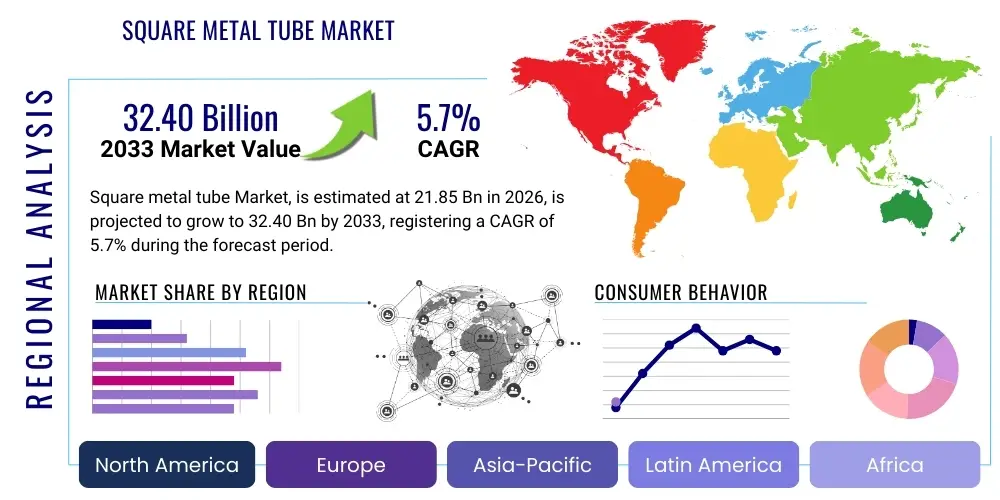

Square metal tube Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439739 | Date : Jan, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Square metal tube Market Size

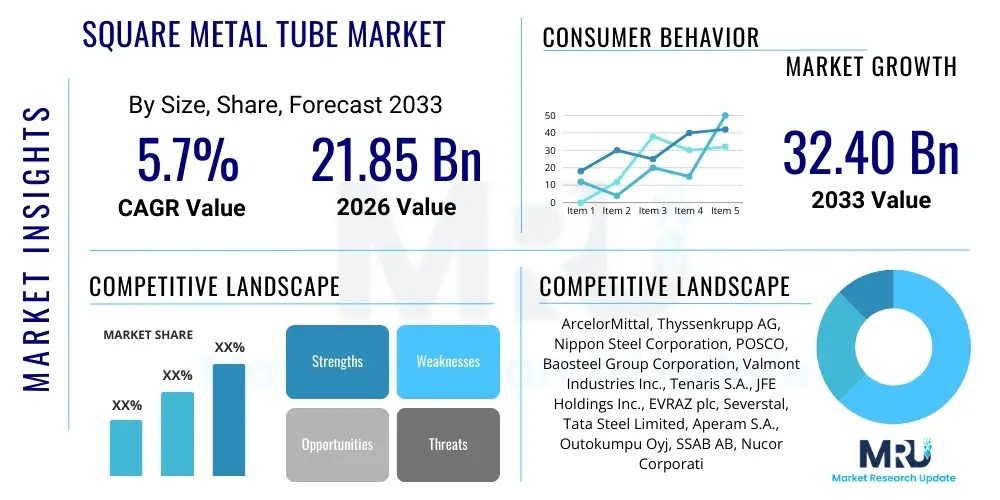

The Square metal tube Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.7% between 2026 and 2033. The market is estimated at $21.85 billion in 2026 and is projected to reach $32.40 billion by the end of the forecast period in 2033.

Square metal tube Market introduction

The square metal tube market encompasses the production, distribution, and consumption of hollow structural sections with a square cross-section, manufactured from various metals such as steel, aluminum, and stainless steel. These tubes are highly valued for their exceptional strength-to-weight ratio, durability, and aesthetic versatility, making them a fundamental component across a multitude of industries. Their inherent structural integrity allows for efficient load bearing and resistance to torsion, providing reliable performance in demanding applications.

Products within this market range from standard commercial grades to specialized alloys designed for high-performance or corrosive environments. Fabrication processes typically involve cold forming or hot rolling, followed by welding or seamless production, ensuring precise dimensional accuracy and superior surface finishes. The distinct square shape facilitates easy connection and integration into complex designs, contributing to reduced fabrication time and costs for end-users.

Major applications for square metal tubes span a broad spectrum, including the construction of buildings, bridges, and other infrastructure, automotive chassis and frames, industrial machinery and equipment, and the manufacturing of furniture and consumer goods. The market's growth is primarily driven by escalating global infrastructure development, rapid urbanization, the expansion of manufacturing capabilities, and a rising demand for lightweight yet robust materials in modern industrial designs. These factors collectively underscore the critical role square metal tubes play in supporting economic development and technological advancement.

Square metal tube Market Executive Summary

The Square metal tube Market is experiencing dynamic shifts, characterized by evolving business trends, significant regional growth disparities, and distinct segmental performance. Business trends are heavily influenced by the increasing demand for sustainable manufacturing practices, the integration of automation and advanced robotics in production lines, and a growing emphasis on custom fabrication and just-in-time delivery to meet specific client requirements. Furthermore, supply chain resilience has become a paramount concern, driving investments in localized sourcing and diversified supplier networks to mitigate disruptions.

Regional trends highlight the Asia Pacific (APAC) region as the primary growth engine, fueled by rapid industrialization, massive infrastructure projects, and expanding manufacturing sectors in countries like China, India, and Southeast Asian nations. North America and Europe demonstrate steady demand, largely driven by refurbishment projects, specialized manufacturing, and a focus on premium and high-strength alloy tubes. Latin America, the Middle East, and Africa are emerging as promising markets, propelled by urban development, energy sector investments, and diversification efforts.

Segmental trends reveal the construction industry as the largest consumer of square metal tubes, with significant demand stemming from residential, commercial, and industrial building projects, as well as critical infrastructure. The automotive sector is also a crucial segment, increasingly adopting lighter and stronger square tubes for vehicle frames and components to improve fuel efficiency and safety. The industrial machinery segment continues to show consistent demand for robust structural elements, while the furniture and consumer goods sectors are driving innovation in smaller, aesthetically appealing square tube applications. The market is also seeing a shift towards higher-grade materials, such as stainless steel and specialized aluminum alloys, to meet performance-critical applications.

AI Impact Analysis on Square metal tube Market

User questions frequently revolve around how artificial intelligence can revolutionize the manufacturing processes of square metal tubes, focusing on aspects such as efficiency improvements, cost reductions, quality control, and predictive maintenance. There is significant curiosity about AI's role in optimizing material usage, minimizing waste, and enhancing the overall precision of fabrication. Users are keen to understand if AI can contribute to more sustainable production methods and provide real-time insights into market demand and supply chain dynamics, ultimately leading to more responsive and intelligent production ecosystems.

Key themes emerging from these inquiries include the potential for AI-driven analytics to predict equipment failures, thereby reducing downtime and maintenance costs. Furthermore, the interest extends to AI's capability in automating complex welding and bending processes, ensuring consistent product quality and higher throughput. The integration of machine learning algorithms for defect detection during production is also a major concern, as it directly impacts product reliability and customer satisfaction, indicating a strong desire for enhanced quality assurance through intelligent systems.

Expectations are high regarding AI's ability to not only streamline current operations but also to foster innovation in new product development and customized solutions. Users envision AI assisting in the design phase, simulating material behavior, and optimizing structural integrity to create more efficient and lighter square tube designs. This forward-looking perspective highlights a belief that AI will be a transformative force, enabling manufacturers to adapt to market fluctuations more swiftly, personalize offerings, and achieve unprecedented levels of operational excellence and competitive advantage.

- AI-driven predictive maintenance optimizes machinery uptime, reducing costly unplanned breakdowns in tube mills.

- Enhanced quality control through AI-powered vision systems for real-time defect detection during manufacturing.

- Optimization of material usage and cut plans using AI algorithms, leading to reduced waste and cost savings.

- Automation of complex welding and bending processes via AI-guided robotics improves precision and production speed.

- AI analytics for demand forecasting and supply chain optimization, improving inventory management and logistics.

- Improved energy efficiency in production processes through AI monitoring and adaptive control systems.

- Accelerated R&D for new alloy compositions and product designs using AI-powered material simulations.

- Personalized product customization and rapid prototyping facilitated by AI-driven design tools.

DRO & Impact Forces Of Square metal tube Market

The Square metal tube Market is significantly influenced by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that shape its trajectory. Key drivers include robust global infrastructure development, particularly in emerging economies, which fuels massive demand for structural components in construction. Rapid urbanization trends necessitate new residential, commercial, and industrial constructions, further boosting the need for versatile and durable square metal tubes. Additionally, the continuous growth of the automotive and general manufacturing sectors, requiring lightweight yet strong materials for various applications, acts as a strong impetus for market expansion. The increasing adoption of modular construction techniques, which rely heavily on prefabricated structural elements, also contributes significantly to market growth.

However, the market faces several notable restraints. Volatility in raw material prices, particularly for steel and aluminum, directly impacts production costs and profit margins, posing a significant challenge for manufacturers. Stringent environmental regulations and increasing pressure for sustainable manufacturing practices can lead to higher compliance costs and require substantial investments in cleaner technologies. Furthermore, the market is characterized by intense competition among numerous domestic and international players, which can lead to price wars and reduced profitability. High initial capital investment required for advanced manufacturing equipment and limited access to specialized alloys also serve as barriers to entry and expansion for some market participants.

Opportunities for growth are abundant, primarily in the development and adoption of lightweighting solutions, utilizing advanced high-strength steels and aluminum alloys to meet the demands of industries like aerospace and electric vehicles. The expansion into emerging markets, where infrastructure and industrialization are still in nascent stages, presents considerable untapped potential. Custom fabrication and value-added services, such as pre-cutting, drilling, and specialized surface treatments, offer avenues for differentiation and increased revenue streams. Moreover, the push for sustainable production methods, including recycling initiatives and energy-efficient manufacturing, can unlock new market segments and enhance corporate social responsibility. The continuous evolution of manufacturing technologies, such as advanced welding and automated processing, also opens doors for improved efficiency and product innovation.

Segmentation Analysis

The square metal tube market is meticulously segmented to understand its diverse facets and cater to specific industry requirements. This segmentation allows for a comprehensive analysis of demand patterns, material preferences, application specificities, and geographical consumption trends. Understanding these segments is crucial for manufacturers to tailor their production, marketing strategies, and product offerings to effectively meet the needs of various end-user industries and gain a competitive edge in a dynamic market landscape.

Segmentation typically revolves around material type, manufacturing process, end-use application, and dimensions. Material segmentation distinguishes between steel, aluminum, stainless steel, and other specialty alloys, each offering unique properties in terms of strength, corrosion resistance, weight, and cost, thereby influencing their suitability for different applications. Manufacturing processes, whether welded or seamless, also form a key differentiator, impacting the structural integrity, cost, and typical uses of the tubes. End-use application is perhaps the most significant segmentation, as it directly reflects the primary industries driving demand for these versatile products.

Furthermore, geographic segmentation provides insights into regional market sizes, growth drivers, and regulatory environments, which can vary significantly across continents. Each segment, when analyzed independently and in conjunction with others, offers a granular view of the market, aiding stakeholders in strategic decision-making, from product development and supply chain management to market entry and expansion initiatives. This detailed breakdown ensures that market participants can identify niche opportunities and address specific market challenges with targeted solutions.

- By Material Type:

- Carbon Steel Square Tubes

- Stainless Steel Square Tubes

- Aluminum Square Tubes

- Alloy Steel Square Tubes

- Other Specialty Metals

- By Manufacturing Process:

- Welded Square Tubes

- Seamless Square Tubes

- By End-Use Application:

- Construction and Infrastructure

- Automotive and Transportation

- Industrial Machinery and Equipment

- Furniture and Fixtures

- Agriculture

- Fencing and Railings

- Consumer Goods

- Other Industrial Applications

- By Dimensions:

- Small Diameter Square Tubes (under 1 inch)

- Medium Diameter Square Tubes (1 to 4 inches)

- Large Diameter Square Tubes (over 4 inches)

Value Chain Analysis For Square metal tube Market

The value chain for the square metal tube market is a complex ecosystem involving several distinct stages, from raw material extraction to final product delivery, each adding value and incurring costs. Upstream analysis begins with the extraction and processing of primary raw materials, predominantly iron ore for steel production and bauxite for aluminum. This stage involves mining, refining, and smelting operations, which are capital-intensive and subject to commodity price fluctuations. Key players at this stage include large mining corporations and primary metal producers who supply billets, slabs, or coils to tube manufacturers. The quality and availability of these raw materials directly impact the cost and characteristics of the final square metal tube product.

The core of the value chain lies in the manufacturing and processing stage, where raw metal stock is transformed into square tubes through processes like hot rolling, cold forming, welding (for welded tubes), or piercing (for seamless tubes). This stage involves significant technological investment in machinery, quality control, and skilled labor. Manufacturers often perform additional value-added services such as cutting, bending, drilling, and surface treatments (e.g., galvanizing, powder coating) to meet specific customer requirements. These fabrication processes are crucial for differentiating products and enhancing their utility across various applications, moving beyond mere commodity production.

Downstream analysis focuses on the distribution and end-use of square metal tubes. Distribution channels are varied, encompassing direct sales from manufacturers to large-scale end-users (e.g., major construction firms, automotive OEMs), sales through wholesalers and distributors who stock and supply to smaller fabricators and contractors, and increasingly, online platforms for smaller orders. Indirect channels involve agents and brokers who facilitate transactions. The final stage involves the utilization of these tubes by end-user industries such as construction, automotive, industrial machinery, and furniture manufacturing, where they are integrated into finished products or structures. Efficiency in the distribution network and responsiveness to end-user demands are critical for market penetration and customer satisfaction, emphasizing timely delivery and customization capabilities.

Square metal tube Market Potential Customers

The square metal tube market serves a broad and diverse customer base, reflecting the versatility and fundamental importance of these structural components across numerous industrial and commercial sectors. One of the largest segments of potential customers is the construction industry, encompassing both residential and commercial building developers, as well as infrastructure project contractors. These entities utilize square metal tubes extensively for structural framing, support columns, roofing systems, mezzanines, scaffolding, and various architectural elements due to their strength, ease of fabrication, and aesthetic appeal in modern designs. From high-rise buildings to public works, the demand from this sector remains consistently robust, driven by global urbanization and development initiatives.

Another significant customer segment is the automotive and transportation industry. Manufacturers of automobiles, trucks, buses, and trailers increasingly rely on square metal tubes for chassis components, roll cages, frames, and interior structural elements. The ongoing pursuit of lightweighting in vehicle design, aimed at improving fuel efficiency and reducing emissions, drives demand for high-strength, low-weight aluminum and advanced steel square tubes. Beyond road vehicles, manufacturers of railcars, agricultural machinery, and specialized transport equipment also represent substantial buyers, valuing the durability and structural integrity offered by these tubes in demanding operational environments.

Furthermore, the industrial machinery and equipment manufacturing sector represents a consistent customer base, using square metal tubes for machine frames, conveyor systems, storage racks, and various equipment enclosures. The furniture manufacturing industry also consumes large volumes, particularly for modern and industrial-style furniture, tables, chairs, and shelving units, where square tubes provide both structural support and a distinct design aesthetic. Other notable potential customers include agricultural equipment manufacturers, companies specializing in fencing and security barriers, and fabricators of consumer goods, highlighting the pervasive utility of square metal tubes across a multitude of applications demanding strong, durable, and versatile structural elements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $21.85 billion |

| Market Forecast in 2033 | $32.40 billion |

| Growth Rate | 5.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ArcelorMittal, Thyssenkrupp AG, Nippon Steel Corporation, POSCO, Baosteel Group Corporation, Valmont Industries Inc., Tenaris S.A., JFE Holdings Inc., EVRAZ plc, Severstal, Tata Steel Limited, Aperam S.A., Outokumpu Oyj, SSAB AB, Nucor Corporation, Steel Dynamics Inc., Reliance Steel & Aluminum Co., Bristol Metals LLC, Tube Methods Inc., Welded Tube Pros |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Square metal tube Market Key Technology Landscape

The Square metal tube Market is continuously evolving through the integration of advanced manufacturing technologies aimed at enhancing efficiency, precision, and product quality. One crucial aspect of this technological landscape involves sophisticated welding techniques, such as laser welding, plasma welding, and robotic welding, which significantly improve weld integrity, speed, and reduce labor costs. These automated systems ensure consistent joint quality and allow for the production of tubes with tighter tolerances and superior mechanical properties. Furthermore, advanced forming technologies like hydroforming and roll forming are gaining traction, enabling the creation of complex geometries and lightweight structures with optimized material distribution, catering to the specific demands of the automotive and aerospace industries.

Precision machining and cutting technologies, including CNC (Computer Numerical Control) machining, laser cutting, and waterjet cutting, play a vital role in providing exact dimensions and clean finishes for square metal tubes. These technologies minimize material waste and allow for highly customized fabrication, responding to the growing demand for bespoke solutions in various applications. Surface treatment innovations are also critical, encompassing advanced galvanizing, powder coating, and specialized corrosion-resistant coatings that extend the lifespan of tubes and enhance their aesthetic appeal, particularly important in outdoor construction and consumer goods sectors.

The broader adoption of Industry 4.0 principles, including the Internet of Things (IoT), artificial intelligence (AI), and big data analytics, is transforming production processes. IoT sensors integrated into manufacturing equipment enable real-time monitoring of machine performance, predictive maintenance, and operational data collection. AI and machine learning algorithms analyze this data to optimize production parameters, forecast demand, and identify potential defects, leading to increased productivity and reduced downtime. Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) software are indispensable for efficient design, simulation, and programming of manufacturing processes, ensuring rapid product development and seamless integration from design to production floor.

Regional Highlights

- North America: This region demonstrates a mature market with stable demand, driven by robust construction and infrastructure projects, particularly in refurbishment and modernization. The automotive sector, including electric vehicle manufacturing, continues to be a key consumer, alongside strong industrial machinery production. Innovation in high-strength and lightweight alloys is a major focus.

- Europe: Characterized by stringent quality standards and a strong emphasis on sustainable manufacturing practices, Europe maintains a significant market share. Germany, France, and the UK are key contributors, with demand stemming from advanced manufacturing, automotive, and specialized construction projects. The focus is on precision engineering and value-added processing.

- Asia Pacific (APAC): The APAC region stands as the fastest-growing market, propelled by rapid urbanization, extensive infrastructure development, and booming manufacturing industries in China, India, and Southeast Asian countries. Massive investments in residential, commercial, and industrial construction, coupled with expanding automotive production, are primary growth drivers here.

- Latin America: This region shows promising growth potential, driven by developing infrastructure, mining activities, and increasing industrialization, particularly in Brazil and Mexico. Investments in public works and energy projects are expected to significantly boost demand for square metal tubes, although economic stability remains a key influencing factor.

- Middle East and Africa (MEA): The MEA market is expanding, primarily due to large-scale construction projects, diversification efforts away from oil economies, and investments in industrial and tourism infrastructure. Countries like UAE, Saudi Arabia, and South Africa are leading this growth, with an emphasis on high-quality structural steel products for iconic developments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Square metal tube Market.- ArcelorMittal

- Thyssenkrupp AG

- Nippon Steel Corporation

- POSCO

- Baosteel Group Corporation

- Valmont Industries Inc.

- Tenaris S.A.

- JFE Holdings Inc.

- EVRAZ plc

- Severstal

- Tata Steel Limited

- Aperam S.A.

- Outokumpu Oyj

- SSAB AB

- Nucor Corporation

- Steel Dynamics Inc.

- Reliance Steel & Aluminum Co.

- Bristol Metals LLC

- Tube Methods Inc.

- Welded Tube Pros

Frequently Asked Questions

Analyze common user questions about the Square metal tube market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of square metal tubes?

Square metal tubes are extensively used in construction for structural support and architectural elements, in the automotive industry for chassis and frames, for industrial machinery, and in the manufacturing of furniture and consumer goods due to their strength and versatility.

Which materials are commonly used to manufacture square metal tubes?

Common materials include carbon steel for general applications, stainless steel for corrosion resistance and aesthetic appeal, and aluminum for lightweight yet strong solutions, along with various alloy steels for specialized high-performance requirements.

What factors are driving the growth of the square metal tube market?

Key drivers include global infrastructure development, rapid urbanization, expansion of the automotive and general manufacturing sectors, and increasing adoption of modular construction techniques requiring durable and versatile structural components.

How does AI impact the manufacturing of square metal tubes?

AI significantly impacts the market through predictive maintenance for machinery, enhanced quality control via vision systems, optimization of material usage, automation of complex processes with robotics, and improved supply chain management and demand forecasting.

What are the main types of segmentation within this market?

The market is primarily segmented by material type (e.g., carbon steel, stainless steel, aluminum), manufacturing process (welded or seamless), end-use application (construction, automotive, industrial), and dimensions (small, medium, large diameter).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager