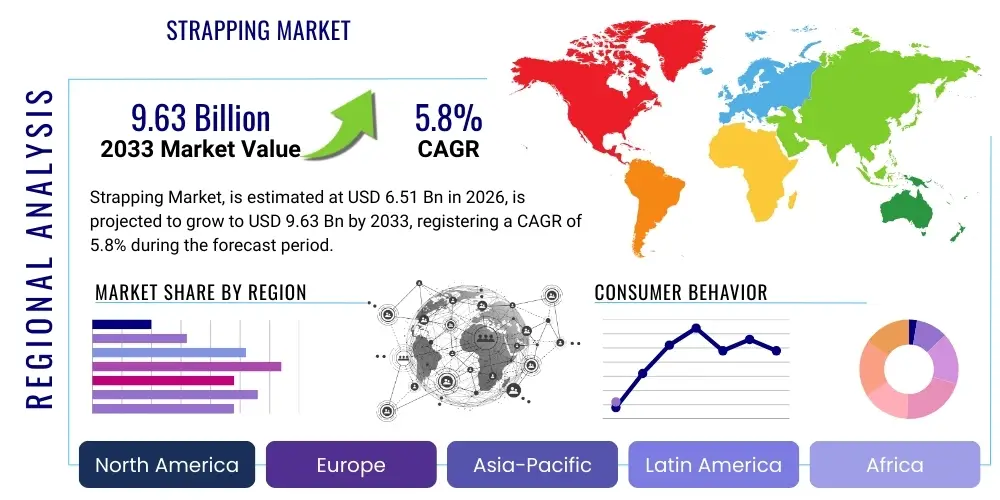

Strapping Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436455 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Strapping Market Size

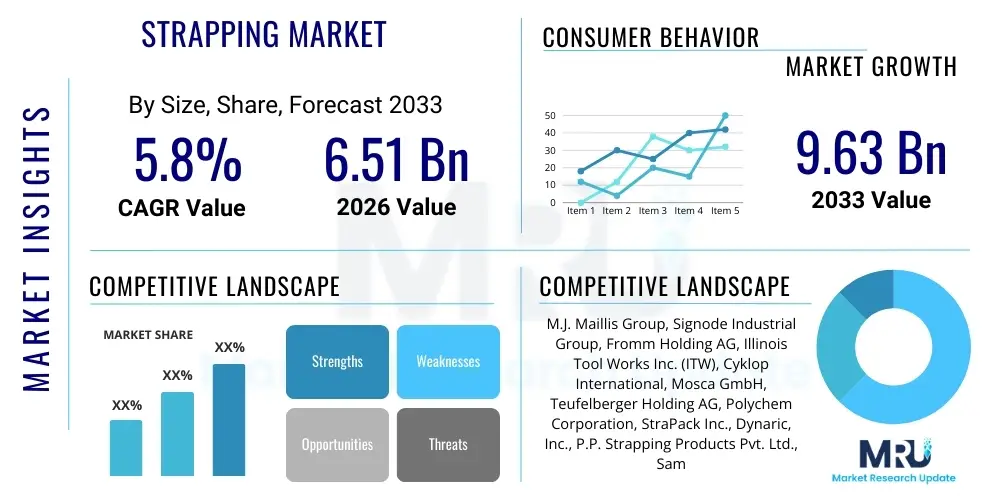

The Strapping Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 6.51 Billion in 2026 and is projected to reach USD 9.63 Billion by the end of the forecast period in 2033.

Strapping Market introduction

The Strapping Market encompasses the production and sale of various materials (such as steel, polyester, polypropylene, and nylon) and equipment used for bundling, reinforcement, securing, and unitizing products for storage and transit. Strapping, also known as banding, is critical for load securement across diverse industries, ensuring product integrity and logistical efficiency during handling and shipping. Major applications include packaging lumber, securing palletized goods, bundling newspaper stacks, and reinforcing heavy industrial products like metals and construction materials. The primary function of strapping materials is to maintain the tension necessary to keep a load cohesive and stable, preventing shifting, damage, or loss during transportation.

The core benefits of adopting industrial strapping solutions include enhanced safety during handling, optimization of supply chain logistics through stable unit loads, and compliance with stringent transport regulations concerning cargo securement. The shift toward lightweight yet high-tensile strength materials, such as Polyethylene Terephthalate (PET) strapping, is a notable trend, driven by sustainability goals and the demand for materials that can withstand high stress during long-haul transit. PET often replaces steel strapping in applications where corrosion resistance and operator safety are paramount, while offering comparable break strength.

Key factors driving market growth include the explosive expansion of the e-commerce sector globally, which necessitates efficient and reliable secondary packaging solutions for high-volume parcel shipping. Furthermore, the robust growth in manufacturing and construction activities, especially in emerging economies of Asia Pacific, increases the demand for automated packaging systems capable of high-speed palletizing and securing heavy goods. Technological advancements in strapping equipment, such as fully automatic strapping machines with tension accuracy control and enhanced energy efficiency, also contribute significantly to market expansion, enabling businesses to reduce labor costs and increase throughput.

Strapping Market Executive Summary

The Strapping Market exhibits strong commercial momentum driven primarily by the acceleration of industrial automation and the structural expansion of global logistics networks. Business trends indicate a marked shift from manual processes toward fully automated strapping systems, which enhance efficiency and reduce material waste, particularly in high-volume industries like food and beverage, and consumer durables. Furthermore, manufacturers are focusing on integrating advanced sensor technology and IoT capabilities into strapping machines to facilitate predictive maintenance and real-time tension monitoring, positioning performance and reliability as key competitive differentiators in the market landscape. Strategic mergers and acquisitions are frequently employed by major players to consolidate regional presence and acquire specialized technology portfolios, enhancing market penetration across various end-use segments.

Regionally, the Asia Pacific (APAC) region remains the dominant growth engine, fueled by rapid industrialization, burgeoning domestic consumption, and extensive foreign direct investment in manufacturing infrastructure, particularly in countries like China, India, and Southeast Asian nations. North America and Europe, while mature markets, emphasize the adoption of sustainable strapping materials (like recycled PET and bio-based plastics) and high-speed automatic equipment, driven by stringent environmental regulations and high labor costs, ensuring steady demand for premium solutions. Latin America and the Middle East & Africa (MEA) are emerging as significant markets, characterized by increasing urbanization and infrastructural development requiring robust material handling and secure transit packaging.

Segment trends highlight the continuous material substitution towards plastic strapping, specifically PET, due to its cost-effectiveness, high tensile strength, elasticity, and superior resistance to environmental factors compared to traditional steel strapping. Within the application segment, pallet strapping and unitizing maintain the largest market share, directly correlated with the growth in global trade and logistics operations. Equipment segmentation shows strong demand for automatic and semi-automatic machines, reflecting the industry-wide push for reduced operational variability and increased throughput capacity. The consumer goods and logistics sectors are anticipated to demonstrate the fastest adoption rates for advanced strapping solutions throughout the forecast period.

AI Impact Analysis on Strapping Market

Common user questions regarding AI's impact on the Strapping Market often center on how automation goes beyond mechanical processes, specifically asking about predictive maintenance, optimized material usage, and enhanced quality control. Users are concerned about whether AI can truly minimize costly load failures caused by insufficient or inconsistent tensioning and how machine learning algorithms can integrate with inventory management systems to forecast material demand. The analysis reveals a strong user expectation that AI will transition strapping equipment from merely applying force to intelligently managing load stability based on real-time environmental and transit variables, thereby maximizing cost savings and supply chain reliability. Key themes revolve around the integration of vision systems for flaw detection and using ML models to determine the optimal strapping pattern and tension for heterogeneous loads, addressing concerns about manual error and labor dependency.

AI’s influence is moving the strapping sector toward intelligent automation, where equipment utilizes machine learning algorithms to fine-tune operational parameters. For instance, AI algorithms can analyze throughput data, material properties, and historical failure rates to dynamically adjust strapping tension, ensuring optimal load securement for specific cargo types and transportation routes. This capability significantly reduces the instances of product damage due to under-tensioning or material breakage due to over-tensioning, leading to substantial cost reduction in claims and re-packaging efforts. Predictive maintenance, powered by AI analyzing sensor data (vibration, temperature, current draw), allows equipment operators to schedule repairs before catastrophic failures occur, dramatically increasing machine uptime and operational efficiency.

Beyond the machine level, AI is impacting supply chain visibility and sustainability within the strapping industry. Machine vision systems integrated with strapping lines can inspect the quality of the applied strapping and the stability of the palletized load in real-time, providing immediate feedback and automated adjustments. Furthermore, AI helps optimize inventory levels of strapping material by accurately forecasting consumption based on production schedules and seasonality, minimizing warehousing costs and reducing the potential for obsolete stock. The application of machine learning also extends to material selection, where systems can recommend the most cost-effective and environmentally suitable strapping material (e.g., thickness, width, type) for a given load requirement, balancing strength, sustainability, and expenditure.

- AI-driven predictive maintenance forecasts equipment failures, maximizing operational uptime.

- Machine Learning algorithms dynamically optimize strapping tension based on load characteristics and material properties, minimizing load shift risk.

- Integrated AI vision systems enable real-time quality control and flaw detection in applied strapping.

- AI optimizes inventory management by accurately predicting material consumption based on production forecasts.

- Enhanced security protocols through AI monitoring prevent unauthorized access or tampering with high-value loads during transit (smart strapping).

- Optimized resource allocation and waste reduction through precise material recommendation systems.

DRO & Impact Forces Of Strapping Market

The Strapping Market is powerfully impacted by the expansion of global trade and the pervasive shift towards automated material handling solutions, acting as the primary drivers. Conversely, volatility in raw material costs, particularly for polymers and steel, poses a consistent restraint on profitability, alongside increasing environmental regulations pressuring the industry to adopt sustainable, recyclable materials. The primary opportunity lies in developing integrated smart packaging systems, leveraging IoT and high-strength, eco-friendly materials like bio-based and highly recycled PET, particularly targeting niche applications in heavy-duty logistics and high-speed packaging lines. These market dynamics collectively dictate strategic investments in research and development, focusing on high-tensile green materials and highly efficient, interconnected strapping machinery.

Key drivers include the massive growth in global e-commerce, which requires reliable unit load protection for countless individual shipments, and the sustained rise in manufacturing output across various sectors (e.g., metals, construction, logistics). The critical need for improved workplace safety, pushing companies away from potentially hazardous steel strapping towards safer PET and PP options, also fuels market adoption. However, market growth is curtailed by significant restraints, including the high initial capital investment required for fully automatic strapping machinery, especially for smaller enterprises, and the lack of standardization in pallet sizes and strapping protocols globally, which can complicate international logistics and require diverse equipment compatibility.

Opportunities are abundant in emerging markets where infrastructure investment is accelerating, creating demand for bulk material securement in construction and basic industries. Innovation in disposable strapping heads that reduce maintenance complexity and the development of strapping solutions that are fully compliant with circular economy principles offer significant potential for competitive advantage. The impact forces show that while automation demands boost the equipment segment, material costs and sustainability mandates are the strongest forces shaping the material composition segment, pushing manufacturers towards advanced polymer science to deliver high performance at a lower environmental footprint. Strategic focus on vertical integration, controlling both material supply and equipment manufacturing, helps key players mitigate the impact of raw material price fluctuations.

Segmentation Analysis

The Strapping Market is segmented extensively based on Material, Type, End-Use Industry, and Equipment. Material segmentation is crucial, differentiating between traditional Steel Strapping, and plastic variants such as Polypropylene (PP), Polyester (PET), and Nylon, with PET consistently gaining market share due to its balance of strength, elasticity, and cost-efficiency, often replacing steel in medium-to-heavy applications. The segmentation by Type focuses on width, thickness, and specialized characteristics like embossed versus smooth surfaces. Equipment segmentation distinguishes between Manual Strapping Tools (hand tools), Semi-Automatic Machines, and Fully Automatic Strapping Machines, where automatic solutions dominate industrial settings seeking high throughput and consistency. End-Use analysis reveals that Logistics & Warehousing, Food & Beverage, and Building & Construction are the largest consumers of strapping products globally, reflecting the pervasive need for secure unit loads across the global supply chain infrastructure.

Within the equipment category, the increasing adoption of fully automated strapping lines, particularly in high-volume production environments, reflects the industry’s push towards minimizing labor costs and ensuring consistent application tension, which is paramount for load stability. The rise of integrated packaging systems, combining wrapping, hooding, and strapping into single operational platforms, is accelerating, driven by large manufacturers seeking end-of-line packaging optimization. This technological integration is highly attractive to industries like paper and printing, and large-scale manufacturing, where product consistency and protection against moisture or shifting are vital.

The strategic importance of segmentation lies in allowing market players to tailor solutions based on specific performance requirements. For example, the heavy-duty metals industry requires high-tensile steel strapping or specialized high-strength PET, whereas the fragile consumer goods sector relies more on consistent tension control offered by advanced PP strapping and semi-automatic equipment. Understanding these nuanced application needs across diverse end-use verticals (e.g., agricultural products requiring breathable strapping vs. electronics needing anti-static solutions) enables targeted marketing and product development efforts, maximizing penetration and achieving premium pricing in specialized market niches.

- By Material:

- Steel Strapping

- Polypropylene (PP) Strapping

- Polyester (PET) Strapping

- Nylon Strapping

- By Type (Format):

- Machine Grade Strapping

- Hand Grade Strapping

- Embossed Strapping

- Smooth Strapping

- By Equipment:

- Manual Tools (Tensioners, Sealers)

- Semi-Automatic Strapping Machines

- Fully Automatic Strapping Machines

- Strapping Heads and Dispensers

- By End-Use Industry:

- Logistics and Warehousing

- Building and Construction (Lumber, Brick, Tile)

- Food and Beverage

- Consumer Goods and Electronics

- Paper, Printing, and Publishing

- Metals and Primary Manufacturing

- Textiles and Apparel

- Agriculture and Horticulture

Value Chain Analysis For Strapping Market

The value chain of the Strapping Market begins with the upstream sourcing of critical raw materials, primarily steel coil for metal strapping and virgin or recycled polymer resins (PET, PP) for plastic strapping. This stage is dominated by large chemical and metals producers, and price volatility in these commodities directly impacts the downstream manufacturing costs. The processing phase involves extrusion, rolling, heat treatment, and surface finishing to produce the final strapping material with specific tensile strengths and dimensional tolerances. Manufacturers invest heavily in specialized production machinery and quality control systems to ensure the consistency required for high-speed automatic equipment, constituting a critical value addition point where material conversion efficiency is paramount.

The distribution channel is segmented into direct sales, especially for large industrial clients requiring custom integrated automatic machinery and bulk material supply, and indirect sales through a network of specialized packaging distributors, wholesalers, and third-party logistics (3PL) providers. Distributors play a vital role in reaching small and medium enterprises (SMEs), offering inventory management, localized technical support, and small-batch material supply. The integration of 3PLs into the value chain is growing, as they often standardize and procure strapping solutions on behalf of their diverse client base, influencing product demand and material specifications across multiple end-use sectors simultaneously.

Downstream analysis focuses on the end-use applications, where the strapping material and equipment perform their final function of load securement. Key value drivers at this stage include ease of application, long-term load integrity during transit and storage, and compliance with safety and environmental standards (e.g., using recyclable materials). After-market services, including maintenance contracts, provision of spare parts for complex automated equipment, and operator training, form a crucial component of the value chain, ensuring sustained machine performance and generating recurring revenue streams for equipment manufacturers. The increasing demand for sustainable end-of-life solutions for strapping waste is beginning to shape material choice and downstream processing requirements.

Strapping Market Potential Customers

Potential customers, or end-users/buyers, of strapping products and equipment span nearly every manufacturing and logistics sector requiring the unitizing and securement of goods. The largest customer base is concentrated within industries that handle bulk, heavy, or palletized items that require consolidation for safe movement. This includes the massive logistics and warehousing sector, encompassing fulfillment centers, distribution hubs, and third-party logistics providers, all of whom utilize vast quantities of plastic and steel strapping for pallet securement and cross-dock operations. The proliferation of automated storage and retrieval systems (AS/RS) further drives demand for machine-grade strapping that performs reliably under high-speed, controlled conditions, making large logistics corporations prime targets.

Another major customer segment is the building and construction industry, where buyers procure heavy-duty steel or high-tensile PET strapping for bundling lumber, reinforcing stacks of bricks, securing metal coils, and packaging insulation materials. These customers require materials capable of resisting harsh outdoor conditions and maintaining high tension over extended periods. Similarly, the metals and primary manufacturing sectors, dealing with extremely heavy and sharp products like steel coils, billets, and aluminum ingots, necessitate the highest strength steel strapping and specialized application equipment, representing a high-value, albeit volume-sensitive, customer group demanding exceptional safety and durability standards in their securement solutions.

Furthermore, the high-volume packaging sectors, particularly Food & Beverage and Paper & Printing, are essential customers driving demand for automated equipment and consistent plastic strapping. Food and beverage manufacturers require sanitary, often moisture-resistant, PP strapping for unitizing cases of drinks or bags of raw materials, prioritizing speed and reliable throughput. Paper and printing facilities depend heavily on strapping to secure heavy stacks of paper rolls or finished printed materials, where consistent tension prevents damage to edges and maintains product shape. Targeting these varied segments requires a portfolio approach, offering customized material grades, tailored equipment sizes, and specialized service packages focused on maximizing efficiency within each unique operational environment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.51 Billion |

| Market Forecast in 2033 | USD 9.63 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | M.J. Maillis Group, Signode Industrial Group, Fromm Holding AG, Illinois Tool Works Inc. (ITW), Cyklop International, Mosca GmbH, Teufelberger Holding AG, Polychem Corporation, StraPack Inc., Dynaric, Inc., P.P. Strapping Products Pvt. Ltd., Samuel Strapping Systems, BÖHLER-UDDEHOLM (voestalpine), Messersì Packaging S.r.l., Transpak Equipment Corp., EAM-Mosca Corporation, Crown Holdings, Inc. (Through Affiliates), Wenzhou Hongye Packaging, Australian Strapping Company, Titan Umreifungstechnik GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Strapping Market Key Technology Landscape

The technology landscape of the Strapping Market is rapidly evolving, driven by the need for increased speed, precision, and efficiency in end-of-line packaging. Key technological innovations center around the development of fully automatic, high-speed strapping machines integrated with existing conveyor and palletizing systems, capable of executing over 60 cycles per minute with minimal manual intervention. These machines feature advanced ultrasonic or heat sealing technology, providing stronger and more consistent strap joints compared to traditional metal seals, minimizing material consumption and enhancing load security. Furthermore, manufacturers are increasingly implementing modular designs and quick-change strapping heads (dispensers) that reduce downtime for maintenance and allow for rapid adjustments to handle different strap widths and types, thereby maximizing production flexibility.

Material technology represents another major focus, specifically the refinement of high-tensile Polyester (PET) strapping. Ongoing research focuses on co-extrusion technologies to create multi-layer plastic strapping that maintains exceptional breaking strength while minimizing material thickness, contributing to sustainability targets by reducing plastic usage per pallet. Innovations in surface treatment, such as specialized embossing patterns, are designed to enhance the grip between the strap and the package, improving stability without compromising tension retention. For steel strapping, advancements include specialized zinc-coating alloys and enhanced heat treatments to improve corrosion resistance and overall ductility, ensuring reliable performance in harsh industrial environments like ports and heavy fabrication yards.

The integration of Industry 4.0 principles, including IoT and sensor technology, is crucial to modern strapping systems. Advanced machines are now equipped with sensors monitoring tension force (measured in Newtons or pounds), material run-out, and component wear, transmitting real-time operational data to centralized Manufacturing Execution Systems (MES). This connectivity facilitates remote diagnostics, allows for proactive tension adjustments to maintain load consistency, and supports AI-driven predictive maintenance schedules. Such technological integration is essential for large, global operations seeking to standardize packaging quality and achieve maximum equipment efficiency across dispersed manufacturing sites, making smart, connected strapping systems the benchmark for future growth.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, largely attributable to the massive expansion of manufacturing bases, high infrastructural spending, and the exponential growth of e-commerce markets in countries such as China, India, and Southeast Asia. The region is characterized by high consumption of both plastic and steel strapping, with significant demand for semi-automatic and automatic machines to handle the increasing volume of goods produced for both domestic consumption and global export. Investment in logistics parks and automated warehouses is a primary catalyst.

- North America: North America represents a mature, high-value market focused intensely on automation, safety, and sustainable packaging. Demand is heavily concentrated on high-speed, fully automatic PET strapping systems to replace manual labor and reduce operational costs. Stringent health and safety regulations, encouraging the shift away from sharp-edged steel strapping, further boost the adoption of PET and PP alternatives. The logistics and warehousing sector, driven by major e-commerce fulfillment centers, is the primary volume driver.

- Europe: The European market is defined by strict environmental mandates and a strong preference for sustainable materials. The rapid adoption of recycled PET (rPET) strapping and commitment to circular economy principles are key trends. Western European countries exhibit high demand for sophisticated, precise, and highly energy-efficient automatic strapping equipment, particularly in the food and beverage and retail logistics sectors, emphasizing high-quality unitization for internal European trade.

- Latin America (LATAM): LATAM is an emerging market showing steady growth, driven by increasing foreign investment in manufacturing, urbanization, and the development of modern retail infrastructure. Demand is currently mixed, with a balance between cost-effective hand tools and semi-automatic machines in smaller operations, and growing investment in automatic equipment in large industries like cement, mining, and exported agricultural products (e.g., fruit and timber).

- Middle East and Africa (MEA): Growth in the MEA region is closely linked to large-scale infrastructure projects, expansion of the petrochemical industry, and diversification of economies away from oil dependency. Major construction projects and growing port activities fuel demand for heavy-duty steel and PET strapping. The adoption of semi-automatic and basic automatic machines is increasing, supported by the need for reliable palletizing solutions in growing consumer goods and logistics hubs (e.g., UAE, Saudi Arabia).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Strapping Market.- M.J. Maillis Group (A company of Carlyle)

- Signode Industrial Group (A division of Crown Holdings, Inc.)

- Fromm Holding AG

- Illinois Tool Works Inc. (ITW)

- Cyklop International

- Mosca GmbH

- Teufelberger Holding AG

- Polychem Corporation

- StraPack Inc.

- Dynaric, Inc.

- P.P. Strapping Products Pvt. Ltd.

- Samuel Strapping Systems

- BÖHLER-UDDEHOLM (voestalpine)

- Messersì Packaging S.r.l.

- Transpak Equipment Corp.

- EAM-Mosca Corporation

- Australian Strapping Company

- Titan Umreifungstechnik GmbH

- Zappe GmbH

- Lantech, LLC

Frequently Asked Questions

Analyze common user questions about the Strapping market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for PET strapping over traditional steel strapping?

The primary driver is the superior combination of high tensile strength, elasticity (shock absorption), corrosion resistance, lower operational cost, and improved user safety offered by PET strapping. Additionally, the increasing focus on sustainability favors PET, especially recycled variants, meeting modern environmental packaging mandates.

How is the growth of the e-commerce sector influencing the Strapping Market?

E-commerce drives demand by requiring fast, reliable, and standardized secondary packaging. The surge in parcel volume necessitates the widespread use of high-speed semi-automatic and automatic strapping machines to secure unitized loads efficiently for transport, ensuring goods arrive undamaged at fulfillment centers.

What role does automation play in the future development of strapping equipment?

Automation is critical, focusing on fully integrated, high-speed strapping systems (Industry 4.0 compliant) that offer consistent tension accuracy, minimize human error, and utilize IoT sensors for predictive maintenance. This shift reduces labor costs and ensures optimal load stability for complex logistics chains.

Which geographical region holds the highest growth potential for the Strapping Market?

The Asia Pacific (APAC) region, driven by extensive manufacturing expansion, rapid industrialization, and massive infrastructural investment in China, India, and Southeast Asia, holds the highest growth potential for both material consumption and equipment adoption.

What are the main sustainable options available for strapping materials?

The main sustainable options include high-quality Polyethylene Terephthalate (PET) strapping manufactured from high percentages of recycled plastic (rPET) content. Manufacturers are also exploring bio-based polymers and focusing on material reduction strategies through co-extrusion technologies to minimize overall plastic usage without compromising strength.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Manual Strapping Tool Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Automatic Banknote Strapping Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Strapping Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Americas Strapping Materials Market Size Report By Type (Steel, Polypropylene, Polyester (PET), Other), By Application (Food & Beverage, Industrial Logistics & Warehouse, Corrugated Card Boxes & Paper, Building & Construction, Metal), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Strapping Machines Market Size Report By Type (Fully Automatic Strapping Machines, Automatic Strapping Machines, Semi-automatic Strapping Machines), By Application (Food & Beverage, Consumer Electronics, Household Appliances, Newspaper & Graphics, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager