Surgical Scalpel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432566 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Surgical Scalpel Market Size

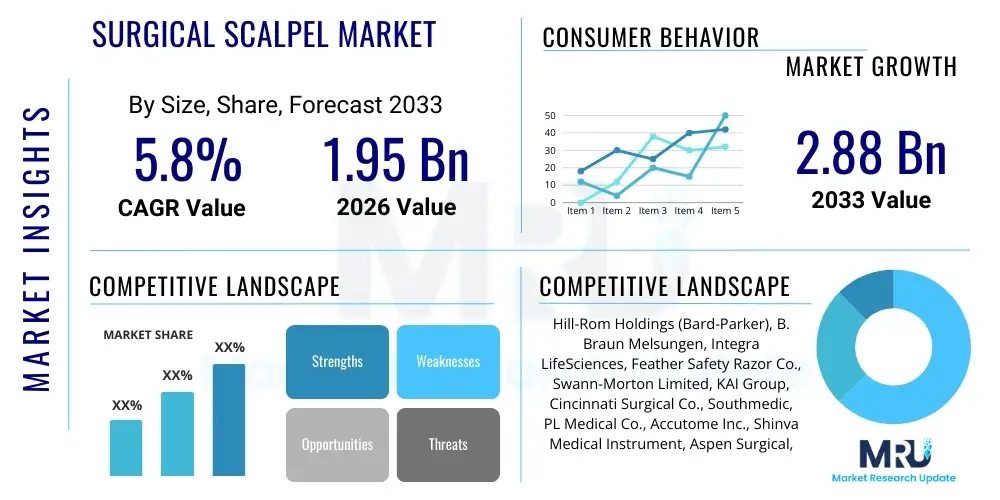

The Surgical Scalpel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $2.88 Billion by the end of the forecast period in 2033.

Surgical Scalpel Market introduction

The Surgical Scalpel Market encompasses instruments primarily designed for making incisions or excisions during surgical procedures. These critical medical devices are characterized by precision-ground blades, typically made from high-carbon or stainless steel, affixed to handles (often plastic or metal). The traditional scalpel is fundamental to virtually all surgical disciplines, including general surgery, cardiology, neurosurgery, orthopedics, and plastic surgery. The market expansion is intrinsically linked to the global rise in surgical procedures, driven by an aging population, increasing prevalence of chronic diseases, and advancements in healthcare infrastructure, particularly in emerging economies. Key benefits offered by modern scalpels include enhanced precision, reduced risk of infection (especially with disposable models), and superior ergonomics for surgeons.

Surgical scalpels are broadly categorized into reusable and disposable types, with the disposable segment experiencing rapid growth due to stringent infection control protocols and regulatory mandates emphasizing single-use devices to minimize cross-contamination risks. The product description spans traditional fixed-blade scalpels, safety scalpels featuring protective shields or retraction mechanisms, and specialized miniature blades used in microsurgery. Major applications include complex organ procedures, routine skin grafting, and minimally invasive surgeries, where precision is paramount. Furthermore, the development of specialized coatings, such as ceramic-tipped or polymer-coated blades, enhances cutting efficiency and reduces friction, contributing to better patient outcomes and driving product adoption.

Driving factors for this market include increased healthcare expenditure globally, the expansion of ambulatory surgical centers (ASCs) which favor cost-effective disposable tools, and continuous technological advancements aimed at improving blade sharpness and user safety. The consistent demand across all levels of healthcare facilities, from tertiary hospitals to small clinics, solidifies the scalpel's position as an indispensable tool. Market players are heavily focused on developing safety-engineered scalpels to comply with needle-stick injury prevention guidelines, ensuring both patient and healthcare worker safety remains a central theme in product innovation and market growth.

Surgical Scalpel Market Executive Summary

The Surgical Scalpel Market is characterized by a strong shift toward safety-engineered disposable products, driven primarily by occupational safety regulations (such as OSHA guidelines in the U.S.) and rising concerns over bloodborne pathogen transmission. Business trends highlight strategic mergers and acquisitions among key manufacturers aimed at consolidating market share and expanding specialized product portfolios, particularly in specialized blade geometries required for endoscopic and robotic-assisted surgeries. Supply chain resilience, especially concerning raw material procurement (high-grade steel), remains a crucial operational challenge, prompting manufacturers to diversify sourcing strategies and invest in automated manufacturing processes to maintain quality and volume stability. Furthermore, the intense competition is pushing pricing strategies toward optimization, balancing the necessity of premium quality with the economic pressures faced by large group purchasing organizations (GPOs).

Regionally, North America and Europe currently dominate the market due to established healthcare infrastructure, high surgical procedure volumes, and early adoption of advanced safety scalpels. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) through 2033, fueled by increasing medical tourism, rapid expansion of hospital networks, and improving access to sophisticated healthcare in countries like China and India. Government initiatives focusing on public health improvements and increased foreign direct investment in the healthcare sector in developing nations are further accelerating this regional growth. Latin America and the Middle East & Africa (MEA) are also showing promising growth trajectories, albeit from a lower base, as surgical volumes rise in response to better disease screening and treatment capabilities.

Segment trends confirm the disposable scalpel category's market leadership over reusable options, reflecting the widespread industry consensus on minimizing infection risks, despite the higher cumulative waste generation. By material, stainless steel and carbon steel continue to be the primary choices, although advancements in ceramic and polymer materials are gaining traction in niche applications requiring non-magnetic or specialized cutting properties. Among end-users, hospitals remain the largest segment, but ambulatory surgical centers (ASCs) are the fastest-growing segment. The efficiency and cost-effectiveness inherent in ASC operations make them ideal environments for the high volume use of disposable surgical tools, further cementing their importance as a critical revenue stream for scalpel manufacturers. Innovation in blade coating technology, enhancing sharpness and longevity while reducing tissue drag, represents another significant trend driving premium pricing within the segmented market.

AI Impact Analysis on Surgical Scalpel Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Surgical Scalpel Market frequently revolve around two core themes: the indirect influence of AI on surgical planning and execution, and the direct impact of automation on scalpel manufacturing and quality control. Users express concerns about whether AI-driven robotic systems will eventually render traditional handheld scalpels obsolete, and conversely, how AI can optimize the use of existing tools. Key expectations include AI-powered predictive maintenance for reusable instrument sterilization cycles and the integration of AI vision systems into surgical robots, which, while not replacing the blade itself, necessitate highly precise, specialized disposable blades compatible with robotic arms. The consensus theme is that AI will enhance, rather than eliminate, the role of high-precision cutting tools by improving workflow efficiency and procedural accuracy, making the demand for perfectly manufactured, standardized, and AI-compatible scalpels paramount.

- AI-enabled preoperative planning optimizes incision placement, potentially reducing the required number or type of scalpel needed per procedure.

- Robotic surgery, heavily reliant on AI and machine learning, requires specialized, disposable scalpel-like end-effectors, sustaining demand for precision manufacturing.

- AI-driven quality control systems significantly enhance the inspection and assurance processes during scalpel manufacturing, ensuring superior blade sharpness and consistency.

- Predictive analytics assists hospitals in optimizing inventory management for various scalpel types, reducing waste and ensuring just-in-time availability.

- AI training modules use simulated environments, increasing surgeon proficiency with specialized blades before real-world application, indirectly promoting safer scalpel use.

- Data aggregation and AI analysis of surgical outcomes inform design improvements, leading to more ergonomic and functionally efficient scalpel handles and blade designs.

DRO & Impact Forces Of Surgical Scalpel Market

The Surgical Scalpel Market is propelled by key drivers (D) such as the increasing volume of surgical procedures globally, the rising prevalence of chronic diseases requiring surgical intervention (e.g., cardiovascular disease, oncology), and the pervasive shift towards disposable safety scalpels mandated by occupational health and safety regulations. These drivers create substantial momentum for sustained market expansion. Restraints (R) include the competitive pressure from advanced alternative cutting technologies like electrosurgical units, lasers, and ultrasonic devices, which reduce the reliance on traditional cold steel scalpels in certain procedures. Furthermore, the inherent risk of sharps injuries and the associated high costs of regulatory compliance for safety devices pose ongoing challenges for manufacturers and healthcare providers alike. The market benefits from significant opportunities (O), particularly the untapped potential in emerging Asian and African economies where healthcare access is rapidly improving, and the development of highly specialized blades compatible with burgeoning robotic and minimally invasive surgery platforms.

Impact Forces are shaping the market trajectory significantly. On the demand side, the increasing global aging population is a powerful external factor, requiring more geriatric surgeries, thus increasing the total addressable market volume. Regulatory forces, particularly those governing sharps injury prevention (e.g., EU Directive 2010/32/EU), act as strong internal pressure, accelerating the obsolescence of standard fixed-blade scalpels in favor of retractable or protected safety alternatives. Economically, the cost-effectiveness and efficiency of disposable scalpels in high-volume settings, especially Ambulatory Surgical Centers (ASCs), drive their rapid adoption. Technologically, ongoing innovation in materials science (e.g., enhanced coatings, ceramic composites) ensures that cold steel scalpels maintain a competitive edge in procedures where thermal or electrical damage is undesirable. The overall impact of these forces suggests a dynamic market that is resilient to external competition but highly responsive to safety and material innovation.

The synergy between increasing surgical complexity and the drive for procedural safety mandates continuous product innovation. While the core function of the scalpel remains unchanged—to provide a precise incision—its surrounding features (handle ergonomics, safety mechanism, disposable format) are in constant evolution. This necessity to comply with global safety standards transforms restraints into opportunities for manufacturers capable of rapid innovation and premium product development. Moreover, the growth in specialized surgical fields, such as ophthalmic and orthopedic surgery, demands highly customized blade sizes and geometries, which manufacturers capitalize on to diversify their product offerings beyond general-purpose scalpels, ensuring market stability despite competition from energy-based surgical tools.

Segmentation Analysis

The Surgical Scalpel Market is meticulously segmented based on product type, material, end-user, and geographic region to analyze market dynamics comprehensively. Product segmentation focuses primarily on differentiating between standard reusable blades/handles and safety-engineered disposable scalpels, reflecting the industry's focus on infection control and occupational safety. Material analysis covers the traditional dominance of carbon and stainless steel, alongside the niche but growing application of advanced ceramics. End-user categorization distinguishes high-volume institutional buyers like hospitals from specialized settings such as Ambulatory Surgical Centers and specialized clinics, each exhibiting distinct purchasing behaviors and product preferences. This granular segmentation allows stakeholders to target specific growth vectors based on regional healthcare infrastructure and regulatory environments.

- By Product Type:

- Disposable Scalpels (Safety Scalpels, Standard Disposable)

- Reusable Scalpel Blades

- Reusable Scalpel Handles (Fixed, Detachable)

- By Material:

- Carbon Steel

- Stainless Steel

- Ceramic

- Polymer/Others

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialized Clinics (Dermatology, Ophthalmology)

- Academic and Research Institutes

- By Application:

- General Surgery

- Cardiothoracic Surgery

- Orthopedic Surgery

- Neurosurgery

- Plastic and Reconstructive Surgery

Value Chain Analysis For Surgical Scalpel Market

The value chain for the Surgical Scalpel Market begins with upstream analysis, focusing on the procurement of specialized, high-quality raw materials, primarily medical-grade stainless steel and high-carbon steel, along with engineering-grade polymers for handles and safety mechanisms. This stage is critical as the quality of the raw steel directly dictates the sharpness, longevity, and structural integrity of the final product. Key upstream activities involve sourcing steel suppliers compliant with stringent international quality standards (e.g., ISO 13485) and negotiating contracts for specialized alloys. Manufacturing involves complex, high-precision processes, including stamping, grinding, and specialized heat treatments to achieve optimal blade hardness, followed by assembly and highly regulated sterilization processes (Gamma radiation or ETO). Efficiency in these manufacturing steps, often involving significant automation, determines final product cost and scalability.

The distribution channel represents a vital midstream component, bridging manufacturers with end-users. Distribution is characterized by both direct and indirect sales models. Direct sales are typically preferred for large institutional buyers, national health services, and military hospitals, allowing manufacturers greater control over pricing, inventory, and customer relationships. Conversely, the indirect model relies heavily on a network of third-party medical device distributors and large Group Purchasing Organizations (GPOs). GPOs play a powerful role, aggregating purchasing power from numerous hospitals and ASCs to secure favorable pricing contracts. The efficiency of this distribution network is crucial for timely delivery and inventory management within high-demand surgical environments, particularly for single-use disposable products.

Downstream analysis focuses on the final consumption and usage within hospitals, ASCs, and clinics. End-users prioritize product reliability, ergonomic design to reduce surgeon fatigue, and critically, compliance with occupational safety standards (e.g., safety-engineered retractable blades). Post-usage, the downstream phase also involves regulated disposal, which adds a layer of complexity and cost, especially for disposable scalpels treated as medical waste. Manufacturers are increasingly focused on improving customer training and support to ensure proper usage of safety features, thereby mitigating liability risks. The overall value chain emphasizes stringent quality control at every stage, from raw material procurement to final sterile packaging, driven by the non-negotiable requirement for high-precision, contaminant-free surgical instruments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $2.88 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hill-Rom Holdings (Bard-Parker), B. Braun Melsungen, Integra LifeSciences, Feather Safety Razor Co., Swann-Morton Limited, KAI Group, Cincinnati Surgical Co., Southmedic, PL Medical Co., Accutome Inc., Shinva Medical Instrument, Aspen Surgical, Myco Medical, Mani, Inc., Huaiyin Medical Instrument, Sklar Instruments, Ailee, Surgical Specialties Corporation, P. J. Dahlhausen & Co., A.R.C. Laser GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Surgical Scalpel Market Potential Customers

The primary end-users and potential customers for surgical scalpels are institutions that perform routine and complex surgical interventions. Hospitals, particularly large tertiary care centers and teaching hospitals, represent the largest customer base due to the sheer volume and variety of surgeries performed, ranging from elective procedures to emergency trauma care. These institutions typically require large volumes of standardized disposable scalpels (for infection control) and maintain specialized inventory for rare procedures.

Ambulatory Surgical Centers (ASCs) constitute the fastest-growing customer segment. ASCs focus predominantly on outpatient procedures (e.g., ophthalmology, orthopedics, gastroenterology) and prioritize cost-efficiency and quick turnover. Their preference strongly leans toward high-quality, high-volume disposable scalpels and instruments, making them crucial targets for manufacturers offering bulk discounts and efficient supply chain logistics.

Specialized clinics, including dermatology, plastic surgery, and podiatry clinics, represent a niche, high-value customer base requiring specialized, smaller-gauge blades for delicate and precision-focused aesthetic or minimally invasive procedures. Furthermore, academic and research institutes, which use scalpels for dissection, experimentation, and surgical training, constitute a smaller but consistently important customer segment focused on educational models and cutting-edge material evaluation.

Surgical Scalpel Market Key Technology Landscape

The technological landscape of the Surgical Scalpel Market is predominantly focused on improving user safety, enhancing surgical precision, and developing compatibility with modern surgical approaches. The most significant technological advancement involves the shift toward safety-engineered scalpels. These devices incorporate automatic or manual retractable blade shields, ensuring that the sharp edge is protected before, during, and after use. This technology drastically reduces the incidence of sharps injuries, addressing a critical occupational hazard and aligning with global regulatory requirements. Manufacturers are continuously innovating the deployment and retraction mechanisms to be intuitive and reliable, often utilizing spring-loaded systems or ergonomic slider mechanisms built into specialized polymer handles.

Another crucial area of technological innovation lies in material science and blade coatings. While carbon steel provides superior initial sharpness and stainless steel offers better corrosion resistance, advanced technologies introduce ceramic coatings, such as zirconium nitride, which can prolong the edge life and reduce friction during cutting. Furthermore, non-stick coatings, often based on proprietary polymers, minimize tissue drag and facilitate smoother incisions, particularly beneficial in high-fat or fibrous tissues. Specialized miniature and ophthalmic blades are also seeing technological improvements in micro-grinding techniques, allowing for unprecedented levels of precision necessary for procedures involving delicate structures like the retina or microvascular anastomosis.

The convergence of traditional scalpels with high-tech surgical platforms, specifically robotic surgery systems, is also defining the technology landscape. Manufacturers are developing custom scalpel attachments and robotic end-effectors that provide the fine control of cold steel cutting within the confined spaces of robotic ports. While these robotic tools are often integrated systems, they maintain the functional need for an extremely sharp, disposable cutting surface. This technological integration ensures that the fundamental cutting functionality of the scalpel remains relevant, evolving from a simple handheld tool to a high-tech disposable component of a complex surgical machine, thereby driving ongoing research into optimized materials and standardized interfaces for robotic compatibility.

Regional Highlights

The global Surgical Scalpel Market exhibits distinct patterns across major geographic regions, influenced by healthcare spending, regulatory environments, and demographic factors.

- North America (NA): Dominates the market due to the high volume of complex surgical procedures, stringent adherence to occupational safety standards (driving the high adoption of safety scalpels), and robust presence of major market players. The U.S. healthcare system's extensive use of Ambulatory Surgical Centers (ASCs) contributes significantly to the demand for disposable, standardized instruments.

- Europe: Represents a mature market characterized by advanced healthcare systems (NHS, etc.) and strict adherence to EU directives on sharps injury prevention. Western European countries, particularly Germany and the UK, are key markets, focusing heavily on sustainability initiatives alongside safety, leading to innovations in environmentally conscious scalpel materials and disposal methods.

- Asia Pacific (APAC): Expected to register the highest CAGR. Growth is driven by burgeoning medical tourism, rapid expansion of public and private hospital infrastructure in nations like China, India, and South Korea, and increasing government investment in public health. While traditional reusable scalpels are still common, the shift toward disposable safety products is accelerating due to rising infection control awareness.

- Latin America (LATAM): Growth is steady, primarily concentrated in large economies such as Brazil and Mexico. Market expansion is supported by increasing access to healthcare services, urbanization, and a gradual improvement in surgical facilities, though price sensitivity remains a key factor influencing purchasing decisions.

- Middle East and Africa (MEA): This region is characterized by substantial variations in healthcare sophistication. Gulf Cooperation Council (GCC) countries show high adoption rates of advanced safety scalpels due to significant healthcare spending, whereas African nations focus more on basic, essential surgical instruments, indicating long-term opportunities for market penetration as infrastructure improves.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Surgical Scalpel Market.- Swann-Morton Limited (A subsidiary of Symmetry Medical)

- B. Braun Melsungen AG

- Hill-Rom Holdings, Inc. (Including legacy Bard-Parker products)

- Integra LifeSciences Corporation

- Feather Safety Razor Co. Ltd.

- KAI Group

- Cincinnati Surgical Co., Inc.

- Aspen Surgical Products, Inc.

- Southmedic Inc.

- PL Medical Co., LLC

- Mani, Inc.

- Myco Medical Designs, Inc.

- Shinva Medical Instrument Co., Ltd.

- Sklar Instruments

- Huaiyin Medical Instrument Co., Ltd.

- Sterile Disposable Blades (A division of GPC Medical Ltd.)

- P. J. Dahlhausen & Co. GmbH

- A.R.C. Laser GmbH (Offers alternative cutting devices)

- Surgical Specialties Corporation

- Vogt Medical Vertrieb GmbH

Frequently Asked Questions

Analyze common user questions about the Surgical Scalpel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of disposable safety scalpels?

The primary driver is stringent global occupational health and safety regulations (e.g., OSHA, EU directives) aimed at preventing sharps injuries and minimizing the risk of bloodborne pathogen transmission among healthcare workers. Disposable safety scalpels feature integrated protective mechanisms that secure the blade after use.

How do electrosurgical units impact the traditional surgical scalpel market?

Electrosurgical units and lasers serve as competitive alternatives, particularly in procedures requiring concurrent coagulation (stopping bleeding). While they reduce the dependence on cold steel scalpels in certain high-heat procedures, scalpels remain indispensable in precision surgeries where thermal damage must be strictly avoided, maintaining their critical role.

Which material is most commonly used for high-precision surgical scalpel blades?

High-carbon steel is the most commonly used material for surgical scalpel blades due to its superior ability to achieve and maintain an extremely sharp cutting edge, though stainless steel is preferred in environments requiring high resistance to corrosion and repeated sterilization.

What role do Ambulatory Surgical Centers (ASCs) play in market growth?

ASCs are crucial growth engines because they specialize in high-volume, cost-effective outpatient procedures. Their operational focus on efficiency and infection control mandates the widespread use of disposable instruments, thereby increasing overall demand for single-use surgical scalpels at an accelerated rate compared to traditional hospitals.

How is technological advancement affecting scalpel design beyond safety features?

Technological advancement is leading to improved ergonomics in handle design to reduce surgeon fatigue, and the application of advanced coatings (like ceramic or non-stick polymers) on blades to minimize tissue drag, enhance cutting efficiency, and improve overall surgical outcomes, especially in specialized microsurgeries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Surgical Scalpel Blade Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Surgical Scalpel Market Size Report By Type (Blade, Handle), By Application (Hospital, Clinic, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Surgical Scalpel Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Handle, Blade), By Application (Clinic, Hospital, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager