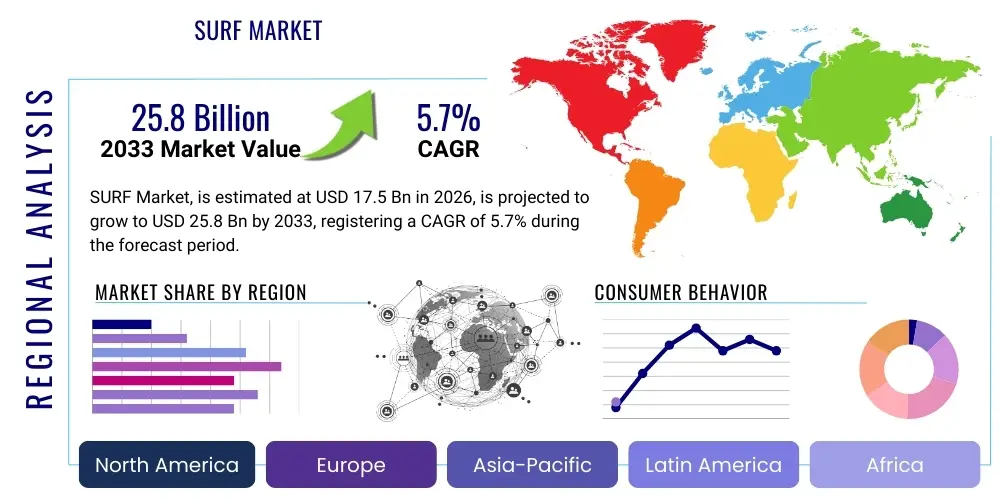

SURF Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438011 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

SURF Market Size

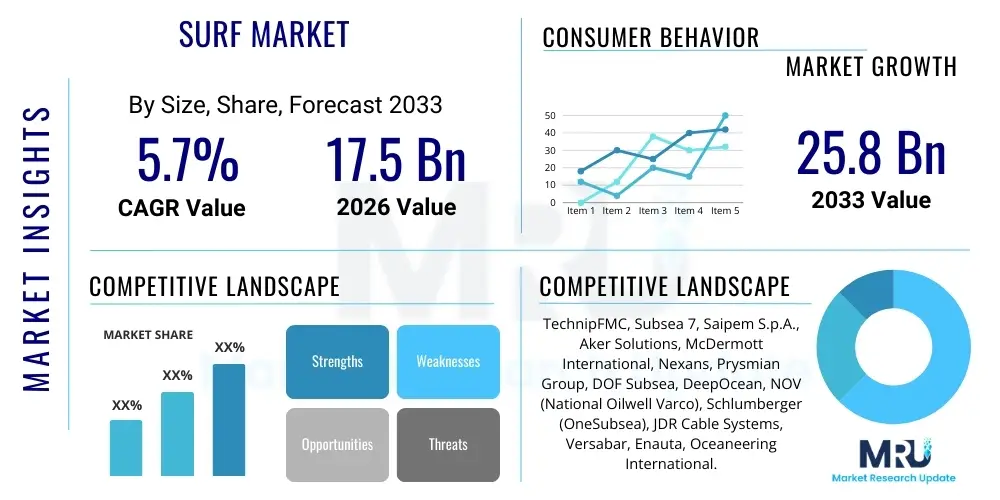

The SURF Market (Subsea Umbilicals, Risers, and Flowlines) is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.7% between 2026 and 2033. The market is estimated at USD 17.5 Billion in 2026 and is projected to reach USD 25.8 Billion by the end of the forecast period in 2033. This growth is fundamentally driven by the resurgence of offshore exploration and production activities, particularly in deepwater and ultra-deepwater fields, where SURF infrastructure is indispensable for connecting subsea production systems to surface facilities. The inherent reliability and capability of advanced SURF systems to withstand extreme hydrostatic pressure, corrosive environments, and harsh hydrodynamic loading are key factors sustaining this upward trajectory, despite volatility in crude oil prices.

SURF Market introduction

The SURF Market encompasses the specialized engineering, procurement, construction, and installation (EPCI) of critical infrastructure required for offshore hydrocarbon extraction and transportation. Subsea Umbilicals provide control, power, chemicals, and communications links; Risers facilitate the transfer of fluids (oil, gas, water) from the seabed to floating facilities; and Flowlines transport processed fluids across the seabed between wells, manifolds, and risers. This triumvirate of technologies forms the backbone of modern subsea production architectures, enabling operations in increasingly remote and challenging environments, particularly those characterized by significant water depth and high-pressure/high-temperature (HPHT) reservoirs.

Major applications for SURF systems span both conventional oil and gas fields and emerging deepwater gas projects. Key benefits include the ability to standardize field layouts, optimize capital expenditure through long tie-backs, and enhance operational efficiency by centralizing control functions via sophisticated umbilical systems. The integration of advanced materials, such as flexible flowlines and hybrid risers, allows for faster deployment and greater resistance to fatigue and internal corrosion. Furthermore, the market is gradually expanding its scope to include subsea electrification infrastructure necessary for carbon capture and storage (CCS) and offshore wind farm connectivity, leveraging core SURF competencies in seabed cable laying and connection management.

Driving factors for sustained market expansion include global energy demand projections, which necessitate tapping into substantial deepwater reserves, particularly off the coasts of Brazil, West Africa, and the Gulf of Mexico. Technological advancements, such as the development of all-electric subsea systems that reduce the required number of hydraulic lines within umbilicals, enhance reliability and minimize environmental footprint. Additionally, the increasing focus on life extension and integrity management of existing aging subsea infrastructure provides a consistent demand stream for maintenance, repair, and replacement (MRR) services, underpinning the long-term stability of the SURF sector across diverse geographical basins.

SURF Market Executive Summary

The SURF market is currently experiencing significant cyclical uplift, driven by sustained high oil prices encouraging Final Investment Decisions (FIDs) on previously shelved deepwater projects. Business trends emphasize integrated service delivery models (i-EPCI), where major contractors handle the entire scope from design to commissioning, minimizing interface risks for operators. There is a perceptible shift towards modular and standardized SURF components to reduce manufacturing lead times and installation costs, particularly relevant for fast-track satellite field developments. Furthermore, innovation in material science, focusing on thermoplastic composite pipes (TCP) and steel lazy wave risers (SLWR), is reshaping the competitive landscape by offering lighter, more durable, and cost-effective alternatives to traditional steel rigid systems, thereby improving project economics in challenging ultra-deepwater settings.

Regionally, the market dynamics are heavily skewed towards regions with extensive deepwater prospects. Latin America, particularly Brazil, remains the dominant region due to massive pre-salt field developments requiring complex, long-distance flowlines and ultra-deepwater risers. Asia Pacific is emerging as a critical growth hub, driven by new gas discoveries in countries like Australia, Indonesia, and Malaysia, necessitating robust subsea gas evacuation infrastructure. Conversely, mature regions like the North Sea are witnessing a pivot from new field developments towards decommissioning and life extension services, though they continue to lead in adopting innovative all-electric and digitalization technologies for existing asset optimization.

Segment trends reveal that the Flowlines segment holds the largest market share by value, directly correlated with the necessity of long tie-backs (up to 200 km) required to connect remote wells back to centralized floating production storage and offloading (FPSO) units. The Umbilicals segment, however, is projected to exhibit the fastest growth, underpinned by the increasing complexity of control systems and the requirement for higher power and fiber optic capacity to support sophisticated subsea processing equipment, pumps, and compressors. Within the Riser category, hybrid and flexible riser configurations are gaining traction over traditional rigid risers due to their superior performance characteristics in areas prone to heave and strong currents, addressing operational challenges posed by aggressive marine environments.

AI Impact Analysis on SURF Market

Common user questions regarding AI's influence on the SURF market frequently revolve around how Artificial Intelligence and Machine Learning (ML) can improve asset integrity management, optimize installation logistics, and reduce non-productive time (NPT) during subsea operations. Users are keenly interested in predictive maintenance models that can analyze sensor data from smart flowlines and risers to forecast potential fatigue failure or corrosion breaches, thereby shifting from reactive or scheduled maintenance to condition-based strategies. Another primary concern focuses on the application of AI in seismic interpretation and route selection optimization for flowlines, seeking to minimize environmental impact and technical hazards (e.g., mudslides, challenging bathymetry) while maximizing the economic viability of the subsea layout. Furthermore, there is growing expectation regarding AI's role in autonomous underwater vehicles (AUVs) used for inspection, maintenance, and repair (IMR), enabling faster data collection and real-time defect identification without requiring continuous human intervention or support vessels. The overall consensus is that AI will primarily serve as a critical tool for risk mitigation, efficiency enhancement, and the extension of asset lifespan in highly capital-intensive subsea environments.

- AI-driven predictive analytics for monitoring fatigue life and corrosion rates in steel and composite risers.

- Machine Learning algorithms optimizing subsea field layout design, including flowline routing and umbilical termination point placement, based on geotechnical and hydrodynamic data.

- Autonomous Underwater Vehicles (AUVs) utilizing vision systems and deep learning for automated, high-resolution inspection and defect classification of SURF infrastructure.

- Optimization of installation vessel schedules and dynamic positioning (DP) using predictive weather modeling and logistical AI tools to minimize offshore downtime.

- Enhancement of flow assurance systems through AI analysis of real-time fluid properties and pressure data, proactively preventing hydrate formation and paraffin deposition in flowlines.

DRO & Impact Forces Of SURF Market

The SURF market is propelled by key drivers such as the escalating global demand for energy, which necessitates the exploitation of vast, untapped deepwater reserves, and continuous technological advancements that make ultra-deepwater projects technically feasible and economically attractive. The strategic national energy security policies of many nations, particularly those with significant offshore territories like Norway, Brazil, and the US, prioritize maximizing hydrocarbon recovery, thereby sustaining investment in new subsea tie-backs and infrastructure upgrades. Furthermore, the trend toward longer tie-back distances, enabled by highly efficient subsea boosting and processing technologies, mandates more sophisticated and resilient flowlines and umbilicals capable of handling extreme lengths and varying temperatures/pressures, directly fueling demand for high-specification SURF systems.

Restraints primarily revolve around the high capital expenditure (CAPEX) associated with deepwater projects and the inherent volatility of global crude oil prices, which directly impacts project sanctioning. Regulatory complexities and increasing environmental scrutiny also pose significant hurdles; obtaining permits for major subsea installations can be lengthy and challenging, especially concerning deep-sea biodiversity protection. Moreover, the shortage of specialized installation vessels and highly skilled personnel capable of executing complex deepwater installation scopes represents a logistical constraint that can inflate project costs and extend timelines. These factors contribute to the cyclical nature of the market, where project delays or cancellations can rapidly dampen growth momentum despite underlying structural demand.

Opportunities for market players are abundant in the areas of standardization and energy transition integration. The industry is aggressively pursuing standardization initiatives (e.g., standardized connectors, modular SURF components) to reduce engineering cycles and supply chain complexities, offering significant cost reduction potential. Crucially, the expansion of the market into non-hydrocarbon applications, such as power cables and control systems for floating offshore wind farms and carbon capture infrastructure, provides a long-term diversification opportunity for SURF technology providers. The push for digitalization and the use of smart sensors embedded in umbilicals and flowlines (Smart SURF) also create new revenue streams centered on data analytics, asset life extension, and integrity monitoring services, enhancing the overall value proposition of subsea infrastructure investments.

Segmentation Analysis

The SURF market is meticulously segmented based on the type of component, the water depth of installation, the material used, and the service provided. This granular segmentation allows operators and service providers to tailor solutions precisely to the unique geotechnical, hydrodynamic, and operational requirements of specific offshore fields. The market is defined by the high technical specification requirements for each segment, reflecting the extreme operating conditions—including high pressure, high temperature, and corrosive fluid environments—that SURF systems must endure for decades without intervention. Understanding these segments is crucial for strategic investment, especially concerning the demand divergence between flexible versus rigid systems and shallow versus ultra-deepwater projects.

The categorization by component type (Umbilicals, Risers, Flowlines) highlights the distinct technological specialization required for each function. Flowlines, which transport hydrocarbons across the seabed, often dominate the volume market, while Umbilicals, which house electrical, hydraulic, and fiber optic elements, represent the high-value, high-technology segment requiring precision manufacturing. Furthermore, segmenting by material—specifically the shift from traditional steel to innovative thermoplastic composite pipes (TCP) and high-density polyethylene (HDPE)—demonstrates the industry's drive towards lighter, more resilient, and corrosion-resistant solutions that facilitate installation in increasingly challenging deepwater environments and reduce long-term operational costs.

Service segmentation, covering EPCI (Engineering, Procurement, Construction, and Installation) versus IMR (Inspection, Maintenance, and Repair), shows the long-term lifecycle revenue profile of the market. While EPCI is highly cyclical and depends on new FIDs, the IMR segment provides relatively stable, high-margin revenues derived from the vast installed base of SURF infrastructure worldwide, emphasizing the growing importance of integrity management and life extension services, often leveraging advanced robotics and digital twin technology for monitoring purposes.

- Component Type

- Umbilicals (Hydraulic, Electric, Hybrid)

- Risers (Flexible, Rigid, Hybrid/SLWR)

- Flowlines (Flexible, Rigid, Spoolbases)

- Material

- Steel (Carbon Steel, CRA Clad)

- Non-Metallic/Composite (TCP, HDPE)

- Water Depth

- Shallow Water (Up to 500 meters)

- Deepwater (500 to 1,500 meters)

- Ultra-Deepwater (Above 1,500 meters)

- Application

- Oil & Gas Production

- Subsea Processing & Boosting

- Offshore Renewables (Inter-array & Export Cables, adapting SURF technology)

Value Chain Analysis For SURF Market

The SURF market value chain begins with highly specialized upstream activities, primarily involving the sourcing and processing of raw materials such as high-grade steel alloys, specialty polymers, and advanced composite fibers necessary for manufacturing the structural and functional components. This upstream segment is characterized by stringent quality control and proprietary material specifications, often requiring long-term supply agreements with specialized mills and chemical companies. Key activities at this stage include the precise manufacturing of steel pipes (rigid flowlines and risers), extrusion of protective sheathing, and the complex assembly of electrical and fiber optic cores into robust umbilicals. Success in the upstream phase hinges on maintaining supply chain resilience, controlling raw material price volatility, and ensuring compliance with stringent subsea material standards (e.g., API specifications).

The midstream phase encompasses the core engineering, procurement, and construction (EPC) activities, dominated by major integrated SURF contractors. This stage involves sophisticated front-end engineering design (FEED), project management, and the fabrication and testing of the finalized SURF systems in highly specialized coastal facilities. A critical component is the management of logistics, including spooling rigid flowlines onto specialized vessels (spoolbases) or preparing flexible products for transport. The distribution channel is predominantly direct, where the SURF EPCI contractor directly interfaces with the E&P operator (the buyer). However, distribution relies heavily on the specialized fleet of installation vessels—laying vessels, pipelay support vessels (PLSVs), and construction support vessels (CSVs)—which are often owned or chartered on long-term contracts by the major SURF players, forming a natural barrier to entry for smaller competitors.

Downstream activities focus on the installation, commissioning, and subsequent operational lifecycle management of the subsea assets. Installation is a highly complex, weather-sensitive operation requiring immense capital investment in vessels and ROV technology. Post-commissioning, the downstream segment shifts to long-term integrity management, utilizing IMR services, often involving sub-contracted specialized inspection companies. Direct interaction (business-to-business, B2B) between the operator and the core SURF contractor dominates the primary market, but indirect channels are crucial in the IMR space, involving specialist providers of diving support services, remote intervention technology, and geotechnical surveys. The efficiency of this downstream segment directly influences the operational expenditure (OPEX) and ultimately the profitability of the entire offshore field.

SURF Market Potential Customers

The primary customers for SURF systems are global Exploration and Production (E&P) companies, specifically the Supermajors, National Oil Companies (NOCs), and major Independent Oil Companies (IOCs) that operate significant deepwater assets. These entities act as the ultimate buyers (End-Users) of the infrastructure, dictating project specifications and scale based on reservoir size, water depth, and operational requirements. Supermajors (like ExxonMobil, Shell, TotalEnergies, BP, and Chevron) are consistently the largest customers, often initiating mega-projects that require extensive, integrated SURF packages, particularly in regions like the Gulf of Mexico, Brazil’s pre-salt fields, and offshore West Africa.

National Oil Companies (NOCs), such as Petrobras (Brazil), Equinor (Norway), Aramco (Saudi Arabia, increasingly involved in offshore gas), and Petronas (Malaysia), represent another critical customer segment. These companies frequently partner with IOCs for technical expertise but often lead the procurement process for projects within their national waters. Their procurement strategies are often influenced by local content requirements, driving demand for localized fabrication and engineering services, which shapes the competitive behavior of international SURF contractors vying for these large tenders.

Additionally, while E&P companies are the direct purchasers of the entire EPCI contract, service companies specializing in Subsea Processing and Boosting (e.g., providing subsea pumps or compressors) are increasingly becoming influential buyers of specialized Umbilicals and Risers that must integrate seamlessly with their advanced hardware. In the emerging non-hydrocarbon sector, developers of large-scale floating offshore wind farms and providers of Carbon Capture and Storage (CCS) infrastructure constitute rapidly expanding customer segments, purchasing modified SURF technology for power transmission (export and inter-array cables) and CO2 transportation flowlines, diversifying the customer base beyond traditional oil and gas exploitation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 17.5 Billion |

| Market Forecast in 2033 | USD 25.8 Billion |

| Growth Rate | 5.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TechnipFMC, Subsea 7, Saipem S.p.A., Aker Solutions, McDermott International, Nexans, Prysmian Group, DOF Subsea, DeepOcean, NOV (National Oilwell Varco), Schlumberger (OneSubsea), JDR Cable Systems, Versabar, Enauta, Oceaneering International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SURF Market Key Technology Landscape

The technological landscape of the SURF market is characterized by a relentless pursuit of solutions that enhance reliability, increase tie-back distance capability, and reduce installation complexity, particularly in challenging ultra-deepwater and high-pressure/high-temperature (HPHT) environments. A pivotal technology involves the maturation of steel lazy wave risers (SLWRs), which utilize buoyancy elements integrated into the riser structure to mitigate excessive fatigue damage caused by vessel motion and strong currents, a critical issue in harsh environments like the North Atlantic or deep-sea regions of the Gulf of Mexico. Furthermore, the development of high-specification corrosion-resistant alloys (CRAs) and specialty internal cladding techniques for rigid flowlines is essential for handling increasingly corrosive and acidic hydrocarbon streams, ensuring the structural integrity of the pipeline over a 25-30 year operational lifespan.

Innovation in the Flowline and Riser segments is heavily centered on composite materials. Thermoplastic Composite Pipes (TCPs) are rapidly gaining prominence due to their lightweight nature, inherent resistance to corrosion, and simplified installation process, which often eliminates the need for welding offshore and significantly reduces installation vessel requirements. These non-metallic solutions are particularly advantageous for small to medium tie-back projects and hydrogen/CO2 transportation applications. Concurrently, the Umbilical technology segment is evolving towards "All-Electric" systems, replacing traditional hydraulic fluid lines with high-voltage electric power and control cables. This shift significantly improves control response times, reduces the environmental risk associated with hydraulic fluid leakage, and enables the use of high-power subsea boosting and processing units, thereby pushing the economic limits of long-distance subsea tie-backs.

Digitalization forms the overarching technological layer across all SURF systems. The integration of fiber optic distributed sensing (DTS/DAS) directly within the flowline or umbilical sheath allows for continuous, real-time monitoring of temperature, strain, and acoustic signatures along the entire length of the asset. This smart infrastructure facilitates the creation of high-fidelity 'digital twins,' enabling precise predictive maintenance, accurate leak detection, and optimized flow assurance management. Furthermore, advancements in specialized installation robotics, including heavy-duty trenching ROVs and automated subsea connection systems (e.g., advanced pipeline end manifolds - PLEMs and subsea intervention tools), are streamlining construction activities and minimizing the operational exposure of human personnel in hazardous environments, further enhancing overall project safety and efficiency metrics.

Regional Highlights

- Latin America (LATAM)

Latin America, dominated by Brazil, is the undisputed leader in SURF demand, primarily fueled by the extensive development of the pre-salt deepwater oil fields (Santos Basin). Petrobras's long-term production plans necessitate continuous investment in complex, high-specification risers, often employing sophisticated Steel Lazy Wave Riser (SLWR) and flexible riser technologies, due to the extreme water depths (over 2,000 meters) and harsh operating conditions. The region's focus on maximizing recovery from these massive reserves ensures a steady pipeline of large-scale, multi-year SURF EPCI contracts, making it the most critical revenue source for major contractors in the deepwater segment. Investment is also expanding marginally into the Guyana-Suriname basin, requiring significant new subsea infrastructure.

- North America

The Gulf of Mexico (GOM) drives the North American SURF market. While mature compared to Brazil, the GOM continues to see strategic investments in ultra-deepwater tie-backs (over 1,500 meters) and the development of new high-pressure, high-temperature (HPHT) reservoirs. The US regulatory environment, focusing on operational safety and environmental protection, pushes operators towards adopting highly robust and digitally monitored SURF systems. A major trend is the ongoing integrity management and life extension programs for infrastructure installed in the 1990s and 2000s, providing consistent demand for IMR services and specialized umbilical replacements, alongside targeted investment in high-capacity flowlines for gas gathering systems.

- Europe

Europe, centered around the North Sea (UK, Norway), presents a complex but technologically advanced market. While new large field developments are becoming less frequent, the region is pioneering the transition of SURF technology towards non-hydrocarbon applications, particularly in offshore renewables. Norway is a global leader in utilizing advanced subsea processing, which demands highly sophisticated, high-power Umbilicals. The focus is heavily skewed toward standardization, digitalization, and cost reduction in existing assets through standardized tie-backs and advanced IMR methodologies. Furthermore, the North Sea is a testing ground for integrated SURF technology supporting hydrogen production and CO2 transport for regional CCS projects.

- Asia Pacific (APAC)

The APAC region is a high-growth market, driven by expanding natural gas production in Australia (LNG projects), Malaysia, and Indonesia. These developments require substantial SURF infrastructure, often characterized by long flowline tie-backs necessary to connect remote gas fields to onshore processing facilities or existing floating assets. The market is highly diverse, ranging from shallow-water installations in Southeast Asia to deepwater developments off the Australian coast. Local content requirements are rising, compelling international SURF providers to establish local fabrication and engineering bases, facilitating technology transfer and supporting regional supply chain development.

- Middle East and Africa (MEA)

The MEA region is characterized by substantial deepwater activity off the coast of West Africa (Nigeria, Angola) and large shallow-to-mid water developments in the Middle East Gulf (Saudi Arabia, UAE). West Africa is a major consumer of deepwater SURF components, similar to Brazil, focusing on major oil and gas FPSO tie-backs, requiring specialized flexible riser systems. In the Middle East, market growth is driven by massive conventional offshore field expansions, such as Qatar’s North Field expansion, where specialized subsea gas infrastructure, including complex manifold and flowline systems, is crucial for handling high volumes of gas destined for global LNG markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SURF Market.- TechnipFMC

- Subsea 7

- Saipem S.p.A.

- Aker Solutions

- McDermott International

- Nexans

- Prysmian Group

- DOF Subsea

- DeepOcean

- NOV (National Oilwell Varco)

- Schlumberger (OneSubsea)

- JDR Cable Systems

- Versabar

- Enauta

- Oceaneering International

- Hellenic Cables

- Unique Group

- Fugro

- Oerlikon Man-Made Fibers

- Sapura Energy

Frequently Asked Questions

Analyze common user questions about the SURF market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the SURF market?

The market growth is primarily driven by the intensified global pursuit of deepwater and ultra-deepwater oil and gas reserves, particularly in Latin America and West Africa. Crucial drivers also include technological advancements enabling longer subsea tie-backs (over 100 km) and the transition toward more robust, high-pressure, high-temperature (HPHT) systems, ensuring economic viability and sustained production from complex reservoirs, alongside new demand from offshore wind and CCS projects.

How do flexible risers compare structurally and economically to rigid risers in deepwater applications?

Flexible risers offer superior fatigue performance and resilience to dynamic vessel motion, often preferred in deepwater and harsh environments where vessel heave is significant. While rigid risers (especially steel catenary risers or SCRs) are highly suitable for straight, shorter tie-backs and high-temperature conditions, flexible systems generally require less complex installation procedures and are more cost-effective for dynamic applications, though they have limitations on extreme pressure ratings compared to highly specialized rigid steel or hybrid options.

Which geographic region holds the largest market share in terms of SURF installation value?

Latin America, specifically Brazil, currently holds the largest market share by installation value. This dominance is attributed to the extensive and continuous development of massive pre-salt reserves in ultra-deepwater environments, which require highly complex, large-scale, and long-distance SURF infrastructure packages, translating into the highest capital expenditure commitments globally for subsea systems.

What role do composite materials, such as TCP, play in the future of flowline technology?

Composite materials, particularly Thermoplastic Composite Pipes (TCPs), are critical for future flowline technology as they offer exceptional corrosion resistance, significantly lower weight, and reduced installation complexity compared to traditional steel. TCPs facilitate faster, weld-free deployment, making them highly attractive for challenging deepwater and acidic service environments, while also opening avenues for use in non-hydrocarbon applications like CO2 transport and hydrogen lines.

How is digitalization impacting the operational lifespan and maintenance of SURF assets?

Digitalization, via embedded fiber optic sensing (DTS/DAS) and smart umbilicals, allows for continuous, real-time monitoring of strain, temperature, and flow parameters. This data enables predictive maintenance, shifting operators from scheduled to condition-based integrity management. Digital twins created from this data improve asset performance forecasting, allow for early anomaly detection, and ultimately extend the operational lifespan of SURF infrastructure while reducing expensive unplanned interventions and associated operational expenditures (OPEX).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Kitesurf Kites Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Wave Windsurf Sails Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Freeride Windsurf Sail Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Surf Watches Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Surf Fishing Rod Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager