Tampons Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431453 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Tampons Market Size

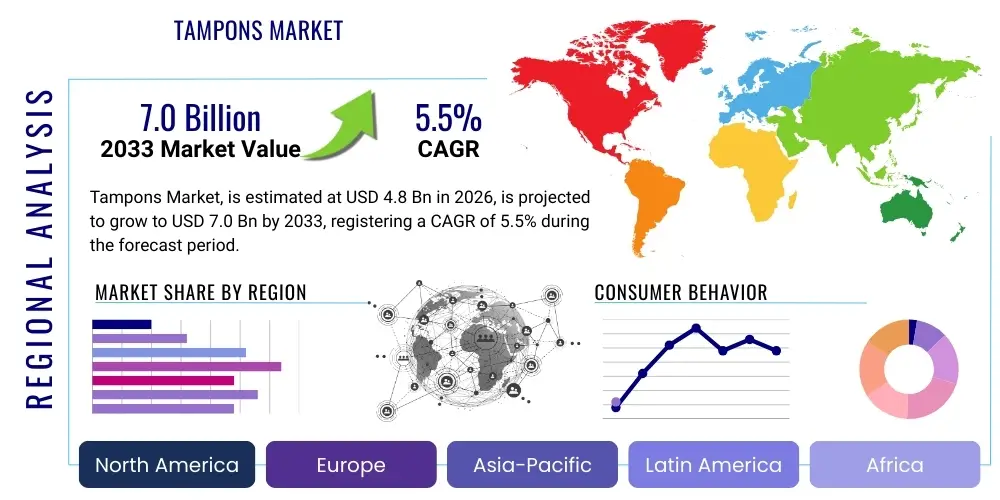

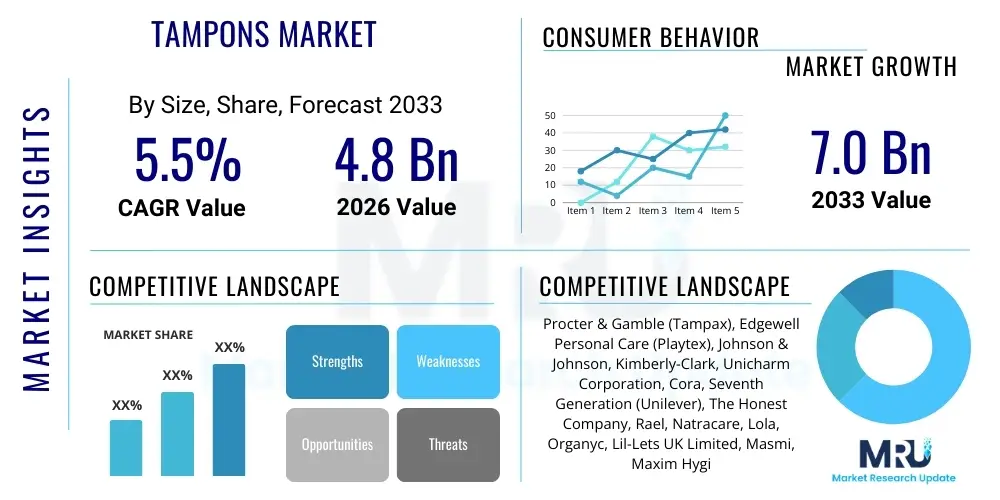

The Tampons Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.0 Billion by the end of the forecast period in 2033.

Tampons Market introduction

The Tampons Market encompasses the global production, distribution, and consumption of menstrual hygiene products designed for internal use. These products are crucial elements of feminine care, providing absorption capabilities for menstrual fluid. The market includes various types, primarily differentiated by applicator type (applicator or digital/non-applicator), material composition (cotton, rayon, or blends), and absorbency levels (light, regular, super, and super plus). Tampons offer discreet, comfortable, and reliable protection, making them a preferred choice for active individuals globally. The continuous focus on improved material quality, enhanced safety standards, and sustainable packaging initiatives significantly shapes the market trajectory.

Product development in this sector is largely driven by consumer demands for organic and environmentally friendly options, leading to the proliferation of certified organic cotton and plant-based bioplastic applicators. Furthermore, innovations in leak-guard technologies and ergonomic designs have enhanced user satisfaction, mitigating concerns often associated with internal menstrual products. Major applications of tampons are exclusively for menstrual management, but manufacturers are increasingly focusing on specialized designs tailored for different lifestyles, such as compact travel sizes and sport-specific variants that maintain efficacy during physical activity.

Key benefits of tampons include superior freedom of movement compared to external pads, discretion, and comfort, especially in warm or humid climates. Driving factors for market expansion involve rising female literacy and disposable income in emerging economies, coupled with increased awareness regarding menstrual hygiene. Public health campaigns promoting modern sanitary methods and the normalization of internal hygiene products further contribute to market penetration across diverse demographics, establishing tampons as an indispensable item in modern feminine hygiene routines.

Tampons Market Executive Summary

The global Tampons Market is characterized by robust growth, primarily fueled by shifting consumer preferences towards convenience, and significant advancements in biodegradable and organic product offerings. Business trends indicate a strong move toward direct-to-consumer (D2C) models and subscription services, ensuring steady revenue streams and building strong brand loyalty. Established multinational corporations are actively acquiring smaller, niche organic tampon brands to quickly capture the ethically conscious consumer segment, leading to consolidation and diversification of product portfolios. Regulatory scrutiny concerning material composition and chemical transparency remains a critical business factor, prompting greater investment in certified sustainable sourcing and transparent labeling practices across the industry value chain.

Regional trends highlight North America and Europe as mature markets experiencing growth driven by premiumization and demand for specialized features, such as applicators made from renewable resources. The Asia Pacific region, particularly India and China, represents the most rapid expansion opportunity, attributable to urbanization, increasing female employment, and improving sanitary infrastructure. Manufacturers are localizing product offerings and marketing strategies in these high-potential regions to overcome cultural barriers and address price sensitivity, leveraging digital platforms for education and product promotion. This dual focus on premium innovation in the West and accessibility/education in the East defines the current geographical landscape.

Segmentation trends reveal a clear dominance of applicator tampons due to ease of use, though non-applicator variants are gaining traction among experienced users and those prioritizing minimal material waste. The materials segment is transitioning rapidly, with organic cotton tampons expected to record the highest CAGR, outpacing traditional rayon and conventional cotton blends. Retail distribution remains essential, but the explosive growth of e-commerce channels, offering greater privacy and choice, fundamentally alters how consumers acquire these products, pushing manufacturers to optimize digital supply chains and enhance their online visibility.

AI Impact Analysis on Tampons Market

User queries regarding AI's influence in the Tampons Market frequently center on three main areas: personalized recommendations based on cycle tracking data, optimization of supply chains and inventory management, and utilizing AI-driven diagnostics for quality control and material sourcing. Users are concerned about how their intimate health data, generated via smart menstrual tracking apps, is being utilized by manufacturers to push specific absorbency or brand choices. There is also significant interest in AI's role in predicting regional demand fluctuations, especially concerning seasonal or cultural events that might impact product usage. Manufacturers are exploring predictive analytics to forecast demand for niche segments like biodegradable tampons, ensuring sustainable materials are consistently available without excess waste. The core expectation is that AI will make the selection and availability of menstrual products more efficient and tailored, while privacy remains the principal concern.

- AI-driven personalized product recommendations based on integrated menstrual tracking apps.

- Optimization of manufacturing lines and quality assurance through machine vision and anomaly detection.

- Predictive demand forecasting, minimizing stockouts in retail and e-commerce channels.

- Enhanced supply chain logistics, using algorithms to optimize raw material procurement (e.g., organic cotton).

- Automated customer service (chatbots) providing discreet and accurate product usage advice.

- Analysis of social media sentiment to rapidly identify product issues or emerging consumer preferences (e.g., preference for specific applicator types).

DRO & Impact Forces Of Tampons Market

The Tampons Market is significantly shaped by dynamic forces relating to consumer health awareness, environmental concerns, and economic accessibility. Key drivers include rising global disposable income, particularly in developing nations, coupled with continuous product innovation focused on comfort, absorbency, and materials. Restraints largely involve persistent cultural taboos and misconceptions surrounding internal feminine hygiene products in various conservative societies, and lingering concerns about Toxic Shock Syndrome (TSS), although rare, necessitating rigorous consumer education. Opportunities are abundant in the sustainable category, where biodegradable applicators and organic fibers address the growing environmental mandate, alongside expansion into rural and underserved markets through subsidized or localized product lines. These forces collectively dictate market trajectory, compelling companies to balance innovation with ethical sourcing and comprehensive consumer education.

Driving factors are primarily concentrated around urbanization and the increasing participation of women in the workforce, leading to a greater demand for convenience and mobility offered by tampons compared to traditional pads. Regulatory harmonization regarding health and safety standards across major trading blocs also facilitates cross-border expansion for established brands. Furthermore, targeted marketing campaigns that de-stigmatize menstruation and promote healthy hygiene practices are effectively converting consumers, particularly younger generations, toward internal products. The shift towards transparency in ingredients, influenced by wellness trends, strongly supports brands that offer clean, chemical-free formulations, thereby accelerating market acceptance.

Restraints are deeply rooted in distribution challenges and consumer trust issues. In certain regions, limited retail infrastructure and high import duties make tampons prohibitively expensive for large segments of the population. Although the risk of TSS is minimal with proper usage, media attention often amplifies fear, requiring manufacturers to prominently display educational material on safe usage guidelines and absorbency limitations. Another structural restraint is the perception of tampons as environmentally detrimental, especially those using non-recyclable plastic applicators, placing pressure on R&D budgets to rapidly transition to fully compostable alternatives. Overcoming these restraints necessitates multi-faceted approaches involving education, sustainable innovation, and logistical optimization.

Segmentation Analysis

The Tampons Market is comprehensively segmented based on product type, material, absorbency level, and distribution channel, providing a granular view of consumer behavior and market dynamics. This segmentation is crucial for manufacturers to tailor product development and marketing efforts effectively. The product type segment, dividing the market into applicator and non-applicator tampons, reveals a preference hierarchy often dictated by regional customs and ease of use. Applicator tampons typically dominate in North America and Western Europe, appealing to first-time users and those seeking maximum convenience, while non-applicator types maintain strong traction in parts of Europe and are favored by environmentally conscious consumers due to reduced material waste.

Material segmentation is rapidly evolving, driven by sustainability trends, highlighting the pronounced shift from conventional blends (rayon and conventional cotton) towards 100% organic cotton. This move is supported by consumer perception that organic materials are healthier, less chemically intensive, and environmentally superior. Absorbency segmentation (light, regular, super, super plus) is essential for catering to the varying physiological needs of the user base, ensuring product efficacy and safety throughout the menstrual cycle. The highest volume sales often concentrate in the regular and super absorbency categories, reflecting the average flow profile of the majority of users.

The distribution channel analysis emphasizes the significant role of retail pharmacies and hypermarkets in immediate purchase decisions, while e-commerce platforms are increasingly vital for repeat purchases and accessing niche or subscription-based brands. Understanding the nuances within each segment allows market players to optimize inventory, pricing strategies, and shelf placement, ultimately improving market penetration and competitive positioning. The organic material segment, in particular, is witnessing intense competition and innovation, attracting venture capital and driving premium pricing strategies across the industry.

- Product Type:

- Applicator Tampons (Plastic, Cardboard, Bioplastic)

- Non-Applicator/Digital Tampons

- Material:

- Cotton

- Rayon

- Blends (Cotton and Rayon)

- Organic Cotton

- Absorbency Level:

- Light

- Regular

- Super

- Super Plus/Ultra

- Distribution Channel:

- Pharmacies/Drug Stores

- Supermarkets/Hypermarkets

- Online Retail (E-commerce)

- Other Retail Outlets

Value Chain Analysis For Tampons Market

The Tampons Market value chain is initiated by the upstream procurement of raw materials, primarily cotton (conventional and organic) and rayon pulp, alongside plastics or cardboard for applicators. This stage is critical as the quality and sustainability of sourcing directly impact the final product's integrity and marketability, particularly given the rising consumer demand for certified organic materials and biodegradable components. Manufacturers must maintain robust relationships with sustainable agricultural suppliers and material processors to ensure consistency and compliance with ethical sourcing mandates. Logistics efficiency in transporting bulk raw materials to production facilities is a key cost driver at this initial stage.

Midstream activities involve sophisticated manufacturing processes, including fiber blending, compression, insertion of the withdrawal cord, and final assembly into the applicator (if applicable). This stage leverages specialized machinery requiring high capital investment and adherence to stringent sanitary and quality control standards, minimizing contamination and ensuring uniform absorbency. Packaging is a crucial midstream element, transitioning towards minimalistic and environmentally friendly designs. Subsequently, the downstream segment focuses on efficient distribution through established networks, involving large-scale warehousing, segmentation, and distribution to various retail and online channels globally.

Distribution channels are dual-pronged: direct sales (including company-owned e-commerce or subscription services) and indirect sales (via retailers, pharmacies, and hypermarkets). Direct channels offer greater margin control and direct consumer data, optimizing marketing efforts. Indirect channels, however, provide essential market reach and physical availability, especially in traditional and emerging markets. The competitive edge is often realized through minimizing logistical delays and maximizing shelf space visibility, making efficient channel management and strong retailer partnerships indispensable for market leaders in the highly sensitive consumer goods sector.

Tampons Market Potential Customers

The primary customer base for the Tampons Market consists of menstruating individuals, predominantly women and others assigned female at birth, spanning diverse age groups from adolescence through menopause. However, within this broad demographic, potential customers are segmented based on lifestyle, purchasing power, and product preference. Highly active individuals, including athletes and those with demanding professional schedules, represent a key target demographic due to the superior freedom, comfort, and discretion offered by internal menstrual protection. These consumers often prioritize high-absorbency, sport-specific, or compact tampon designs that align with their dynamic daily activities.

A rapidly growing segment of potential customers includes environmentally conscious consumers (often Millennials and Gen Z) who actively seek out products that minimize ecological footprint. These individuals drive the demand for organic cotton tampons, bio-plastic applicators, and non-applicator digital formats. Manufacturers target this demographic through sustainability certifications, transparent sourcing narratives, and packaging designed to emphasize compostability or recyclability. Furthermore, customers utilizing digital health and cycle tracking applications are becoming increasingly important, as they represent an audience receptive to targeted, data-driven product recommendations tailored to their unique flow patterns and cycle regularity.

Geographically, potential customers in emerging markets, characterized by increasing urbanization and improved awareness regarding modern menstrual hygiene, constitute a substantial untapped reservoir of demand. As economic conditions improve and education levels rise in regions like Southeast Asia and Latin America, cultural acceptance of tampons increases, transitioning consumers away from older, often less hygienic methods. Manufacturers must address the needs of this segment through value-based offerings, appropriate packaging sizes, and educational initiatives that build trust and overcome traditional societal barriers concerning internal use products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.0 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Procter & Gamble (Tampax), Edgewell Personal Care (Playtex), Johnson & Johnson, Kimberly-Clark, Unicharm Corporation, Cora, Seventh Generation (Unilever), The Honest Company, Rael, Natracare, Lola, Organyc, Lil-Lets UK Limited, Masmi, Maxim Hygiene Products, Diva International, First Quality Enterprises, Premier Healthcare, O.B. (Johnson & Johnson), Elle. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tampons Market Key Technology Landscape

The technology landscape in the Tampons Market primarily focuses on two areas: materials science innovation to enhance safety and sustainability, and manufacturing technology to optimize product design and high-speed production. In materials science, the core technologies revolve around developing highly absorbent, yet natural fibers, such as genetically optimized cotton strains or Tencel fibers derived from sustainable wood pulp, which offer superior fluid retention with reduced material bulk. A significant technological push involves the creation of biodegradable and compostable bioplastics derived from starch or plant sugars, replacing traditional polyethylene and polypropylene used in applicators, aligning product lifecycle with ecological mandates.

Manufacturing advancements leverage sophisticated automation and precision engineering. High-speed assembly lines incorporate non-contact monitoring systems and advanced sensor technologies to ensure consistent density and uniform shaping of the absorbent core, which is critical for preventing leakage and maximizing comfort. Furthermore, sterilization technologies, including gamma radiation or heat treatment, are crucial for maintaining the highest standards of hygiene and safety during packaging. These precise manufacturing technologies enable mass production while drastically minimizing defects, supporting the scalability required by global market demand.

Beyond the product itself, digital technology plays an increasing role, particularly in smart packaging and traceability. QR codes and RFID tags are being integrated to provide consumers with transparent information regarding sourcing and manufacturing location, fulfilling the demand for ingredient transparency. Moreover, smart inventory management systems, utilizing IoT sensors in distribution centers, are critical for maintaining stock freshness and minimizing logistical bottlenecks, particularly when dealing with organic materials that may have shorter shelf-life sensitivities compared to conventional plastic-based products. These technological integrations ensure product quality while streamlining the entire supply chain.

Regional Highlights

The global Tampons Market exhibits distinct consumption patterns and growth drivers across major geographic regions. North America currently holds a significant market share, characterized by high product penetration, sophisticated consumer awareness, and a willingness to pay premium prices for organic, customizable, and high-performance products. Market maturity in the U.S. and Canada necessitates continuous product differentiation, with brands heavily investing in marketing focused on comfort, sustainability claims, and personalized subscription models. Regulatory standards in this region, particularly those enforced by the FDA regarding absorbency labeling and material safety, are benchmarks for global operations.

Europe represents another key region, driven by strong environmental consciousness, especially in Western European countries like Germany, the UK, and Scandinavia. This market displays a higher adoption rate of non-applicator tampons and is the global leader in the demand for certified organic cotton products and chemical-free formulations. Government initiatives promoting menstrual equity and tax exemptions on hygiene products further stimulate market accessibility. Conversely, the Asia Pacific (APAC) region is forecasted to be the fastest-growing market, propelled by rapidly increasing middle-class populations, improvements in female health education, and widening availability through modern retail and e-commerce channels. Although price sensitivity remains a factor, the shift from traditional methods to modern internal protection is accelerating in urban centers of China, India, and Southeast Asian nations.

Latin America and the Middle East & Africa (MEA) markets present substantial opportunities, albeit with unique challenges related to cultural acceptance and infrastructure. In Latin America, urbanization and increased purchasing power are driving growth, similar to APAC, but distribution logistics can be complex. The MEA region is characterized by nascent market development; growth is concentrated in economically advanced areas, yet hindered by persistent cultural taboos and limited disposable income among large populations. Success in these emerging markets relies heavily on accessible pricing, culturally sensitive marketing, and partnering with local healthcare initiatives to educate consumers on the benefits and safe usage of tampons.

- North America: Market leader in value; high demand for premium, organic, and subscription-based services. Innovation focused on biodegradable applicators.

- Europe: High penetration of digital tampons and certified organic materials; strong regulatory push toward environmental sustainability.

- Asia Pacific (APAC): Highest projected growth rate; driven by urbanization, rising awareness, and increasing female employment; market entry focuses on localized pricing and extensive digital promotion.

- Latin America: Growing middle-class driving demand; focus on improving retail reach and brand visibility outside major metropolitan areas.

- Middle East & Africa (MEA): Low current penetration; significant long-term opportunity tied to economic development and breaking down cultural barriers through education.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tampons Market.- Procter & Gamble (Tampax)

- Edgewell Personal Care (Playtex)

- Johnson & Johnson (O.B.)

- Kimberly-Clark

- Unicharm Corporation

- Cora

- Seventh Generation (Unilever)

- The Honest Company

- Rael

- Natracare

- Lola

- Organyc

- Lil-Lets UK Limited

- Masmi

- Maxim Hygiene Products

- Diva International

- First Quality Enterprises

- Premier Healthcare

- SCA Group

- Patanjali Ayurved Limited

Frequently Asked Questions

Analyze common user questions about the Tampons market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for organic tampons globally?

The increasing consumer focus on health, wellness, and environmental sustainability is the primary driver. Consumers are actively seeking products free from synthetic chemicals, chlorine, and pesticides, opting instead for 100% certified organic cotton alternatives due to perceived safety and eco-friendliness.

Which distribution channel is expected to see the fastest growth rate in the Tampons Market?

Online retail (E-commerce) is projected to experience the fastest growth rate. E-commerce platforms offer discretion, a wide range of niche sustainable brands, subscription convenience, and are particularly effective for educating consumers in emerging markets.

Are applicator tampons or non-applicator tampons more dominant in terms of market share?

Applicator tampons generally hold a larger market share globally, driven by their popularity in North America and their ease of use, making them highly favored by younger or first-time users. However, non-applicator tampons are gaining share due to their environmental advantages (less waste).

What is the greatest constraint impacting market penetration in Asia Pacific countries?

The primary constraints are deep-rooted cultural taboos and misconceptions surrounding internal feminine hygiene products, combined with price sensitivity and lack of accessible distribution infrastructure, particularly in rural and non-urbanized areas.

How is technology being utilized to improve the safety profile of tampons?

Technology is utilized in advanced manufacturing processes to ensure precise, consistent absorbency levels and to guarantee rigorous sterilization. Furthermore, AI-driven quality control and clear, standardized labeling mandated by regulatory bodies ensure consumers select the correct absorbency, mitigating rare risks like TSS.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Organic and Natural Tampons Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Natural and Organic Tampons Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Tampons Market Size Report By Type (Radially Wound Pledget, Rectangular/Square Pad), By Application, By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager