supply chain diversification and digitalization within the square tube manufacturing industry. Companies are now strategically focusing on developing multi-regional sourcing strategies and integrating advanced digital tools for real-time inventory and production monitoring. This focus on resilience and agility ensures that the market is better prepared to handle future economic shocks. The sustained growth in e-commerce infrastructure, combined with committed public spending on energy transition projects (solar and wind), means the underlying drivers of demand for square metal tubing remain robust, positioning the market favorably post-crisis.

Market Dynamics and Competitive Landscape

The competitive landscape of the Square metal tube market is highly fragmented yet characterized by the dominance of large, globally integrated steel and metal producers that leverage economies of scale and control over upstream raw materials. Key competitive differentiators include product quality certifications, the breadth of product dimensions offered, and the capacity to deliver customized or value-added services such as precise cutting, drilling, and pre-welding assemblies. Major players, including ArcelorMittal and Nippon Steel, compete intensely on both price and quality across the high-volume carbon steel segment, while smaller, specialized firms often focus on niche segments like high-grade stainless steel or complex aluminum profiles where technical expertise commands a price premium.

Market dynamics are intensely influenced by the business cycles of the global construction and automotive industries. High infrastructure spending translates directly into high demand and improved profitability, whereas slowdowns can quickly lead to oversupply and price erosion. To counteract cyclicality, major manufacturers are strategically expanding their global footprint, establishing localized production facilities closer to high-growth consumption centers, particularly in Southeast Asia and Latin America. This strategy reduces logistical costs and minimizes the impact of international trade tariffs and protectionist policies, thereby enhancing overall supply chain responsiveness and market access capabilities across diverse geographical regions.

Innovation in coating technology and material composition is essential for maintaining a competitive edge. The shift towards zinc-aluminum-magnesium coatings, which offer superior corrosion resistance compared to traditional galvanization, is becoming a performance benchmark, particularly in external and highly corrosive applications. Furthermore, the adoption of specialized equipment for automated tube manipulation and fabrication is enabling manufacturers to reduce lead times and meet the increasingly complex design requirements of modern engineering projects. Ultimately, success in this market hinges upon balancing efficient, low-cost mass production with the flexibility to deliver specialized, high-quality solutions, requiring continuous capital investment in both material science and advanced manufacturing machinery.

Future Growth Opportunities

One of the most compelling future growth opportunities lies within the renewable energy sector, specifically the rapidly expanding global deployment of solar photovoltaic (PV) systems. Square metal tubes are indispensable components in ground-mounted solar racking systems and tracker mechanisms, providing the essential structure to support solar panels. As governments worldwide commit to net-zero carbon goals, the demand for highly durable, corrosion-resistant steel and aluminum square tubes in this specialized application is expected to multiply exponentially, creating a stable, high-volume revenue stream distinct from traditional construction cycles.

Another significant opportunity is the increasing global adoption of modular and prefabricated construction techniques. These methods rely on standardized, pre-cut, and often pre-assembled structural components, for which the dimensional consistency and ease of fabrication offered by square metal tubes are perfectly suited. Modular construction accelerates project completion, reduces on-site waste, and improves quality control, making it highly attractive for multi-unit residential projects, temporary housing, and commercial buildings. Manufacturers who can supply customized SHS kits, delivered Just-In-Time (JIT) to fabrication yards, stand to gain substantial market share in this rapidly evolving construction segment.

Lastly, market players can leverage the demand for specialized, high-performance structural materials in the automotive and transportation industries. As vehicles become lighter to meet fuel economy and emissions standards, there is a persistent opportunity for aluminum and high-strength steel square tubes in chassis and safety cage manufacturing. Furthermore, the expansion of high-speed rail and public transportation networks globally requires high-specification, low-maintenance tubular components for support structures and ancillary equipment. These opportunities demand significant investment in R&D to optimize material properties and dimensional tolerances, positioning manufacturers not just as commodity suppliers but as crucial partners in advanced engineering solutions.

Market Challenges and Mitigation Strategies

The primary challenge confronting the Square metal tube market is the inherent volatility in the pricing of core raw materials, predominantly steel coil and aluminum billet. Since material costs constitute a substantial portion of the final product price, sudden spikes can drastically erode profit margins and complicate long-term fixed-price contracts. Mitigation strategies include utilizing advanced hedging mechanisms in commodity markets, establishing strategic long-term supply agreements with integrated mills to secure preferential pricing and volume commitments, and strategically diversifying the supplier base across various geographical regions to minimize reliance on any single source or market condition.

A secondary challenge is navigating the increasingly complex global regulatory landscape, particularly concerning environmental sustainability and trade tariffs. Steel production, a major upstream component, is energy-intensive and faces pressure to reduce carbon emissions. Compliance with evolving environmental regulations, especially in Europe and North America, necessitates significant investment in cleaner production technologies, which increases operating expenditure. Mitigation involves adopting energy-efficient manufacturing processes, investing in carbon capture technologies, and strategically sourcing "green steel" or recycled materials, positioning the company favorably in markets sensitive to ecological footprints, effectively turning a compliance cost into a competitive advantage.

Furthermore, maintaining high product quality and dimensional precision across massive production volumes poses a persistent operational challenge. Defects such as wall thickness variations or weld inconsistencies can lead to costly rework or, critically, structural failures in end-use applications. This challenge is addressed through the aggressive adoption of advanced non-destructive testing (NDT) methodologies, such as ultrasonic and electromagnetic testing, integrated directly into the production line. Continuous investment in cutting-edge machinery and rigorous implementation of ISO quality management standards ensure that manufactured square tubes consistently meet the stringent specifications required by modern engineering and construction projects, thereby preserving brand integrity and reducing liability risks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager